Evaluating the Production Cost of N-Methyl Aniline: A Detailed Cost Model Approach

What is N-Methyl Aniline?

N-Methyl Aniline (NMA) is an organic chemical compound widely used as an intermediate in various industrial applications.

Key Applications Across Industries:

It plays a crucial role in the production of dyes, agrochemicals, pharmaceuticals and fuel additives. As a key component in high-octane fuel formulations NMA enhances combustion efficiency and reduces engine knocking making it valuable in the automotive and petroleum industries. Its use in the synthesis of specialty chemicals and pigments further expands its industrial significance. With its chemical stability, versatile reactivity and widespread applicability N-Methyl Aniline remains an essential material in multiple sectors including chemicals, energy and manufacturing.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global N-methyl aniline market reached a volume of 1,594.1 Thousand Tons in 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 3.9% from 2025 to 2033, reaching a projected volume of 2,254.4 Thousand Tons by 2033.

The global N-Methyl Aniline (NMA) market is driven by diverse factors including its crucial role in fuel additives, agrochemicals and dye intermediates. The increasing demand for high-performance fuels in the automotive and aviation industries has significantly contributed to NMA’s market growth as it enhances octane ratings and improves combustion efficiency. Additionally, its use in the production of pesticides and herbicides supports the expanding agricultural sector particularly in Asia-Pacific and Latin America. The growing textile and chemical industries also drive demand with NMA serving as a key precursor in dye and pigment manufacturing. Furthermore, advancements in sustainable manufacturing processes and stringent environmental regulations are influencing market trends pushing for cleaner production methods. With its widespread applications across multiple industries N-Methyl Aniline remains a vital chemical in addressing the evolving needs of fuel technology, agriculture and specialty chemicals on a global scale.

Case Study on Cost Model of N-Methyl Aniline Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale N-methyl aniline manufacturing plant in India.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with a production capacity of 40 tons (Phase I), and 60 tons (Phase II) of N-methyl aniline per day.

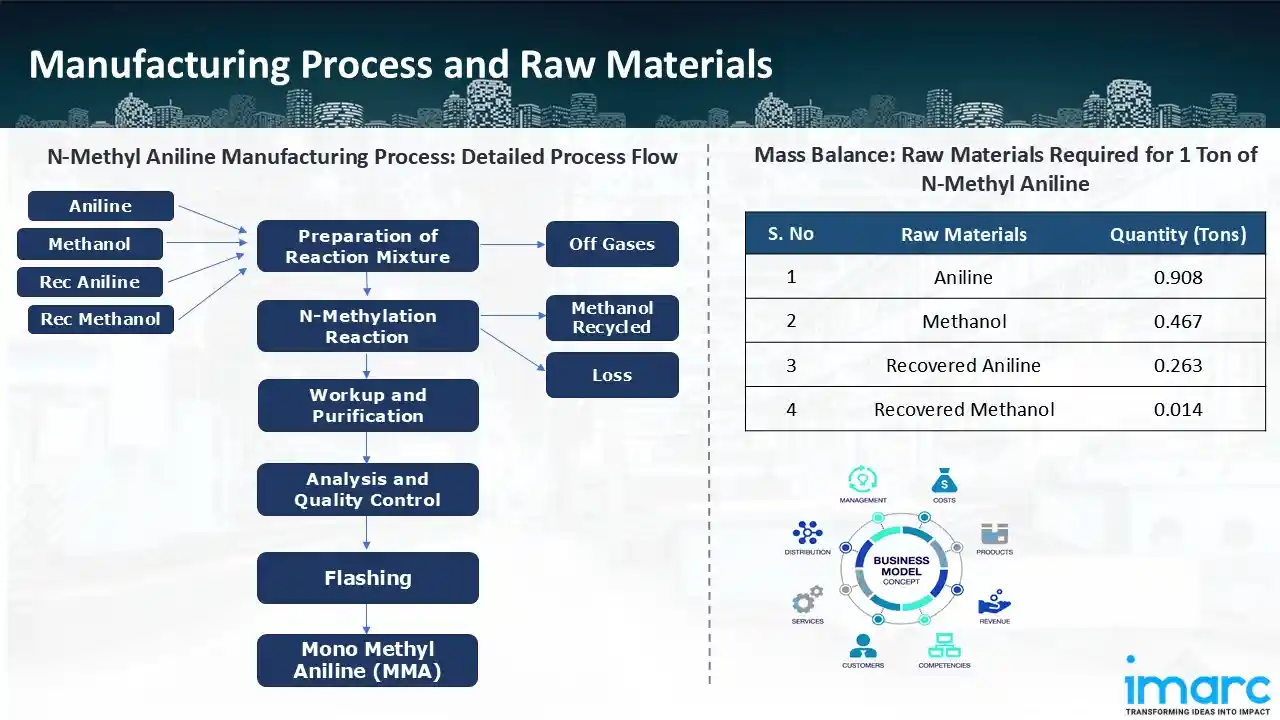

Manufacturing Process: The production of N-Methyl Aniline (MMA) begins with mixing aniline and methanol in a 7:3 ratio. A strong acid catalyst, such as HCl or H2SO4, is used to facilitate the N-methylation reaction. The mixture is preheated and fed into a reactor, where protonation of aniline occurs, enhancing its reactivity. Methanol donates a methyl group to form N-methyl aniline, with water as a by-product. Post-reaction, quenching neutralizes excess acid, followed by phase separation. The organic layer undergoes solvent extraction, washing, and drying. Purification includes distillation or vacuum distillation to remove residual methanol and impurities. In the flashing column, high-purity MMA (99%) is separated, while high-boiling residues are removed. The final product is blended per market specifications, such as MMA with 98.5% purity or mixed with xylene. Quality control ensures compliance with industry standards.

Mass Balance and Raw Material Required: The primary raw materials utilized in the N-methyl aniline manufacturing plant include aniline, methanol, recovered aniline and recovered methanol. To produce 1 ton of N-methyl aniline, we require 0.908 tons aniline, 0.467 tons methanol, 0.263 tons recovered aniline, and 0.014 tons recovered methanol.

Get a Tailored Feasibility Report for Your Project Request Sample

List of Machinery:

The following equipment was required for the proposed plant:

- Continuous Stirred-Tank Reactors (CSTRs)

- Fractional Distillation Column

- Shell And Tube Condensers

- Shell And Tube Heat Exchangers

- Centrifugal Pumps

- Vertical Storage Tanks

- Filtration Equipment (Bag or Cartridge Filters)

- Reciprocating Or Centrifugal Compressors

- Control Systems: PLC (Programmable Logic Controller)

- Instruments: Flow Meters, Pressure Gauges, Temperature Sensors, Level Indicators, Etc.

- Safety Equipment: Safety Showers, Eyewash Stations, Fire Suppression Systems, Etc.

- Cooling Water System, Steam Generation System, Utilities For Heating, Etc.

- Ancillary Equipment: Piping, Valves, Fittings, Etc.

- Drying Equipment (Rotary Dryer or Other Suitable Drying Equipment)

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

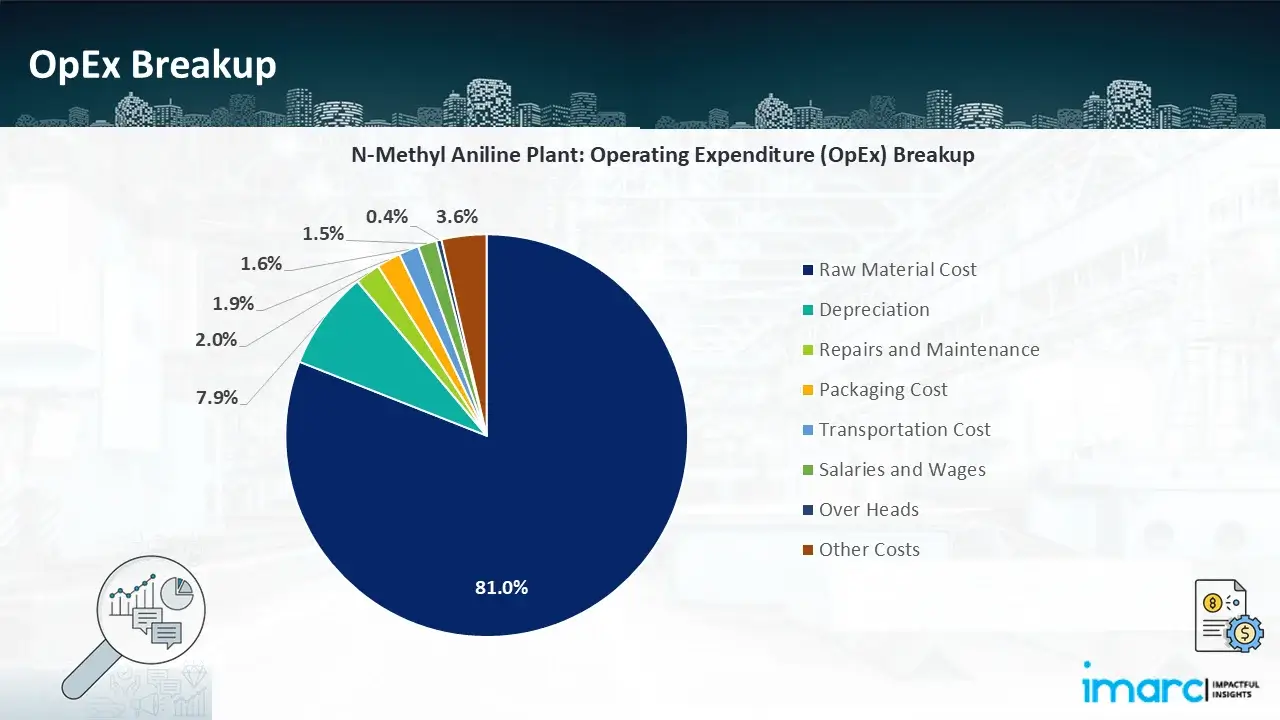

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

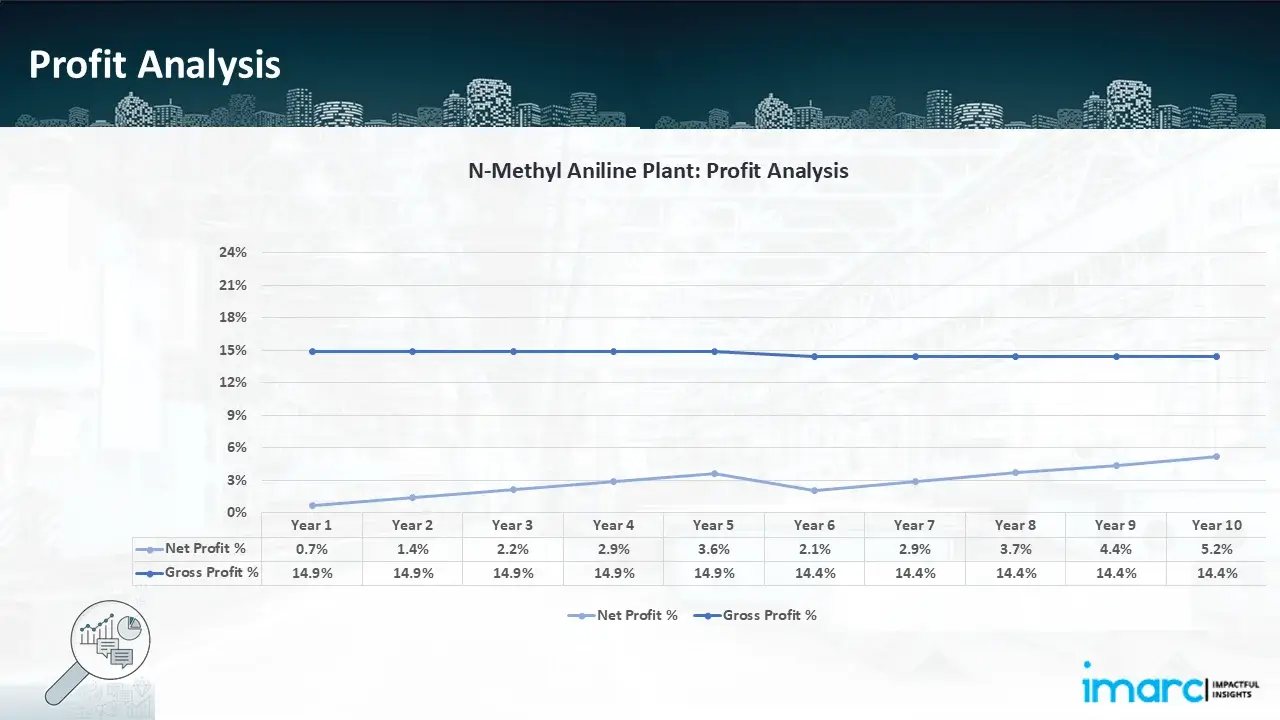

- Profitability Analysis Year on Year Basis: The proposed N-methyl aniline plant, with a capacity of 40 tons (Phase I), and 60 tons (Phase II) of N-methyl aniline per day, achieved an impressive revenue of USD 24.3 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the years. Gross profit margin reduced from 14.9% in year 1 to 14.4% in year 10, and net profit went up from 0.7% to 5.2%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our N-methyl aniline manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 40 tons (Phase I), and 60 tons (Phase II) of N-methyl aniline per day. Our commitment to offering precise, client-cantered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In November 2024, the European Chemicals Agency (ECHA) initiated regulatory reviews on aromatic amines, including NMA, due to environmental and health concerns. Potential restrictions could impact its usage in fuel additives, dyes, and coatings, prompting industry players to explore alternative formulations.

- In May 2023, Sinochem Corporation reported that the project to increase capacity at its aniline production facility in Taiyuan, Shanxi Province, was completed, increasing its yearly production by 100,000 tons.

- In August 2023, Sinochem Corporation introduced a new environment-friendly aniline production method at its plant in Quanzhou, Fujian Province, leading to a decrease in water usage and enhanced energy efficiency.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104