India Social Commerce Market Size, Share, Trends and Forecast by Business Model, Device Type, Product Type, and Region, 2026-2034

India Social Commerce Market Summary:

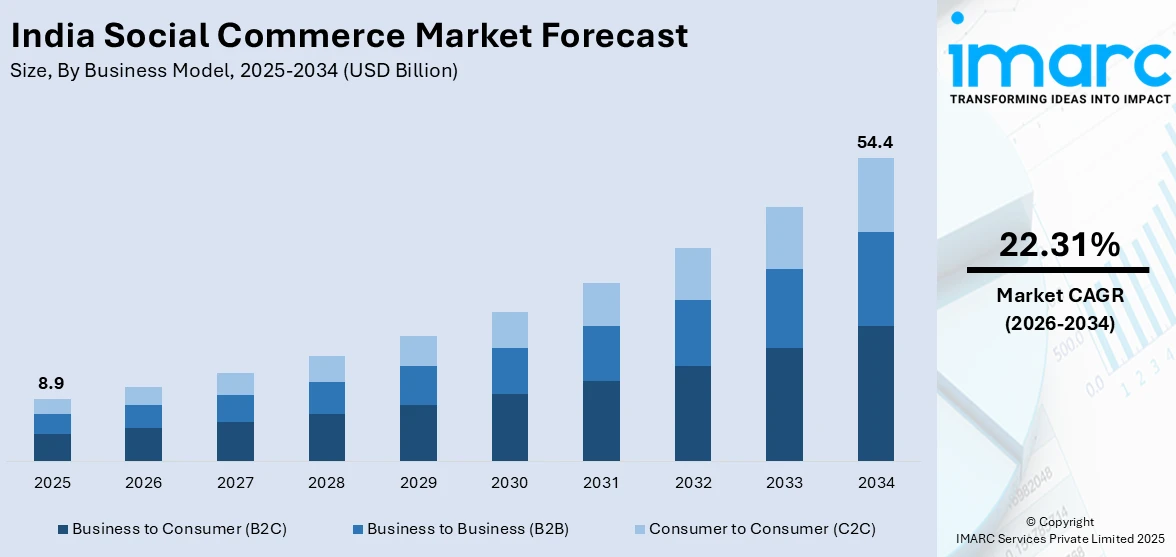

The India social commerce market size was valued at USD 8.9 Billion in 2025 and is projected to reach USD 54.4 Billion by 2034, growing at a compound annual growth rate of 22.31% from 2026-2034.

The India social commerce market is experiencing robust expansion, as social media platforms increasingly integrate seamless shopping functionalities that blend product discovery with instant purchasing. The widespread adoption of smartphones, affordable mobile internet driven by competitive data plans, and the rapid proliferation of digital payment systems, such as Unified Payments Interface (UPI), are accelerating consumer participation across urban and semi-urban regions.

Key Takeaways and Insights:

- By Business Model: Business to consumer (B2C) dominates the market with a share of 55% in 2025, owing to the increasing preference for direct online purchases through social media platforms, seamless checkout experiences, and influencer-driven product promotions that build consumer confidence.

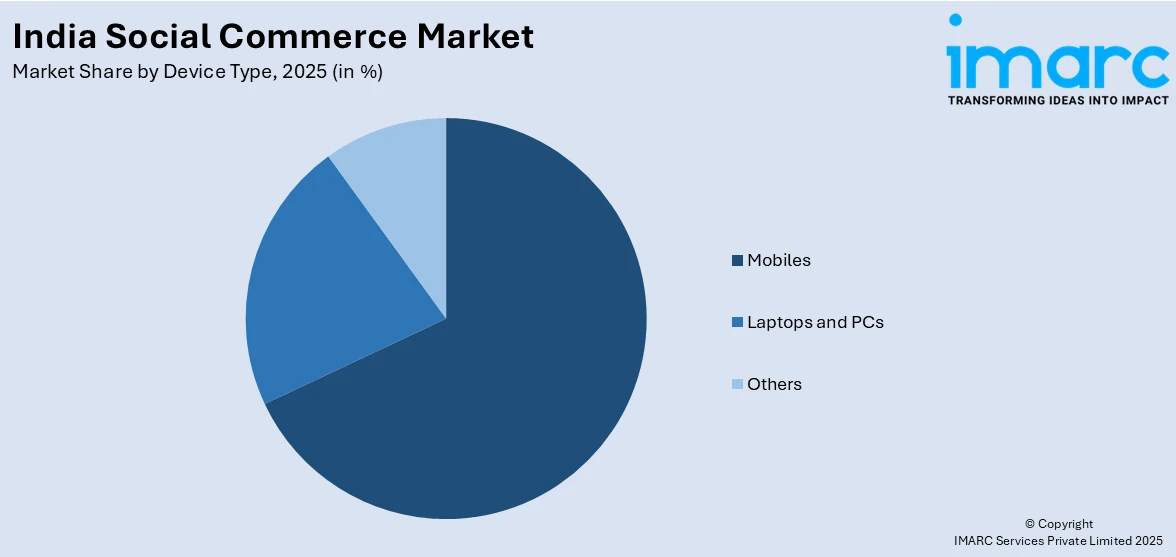

- By Device Type: Mobiles lead the market with a share of 68% in 2025, driven by widespread smartphone adoption, affordable mobile internet, and mobile-first features, including UPI payments and short-video content that enhance accessibility across urban and rural regions.

- By Product Type: Personal and beauty care prevail the market with a share of 20% in 2025, reflecting the rising influence of video tutorials, creator endorsements, and virtual try-on features that simplify purchase decisions for skincare, cosmetics, and grooming products.

- By Region: West and Central India represents the largest region with 30% share in 2025, driven by rapid urbanization, robust digital infrastructure, and strong consumer purchasing power concentrated in metropolitan hubs, such as Mumbai and Ahmedabad.

- Key Players: Key players drive the India social commerce market by expanding platform capabilities, integrating advanced artificial intelligence (AI)-driven personalization, strengthening logistics networks, and forging strategic partnerships with creators and influencers to boost product discovery and accelerate consumer adoption nationwide.

To get more information on this market Request Sample

The India social commerce market is advancing, as brands, platforms, and individual entrepreneurs harness the convergence of social media engagement and digital transactions to reshape retail. The sector is witnessing a structural transformation, fueled by the government's Digital India initiative. India's UPI ecosystem processed 228.3 Billion transactions in 2025, reinforcing the digital payment infrastructure that underpins social commerce growth. The integration of live commerce and shoppable short-form videos is creating multiple touchpoints for consumer conversion, particularly among first-time online shoppers in smaller cities. Low data costs and widespread smartphone penetration are accelerating user participation across tier II and tier III cities. Influencer-led community selling and vernacular content are improving trust and relatability among regional consumers. Social commerce platforms are also enabling small sellers and homegrown brands to access nationwide markets with minimal upfront investment.

India Social Commerce Market Trends:

Rising Adoption of Video Commerce and Live Shopping Experiences

Video commerce is rapidly emerging as a dominant sales channel within the India social commerce ecosystem, as platforms integrate shoppable content directly into short-form video feeds and live streaming sessions. Consumers are increasingly engaging with product demonstrations, tutorials, and influencer-led showcases that combine entertainment with instant purchasing options. Real-time interaction through live chats and limited-time offers is enhancing consumer engagement and urgency to purchase. As brands gain access to viewer analytics and performance data, video commerce strategies are becoming more targeted and return on investment (ROI)-driven.

Expansion of Vernacular Content and Tier II and Tier III City Penetration

Social commerce platforms are experiencing accelerated adoption in tier II and tier III cities, driven by the availability of vernacular language interfaces, regional content, and community-based selling models that resonate with non-metropolitan consumers. Trust in peer recommendations and nano-influencer endorsements is particularly strong in these markets, where traditional e-commerce penetration remains relatively low. According to IAMAI, rural areas accounted for over 57% of all new internet users in India, as of January 2026, signaling a structural shift in the digital landscape that is fueling the market growth.

Integration of AI-Driven Personalization and Conversational Commerce

AI is transforming how social commerce platforms deliver personalized shopping experiences, from algorithmic product recommendations to chatbot-assisted transactions via messaging applications. Platforms are leveraging machine learning (ML) to analyze browsing patterns, purchase histories, and social interactions to curate tailored product feeds that enhance conversion rates. AI-driven sentiment analysis, dynamic pricing, and automated customer support are further improving discovery, engagement, and post-purchase service, while helping sellers optimize inventory planning and customer retention across rapidly scaling social commerce ecosystem nationwide.

Market Outlook 2026-2034:

The India social commerce market is poised for sustained expansion over the forecast period, driven by the convergence of expanding digital infrastructure, rising smartphone adoption, and the deepening integration of commerce functionalities within social media platforms. The proliferation of UPI-enabled transactions is eliminating payment friction and empowering micro-entrepreneurs to conduct seamless transactions. The market generated a revenue of USD 8.9 Billion in 2025 and is projected to reach a revenue of USD 54.4 Billion by 2034, growing at a compound annual growth rate of 22.31% from 2026-2034. The continued expansion of creator-led commerce models, live shopping formats, and vernacular-first platform strategies is expected to unlock significant consumer participation from underserved markets.

India Social Commerce Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Business Model |

Business to Consumer (B2C) |

55% |

|

Device Type |

Mobiles |

68% |

|

Product Type |

Personal and Beauty Care |

20% |

|

Region |

West and Central India |

30% |

Business Model Insights:

- Business to Consumer (B2C)

- Business to Business (B2B)

- Consumer to Consumer (C2C)

Business to consumer (B2C) dominates with a market share of 55% of the total India social commerce market in 2025.

Business to consumer (B2C) leads the India social commerce market, as brands and retailers increasingly leverage social media platforms to engage consumers with personalized promotions, influencer collaborations, and seamless checkout experiences. The convenience of discovering products through social feeds, combined with secure digital payment options, including UPI and buy-now-pay-later services, has accelerated B2C adoption. In December 2025, Meesho launched its USD 606 Million IPO, becoming India's first major horizontal e-commerce platform to go public, with 234.2 Million transacting users in the preceding 12 months, reflecting the massive scale of B2C social commerce adoption across the country.

The proliferation of mobile-first shopping experiences that combine product discovery, video-based content, and fast purchasing in a single application environment is another factor contributing to the growth of B2C social commerce. In order to boost conversion rates, especially among younger demographics and first-time online consumers in smaller cities, brands are investing more in creative collaborations and shoppable content formats. Additionally, within B2C social commerce platforms, enhanced last-mile logistics and streamlined return procedures are boosting customer confidence and promoting repeat business.

Device Type Insights:

Access the comprehensive market breakdown Request Sample

- Laptops and PCs

- Mobiles

- Others

Mobiles lead with a share of 68% of the total India social commerce market in 2025.

Mobiles command the largest share of the India social commerce market, driven by the massive proliferation of affordable smartphones and the availability of competitively priced mobile data plans across the country. The mobile-first nature of social media platforms, combined with integrated UPI payment rails and short-video content formats, creates a seamless journey from product discovery to checkout within a single device. As per the Comprehensive Modular Survey: Telecom, conducted from January 2025 to March 2025, in India, around 85.5% of homes owned at least one smartphone, providing the foundational infrastructure that enables social commerce to reach both urban consumers and rural populations alike.

The dominance of mobiles in social commerce is further reinforced by the deployment of 4G and 5G networks that enable reliable video streaming, augmented reality (AR) experiences, and real-time communication between buyers and sellers. Platforms are optimizing user interfaces for mobile screens, incorporating voice search capabilities in regional languages, and integrating messaging-based catalog commerce to cater to consumers who prefer conversational shopping experiences. This mobile-first approach is also lowering entry barriers for small sellers, enabling faster onboarding, wider reach, and more frequent consumer interactions across diverse regional markets.

Product Type Insights:

- Personal and Beauty Care

- Apparels

- Accessories

- Home Products

- Health Supplements

- Food and Beverages

- Others

Personal and beauty care comprise the leading segment with a 20% share of the total India social commerce market in 2025.

Personal and beauty care lead the India social commerce market, as video tutorials, influencer endorsements, and AR try-on features simplify purchase decisions for skincare, cosmetics, and grooming items. The visual and demonstrative nature of beauty content aligns perfectly with short-form video and live streaming formats prevalent on social platforms. The rise of vernacular content creators and nano-influencers, who establish credibility through genuine product reviews and suggestions catered to local tastes, is further propelling the expansion of the personal and beauty care segment.

In order to reach consumers in tier II and tier III cities, brands are increasingly implementing digital-first strategies and collaborating with social media marketplaces and e-commerce platforms. In March 2025, the Department for Promotion of Industry and Internal Trade (DPIIT) and the Estée Lauder Companies Inc. signed a Memorandum of Understanding (MoU) to support innovation and entrepreneurship in India's beauty and personal care sector, integrating Startup India's platform with the BEAUTY&YOU India program to fund and mentor beauty startups.

Regional Insights:

- North India

- West and Central India

- South India

- East India

West and Central India represents the leading region with a 30% share of the total India social commerce market in 2025.

West and Central India accounts for the largest share of the India social commerce market, driven by rapid urbanization, robust digital infrastructure, and strong consumer purchasing power concentrated in key metropolitan hubs. States, including Maharashtra, Gujarat, and Madhya Pradesh, have a tech-savvy population that actively engages with social media platforms for product discovery and purchasing. Mumbai and Ahmedabad serve as prominent centers for e-commerce and direct-to-consumer (D2C) brands. According to the ICRIER State of India's Digital Economy Report 2024, Karnataka, Maharashtra, Telangana, Gujarat, and Haryana occupy the top five positions in sub-national digitalization rankings, reinforcing the region's digital commerce leadership.

The existence of local artisan networks and manufacturing clusters that guarantee a consistent supply of popular clothing, handicrafts, and consumer electronics for social media platforms further solidifies the region's dominance. Transaction volumes are accelerated by the region's widespread smartphone adoption and smooth UPI acceptance, while tier II cities like Pune, Surat, and Nagpur support rising consumer demand. Additionally, the social commerce ecosystem in West and Central India is strengthening regional supply chains and diversifying product offerings, as a result of the growing involvement of small and medium-sized businesses.

Market Dynamics:

Growth Drivers:

Why is the India Social Commerce Market Growing?

Rapid Proliferation of Smartphones and Affordable Mobile Internet

The rapid use of smartphones and reasonably priced mobile internet services in India is laying a broad basis for the expansion of social commerce. Customers in urban, semi-urban, and rural locations may access social media platforms and make purchases online, owing to competitive data pricing from major telecom providers, continuous 4G coverage extension, and 5G implementation. The mobile-first nature of India's digital ecosystem guarantees that finding products, watching videos, and completing transactions happen smoothly on a single device. As of March 2024, there were 954.40 Million internet users in India, indicating the growing digital reach that supports the expansion of social commerce into previously untapped markets. The availability of affordable smartphones, equipped with capabilities for AR features and high-definition video streaming, further democratizes access to social shopping experiences.

Expansion of Digital Payment Infrastructure and UPI Ecosystem

The development of the digital payment infrastructure in India, enabled by the UPI system, is removing the barriers that limited the adoption of online commerce. The India UPI market was valued at USD 16.9 Billion in 2024, as per IMARC Group. Micro business owners who operate their businesses through social media platforms are able to benefit from the zero merchant transaction fees policy, offered by the UPI system. This policy eliminates payment processing expenses for low-value transactions. The one-touch checkout functionalities of the social commerce sites are facilitated by the UPI system, which ensures lower cart abandonment rates and an easy checkout process for users. The expansion of the digital payment system through the launch of UPI Lite, credit on the UPI system, and the AutoPay mandate further helps the growth of the social commerce industry in India.

Integration of Video Commerce, Live Shopping, and Creator Economies

The rapid integration of video commerce and live shopping formats is emerging as a powerful growth driver for the India social commerce market. Short-form videos, live product demonstrations, and creator-led selling formats are transforming passive content consumption into interactive shopping experiences. Consumers increasingly prefer watching product reviews, tutorials, and real-time demonstrations that reduce uncertainty and replicate in-store engagement. Influencers and micro-creators play a critical role in building authenticity and trust, particularly among younger demographics and first-time online shoppers. Regional language content further expands reach into tier II and tier III cities, improving inclusivity and conversion rates. Platforms are embedding instant purchase options, limited-time offers, and live chat features within video streams, creating urgency and boosting impulse buying. As brands gain access to granular viewer analytics, video commerce strategies are becoming more performance-driven, making this format a sustainable growth catalyst for social commerce adoption.

Market Restraints:

What Challenges the India Social Commerce Market is Facing?

Trust Deficit and Product Quality Concerns Among Consumers

The prevalence of counterfeit products, inconsistent quality standards, and limited return or refund mechanisms on peer-to-peer and reseller-driven social commerce platforms continue to undermine consumer confidence. Unlike established e-commerce marketplaces that offer standardized quality checks and buyer protection policies, many social commerce transactions rely on informal trust networks, making consumers vulnerable to misleading product representations and fraudulent sellers. This trust deficit is particularly pronounced in categories, such as electronics, where product authenticity is critical.

Logistics and Last-Mile Delivery Challenges in Rural Areas

Despite significant advancements in India's logistics infrastructure, last-mile delivery remains a persistent challenge for social commerce platforms targeting consumers in rural and semi-urban regions. The fragmented nature of transportation networks in remote areas leads to delayed deliveries, elevated shipping costs, and inconsistent service quality that diminish the overall customer experience. These logistical bottlenecks are particularly detrimental for perishable and time-sensitive product categories, limiting the ability of social commerce platforms to fully capitalize on growing rural demand.

Regulatory Uncertainty and Evolving Compliance Requirements

The rapidly evolving regulatory landscape governing digital commerce, influencer marketing, and data privacy in India presents compliance challenges for social commerce platforms and individual sellers. Frequent updates to advertising disclosure norms, consumer protection guidelines, and data localization requirements increase operational complexity and compliance costs. Smaller sellers and creators often face difficulties in interpreting and implementing these regulations consistently. Uncertainty around future policy directions may also slow platform innovation and expansion initiatives.

Competitive Landscape:

The India social commerce market exhibits a moderately fragmented competitive structure, with a diverse mix of established e-commerce platforms, dedicated social commerce startups, and individual micro-entrepreneurs competing for consumer attention and market share. Leading platforms are differentiating through technology-driven innovations, including AI-powered product recommendations, creator-led commerce tools, and integrated logistics solutions that streamline the seller experience. Strategic investments in vernacular content capabilities and live shopping features are enabling market participants to deepen penetration in tier II and tier III cities. The sector is witnessing increasing consolidation and capital inflows, with platform players expanding product category coverage and strengthening creator networks to sustain competitive positioning.

India Social Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Business to Consumer (B2C), Business to Business (B2B), Consumer to Consumer (C2C) |

| Device Types Covered | Laptops and PCs, Mobiles, Others |

| Product Types Covered | Personal and Beauty Care, Apparels, Accessories, Home Products, Health Supplements, Food and Beverages, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India social commerce market size was valued at USD 8.9 Billion in 2025.

The India social commerce market is expected to grow at a compound annual growth rate of 22.31% from 2026-2034 to reach USD 54.4 Billion by 2034.

Business to consumer (B2C) dominated the market with a share of 55%, driven by direct online purchases through social media platforms, personalized promotions, influencer collaborations, and seamless digital checkout experiences.

Key factors driving the India social commerce market include rapid smartphone proliferation, affordable mobile internet, the expansion of UPI-enabled digital payments, growing influence of creator-led commerce, and government initiatives promoting micro, small and medium enterprises (MSME) digital onboarding.

Major challenges include trust deficits related to product quality and counterfeit goods, last-mile delivery constraints in rural and semi-urban areas, evolving regulatory compliance requirements, limited seller digital literacy, and fragmented logistics infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)