Africa E-Commerce Market Report by Business Model (B2C, B2B, C2C, and Others), Mode of Payment (Payment Cards, Online Banking, E-Wallets, Cash-On-Delivery, and Others), Service Type (Financial, Digital Content, Travel and Leisure, E-Tailing, and Others), Product Type (Groceries, Clothing and Accessories, Mobiles and Electronics, Health and Personal Care, and Others), and Country 2025-2033

Market Overview:

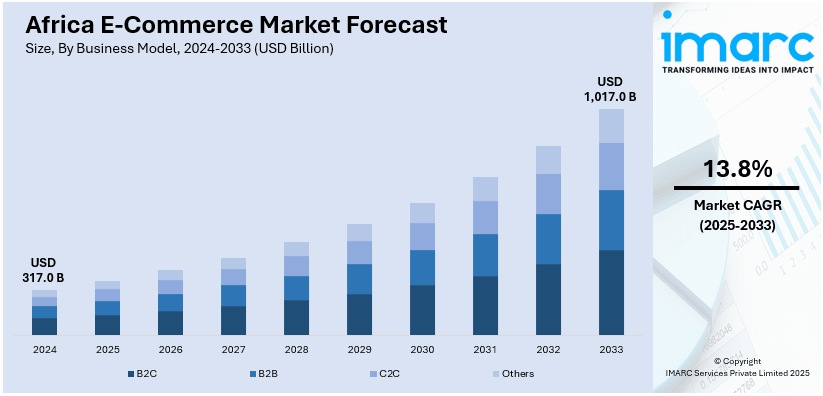

The Africa e-commerce market size reached USD 317.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,017.0 Billion by 2033, exhibiting a growth rate (CAGR) of 13.8% during 2025-2033. The growing penetration of internet and smartphones across the continent, the increasing availability of affordable data packages, the growing number of young and tech-savvy population, and the advent of localized payment solutions represent some of the factors that are propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 317.0 Billion |

|

Market Forecast in 2033

|

USD 1,017.0 Billion |

| Market Growth Rate 2025-2033 | 13.8% |

E-commerce refers to the buying and selling of goods and services through digital platforms, facilitated by the internet. This digital marketplace boasts a myriad of characteristics including accessibility, convenience, and a broad range of product offerings. Functioning through a set of technologies such as mobile applications and web browsers, e-commerce in Africa enables secure transactions, often utilizing digital payment systems or cash-on-delivery methods. The platforms are usually designed with user-friendly interfaces and robust search features that guide consumers to desired products or services. Advantages of this marketplace include the ability to shop anytime, anywhere, quicker transactions, and the availability of customer reviews to inform purchasing decisions.

The market in Africa is primarily driven by the growing penetration of internet and smartphones across the continent. In line with this, the increasing availability of affordable data packages is also providing an impetus to the market. Moreover, the growing number of young and tech-savvy population is acting as a significant growth-inducing factor. In addition to this, the absence of widespread traditional retail infrastructure is resulting in an increased reliance on e-commerce platforms. Besides this, the advent of localized payment solutions is easing transactions, thereby creating lucrative opportunities in the market. The market is further driven by favorable government regulations aimed at providing a boost to digital economies. Apart from this, rising consumer trust in online payment systems is propelling the market. Some of the other factors contributing to the market include the burgeoning middle class willing to spend on online retail, development of digital logistics and warehousing solutions, diversified and localized product offerings, and ongoing investments in R&D activities aiming to optimize user experience and security features.

Africa E-Commerce Market Trends/Drivers:

Increasing digital literacy among the masses

The escalating levels of digital literacy across Africa serve as a cornerstone for the flourishing e-commerce market in the continent. Digital literacy is not merely about the ability to browse the internet or use a smartphone; it extends to understanding how to carry out transactions online, how to discern credible information and vendors, and how to secure personal data while navigating digital platforms. This literacy is increasingly becoming a mainstream skill due to focused educational initiatives, both governmental and non-governmental, which aim to elevate the general populace's proficiency in digital tasks. As this level of expertise becomes more commonplace, so does the comfort with which individuals approach digital transactions, leading to increased engagement with e-commerce platforms. Additionally, digital literacy supports the e-commerce ecosystem in an indirect yet powerful manner. When consumers are digitally literate, they are more likely to contribute product reviews, share recommendations, and even promote trustworthy platforms, thus playing an active role in enhancing the reliability and credibility of the e-commerce ecosystem.

Economic stability and growth

The e-commerce landscape is notably influenced by the overarching economic conditions of a region. In the context of Africa, increasing economic stability and subsequent growth have significantly propelled the e-commerce market. A stable economic backdrop facilitates consumer confidence, directly translating into a willingness to engage in digital transactions. Consumers, with the assurance that comes from a robust economy, are more inclined to expand their spending on a range of products and services available online, from basic essentials to discretionary items. Moreover, economic prosperity often corresponds with increased foreign and domestic investment. A stable economy draws the attention of both local and global investors looking for burgeoning markets to invest in. E-commerce platforms, due to their scalable nature and low overheads compared to traditional retail, become attractive investment opportunities. Capital influx into these platforms can result in substantial advancements in technology, user interface design, security features, and logistical capabilities, thereby making the e-commerce experience more streamlined and secure for consumers.

Africa E-Commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on business model, mode of payment, service type, and product type.

Breakup by Business Model:

- B2C

- B2B

- C2C

- Others

The report has provided a detailed breakup and analysis of the market based on the business model. This includes B2C, B2B, C2C, and others.

In the B2C segment, the proliferation of smartphones is a key factor that enables direct consumer engagement. Easier access to the internet has led to an increase in digital literacy, making consumers more comfortable with online shopping. The vast variety of available products also acts as an incentive. Marketing strategies like targeted advertisements and flash sales are successfully driving traffic. The appeal of home delivery services is another significant driver. Moreover, frequent promotional activities and discounts are often employed to attract a broader consumer base. Also, user-friendly interfaces on websites and apps enhance the overall shopping experience, making it a preferred choice for many.

On the contrary, in the B2B segment, bulk purchasing capabilities are a significant attraction. The ease of procurement processes and centralized supply chain management offered by online platforms adds operational efficiency. Customization options in ordering, tailored to business needs, also act as an incentive. The presence of credible vendors on these platforms eases trust issues. Real-time tracking of orders is becoming a standard feature, improving planning and logistics for businesses.

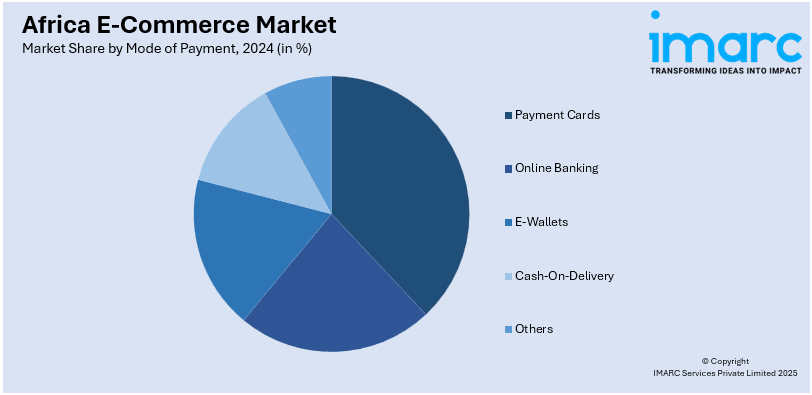

Breakup by Mode of Payment:

- Payment Cards

- Online Banking

- E-Wallets

- Cash-On-Delivery

- Others

A detailed breakup and analysis of the market based on the mode of payment has also been provided in the report. This includes payment cards, online banking, e-wallets, cash-on-delivery, and others.

The adoption of payment cards is driven by factors such as heightened security measures like two-factor authentication, making transactions safer. Easier record-keeping and tracking of expenses are other attractions. Reward points and cash-back offers entice more users. The convenience of not having to carry cash is a big plus. Fast transaction times also make it a preferred method. The ability to execute international transactions effortlessly is another contributing factor. Cards are also universally accepted on all major platforms, making them versatile. Mobile integration allows for easier management of expenses. Prepaid cards, specifically, offer a controlled spending environment, which many find advantageous.

On the other hand, for the online banking segment, the primary drivers include the convenience of 24/7 account accessibility and the ease of executing various transactions from the comfort of one's home or office. Advanced security protocols such as encryption and multi-factor authentication boost consumer confidence. Features like immediate fund transfers, bill payments, and scheduled payments add to the convenience. Real-time account monitoring allows for better financial management.

Breakup by Service Type:

- Financial

- Digital Content

- Travel and Leisure

- E-Tailing

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes financial, digital content, travel and leisure, e-tailing, and others.

In the financial segment of e-commerce, the ability to access and manage multiple financial products like loans, insurance, and investments online is a significant draw. Digital platforms often provide financial literacy content, enhancing consumer knowledge and confidence. Automated investment and savings plans simplify asset management. The capability to compare different financial products online helps consumers make informed decisions. Security features like biometric verification add an additional layer of security. Virtual financial advisors offer personalized advice, making the service more attractive.

On the contrary, for the Digital Content segment, the main drivers include the instant availability of content such as music, movies, and books. Subscription models offer consumers a cost-effective way to access multiple pieces of content. Exclusive releases and early access perks are used to attract a dedicated consumer base. User recommendations and algorithms personalize the consumer experience. High-quality streaming capabilities make the service appealing. Multi-device access ensures users can consume content wherever they are.

Breakup by Product Type:

- Groceries

- Clothing and Accessories

- Mobiles and Electronics

- Health and Personal Care

- Others

Clothing and accessories exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the product type has also been provided in the report. This includes groceries, clothing and accessories, mobiles and electronics, health and personal care, and others. According to the report, clothing and accessories accounted for the largest market share.

In the clothing and accessories segment, the ability to browse through extensive catalogs with multiple brands is a major driver. Virtual try-on features and size guides are minimizing the risk of incorrect purchases. Easy return and refund policies also add a layer of assurance. Seasonal sales and discounts are major attractions. The option for customization appeals to those looking for unique items. Reviews and user-generated content like photos offer real-world validation. Loyalty programs often reward repeat purchases, encouraging customer retention. Exclusive collaborations and limited edition releases create a buzz. Furthermore, expedited shipping options satisfy the need for instant gratification among consumers.

Breakup by Country:

- South Africa

- Nigeria

- Egypt

- Morocco

- Kenya

- Others

South Africa leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include South Africa, Nigeria, Egypt, Morocco, Kenya, and others. According to the report, South Africa was the largest market for Africa e-commerce in the country.

In the South Africa region, the increasing penetration of high-speed internet is a major driving factor for e-commerce. A relatively stable economic environment provides a fertile ground for online businesses. The consumer base is becoming more diversified, including various age groups and socio-economic classes, broadening the market. A strong logistics infrastructure supports efficient delivery systems. Localized payment solutions are breaking down barriers to entry for many consumers.

Government regulations are increasingly supportive of digital economies, providing a favorable environment for growth. The existing retail culture also influences online shopping trends, creating an integrated shopping ecosystem. Businesses are leveraging data analytics for localized market strategies. Lastly, the relatively high GDP per capita compared to other African countries indicates a consumer base with significant purchasing power.

Competitive Landscape:

Key players are actively investing in technology upgrades to enhance user experience. They are consistently expanding their product portfolios to capture a broader customer base, diversifying into categories like electronics, fashion, and groceries. To mitigate logistical challenges, these market leaders are developing in-house delivery and warehousing solutions. Simultaneously, they are integrating localized payment methods to facilitate transactions and reduce payment friction for consumers. Recognizing the importance of mobile connectivity, they are optimizing their platforms for mobile users, developing user-friendly apps and mobile-responsive websites. Furthermore, they are heavily focusing on data analytics to understand consumer behavior and tailor marketing strategies accordingly.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alibaba Group

- Amazon.com, Inc.

- Avito Holding AB

- Bidorbuy.com Inc

- DHL International GmbH

- DealDey Ltd.

- eBay Inc

- GumTree.com Limited

- Jiji Press Ltd.

- Jumia Technologies AG

- Konga Online Shopping Ltd

- Naspers Ltd.

- OLX Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Africa E-Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | B2C, B2B, C2C, Others |

| Mode of Payments Covered | Payment Cards, Online Banking, E-Wallets, Cash-On-Delivery (COD), Others |

| Service Types Covered | Financial, Digital Content, Travel and Leisure, E-Tailing, Others |

| Product Types Covered | Groceries, Clothing and Accessories, Mobiles and Electronics, Health and Personal Care, Others |

| Countries Covered | South Africa, Nigeria, Egypt, Morocco, Kenya, Others |

| Companies Covered | Alibaba Group, Amazon.com, Inc., Avito Holding AB, Bidorbuy.com Inc., DHL International GmbH, DealDey Ltd., eBay Inc., GumTree.com Limited, Jiji Press Ltd., Jumia Technologies AG, Konga Online Shopping Ltd., Naspers Ltd., OLX Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Africa e-commerce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Africa e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Africa e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the Africa e-commerce market to exhibit a CAGR of 13.8% during 2025-2033.

The rising penetration of smart devices, along with the growing utilization of e-commerce platforms, as they provide various benefits, including controlled inventory cost, improved profit margins, hassle-free delivery of goods and services, etc., is primarily driving the Africa e-commerce market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of e-commerce platforms across several African nations, owing to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms, during the lockdown scenario.

Based on the product type, the Africa e-commerce market can be bifurcated into groceries, clothing and accessories, mobiles and electronics, health and personal care, and others. Currently, clothing and accessories exhibit a clear dominance in the market.

On a regional level, the market has been classified into South Africa, Nigeria, Egypt, Morocco, Kenya, and others, where South Africa currently dominates the Africa e-commerce market.

Some of the major players in the Africa e-commerce market include Alibaba Group, Amazon.com, Inc., Avito Holding AB, Bidorbuy.com Inc., DHL International GmbH, DealDey Ltd., eBay Inc., GumTree.com Limited, Jiji Press Ltd., Jumia Technologies AG, Konga Online Shopping Ltd., Naspers Ltd., and OLX Group.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)