United States Healthcare BPO Market Size, Share, Trends and Forecast by Payer Service, Provider Service, Pharmaceutical Service, and Region, 2025-2033

United States Healthcare BPO Market Size and Share:

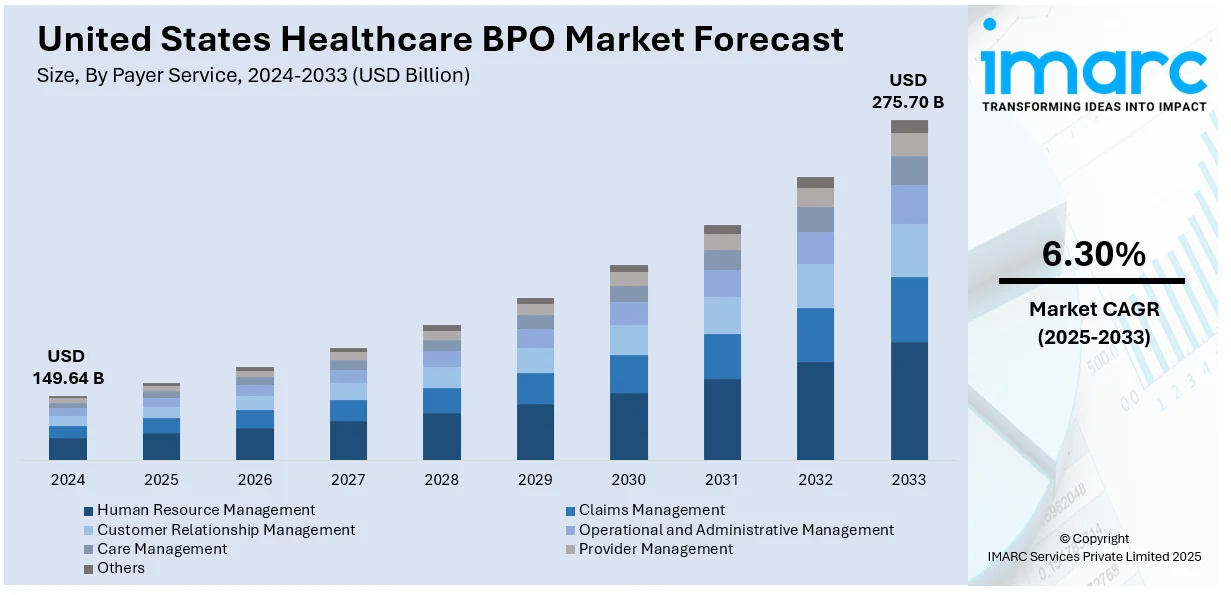

The United States healthcare BPO market size was valued at USD 149.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 275.70 Billion by 2033, exhibiting a CAGR of 6.30% from 2025-2033. The rising need for streamlined healthcare administrative processes, increasing emphasis on cost reduction and operational efficiency, and rapid shift toward patient-centric care across the region are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 149.64 Billion |

|

Market Forecast in 2033

|

USD 275.70 Billion |

| Market Growth Rate (2025-2033) | 6.30% |

Increased sophistication of healthcare administration is a key propeller for BPO adoption in the U.S. healthcare industry. Providers and payers are confronted with increasing challenges in managing billing, coding, claims processing, compliance, and patient information. All these require substantial time, knowledge, and regulatory compliance. Outsourcing these functions allows companies to alleviate internal workload, avoid errors, and keep their core clinical services intact. With continually changing healthcare regulations and payer policies, numerous healthcare facilities depend on BPO providers to automate, streamline operations, ensure timely reimbursement, and enhance patient satisfaction by outsourcing non-clinical activities to expert service partners.

BPO solutions are becoming more and more popular among US healthcare providers as part of a strategic effort to control expenses and boost productivity. Increasing healthcare demand, rising labor costs, and pressure to enhance care delivery are pushing providers to look for more affordable options. BPO provides access to skilled workforce and sophisticated technology without the cost of in-house operations. Through the outsourcing of processes such as revenue cycle management, IT support, and customer service, healthcare organizations can lower operating costs, enhance turnaround times, and redirect resources to patient care and innovation, thereby enhancing their competitive position within a value-based care setting.

United States Healthcare BPO Market Trends:

Rise in Demand for Enhanced Operational Efficiency

The demand for operational effectiveness compels healthcare providers to utilize healthcare BPO services. For example, over 90% of hospitals in the U.S. have outsourced one or more of their processes. By outsourcing non-core functions, like medical coding, claims processing, and appointment scheduling, to specialized BPO firms, healthcare organizations can streamline their operations and better allocate resources. This transfer of administrative responsibilities enhances internal efficiency and enables medical personnel to spend more time on patient care. In addition, healthcare BPO providers tend to introduce industry best practices and technology into the organization, enhancing overall process efficiency. The resulting operational optimization enables healthcare providers to provide higher-quality care while minimizing administrative burdens, thereby enabling the market growth.

Shifting Focus Toward Cost Containment and Financial Optimization

Rising healthcare expenses in the United States lead to healthcare providers seeking means to optimize finances. Healthcare BPO comes as a viable option by enabling providers to reduce costs of operations without affecting the quality of service. Through outsourcing revenue cycle management, billing, and claims processing, healthcare providers are able to leverage the expertise and economies of scale of BPO firms. Such niche third-party BPO service organizations are able to accomplish tasks more effectively, minimizing overheads that are part of in-house operations. This cost-control measure adds to the bottom line and allows organizations to direct resources towards core medical services and investment in patient care infrastructure.

Integration of Artificial Intelligence and Automation

Artificial Intelligence (AI), Robotic Process Automation (RPA), and machine learning integration are revolutionizing the healthcare BPO industry quite substantially. RPA simplifies routine work such as claims processing, data entry, and billing, reducing time consumed by transactional activities by as much as 80%, which results in lower labor costs and less human error. AI-powered solutions aid better decision-making through processing huge amounts of data, better diagnostics, and forecasting patient outcomes. Machine learning (ML) algorithms assist in finding patterns, using insights to optimize patient care and facilitate personalized medicine. Incorporating these technologies into healthcare organizations, they can enhance operational effectiveness, contain costs, and enhance service quality. Automation also enables healthcare professionals to work on higher-order tasks while AI facilitates quicker response time as well as the better allocation of resources. This overlap of technologies assures that the healthcare BPO industry is competitive and able to meet increasing patient needs.

United States Healthcare BPO Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States healthcare BPO market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on payer service, provider service, and pharmaceutical service.

Analysis by Payer Service:

- Human Resource Management

- Claims Management

- Customer Relationship Management

- Operational and Administrative Management

- Care Management

- Provider Management

- Others

Claims management is the leader in market growth within the U.S. Healthcare BPO industry because of its pivotal role in making reimbursements timely and reducing financial losses to healthcare providers. It is a very intricate process, with careful documentation, coding accuracy, regulatory adherence, and liaison with numerous payers. Claims management outsourcing assists healthcare providers in minimizing errors, processing claims fast, and preventing claim denials or delays. As reimbursement schemes turn more value-based and insurance coverage more complex, the requirement for specialized knowledge increases. BPO vendors introduce sophisticated tools, automation, and qualified resources to meet such demands in an effective way. This not only improves revenue cycle performance but also enables healthcare professionals to concentrate on patient care, leading to popularity and dominance of this service segment.

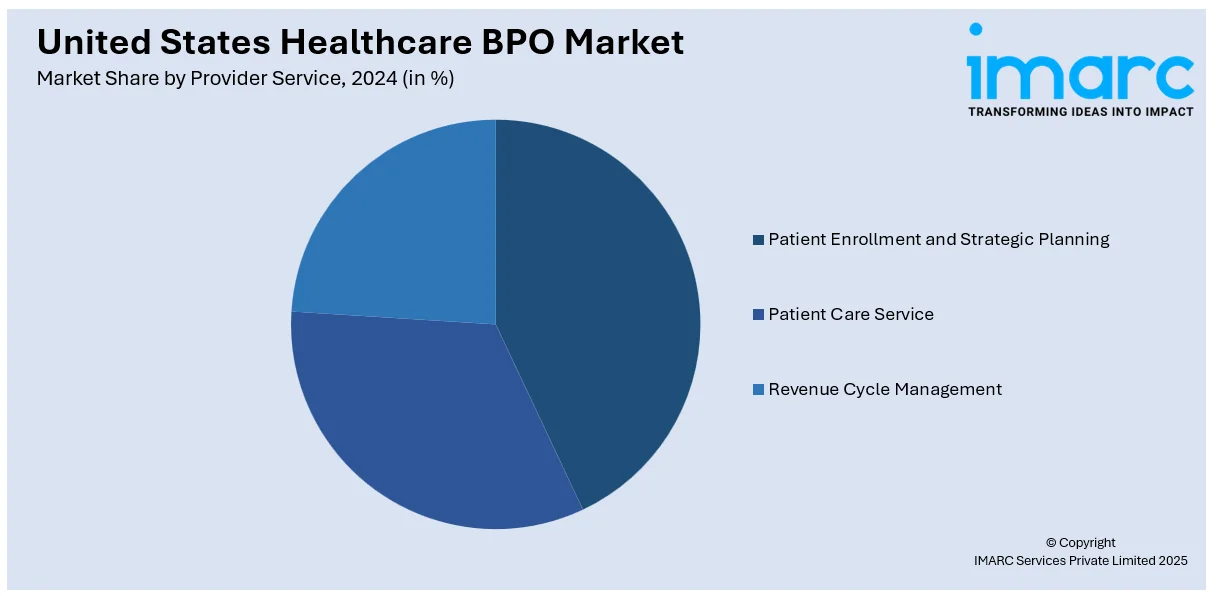

Analysis by Provider Service:

- Patient Enrollment and Strategic Planning

- Patient Care Service

- Revenue Cycle Management

Revenue Cycle Management (RCM) commands most of the shares in the U.S. Healthcare BPO market because it is at the core of the financial well-being of healthcare providers. RCM is the complete cycle of generating patient revenue, from scheduling appointments and verifying insurance to billing, coding, and collection of final payments. As the healthcare environment becomes increasingly complicated with changing payer regulations and regulatory demands, providers are under increasing pressure to maximize cash flow and minimize administrative expenses. Outsourcing RCM provides access to specialized knowledge, automation technology, and data analytics that enhance accuracy and speed up payment cycles. By optimizing these functions, healthcare organizations promote financial performance and compliance, resulting in RCM being a high priority and the leading driver in the BPO industry.

Analysis by Pharmaceutical Service:

- Manufacturing Services

- Research and Development Services

- Non-clinical Services

Manufacturing services account for the largest number of shares in the U.S. Healthcare BPO market due to the growing demand for effective production, supply chain management, and regulatory compliance in the healthcare sector. Medical device and pharmaceutical companies are among the healthcare manufacturers that heavily depend on outsourcing non-core activities like procurement, assembly, packaging, and logistics in a bid to lower costs and increase efficiency. BPO providers provide specialized services in handling intricate supply chains, quality control, and adhering to strict regulations such as FDA requirements. The outsourcing of manufacturing services enables firms to concentrate on innovation and core functions while enjoying operational flexibility and scalability. With growing healthcare demand, the pressure for cost-effective and efficient manufacturing operations propels outsourced services in this sector, earning a notable market share.

Analysis by Region:

- Northeast

- Midwest

- South

- West

The Northeast region, with heavy healthcare centers such as Boston and New York, is the leader in healthcare infrastructure and innovation. It enjoys robust healthcare networks, cutting-edge research facilities, and high technology adoption rates, fueling demand for BPO services, especially for claims processing, RCM, and administrative services.

In addition, the Midwest, which is characterized by its big healthcare providers and manufacturing sector, has experienced tremendous growth in healthcare BPO. The region is appealing due to low operating costs and a concentration on operating efficiency, enabling it to receive services such as medical billing, IT support, and revenue cycle management, leading to market expansion.

Moreover, the South, with its large healthcare centers and expanding population, increasingly depends on healthcare BPO to cope with increasing patient volumes. Texas and Florida states experience high demand for services like patient support, billing, and coding, spurred by cost-effectiveness and the requirement for scalable healthcare solutions.

Apart from this, the West, particularly technologically advanced regions such as California, places considerable emphasis on e-healthcare solutions. The emphasis of the region on innovation, telemedicine, and cutting-edge technologies fuels the use of BPO services such as IT management, customer service, and data analysis, with a competitive market scenario for healthcare outsourcing.

Competitive Landscape:

The competitive environment of the U.S. healthcare BPO market is active and diversified with many participants covering a wide spectrum of niche services. Competition arises due to demands for high-quality, compliant, and low-cost solutions for activities such as claims processing, medical billing, patient support, and information technology (IT) services. Competition among providers arises due to differences in technological competence, scalability, and domain knowledge regarding healthcare regulations. While increased demand for digital transformation prompts players to invest in automation, analytics, and artificial intelligence to provide better services, the market observes frequent alliances, mergers, and acquisitions with companies aiming to increase capabilities as well as regional presence. At large, the market is distinguished by innovation, close regulatory adaptation, and its emphasis on rendering enhanced operational effectiveness to healthcare clients.

The report provides a comprehensive analysis of the competitive landscape in the United States healthcare BPO market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: Advent International, Blackstone, Carlyle, and Hillhouse Investment submitted non-binding offers to acquire a 60-70% stake in Access Healthcare, a healthcare BPO based in Texas. The company’s valuation stands between USD 1.4-1.5 billion.

- August 2024: EnableComp finalized the acquisition of ANI Healthcare Solutions, a San Francisco-based company specializing in denial management services. The deal strengthens EnableComp’s capabilities in the healthcare revenue cycle space and enhances the functionality of its E360 RCM intelligent automation platform.

- July 2024: Transworld Systems Inc. (TSI) launched PULSE, an AI-powered denial management solution designed to enhance healthcare revenue recovery. By integrating intelligent document processing, robotic process automation, and generative AI, PULSE streamlines denial analysis and appeals creation.

- July 2024: Everise entered into a strategic partnership with Sanas, a player in real-time speech and accent transformation technology, as the former moved to gain exclusive access to Sanas’ services in the healthcare BPO sector.

United States Healthcare BPO Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Payer Services Covered | Human Resource Management, Claims Management, Customer Relationship Management, Operational and Administrative Management, Care Management, Provider Management, Others |

| Provider Services Covered | Patient Enrollment and Strategic Planning, Patient Care Service, Revenue Cycle Management |

| Pharmaceutical Services Covered | Manufacturing Services, Research and Development Services, Non-clinical Services |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States Healthcare BPO market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States Healthcare BPO market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States Healthcare BPO industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States healthcare BPO market was valued at USD 149.64 Billion in 2024.

The United States healthcare BPO market was valued at USD 275.70 Billion in 2033 exhibiting a CAGR of 6.30% during 2025-2033.

The United States healthcare BPO market is driven by several key factors. Healthcare organizations face increasing pressure to reduce operational costs while maintaining high-quality patient care. Outsourcing administrative and non-core functions, such as billing, coding, and data entry, allows healthcare organizations to focus on their primary mission of patient care, leading to increased efficiency and cost savings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)