Advancing Sustainability in Battery Electrolytes: A Comprehensive Cost Analysis

_11zon.webp)

What is Battery Electrolytes?

Battery electrolyte is a key element of energy storage, facilitating the flow of ions between electrodes to drive devices effectively.

Key Applications Across Industries:

It is an important factor in lithium-ion, solid-state, and future batteries, influencing performance, safety, and durability. In electric vehicles, renewable energy storage systems, and consumer devices, development in electrolyte technology targets sustainability, improved conductivity, and heat resistance for unlocking the future of clean energy technologies.

What the Expert Says: Market Overview & Growth Drivers

As per an IMARC report, the market size of global battery electrolytes market reached USD 10.7 Billion in 2024 at a CAGR of 7.65% during the period 2019-2024. Going forward, the market is forecasted to increase at a CAGR of about 6.05% from 2025 to 2033 and reach an estimated value of USD 18.6 Billion in 2033.

The growth in the market is fueled by battery electrolyte's vital role in energy storage as well as its varied uses. Major drivers of this growth are its application in lithium-ion batteries for electric vehicles, growing demand in renewable energy storage systems, and its role in consumer electronics. Continuous technological innovations and R&D activities have resulted in high-performance and safer electrolyte formulations. Growing demand for sustainable, high-energy-density solutions and the growth of EV and energy storage markets further drive growth.

Case Study on Cost Model of Battery Electrolyte Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale battery electrolyte manufacturing plant in Hungary.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a comprehensive financial model for the plant's setup and operations. The proposed facility is designed with a production capacity of 67 tons per day.

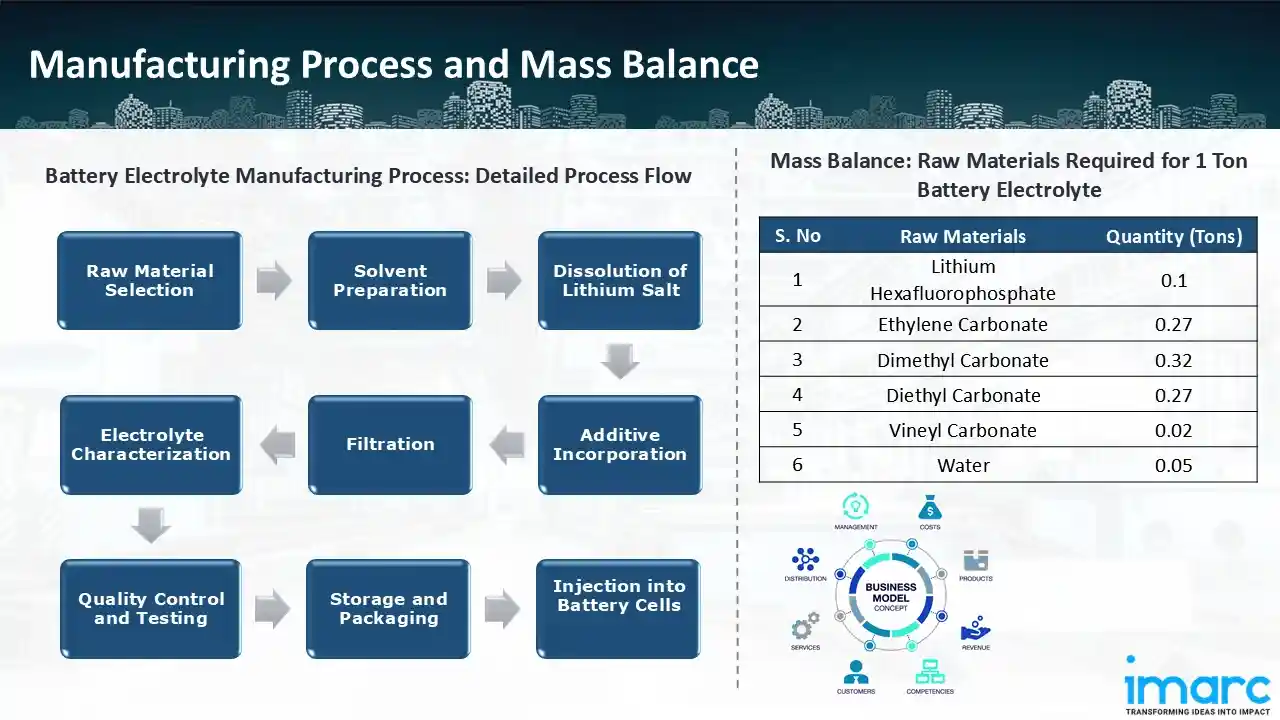

Manufacturing Process: The production process of battery electrolytes starts with raw material selection, in which lithium salts (e.g., LiPF6, LiBF4) are selected for conductivity and organic solvents (e.g., EC, DMC, DEC) as a stable medium. Additives such as VC are used to improve performance and safety. Solvent preparation is the second step, in which solvents are purified by removing impurities and moisture to ensure stability. In dissolution, the lithium salt is accurately weighed and blended with solvents under controlled conditions to ensure total dissolution. Additive incorporation follows, where performance-enhancing compounds are added to enhance thermal stability and avoid degradation. The electrolyte solution is then filtered to eliminate undissolved particles or impurities, improving purity and safety. Characterization of the electrolyte comes next, in which properties such as ion conductivity, viscosity, and thermal stability are subjected to testing to industry standards. Intensive quality control and testing guarantee consistency and compliance with regulatory standards. Once quality inspected, the electrolyte is packaged to store in moisture-free containers to minimize degradation. Lastly, in injection into battery cells, the electrolyte is injected slowly into assembled cells in a clean room environment for maximum ion flow between electrodes and improved battery performance, safety, and lifespan.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the battery electrolyte manufacturing plant include lithium hexafluorophosphate, ethylene carbonate, dimethyl carbonate, diethyl carbonate and vineyl carbonate. To produce 1 ton of battery electrolyte, we require lithium hexafluorophosphate (0.1 ton), ethylene carbonate (0.27 ton), dimethyl carbonate (0.32 ton), diethyl carbonate (0.27 ton), vineyl carbonate (0.02 ton), and water (0.05 ton).

List of Machinery:

The following equipment was required for the proposed plant:

- High Water Tanks

- Low Water Tanks

- Gauge Tanks

- Ultra Filter

- Microporous Membrane Filter

- Purification of Water Unit

- Magnetic Drive Pumps

- Measurement Tank Control Cabinet

- Control Cabinet

- Explosion-Proof Electric Control Box

- Positive Pressure Explosion-Proof Cabinet

- Explosion-Proof Operation Box

- Pipes, Flanges, Screws, and Gaskets

- Pipe Valve Accessories

- Pipeline Insulation

- Pipeline and Electrical Appliance Installation Consumables

- Hot Water Circulation System

- Nitrogen System

- Vacuum Unit System

- Air Compressor System

- Gas Chromatograph

- Conductivity Meter

- Density Instrument

- Dew Point Instrument

- Water Part Instrument

- Lift Platform

- Electric Hoist

- Hydraulic Truck

- Platform Scales

- Water Chilling Unit BS-580WSEF

- Water Chilling Unit BS-710WSET

- Water Chilling Unit BS-260WSE

- Water Chilling Unit BS-100WSE

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

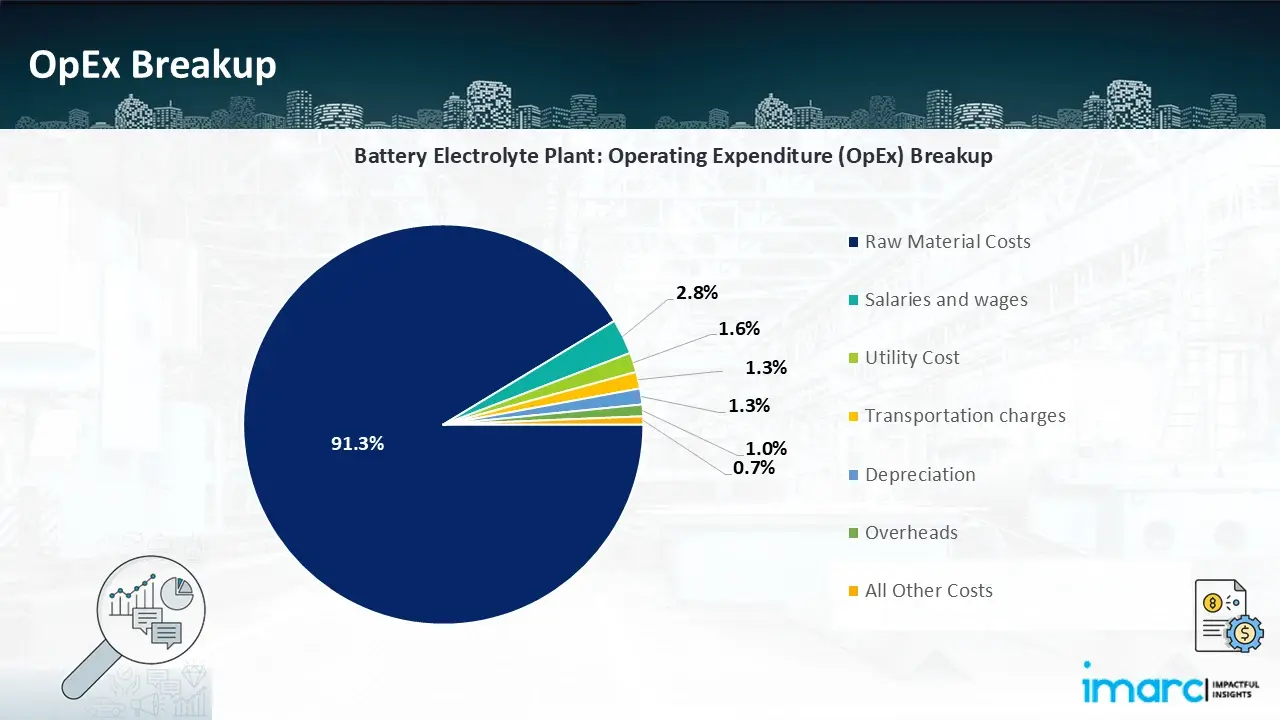

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

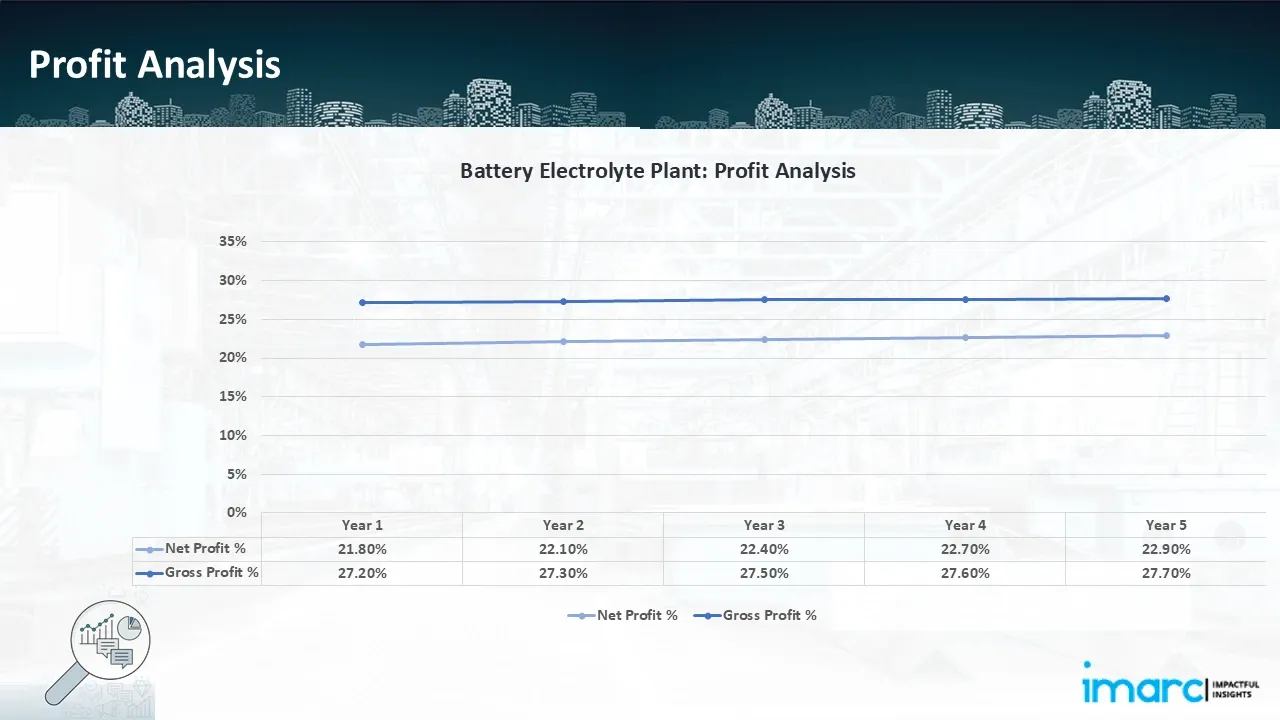

- Profitability Analysis Year on Year Basis: The proposed battery electrolyte plant, with a capacity of 67 tons per day, achieved an impressive revenue of US$ 43.3 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the years. Gross profit margin improved from 27.2% to 27.7% throughout the years, and net profit went up from 21.8% to 22.9%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the battery electrolyte manufacturing plant was meticulously designed to meet the client’s objectives. It provided a thorough analysis of production costs, including raw materials, manufacturing processes, capital expenditure, and operational expenses. Tailored to the specific requirement of producing 67 tons of battery electrolyte per day, the model highlights key cost drivers and forecasts profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model offers the client valuable insights for strategic decision-making, demonstrating our commitment to delivering precise, client-focused solutions that ensure the long-term success of large-scale manufacturing projects.

Latest News and Developments:

- In February 2025, Dongwha Enterprise subsidiary Dongwha Electrolyte has finished its first U.S. electrolyte manufacturing plant in Tennessee. The 86,000 tons-per-year capacity facility can provide material to cover 2 Million EVs. Strategically situated near key battery and auto firms, the plant further reinforces the company's worldwide presence, doubling its total capacity to 160,000 tons in Korea, China, Malaysia, and Hungary.

- In June 2024, Japanese tech firm Asahi Kasei was able to show proof of concept (POC) for lithium-ion batteries (LIBs) with its own high-ionic conductive electrolyte. This innovation will boost power at low temperatures and enhance endurance at high temperatures—two of the main issues with existing LIBs. The technology also promotes cost savings and smaller battery packs, ultimately making energy density higher.

- In January 2024, Australian Vanadium (AVL) opened its new factory for producing vanadium flow battery electrolyte in Wangara, Western Australia. The factory has been planned to produce high-purity vanadium pentoxide that will be converted to vanadium electrolyte. Though the initial capacity of production has not been revealed, AVL wants to increase production capacity to 33MWh per year.

- In October 2023, Idemitsu Kosan Co., Ltd. and Toyota Motor Corporation announced a joint project to create mass production technology for solid electrolytes, increase productivity, and form a supply chain for all-solid-state batteries. The joint venture is to accelerate the commercialization of the new-generation batteries for battery electric vehicles (BEVs) with efficient production and a stable supply.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104