Breakdown of Production Costs of Calcium Bromide Manufacturing Plant: A Cost Model Approach

What is Calcium Bromide?

Calcium bromide (CaBr2) is an inorganic compound commonly used in drilling fluids for oil and gas exploration, as well as in pharmaceutical and photographic applications.

Key Applications Across Industries:

It is a white, crystalline solid or solution that dissolves very easily and is used as a clear, dense brine in well drilling operations. Calcium bromide is prized for its capacity to manage pressure and avoid well blowouts due to its exceptional thermal and chemical stability. The growing energy industry and improvements in drilling technology are the main drivers of its demand.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global Calcium Bromide market reached US$ 262.8 Million in 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 4.9% from 2025 to 2033, reaching a projected size of US$ 409.1 Million by 2033. Calcium bromide is fueled in the market by its widespread application in the oil and gas sector, especially as a drilling and completion fluid in wellbore stability and pressure control.

Its use in the global increase in energy demand and deepwater drilling operations also spurs market growth. Its use in pharmaceuticals as a sedative and anticonvulsant also provides support to demand. The chemical finds use in wastewater treatment and photography as well. Increasing investment in improved oil recovery (IOR) methods and drilling fluid technologies enhances its market potential. Further, the increased use of calcium bromide due to its reduced toxicity compared to other bromine chemicals used in industry helps contribute to its increasing market. Regulating policies concerning bromine chemicals and raw material supply can determine production cost and market trends, though.

Case Study on Cost Model of Calcium Bromide Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale calcium bromide manufacturing plant in Saudi Arabia.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 5,000 tons of Calcium Bromides.

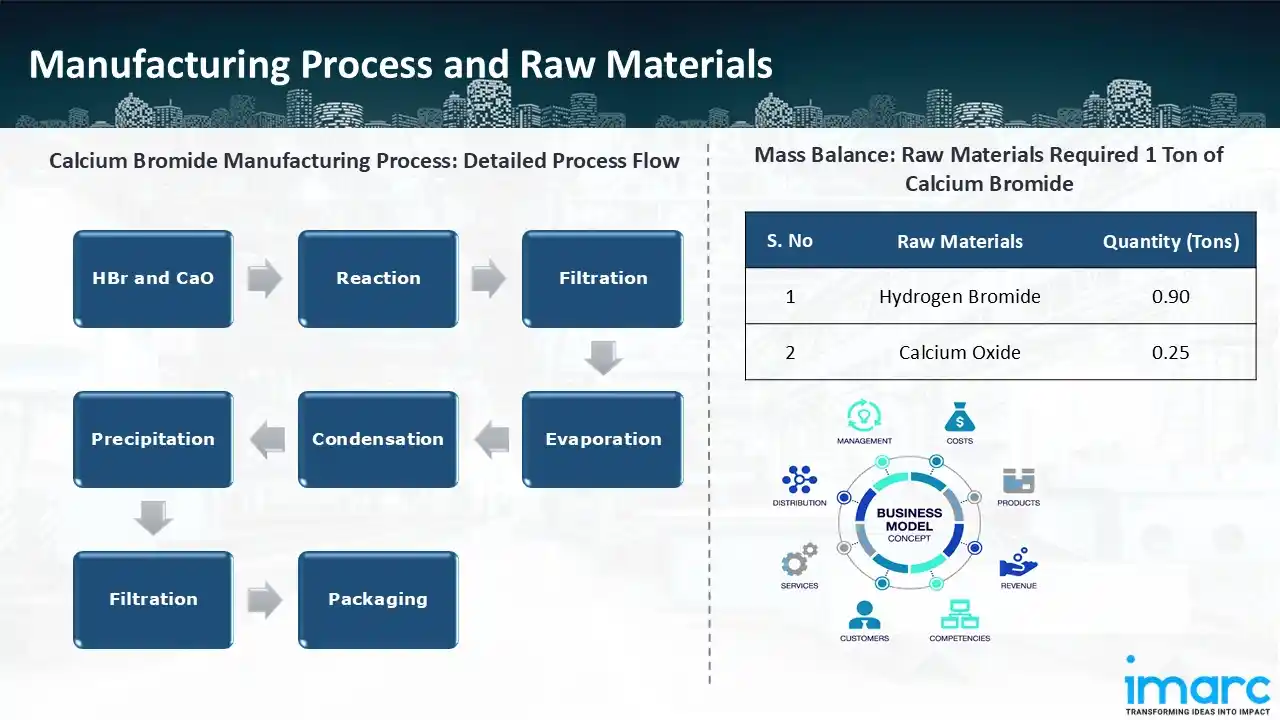

Manufacturing Process: The manufacturing process of calcium bromide begins with the reaction of hydrobromic acid (HBr) and calcium oxide (CaO) in a reactor, producing calcium bromide (CaBr2) and water. For the best yield, this exothermic process necessitates meticulous temperature and reactant concentration control. To guarantee a clear calcium bromide solution, the resultant solution is filtered to exclude contaminants and unreacted solids. After that, under carefully regulated pressure and temperature, the solution is evaporated to remove extra water and raise its concentration. Condensation is then used to recover the evaporated water, improving sustainability and efficiency. After additional concentration or chilling, precipitation is used to further treat the concentrated solution and generate solid calcium bromide crystals. The solid crystals are separated from the remaining liquid by a second filtration. In order to eliminate any remaining moisture and guarantee product stability, these crystals are subsequently dried using rotary or fluidized bed dryers. To prevent contamination and ensure that it satisfies industry distribution standards, the dried calcium bromide is lastly packed in sealed containers.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the calcium bromide manufacturing plant include calcium oxide and hydrogen bromide. To produce 1 ton of calcium bromide, we require 0.90 tons of hydrogen bromide and 0.25 tons of calcium oxide.

List of Machinery:

The following equipment was required for the proposed plant:

- HBr storage tank

- Vacuum pump set

- Reaction kettle

- Pressure filter

- HBr metering tank

- Air compressor

- Water metering tank

- Materials transforming pool

- Acid feeding pump

- Materials transforming pump

- Condensator

- Material mixing pool

- Settling pool

- Evaporation kettle

- Precision filter

- Products storing tank

- Cooling pool

- Cooling tower

- Cooling pump

- Pressure transformer

- Boiler

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

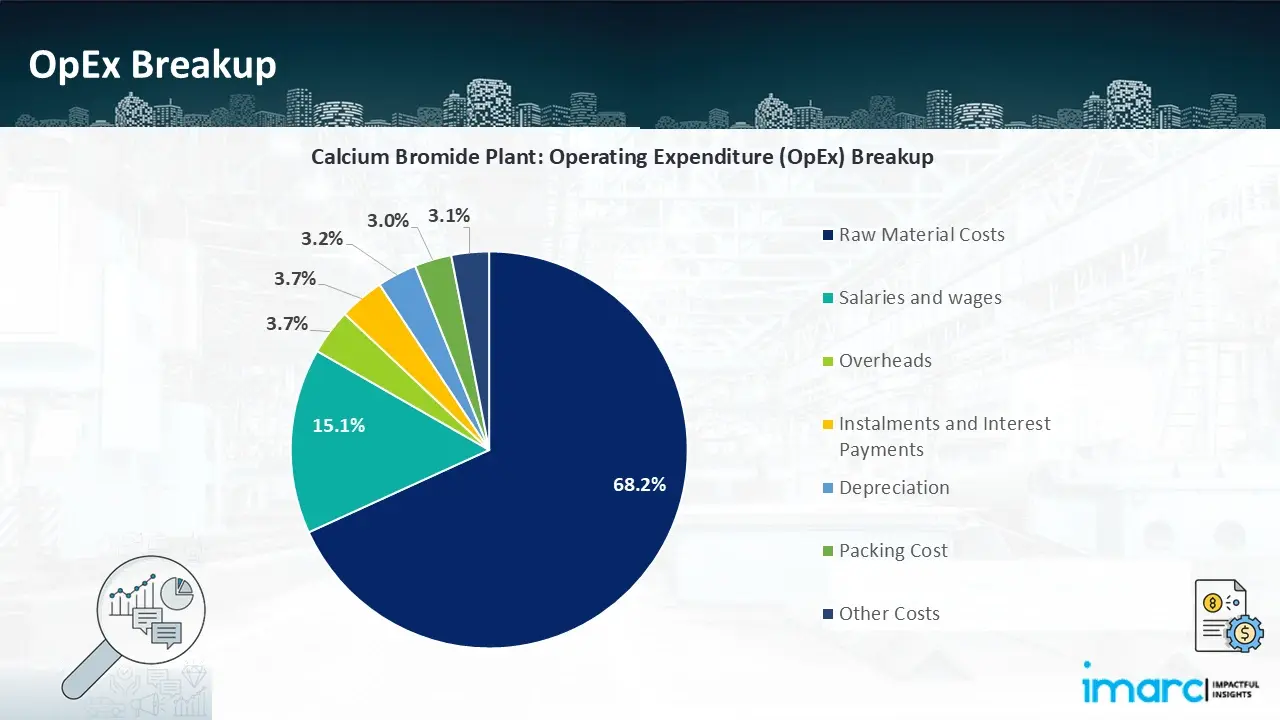

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

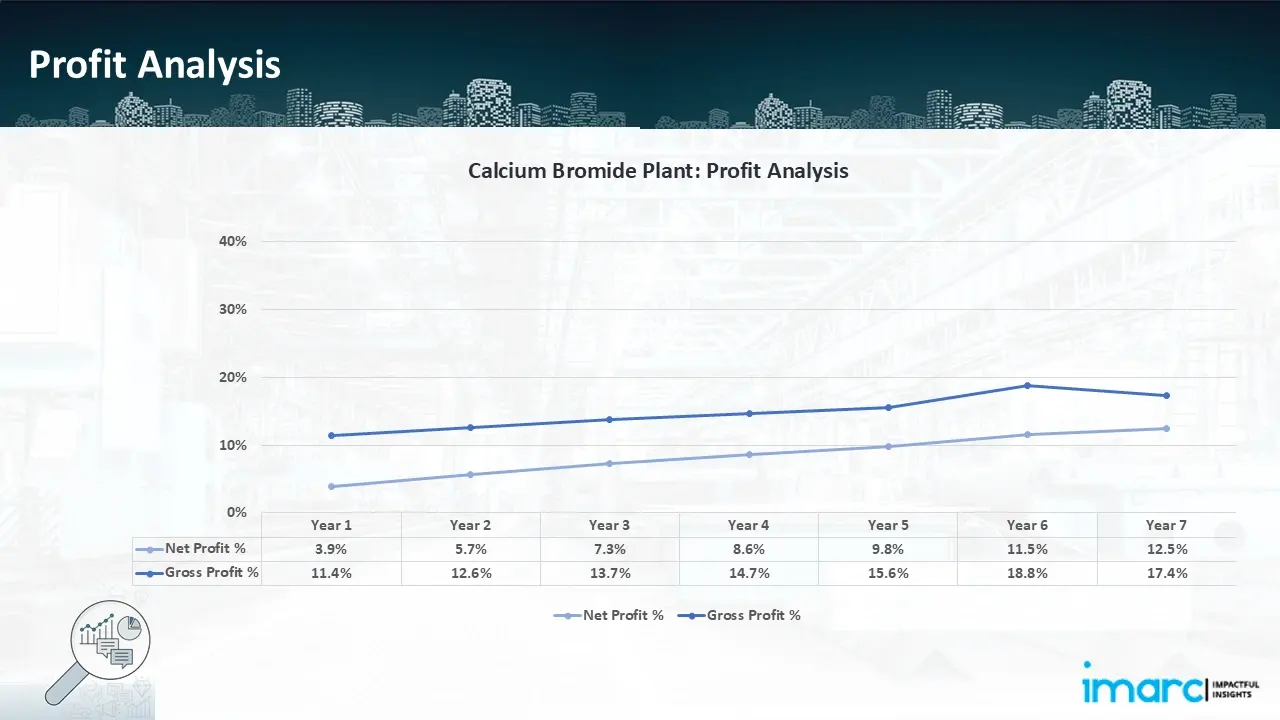

- Profitability Analysis Year on Year Basis: The proposed calcium bromide plant, with an annual capacity of 5,000 tons of calcium bromide, achieved an impressive revenue of US$ 9.2 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Gross profit margins improved from 11.4% to 17.4% during the period, and net profit margins rise from 3.9% to 12.5%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

Our calcium bromide manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 5,000 tons of calcium bromide annually. Our commitment to offering precise, client-cantered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In August 2024, TETRA Technologies, Inc. announced that an S-K 1300 Bromine Definitive Feasibility Study ("DFS") was completed with positive findings. These findings include specific financial data regarding the development of TETRA's Arkansas bromine assets in the Evergreen Unit, which was derived from reservoir analysis, engineering studies, certain cost and revenue assumptions, and quotes for major components that have been received.

- In November 2022, Albemarle announced its plan to invest up to $540 Million to upgrade and expand its bromine facilities in Magnolia, Arkansas in a project that would last until 2027.

- In September 2021, SICCO, a company located in Jubail, is constructing a plant for calcium bromide, a clear liquid that controls wellbore pressure in both onshore and offshore oil and gas wells. At the 15,000 square meter facility, it intends to produce up to 4,000 tonnes of the compounds per year.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104