Indian Advertising Market Size, Share, Trends and Forecast by Segments, and Region, 2026-2034

Indian Advertising Market Summary:

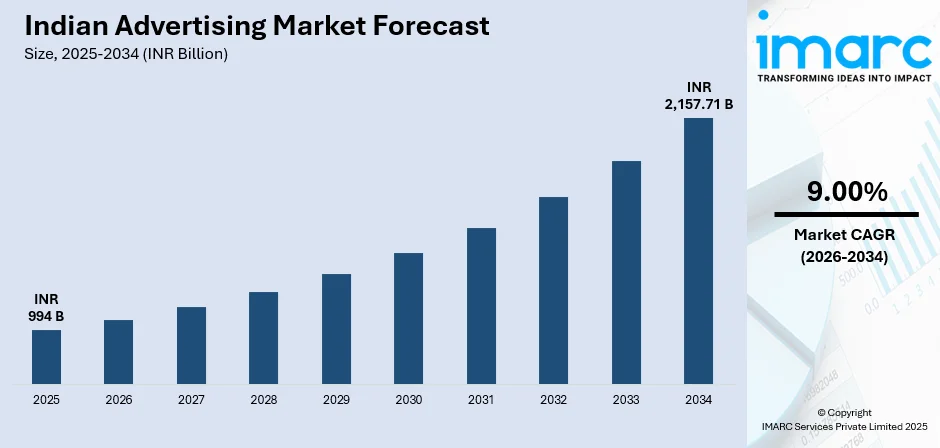

The Indian advertising market size was valued at INR 994 Billion in 2025 and is projected to reach INR 2,157.71 Billion by 2034, growing at a compound annual growth rate of 9.00% from 2026-2034.

The Indian advertising market is experiencing robust expansion driven by rapid digital adoption, increasing smartphone penetration, and the proliferation of e-commerce platforms. The state of the media is changing as more consumers engage with online content and demand customized and personalized ways of advertising. The growth of artificial intelligence, programmatic advertising and the development of immersive technologies are facilitating brands to conduct highly relevant campaigns. Its penetration of the internet through tier-II and tier-III cities, as well as positive government programs to favor digital infrastructure, are further boosting the Indian advertising market share.

Key Takeaways and Insights:

-

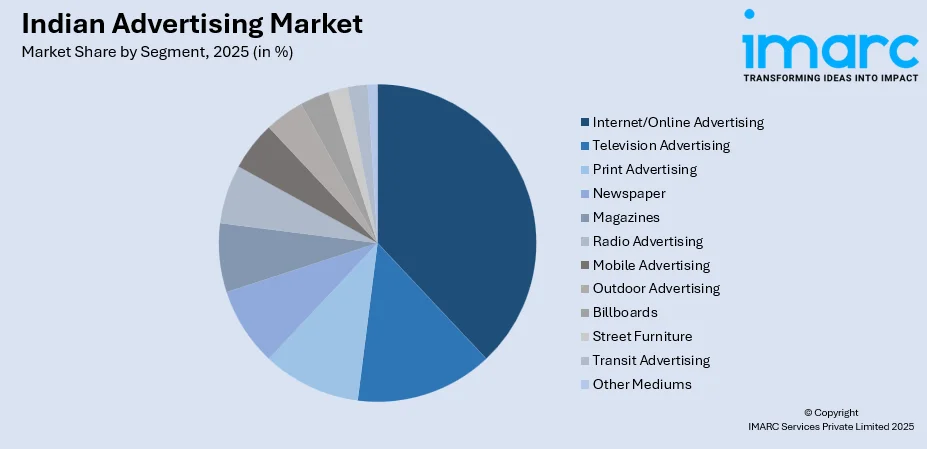

By Segment: Internet advertising dominates the market with a share of 38.08% in 2025, driven by surging digital consumption, mobile-first browsing behavior, and increasing investments by brands in online channels to reach digitally savvy consumers.

-

By Region: North India leads the market with a share of 28% in 2025, supported by high population density, strong economic activity, concentration of corporate headquarters, and extensive media infrastructure across major metropolitan areas.

-

Key Players: The Indian advertising industry has been very competitive with international networks and national agencies competing in the creative, media planning, as well as digital services. To win market share and provide results on the campaign, players are making increased investments in data analytics, artificial intelligence solutions, and integrated marketing solutions. Some of the key players operating in the market include DDB Mudra Group, Dentsu India, FCB Worldwide, Inc, Leo Burnett India, McCann Worldgroup, MullenLowe, Ogilvy India, Rediffusion, WPP Media, etc.

To get more information on this market Request Sample

The Indian advertising market is undergoing a fundamental transformation as digital channels increasingly dominate media budgets and consumer attention shifts toward online platforms. The ecosystem spans traditional formats including television, print, radio, and outdoor advertising, alongside rapidly growing digital segments encompassing social media, video streaming, programmatic display, and mobile advertising. In fiscal year 2024-25, digital advertising spending reached approximately INR 49,000 crore, marking a significant milestone as digital media surpassed television to claim the largest share of total advertising expenditure. This shift reflects changing consumption patterns among India's youthful population, with mobile platforms accounting for nearly four-fifths of digital ad spending. The market benefits from strong advertising demand across sectors including fast-moving consumer goods, e-commerce, financial services, and technology, with brands increasingly prioritizing performance marketing and return on investment measurement.

Indian Advertising Market Trends:

Digital Dominance and Mobile-First Advertising

Digital advertising has emerged as the dominant force in the Indian advertising market, now commanding approximately 44% of total advertising expenditure. Mobile platforms drive this transformation, accounting for nearly 78% of digital ad spending as consumers increasingly access content through smartphones. This shift reflects fundamental changes in media consumption patterns, as brands increasingly reallocate budgets from traditional channels to digital formats that provide stronger targeting, better performance tracking, and deeper audience engagement. The growing preference for digital platforms over conventional media underscores a long-term structural transformation in advertising strategies, which continues to support the overall expansion of the Indian advertising market.

AI-Powered Personalization and Programmatic Advertising

Artificial intelligence is revolutionizing campaign delivery and optimization across the Indian advertising landscape. Brands are leveraging machine learning algorithms to enable real-time targeting, dynamic creative optimization, and predictive analytics that enhance campaign effectiveness. Programmatic advertising, which utilizes automated bidding and placement systems, contributed approximately INR 20,686 crore to digital ad spending in 2024. Major e-commerce platforms have deployed AI-powered recommendation engines that analyze user behavior to deliver personalized advertising experiences, reportedly achieving significant improvements in conversion rates. This technology-driven approach enables advertisers to reach specific audience segments with relevant messaging at optimal moments.

Digital Out-of-Home and Immersive Technologies

India's out-of-home advertising sector is experiencing significant modernization through the integration of digital technologies and immersive experiences. Traditional static billboards are being replaced by digital out-of-home formats across urban centers, transportation hubs, and retail environments. Advertisers are deploying augmented reality, virtual reality, and interactive touch-enabled displays to create engaging consumer experiences that transcend conventional messaging. Location-based targeting and real-time data analytics enable content customization based on time of day, demographic movement patterns, and environmental conditions. At Maha Kumbh 2025, brands including ITC Mangaldeep deployed three-dimensional augmented reality technology to reshape spiritual experiences for attendees, demonstrating innovative applications of immersive advertising.

Market Outlook 2026-2034:

The Indian advertising market is positioned for sustained expansion over the forecast period, driven by deepening digital penetration, evolving consumer behavior, and technological innovation. The continued growth of internet users, projected to exceed 900 million by the mid-decade, combined with rising smartphone adoption and expanding e-commerce activity, will create substantial opportunities for advertisers. Connected television and over-the-top streaming platforms are emerging as significant advertising channels, while retail media networks are enabling brands to reach consumers at the point of purchase. The market generated a revenue of INR 994 Billion in 2025 and is projected to reach a revenue of INR 2,157.71 Billion by 2034, growing at a compound annual growth rate of 9.00% from 2026-2034

Indian Advertising Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Segment |

Internet Advertising |

38.08% |

|

Region |

North India |

28% |

Segment Insights:

Access the comprehensive market breakdown Request Sample

- Television Advertising

- Print Advertising

- Newspaper

- Magazines

- Radio Advertising

- Internet/Online Advertising

- Mobile Advertising

- Outdoor Advertising

- Billboards

- Street Furniture

- Transit Advertising

- Other Mediums

Internet advertising dominates the market with a share of 38.08% of the total Indian advertising market in 2025.

Internet advertising has established itself as the primary growth engine of the Indian advertising market, driven by fundamental shifts in consumer behavior and media consumption patterns. The segment encompasses diverse formats including search advertising, social media campaigns, display advertising, video content, and programmatic placements. E-commerce platforms have become key drivers of digital advertising activity, with shopping-led promotions accounting for a significant share of overall online ad spending. Leading marketplaces such as Flipkart and Amazon, along with fast-growing quick commerce players, are steadily expanding their advertising offerings to engage consumers at high-intent points along the purchase journey. At the same time, social media continues to be a major growth engine within digital advertising, supported by strong advertiser demand and its effectiveness in reaching and influencing consumers across platforms.

The rapid expansion of internet advertising reflects broader technological and demographic transformations within India. Mobile internet accessibility has democratized digital consumption, enabling brands to reach consumers across geographic and socioeconomic segments. Video advertising, particularly through short-form content and streaming platforms, has gained significant traction among younger demographics. The integration of influencer marketing with digital advertising strategies has proven effective in driving engagement and conversions, with India's creator economy projected to significantly influence consumer spending. Performance marketing capabilities, offering measurable outcomes and return on investment tracking, have attracted advertisers seeking accountability in their media investments.

Regional Insights:

- North India

- South India

- West and Central India

- East India

North India leads the market with a share of 28% of the total Indian advertising market in 2025.

North India maintains its position as the largest regional advertising market, supported by significant economic activity, high population concentration, and the presence of major corporate headquarters in the National Capital Region. The region benefits from a well-developed media infrastructure, including extensive broadcast networks, established print publications, and growing digital connectivity. Delhi and the surrounding areas serve as headquarters for numerous multinational corporations and domestic conglomerates, generating substantial advertising demand across consumer and business-to-business segments. The region's diverse linguistic landscape has fostered growth in vernacular content and regional language advertising campaigns targeting specific audience segments.

Advertising activity in North India spans traditional and digital channels, with increasing emphasis on integrated multichannel campaigns. The region hosts major advertising industry events and serves as a hub for media planning and creative development. Quick commerce and e-commerce platforms have expanded aggressively across North Indian cities, driving digital advertising investments. Out-of-home advertising infrastructure is well-established in metropolitan areas, with digital transformation accelerating across transit networks and commercial zones. Government advertising, particularly around elections and public awareness campaigns, contributes meaningfully to regional advertising expenditure.

Market Dynamics:

Growth Drivers:

Why is the Indian Advertising Market Growing?

Rapid Digital Adoption and Internet Penetration

The exponential growth of internet users and smartphone adoption represents a fundamental driver of advertising market expansion in India. The country has emerged as one of the world's largest digital markets, with internet user projections exceeding 900 million. Affordable mobile data plans and the widespread availability of budget smartphones have democratized digital access, extending connectivity beyond metropolitan areas into tier-II, tier-III cities, and rural regions. This expanded digital footprint has created unprecedented opportunities for advertisers to reach previously underserved audiences. In fiscal year 2024-25, India added approximately 56 million new internet users, expanding the addressable market for digital advertising. The shift toward mobile-first consumption patterns has prompted brands to reallocate budgets from traditional media toward digital channels that offer superior targeting and measurement capabilities.

E-Commerce Expansion and Retail Media Networks

The rapid growth of e-commerce and quick commerce platforms has created substantial new advertising inventory and driven significant increases in digital ad spending. Online shopping platforms have become the dominant force in digital advertising, with retail-focused promotions making up a significant share of overall online ad activity. E-commerce giants have developed sophisticated retail media networks that leverage first-party transaction data to enable highly targeted advertising at the point of purchase. Quick commerce platforms, including Blinkit, Zepto, and Swiggy Instamart, are offering brands opportunities for hyper-targeted campaigns based on user location and purchase history. The India e-commerce market size was valued at USD 129.72 Billion in 2025 and is projected to reach USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034, creating sustained demand for advertising services that connect brands with online shoppers.

Government Initiatives and Policy Support

Government policies and public sector initiatives play a pivotal role in shaping the Indian advertising industry and supporting market growth. Strategic programs including Digital India, Make in India, and Startup India, have stimulated advertising activity by encouraging entrepreneurship, digital literacy, and economic development. The expansion of rural connectivity through public infrastructure investments has created new target audiences, prompting brands to invest in regional content and multilingual campaigns. State and central governments remain among the largest advertisers in India, particularly during elections and public health awareness campaigns, contributing significantly to the media industry revenue. Regulatory developments aimed at data privacy and digital platform accountability are encouraging industry formalization, while the proposed removal of the digital advertisement tax signals potential relief for advertisers and platforms. These policy frameworks are building confidence and enabling businesses to scale digital strategies.

Market Restraints:

What Challenges the Indian Advertising Market is Facing?

Ad Fraud and Brand Safety Concerns

Digital advertising growth has been accompanied by significant ad fraud challenges that erode advertiser confidence and campaign effectiveness. Industry analyses suggest that a substantial portion of digital ad spending is lost to fraudulent activities, including bot traffic, click fraud, and impression manipulation. Brand safety concerns regarding inappropriate content adjacency further complicate digital advertising strategies, requiring enhanced verification and monitoring solutions.

Data Privacy Regulations and Compliance Requirements

The implementation of India's Digital Personal Data Protection Act imposes strict regulations on data collection and usage, requiring advertisers to adapt targeting strategies while maintaining compliance. Navigating these requirements adds operational complexity and may limit certain personalization capabilities. Non-compliance carries substantial financial penalties, compelling organizations to invest in compliance infrastructure and privacy-first advertising approaches.

Media Fragmentation and Measurement Standardization

The proliferation of media channels and platforms has created a fragmented landscape that complicates campaign planning and performance measurement. The absence of unified measurement standards across traditional and digital media makes it difficult to compare channel effectiveness and optimize media allocations. Advertisers face challenges in achieving comprehensive audience reach while managing complexity across multiple platforms with varying metrics.

Competitive Landscape:

The Indian advertising market exhibits a highly competitive structure with global agency networks, regional independents, and specialized digital firms competing across creative, media planning, and technology services. Major international holding companies maintain significant presence through integrated agency offerings that combine creative development, media buying, and data analytics capabilities. Competition is increasingly driven by investments in technology infrastructure, artificial intelligence capabilities, and programmatic advertising platforms that enable more efficient and effective campaign delivery. Strategic partnerships and acquisitions continue to reshape the competitive landscape as agencies seek to expand capabilities and client portfolios. The industry is witnessing growing emphasis on performance marketing, measurable outcomes, and integrated solutions that combine brand-building creativity with conversion-focused tactics.

Some of the key players include:

- DDB Mudra Group

- Dentsu India

- FCB Worldwide, Inc

- Leo Burnett India

- McCann Worldgroup

- MullenLowe

- Ogilvy India

- Rediffusion

- WPP Media

Recent Developments:

-

July 2025: Tuborg, a brand under the Carlsberg Group, appointed Lowe Lintas (Gurgaon) as its creative agency in India following a competitive multi-agency pitch. The agency will handle the brand's overall creative strategy and integrated communication efforts, focusing on enhancing youth engagement through culturally relevant storytelling.

-

March 2025: Amazon Ads introduced Sponsored TV in India, a self-service streaming television advertising solution enabling brands to run video campaigns across premium Amazon content, beginning with Amazon MX Player. The platform leverages machine-learning models powered by first-party shopping and streaming data to optimize reach and deliver measurable campaign metrics.

-

January 2025: Aarki Inc., a leader in AI-driven advertising solutions, inaugurated Aarki Labs in Bangalore, marking a strategic expansion aimed at accelerating innovation in AI-powered performance marketing across mobile app ecosystems. The facility will develop advanced tools utilizing deep neural networks and privacy-first frameworks for global app developers.

Indian Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion |

| Scope of the Report Covered |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Television Advertising, Print Advertising, Newspaper Magazines, Radio Advertising, Internet/Online Advertising, Mobile Advertising, Outdoor Advertising Billboards, Street Furniture, Transit Advertising, Other Mediums. |

| Region Covered | North India, South India, West and Central India, East India |

| Companies Covered | DDB Mudra Group, Dentsu India, FCB Worldwide, Inc, Leo Burnett India, McCann Worldgroup, MullenLowe, Ogilvy India, Rediffusion, WPP Media, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian advertising market size was valued at INR 994 Billion in 2025.

The Indian advertising market is expected to grow at a compound annual growth rate of 9.00% from 2026-2034 to reach INR 2,157.71 Billion by 2034.

Internet advertising represents the largest market share at 38.08% in 2025, driven by surging digital consumption, mobile-first browsing behavior, and increasing investments by brands in online channels that offer superior targeting and measurement capabilities compared to traditional media.

Key factors driving the Indian advertising market include rapid digital adoption and internet penetration, growth of e-commerce and quick commerce platforms, government initiatives supporting digital infrastructure, increasing smartphone usage, and technological advancements in AI-powered advertising and programmatic buying.

Major challenges include ad fraud and brand safety concerns in digital advertising, compliance requirements under data privacy regulations, media fragmentation across multiple platforms, lack of unified measurement standards, and the need for skilled digital talent to execute sophisticated marketing strategies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)