Economic Insights into Sodium Cyanide Manufacturing: A Cost Model Approach

What is Sodium Cyanide?

Sodium cyanide (NaCN) is a highly toxic, colorless crystalline compound with a faint almond-like odor.

Key Applications Across Industries:

It is a water-soluble salt composed of sodium (Na+) and cyanide (CN-) ions, known for its versatile applications across various industrial sectors. Despite its hazardous nature, sodium cyanide is extensively used due to its unique properties and efficacy in specific processes. It exhibits several key properties, including high solubility in water, a melting point of 563.7°C, and a density of 1.595 g/cm³.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global sodium cyanide market was valued at US$ 2,844 Million in 2024, growing at a CAGR of 3.0% from 2019 to 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 7.7% from 2025 to 2033, reaching a projected value of US$ 4,357 Million by 2033. The sodium cyanide market finds its driving factor in the substantial use of sodium cyanide for gold and silver mining, for which it forms a critical extractive process of cyanidation.

The overall demand for gold in investments, jewelry, and other industrial applications has increased the sodium cyanide usage to a great extent. Its role in chemical synthesis for the pharmaceutical, dyes, and agrochemical products is another strong market driver for sodium cyanide. Rising industrialization in developing countries and increasing mining activities worldwide further propel demand. Cost-effectiveness compared to alternatives and technological advancements in production methods enhance its market penetration. However, stringent environmental regulations on cyanide usage may slightly offset this growth.

Case Study on Cost Model of Sodium Cyanide Manufacturing Plant:

Objective

A client had approached us to conduct a feasibility study for establishing a mid to large-scale sodium cyanide manufacturing plant in the South of Iran.

IMARC Approach: Comprehensive Financial Feasibility

We then developed an elaborate financial model for the plant's setup and operations. The proposed facility is designed with a production capacity of 12 tons of sodium cyanide per day.

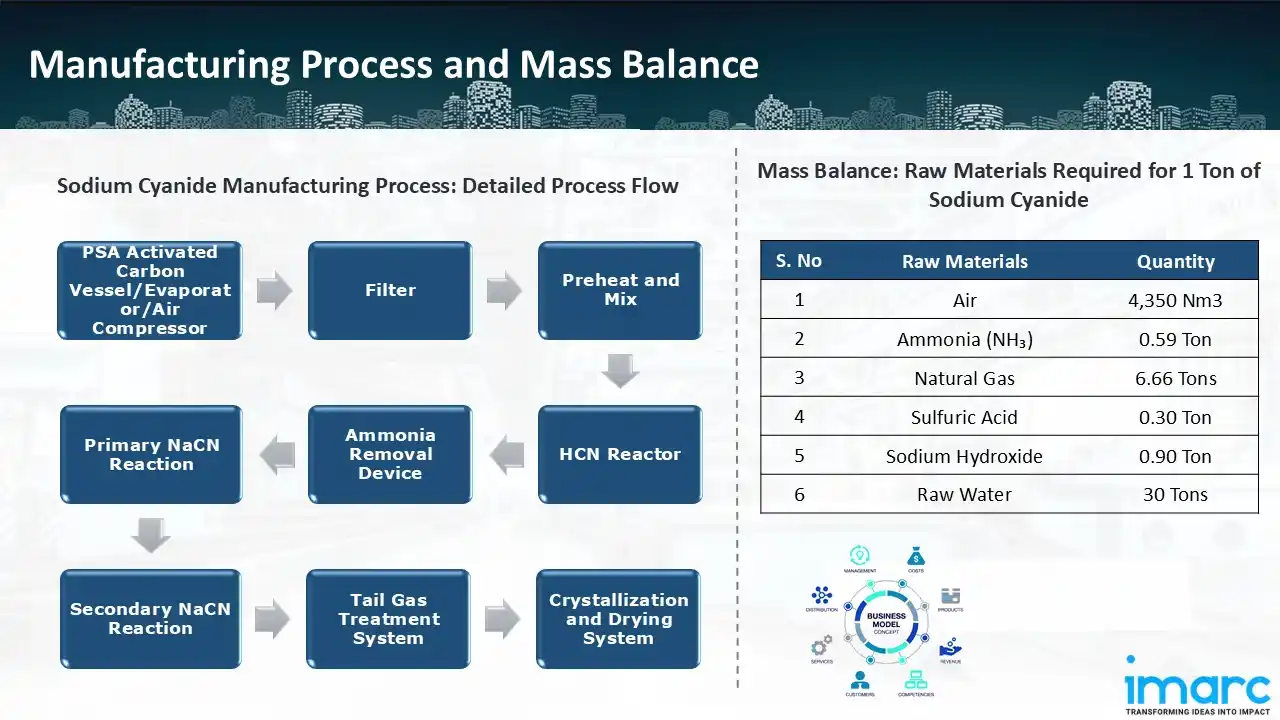

Manufacturing Process: Sodium cyanide is manufactured using a number of exacting procedures to guarantee effectiveness and security. Initially, raw materials like ammonia and natural gas are treated in an evaporator or vessel using PSA-activated carbon and an air compressor to eliminate contaminants. To produce the necessary feedstock, the purified gas is filtered, heated, and combined. A hydrogen cyanide (HCN) reactor is then filled with this feedstock, and ammonia, methane, and air react to produce HCN. After that, the intermediate product is purified by removing ammonia from the HCN. When HCN and sodium hydroxide combine, NaCN is produced, starting the primary sodium cyanide (NaCN) reaction. A secondary reaction maximises yield by guaranteeing the full conversion of intermediates. In accordance with environmental safety regulations, the tail gas treatment system eliminates and neutralises hazardous wastes. After entering the crystallisation and drying system, the sodium cyanide solution is converted into solid crystals or granules. Lastly, controlled packaging is used to distribute the dry sodium cyanide. High levels of precision and stringent oversight are hallmarks of this method, which guarantees both environmental compliance and product quality.

Mass Balance and Raw Material Required: The primary raw materials utilized in the sodium cyanide manufacturing plant include air, ammonia (NH3), natural gas, sulfuric acid, sodium hydroxide (NaOH), and raw water. To manufacture 1 tons of sodium cyanide, the raw materials requirements are as follows: 4,350 Nm3 of Air, 0.59 tons of Ammonia (NH3), 6.66 tons of Natural Gas, 0.30 tons of Sulfuric Acid, 0.90 tons of Sodium Hydroxide (NaOH), and 30 tons of Raw Water.

List of Machinery

The following equipment was required for the proposed plant:

- HCN Reactor (321/CS)

- Primary/Secondary Deammonia Reactor (316L)

- Three-Stage Deammonia Reactor (316L)

- Primary/Secondary Mixed Reactor (316L)

- Raw Gas Mix (316L)

- High Efficiency Gas-Liquid Separator (316L)

- High Efficiency Gas-Liquid Separator (316L)

- Primary/Secondary/Tertiary Heat Exchanger (316L/CS)

- Primary/Secondary Heat Exchanger (316L/CS)

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

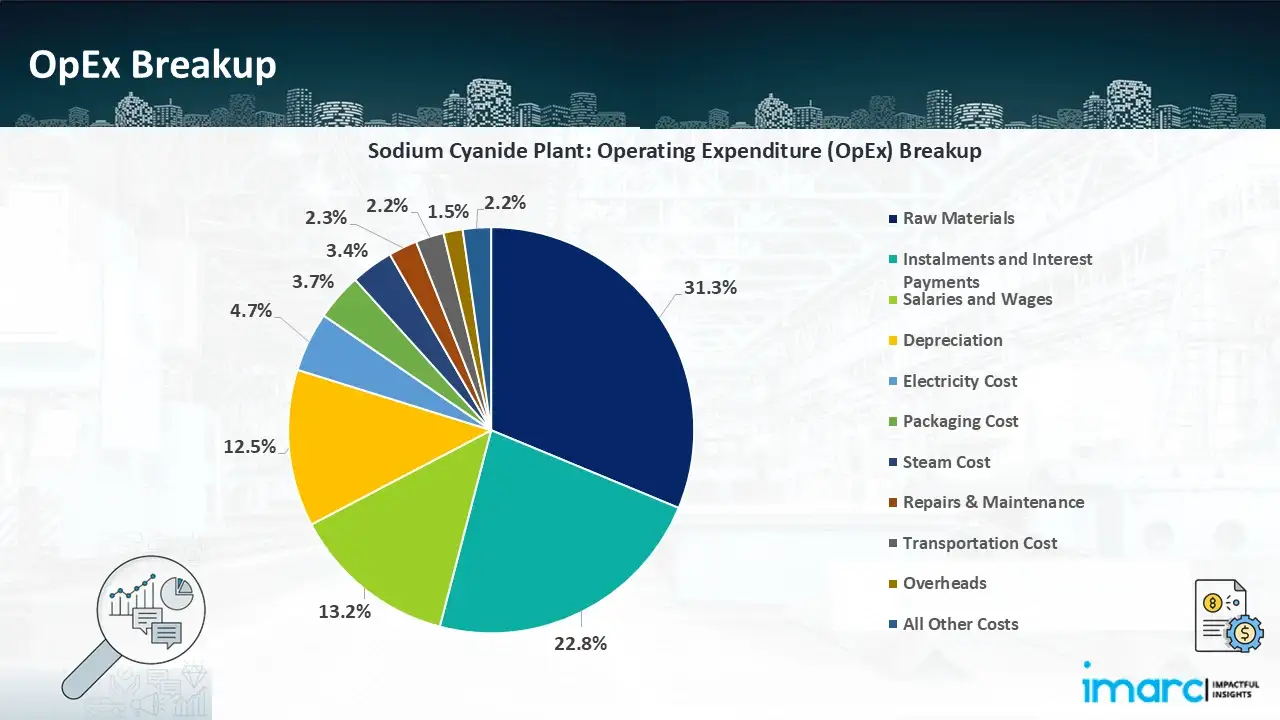

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

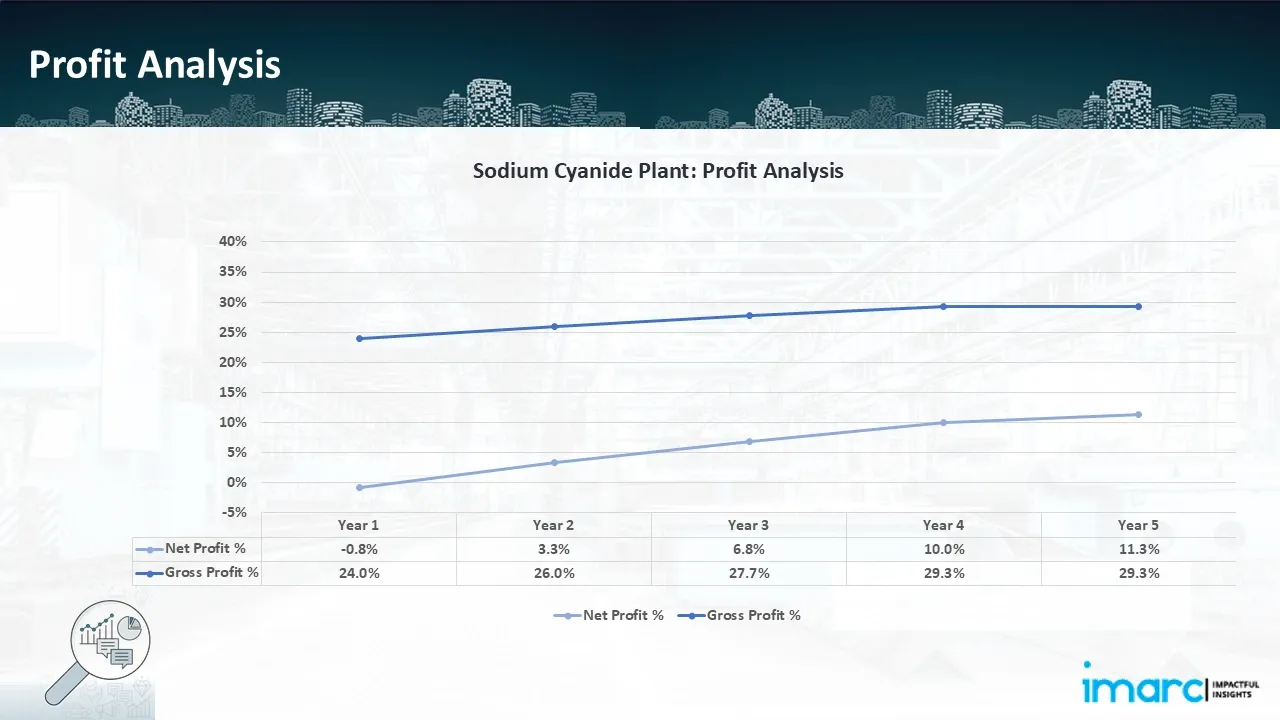

- Profitability Analysis Year on Year Basis: The proposed sodium cyanide plant, with a capacity of 12 tons of sodium cyanide per day, achieved an impressive revenue of US$ 8.75 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit improved from 24.0% to 29.3%, and net earnings rise from a negative 0.8% to a positive 11.3%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

Our financial model for the sodium cyanide manufacturing plant was meticulously designed to meet the client’s objectives. It provided a thorough analysis of production costs, including raw materials, manufacturing processes, capital expenditure, and operational expenses. Tailored to the specific requirement of producing 12 tons of sodium cyanide per day, the model highlights key cost drivers and forecasts profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model offers the client valuable insights for strategic decision-making, demonstrating our commitment to delivering precise, client-focused solutions that ensure the long-term success of large-scale manufacturing projects.

Latest News and Developments:

- In August 2024, Anochrome Ltd., a coatings and electroplating company, took the responsibility for a poisonous sodium cyanide discharge in Walsall canal that has caused a significant disaster in the United Kingdom.

- In July 2024, Australian Gold Reagents (AGR) announced their plans to expand the capacity of its sodium cyanide plant. With the extension, AGR's current production capacity would rise by over 28,000 tonnes annually, reaching over 90,000 tonnes annually.

- In April 2024, anti-dumping duties on sodium cyanide (NaCN) imports from China, the EU, Japan, and Korea have now been suggested by the Indian Directorate General of Trade Remedies (DGTR). The updated decisive anti-dumping duties on sodium cyanide imports that come from or are exported from these nations are in effect for five years.

- In February 2024, Orica has committed to buying all of Cyanco Intermediate 4 Corp.'s (Cyanco) common stock (the Acquisition). The acquisition of Cyanco will allow the company to grow its mining chemicals business because Cyanco is a very complementary business to Orica, which can further reinforce its position by merging it with its established sodium cyanide business.

- In March 2022, the cyanide-based chemical specialities and agricultural chemicals company Draslovka Holding, based in the Czech Republic, has temporarily lowered its production of sodium cyanide (NaCN) to a minimal level at its facility in Kolin, Czech Republic, as a result of the remarkable increase in input costs.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104