Zero Liquid Discharge (ZLD) Systems Market Size, Share, Trends and Forecast by Process, Systems, Technology, End Use Industry, and Region, 2025-2033

Zero Liquid Discharge (ZLD) Systems Market Size and Share:

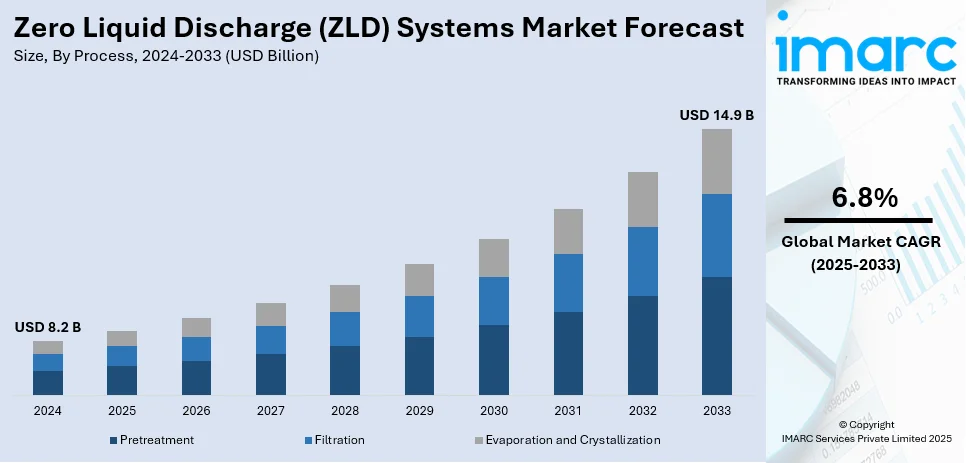

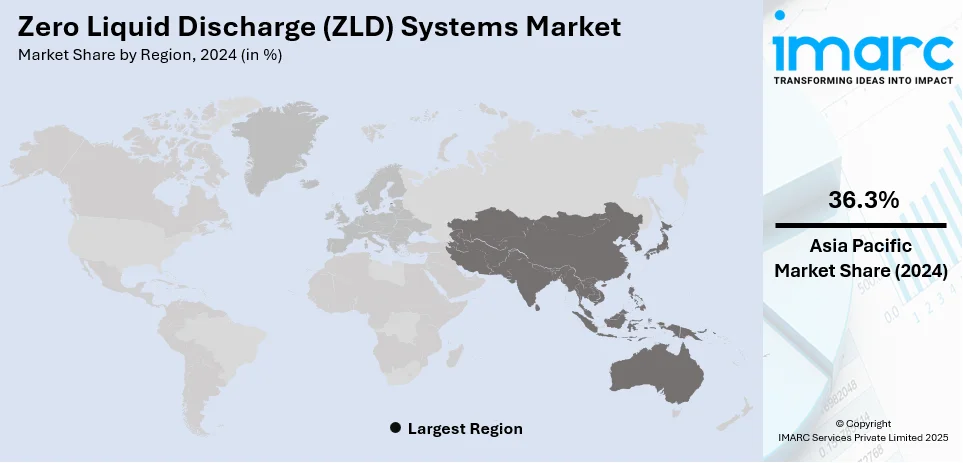

The global zero liquid discharge (ZLD) systems market size was valued at USD 8.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.9 Billion by 2033, exhibiting a CAGR of 6.8% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 36.3 % in 2024. The strict environmental policies, escalating demand for sustainable water treatment techniques and rapidly deploying ZLD systems to lower their wastewater production and improve resource efficiency, thereby propelling the zero liquid discharge (ZLD) systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.2 Billion |

|

Market Forecast in 2033

|

USD 14.9 Billion |

| Market Growth Rate (2025-2033) | 6.8% |

The global zero liquid discharge (ZLD) systems market has several drivers, including strict environmental regulations, increasing water scarcity, and demand for sustainable water resource management. With governments worldwide enacting stricter regulations for wastewater disposal and recycling, industries are adapting ZLD systems to alleviate environmental impact through the disposal of liquid waste and achievement of zero discharge. Growing water shortages, particularly in arid zones, are fueling the need for water reuse and conservation technologies. Moreover, industries like power generation, chemicals, and textiles are implementing ZLD systems to recycle water and recover useful by-products. Filtration technology advancements and growing awareness of sustainable practices have further stimulated the market, causing the adoption of water treatment systems among enterprises that enhance resource efficiency and lower operational expenses.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by the strong legislative underpinning, rapid advancement in science and technology, and the varying industrial spectrum it encompasses. The stringent regulatory framework concerning environmental hazards, especially regarding wastewater treatment and discharge, has compelled various industries in the United States to adopt ZLD solutions. The emphasis on sustainability, resource conservation, and related issues of water scarcity have further propelled the demand for water management systems. Furthermore, the advances in ZLD technologies, sustained by heavy investments in research and development, have placed the US in a key position to shape global market trends and facilitate the adoption of advanced water recycling solutions in various industries.

Zero Liquid Discharge (ZLD) Systems Market Trends:

Increasing Adoption of Advanced Membrane Technologies

The global zero liquid discharge (ZLD) systems market is experiencing a notable trend towards the increasing deployment of advanced membrane technologies, majorly driven by their efficacy in filtering out contaminants from wastewater. Such technologies, including nanofiltration and reverse osmosis, are rapidly being preferred for their high recovery rates and capability to manage complex effluents released from industrial sectors. The global reverse osmosis (RO) membrane market size reached USD 4.7 Billion in 2024. Also, for instance, in May 2024, NX Filtration secured a contract with SAPAL, a Mexican municipal public water administration, to supply hollow-fiber nanofiltration membranes for an indirect potable water reuse system aimed at managing water shortage issues in Mexico. The significant shift towards membranes is further aided by their lower energy consumption in comparison to conventional thermal processes, establishing them as more cost-efficient. With industries prioritizing sustainability, the demand for membrane-based ZLD systems is anticipated to boost, particularly in water-consumptive sectors.

Integration of Automation and Digital Monitoring Technologies

The zero liquid discharge (ZLD) systems market growth is significantly influenced by the integration of automation and digital monitoring technologies. Numerous companies are rapidly deploying smart control systems to upgrade ZLD operations, permitting the real-time monitoring of proactive maintenance and parameters of such operations. For instance, in July 2023, SUEZ, one of the leading ZLD systems provider, and Schneider Electric announced a partnership to spur the execution of digital solutions aimed at improving carbon impact, resource conservation, and energy efficiency in water cycle management techniques. As per the agreement, Schneider will incorporate SUEZ’S digital AQUAADVANCED product range into its water advisor software called Ecostruxure for management of water cycle. The global digital transformation market size reached USD 809.1 Billion in 2024. Furthermore, this trend improves system efficacy, lowers downtime, and reduces operational costs, thereby enhancing the appeal of ZLD solutions for industries. In addition, the utilization of IoT-enabled devices and data analytics in ZLD systems is facilitating more accurate control over water treatment operations, substantially contributing to better resource management and adherence to environmental protocols. The global internet of things (IoT) market size reached USD 1,022.6 Billion in 2024.

Increasing Inclination Towards Energy-Efficient Solutions

The zero liquid discharge (ZLD) systems market report highlights the growing inclination towards energy-efficient solutions which is steering the global market growth. According to industry reports, energy efficiency improved by 2% in 2022 due to the energy crisis. This inclination is driven by industries which are currently seeking to lower their high energy consumption, traditionally associated with ZLD systems. Moreover, innovations in hybrid ZLD systems, which blend membrane and thermal technologies, are gaining momentum for their ability to lower energy consumption while sustaining high recovery rates. Moreover, progressions in energy recovery technology, paired with the incorporation of renewable energy sources in ZLD processes, are paving the way towards ever more sustainable systems. However, this is also in line with the industry trends which are already shifting toward lowering operational costs and carbon footprints. For instance, Globe Textile India Limited announced the acquisition of Globe Denwash Private Limited in February 2024 to strengthen market consolidation and sustainability practices. This acquisition is consistent with the promise of the company to the environment because it helps reduce energy consumption and increase water recycling through their zero liquid discharge system.

Zero Liquid Discharge (ZLD) Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global zero liquid discharge (ZLD) systems market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on process, systems, technology, and end use industry.

Analysis by Process:

- Pretreatment

- Filtration

- Evaporation and Crystallization

Evaporation and crystallization stand as the largest component in 2024, holding around 49.7% of the market. The zero liquid discharge (ZLD) systems market outlook points to the prominent domination of pretreatment process globally due to its crucial role in improving overall system efficacy. This segment involves the removal of organic matter, various contaminants, and suspended solids before the core ZLD process, facilitating more seamless operation and enhanced lifespan of successive treatment stages. A research paper published in March 2024 in the Journal of Membrane Science describes the development of an advanced pretreatment system for Zero Liquid Discharge (ZLD) applications. This cutting-edge technology, which integrates nanofiltration, reverse osmosis, and disk tube osmosis, has achieved an impressive water recovery rate of 91% for the ZLD system, all while keeping energy consumption minimal. Furthermore, numerous industries prefer pretreatment to lower fouling, operational, and scaling issues, thereby establishing this segment as a critical component in attaining effective zero liquid discharge.

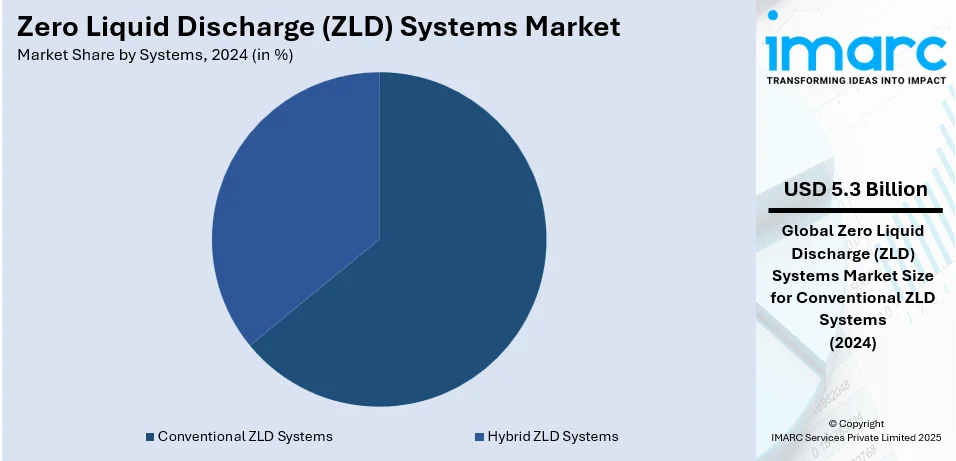

Analysis by Systems:

- Conventional ZLD Systems

- Hybrid ZLD Systems

Conventional ZLD systems leads the market with around 64.2% of market share in 2024. As per the zero liquid discharge (ZLD) systems industry, conventional systems are the forefront in the global market, principally due to their evidenced credibility and extensive adoption across numerous sectors. Such systems, which generally leverage thermal crystallization and evaporation processes, are preferred for their capability to attain near-total water recovery. Furthermore, the segment’s dominance is also supported by their excellent effectiveness in managing complex wastewater effluent, making them a favorable option for sectors with strict discharge norms and elevated wastewater volumes.

Analysis by Technology:

- Thermal-based

- Membrane-based

Thermal-based leads the market with around 58.4% of market share in 2024. According to the zero liquid discharge (ZLD) systems market forecast, thermal-based technology is anticipated to maintain its dominant position in the global market primarily due to its efficacy in treating extreme level of contamination in industrial wastewater. A research paper published in June 2024 details the development of a sustainable thermal-based ZLD system known as interfacial solar evaporation, which leverages solar energy to produce freshwater production. This technology, which involves processes such as crystallizers and evaporators, is preferred for its ability to offer almost complete water recovery and minimization of solid waste. Although this technology consumes higher energy, its sturdiness in handling complicated effluents establishes it as an ideal option in sectors like oil and gas, power generation, and chemicals, where strict environmental framework is mandated.

Analysis by End Use Industry:

- Power

- Oil and Gas

- Metallurgy and Mining

- Chemicals and Petrochemicals

- Pharmaceutical

- Others

Power leads the market with around 40.0% of market share in 2024. The power industry represents the largest market share for the global zero liquid discharge (ZLD) systems market, principally driven by the intense demand to manage massive volumes of wastewater and strict environmental guidelines. Power plants, especially those leveraging thermal processes, demand effective water treatment solutions to adhere to compliance standards and lower environmental impact. The deployment of ZLD systems in this industry is further boosted by the sector’s emphasis on resource conservation, lowering water-associated operational risks, and sustainability.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 36.3%. North America constitutes the largest regional market for the global ZLD systems market, primarily driven by stringent environmental policies, and robust industrial demand across numerous sectors. The zero liquid discharge (ZLD) systems market recent developments, such as heavy investments in sustainable water management techniques, further bolsters the regional market expansion, particularly in the United States. According to the U.S. Environmental Protection Agency, almost 34 Billion gallons of wastewater in United States is treated or processed every day. Moreover, the region’s authority in adopting advanced ZLD systems is further aided by ongoing advancements in digital monitoring technologies and energy-efficient approaches. As industries are rapidly prioritizing environmental compliance, North America’s leadership in the global market is anticipated to sustain in the coming years.

Key Regional Takeaways:

United States Zero Liquid Discharge (ZLD) Systems Market Analysis

In 2024, the United States accounted for 88.20% of the zero liquid discharge (ZLD) systems market in North America. The market is expanding due to strict environmental regulations, particularly the Clean Water Act and the National Pollutant Discharge Elimination System (NPDES), which enforce stringent wastewater treatment standards. Rising industrial adoption of sustainable water management solutions, especially in power generation, chemicals, and pharmaceuticals, is driving demand. Water intensive industries, including agriculture and food processing, sectors that employed 22.1 Million full and part time workers in 2022, accounting for 10.4% of total United States employment, are increasingly adopting ZLD to ensure compliance and resource efficiency. Water scarcity concerns and high industrial discharge volumes further necessitate advanced ZLD technologies. Additionally, growing investments in infrastructure and industrial expansion encourage the adoption of cost-effective wastewater treatment solutions. Technological advancements, such as energy efficient membrane based and hybrid ZLD systems, are gaining traction. The shale gas industry’s wastewater treatment needs and the growth of semiconductor manufacturing, which relies on ultrapure water, further boost demand. Federal and state level incentives promoting water conservation and sustainability efforts also support market expansion.

Asia Pacific Zero Liquid Discharge (ZLD) Systems Market Analysis

Rapid industrialization, increasing water pollution, and strict environmental ordinances in countries such as China and India are some of the major drivers substantiating growth in the Asia-Pacific ZLD systems market. Several initiatives have also been undertaken to further endorse and promote the adoption of zero-liquid discharge; examples are China's Water Ten Plan and India's ZLD mandate for textile and chemical industries. Water availability is a huge challenge for this region, with estimates by the WHO/UNICEF indicating that around 500 million people lack a basic water supply and 1.14 billion are without sanitation, underscoring an urgent need for wastewater management and water reuse technologies. On the other hand, the region's expanding manufacturing industries such as electronics, pharmaceuticals, and power generation are adopting high-end ZLD solutions not just to comply with regulations, but also in an attempt to save water. Cost-effective membrane technologies and hybrid ZLD systems have gained more importance in recent days due to their environmentally friendly and efficient energy use. The other contributing factor to the growth of the market is foreign investment and PPPs in wastewater infrastructure.

Europe Zero Liquid Discharge (ZLD) Systems Market Analysis

The European zero liquid discharge (ZLD) systems market is driven by stringent wastewater discharge regulations, including the European Union Water Framework Directive and Industrial Emissions Directive, which enforce strict effluent treatment standards. Concerns over water pollution and freshwater scarcity, particularly in Southern Europe, are pushing industries to adopt ZLD technologies. The chemicals, pharmaceuticals, and power generation sectors are major drivers, as they seek compliance with environmental regulations while reducing operational costs. Agriculture also plays a key role, with the EU’s agricultural labor input in 2023 equivalent to 7.6 Million full-time workers, according to report, reflecting the sector’s significant water use and the need for sustainable management solutions. Circular economy principles, which emphasize resource recovery and water reuse, are gaining traction in the region, further supporting ZLD adoption. Energy-efficient technologies such as evaporators and crystallizers are increasingly in demand due to their cost-saving benefits and environmental impact. Additionally, the growing expansion of desalination projects in coastal regions, particularly for industrial applications, is boosting market growth. Government initiatives promoting green technologies and corporate sustainability commitments are also contributing to the increasing market share of ZLD systems. As industries in Europe strive to minimize water usage and maximize efficiency, ZLD technologies are seen as essential tools to ensure both environmental responsibility and cost-effectiveness.

Latin America Zero Liquid Discharge (ZLD) Systems Market Analysis

The Latin American ZLD systems market is driven by rising industrialization, increasing water scarcity, and tightening environmental regulations primarily in Brazil, Mexico, and Chile. The mining industry, which accounted for 6.6% of total global mining production in 2019, as per World Mining Data, creates demand for ZLD systems by trying to comply with the environmental requisites for wastewater management. Governments are investing in sustainable water management infrastructures, highlighting advanced treatment technologies. In addition, the booming food and beverage and textile sectors in the region help to sustain zero liquid discharge (ZLD) systems market demand. Sustainability endeavors by multinational corporations, advocate for the adoption of ZLDs.

Middle East and Africa Zero Liquid Discharge (ZLD) Systems Market Analysis

Scarcity of water, government regulations regarding wastewater, and investments into industries are the main reasons that the zero liquid discharge systems market for the Middle East and Africa is receiving growth. ZLD solution demand is being driven by the oil and gas industry that looks to maximize water reuse and meet environmental regulations with a projected growth of 6.30% CAGR between 2025 and 2033. Likewise, the mining and power generation industries of Africa support the growth of this market. Meanwhile, in the context of ambitious water sustainability programs being implemented in the GCC, particularly in Saudi Arabia and the UAE, ZLD adoption is being accelerated. These technological improvements have also been favorable to the growth of the market.

Competitive Landscape:

Key players in the zero liquid discharge (ZLD) systems market provide innovative solutions that help industries recover and reuse water, minimizing waste and environmental impact. Major trends in the ZLD systems market include increased adoption of membrane filtration technologies, which enhance water recovery efficiency, and the growing integration of automation and IoT for better system monitoring and control. Another trend is the rising demand for ZLD in industries such as power generation, textiles, and pharmaceuticals, driven by stringent environmental regulations and the need for sustainable water management. Additionally, advancements in energy recovery technologies are improving the cost-effectiveness of ZLD systems, making them more accessible to a broader range of industries.

The report provides a comprehensive analysis of the competitive landscape in the zero liquid discharge (ZLD) systems market with detailed profiles of all major companies, including:

- Alfa Laval

- Aquatech

- ENCON Evaporators

- GEA Group Aktiengesellschaft

- Gradiant Corporation

- H2O GmbH

- Petro Sep Corporation

- Praj Industries

- Saltworks Technologies Inc.

- Thermax Limited

- Toshiba Corporation

- Veolia Water Technololgies, Inc.

Latest News and Developments:

- April 2024: Thermax established a new water and wastewater treatment system manufacturing plant in Pune. The facility, which covers two acres, is a testament to the company's dedication to sustainability and resource conservation. Additionally, it emphasizes Zero Liquid Discharge (ZLD) solutions, sewage treatment plants (STP), reverse osmosis (RO), and effluent recycling systems (ERS).

- May 2024: Veolia Water technologies, a leading zero liquid discharge (ZLD) provider, unveiled its first regeneration plant in China as a strategic move to expand its business in the country and improve its offerings by addressing their ultrapure and treated water requirements. Additionally, this facility will provide treated water to sectors including food and beverage, power, microelectronics, petrochemicals, and pharmaceuticals.

- February 2024: SUEZ, a renowned water treatment and ZLD systems provider, signed a contract with Buaran III, a water treatment plant in Jakarta, to provide technical advisory services and essential equipment for the water treatment processes.

- October 2023: Murugappa Water Technology and Solutions (MWTS) has partnered with Scalene Livprotec to introduce Aquatron, a groundbreaking wastewater treatment technology. Unveiled at the IFAT exhibition in Mumbai, Aquatron uses principles of physics to treat wastewater to drinking water standards without relying on biological, chemical, or Reverse Osmosis processes. The technology aims to achieve Zero Liquid Discharge (ZLD) and avoid hazardous chemical discharge.

- March 2022: UFlex's Chemicals production unit in Noida has recently achieved the Zero Liquid Discharge (ZLD) status, ensuring that no industrial wastewater is released into the environment. This move primarily aims to reduce water consumption and pollution. The ZLD system treats effluent using technologies like that of Membrane Bio-Reactor (MBR), Reverse Osmosis (RO), and Agitated Thin Film Dryer (AFTD). The treated water is then reused for various processes like boiler feed and cooling tower makeup.

Zero Liquid Discharge (ZLD) Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Pretreatment, Filtration, Evaporation and Crystallization |

| Systems Covered | Conventional ZLD Systems, Hybrid ZLD Systems |

| Technologies Covered | Thermal-Based, Membrane-Based |

| End Use Industries Covered | Power, Oil and Gas, Metallurgy and Mining, Chemicals and Petrochemicals, Pharmaceutical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alfa Laval, Aquatech, ENCON Evaporators, GEA Group Aktiengesellschaft, Gradiant Corporation, H2O GmbH, Petro Sep Corporation, Praj Industries, Saltworks Technologies Inc., Thermax Limited, Toshiba Corporation, Veolia Water Technololgies, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the zero liquid discharge (ZLD) systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global zero liquid discharge (ZLD) systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the zero liquid discharge (ZLD) systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The zero liquid discharge (ZLD) systems market was valued at USD 8.2 Billion in 2024.

The zero liquid discharge (ZLD) systems market is projected to exhibit a CAGR of 6.8% during 2025-2033.

The zero liquid discharge (ZLD) systems market is driven by stringent environmental regulations, water scarcity concerns, and the need for sustainable wastewater management. Industries seek ZLD solutions to minimize waste, comply with environmental laws, recycle water, and recover valuable by-products, promoting resource conservation and operational efficiency across various sectors.

Asia Pacific currently dominates the market driven by rapid industrial growth, increasing water scarcity, and stringent environmental regulations.

Some of the major players in the zero liquid discharge (ZLD) systems market include Alfa Laval, Aquatech, ENCON Evaporators, GEA Group Aktiengesellschaft, Gradiant Corporation, H2O GmbH, Petro Sep Corporation, Praj Industries, Saltworks Technologies Inc., Thermax Limited, Toshiba Corporation, Veolia Water Technololgies, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)