Cost Breakdown and Analysis of Electrolytic Manganese Metal Manufacturing Plant: A Deep-Dive into Manganese Extraction

What is Electrolytic Manganese Metal?

Electrolytic manganese metal is a pure form of the metallic element manganese, Mn concentration ranges from 99.7% to 99.9%. It is termed "electrolytic" because the refining process involves electrolysis.

Key Applications Across Industries:

In other words, a chemical reaction powered by an electric current. Heating the ore and applying chemical processes to remove most impurities is the first steps in the processing of manganese. The metal is then further refined using electrolysis. An electrolytic cell is filled with the material's solution, and a direct electrical current is then run through it.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global electrolytic manganese metal market was valued at US$ 4,623 Million in 2024, growing at a CAGR of 3.7% from 2019 to 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 4.7% from 2025 to 2033, reaching a projected value of US$ 7,037 Million by 2033.

The growing use of electrolytic manganese metal flakes in stainless steel production is fueling the expansion of this segment. The increasing need for stainless steel across diverse sectors like construction and automotive is driving the demand for electrolytic manganese metal flakes. Moreover, electrolytic manganese metal can enhance the strength and toughness of steel. In this context, the growing emphasis of steel producers on creating steel with enhanced strength is further influencing the need for electrolytic manganese metal flakes. In the meantime, the electrolytic manganese metal powder sector is expected to experience significant demand during the forecast period due to its growing use in non-ferrous and steel alloys. It is utilized to enhance the strength and durability of an alloy, which is expected to enhance the use of the product in premium alloys.

Case Study on Cost Model of Electrolytic Manganese Metal Manufacturing Plant:

Objective

A client had approached us to conduct a feasibility study for establishing a mid to large-scale electrolytic manganese metal manufacturing plant in Zambia.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 10,000 tons of electrolytic manganese metal and will cover a land area of 18,000 square meters.

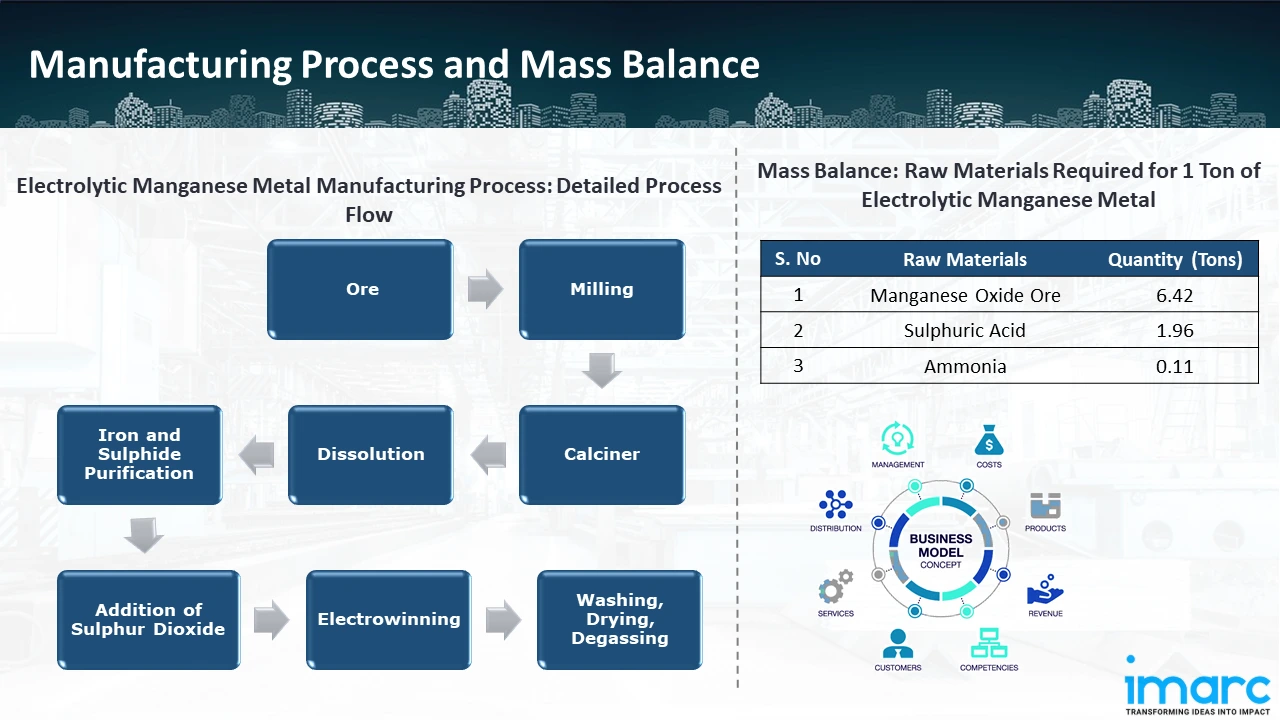

Manufacturing Process: Manganese ore is acquired and processed as the first step in the production of Electrolytic Manganese Metal (EMM). To enhance surface area for subsequent processing, the ore is subsequently crushed and ground into a fine powder. To prepare it for dissolution, the milled ore is moved to a calciner, where it is heated to eliminate moisture and volatile contaminants. A manganese sulphate solution is produced during the dissolution step by leaching the calcined ore with sulphuric acid. Through chemical precipitation, impurities like iron and other undesirable components are eliminated from the solution during the iron and sulphide purification process. Sulphur dioxide is added to manganese to increase its purity, which lowers any remaining impurities and improves the electrolysis solution quality. Pure manganese metal is deposited onto cathodes by an electrowinning process that involves passing an electric current through the electrolyte in the refined manganese sulphate solution. To get rid of any remaining acids and contaminants, the deposited manganese is periodically removed and then cleaned, dried, and degassed. The high-purity manganese metal is then gathered, ground into flakes or powder, and packed for use in manufacturing steel, batteries, and speciality alloys, among other industrial uses.

Mass Balance and Raw Material Required: The primary raw materials utilized in the electrolytic manganese metal manufacturing plant include manganese oxide ore (28% Grade), sulphuric acid (98%) and ammonia. To manufacture 1 Ton of electrolytic manganese metal, 6.42 Tons of Manganese Oxide Ore (28% Grade), 1.96 Tons of Sulphuric Acid (98%) and 0.11 Tons of Ammonia is required as raw materials.

Techno-Commercial Parameter:

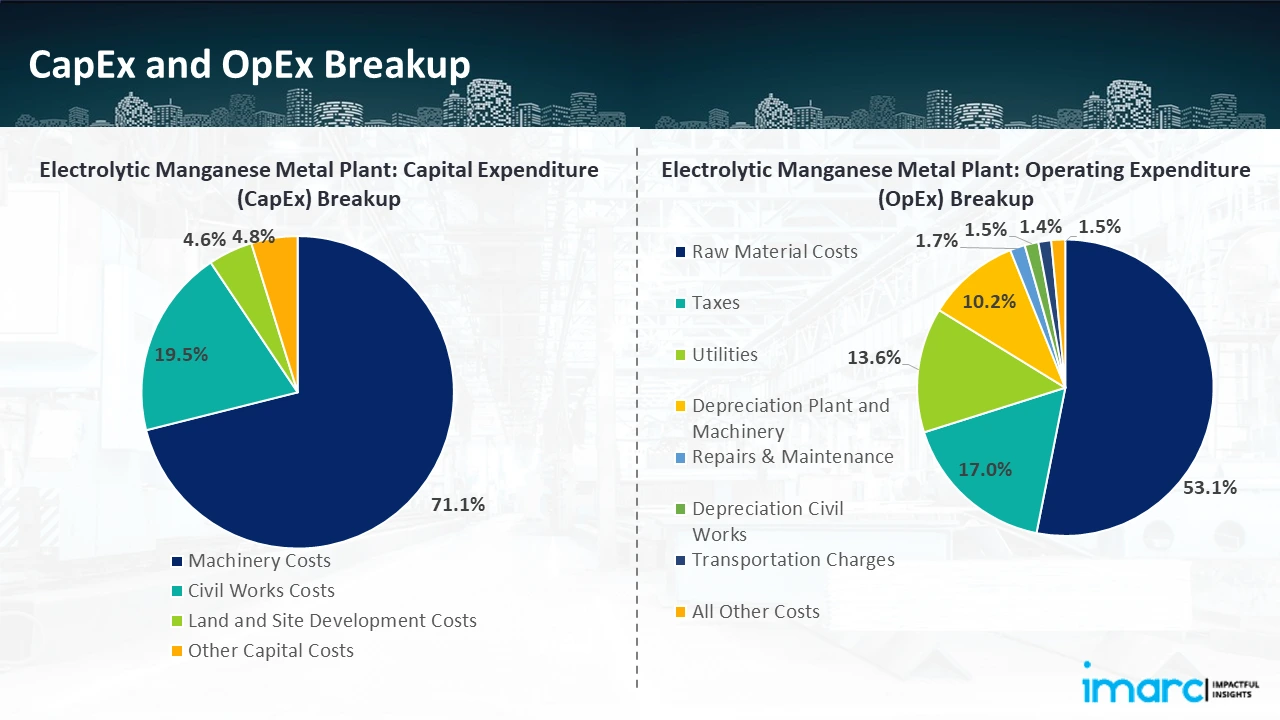

- Capital Investment (CapEx): The total capital cost for establishing the proposed electrolytic manganese metal manufacturing plant is approximately US$ 24.94 Million. Machinery cost account for 71.1% of the total capital cost, while civil works cost are estimated at US$ 4.86 Million. The land and site development cost for an electrolytic manganese metal manufacturing plant constitutes a significant portion of the total capital cost, including the land registration charges, developmental charges of building walls, steel gates, and other development charges. This ensures a strong foundation for safe and efficient plant operations.

- Operating Expenditure (OpEx): In an electrolytic manganese metal manufacturing plant, the operating cost for the first year of operations is projected at US$ 16.61 Million. This estimate includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. By the fifth year of operations, the total operational cost is expected to increase by 28.3% compared to the first year, driven by inflation, market fluctuations, and potential rises in the cost of key materials. Disruptions to the supply chain, rising consumer demand, and shifts in the state of the world economy are some of the factors causing this growth.

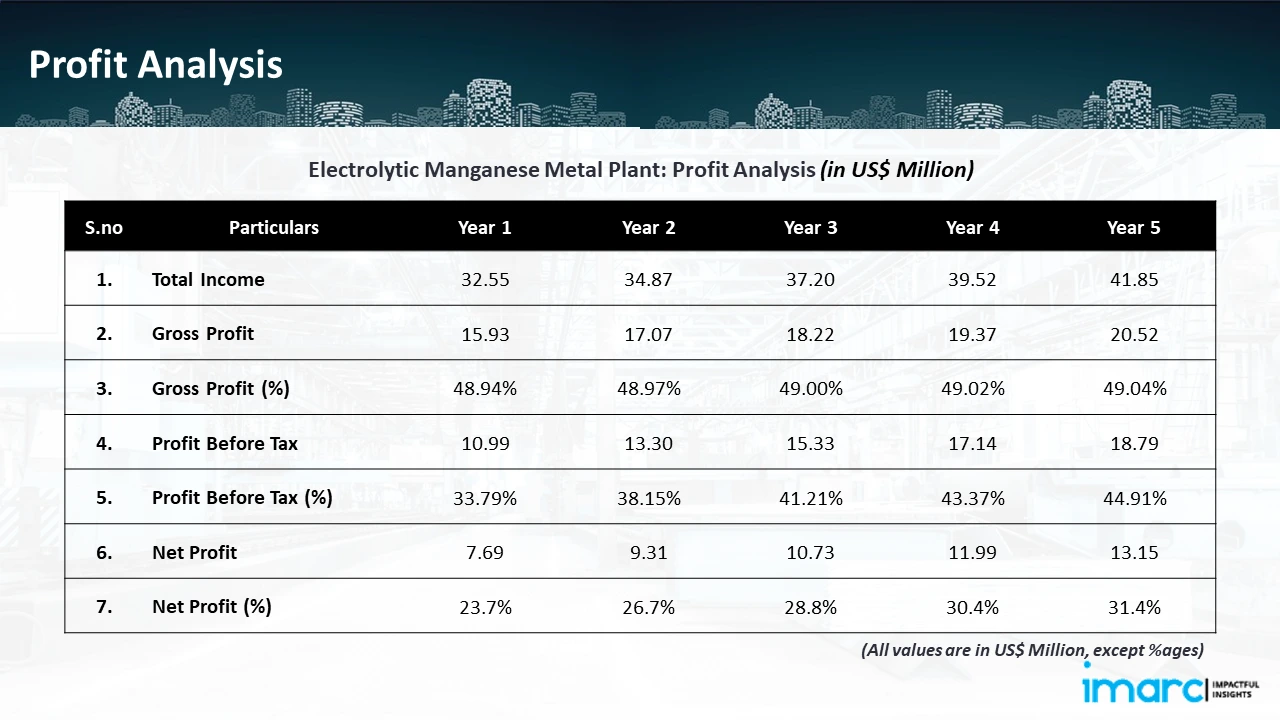

- Profitability Analysis Year on Year Basis: The proposed electrolytic manganese metal plant, with a capacity of 10,000 tons per annum, achieved an impressive revenue of US$ 32.55 Million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue reaching US$ 41.85 Million by Year 5. Gross profit margins improve from 48.9% to 49.0%, and net profit margins rise from 23.7% to 31.4%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

We carefully crafted our financial model for the electrolytic manganese metal production facility to satisfy the client's needs. Including capital expenditures, manufacturing processes, raw materials, and operating costs, it provided a thorough analysis of production costs. Specifically created to fulfil the need for producing 10,000 tonnes of electrolytic manganese metal annually, the model predicts profitability while accounting for inflation, market trends, and any shifts in the price of raw materials. Our commitment to offering precise, client-centered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In January 2025, MOIL Ltd., a state-owned manganese ore mining company in India, increased the pricing of all ferro grades of manganese ore with a Mn concentration of 44% and higher by 1% over the previous rates, with effect from January 1st, 2025.

- In November 2024, Euro Manganese Inc. announced that the on-site Demonstration Plant at the company's Chvaletice Manganese Project in the Czech Republic has successfully finished a 5-day continuous operation program for the manufacture of high-purity electrolytic manganese metal.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104