Economic Assessment of EPDM Rubber Manufacturing Plant: A Comprehensive Cost Model

What is EPDM Rubber?

Ethylene propylene diene monomer (EPDM) is an adaptable synthetic rubber with unique performance properties. It is a copolymer of ethylene, propylene, and diene monomers and is manufactured through suspension, solution polymerization, or gas-phase polymerization processes.

Key Applications Across Industries:

It is commonly used in belts, window and door seals, tubing, roofing membrane, non-slip coatings, radiator, drain tubes, and trunk seals. EPDM exhibits various properties, such as excellent aging, heat, chemical, ozone and weathering resistance, electrical insulation, compression set, along with low operating temperatures.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global EPDM rubber market sales volume stood at 2.09 Million Tons in 2024, growing at a CAGR of 3.2% from 2019 to 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 2.9% from 2025 to 2033, reaching a projected volume of 2.75 Million Tons by 2033. Prominent growth in the automotive industry across the globe is creating a positive outlook for the market.

EPDM is used in cable jacketing, suspension bellows, plugs, molded seals, tubing, and air ducts. Additionally, the increasing product utilization in construction and building applications, such as roofing solutions, basements, swimming pools, and podium decks due to their high flexibility and cost-effectiveness, is favouring the market growth. Various product innovations, such as the introduction of bio-based EPDM, which offer temperature flexibility, adhesion to metal, and oil resistance are providing an impetus to the growth of the market. This, in turn, is assisting sectors in reducing carbon footprint, which is acting as another growth-inducing factor. Moreover, the increasing product utilization in heating, ventilation, and air conditioning (HVAC) applications, due to its high electrical insulation and resistance against water and heat, is positively impacting the market growth.

Case Study on Cost Model of EPDM Rubber Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale EPDM rubber manufacturing plant in Saudi Arabia.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 90,000 tons of EPDM rubber per year.

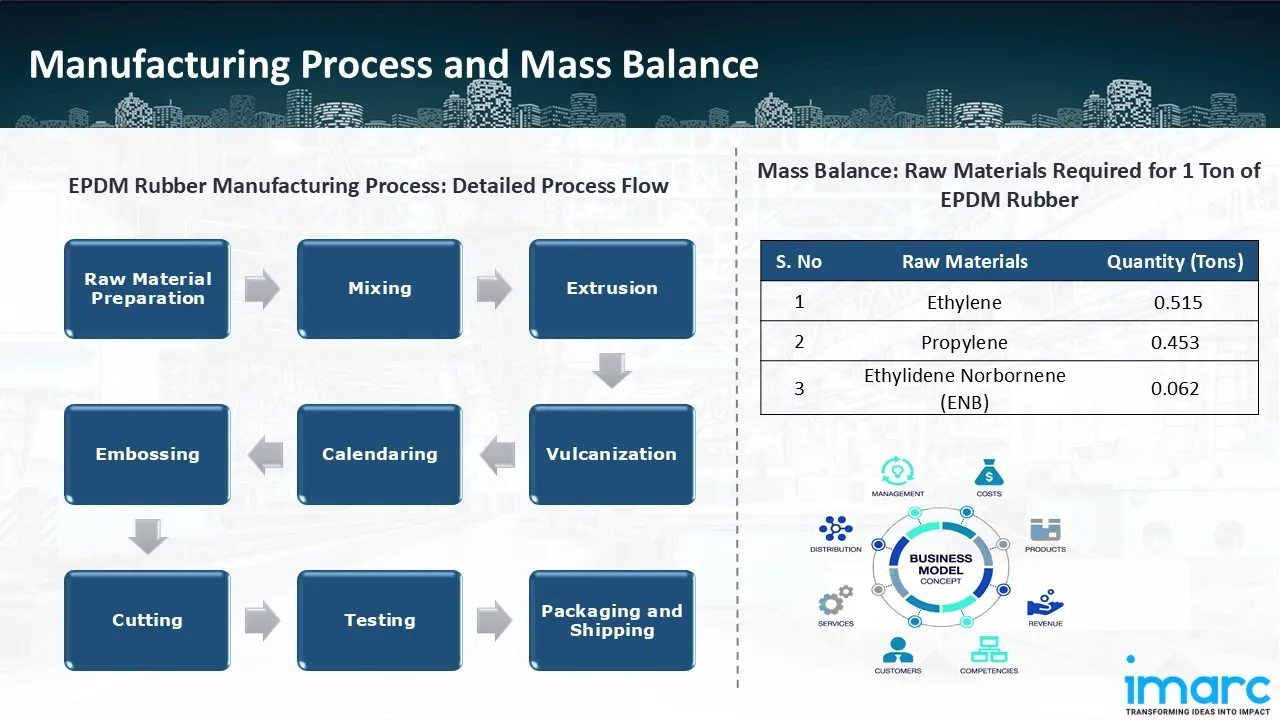

Manufacturing Process: Procurement of Ethylene, propylene, and diene monomers and their preparation for processing is the first step in the creation of EPDM (Ethylene Propylene Diene Monomer) rubber. To obtain the required qualities, these components are then combined with additives such as fillers, plasticisers, and curing agents during the mixing stage. The combined compound is then formed into continuous profiles or sheets via extrusion. After the material has been extruded, it undergoes vulcanisation, a critical process that increases the rubber's strength, flexibility, and durability by causing cross-linking through heat and pressure. After vulcanisation, the rubber is handled via calendaring, which involves rolling it into exact thicknesses, and embossing, which involves applying surface textures or patterns for practical or decorative reasons. The rubber profiles or sheets are then cut to the proper size and put through a thorough testing process to make sure they match industry standards for weather resistance, flexibility, and tensile strength. The final EPDM rubber goods are then packaged and transported for usage in a variety of industries, such as construction, automotive, and industrial applications, because of its exceptional resilience to heat, ozone, and weather.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the EPDM rubber manufacturing plant include ethylene, propylene, and Ethylidene Norbornene (ENB). To produce 1 ton of EPDM rubber, around 0.515 ton of ethylene, 0.453 ton of propylene, and 0.062 ton of Ethylidene Norbornene (ENB).

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

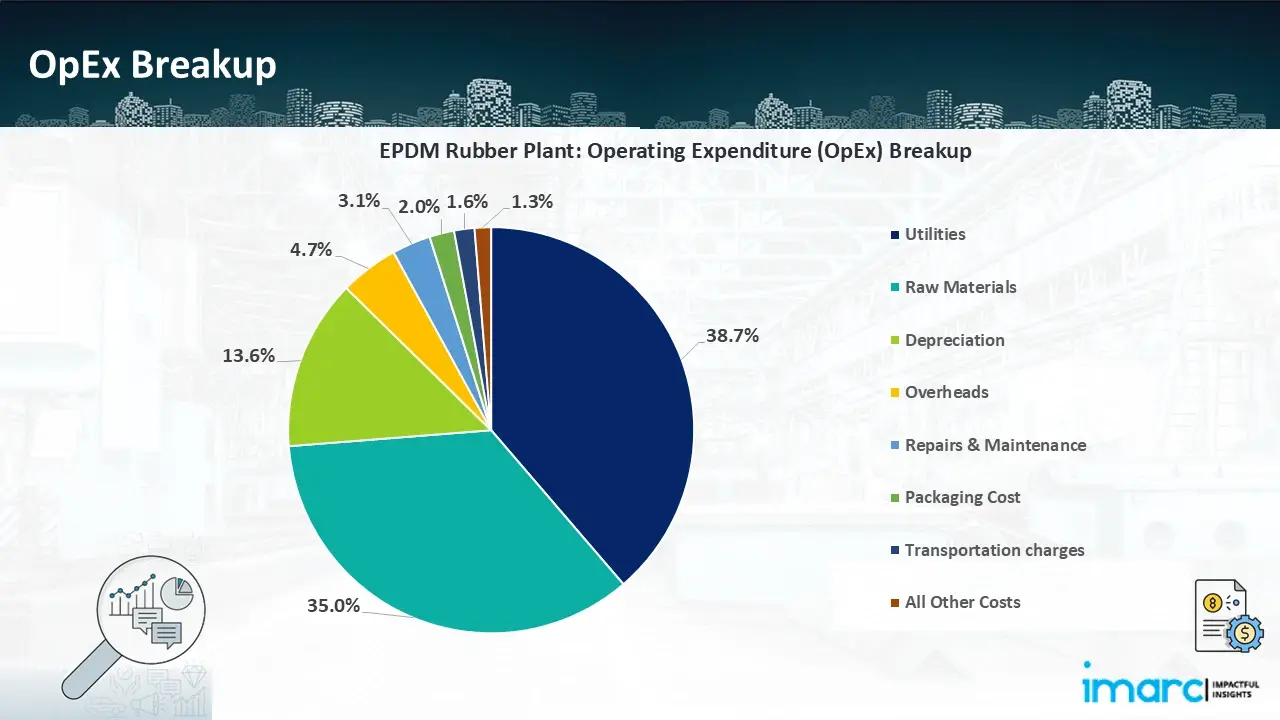

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

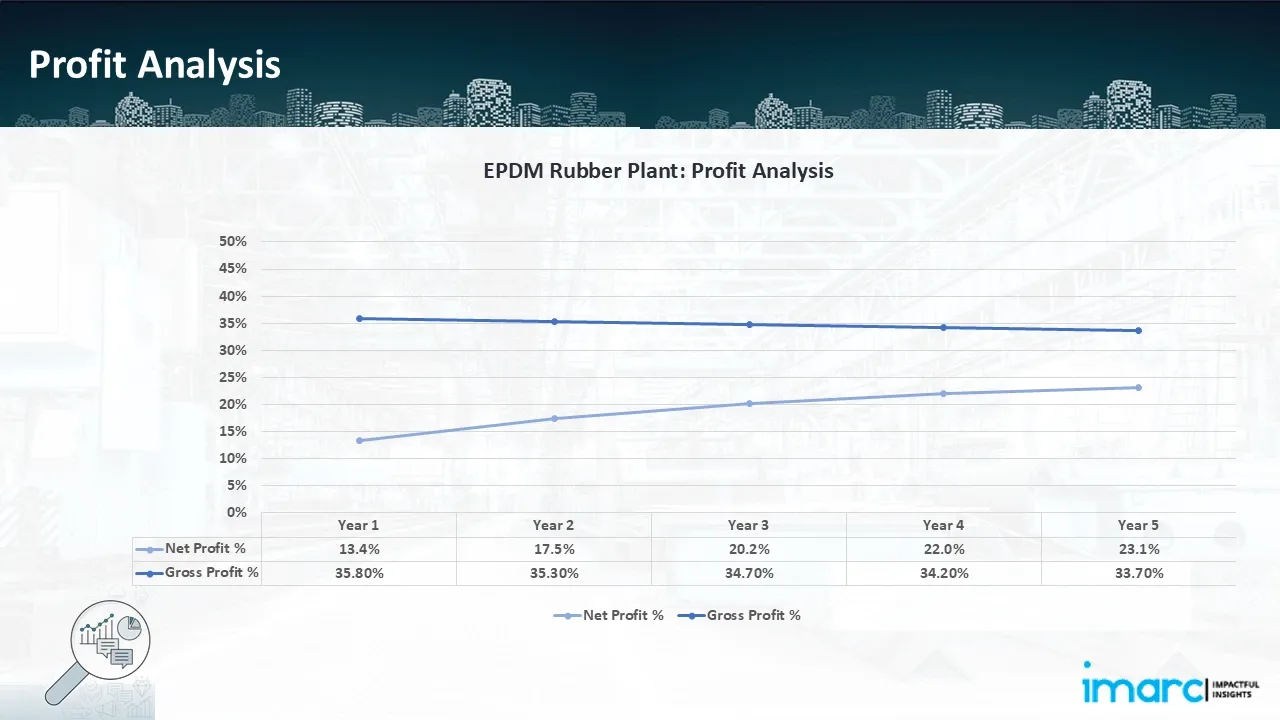

- Profitability Analysis Year on Year Basis: The proposed EPDM Rubber plant, with a capacity of 90,000 tons EPDM Rubber per year, achieved an impressive revenue of US$ 196.5 Million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue reaching US$ 252.7 Million by Year 5. Gross profit margins change from 35.8% to 33.7%, and net profit margins rise from 13.4% to 23.1%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

Our EPDM rubber manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 90,000 tonnes of EPDM rubber annually. Our commitment to offering precise, client-centered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In July 2024, NORDELTM REN Ethylene Propylene Diene Terpolymers (EPDM), a bio-based version of Dow's EPDM rubber material used in consumer, automotive, and infrastructure applications, was introduced by the company at the German Rubber Conference (DKT) 2024.

- In August 2023, Mitsui Chemicals announced plans to expand its EPDM production capacity at its Singapore plant.

- In July 2023, Trelleborg Sealing Solutions launches the H2ProTM line of sealing materials for all hydrogen value chain applications. These materials include a novel thermoplastic polyurethane (TPU) for extremely low temperatures and a new ethylene propylene diene monomer (EPDM) rubber for high-pressure settings over a broad temperature range.

- In March 2022, Arlanxeo announced a 15% increase in the capacity of its Changzhou, China, plant to produce EPDM. The goal of the expansion is to facilitate the production of several grades of Keltan that are utilised in new infrastructure applications including charging heaps, ultra-high voltage systems, and 5G construction.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104