Biopharmaceutical Manufacturing Market Report by Cell Culture (Mammalian Cell Culture, Microbial Cell Culture), Class (Monoclonal Antibodies, Recombinant Proteins, Interferon, Granulocyte Colony-Stimulating Factor (G-CSF), Erythropoietin, Recombinant Human Insulin, Vaccines, Human Growth Hormones (HGH)), and Region 2025-2033

Global Biopharmaceutical Manufacturing Market:

The global biopharmaceutical manufacturing market size reached USD 449.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 967.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.9% during 2025-2033. The rising investments in biotechnology are leading to more facilities and improved manufacturing processes, further stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 449.9 Billion |

|

Market Forecast in 2033

|

USD 967.7 Billion |

| Market Growth Rate 2025-2033 |

8.9%

|

Biopharmaceutical Manufacturing Market Analysis:

- Major Market Drivers: The increasing demand for advanced therapies, boosting production of biological drugs globally, is acting as a significant growth-inducing factor.

- Key Market Trends: The growing focus on personalized medicine is driving the need for scalable and efficient production methods, which is one of the biopharmaceutical manufacturing industry trends.

- Competitive Landscape: Some of the major market companies include AbbVie Inc., Amgen Inc., Biogen Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Merck & Co. Inc., Novo Nordisk A/S, Pfizer Inc., and Sanofi S.A., among many others.

- Geographical Trends: Strong research infrastructure, high investment in biotechnology, and advanced regulatory frameworks supporting innovation and production are augmenting the market in North America.

- Challenges and Opportunities: The complexity of production processes is hindering the market. However, automation and improved bioprocessing technologies will continue to accelerate the market over the forecasted period.

To get more information on this market, Request Sample

Biopharmaceutical Manufacturing Market Trends:

Increasing Demand for Advanced Therapies

The growing need for innovative treatments is driving the market. As more complex diseases emerge, there is a heightened focus on developing biologics that offer targeted and effective solutions. Therefore, requiring specialized production techniques to meet regulatory standards and ensure product safety and efficacy. For instance, in April 2024, NIIMBL announced US$10 Million for eight new biopharmaceutical manufacturing projects, focusing on intensified processing for monoclonal antibodies, viral vectors, and cell therapy. Along with this, workforce development initiatives in data analytics training and neurodiverse talent recruitment to meet industry needs. As per the biopharmaceutical manufacturing industry analysis, this is acting as a significant growth-inducing factor.

Expansion of Global Manufacturing Facilities

Biopharmaceutical companies are continuously expanding their global manufacturing footprint to keep up with rising demand. In contrast, this includes building state-of-the-art facilities with advanced production capabilities, thereby enabling them to scale operations efficiently and meet the growing requirements for both clinical and commercial drug manufacturing. For instance, in July 2024, BeiGene opened its US$800 Million flagship biologics manufacturing and clinical R&D facility in Hopewell, N.J., U.S., featuring advanced capabilities for cancer treatments and creating hundreds of skilled jobs, thereby supporting global oncology innovation and production scalability. This is creating a positive biopharmaceutical manufacturing outlook.

Growth in Personalized Medicine Production

Personalized medicine, tailored to individual patients, is gaining momentum in biopharmaceuticals manufacturing market overview. In addition, this approach requires more flexible manufacturing processes that can adapt to smaller batch sizes while maintaining high-quality standards. Apart from this, the need for specialized production methods is driving the development of scalable biopharmaceutical manufacturing solutions to support this evolving field. For instance, in September 2024, Rentschler Biopharma launched a lentiviral vector manufacturing toolbox at its Stevenage, U.K. site, thereby enhancing its advanced therapy medicinal products offering. This service expansion supports gene therapy development, complementing the company’s existing adeno-associated virus vector capabilities for biopharmaceutical manufacturing.

Global Biopharmaceutical Manufacturing Industry Segmentation:

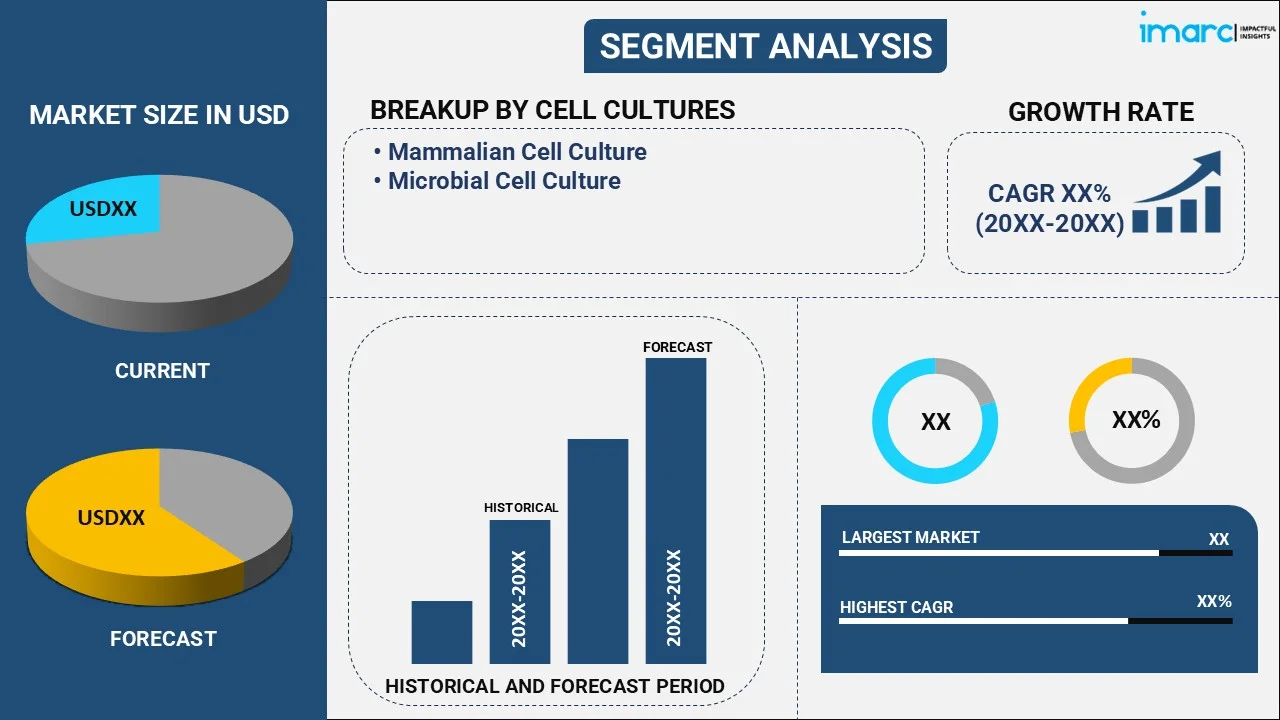

IMARC Group provides an analysis of the key trends in each segment of the market, along with the biopharmaceutical manufacturing market forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on cell culture and class.

Breakup by Cell Culture:

- Mammalian Cell Culture

- Microbial Cell Culture

Mammalian cell culture currently holds the largest biopharmaceutical manufacturing market share

The report has provided a detailed breakup and analysis of the market based on the cell culture. This includes mammalian cell culture and microbial cell culture. According to the report, mammalian cell culture represented the largest market segmentation.

Mammalian cell culture plays a critical role in biopharmaceutical manufacturing, as these cells replicate human protein structures necessary for producing complex biologics like monoclonal antibodies. For instance, in June 2024, Syntegon launched its Modular Bioprocessing Platform, supporting efficient mammalian cell culture for clinical and commercial applications.

Breakup by Class:

- Monoclonal Antibodies

- Recombinant Proteins

- Interferon

- Granulocyte Colony-Stimulating Factor (G-CSF)

- Erythropoietin

- Recombinant Human Insulin

- Vaccines

- Human Growth Hormones (HGH)

Monoclonal antibodies currently hold the largest biopharmaceutical manufacturing market statistics

The report has provided a detailed breakup and analysis of the market based on the class. This includes monoclonal antibodies, recombinant proteins, interferon, granulocyte colony-stimulating factor (G-CSF), erythropoietin, recombinant human insulin, vaccines, and human growth hormones (HGH). According to the report, monoclonal antibodies represented the largest market segmentation.

Monoclonal antibodies are vital in biopharmaceutical manufacturing as they provide precise treatment by targeting specific disease cells, minimizing side effects, and improving therapeutic outcomes, especially in cancer therapies. For instance, in April 2024, NIIMBL invested US$10 Million in projects focused on improving monoclonal antibody processing and enhancing efficiency in clinical and commercial production.

Breakup by Region:

- North America

- Europe

- Asia Pacific

North America currently dominates the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, and Asia Pacific. According to the report, North America accounted for the largest market share.

As per the biopharmaceutical manufacturing market dynamics, North America exhibits a clear dominance in biopharmaceutical manufacturing driven by its cutting-edge infrastructure, substantial biotechnology investments, and highly skilled workforce. Therefore, enabling efficient production, innovative research, and the development of advanced therapies on a global scale. Notably, BeiGene's US$800 Million biologics manufacturing facility in Hopewell, N.J., exemplifies the region's commitment to advancing cancer treatment and maintaining its dominance in biopharmaceutical production and research.

Competitive Landscape:

The biopharmaceutical manufacturing market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- AbbVie Inc.

- Amgen Inc.

- Biogen Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services Inc.

- Merck & Co. Inc.

- Novo Nordisk A/S

- Pfizer Inc.

- Sanofi S.A.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Biopharmaceutical Manufacturing Market Recent Developments:

- September 2024: Axio BioPharma launched protein manufacturing services at its Madison, WI facility, specializing in recombinant protein projects, aiming to advance life-saving therapies with innovative manufacturing approaches.

- June 2024: Syntegon introduced its Modular Bioprocessing Platform (MBP) at Achema, offering a fully integrated, automated solution for biologic drug production design for shortens lead times and reduces costs.

- March 2024: Syngene announced the operational launch of its upgraded biologics facility, Unit 3, in Bangalore, India. The site supports clinical and commercial biologics manufacturing and U.S. FDA and EMA approvals with tripled capacity, including 20KL bioreactors and high-speed vial filling lines for biotech and pharma clients.

Biopharmaceutical Manufacturing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Kilo Liters, Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Cell Cultures Covered | Mammalian Cell Culture, Microbial Cell Culture |

| Classes Covered | Monoclonal Antibodies, Recombinant Proteins, Interferon, Granulocyte Colony-Stimulating Factor (G-CSF), Erythropoietin, Recombinant Human Insulin, Vaccines, Human Growth Hormones (HGH) |

| Regions Covered | Asia Pacific, Europe, North America |

| Companies Covered | AbbVie Inc., Amgen Inc., Biogen Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Merck & Co. Inc., Novo Nordisk A/S, Pfizer Inc., Sanofi S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biopharmaceutical manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biopharmaceutical manufacturing market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biopharmaceutical manufacturing industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global biopharmaceutical manufacturing market was valued at USD 449.9 Billion in 2024.

We expect the global biopharmaceutical manufacturing market to exhibit a CAGR of 8.9% during 2025-2033.

The rising demand for biopharmaceutical manufacturing in providing innovative and effective treatments for various diseases, such as cancer, autoimmune disorders, and genetic conditions, is primarily driving the global biopharmaceutical manufacturing market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of biopharmaceutical manufacturing in producing medical drugs and therapies for the treatment of the coronavirus-infection.

Based on the cell culture, the global biopharmaceutical manufacturing market has been segmented into mammalian cell culture and microbial cell culture, where mammalian cell culture currently holds the majority of the total market share.

Based on the class, the global biopharmaceutical manufacturing market can be divided into monoclonal antibodies, recombinant proteins, interferon, Granulocyte Colony-Stimulating factor (G-CSF), erythropoietin, recombinant human insulin, vaccines, and Human Growth Hormones (HGH). Currently, monoclonal antibodies exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, and Asia Pacific, where North America currently dominates the global market.

Some of the major players in the global biopharmaceutical manufacturing market include AbbVie Inc., Amgen Inc., Biogen Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson Services Inc., Merck & Co. Inc., Novo Nordisk A/S, Pfizer Inc., Sanofi S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)