Zero Turn Mowers Market Report by Cutting Width (Less than 50 inches, 50 to 60 inches, More than 60 inches), Application (Residential, Commercial), and Region 2025-2033

Zero Turn Mowers Market Size:

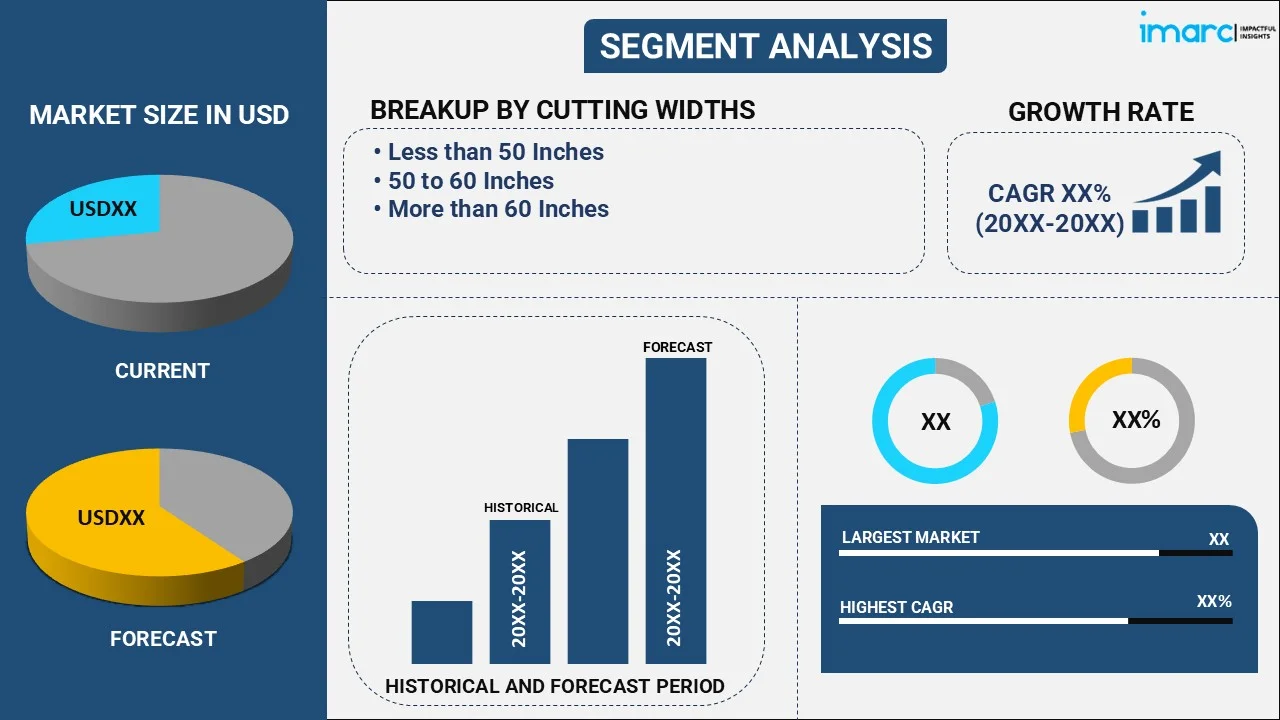

The global zero turn mowers market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The increasing demand for efficient lawn maintenance, significant technological advancements, enhanced maneuverability, time-saving benefits, rising disposable incomes, increasing landscaping activities, and growth in commercial and residential property developments are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.1 Billion |

|

Market Forecast in 2033

|

USD 5.1 Billion |

| Market Growth Rate 2025-2033 | 5.23% |

Zero Turn Mowers Market Analysis:

- Major Market Drivers: The increasing demand for efficient lawn maintenance solutions represents one of the major drivers of the market. These mowers offer superior maneuverability and speed, reducing mowing time significantly compared to traditional mowers. Significant technological advancements including improved engine performance and enhanced durability, further boost the adoption of zero turn mowers, catering to both commercial and residential users.

- Key Market Trends: The increasing integration of advanced technologies including GPS and remote-control capabilities represents the key trends in the market. These innovations enhance user convenience and mowing precision, making lawn care more efficient and less labor-intensive. There is a growing preference for eco-friendly mowers, with manufacturers introducing electric and battery-powered models that reduce emissions and operational noise, aligning with global sustainability efforts.

- Geographical Trends: North America accounts for the largest region in the zero-turn mowers market growth. The growing commercial landscaping services, increasing residential lawn care investments, technological advancements in mowers, and the popularity of large properties requiring efficient maintenance are driving the market growth across the North American region.

- Competitive Landscape: Some of the major market players in the zero turn mowers industry include Ariens Company, BigDog Mower Co., Briggs & Stratton LLC., Husqvarna AB, Deere & Company, Kubota Corporation, Mtd Products Inc, Spartan Mowers, Swisher Inc and The Toro Company, among many others.

- Challenges and Opportunities: The market faces various challenges including high initial costs which can deter price-sensitive consumers, along with maintenance and repair expenses, as well as the need for skilled operators, to add to the cost concerns. However, the market also faces several opportunities, such as increasing demand for eco-friendly, electric, and battery-powered models and significant technological advancements including automation and smart features can attract tech-savvy consumers.

Zero Turn Mowers Market Trends:

Rising Focus on Time-Saving and Efficiency

Zero-turn mowers offer superior maneuverability and speed, significantly reducing mowing time compared to traditional movers which are highly valued in both residential and commercial applications. For instance, in October 2022, Toro introduced several new outdoor power equipment offerings including a lineup of battery and gas-powered tools at the 2022 Equip Expo Louisville, Ky. New products from the company include 60V Max Revolution Series Handheld Tools. Powered by Toro’s Flex-Force Power System, the new line includes a dual-battery backpack that can hold two 10Ah batteries. Toro says the 60V batteries take 50 minutes to fully charge in its new six-pod rapid charger. The batteries also power both Revolution Series handheld tools and the Toro 60V Max 21-inch Heavy Duty mower. Similarly, in January 2023, the Kubota Tractor Corporation recently announced the expansion of its residential mower line with an updated Z200 Series of zero-turn mowers. The series comprises three models, the Z232 with a 42-inch mower deck and the Z242 and Z252, which are available with either a 48-inch or 54-inch deck and Kohler or Kawasaki engines.

Significant Technological Advancements

The rising innovations including improved engine performance, enhanced durability, and increasing integration of GPS and remote-control capabilities are making zero-turn Morse more efficient and user-friendly. For instance, in November 2023, Kubota launched their latest Generation of Zero-Turn Mowers, the Ze Electric Zero-Turn range, with the Ze-421 and Ze-481. Kubota fully supports the declaration that the world will become a fully sustainable carbon-neutral environment by 2050. In conjunction with the world demand for zero emissions, Kubota must deliver and meet the customer's needs for a productive, efficient, and durable machine. The Ze electric zero-turn models not only meet productivity requirements but also with a higher level of operator comfort through reduced noise levels and less vibration during operation. Similarly, in November 2022, Husqvarna Group, one of the world’s leading manufacturers of innovative outdoor lawn and garden products introduced two new Xcite zero-turn mowers, the Z350 and Z380, to its riding mower portfolio for consumers. These two new mowers feature the latest in grass-cutting technology with a best-in-class suspension system, industry-first on-stick controls, and blades designed to last up to five years and ensure users enjoy the thrill of the cut for many seasons. This is expected to boost the zero turn mowers market forecast over the coming years.

Expanding Landscaping Services

The growing commercial landscaping services and the increasing trend of maintaining well-manicured residential lawns drive the demand for efficient and reliable mowing solutions like zero-turn mowers. For instance, in February 2023, John Deere launched its first all-electric zero-turn mower, the Z370R Electric ZTrak. This tractor is targeted at residential property owners for yard maintenance uses. This tractor is designed to produce less noise and vibration while moving to promote a more comfortable operating experience. Similarly, in March 2024, Husqvarna Group, the market leader in robotic lawn care introduced two new models of Husqvarna Automower specifically designed for medium-sized gardens. The new models, Automower 310E NERA and Automower 410XE NERA, seamlessly integrate with Husqvarna’s EPOS1 satellite navigation system and feature the new EdgeCut technology, ensuring neatly trimmed lawn edges.

Zero Turn Mowers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on cutting width, and application.

Breakup by Cutting Width:

- Less than 50 inches

- 50 to 60 inches

- More than 60 inches

More than 60 inches accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the cutting width. This includes less than 50 inches, 50 to 60 inches, and more than 60 inches. According to the report, more than 60 inches represented the largest segment.

The demand for zero-turn mowers with more than 60 inches of cutting width is influenced by the need for efficiency in maintaining large lawns and commercial properties. These mowers significantly reduce mowing time by covering more ground in fewer passes. They are ideal for golf courses, parks, and expensive residential properties where time and precision are critical. Significant advancements in mower technology such as enhanced durability and powerful engines, support the effective use of wider cutting decks. Professional landscapers and property managers prefer these models for their ability to deliver consistent, high-quality results on large-scale projects.

Breakup by Application:

- Residential

- Commercial

Residential holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial. According to the report, residential accounted for the largest market share.

The demand for zero-turn mowers in residential applications is influenced by their superior maneuverability and efficiency, significantly reducing mowing time. Homeowners appreciate the ability to easily navigate around obstacles, ensuring a well-manicured lawn with minimal effort. Rising disposable incomes and an increased focus on outdoor aesthetics further boost demand. Technological advancements, such as user-friendly controls and eco-friendly, battery-powered models, attract environmentally conscious consumers. The trend towards larger residential properties necessitates efficient and effective lawn care solutions, making zero-turn mowers a preferred choice for many homeowners.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest zero turn mowers market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for zero turn mowers.

Significant technological advancements in mower design, expanding commercial landscaping services, and increasing investments in residential lawn care are fueling the market growth across the region. The popularity of large properties requiring efficient maintenance, increasing disposable incomes, and the rising focus on outdoor aesthetics are driving the growth of the market. The growing demand for eco-friendly, battery-powered models and smart features such as GPS and remote-control capabilities contribute to the expansion of the market in the region. For instance, in June 2024, RoboUP, a robotic lawn care solution manufacturer, launched the T1200 Pro robot mower in the United States. The second-generation robot mower is designed to deliver precision and adaptability for multi-zone management while maintaining quiet operation. Users can map out up to 10 separate areas in your garden and customize and schedule mowing sessions on the RoboUP app.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the zero turn mowers industry include Ariens Company, BigDog Mower Co., Briggs & Stratton LLC., Husqvarna AB, Deere & Company, Kubota Corporation, Mtd Products Inc, Spartan Mowers, Swisher Inc., and The Toro Company.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The competitive landscape of the zero turn mowers market is highly competitive, featuring major players such as John Deere, Husqvarna, and Toro. These players on technological advancements like GPS and remote-control features, to differentiate their products. Innovations in eco-friendly, battery-powered models are also a competitive edge. For instance, in August 2022, Kubota Corporation and Accenture formed a new joint venture company, Kubota Data Ground, Inc., to accelerate the digital transformation (DX) of the Kubota group’s business model and operating infrastructure.

Zero Turn Mowers Market News:

- In October 2023, Ariens Nordic Center announced its new partnership with The Diff Agency, a leading sports and entertainment agency. This collaboration will play a crucial role in developing and maintaining corporate partnerships for Ariens Nordic Center, as well as managing the comprehensive rights program, including signage, event making, and official website sponsorships.

- In March 2023, Husqvarna, the global market leader in robotic lawnmowers announced its partnership as the main partner for the Volvo Car Scandinavian Mixed 2023 golf tournament. This partnership marks an important step for Husqvarna Group as it further expands the Husqvarna brand into the golf industry and positions itself as a leader in autonomous green space technology. The agreement makes Husqvarna the main sponsor through 2025.

- In December 2023, HCLTech, a global technology company, and Swedish manufacturer Husqvarna Group extended their strategic IT and digital transformation partnership. “In a major milestone for HCLTech, this is the first time a large global IT contract by an India-headquartered technology company has been Vested certified,” it said.

Zero Turn Mowers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cutting Width Covered | Less than 50 Inches, 50 to 60 Inches, More than 60 Inches |

| Applications Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ariens Company, BigDog Mower Co., Briggs & Stratton LLC., Husqvarna AB, Deere & Company, Kubota Corporation, Mtd Products Inc, Spartan Mowers, Swisher Inc, The Toro Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global zero turn mowers market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global zero turn mowers market?

- What is the impact of each driver, restraint, and opportunity on the global zero turn mowers market?

- What are the key regional markets?

- Which countries represent the most attractive zero turn mowers market?

- What is the breakup of the market based on the cutting width?

- Which is the most attractive cutting width in the zero turn mowers market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the zero turn mowers market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global zero turn mowers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the zero turn mowers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global zero turn mowers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the zero turn mowers industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)