Healthcare BPO Market Report by Payer Service (Human Resource Management, Claims Management, Customer Relationship Management, Operational and Administrative Management, Care Management, Provider Management, and Others), Provider Service (Patient Enrollment and Strategic Planning, Patient Care Service, Revenue Cycle Management), Pharmaceutical Service (Manufacturing Services, Research and Development Services, Non-clinical Services), and Region 2026-2034

Global Healthcare BPO Market:

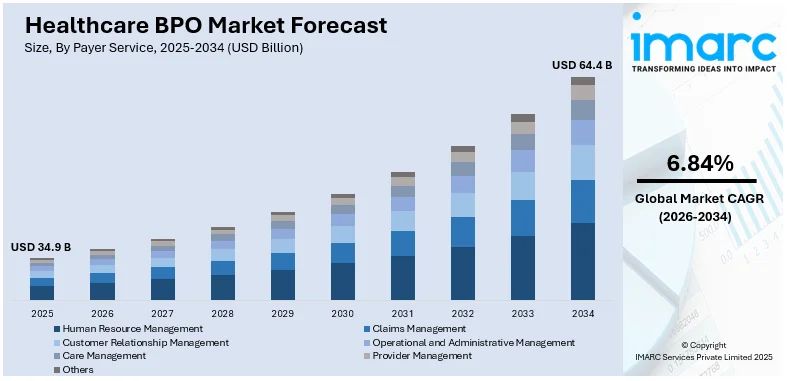

The global healthcare BPO market size reached USD 34.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 64.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.84% during 2026-2034. The growing need to reduce workload and operational costs, rising prevalence of various chronic diseases, and increasing adoption to generate more profit margins among healthcare facilities represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 34.9 Billion |

|

Market Forecast in 2034

|

USD 64.4 Billion |

| Market Growth Rate 2026-2034 | 6.84% |

Healthcare BPO Market Analysis:

- Major Market Drivers: The increasing focus on enhancing patient safety and health represents one of the key factors contributing to the growth of the market. Furthermore, the rising prevalence of various infectious diseases and the escalating number of patients being admitted to hospitals are also contributing to the market growth.

- Key Market Trends: The rising emergence of machine learning (ML) and artificial intelligence (AI)-based tools that assist in making the patient management process more efficient is creating a positive outlook for the overall market.

- Competitive Landscape: Some of the leading healthcare BPO market companies are Accenture plc, Cognizant, GeBBS Copyright, Genpact, International Business Machines Corporation, Invensis Technologies Pvt Ltd, IQVIA Inc., NTT DATA, Inc., Omega Healthcare Management Services, and WNS (Holdings) Ltd., among others.

- Geographical Landscape: According to the report, North America was the largest market for healthcare BPO. The North America healthcare system is a rapidly growing industry which includes pharmacies, pharmaceutical companies, medical equipment manufacturers, and medical care facilities. This complex industry infrastructure heavily relies on specialized professionals who oversee these operations, like healthcare BPOs, which are augmenting market growth in the region.

- Challenges and Opportunities: In the healthcare BPO market, challenges include maintaining regulatory compliance, ensuring data security, and addressing concerns about quality control. However, opportunities arise from technological advancements, cost reduction potential, and the increasing demand for specialized services. Balancing these challenges and opportunities is key to the evolving healthcare BPO landscape.

To get more information on this market Request Sample

Healthcare BPO Market Trends:

Increasing Patient Count and Rising Focus on Enhanced Patient Safety

The increasing focus on enhancing patient safety and health represents one of the key factors contributing to the growth of the market. It is essential for a healthcare facility to treat patients with the highest level of care and offer the best treatment options. Healthcare BPOs assist in managing non-core activities in an organization, which reduces the workload of staff members and care providers and helps them become more focused on patient health. Moreover, the rising number of patients admitted to the hospital is also significantly contributing to the healthcare BPO market demand. For instance, in 2022, there were over 33.7 million hospital admissions in the United States. Moreover, the inpatient care market worldwide is predicted to witness a prominent growth, with projected revenue reaching a staggering US$ 2.37 Trillion by 2024. Furthermore, the escalating number of hospitals across the globe is also augmenting the need for healthcare BPOs. For instance, in 2019, Niti Aayog, the Government of India, stated that in the next five years, India will have around 2,500 new hospitals, and by 2024, India is also likely to attain the WHO norm of having one doctor for every thousand patients. Such expansion in both hospitals and the number of patients is prompting healthcare facilities to adopt healthcare BPO services.

Emerging Need for Revenue Cycle Management in Healthcare

Healthcare systems use revenue cycle management (RCM) to track the financial dealings with patients, from their initial appointment to the final payment of the balance associated with the healthcare system. Moreover, the report published by Hyperon in September 2022 stated that healthcare facilities can only deliver high-quality care while maintaining their financial stability with properly configured RCM processes. Thus, the usage of RCM has increased across healthcare, which is anticipated to propel the healthcare BPO market revenue in the coming years. In addition to this, various key market players are increasingly focusing on new collaborations and agreements to strengthen their market positions, which is further catalyzing the market growth. For instance, in July 2021, revenue cycle management (RCM) vendor Waystar planned to acquire Patientco in the latest deal between an RCM vendor and a patient payment company. The RCM vendor intends for the combination to boost the patient's financial experience by offering users consumer-friendly options for paying medical bills.

Growing Influence of AI on Healthcare BPO

The rising emergence of artificial intelligence (AI)-based tools in healthcare BPO that assist in streamlining numerous non-clinical tasks is positively impacting the healthcare BPO market outlook. This includes enhancing workflow automation, assisting representatives, refining data administration for analytical purposes, and offering predictive insights. AI is a burgeoning phenomenon across myriad sectors. In 2021, the global AI industry's valuation stood at nearly US$ 60 Billion, with forecasts predicting a surge to US$ 422.37 Billion by 2028. Furthermore, the escalating need for AI-powered communication tools (like IVR, IVA, and chatbots) tailored for healthcare interactions and medical invoicing and coding is offering lucrative growth opportunities to the overall market. Moreover, an analysis report highlighting AI's imprint on healthcare showcased that 75% of health centers amplified their disease control capabilities, and 90% of the healthcare units considerably minimized staff exhaustion. The same report also underscored that 80% of health centers are of the view that AI bolsters their financial health. An additional 81% believe that using AI gives them a competitive edge. Thus, the integration of AI with healthcare BPO is projected to propel the healthcare BPO market share in the coming years.

Global Healthcare BPO Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthcare BPO market report, along with forecasts at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on payer service, provider service, and pharmaceutical service.

Breakup by Payer Service:

- Human Resource Management

- Claims Management

- Customer Relationship Management

- Operational and Administrative Management

- Care Management

- Provider Management

- Others

Claims management represented the largest segment

The report has provided a detailed breakup and analysis of the healthcare BPO market based on the payer service. This includes human resource management, claims management, customer relationship management, operational and administrative management, care management, provider management, and others. According to the healthcare BPO market report, claims management represented the largest segment.

Claims management service provides compensation and minimizes expenses. It assists in simplifying the claiming process, recording claim data, and reducing the time of providers and customers. It reduces thefts and manages complaints while maintaining client satisfaction.

Breakup by Provider Service:

.jpeg)

Access the comprehensive market breakdown Request Sample

- Patient Enrollment and Strategic Planning

- Patient Care Service

- Revenue Cycle Management

Revenue cycle management accounted for the largest market share

A detailed breakup and analysis of the healthcare BPO market based on the provider service has also been provided in the report. This includes patient enrollment and strategic planning, patient care service, and revenue cycle management. According to the report, revenue cycle management accounted for the largest market share.

The revenue management cycle is widely utilized to track the financial dealings with patients from the initial appointment to the final payment of the balance associated with healthcare systems. In addition to this, it assists in handling administrative functions through billing, payment processing, and electronic health record systems. Moreover, the healthcare BPO market overview indicates that various key market players are focusing on new collaborations and agreements to strengthen their positions in the RCM segment. For instance, in March 2022, CPSI, a healthcare solutions company, acquired Healthcare Resource Group Inc., based in Spokane, Washington. HRG is a leading provider of customized revenue cycle management ('RCM') solutions and consulting services that enable hospitals and clinics to improve efficiency, profitability, and patient satisfaction. Thus, the activities done by the major players are expected to propel the healthcare BPO market’s recent price in the coming years.

Breakup by Pharmaceutical Service:

- Manufacturing Services

- Research and Development Services

- Non-clinical Services

A detailed breakup and analysis of the healthcare BPO market based on the pharmaceutical service has also been provided in the report. This includes manufacturing services, research and development services, and non-clinical services.

Manufacturing services refer to the process of outsourcing the work of manufacturing or producing numerous medications, such as pills, tablets, and capsules for consumption by a third party. They comprise drug development processes and regulatory support to reduce the lengthy approval procedure for a drug to be released in the market.

Research and development (R&D) services refer to the series of activities that are designed to reach the goal of discovering and delivering new medical drugs, devices, and therapies to market. Non-clinical services comprise supply chain management and logistics, sales and marketing services, such as forecasting, performance reporting, analytics, research, and marketing in pharmaceuticals.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America was the largest market for healthcare BPO

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America (the United States and Canada) was the largest market for healthcare BPO.

The North America healthcare system is a rapidly growing industry that includes pharmacies, pharmaceutical companies, medical equipment manufacturers, and medical care facilities. This complex industry infrastructure relies on specialized professionals who oversee these operations. High awareness levels about outsourcing healthcare IT services and the strong presence of prominent market players in the region are attributed to the regional market's growth. Furthermore, healthcare BPO market statistics by IMARC indicate that rising government initiatives in the region are anticipated to drive growth in the healthcare industry, which in turn is expected to propel the market for healthcare BPOs. For instance, in February 2022, the Department of HHS awarded nearly US$ 55 Million to 29 HRSA-funded health centers to increase healthcare access and quality for underserved populations through virtual care. Virtual care has been a game-changer for patients, especially during the pandemic. Thus, the initiatives by government organizations are expected to drive market growth in North America.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global healthcare BPO market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- Accenture plc

- Cognizant

- GeBBS Copyright

- Genpact

- International Business Machines Corporation

- Invensis Technologies Pvt Ltd

- IQVIA Inc.

- NTT DATA, Inc.

- Omega Healthcare Management Services

- WNS (Holdings) Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Healthcare BPO Market Recent Developments

- April 2024: ChrysCapital, India’s biggest homegrown private equity (PE) firm, reportedly explored the sale of GeBBS Healthcare Solutions, a Los Angeles-based healthcare business process outsourcing (BPO) company. ChrysCapital is looking forward to selling GeBBS Healthcare Solutions for US$ 1 Billion.

- December 2023: Everise secured funding from Warburg Pincus, a global investment company. Everise practically made it in its journey to a US$ 1 Billion valuation, feeding high hopes for the future of global services in the healthcare vertical.

- August 2023: McKesson, a provider of healthcare services, and Genpact, a professional services firm, announced the extension of their collaboration to enhance efficiency and automation capabilities within McKesson’s finance operations.

Global Healthcare BPO Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payer Services Covered | Human Resource Management, Claims Management, Customer Relationship Management, Operational and Administrative Management, Care Management, Provider Management, Others |

| Provider Services Covered | Patient Enrollment and Strategic Planning, Patient Care Service, Revenue Cycle Management |

| Pharmaceutical Services Covered | Manufacturing Services, Research and Development Services, Non-clinical Services |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Cognizant, GeBBS Copyright, Genpact, International Business Machines Corporation, Invensis Technologies Pvt Ltd, IQVIA Inc., NTT DATA, Inc., Omega Healthcare Management Services, WNS (Holdings) Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare BPO market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global healthcare BPO market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare BPO industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global healthcare BPO market was valued at USD 34.9 Billion in 2025.

We expect the global healthcare BPO market to exhibit a CAGR of 6.84% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic has led to the increasing demand for healthcare BPO strategy for medical coding and billing as well as data and claim processing, that allows healthcare providers to treat the coronavirus-infected patients more efficiently.

The rising instances of data breaches and the growing adoption of BPO strategy for verifying insurance plans, filling, claiming, examining codding errors, and ensuring data security, are some of the healthcare BPO market recent opportunities, driving the growth of the market.

Based on the payer service, the global healthcare BPO market has been categorized into human resource management, claims management, customer relationship management, operational and administrative management, care management, provider management, and others. Among these, claims management currently holds the majority of the total market share.

Based on the provider service, the global healthcare BPO market can be segmented into patient enrollment and strategic planning, patient care service, and revenue cycle management. According to the healthcare BPO market forecast by IMARC, revenue cycle management exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global healthcare BPO market include Accenture plc, Cognizant, GeBBS Copyright, Genpact, International Business Machines Corporation, Invensis Technologies Pvt Ltd, IQVIA Inc., NTT DATA, Inc., Omega Healthcare Management Services, and WNS (Holdings) Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)