Semiconductor Market Size, Share, Trends and Forecast by Components, Material Used, End User, and Region, 2026-2034

Semiconductor Market Size and Share:

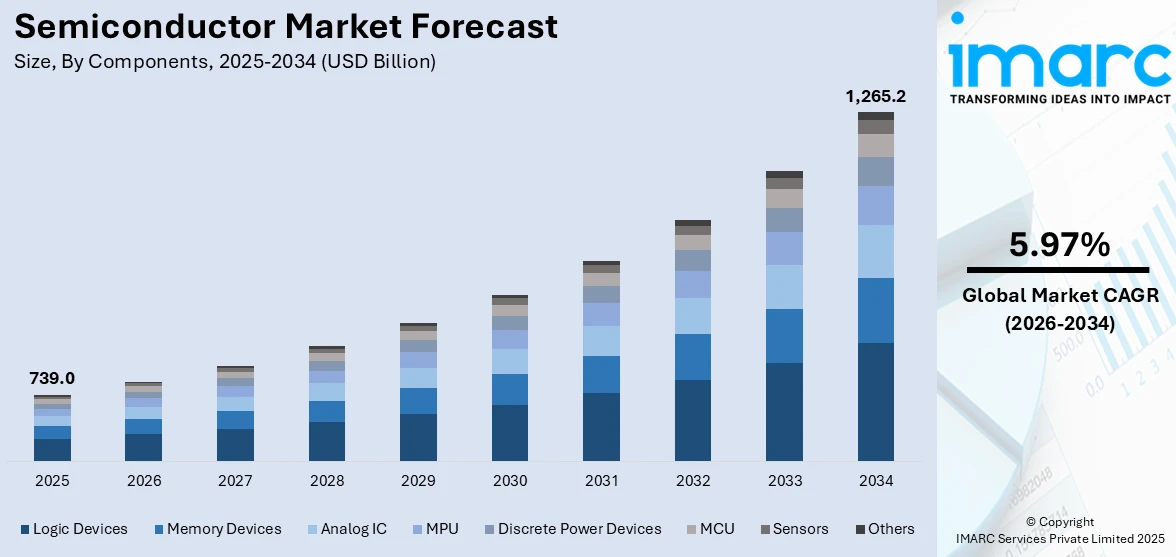

The global semiconductor market size was valued at USD 739.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,265.2 Billion by 2034, exhibiting a CAGR of 5.97% during 2026-2034. Asia-Pacific currently dominates the market in 2025. The increasing demand for consumer electronics, continual advancements in automotive technology and electric vehicles, expanding 5G network deployment, and growing investments in data centers and cloud computing infrastructure are some of the factors that are augmenting the semiconductor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 739.0 Billion |

| Market Forecast in 2034 | USD 1,265.2 Billion |

| Market Growth Rate 2026-2034 | 5.97% |

The global market is majorly influenced by the increasing demand for advanced consumer electronics, including smartphones, tablets, and wearable devices, as consumers seek faster, more efficient, and feature-rich devices. Furthermore, the transition towards electric vehicles (EVs) and autonomous driving technologies is generating substantial demand for semiconductors in automotive applications. On September 9, 2024, the U.S. Department of State announced a collaboration with India's Semiconductor Mission under the Union Electronics and IT Ministry to explore opportunities for expanding and diversifying the global semiconductor ecosystem. The initiative falls under the U.S. International Technology Security and Innovation Fund, established by the CHIPS Act of 2022, which allocates USD 500 Million over five years to promote the development of secure and trusted semiconductor supply chains. Strategic collaborations and partnerships like this further strengthen the semiconductor market growth.

To get more information on this market Request Sample

The United States stands out as a key regional market and is experiencing significant growth due to the increasing emphasis on domestic manufacturing and supply chain resilience, which raised significant investments in semiconductor fabrication facilities. Additionally, the strong presence of leading technology firms and startups in the United States is stimulating innovation in semiconductor design and material, particularly using artificial intelligence (AI) for customized processes. For example, on October 2, 2024, the U.S. Commerce Department announced plans to allocate USD 100 million to enhance the application of artificial intelligence in developing sustainable semiconductor materials. The initiative is part of the department's oversight of USD 52.7 Billion in U.S. chip manufacturing and research grants, focusing on reducing the time required to innovate new semiconductor materials. Moreover, the U.S. defense and aerospace sectors heavily rely on advanced semiconductors for critical applications, including radar systems, secure communications, and satellite technologies, which support the overall semiconductor market demand.

Semiconductor Market Trends:

Rising Demand for Electric Vehicles

The growing adoption of electric vehicles among consumers are creating an increased demand for advanced semiconductors. According to industry reports, the total number of electric cars worldwide exceeded 40 million in 2023, compared to 26 Million in 2022. These chips help in managing the distribution of power, battery performance, and the efficiency of the vehicle as a whole, thus playing a vital role in the EV manufacturing process. For example, in April 2024, indie Semiconductor, Inc. released high-performance video converters to enable in-cabin connectivity applications. These new capabilities expand indie's innovative lineup of in-cabin solutions, empowering global Tier 1 system integrators to deliver the best vehicle experiences to automakers.

Growing Investment in Research Facilities

Investments in research and development (R&D) activities for semiconductors are on the rise as companies aim to innovate and create more efficient, powerful chips. This funding supports advancements in new materials, chip designs, and production technologies to meet the changing demands of various industries. For instance, in February 2024, Samsung inaugurated a new semiconductor R&D facility in Bengaluru, India, through its division Samsung Semiconductor Research (SSIR). Also, in October 2024, Foxconn, the iPhone contract manufacturer, plans to invest up to INR 4.24 Billion (USD 50 Million) in collaboration with HCL for a semiconductor joint venture (JV) in India, focusing on establishing an OSAT facility. The modern campus promotes collaboration and agility, focusing on advancing semiconductor research and development to meet the company's growing infrastructure needs.

Increasing Focus on Local Semiconductor Manufacturing

One of the major semiconductor market trends is the considerable increase in investments in local semiconductor manufacturing. This is to reduce reliance on imports and ensure a stable supply chain, which significantly influences market expansion. The focus on domestic production helps boost technological sovereignty, enhance industrial competitiveness, and create high-tech jobs within the local economy. For example, in February 2024, the Indian government approved 3 new semiconductor manufacturing units in partnership with Tata Group set to establish two of them. This initiative aims to bolster the semiconductor industry in the region.

Semiconductor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global semiconductor market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on components, material used, and end user.

Analysis by Components:

- Memory Devices

- Logic Devices

- Analog IC

- MPU

- Discrete Power Devices

- MCU

- Sensors

- Others

Logic devices dominate the market in 2025. The logic device constitutes the backbone of the computing and processing system and allows electronic devices to perform highly complex decisions and operations. There is an increasing need for high-performance computing, largely propelled by developments in artificial intelligence (AI), machine learning (ML), and big data analytics, which increased the usage of logic devices significantly. The integration of data centers, smartphones, Internet of Things (IoT) devices, and other consumer electronics indicates the importance of logic chips in modern technology ecosystems. Additionally, with the shift towards 5G networks and autonomous vehicles, advanced processing requirements necessitate more complex logic chips. These factors, together with continuous research and development (R&D) activities to render the devices more efficient and with less power consumption, making logic devices a vital component of innovation and growth in the semiconductor market.

Analysis by Material Used:

- Silicon Carbide

- Gallium Manganese Arsenide

- Copper Indium Gallium Selenide

- Molybdenum Disulfide

- Others

Silicon carbide leads the market segment in 2025. Silicon carbide (SiC) is characterized by its exceptional thermal conductivity, high breakdown voltage, and elevated operating temperatures, which render it suitable for electric vehicles, renewable energy systems, and industrial equipment. As more people embrace EVs and the growth in charging infrastructure is seen, the demand for SiC-based power semiconductors is also expected to rise. They offer improved energy efficiency and reduced power loss. Furthermore, solar and wind energy projects are heavily dependent on SiC due to efficient power conversion and management. The material enhances system performance in demanding environments, so especially high-performance applications cannot do without it. As industries continue to focus on energy-efficient solutions, the scope of SiC in the market continues to grow, driving the pace of technological innovation and growth in the market.

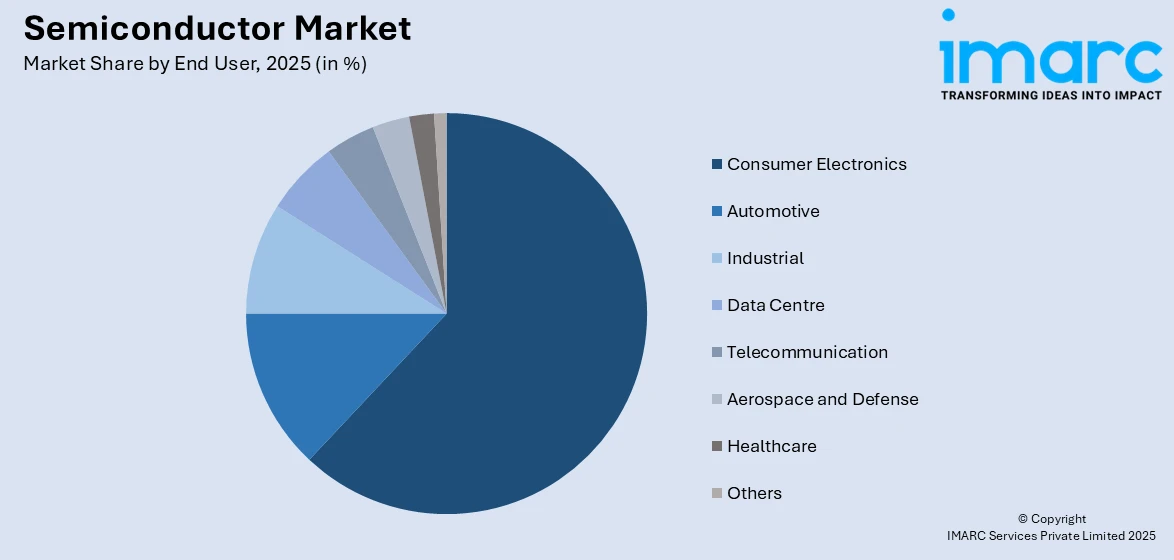

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Automotive

- Industrial

- Data Centre

- Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Others

Consumer electronics lead the market, accounting for 62.2% of the share in 2025 as demand for handsets, computers, tablets, and gaming consoles creates an additional need for advanced technologies and high-performance semiconductors at a faster scale. Semiconductors are indispensable for energy efficiency in processing, memory, or connectivity. The usage of integrated circuits and sensors within smart home technologies like smart TVs, speakers, and appliances further supports market growth. Apart from this, increased research in artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) not only resulted in the development of more complicated consumer electronics but also high-performance chips. A rise in the adoption of 5G technology worldwide, with growing attention given to internet of things (IoT)-enabled devices, continues to propel the use of semiconductors in the consumer electronics sector.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for 63.8% of the market share due to its strength in manufacturing base, strong demand, and government support. Most of the huge semiconductor manufacturing facilities are located in this region. The advantages of modern infrastructure, skilled labor, and low-cost production benefit the market in the region. Countries such as China, South Korea, and Taiwan are known for the rapid growth of consumer electronics, automotive, and telecommunications industries, which add to the semiconductor demand. Also, emerging technologies like 5G, internet of things (IoT), and artificial intelligence (AI) have increasingly augmented the requirement for high-performance chips in this region. Governments in Asia-Pacific are also heavily investing in semiconductor research and development to enhance local production and minimize imports. Its strategic location in the global supply chain, combined with its innovation focus, is what makes this region dominant in the semiconductor market.

Key Regional Takeaways:

United States Semiconductor Market Analysis

The U.S. semiconductor market is fueled by technological advancement and high demands in various sectors alongside the government's policies. According to reports, between 2013 and 2022, there emerged 4,633 AI startups, mainly from the United States. Such growth in AI innovation led to a rise in the demand for high-performance semiconductor chips in the medical, automotive, and finance markets. Aside from this, American government efforts that reduce dependence on the production of semiconductors outside by passing acts, including the CHIPS Act, continue to fuel manufacturing in the homeland. Additionally, significant consumer electronics demand is also fueling momentum in the market. Smartphones and laptops are important drivers, alongside gaming consoles, for this market. Electric vehicles, advanced driver-assistance systems in the automotive sector, and data centers and high-performance computing will continue to propel the need for advanced semiconductor solutions. In addition, market appeal and innovation are driven by increased investments made by Intel, AMD, and Nvidia in research and development (R&D) activities. All of these investments, ongoing processes, support from the government, and demand for technology support the market in the United States.

Asia Pacific Semiconductor Market Analysis

The Asia Pacific market is shaped by the high demand in consumer electronics, automotive, and telecommunications. According to the GSMA's Mobile Economy APAC 2023 Report, 5G will account for over two-fifths, or 41%, of mobile connections in the region as of 2030, compared to just 4% in 2022. This fast expansion of 5G leads to an increase in semiconductor need, as the development of advanced chips is needed for both 5G infrastructures and 5G devices. Other drivers that contribute to the rise in semiconductor consumption include rapidly growing electric vehicles and autonomous driving technologies, primarily in China, Japan, and South Korea. Also, in the region, increased investments in artificial intelligence (AI), the internet of things (IoT), and high-performance computing generate additional requirements for chips. Additionally, government schemes for local production and improved supply chains, particularly in China, further create a favorable semiconductor market outlook in the APAC region.

Europe Semiconductor Market Analysis

Automotive electronics, renewable energy, and Industry 4.0 applications are drivers of growth for the Europe semiconductor market. Automotive is the largest semiconductor consumer in Europe, as the region is transitioning to electric vehicles. International Energy Agency statistics show that close to 3.2 Million new electric car registrations occurred in Europe by the end of 2023, which increased almost 20% compared with 2022. The European Union recorded 2.4 million sales, with growth rates nearly matching those of Europe. . Growing demand for EVs contributes to higher semiconductor demand, especially for power electronics, batteries, and in-car connectivity. This trend of green technology, including solar energy, along with the modernization of the electric grids, is fueling demand in the market. Digitalization of industries in Europe through programs like Industry 4.0 sparks demand for automation, robotics, and other IoT-based solutions that require semiconductors. Investment by the European Union in strengthening semiconductor supply chains through initiatives like the Digital Compass and the European Semiconductor Alliance would help reduce dependency on external suppliers and foster market appeal. Research and development (R&D) investments by companies like ASML and STMicroelectronics will continue to push technological advancement in the sector and ensure long-term market expansion in Europe.

Latin America Semiconductor Market Analysis

Consumer and automotive advances, smart technologies, and growth in Latin America are driving the demand for semiconductor services and products. According to GSMA, mobile technologies and services generated 8% of GDP in the region in 2023, generating an economic value added USD 520 Billion. Increased mobile technology adoption in the region will raise the need for semiconductors due to high smartphone penetration and connectivity. The automobile industry, coupled with rising electric vehicles, is the driver for the requirement of semiconductors. The implementation of favorable government initiatives and the rise in foreign investments are also adding to the growth of the market in the region.

Middle East and Africa Semiconductor Market Analysis

The Middle East and Africa semiconductor market is majorly influenced by the adoption of emerging technologies such as 5G, internet of things (IoT), and artificial intelligence (AI), which increase demand for advanced semiconductor components. According to industry reports, in 2023, there were 0.28 Billion IoT devices in the MENA region, which further fuels the need for semiconductors. The region's smart cities, infrastructure projects, and renewable energy investments add to the increasing demand for semiconductors in the energy, transportation, and construction sectors. With the challenges in local manufacturing, governments in the region focus on promoting development in technology and entering into global partnerships for the market's growth.

Competitive Landscape:

The competition in the semiconductor market is projected to be extreme, innovational, and highly technological. Technological market players engage more in developing the latest products that respond to the highly increasing demand for high-performance and energy-efficient solutions. Numerous industries, including consumer electronics, automotive, and telecommunications, seek more efficient solutions. Research and development activities in the market are also important, concentrating on upgrading production processes and improving product capabilities. Most strategic steps through mergers and acquisitions or partnerships have positive effects on the market. Regional factors, like government initiatives and the latest trends in the increase of local production, also affect the growth of the market.

The report provides a comprehensive analysis of the competitive landscape in the semiconductor market with detailed profiles of all major companies, including:

- Broadcom Inc.

- Infineon Technologies AG

- Intel Corporation

- Micron Technology Inc.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd.

- SK hynix Inc.

- STMicroelectronics N.V.

- Taiwan Semiconductor Manufacturing Company Limited

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation)

Latest News and Developments:

- May 2024: Mindgrove Technologies unveiled Secure IoT, India’s first semiconductor System-on-Chip (SoC) specifically designed for IoT devices. This advanced chip integrates programmability, flexibility, and robust security features, catering to applications such as wearables, smart city infrastructure, and EV battery management systems. It also supports Indian brands in developing innovative solutions within the semiconductor ecosystem.

- May 2024: By mid-2025, Micron Technology's Sanand, Gujarat factory will be producing semiconductor chips built in India. These chips, primarily for export, will serve data centers, smartphones, notebooks, and IoT devices, with allocations based on market demand and customer requirements.

- April 2024: indie Semiconductor, Inc. launched high-performance video converters to enable in-cabin connectivity applications. These new capabilities enhance indie's revolutionary array of in-cabin solutions, allowing global Tier 1 system integrators to provide manufacturers with best-in-class in-vehicle experiences.

- February 2024: Samsung inaugurated a new semiconductor R&D facility in Bengaluru, India, through its division Samsung Semiconductor Research (SSIR). The modern campus promotes collaboration and agility, focusing on advancing semiconductor research and development to meet the company's growing infrastructure needs.

- February 2024: The Indian government approved three new semiconductor manufacturing units in partnership with Tata Group set to establish two of them. This initiative seeks to strengthen the semiconductor industry.

Semiconductor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Memory Devices, Logic Devices, Analog IC, MPU, Discrete Power Devices, MCU, Sensors, Others |

| Materials Used Covered | Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulfide, Others |

| End Users Covered | Automotive, Industrial, Data Centre, Telecommunication, Consumer Electronics, Aerospace and Defense, Healthcare, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc., Infineon Technologies AG, Intel Corporation, Micron Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Samsung Electronics Co. Ltd., SK hynix Inc., STMicroelectronics N.V., Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the semiconductor market from 2020-2034.

- The semiconductor market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the semiconductor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global semiconductor market was valued at USD 739.0 Billion in 2025.

The semiconductor market is expected to exhibit a CAGR of 5.97% during 2026-2034, reaching a value of USD 1,265.2 Billion by 2034.

The key factors driving the market include rising demand for advanced electronic devices, growth in emerging technologies like internet of things (IoT) and artificial intelligence (AI), increasing adoption of 5G, expanding automotive electrification, and the need for energy-efficient solutions. Robust investments in research and development (R&D) activities and a rise in smart device penetration also propel market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global semiconductor market include Broadcom Inc., Infineon Technologies AG, Intel Corporation, Micron Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Samsung Electronics Co. Ltd., SK hynix Inc., STMicroelectronics N.V., Taiwan Semiconductor Manufacturing Company Limited, Texas Instruments Incorporated, and Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)