Tequila Market Size, Share, Trends and Forecast by Product Type, Purity, Price Range, Distribution Channel, and Region, 2025-2033

Tequila Market 2024, Size and Trends:

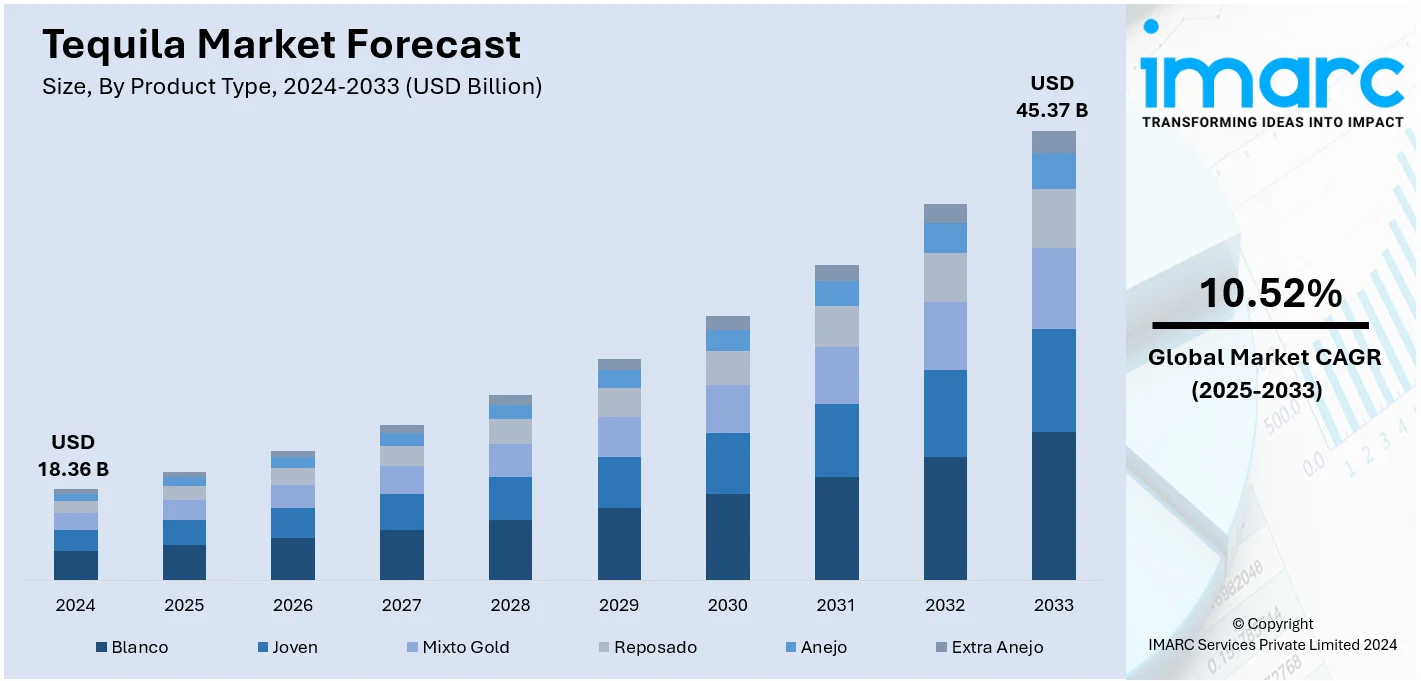

The global tequila market size was valued at USD 18.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.37 Billion by 2033, exhibiting a CAGR of 10.52% from 2025-2033. North America currently dominates the market. The growth of the North American region is driven by strong demand for premium and craft spirits, expanding cocktail culture, increased exports, and robust brand marketing initiatives highlighting authenticity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.36 Billion |

|

Market Forecast in 2033

|

USD 45.37 Billion |

| Market Growth Rate (2025-2033) | 10.52% |

An increasing shift in consumer preference toward high-quality, premium spirits is a major factor supporting the market growth. People are showing more interest in craft and artisanal tequila, appreciating its unique production process and flavors. This trend is leading to the expansion of luxury tequila offerings, catering to a more refined palate. Additionally, tequila is becoming a favored ingredient in mixology, with its versatility making it a staple in various cocktails. The growing social culture of enjoying cocktails at restaurants, bars, and events is driving the demand for tequila as a base spirit, particularly for innovative and customized drink options. Furthermore, tequila producers are leveraging creative marketing campaigns and collaborations with celebrities to build brand recognition. This is resulting in heightened awareness and a stronger connection with younger demographics, enhancing the product’s appeal across different age groups.

The United States plays a crucial role in the market, driven by the introduction of new tequila variants that blend traditional craftsmanship with modern production techniques. Brands are focusing on additive-free options, unique aging processes, and visually appealing packaging to attract discerning consumers. These premium offerings cater to the demand for high-quality spirits while highlighting a commitment to authenticity and innovation, boosting their appeal in the market. In 2024, Patrón made its debut in the Cristalino tequila segment with its initial additive-free product, matured in four barrels for 12-15 months and filtered through charcoal for transparency. The distinctive bottle design, drawn from Mexico’s natural splendor, showcases Patrón's fusion of tradition and modernity. It can be found at US stores for $79. Besides this, online platforms are simplifying access to a wide range of tequila brands, offering convenience and variety to consumers. The digital marketplace is opening opportunities for tequila producers to reach a broader audience.

Tequila Market Trends:

Rising Demand for Premium and Artisanal Tequila

The increasing consumer demand for premium and artisanal offerings represent one of the key factors impelling the market growth. Consumers are increasingly valuing quality over quantity, leading to a surge in interest for ultra-premium offerings. For example, in October 2022, Pernod Ricard, a leading global spirits company, took a controlling interest in Código 1530 Tequila, a producer of premium tequila, highlighting the industry's shift towards higher-end products. Younger consumers, particularly those aged 18-34, are driving this trend, with 54% expressing a preference for premium tequila, as reported by industry analysts. The popularity of 100% agave tequila, known for its superior quality and craftsmanship, further highlights this shift. Additionally, tequila’s versatility as a sipping spirit and its use in sophisticated cocktails enhances its appeal to modern consumers. Increased investments in branding, innovative aging techniques, and unique flavor profiles also attract a broader audience globally. This growing premium segment is expected to revolutionize the tequila market, significantly boosting its revenue growth worldwide.

Time Efficiency and Convenience

E-commerce penetration has greatly influenced tequila sales, especially after the COVID-19 pandemic, which fast-tracked online buying habits. Consumers are now more likely to buy alcoholic beverages online, and this opens up new market opportunities. As noted in International Wine and Spirits Record (IWSR), e-commerce sales of beverage alcohol hit USD 27 Billion in value and gained 42% in the year 2020. Further research evidence is documented in NCBI. Their study reveals how the adoption of lockdown and social distancing measures forced many bars to be closed. For example, within the period from March through September 2020, on-premises sales declined by 27%, and off-premises rose by 20%. This change marks the shift from bar consumption to home drinking, with customers increasingly opting for e-commerce platforms to buy tequila and other spirits. With the continued trend of online shopping, the global tequila market is likely to gain due to the increased consumer demand for convenience and ease of buying spirits online.

Innovation and Product Launches

The global tequila market remains a very growing market, backed by innovative product offerings released from major players in this industry. In February 2022, Pernod Ricard's brand Avión launched Reserva Cristalino Tequila, a premium blended tequila that is distilled with a blend of a 12-month-old añejo tequila alongside a hint of three-year old Extra Añejo Reserva. This is against the increasing demand from various consumers for high-quality ultrapremium tequilas. In like manner, Suntory Holdings Limited brought Añejo Cristalino from its Tres Generaciones brand in February 2022. Ultra-premium and made from master distillers at La Preserancia Distillery in Jalisco, Mexico, it seeks to tap a growing interest in crystal clear tequilas with refined flavor profiles. On the other hand, Bacardi launched an RTD offering under Cazadores tequila, which arrived in April 2021. The new product offers 5.9% ABV, is 100 percent blue agave, and is available. These product offerings are in Spicy Margarita and Paloma flavors. This provides scope for growth due to rising demand for alcoholic beverages with an increase in convenience and read-to-drink consumption.

Tequila Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tequila market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, purity, price range, and distribution channel.

Analysis by Product Type:

- Blanco

- Joven

- Mixto Gold

- Reposado

- Anejo

- Extra Anejo

Blanco accounts for the majority of the market share, driven by its versatile and unaged profile that appeals to a wide range of consumers. Renowned for its pure agave flavor and crisp taste, Blanco tequila is widely favored for use in cocktails and as a standalone drink. Its affordability compared to aged varieties makes it accessible to both new and experienced tequila enthusiasts. The growing preference for authentic and unaltered spirits aligns with Blanco tequila’s traditional production methods, further enhancing its appeal. Additionally, the rise of mixology culture is driving the demand, as bartenders and consumers recognize its ability to blend seamlessly with various ingredients. The prominence of Blanco tequila is also supported by its strong presence in the international export market, ensuring widespread availability. Its clear and fresh flavor profile continues to attract attention from a broad demographic, cementing its position as a staple in the tequila industry.

Analysis by Purity:

- 100% Tequila

- 60% Tequila

The 100% tequila segment holds the biggest market share due to its premium quality and authentic production process, made entirely from blue agave without any additives. Consumers value the craftsmanship and traditional methods associated with 100% tequila, as it delivers a pure and refined flavor profile. Its growing popularity is driven by heightened consumer awareness about ingredients and a preference for premium spirits that offer superior taste and experience. The demand for 100% tequila is particularly high among connoisseurs and in regions where artisanal and heritage products are celebrated. Additionally, the segment benefits from the trend of clean-label products, where transparency and authenticity in production are prioritized. Marketing efforts emphasizing its heritage and high-quality production are further elevating its status. The use of 100% tequila in premium cocktails, as well as its rising popularity as a sipping spirit, position as the leading choice among tequila enthusiasts.

Analysis by Price Range:

- Premium Tequila

- Value Tequila

- Premium and Super-Premium Tequila

- Ultra-Premium Tequila

Premium and super-premium tequila leads the market, driven by the rising consumer preference for high-quality, artisanal spirits that offer a superior drinking experience. These tequilas are often associated with meticulous production processes, including longer aging periods and the use of hand-selected agave, which enhance their flavor and complexity. Consumers are drawn to the unique craftsmanship and heritage that these products represent, positioning them as a luxurious choice for special occasions and gifting. This segment benefits from the growing trend of premiumization in the alcohol industry, where individuals are willing to invest in refined, authentic beverages. Marketing efforts by leading brands focusing on exclusivity and limited-edition releases further amplify the appeal of premium and super-premium tequila. The expanding presence of these offerings in high-end bars, restaurants, and retail outlets also plays a crucial role in their accessibility and popularity. This segment’s strong association with sophistication and quality solidifies its dominance in the market.

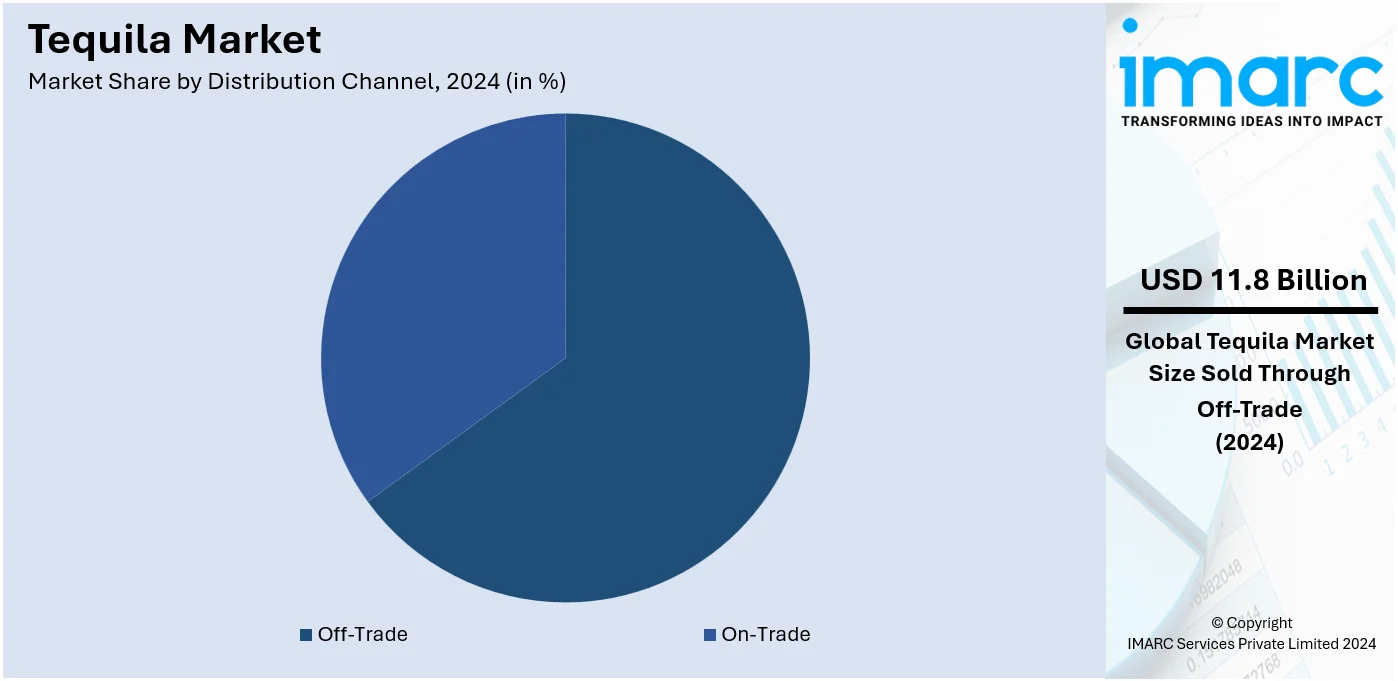

Analysis by Distribution Channel:

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

On-trade (restaurants and bars, liquor stores, and others) leads the market due to its role in providing a direct and experiential approach to consumer engagement. In these environments, tequila is not merely drunk but also examined, with bartenders and sommeliers taking a central role in informing individuals about various types, manufacturing processes, and pairing possibilities. The communal aspect of these venues boosts the allure of tequila, frequently making it the preferred beverage for festivities and get-togethers. High-end and artisanal tequila brands gain substantial advantages from the on-premise sector, as these settings emphasize uniqueness and quality via specialized menus and distinctive cocktails. The rise of mixology culture further amplifies the segment's importance, as tequila-based cocktails continue to gain traction among consumers seeking innovative and sophisticated beverage options. Moreover, collaborations between tequila brands and hospitality establishments enhance brand exposure and client loyalty, establishing the on-trade segment as a fundamental aspect of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market because of its robust consumer demand and established distribution systems. The area boasts significant brand recognition, allowing tequila to be easily available in numerous retail and hospitality industries. The growing demand for high-quality and artisanal products has continued to fuel growth, as consumers express interest in premium and ultra-premium options. Tequila's adaptability as a drink meant for sipping and as an essential component in cocktails boosts its appeal in social and festive occasions. Furthermore, marketing approaches that highlight authenticity and craftsmanship connect with local consumers, enhancing brand loyalty and involvement. In 2024, Espolòn Tequila marked its 25th anniversary with a limited-edition bottle created by Mexican artist Edgar “Saner” Flores in the United States. This achievement features underground activities, a streetwear line, and a $10,000 Modern Maverick Artist Grant aimed at assisting upcoming Latinx artists. The celebration showcases Espolòn’s heritage of creativity, Mexican traditions, and groundbreaking tequila production.

Key Regional Takeaways:

United States Tequila Market Analysis

A significant factor contributing to the expansion of the US tequila market is the rising consumer demand for premium and super-premium tequilas. As a result of increased sophistication, consumers want to pay a premium for 100% blue agave products. This premiumization trend is part of the larger spirits industry trend: quality over quantity, specifically among younger consumers looking for unique and elevated drinking experiences.

In 2022, the United States imported USD 26.6 Billion in alcoholic beverages, with distilled spirits accounting for nearly half of these imports. Distilled spirits, including tequila, are the largest and fastest-growing segment of US alcohol imports, amounting to USD 12 Billion, according to the USDA. The growing preference for high-quality tequila is contributing to this surge, with premium and super-premium tequilas gaining popularity across the nation. This trend not only supports expansion of the tequila market but also reveals a significant change in consumer habits from unrefined to rather more sophisticated and refined choices in alcohol industries.

Europe Tequila Market Analysis

Increasing demand for tequila in Europe is largely being fueled by an increase in imports. Nations such as Germany and Spain are playing a significant role in propelling the market forward. As per Industry reports, Germany alone imports about 4 million liters of tequila per year. The trend indicates the growing consumption of premium as well as artisanal varieties, which mainly reflect a strong trend of demand from German consumers emphasizing high-quality 100% agave tequilas. Spain is another market leader in Europe. It bought almost 3 million liters of tequila in 2020, thereby making it one of the leading importers in the region. Growth in Spain is primarily due to an increase in the demand for premium and super-premium tequilas among young age groups in search of unique experiences and premium quality drinks. These figures reflect the overall trend for increasing tequila consumption in Europe, which is characterized by a move from low-quality to higher-quality products. The growing demand for premium and super-premium tequilas is a major growth driver in the European market, thus strengthening the expansion of the tequila industry in the region even further.

Asia Pacific Tequila Market Analysis

Despite challenges such as high import tariffs, state-specific excise rates differ from one state to the other, and complex, state-specific regulations in place in a country like India, the Asia-Pacific market for tequila is burgeoning. In India, for instance, the alcoholic drinks sector would reach USD 55 Billion by 2027 as per industry reports. Key growth drivers are the country's increasing young and middle-class population and premiumization in the spirits market. There is an increased demand for high-quality imported alcoholic beverages as Indian imports of alcoholic drinks amount to USD 1 Billion for the year 2023. This marks a year-on-year increase of 74%. distilled spirits, of which tequila forms a large part, account for 56% of these imports.

The second factor that makes India an attractive growth market for tequila and other spirits is its low per capita alcohol consumption, relatively speaking. The consumer demand for premium and artisanal products is shifting. Premium quality 100% agave tequila will enjoy greater demand with such a change in the trend of preferences among consumers, further expanding the growth of the Asia-Pacific region's tequila market.

Latin America Tequila Market Analysis

Tequila is very important for Mexican culture and economy; thus, it is given priority by the Tequila Regulatory Council (CRT) regarding soil and water quality in producing tequila and the amount of blue agave used for such process. The seriousness for good quality has led the industry of tequila to remain steady and even growing up these years. For instance, in 2021, Mexico managed to produce 527 million liters of tequila. This was the highest volume since 1995. In the last two and half decades, tequila production has increased by approximately 405%. Between 2020 and 2021, the increase was a massive 153 million liters, according to Industry Reports.

One such strong growth driver for tequila in Latin America includes increasing demand for high quality, both at home and in exports, driving more industries related to tequila forward. Sustained growth is envisaged for the region mainly from commitments toward high-quality tequilas and authenticity paired with an ever-growing demand from worldwide consumers for premium spirituous beverages.

Middle East and Africa Tequila Market Analysis

According to Industry reports, in 2022, South African consumers are among the heaviest drinkers globally, consuming 9.45 liters of alcohol per person annually. This trend is contributing to the growth of the Middle East and Africa (MEA) tequila market, as there is an increasing demand for premium spirits, including tequila. Growing demand for premium and luxury alcoholic beverages in the region, along with a growing middle class, is driving the consumption of tequila. Demand for tequila has grown more significantly in South Africa due to an increasing number of consumers demanding high-quality products. Furthermore, urbanization, changes in social patterns, and the increased consumption of tequila-based cocktails in bars and restaurants are also adding fuel to market growth. With tequila increasingly popular across MEA and with imported brands in wider availability, the region is expected to maintain its upward trend regarding the consumption of tequila driven by a young, relatively wealthy demographic and rising incomes.

Competitive Landscape:

Key players in the market are focusing on strategic initiatives to strengthen their presence and capture a larger share of the growing demand. They are investing in innovative production techniques to enhance quality while maintaining the authenticity of the spirit. Branding efforts are geared toward highlighting heritage and premium positioning to attract discerning consumers. Expansion into emerging markets and partnerships with distributors are helping to widen their reach. Companies are also diversifying product lines, introducing flavored and aged varieties to cater to varied consumer preferences. Digital marketing campaigns and collaborations with influencers are further amplifying consumer engagement and brand visibility. In 2024, Bacardi Global Travel Retail launched the Experiencia Patrón pop-up at Heathrow Airport, marking the European debut of Patrón El Alto. This multi-sensory activation blends digital and physical elements to showcase Patrón’s craftsmanship, including its premium tequila range. The engaging campaign emphasizes tailored experiences and tastings to captivate travelers and enhance the tequila category.

The report provides a comprehensive analysis of the competitive landscape in the tequila market with detailed profiles of all major companies, including:

- Bacardi Limited

- Becle SAB de CV

- Brown-Forman Corporation

- Casa Aceves

- Clase Azul México

- Diageo Plc

- Heaven Hill Brands

- Pernod Ricard S.A.

- Sazerac Company Inc.

- Suntory Holdings Limited

Latest News and Developments:

- December 2024: Louis Vuitton-Moët Hennessy introduced Volcan de Mi Tierra, a high-end tequila brand, in India. Grounded in 300 years of Mexican tradition, it provides tequilas without additives made from 100% Blue Weber Agave. The selection features Blanco, Reposado, Cristalino, and Volcan X.A, showcasing luxury and remarkable craftsmanship.

- January 2024: Don Julio, a tequila brand owned by Diageo, has introduced Alma Miel, which is a combination of añejo and blanco Tequilas mixed with oven-roasted agave nectar.

- December 2023: Diageo Plc, a British multinational firm specializing in alcoholic drinks, has broadened its premium tequila line by launching the complete Don Julio range in India.

Tequila Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blanco, Joven, Mixto Gold, Reposado, Anejo, Extra Anejo |

| Purities Covered | 100% Tequila, 60% Tequila |

| Price Ranges Covered | Premium Tequila, Value Tequila, Premium and Super-Premium Tequila, Ultra-Premium Tequila |

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bacardi Limited, Becle SAB de CV, Brown-Forman Corporation, Casa Aceves, Clase Azul México, Diageo Plc, Heaven Hill Brands, Pernod Ricard S.A., Sazerac Company Inc., Suntory Holdings Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tequila market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global tequila market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tequila industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Tequila is an alcoholic beverage prepared from the fermented juice of the blue agave plant. It is categorized into Blanco, Reposado, Añejo, and Extra Añejo, based on aging. It is a key ingredient in popular drinks like margaritas, palomas, and tequila sunrise, enhancing the flavor with its distinctive taste.

The tequila market was valued at USD 18.36 Billion in 2024.

IMARC estimates the global tequila market to exhibit a CAGR of 10.52% during 2025-2033.

The global tequila market is driven by rising demand for premium and artisanal spirits, growing consumer interest in craft beverages, and tequila's versatility in cocktails. Additionally, health-conscious individuals favor tequila for its lower calorie content and natural ingredients, while innovative flavors and aging techniques attract diverse audiences.

In 2024, Blanco represented the largest segment by product type, driven by its pure agave flavor, affordability, versatility in cocktails, and widespread consumer preference for unaged, fresh tequila options.

100% tequila leads the market by purity owing to its superior quality, authentic production from blue agave, rich flavor profile, and growing consumer demand for premium, natural, and artisanal spirits.

Premium and super-premium tequila are the leading segment by price range due to increasing consumer preference for high-quality products, enhanced craftsmanship, unique aging processes, and their association with luxury and exclusivity.

On-trade leads the market by distribution channel attributed to the growing popularity of bars, restaurants, and nightclubs, where tequila is widely consumed in cocktails and premium experiences are highly valued by consumers.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global tequila market include Bacardi Limited, Becle SAB de CV, Brown-Forman Corporation, Casa Aceves, Clase Azul México, Diageo Plc, Heaven Hill Brands, Pernod Ricard S.A., Sazerac Company Inc., Suntory Holdings Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)