Web Analytics Market Size, Share, Trends and Forecast by Offering, Deployment Mode, Application, End User, and Region, 2025-2033

Web Analytics Market Size and Share:

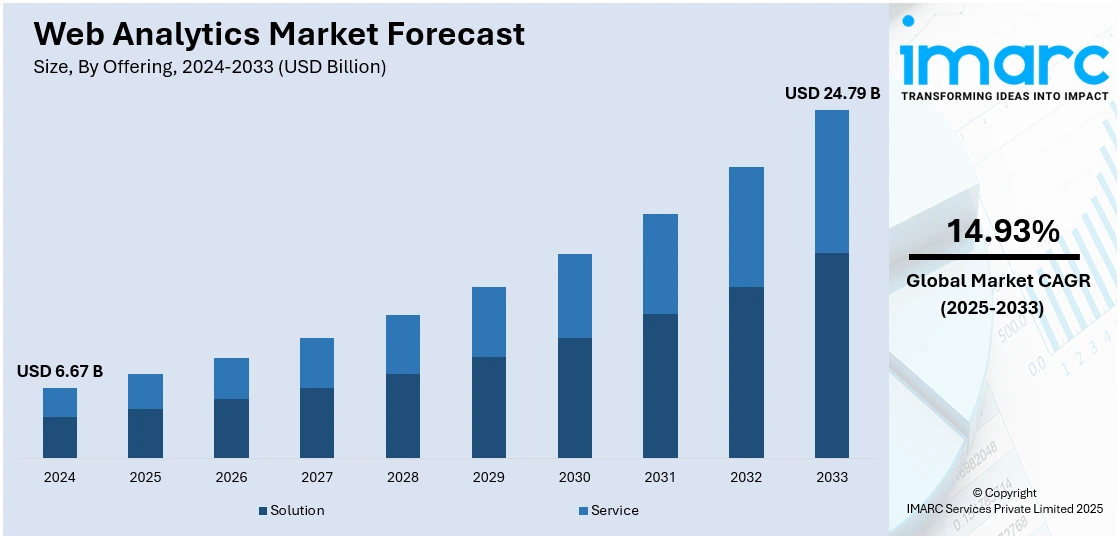

The global web analytics market size was valued at USD 6.67 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.79 Billion by 2033, exhibiting a CAGR of 14.93% from 2025-2033. North America currently dominates the market, holding a market share of 34.7% in 2024. The dominance of the region is driven by its highly developed digital infrastructure, early adoption of advanced technologies, and a strong presence of global tech companies. The region benefits from the widespread use of e-commerce platforms, high internet penetration, and increasing investments in data-driven marketing. Additionally, strict regulatory standards around data privacy and the growing need for client behavior insights contribute to the rising web analytics market share in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.67 Billion |

|

Market Forecast in 2033

|

USD 24.79 Billion |

| Market Growth Rate 2025-2033 | 14.93% |

Businesses in various sectors are significantly investing in digital marketing strategies like search engine optimization (SEO), pay-per-click ads, email marketing, and social media interactions. Web analytics tools assist marketers in monitoring campaign effectiveness, assessing return on investment (ROI), and refining content according to user engagement. The necessity to rationalize marketing expenses and consistently enhance outreach techniques is catalyzing the demand for comprehensive analytics. Additionally, cloud-based web analytics services provide advantages like scalability, reduced initial expenses, and access from a distance. Small and medium-sized enterprises (SMEs) especially gain from cloud solutions as they lessen the requirement for in-house information technology (IT) resources. These platforms enable quicker deployment, simpler updates, and seamless integration with other cloud-based applications, including customer relationship management (CRM) and marketing automation systems.

The increasing number of online shopping transactions is a significant factor influencing the web analytics market in the United States. According to the Census Bureau of the Department of Commerce, total e-commerce sales in 2024 hit $1,192.6 billion, reflecting an 8.1 percent rise from 2023 and representing 16.1 percent of overall retail sales. This notable increase in digital commerce is driving companies to utilize sophisticated web analytics tools to track user behavior, improve online shops, and boost client interaction in a competitive landscape. Besides this, US enterprises increasingly integrate web analytics tools with broader martech stacks, including CRMs, automation tools, and user data platforms. This integration allows for unified data views, advanced targeting, and performance attribution across campaigns, boosting the demand for interoperable and customizable analytics solutions.

Web Analytics Market Trends:

Rising Adoption of Automation Technologies

Automation tools incorporate sophisticated analytical methods, including machine learning (ML) and AI algorithms, into web analytics platforms. These technologies can intuitively identify patterns, forecast trends, and reveal actionable insights from intricate datasets that would be difficult to examine manually. The impact of AI on reshaping work is significant, with predictions that by 2030, AI will change 70% of job skills and promote innovation among 80% of C-suite leaders, as reported by the World Economic Forum. For example, in March 2024, SAP SE introduced groundbreaking data innovations that help clients fully harness their data to generate deeper insights, accelerate growth, and enhance efficiency in the age of AI. The latest features of SAP Datasphere, which encompass generative AI advancements, are revolutionizing business planning by streamlining data ecosystems and enhancing the intuitiveness of data engagement. These factors are further supporting the web analytics market growth.

Growing Trend of Online Shopping

The swift growth of online shopping is significantly contributing to the expansion of the web analytics market, as companies are dependent on digital resources to comprehend user habits and enhance online effectiveness. As more internet users turn to e-commerce platforms for shopping, businesses are allocating resources to advanced analytics for understanding client preferences, navigation behaviors, and factors influencing purchases. In 2022, around 268 million online shoppers were noted in the United States, with projections suggesting this figure will rise to almost 285 million by 2025, highlighting a significant transition toward digital commerce. Web analytics entails the organized gathering, handling, and analysis of information concerning website traffic and user behavior. It assists organizations in assessing the efficiency of their websites, tracking engagement rates, and enhancing conversion tactics. The increasing dependence on data-driven decision-making is driving the need for web analytics solutions across multiple industry sectors, thereby positively influencing the web analytics industry forecast.

Increasing E-Commerce Platforms

Conventional web analytics offered insights based on historical data. Nonetheless, technological progress now allows for immediate data processing and analysis. This feature enables companies to track and react to user actions in real-time, enhancing campaigns, identifying problems, and refining user experience immediately. For example, in February 2024, Cisco introduced several intriguing new solutions on the Cisco Observability Platform that are enriched with business context. Moreover, the expanding e-commerce sector is driving the need for web analytics, as worldwide e-commerce revenue is anticipated to hit USD 8.3 Trillion by 2025, increasing by over 55% since 2021. With applications acting as the main entry point for almost all organizations and ensuring a seamless user experience remains a primary focus for IT teams, newest improvements will help businesses provide safe and efficient clients and application experiences. Cisco's latest DEM application includes Real User Monitoring (RUM) and Session Replay modules for in-depth insights into the performance of web and mobile applications, as well as effective resolution of session-related problems.

Web Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global web analytics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, deployment mode, application, and end user.

Analysis by Offering:

- Solution

- Search Engine Tracking and Ranking

- Heat Map Analytics

- Marketing Automation

- Behavior Based Targeting

- Others

- Service

- Professional Services

- Support and Maintenance

Solutions (search engine tracking and ranking, heat map analytics, marketing automation, behavior-based targeting, and others) lead the market because they provide actionable insights that significantly influence business outcomes. These tools enable organizations to track user engagement, assess website performance, and improve marketing strategies using real-time data. Search engine monitoring aids companies in enhancing their visibility and rankings, leading to increased organic traffic, while heatmap analysis uncovers where users concentrate and where they leave, facilitating improved user interface design. Marketing automation simplifies campaign management and guarantees prompt, personalized communication, enhancing client retention and conversion rates. Targeting based on behavior improves the pertinence of content and advertisements, resulting in increased engagement and return on investment. The need for these tools is also driven by rising competition in digital environments, where companies must remain agile and responsive to user behavior trends to sustain growth and enhance user experiences across various touchpoints.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises represents the largest segment, accounting 66.5% of the market share, owing to the greater control, customization, and security it provides, especially for entities managing sensitive or regulated information. Businesses in sectors like banking, healthcare, government, and defense frequently favor on-premises solutions to maintain compliance with internal policies and external regulations related to data privacy and storage. These deployments allow organizations to customize their analytics infrastructure to meet operational needs without depending on external hosting environments. Moreover, on-premises systems provide reduced latency and continuous access to analytics even without a stable internet connection, which is vital for mission-critical activities. While cloud-based solutions are becoming more popular because of their flexibility and scalability, numerous large companies still invest in on-premises systems to retain complete ownership of their data and infrastructure. This inclination is strengthened by concerns about data breaches and the necessity to adhere to strict security standards, resulting in sustained demand for on-premises solutions among organizations that prioritize security.

Analysis by Application:

- Social Media Management

- Targeting and Behavioral Analysis

- Display Advertising Optimization

- Multichannel Campaign Analysis

- Online Marketing

- Others

Targeting and behavioral analysis hold the biggest market share with 31.6%, as they directly influence improving user engagement, conversion rates, and overall marketing efficiency. These tools allow companies to gather, categorize, and examine user information, facilitating the development of highly customized experiences based on browsing habits, click actions, and purchase records. As competition intensifies on digital platforms, businesses are focusing on solutions that enable them to detect high-value clients, forecast future behaviors, and send customized messages at the appropriate moment. Behavioral analysis offers essential understanding of individual journeys, preferences, and challenges, facilitating data-driven decisions and a more effective distribution of marketing funds. The increasing use of AI and ML enhances the effectiveness of these tools, allowing for more accurate and scalable real-time targeting. With user demands for tailored and pertinent content on the rise, companies in various sectors are progressively allocating resources to targeting and behavioral analytics to maintain competitiveness and foster lasting brand loyalty.

Analysis by End User:

- BFSI

- Retail

- Healthcare

- Government

- Travel and Hospitality

- IT and Telecommunications

- Media and Entertainment

- Others

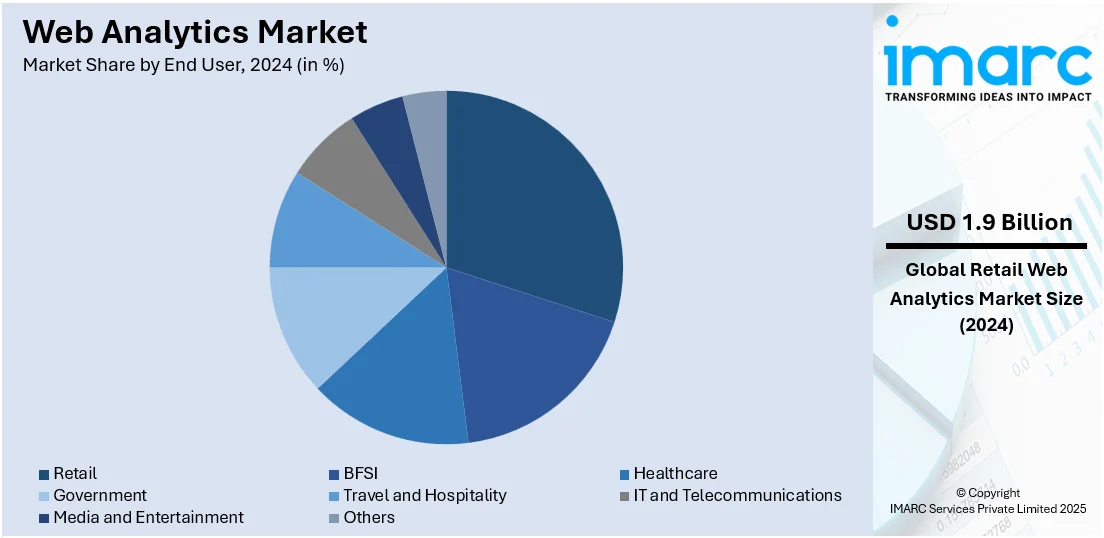

Retail is the leading segment in the market with 28.7%, attributed to its significant reliance on digital channels for acquiring, engaging, and retaining clients. With the expansion of e-commerce and the shift in user habits online, retailers are progressively using web analytics to assess website effectiveness, observe user interactions, and enhance product positioning and pricing approaches. These instruments assist retailers in grasping shopper preferences, tailoring recommendations, and enhancing client experiences by examining metrics, such as traffic origins, bounce percentages, and conversion pathways. The retail industry's competitive environment forces companies to utilize real-time data for adaptive pricing, focused promotions, and inventory management. Furthermore, combining web analytics with CRM and marketing automation tools allows for smooth campaign execution and evaluation. As omnichannel approaches gain traction, web analytics is essential for harmonizing online and offline experiences, enabling retailers to boost growth, improve client satisfaction, and sustain a robust market position in a digitally influenced landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, holding 34.7% market share, owing to the swift and extensive embrace of digital technologies in major sectors, such as retail, finance, healthcare, media, and education. This digital transformation is catalyzing the demand for sophisticated analytics tools to assess online performance, comprehend user behavior, and enhance user experiences. Organizations throughout the region are progressively depending on web analytics to customize content, improve conversion rates, and facilitate data-driven decision-making in a competitive environment. The existence of major tech corporations and a solid digital framework enhances the market standing of North America. Moreover, the emphasis on adhering to regulations, including data privacy and security requirements, is encouraging companies to implement more advanced analytics systems. A case in point of this digital-centered strategy is EY Canada’s introduction in February 2024 of the EY Climate Stress Testing and Scenario Analysis solution, a service based on Microsoft Azure designed to assist Canada’s financial sector in handling climate-related risks via data insights and scenario modeling.

Key Regional Takeaways:

United States Web Analytics Market Analysis

The web analytics market in the United States is experiencing consistent growth, accounting 84.60% market share, fueled by the swift changes in digital user behavior and the rising incorporation of AI and ML in data analysis. The Government anticipates that AI investment will rise to approximately USD 100 Billion in the United States by 2025, driving additional progress in analytics technologies. The extensive use of omnichannel marketing approaches is catalyzing the demand for sophisticated analytics tools that provide real-time information. Companies are utilizing web analytics to customize user experiences and improve engagement across different digital channels. Moreover, frameworks for regulatory compliance are encouraging organizations to implement analytics platforms that can guarantee data transparency and accountability. The growth of digital advertising budgets is significantly contributing to promoting investments in analytical technologies. Cloud-based analytics solutions are becoming popular because of their scalability and simple deployment, allowing companies of all sizes to make decisions based on data. The need for predictive analytics and behavioral analysis tools is growing, particularly in industries that emphasize client retention and optimizing conversion rates. Additionally, the rising complexity of digital platforms is encouraging organizations to adopt advanced tracking methods for more profound understanding of user experiences.

Europe Web Analytics Market Analysis

In Europe, the market for web analytics is growing as companies aim to enhance their online presence and boost operational efficiency. The European Commission indicates that the EU's Digital Decade seeks to have 75% of enterprises utilizing cloud-edge technologies by 2030, thereby increasing the need for sophisticated analytics tools. The area is experiencing an increase in the need for privacy-centric analytics solutions, especially due to strict data protection laws. This is leading to the development of tools that facilitate anonymized data monitoring and user consent administration. Furthermore, the growing focus on sustainability and ethical data practices is influencing the creation of analytics platforms that coincide with corporate social responsibility objectives. The increasing dependence on digital self-service systems in industries like finance and retail is further enhancing the significance of analytics in comprehending user engagements. Companies are employing web analytics to improve digital processes and communication tactics, placing increasing emphasis on data visualization and dashboard personalization, which facilitates effective decision-making.

Asia Pacific Web Analytics Market Analysis

The web analytics market in the Asia Pacific region is growing, because of internet accessibility and mobile-centric digital strategies, as companies allocate funds toward analytics to comprehend user behavior across various platforms and languages. An increasing number of educational and public sector organizations are also utilizing analytics to oversee digital learning platforms and services for citizens. Significantly, government programs are also driving this expansion. As per the Ministry of Electronics & IT, the Government of India sanctioned the IndiaAI Mission in 2024, designating around ₹10,300 crore over five years to bolster AI capabilities, anticipated to improve the analytical infrastructure and innovation ecosystem. The combination of web analytics with chatbots and automation tools is becoming common, improving user interaction and service effectiveness. Moreover, the rising prevalence of video content is increasing curiosity in tools that assess engagement metrics for multimedia types. As the digital landscape quickly advances, analytics platforms designed for real-time interaction and flexible marketing are becoming more significant throughout the area.

Latin America Web Analytics Market Analysis

The web analytics market in Latin America is growing attributed to increased digital penetration, mobile platforms, as well as the rise of influencer and social media marketing, aiming to enhance user experiences. Local businesses are progressively utilizing analytics to evaluate online performance and improve user interface design. In addition, Brazil is initiating an ambitious path toward digital transformation, planning to invest around R$ 186.6 billion to transform its industrial sector, as reported by Brazilian NR. This significant investment is anticipated to promote broader utilization of digital tools, such as web analytics, in major industries. Real-time dashboards and heat mapping tools are favored in media, content, nonprofit, and education fields to analyze audience engagement trends and market growth.

Middle East and Africa Web Analytics Market Analysis

The market in the Middle East and Africa is witnessing growth because of digital transformation efforts, localization, and personalized content, necessitating insights tailored to the region. The International Trade Administration (ITA) highlights the region's swift transition to digital consumption, stating that by 2025, Africa is projected to exceed half a billion e-commerce users, achieving a 17% CAGR. Africa dominates the creation of web traffic from mobile phones, with 69% of its overall web traffic comprised of mobile internet users in 2021, and it is projected to evolve into a nearly entirely mobile-centric market by 2040. This mobile-centric environment is catalyzing the demand for adaptive analytics solutions designed for portable devices. Analytics tools are being employed to enhance digital education and awareness initiatives and to track user involvement and accessibility in public services because of their growing significance.

Competitive Landscape:

Major participants in the market are concentrating on enhancing their product features by incorporating AI, ML, and automation to provide more precise and predictive insights. They are focusing on real-time analytics capabilities, improved user interfaces, and cross-platform compatibility to satisfy increasing client demands. Strategic partnerships, mergers, and acquisitions are being sought to enhance market presence and expand service offerings. These companies are also focusing on data privacy adherence and security improvements to meet the growing regulatory demands. There are initiatives underway to create scalable solutions that address the needs of both small businesses and large corporations, focusing on adaptable dashboards, client journey visualization, and smooth integration with digital marketing tools. In 2024, Ahrefs launched a web analytics tool across all plan tiers, including free access, marking its entry into the analytics market. The tool offered performance metrics like traffic sources, user behavior, and geographic distribution while ensuring strict data privacy.

The report provides a comprehensive analysis of the competitive landscape in the web analytics market with detailed profiles of all major companies, including:

- Adobe Inc.

- AT Internet

- Google LLC (Alphabet Inc.)

- International Business Machines Corporation

- Microsoft Corporation

- MicroStrategy Incorporated

- SAS Institute Inc.

- Splunk Inc.

- Tableau Software LLC (Salesforce.com Inc.)

- Teradata Corporation

- Webtrends Inc.

Latest News and Developments:

- February 2025: Pico launched IntelliVUE, integrating PicoNet™ and Corvil Analytics for real-time network connectivity monitoring. This solution provides financial institutions with on-demand visibility and actionable insights into network performance, latency, and service disruptions.

- February 2025: BlueSkyHunter launched as a subscription service offering a dashboard with tools for managing and tracking Bluesky's presence. It provides scheduling, analytics, and automation features, including DM automation and performance metrics. Aimed at creators, brands, and small businesses, it also helps identify trending posts and track competitor performance.

- February 2025: Fujitsu launched a software analysis and visualization service in Japan using generative AI to analyze and visualize software, improving system modernization planning. The service features advanced analytics to visualize complex application structures and evaluate migration difficulty.

- January 2025: Accenture launched AI Refinery™ for Industry, offering 12 industry-specific AI agent solutions to accelerate the deployment of AI-driven business processes. Powered by NVIDIA AI, these agents help optimize functions like revenue growth, clinical trials, and asset troubleshooting. The platform uses advanced web analytics to streamline workflows and enhance productivity across sectors.

Web Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Offerings Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Applications Covered | Social Media Management, Targeting and Behavioral Analysis, Display Advertising Optimization, Multichannel Campaign Analysis, Online Marketing, Others |

| End Users Covered | BFSI, Retail, Healthcare, Government, Travel and Hospitality, IT and Telecommunications, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adobe Inc., AT Internet, Google LLC (Alphabet Inc.), International Business Machines Corporation, Microsoft Corporation, MicroStrategy Incorporated, SAS Institute Inc., Splunk Inc., Tableau Software LLC (Salesforce.com Inc.), Teradata Corporation, Webtrends Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the web analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global web analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the web analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The web analytics market was valued at USD 6.67 Billion in 2024.

The web analytics market is projected to exhibit a CAGR of 14.93% during 2025-2033, reaching a value of USD 24.79 Billion by 2033.

The web analytics market is driven by rising digital transformation, increased adoption of data-driven marketing, robust e-commerce activity, and the need for real-time user behavior insights. Businesses are leveraging analytics tools to enhance user engagement, optimize content strategies, and improve return on investment across digital platforms.

North America currently dominates the web analytics market, accounting for a share of 34.7%. The dominance of the region is accredited to widespread digital adoption, advanced IT infrastructure, high internet penetration, and the strong presence of leading analytics providers.

Some of the major players in the web analytics market include Adobe Inc., AT Internet, Google LLC (Alphabet Inc.), International Business Machines Corporation, Microsoft Corporation, MicroStrategy Incorporated, SAS Institute Inc., Splunk Inc., Tableau Software LLC (Salesforce.com Inc.), Teradata Corporation, Webtrends Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)