Xylitol Market Report by Form (Solid, Liquid), Application (Chewing Gum, Confectionery, Pharmaceutical and Personal Care, and Others), and Region 2026-2034

Xylitol Market Size:

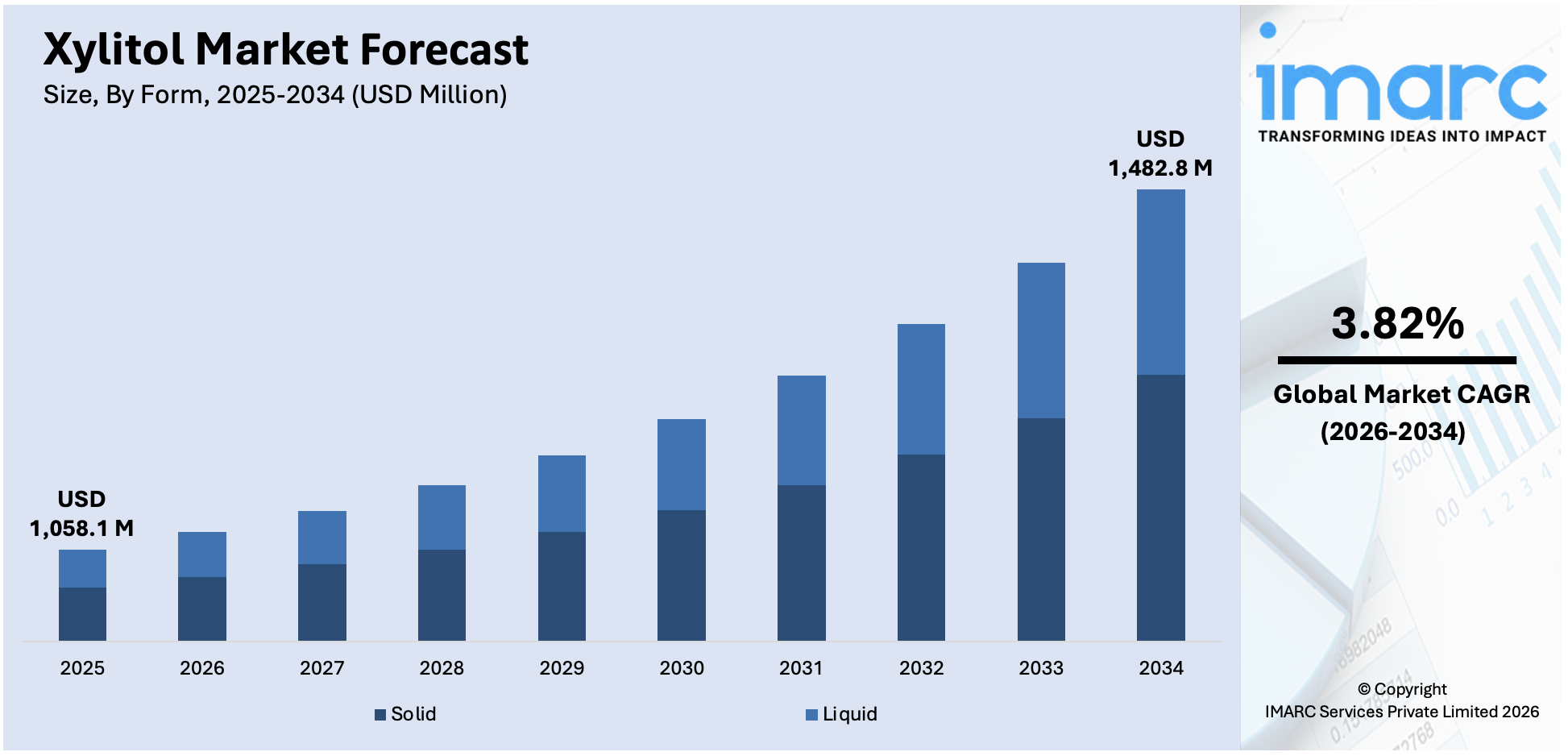

The global xylitol market size reached USD 1,058.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,482.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.82% during 2026-2034. The market is experiencing steady growth driven by expanding applications in the food and beverage industry, regulatory support and favorable policies promoting natural sweeteners over artificial sweeteners, and the rising prevalence of diabetes and obesity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,058.1 Million |

|

Market Forecast in 2034

|

USD 1,482.8 Million |

| Market Growth Rate 2026-2034 | 3.82% |

Xylitol Market Analysis:

- Major Market Drivers: Xylitol, being a low-calorie and natural sweetener, is expanding globally due to the growing health and wellness trends among consumers, driving the xylitol market growth. Moreover, its extended utilization in food and beverage applications drives the market as it supports healthy, sugar-free products.

- Key Market Trends: Xylitol continues to be used across various food and beverage products, including confectioneries, baked goods, and chewing gums. This is mainly attributed to its application mobility, which gives the ingredient a functional edge. Regulatory support and policies promoting the use of xylitol also appear to be an emerging trend, aiding market acceptance.

- Geographical Trends: The demand for xylitol has been significantly high in North America and Western Europe, two major regions. This is driven by higher consumer awareness and stringent regulatory standards favoring natural sweeteners. Rising health consciousness and disposable income are enhancing growth in emerging markets such as APAC.

- Competitive Landscape: The xylitol market research report covers a descriptive study of the market trends and growth, including segmentation analysis. More research is being done by companies to develop systems that improve the production process, reducing costs and making them competitive. Some of the major market players in the xylitol industry include Cargill, Incorporated, Foodchem International Corporation, Herboveda India, Jining Hengda Green Engineering Co., Ltd., Merck KGaA, Mitsubishi Corporation Life Sciences Limited, Roquette Freres, Shandong Futaste Co., Shandong Longlive Bio-technology Co., Ltd. and Zhejiang Huakang Pharmaceutical Co., Ltd., among many others.

- Challenges and Opportunities: The market for xylitol is anticipated to face significant challenges as production costs are high and other sweeteners, including sucrose, may be readily available in global markets. Yet, the rising consumer demand for natural and health-promoting ingredients, along with regulatory pressure to reduce sugar consumption is providing opportunities for the market.

To get more information on this market Request Sample

Xylitol Market Trends:

Growing health and wellness trends

The growing concern for health and wellness among consumers is one of the major xylitol market drivers. Along with this, the accelerating concern of consumers about their health is favoring sweeteners that are natural and low in calories compared to traditional sugars. Xylitol is considered one of the most popular of all sugar alcohols currently as it is a polyol found in numerous plants and fruits. Additionally, it is being bandied about for its low glycemic index which would suggest that even diabetics/pre-diabetic individuals can safely consume Xylitol. In addition, xylitol carries oral health benefits (anti-cavity and anti-tooth decay) that are highly desired by healthy-savvy consumers. Therefore, this is significantly supporting the market. Moreover, the rising health awareness amongst consumers with a shift of preference to natural and healthy ingredients for food as well as beverages is further contributing towards the growth in demand for xylitol, globally.

Expanding applications in food and beverages

Xylitol has a wide range of applications in the food and beverage sector, which adds to xylitol market demand, thus playing an important role in market growth. A popular sweetening agent in various products such as confectioneries, baked goods, chewing gums, and beverages is xylitol, by its a similar sweetness profile to sugar with less calorie content. This is one of the reasons it has seen much use in sugar-free and light-food products, as consumer demand for healthier food options becomes stronger. In addition, xylitol is considered functional due to its ability to retain moisture and increase the shelf-life of several food products. This is a key factor driving the global market due to constant innovation and the introduction of new products containing xylitol aligned with consumer preferences.

Regulatory support and favorable policies

Supportive government regulations as well as favorable policies regarding the utilization of natural sweeteners such as xylitol are significantly creating a positive xylitol market outlook. Several regulatory bodies around the world are now accepting xylitol as a healthy, and better alternative to sugar and other man-made sweeteners. Along with this, the demand for xylitol is driven by the regulatory endorsements and approvals of major food authorities that encourage xylitol acceptance in a plethora of applications, prompting the manufacturers to adapt its use. Moreover, various government campaigns encourage low sugar intake to prevent obesity and diabetes and increase the use of xylitol. It is fueling a significant need for products such as salad dressings with an overall market worldwide.

Xylitol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global xylitol market report, along with forecasts at the global and regional levels from 2026-2034. Our report has categorized the market based on form and application.

Breakup by Form:

- Solid

- Liquid

Solid accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the form. This includes solid and liquid. According to the report, solid represented the largest segment.

The solid form segment holds the major xylitol market share in terms of value due to its broad applications across end-use industries. Powder and granulated forms of solid xylitol are used extensively in food manufacturing, especially confectionery, chewing gum, and bakery, where its superficial resemblance to sucrose has allowed it to be a stand-in for sugar. For manufacturers, the solid form is also sought after as it provides stability for a longer shelf-life. Its ability to combine with other flavors without changing the consistency and taste of the final product also contributes to its favor. Maintaining the demand, the popularity of solid xylitol in sugar-free medications and oral hygiene (toothpaste and mouthwash) production used by pharmaceuticals and personal care industries is extending. The multifunctional properties, dietary energy benefits, and wide range of applications stick xylitol provides make it the leading segment by the form in terms of size and influence in the global market being increasingly used as an ingredient meeting versatile needs across consumer markets through industrial end-use categories.

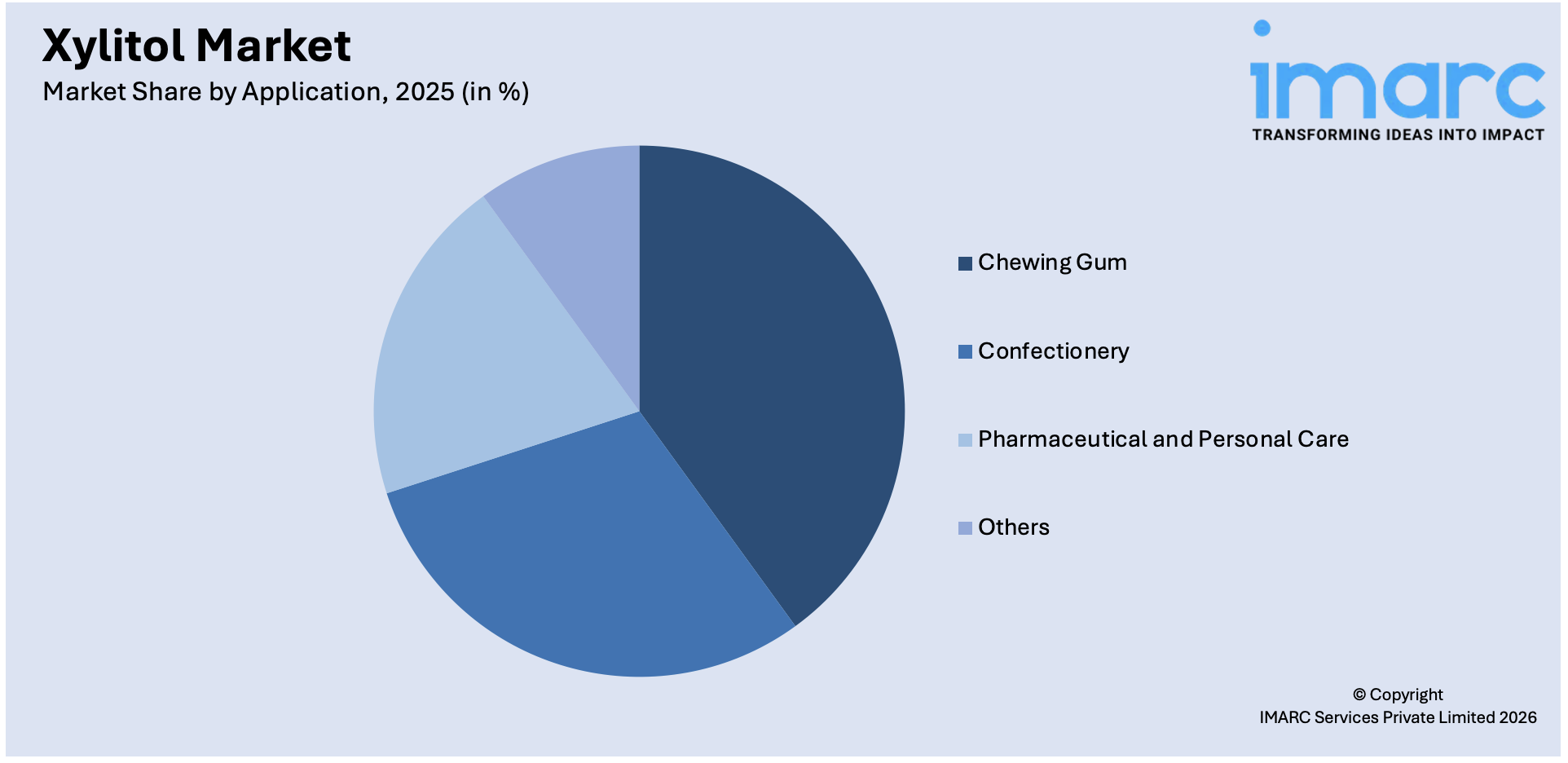

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Chewing Gum

- Confectionery

- Pharmaceutical and Personal Care

- Others

Chewing gum holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chewing gum, confectionery, pharmaceutical and personal care, and others. According to the report, chewing gum accounted for the largest market share.

Chewing gum is the leading application of xylitol, mainly supported by the accelerating demand for chewing gum from teenagers and the health benefits associated with the consumption of xylitol. In addition, the anti-plaque properties and superior cariostatic activity of xylitol make it an excellent choice for use in sugar-free chewing gums aimed at health-conscious consumers who are interested in taking care of their teeth. Along with this, the prevailing inclination for sugar-free and low-cal varieties in the confectionery sector is resulting in the introduction of new product and flavor formulations targeting different types of consumers' preferences. The global xylitol market is witnessing good growth based on this aspect, and its use in chewing gum due to the widespread acceptance of sugar alcohols. This adaptation to consumer preferences highlights the dynamic xylitol market trends that are shaping the industry.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest xylitol market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, the Middle East and Africa and Latin America. According to the report, Asia Pacific represents the largest regional market for xylitol.

The Asia Pacific is proclaimed as a leading market for xylitol due to the rapidly growing urban population with increasing disposable incomes and a focus on consuming healthy foods. In addition, the escalating incidences of diabetes and obesity cases in various countries such as China, and India is leading to high demand for low-calorie sugar alternatives such as xylitol which further enhances market growth. According to the xylitol industry overview, the growing middle class and changing dietary patterns are supporting the consumption of natural sweeteners in daily intake. The food and beverage industry in the region is also witnessing substantial growth due to the preference of consumers for healthy alternatives, alongside an increasing application of xylitol-infused confectioneries and beverages along with dairy products. This, along with favorable government laws and regulations to lower sugar consumption and drive public health, is driving the market growth. Moreover, growing investment in research and development alongside a huge population base are triggers shaping the Asia Pacific as a forerunning region across the world market with a sustainable growth rate.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the xylitol industry include:

- Cargill, Incorporated

- Foodchem International Corporation

- Herboveda India

- Jining Hengda Green Engineering Co., Ltd.

- Merck KGaA

- Mitsubishi Corporation Life Sciences Limited

- Roquette Freres

- Shandong Futaste Co.

- Shandong Longlive Bio-technology Co., Ltd.

- Zhejiang Huakang Pharmaceutical Co., Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Xylitol companies are focusing on strategic actions, including mergers and acquisitions to work closely with entrants looking at tapping opportunities for entry by meeting burgeoning consumer demand. Key players such as Roquette Freres, and Cargill, Incorporated are investing significantly in increasing their production capacities and strengthening the supply chain to ensure a continuous flow of high-grade xylitol. Innovative new product formulations that suit the varying requirements across food, beverage, pharmaceuticals, and personal care industries are being developed by these companies through significant R&D investment. Companies are partnering up for collaborations, whether they be long-term or one-off, and using mergers to strengthen their market share so that companies can capitalize on each other's respective technological expertise. To respond to global environmental trends, sustainability initiatives such as using birch and corn cobs rather than nonrenewable resources for xylitol procurement are also focused. According to the xylitol market analysis, adoption of these strategies is aiding players to maintain their leading positions in the fast-growing market.

Xylitol Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Solid, Liquid |

| Applications Covered | Chewing Gum, Confectionery, Pharmaceutical and Personal Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cargill, Incorporated, Foodchem International Corporation, Herboveda India, Jining Hengda Green Engineering Co., Ltd., Merck KGaA, Mitsubishi Corporation Life Sciences Limited, Roquette Freres, Shandong Futaste Co., Shandong Longlive Bio-technology Co., Ltd., Zhejiang Huakang Pharmaceutical Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the xylitol market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global xylitol market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the xylitol industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global xylitol market was valued at USD 1,058.1 Million in 2025.

We expect the global xylitol market to exhibit a CAGR of 3.82% during 2026-2034.

The high prevalence of numerous lifestyle disorders, such as CVDs, diabetes, obesity, etc., coupled with the growing demand for xylitol as healthier and safer substitute to sugar, is primarily driving the global xylitol market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of xylitol and xylitol-based food items.

Based on the form, the global xylitol market has been segregated into solid and liquid. Currently, solid xylitol holds largest market share.

Based on the application, the global xylitol market can be bifurcated into chewing gum, confectionery, pharmaceutical and personal care, and others. Among these, chewing gum represents the majority of the total market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global xylitol market include Cargill, Incorporated, Foodchem International Corporation, Herboveda India, Jining Hengda Green Engineering Co., Ltd., Merck KGaA, Mitsubishi Corporation Life Sciences Limited, Roquette Freres, Shandong Futaste Co., Shandong Longlive Bio-technology Co., Ltd. and Zhejiang Huakang Pharmaceutical Co., Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)