The Economics of Aluminum Wire Rods: A Comprehensive Cost Model

What is Aluminum Wire Rods?

Aluminum wire rods are critical industrial products renowned for their high conductivity, strength, and versatility. They are cylindrical metal rods that are the backbone of electrical transmission and distribution systems and play a fundamental role in power infrastructure, building construction, and manufacturing.

Key Applications Across Industries:

Due to their good conductivity and low weight, they are a top choice for cable production, overhead power lines, and electrical wires. Outside of electrical uses, aluminum wire rods find extensive application in the automotive, aerospace, and industrial industries, where their corrosion resistance and recyclability play important roles in sustainability initiatives. With growing demand for energy-efficient solutions and lightweight materials, the market for aluminum wire rods remains dynamic, driven by technological innovation in production and the increasing focus on environmentally friendly manufacturing.

What the Expert Says: Market Overview & Growth Drivers

As per an IMARC study, the worldwide aluminum wire rods market was worth USD 17.3 Billion in 2024. In the future, the market is anticipated to expand at a CAGR of around 1.5% during 2025-2033, reaching a size of USD 19.2 Billion by 2033. The worldwide aluminum wire rods market is driven by a number of major factors. Rapid urban growth and infrastructure development have raised demand, especially in construction and power transmission industries.

The increase in focus towards renewable energy sources, such as wind and solar power, has also fuelled the demand for high-conductivity aluminum wires. The automobile and aerospace industries are also using aluminum wire rods because of their light weight, resistance to corrosion, and recyclability, and in the process, offering fuel efficiency and sustainability advantages. Production process advances in technology have enhanced cost-effectiveness, product quality, and environmental regulation. Developing economies in Asia and the Middle East are experiencing increasing demand with massive electrification projects and industrialization. While industries keep energy efficiency and sustainable materials as top priorities, aluminum wire rods continue to play a critical role in responding to new global demands.

Case Study on Cost Model of Aluminum Wire Rods Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale aluminum wire rods manufacturing plant in United States.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with a production capacity of 24,000 tons of aluminum wire rods per year.

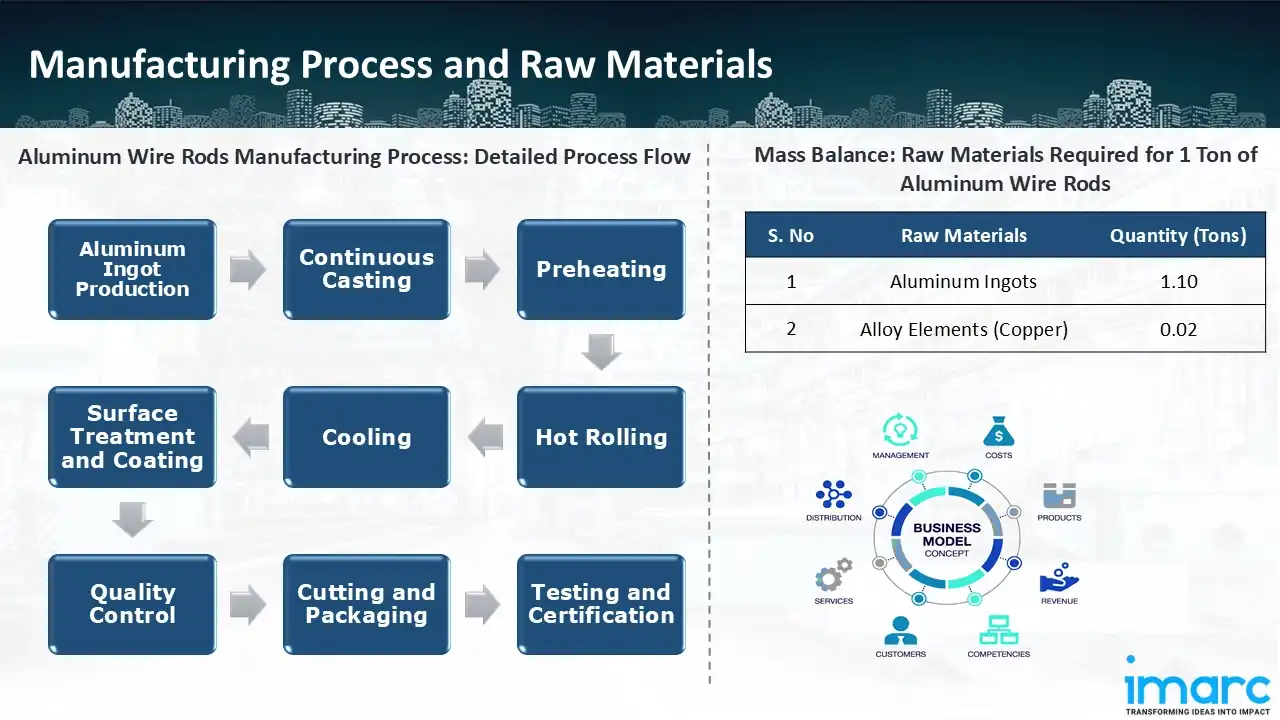

Manufacturing Process: The production of aluminum wire rod consists of several processes for maintaining quality and accuracy. It starts with the production of aluminum ingot, where aluminum is mined from bauxite, refined, melted, and cast into ingots. The ingots are melted and formed into rod-shaped billets through the continuous casting process. Preheating follows next to increase the malleability of the billets for effective shaping. Preheated billets undergo hot rolling through rolling mills, decreasing their diameter and structurally refining them. Cooling stabilizes the shape and mechanical properties of the rods after rolling. Surface treatment and coating are done to remove impurities and increase durability via processes such as pickling and anodizing. Quality control checks for dimensional accuracy, mechanical strength, and surface integrity. The rods are cut and packaged according to customer requirements for safe transportation. Lastly, testing and certification confirm their conformity to industry standards, especially in electrical use. These processes guarantee aluminum wire rods are efficiently meeting varied industrial demands.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the aluminum wire rods manufacturing plant include aluminum ingots and alloy elements (copper). To produce 1 ton of aluminum wire rods, we require 1.10 tons aluminum ingots and 0.02 tons alloy elements (copper).

List of Machinery:

The following equipment was required for the proposed plant:

- Aluminum Melting and Holding Furnace

- Continuous Casting and Rolling Line

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

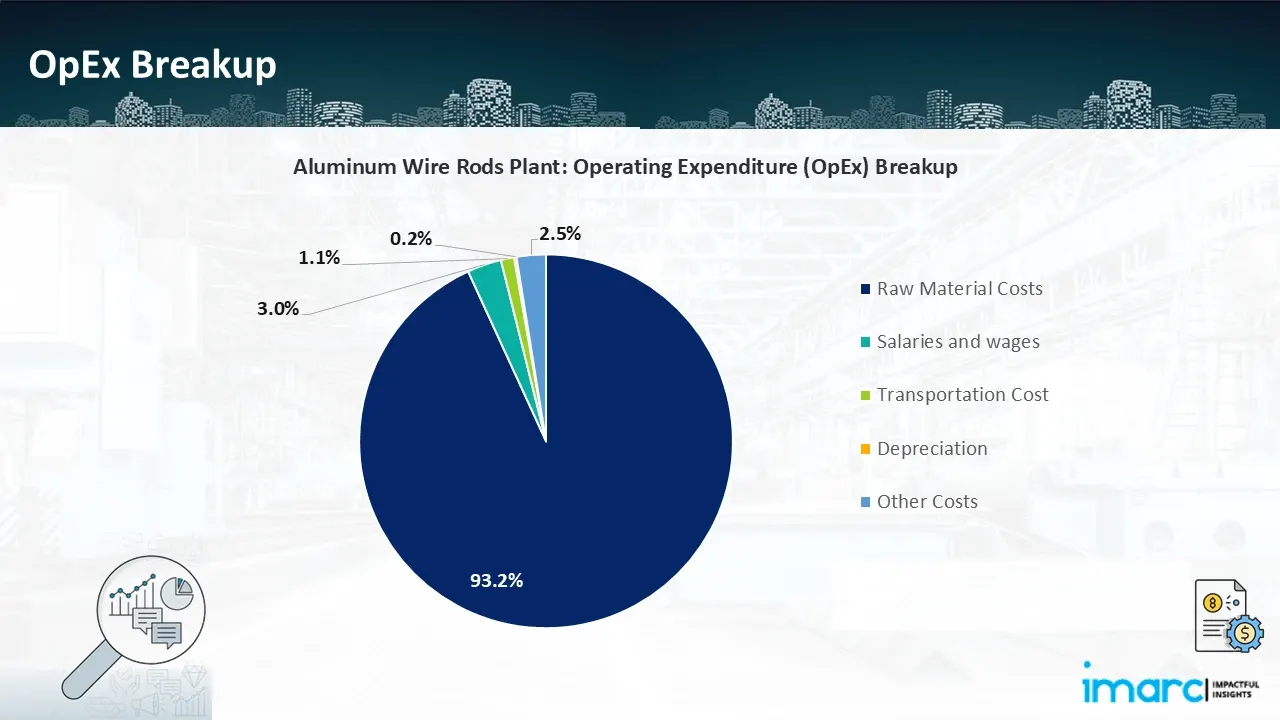

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

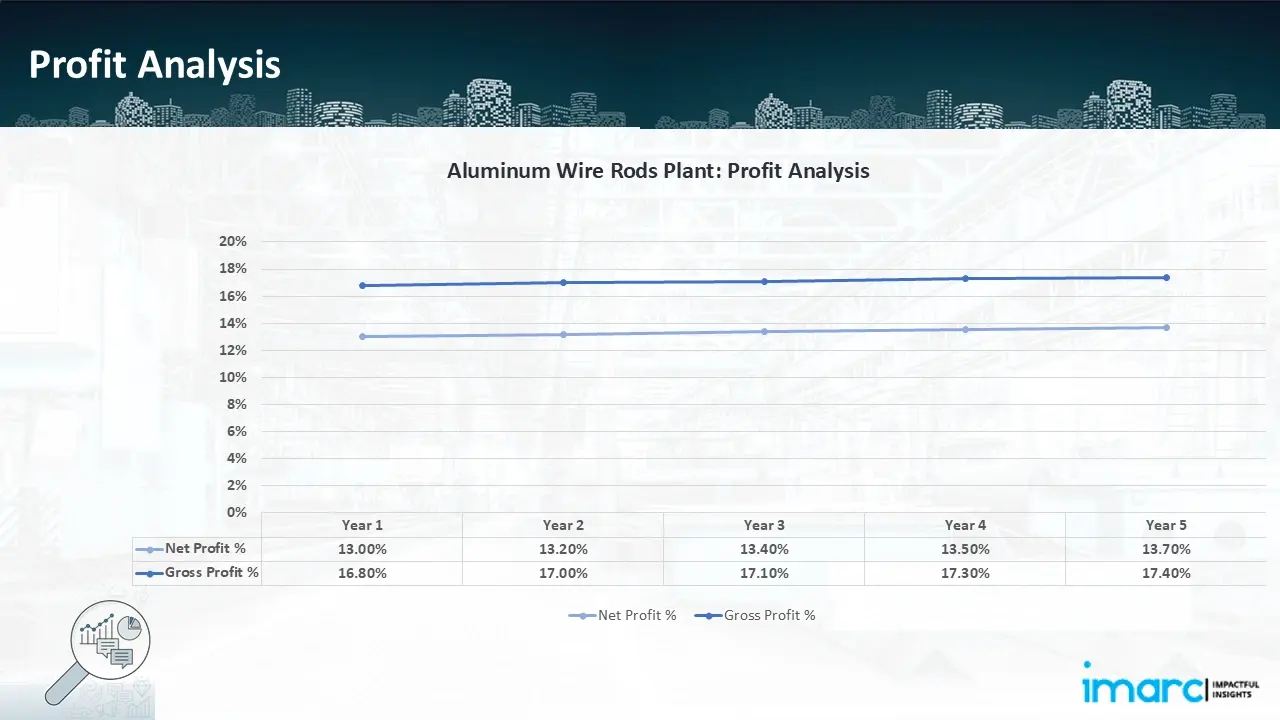

- Profitability Analysis Year on Year Basis: The proposed aluminum wire rods plant, with a capacity of 24,000 tons of aluminum wire rods per year, achieved an impressive revenue of USD 87.8 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the years. Gross profit margin improved from 16.8% to 17.4% throughout the years, and net profit went up from 13.0% to 13.4%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our aluminum wire rods manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 24,000 tons of aluminum wire rods per year. Our commitment to offering precise, client-cantered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In September 2024, Vedanta Aluminium, India’s leading aluminum producer and the world’s largest aluminum wire rod manufacturer, introduced two innovative products at PowerEdge 2024. The AL59 Ingot is designed for remelting and is known for its superior electrical conductivity. The Electrical Conductor (EC) Grade Wire Rod is developed for winding strip applications, offering a balance of strength, conductivity, workability, and formability. These advancements cater to the growing demand in the power and transmission sectors.

- In August 2024, Vedanta Aluminium announced that the Bureau of Indian Standards (BIS) has certified its 12 mm aluminum wire rods produced at its Bharat Aluminium Company Limited (BALCO) facility in Korba, Chhattisgarh. These wire rods are widely used in power and electrical transmission due to their excellent conductivity, lightweight properties, and high durability. The certification enhances their credibility in the industry and supports the growing infrastructure and energy sector.

- In February 2023, National Aluminium Company Limited (NALCO) increased its aluminum ingot and product prices effective February 23, 2023. This decision followed a series of price reductions since February 7, 2023. The price hike reflects shifts in market demand, raw material costs, and global aluminum price fluctuations. NALCO remains a key player in the aluminum industry, influencing market trends through its pricing strategies.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104