Exploring the Fascinating Profit Potential of Ethanol Manufacturing Plant: A Detailed Cost Model Study

What is Ethanol?

Ethanol is a renewable biofuel produced primarily from crops such as corn, sugarcane, and biomass. It is often added to fuel to lower carbon emissions and improve energy security.

Key Applications Across Industries:

Additionally, ethanol is used in the beverage, chemical, and pharmaceutical sectors. Ethanol is becoming more popular as a cleaner substitute for fossil fuels due to the rising need for sustainable energy solutions, which is propelling improvements in biofuel technology and production efficiency.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the U.S. ethanol market was valued at US$ 36.14 Billion in 2024, growing at a CAGR of 11.3% from 2019 to 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 6.2% from 2025 to 2033, reaching a projected value of US$ 63.17 Billion by 2033. The growing need for biofuels and renewable energy, especially in the transportation industry, is propelling the ethanol market.

Government initiatives that encourage the blending of ethanol with petrol, like the U.S. Renewable Fuel Standard (RFS) and India's E20 target, are important drivers of growth. Ethanol use is further boosted by growing environmental concerns and the need to minimise greenhouse gas emissions. Furthermore, improvements in second-generation bioethanol made from non-food biomass improve the sustainability of production. Because of ethanol's solvent qualities, the chemical and pharmaceutical sectors also contribute to demand. Ethanol is a desirable alternative fuel due to its growing industrial uses and the volatility of crude oil prices. Market expansion is further accelerated by rising investments in global sustainability programs and infrastructure for ethanol production.

Case Study on Cost Model of Ethanol Manufacturing Plant:

Objective

A client had approached us to conduct a feasibility study for establishing a mid to large-scale ethanol manufacturing plant in Iowa (Midwestern United States).

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 100,000,000 gallons of ethanol.

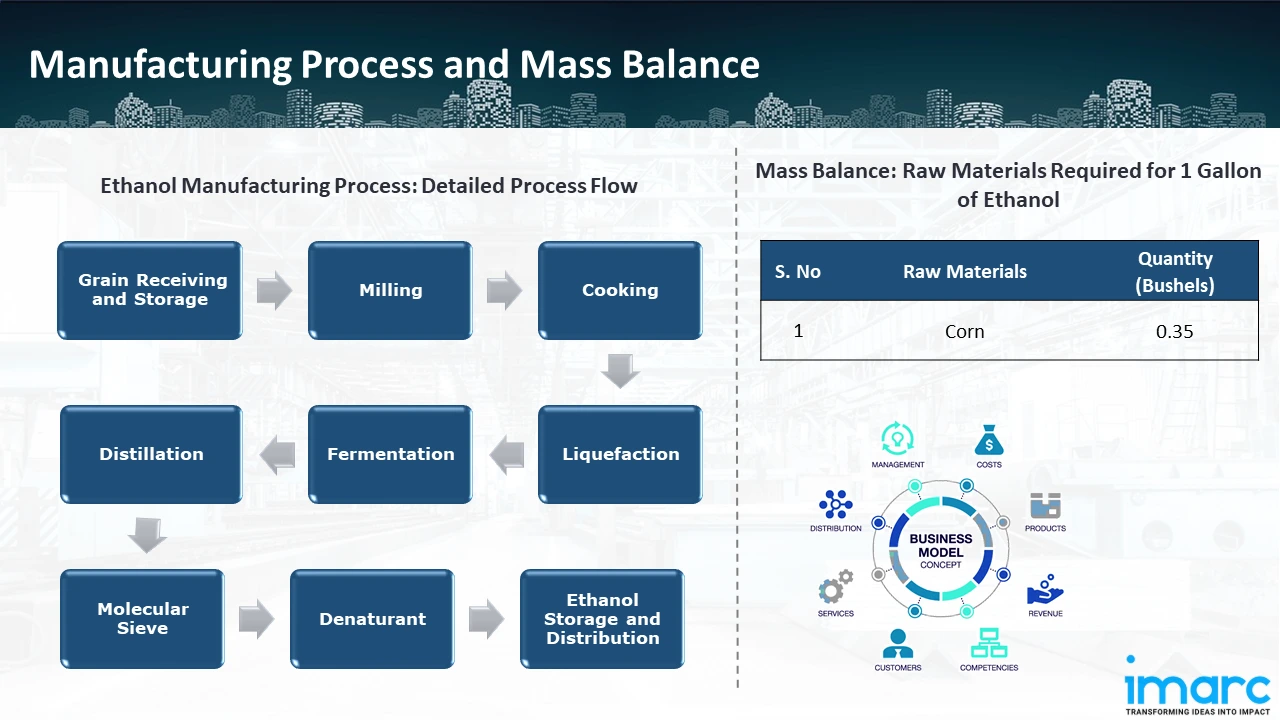

Manufacturing Process: Ethanol production starts with the delivery and storage of corn kernels in silos. After cleaning, the maize is ground into a fine meal to improve starch conversion by increasing its surface area. To gelatinise the starch and make it soluble, water and maize are combined to create a slurry, which is then heated. The starch is broken down into dextrins by the addition of the alpha-amylase enzyme. Then, in a process called saccharification, the glucoamylase enzyme is added to transform dextrins into simple sugars, mainly glucose. After the mash is moved to fermentation tanks, yeast turns the glucose into carbon dioxide and ethanol. When temperatures are ideal, fermentation usually takes 48 to 72 hours. The mash, which is now referred to as "beer," is distilled in a beer column following fermentation, where ethanol is separated by condensation and vaporisation. To achieve a concentration of roughly 95%, the resultant ethanol is further purified in a rectifier column. By drying and centrifuging the stillage, co-products like Dry Distillers Grains with Solubles (DDGS) are recovered, and maize oil is separated for use as a feed ingredient or in the manufacturing of biodiesel. Corn is converted during the process into ethanol, a renewable energy source, along with useful byproducts.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the ethanol manufacturing plant include corn. To produce 1 gallon of ethanol, 0.35 bushels of corn is required as raw material.

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

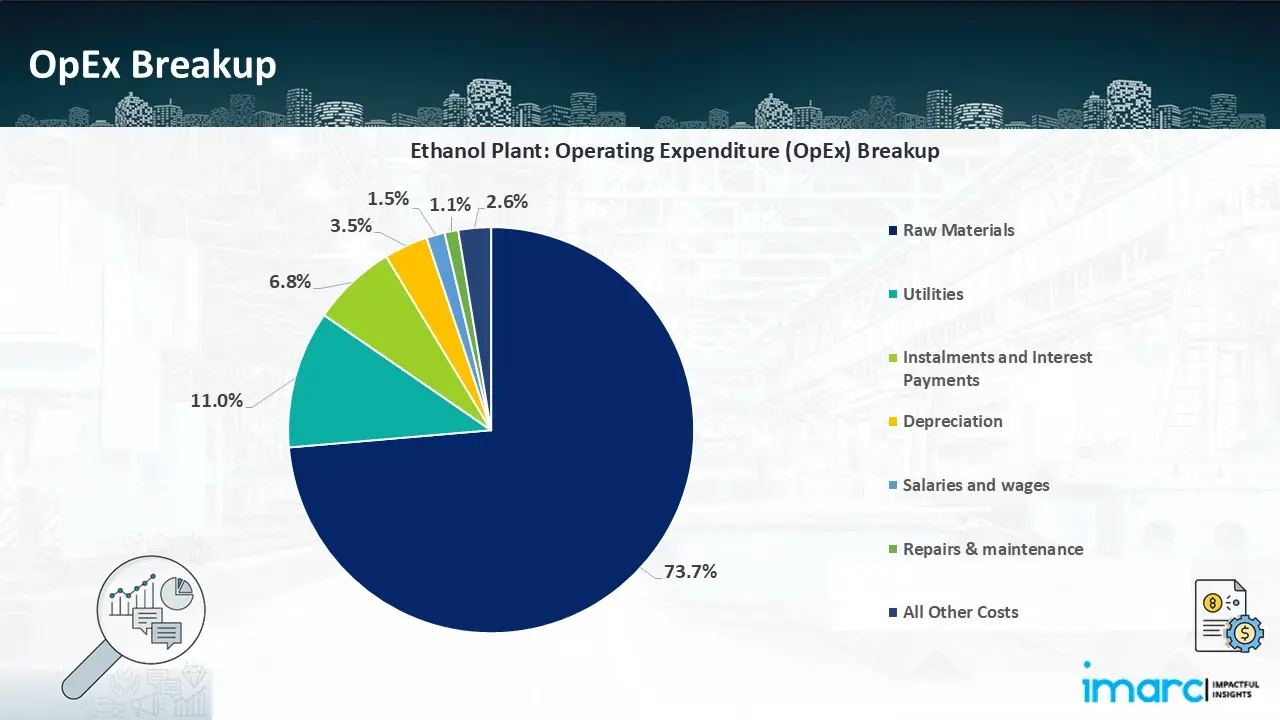

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

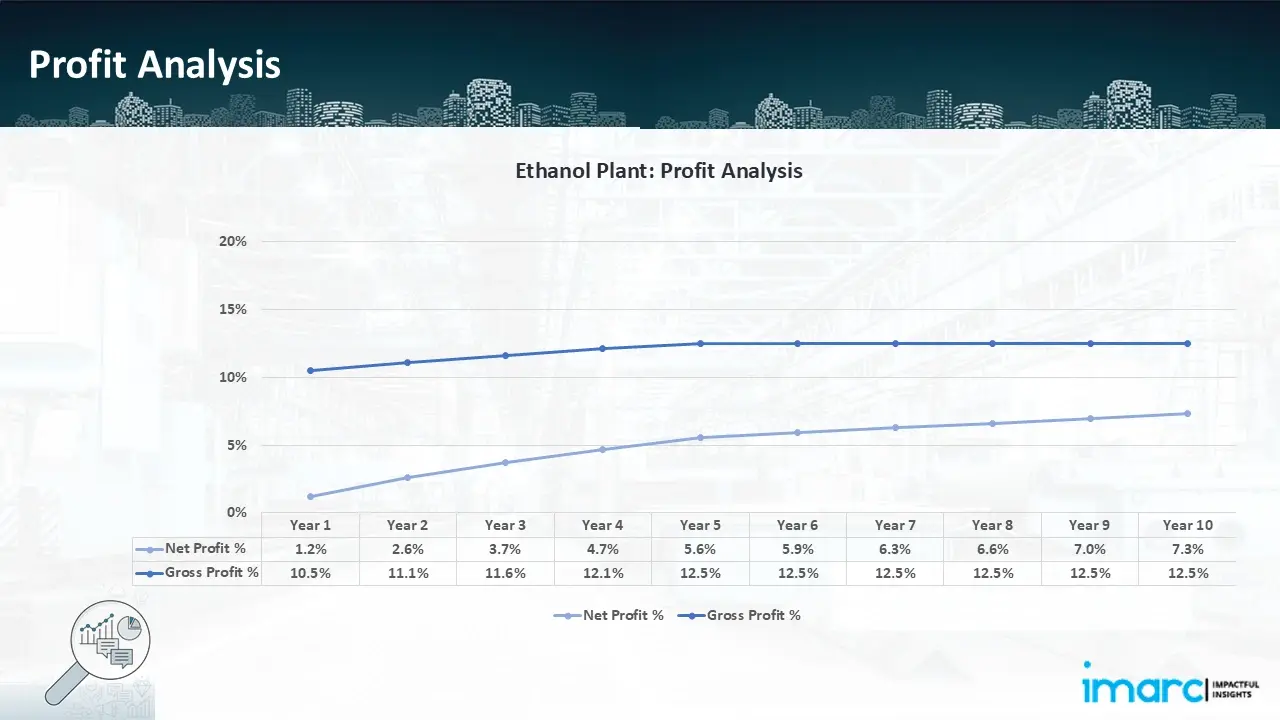

- Profitability Analysis Year on Year Basis: The proposed ethanol plant, with a capacity of 100,000,000 gallons per annum, achieved an impressive revenue of US$ 184.63 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising up to year 5 and staying constant till Year 10. Moreover, gross profit improved from 10.5% to 12.5%, and net profit rose from 1.2% to 7.3%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

We meticulously developed our financial model for the ethanol producing plant to meet the client's objectives. It offered an in-depth examination of production costs, considering capital expenditures, manufacturing procedures, raw materials, and operating expenses. Constructed specifically to meet the demand for producing 100,000,000 gallons of ethanol per year, the model forecasts profitability while taking market trends, inflation, and changes in raw material prices into consideration. This thorough financial model demonstrates our dedication to providing accurate, client-centered solutions that guarantee the long-term success of major industrial projects by providing the client with valuable data for strategic decision-making.

Latest News and Developments:

- In January 2025, the New Ethanol eXpansion Technology (NEXT) program was introduced by RCM Thermal Kinetics, a branch of RCM Technologies, with the goal of increasing the production capacity and efficiency of ethanol facilities without the need for expensive equipment changes. Given the anticipated sharp rise in the world's fuel ethanol consumption, the NEXT program provides a viable way for producers to raise profitability by more than 20% per year for plants that are already in operation.

- In November 2024, Raizen, BP, and Inpasa are negotiating a possible joint venture in the manufacture of ethanol with Petrobras, the state-owned oil giant of Brazil. In order to become a major player in the ethanol industry, Petrobras plans to invest $2.2 Billion in ethanol distilleries over the next five years. This move is in line with that objective.

- In October 2024, KATZEN International, Inc., a bioethanol process technology, design, and engineering firm, announced that the INPASA Agroindustrial S/A bioethanol plant expansion project in Sinop, Mato Grosso, Brazil, was completed and put into operation. The extension increased the plant's annual output capacity to 2.1 Billion litres, making it the largest "dry mill" bioethanol factory in the world based on grains.

- In August 2024, the Brazilian bioenergy company BP Bunge Bioenergia, which is owned by BP Plc (BP.L), plans to invest 530 Million reais ($94.49 Million) to increase the capacity of its Pedro Afonso plant in the state of Tocantins to crush sugarcane. After reaching a deal with Bunge Global SA, BP opened a new tab in June to purchase Bunge's 50% stake in the business.

- In August 2024, the Union government will remove the restriction on sugar diversion for the manufacturing of ethanol on November 1, 2024, enabling the use of cane juice, syrup, and different kinds of molasses. The Food Corporation of India has also made it possible for distilleries to buy up to 2.3 Million metric tonnes of rice for ethanol.

- In January 2024, Cardinal Colwich LLC, which is a completely owned subsidiary of Cardinal Ethanol LLC, finished the acquisition of Element LLC, a 70 MMgy corn ethanol plant situated in Colwich, Kansas that was earlier owned by a joint venture between ICM Inc. and The Andersons Inc.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104