Xenon Lights Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

Xenon Lights Market Size and Share:

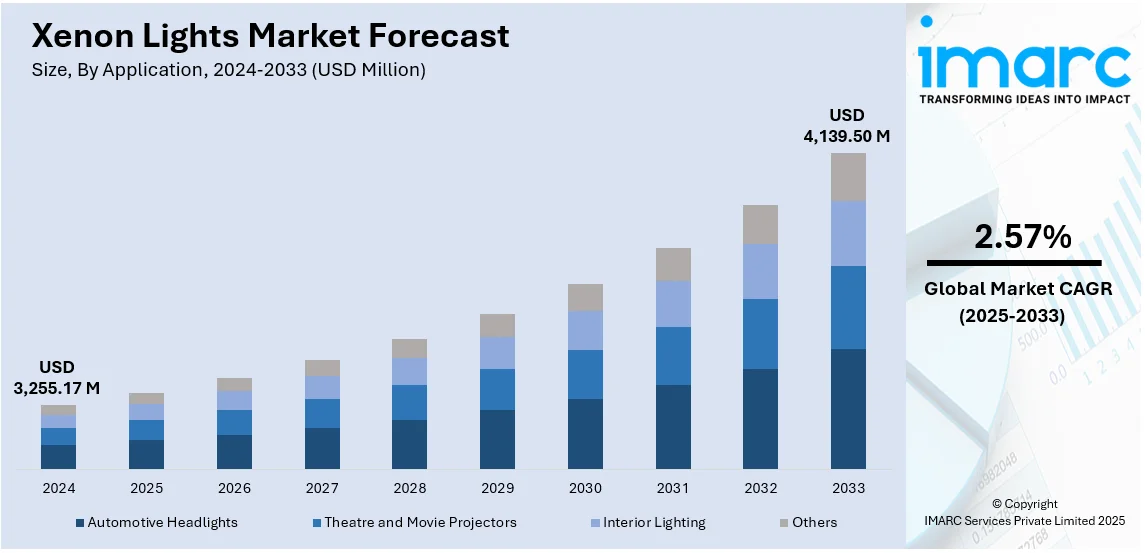

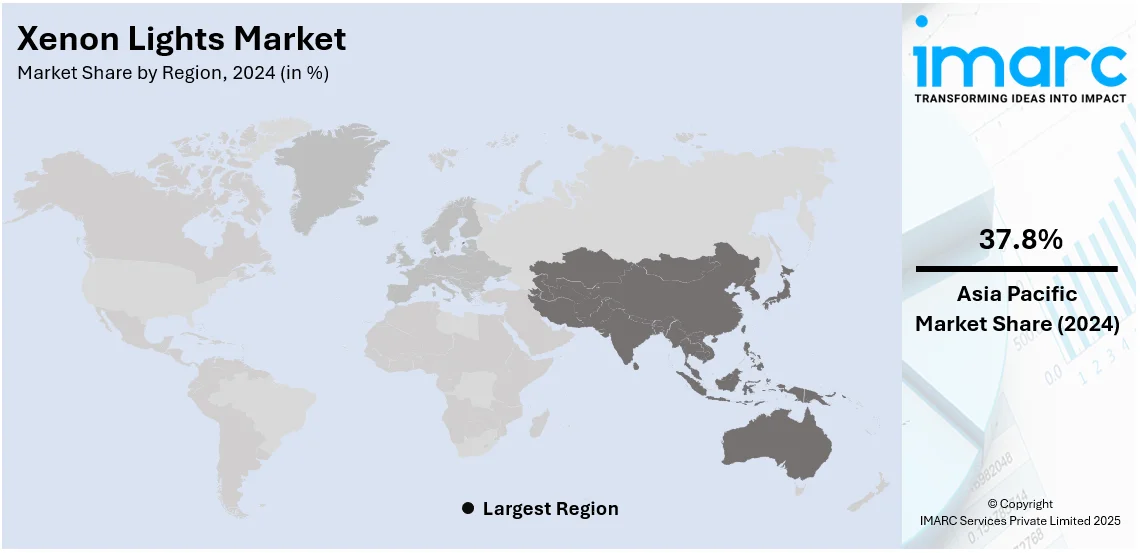

The global xenon lights market size was valued at USD 3,255.17 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,139.50 Million by 2033, exhibiting a CAGR of 2.57% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 37.8% in 2024. This dominance is driven by strong automotive production, increasing demand for advanced lighting, and technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,255.17 Million |

|

Market Forecast in 2033

|

USD 4,139.50 Million |

| Market Growth Rate (2025-2033) | 2.57% |

The key driver for the demand for xenon lights is the growing need for automotive lighting in luxury and premium vehicle models. Xenon light, or high-intensity discharge (HID) lamp, is significantly brighter, longer-lasting, and consumes much less energy than a halogen lamp. This has made them very popular in high-end cars where advanced lighting solutions are considered to be one of the major features that make the vehicle appealing to the aesthetic senses and increase safety while driving. Apart from these, the recent trend in the automotive industry regarding fuel efficiency and environmental sustainability has also increased the utilization of energy-efficient xenon lighting technology in modern vehicles. For example, according to the industry reports, xenon flashlights and headlamps provide daylight-like beam with excellent contrast in good visibility. Long-range, lesser energy consumption as compared to incandescent bulbs, full brightness in the instant time, and lifespan of about 2,000 hours.

The United States is an important player in the xenon lights market, through a combination of advanced manufacturing capabilities, innovation, and strategic market demand. Several U.S.-based companies are key players in the production and distribution of xenon lighting solutions, particularly for the automotive and commercial sectors. For example, in September 2024, Excelitas Technologies released Cermax PE300BFX and PE322BFX Xenon lamps for medical applications. These offer extended 1000-hour lifetimes, better outputs, and versatile mounting options for seamless OEM system integration. These companies focus on developing only high-quality, energy-efficient lighting systems that meet strict regulatory standards. In addition, the increasing usage of xenon lights in luxury vehicles, coupled with the trend of high-end lighting technologies across sectors, places the U.S. at the center of research, development, and deployment of innovations in xenon lighting.

Xenon Lights Market Trends:

Increased Adoption in Automotive Lighting

Xenon lights are also referred to as High-Intensity Discharge (HID) lamps. Often preferred for the more expensive and luxury cars, they have a brighter output and longer life cycles compared to halogen lights and consume less energy. According to reports, the overall automotive lighting market size globally would reach USD 34.3 Billion in 2024. The xenon lighting technology itself has gained immense popularity and is increasingly being used among high-performance models for better view and road safety by most automobile manufacturers. Demand for higher-performing driver assistance systems and autonomous cars has reinforced the need for high-performance lighting. Moreover, with vehicle manufacturers on their way to sustainability, the requirement still remains for xenon lights as these are energy-efficient solutions that can also reduce the harmful effect of pollution, thereby fulfilling the strict environmental regulations.

Growing Production of Vehicles and Demand for Advanced Lighting Solutions

As the global automotive industry sees a surge in vehicle production, the demand for advanced lighting solutions like xenon lamps is also increasing. According to reports, 12% of the global population currently owns a vehicle. Manufacturers are incorporating xenon lights into more vehicle models, driven by consumer preferences for high-performance lighting systems that improve driving safety, enhance vehicle aesthetics, and support features such as adaptive headlights and night-driving capabilities. Increased numbers of electric and autonomous vehicle productions are demanding effective and robust lightings that make these automobiles not only require technologically integrated units but also integrate superior light solutions. The increasing volume of car production in premium and luxury vehicles is mainly supporting the uptake of xenon lights in the auto industry.

Rising Demand for Xenon Lights in Agricultural Applications

One other trend significantly pushing the market of xenon lights is that the adoption of advanced lighting technologies in agriculture. Xenon lamps, especially pulsed xenon lighting, are applied in horticulture and indoor farming for stimulating plant growth as they are equipped with full-spectrum light mimicking the sun's light. For example, in 2024, Neotek Lighting launched Pulsed Xenon Light fixtures, which offer a full-spectrum sunlight-like illuminance at the mere power level of 29 Watts, while promoting growth among plants and conserving considerable energy. Crop yields and overall plant health rise with the invention, and also reduce energy expenditure compared to those of conventional systems. With the ongoing adoption of controlled-environment agriculture by the agriculture industry through means such as vertical farming and greenhouse cultivation, demand for energy-efficient, high-intensity lighting, such as that provided by xenon lamps, is likely to increase. Another factor adding impetus to the trend is sustainable farming and food production requirements for the globe.

Xenon Lights Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global xenon lights market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Automotive Headlights

- Theatre and Movie Projectors

- Interior Lighting

- Others

Automotive headlights dominate the market in 2024. In vehicle safety and aesthetics, headlamps are crucial components as they ensure proper visibility at night, avoid accidents, and provide an improved driving experience. The major reason for adopting advanced lighting technologies, such as xenon and LED headlights, is the increasing demand for high-performance lighting solutions in luxury and standard vehicles. The former boasts superior brightness, energy efficiency, and a longer lifespan compared to traditional halogen lights. Another factor driving the increase in the automotive headlights segment is the rising consumer demand for stylish, high-tech features in vehicles. This has added much to the market's growth in 2024.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37.8%. The major market position is attributed to multiple factors such as a strong automotive industry in the region along with rapidly growing demand for advanced lighting solutions, and rising vehicle production rates, especially in countries like China, Japan, and South Korea. A principle driver also includes the growing adoption of high-performance technologies such as xenon and LED lights in passenger and commercial vehicles. Besides, the government policies aimed at making the automobile industry safe and energy efficient have contributed further to the market growth. In this context, the region would continue to spend on infrastructure development and technological upgrades and hence lead the global market till 2024.

Key Regional Takeaways:

United States Xenon Lights Market Analysis

US accounts for 85% share of the market in North America. The xenon lights market in the United States is driven by the growing demand for high-performance lighting solutions across various sectors. Automotive applications, particularly in luxury and high-end vehicles, continue to be the primary market driver, as xenon headlights offer superior illumination and energy efficiency compared to traditional halogen lights. As more consumers opt for advanced lighting systems for safety and aesthetic reasons, the demand for xenon lights remains strong. The electric vehicle (EV) sector is also aiding this expansion, with sales rising 15.2% compared to the previous year in the fourth quarter of 2024, totaling 365,824 units, as per industry reports. As EV manufacturers seek to provide premium features, including advanced lighting solutions, xenon lights are becoming a key component in their design. Furthermore, the commercial sector is witnessing the adoption of xenon lights for street and architectural lighting due to their brightness and long lifespan. Government regulations enforcing stricter lighting standards in both the automotive and commercial sectors have also contributed to the adoption of xenon technology. In parallel, the continuous advancements in xenon technology, such as the development of xenon HID bulbs with improved longevity and color quality, have further stimulated market growth.

North America Xenon Lights Market Analysis

North America is relatively a stable growth region for xenon lights. This is due to the high demand for vehicles in the automotive sector, particularly for premium and luxury vehicles. For instance, in 2024, it was estimated that Canada accounted for approximately 7.3% of the total vehicle production in the region. Xenon lights have better brightness, longer life, and energy efficiency, making them the first choice for luxury vehicles. Moreover, strict government regulations on safety and lighting for vehicles also open up the market, as companies opt for high-tech lighting solutions. The United States is one of the primary markets, and the top companies in the country are Osram, Philips, and General Electric. One more trend being observed is eco-friendly and energy-saving solutions, in favor of taking xenon lights over conventional halogen lights. The technological growth of LEDs against the advancement of the market was challenging companies to innovate and improvise the same.

Asia Pacific Xenon Lights Market Analysis

The xenon lights market in the Asia-Pacific (APAC) region is experiencing significant growth due to rapid urbanization, technological advancements, and an increasing automotive industry. The automotive sector, particularly in countries like China, Japan, and India, is a major contributor to the demand for xenon lighting, driven by consumer preference for superior vehicle aesthetics and enhanced driving safety. Economic growth has a significant impact, as industry reports suggest that gross national disposable income is projected to rise by 8.9% in FY24 and 14.5% in FY23, potentially enhancing the purchasing power for luxury vehicles fitted with advanced lighting technologies. The rise of electric vehicles (EVs) in the region continues to add to market growth, as EV manufacturers incorporate advanced lighting solutions. Moreover, xenon lighting is gaining traction in the commercial sector, especially for street and urban area illumination, as governments focus on enhancing public infrastructure. The increasing adoption of energy-efficient and environmentally friendly solutions further boosts the demand for xenon lights.

Europe Xenon Lights Market Analysis

The xenon lights market in Europe is largely driven by the automotive industry's shift toward advanced lighting solutions that offer improved visibility, safety, and energy efficiency. Xenon headlights, particularly those in luxury and high-performance vehicles, are increasingly being preferred due to their superior brightness and longer lifespan compared to traditional halogen lights. This preference is reinforced by consumer demand for high-tech automotive features, especially in the context of stringent regulations requiring better safety standards in vehicle lighting. The rise of electric vehicles (EVs) in Europe plays a crucial role in this trend, as new electric car registrations hit almost 3.2 million in 2023, marking an increase of nearly 20% from 2022, as reported by the International Energy Agency (IEA). The European Union represented 2.4 million of these sales, displaying comparable growth rates. As EV manufacturers seek to differentiate their products with advanced features, including high-performance lighting systems, the demand for xenon lights continues to rise. Additionally, the European Union’s focus on energy efficiency and sustainability plays a significant role, as xenon lighting provides an environmentally friendly solution that reduces power consumption while maintaining high luminosity. In the commercial sector, there is increasing use of xenon lights for street, tunnel, and architectural lighting, further driving market growth.

Latin America Xenon Lights Market Analysis

The xenon lights market in Latin America is primarily driven by the automotive sector, where increasing demand for premium and luxury vehicles equipped with advanced lighting technologies is evident. The area's urbanization, currently about 80% as per studies, exceeds that of several other regions, increasing the need for contemporary infrastructure and lighting options. As urban areas expand, there is a growing interest in energy-efficient lighting, boosting the adoption of xenon lights in both the automotive and commercial sectors. Additionally, infrastructure development projects in major cities have led to an increase in the use of xenon lights for street lighting.

Middle East and Africa Xenon Lights Market Analysis

The xenon lights market in the Middle East and Africa is driven by the rising demand for high-performance lighting in the automotive sector, particularly among luxury vehicle owners. As disposable incomes increase, consumers are seeking advanced lighting technologies that offer better illumination and vehicle aesthetics. The increasing urbanization in the region, with the Middle East and North Africa (MENA) already 64% urbanized as reported by the World Bank, has resulted in greater demand for contemporary infrastructure and lighting solutions. This growth has stimulated the use of xenon lights for street and architectural lighting projects, in addition to their automotive applications.

Competitive Landscape:

The competitive landscape of the xenon lights market is characterized by the presence of both established multinational companies and emerging players, all vying for market share in the automotive, commercial, and industrial sectors. Key players, such as Osram, Philips, and General Electric, dominate the market through their strong brand recognition, technological advancements, and extensive distribution networks. These companies continue to innovate, focusing on improving the energy efficiency, durability, and brightness of xenon lights. Additionally, the market sees increasing competition from alternative lighting technologies, such as LED and laser-based lighting, prompting companies to enhance their product offerings to maintain a competitive edge. For instance, in 2024, Stanley Electric and Mitsubishi Electric Mobility formed a joint venture to develop advanced vehicle lamp systems, enhancing safety and supporting self-driving technology for a sustainable, zero-traffic-fatality future.

The report provides a comprehensive analysis of the competitive landscape in the xenon lights market with detailed profiles of all major companies, including:

- Osram

- General Electric

- Philips

- Stanley Electric

- Hella

Latest News and Developments:

- September 2024: OSRAM presented its automotive aftermarket range at Automechanika Frankfurt from September 10 to 14, 2024. The exhibition featured powerful xenon lights, LED extra headlights, workshop tools, and the standout item, the OSRAM NIGHT BREAKER® LED SPEED H7.

- November 2023: XENON Corporation, a pioneer in pulsed xenon light technology, has unveiled the X-1100/2x Pulsed Light Research System, an enhanced iteration of the X-1100 released in 2016. Known for its uses in sterilization, disinfection, curing, and sintering, the system employs pulsed xenon light to provide 7.8 Joules/cm² of radiant energy with each pulse, facilitating innovations like single-flash sintering of multilayer copper printed circuits.

- January 2022: XENON Corporation has introduced the Compact Integrated Xenon Lamp (CIXL), an affordable option utilizing high-energy xenon illumination for Pulsed Light technology uses. Intended for decontaminating food contact surfaces, enhancing food products, and disinfecting surfaces, the CIXL features an 11-inch xenon arc lamp, a diffuse reflector, and sophisticated electronics.

Xenon Lights Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automotive Headlights, Theatre and Movie Projectors, Interior Lighting, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Osram, General Electric, Philips, Stanley Electric, Hella etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the xenon lights market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global xenon lights market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the xenon lights industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The xenon lights market was valued at USD 3,255.17 Million in 2024.

IMARC estimates the xenon lights market to reach USD 4,139.50 Million by 2033, exhibiting a CAGR of 2.57% during 2025-2033.

Key factors driving the xenon lights market include growing demand for high-performance automotive lighting, particularly in luxury vehicles, advancements in lighting technology, and increased focus on energy efficiency and safety. Xenon lights offer superior brightness, longer lifespan, and improved road visibility, contributing to their widespread adoption in modern vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)