Indian Toys Market Size, Share, Trends and Forecast by Toy Type, Gender, Distribution Channel, and State, 2026-2034

Indian Toys Market Summary:

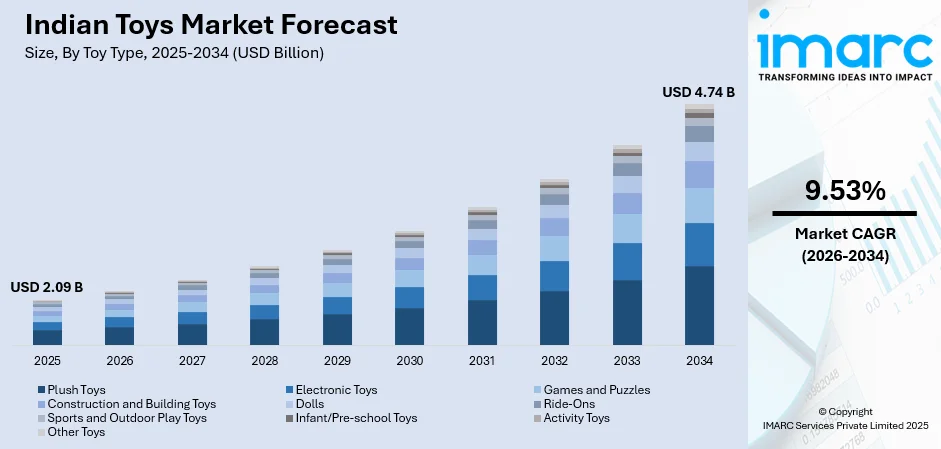

The Indian toys market size was valued at USD 2.09 Billion in 2025 and is projected to reach USD 4.74 Billion by 2034, growing at a compound annual growth rate of 9.53% from 2026-2034.

The Indian toy market is registering significant growth due to the increase in disposable income levels, a substantial youth population, and the growing awareness of child development through play amongst parents. The Indian toy industry comprises various product segments like plush toys, electronics toys, learning games, construction toys, and outdoor play equipment.

Key Takeaways and Insights:

-

By Toy Type: Plush toys lead the market with a share of 16% in 2025, driven by enduring consumer preference for soft, cuddly toys that offer comfort and companionship to children while serving as safe play options for various age groups.

-

By Gender: Unisex toys dominate the market with a share of 58% in 2025, owing to growing parental preference for gender-neutral products that promote inclusive play experiences and can be shared among siblings and playmates.

-

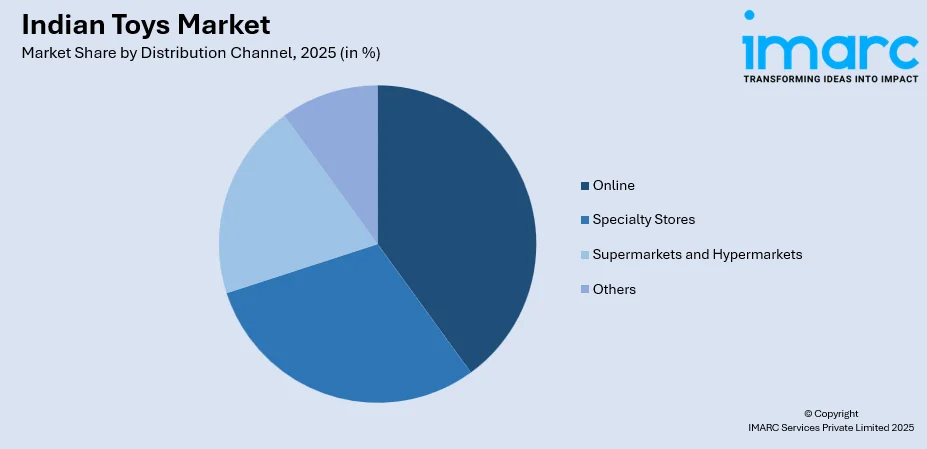

By Distribution Channel: Online dominates the market with a share of 38% in 2025, fueled by expanding e-commerce penetration, convenience of doorstep delivery, and access to wider product assortments across tier-two and tier-three cities.

-

By State: Maharashtra leads the market with a share of 20% in 2025, supported by the presence of major toy manufacturing units, strong retail infrastructure, and a large consumer base in metropolitan areas.

-

Key Players: The Indian toys market exhibits a moderately fragmented competitive structure with established domestic manufacturers and international brands operating alongside numerous regional players. Some of the key players include, Funskool India, Hamleys India, Hasbro, Mattel, Micro Plastics Private Limited, Plastech International Private Limited, Simba Toys India Pvt. Ltd., The LEGO Group, Toyzone, and Tripple Ess Toys.

To get more information on this market Request Sample

The Indian toys market is experiencing a transformative phase driven by favorable government policies, shifting consumer preferences toward educational and STEM-based toys, and rapid e-commerce expansion. In December 2025, Funskool India officially entered the electronic toys segment, signaling how domestic manufacturers are innovating to meet changing demand and expand product offerings in tech‑driven play experiences. The implementation of quality control regulations has enhanced product safety standards while supporting domestic manufacturing capabilities. Parents increasingly prioritize toys that facilitate cognitive development, motor skills, and creative thinking among children. The growing middle-class population with rising disposable incomes continues to fuel demand across urban and semi-urban markets. Additionally, the influence of media, entertainment franchises, and character-licensed products is strengthening consumer engagement and driving premiumization trends across the market.

Indian Toys Market Trends:

Rising Demand for Educational and STEM-Based Toys

Indian parents are increasingly investing in toys that combine entertainment with educational value, driving demand for STEM learning kits, coding robots, and interactive puzzles. In 2025, this shift is reflected in the growing popularity of AI‑powered educational toys that adapt to children’s learning pace, making cognitive play more engaging and personalized. The trend highlights heightened awareness of early childhood development and the importance of nurturing problem‑solving, analytical thinking, and cognitive skills through play-based learning.

E-Commerce Expansion and Digital Retail Transformation

The Indian toys market is undergoing a transformative phase driven by supportive government policies, growing demand for educational and STEM-based toys, and rapid e-commerce growth. Online retail platforms are expanding access to diverse toys in smaller cities and rural areas, offering convenience, competitive pricing, and detailed product information. With the India e-commerce market valued at USD 129.72 billion in 2025 and projected to reach USD 651.10 billion by 2034 at a 19.63% CAGR, combined with quality control and safety regulations, consumer trust and market expansion are set to strengthen.

Sustainable and Eco-Friendly Product Innovation

Environmental consciousness is increasingly shaping toy purchasing decisions, with manufacturers offering products made from recycled materials, sustainable wood, and non‑toxic components. According to reports, prime minister Narendra Modi recently urged Indian toy makers to use less plastic and adopt eco-friendly, recyclable materials, highlighting a national push for sustainable production. This shift aligns with growing consumer demand for safe and responsible toys while meeting evolving regulatory standards for child safety and environmental sustainability.

Market Outlook 2026-2034:

The Indian toys market is positioned for sustained double-digit growth throughout the forecast period, supported by favorable demographics, government initiatives promoting domestic manufacturing, and evolving consumer preferences toward quality products. The Make in India initiative and Quality Control Orders are strengthening the domestic manufacturing ecosystem while reducing import dependency. The market generated a revenue of USD 2.09 Billion in 2025 and is projected to reach a revenue of USD 4.74 Billion by 2034, growing at a compound annual growth rate of 9.53% from 2026-2034.

Indian Toys Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Toy Type | Plush Toys | 16% |

| Gender | Unisex Toys | 58% |

| Distribution Channel | Online | 38% |

| State | Maharashtra | 20% |

Toy Type Insights:

- Plush Toys

- Electronic Toys

- Games and Puzzles

- Construction and Building Toys

- Dolls

- Ride-Ons

- Sports and Outdoor Play Toys

- Infant/Pre-school Toys

- Activity Toys

- Other Toys

The plush toys lead with a market share of 16% of the total Indian toys market in 2025.

The plush toys segment remains the market leader due to strong consumer preference for soft, huggable products that offer comfort and emotional support. Appealing to all ages, they serve as companions, sleep aids, and decorative items. Indian companies are innovating, for example in July 2025, Ultra Soft Toys launched its ‘Cuddle & Calm’ weighted plush range for emotional wellness and sensory comfort, alongside cultural and festive lines. Character licensing further boosts appeal and collectability.

Manufacturers are enhancing their offerings with premium materials, interactive features, and customizable options to differentiate in a competitive market. Safety certifications and non-toxic materials have become key considerations for parents, prompting improvements in product quality across the segment. These innovations not only build consumer trust but also support premium pricing strategies for branded toys, reinforcing their value and appeal in India’s growing toy market.

Gender Insights:

- Unisex Toys

- Toys for Boys

- Toys for Girls

The unisex toys dominate with a share of 58% of the total Indian toys market in 2025.

The unisex toy category is leading in the market because of the shift in mindset among parents regarding encouraging children in a gender-free manner with activities and skills, thus avoiding any male/female stereotypes. The category consists of construction toys, educational toys, puzzles, and outdoor play materials, so it offers a versatile choice suited to children of all ages.

The demand for products that involve equal learning opportunities has encouraged manufacturers and retailers to produce inclusive toys that break beyond the boundaries of gender. The benefits are not only confined to helping the children of both genders play together, but also to providing a practical advantage by allowing children of different genders to share toys.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Online

- Others

The online dominates with a market share of 38% of the total Indian toys market in 2025.

The online distribution channel has become the leading sales platform, driven by expanding e‑commerce infrastructure, smartphone adoption, and shifting consumer shopping habits. India’s top omni-channel retailer FirstCry reported an 18% growth in online gross merchandise value in the 2024‑25 fiscal year, surpassing offline growth. This underscores the rising importance of digital channels in reaching consumers across both urban and emerging markets for toys and children’s products.

E-commerce growth is especially strong in tier-two and tier-three cities, where limited physical retail is offset by improving internet connectivity and digital payment adoption. Major platforms are investing in logistics networks, same-day delivery, and seasonal promotions, boosting toy category growth and attracting customers across diverse demographics. This expansion is enabling broader access to a variety of products while strengthening consumer engagement in emerging markets.

State Insights:

- Maharashtra

- Tamil Nadu

- Karnataka

- Gujarat

- Delhi

- Other States

Maharashtra exhibits a clear dominance with a 20% share of the total Indian toys market in 2025.

Maharashtra continues to hold its leading market share position in the Indian toys market because of its strong production infrastructure, widespread distribution channels, and larger number of city-based consumers residing in cities like Mumbai and Pune. Maharashtra is home to many manufacturing units of toys, acting as an essential distribution channel for both domestic and foreign toys entering the Indian market.

Growing economic development at the state level, along with higher disposable incomes and familiarity with international trends in consuming various products, translates to rising demand for better toys. Customers have benefited from well-organized retail channels, with modern retail and specialty stores available for toys, giving them exposure to varied offerings of good quality. In addition to providing ease of shopping, the organized retailing channels help to boost the overall growth of the toy industry in the region.

Market Dynamics:

Growth Drivers:

Why is the Indian Toys Market Growing?

Favorable Demographics and Rising Disposable Incomes

India’s vast young population provides a substantial market for toy manufacturers and retailers, with approximately 24% of the country’s estimated 1.44 billion people aged 0–14, underscoring the strong child demographic driving demand for toys and related products. Rising disposable incomes among the expanding middle class have increased spending on educational and recreational toys, with parents prioritizing quality products that support child development. Rapid urbanization is creating new consumer clusters exposed to global trends and fostering a preference for branded toys that meet international quality, safety, and developmental standards, further expanding market opportunities.

Government Initiatives Supporting Domestic Manufacturing

The Indian government has implemented comprehensive policies to strengthen the domestic toy manufacturing ecosystem under the Make in India and Atmanirbhar Bharat initiatives. In July 2025, Union Commerce Minister Piyush Goyal highlighted that India’s toy exports now reach 153 countries, reflecting the success of initiatives supporting local manufacturing and quality standards. Increased customs duties on imported toys, mandatory quality certifications through the Bureau of Indian Standards, and the establishment of toy manufacturing clusters have reduced import dependency while boosting local production capabilities. The government's announcement of dedicated schemes to position India as a global toy manufacturing hub provides further momentum for industry growth and export development.

E-Commerce Expansion and Digital Accessibility

The rapid proliferation of e-commerce platforms has democratized access to diverse toy products across geographic and demographic segments. Initiatives like the Open Network for Digital Commerce (ONDC) are enabling small and indigenous sellers from rural India to join digital marketplaces, increasing product availability and helping toy manufacturers and retailers reach consumers in smaller towns and villages. Online retail channels enable manufacturers to reach consumers in smaller towns and rural areas where traditional retail presence remains limited. Digital platforms offer convenience, product comparisons, customer reviews, and competitive pricing that attract time-constrained urban parents. The integration of digital payment solutions and improved logistics infrastructure continues to accelerate online toy purchases across the country.

Market Restraints:

What Challenges the Indian Toys Market is Facing?

Competition from Unorganized Sector

The influx of unorganized manufacturers offering low-cost toys creates significant pricing pressure on organized players striving to maintain quality standards. Price-sensitive consumers often choose cheaper options despite potential safety and quality risks, posing challenges for brands attempting to promote premium products and drive market premiumization, ultimately affecting profitability and brand positioning.

Limited Domestic Technology and Design Capabilities

Many domestic manufacturers continue to rely on outdated machinery and technology, restricting product quality, design innovation, and production efficiency. Building competitive capabilities in electronic and technologically advanced toys is challenging without significant investment in modern equipment and workforce skill development, limiting growth potential in high-tech and innovation-driven market segments.

Digital Entertainment Competition

Growing screen time on smartphones, tablets, and gaming devices is shifting children’s attention and spending away from traditional toys. To stay competitive, toy manufacturers must innovate continuously, designing products that engage children effectively and appeal to parents’ preferences, ensuring traditional toys remain relevant and attractive despite the increasing dominance of digital entertainment.

Competitive Landscape:

The Indian toys market exhibits a moderately fragmented competitive structure characterized by the presence of established domestic manufacturers, international brands, and numerous regional players operating across price segments. Leading companies differentiate through product innovation, quality certifications, brand building, and distribution network expansion. International players leverage global brand recognition and licensing partnerships while domestic manufacturers focus on cost competitiveness and local market understanding. The implementation of quality control regulations has elevated entry barriers and encouraged consolidation among organized players committed to compliance. Strategic partnerships between domestic manufacturers and international brands for technology transfer and product licensing are becoming increasingly common.

Some of the key players include:

- Funskoolindia

- Hamleys India

- Hasbro

- Mattel

- Micro Plastics Private Limited

- Plastech International Private Limited

- Simba Toys India Pvt Ltd.

- The LEGO Group

- Toyzone

- Tripple Ess Toys

Recent Developments:

-

In July 2025, Startup WOL3D launched Vinglits, India’s first line of 3D‑printed flexible toys, combining advanced additive manufacturing with biodegradable materials. The launch positions WOL3D at the forefront of sustainable and innovative toy design, catering to environmentally conscious consumers while introducing cutting-edge production technology to the Indian toy market.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Toy Types Covered | Plush Toys, Electronic Toys, Games and Puzzles, Construction and Building Toys, Dolls, Ride-Ons, Sports and Outdoor Play Toys, Infant/Pre-school Toys, Activity Toys, Other Toys |

| Genders Covered | Unisex Toys, Toys for Boys, Toys for Girls |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Online, Others |

| States Covered | Maharashtra, Tamil Nadu, Karnataka, Gujarat, Delhi, Others |

| Companies Covered | Funskoolindia, Hamleys India, Hasbro, Mattel, Micro Plastics Private Limited, Plastech International Private Limited, Simba Toys India Pvt Ltd., The LEGO Group, Toyzone, Tripple Ess Toys, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian toys market size was valued at USD 2.09 Billion in 2025.

The Indian toys market is expected to grow at a compound annual growth rate of 9.53% from 2026-2034 to reach USD 4.74 Billion by 2034.

Plush toys led the market with a 16% share, driven by enduring consumer preference for soft, cuddly toys that offer comfort and companionship to children across various age groups.

Key factors driving the Indian toys market include favorable demographics with a large young population, rising disposable incomes, government initiatives supporting domestic manufacturing, growing demand for educational and STEM-based toys, and expanding e-commerce penetration.

Major challenges include competition from the unorganized sector offering low-cost products, limited domestic technology and design capabilities, increasing digital entertainment alternatives competing for children's attention, and the need for continuous innovation to meet evolving consumer preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)