Xanthan Gum Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

Xanthan Gum Market Size and Share:

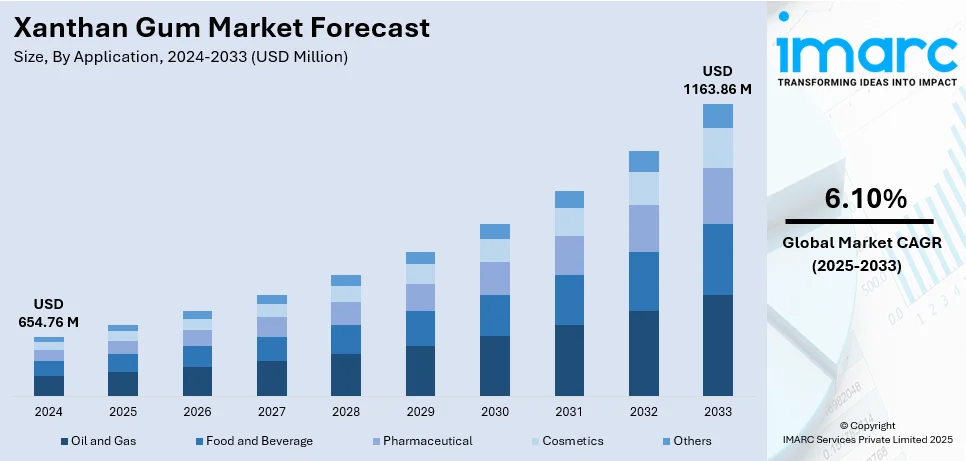

The global xanthan gum market size was valued at USD 654.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1163.86 Million by 2033, exhibiting a CAGR of 6.10% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 43.2% in 2024, mainly due to heightened need in the personal care, food, or oil and gas sectors, which is typically propelled by magnifying urbanization, population growth, and booming disposable incomes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 654.76 Million |

| Market Forecast in 2033 | USD 1163.86 Million |

| Market Growth Rate (2025-2033) | 6.10% |

The xanthan gum industry is expanding globally because it serves multiple industries including food and beverage as well as pharmaceutical applications, combined with its uses in oil and gas sectors and personal care solutions. Industry demand for gluten-free food alongside vegan options and low-fat products is creating an uptick for natural stabilization and emulsion-thickening applications of xanthan gum. Moreover, the processing industry is preferring xanthan gum because it maintains stability and textures at multiple environmental conditions to improve their utilization in food and beverage products. In addition to this, xanthan gum supports drug formulation with its application to improve drilling performance drives industry demand from the oil and gas sector. Rising consumer preference for clean-label and sustainable ingredients further drives xanthan gum market growth.

The United States has emerged as a prominent nation in the global xanthan gum market that is principally impacted by robust need from key sectors, mainly encompassing oil and gas, food, and pharmaceutical. Its intense utilization in low-fat, gluten-free, and vegan food products caters to the transforming dietary trends and customer shift towards clean-label ingredients. For instance, as per industry reports, around 4% of the U.S. population strictly consume plant-derived diet. This can lead to significant demand elevation for xanthan gum. Furthermore, the pharmaceutical sector leverages xanthan gum for drug stabilization and formulation. In addition to this, the oil and gas sector deploys xanthan gum in drilling and hydraulic fracturing processes. Growing awareness of natural additives and sustainable practices further supports the market, with key manufacturers focusing on innovation and compliance with regulatory standards.

Xanthan Gum Market Trends:

Rising Demand for Clean-Label Ingredients

The global xanthan gum market is experiencing increased demand for clean-label ingredients, driven by shifting consumer preferences toward healthier and transparent food products. Xanthan gum, derived through fermentation, aligns with these expectations due to its natural origin and versatility in applications. Food manufacturers are leveraging xanthan gum to replace artificial stabilizers and emulsifiers in processed foods, beverages, and gluten-free products. Regulatory frameworks promoting the use of natural and non-GMO additives have further accelerated this trend. For instance, in December 2024, Health Canada introduced significant updates to food additive regulations through amendments published in the Canada Gazette Part II. These changes aim to streamline and modernize the regulatory framework for food additives under the Food and Drug Regulations (FDR). Such policies can significantly influence market dynamics by restricting the use of certain additives and prompting manufacturers to opt for natural substitutes. In addition to this, rising health consciousness has amplified the demand for organic and additive-free products, positioning xanthan gum as a key ingredient for brands aiming to meet these evolving consumer standards, particularly in developed markets, thereby shaping a positive xanthan gum market outlook.

Expansion in Gluten-Free and Vegan Products

Xanthan gum industry growth attributes mainly to increased consumer demand for gluten-free and vegan diet options. Xanthan gum functions as a vital additive that delivers texture while providing both stability and viscosity to products which lack the typical thickening influence from gluten. Moreover, xanthan gum integration by food manufacturers serves customers who are actively navigating for allergen-free healthier processes for their baked goods, vegan sauces, and dairy alternatives. In line with this, a quick shift in dietary preferences has become most observable within North American and European regions. For instance, according to a research article published in the journal Foods, in October 2024, a significant number of customers are preferring gluten-free products, with market estimated to be USD 3.62 Billion in the year 2024. As a result, the increasing awareness of food sensitivities and the preference for plant-based products have positioned xanthan gum as an essential additive, ensuring consistent quality and enhanced sensory appeal in these specialized food categories and, in turn, boosting the xanthan gum market demand.

Advancements in Sustainable Production

Sustainability has become a critical focus in the xanthan gum market, prompting manufacturers to invest in eco-friendly production practices. For instance, as per industry reports, xanthan gum, a biopolymer produced through the fermentation of Xanthomonas campestris strains, is widely preferred due to the high efficiency of X. campestris, achieving an 80% conversion rate. However, to reduce costs, an alternative method using kitchen waste, such as inedible broccoli and cauliflower parts, as a sustainable carbon source with X. campestris NCIM 2961 has been proposed.Companies are optimizing fermentation processes and exploring alternative feedstocks to reduce environmental impact while ensuring consistent product quality. These efforts align with global sustainability goals and increasing consumer awareness of environmentally responsible production methods. Regulatory frameworks supporting greener manufacturing and waste reduction are further encouraging the adoption of sustainable practices. Moreover, in emerging economies, where demand for xanthan gum is rising, sustainable production offers a competitive advantage. As brands prioritize ethical sourcing and production transparency, manufacturers are expected to adopt innovative methods that align with these global trends and support the expansion of xanthan gum market share.

Xanthan Gum Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global xanthan gum market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Oil and Gas

- Food and Beverage

- Pharmaceutical

- Cosmetics

- Others

The food and beverage segment accounted for largest application segment with 47.5% of the market share in 2024, owing to its versatile functionality as a thickening, stabilizing, and emulsifying agent. It is widely utilized in processed foods, including sauces, dressings, bakery products, and dairy substitutes, where it enhances consistency, texture, and product stability. The increasing demand for gluten-free, vegan, and low-fat alternatives has further driven its adoption, as xanthan gum provides the necessary binding and textural properties in these formulations. Its stability under varying temperature and pH conditions makes it an essential ingredient in ready-to-eat meals and beverages. In addition, the trend toward clean-label and natural food products has bolstered its appeal, as consumers seek healthier, additive-free options, further reinforcing its significance in the food and beverage sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific accounted for 43.2% of the market share in 2024, emerging as the largest market for xanthan gum, driven by its widespread applications in the food and beverage, pharmaceutical, and oil and gas industries. Major economies such as China and India dominate due to their rapidly growing population, increasing urbanization, and expanding food processing sectors. For instance, as per industry reports, by the year 2033, China is anticipated to attain a market valuation of USD 171.9 Million, with India projected to depict a CAGR of 6.6% in the same period. In addition, magnified need for convenience foods, combined with robust establishment of xanthan gum manufacturers, is bolstering market expansion. Furthermore, the oil and gas sector leverages xanthan gum in drilling and fracking activities, especially in Southeast Asia and China. Rising disposable incomes and the adoption of natural thickeners in personal care products further contribute to market growth in this region.

Key Regional Takeaways:

United States Xanthan Gum Market Analysis

In 2024, the United States accounted for 83.20% of the market share in North America. The prominence of this nation is underpinned by its advanced food and beverage industry and robust pharmaceutical sector. The U.S. has a high demand for xanthan gum as a stabilizer, thickener, and emulsifier in processed foods, including gluten-free and low-fat products. Stringent regulations promoting clean-label ingredients have further increased its adoption in the food industry. Moreover, the pharmaceutical sector uses xanthan gum in drug formulations due to its stabilizing and thickening properties. In addition to this, the oil and gas industry utilizes xanthan gum for enhanced oil recovery and drilling fluid formulations, particularly in regions like Texas. For instance, U.S. Energy Information Administration 2024 reports forecasted that U.S. crude oil production will elevate to 13.7 Million barrels per day, with most of this growth contributed by the Permian region of western Texas. This growth will prompt increased drilling activities, which in turn, will significantly bolster the demand for xanthan gum. Furthermore, increased consumer preference for organic and natural products is driving innovation, leading to a rise in demand across various applications.

Europe Xanthan Gum Market Analysis

Europe represents a stable and growing market for xanthan gum, supported by its established food and pharmaceutical industries. Countries like Germany, France, and the U.K. lead the region due to their advanced manufacturing capabilities and stringent quality standards. Moreover, the demand for gluten-free and plant-based products is rising, increasing xanthan gum usage in baked goods, dairy alternatives, and sauces. For instance, according to the European Food Safety Authority, more than 5 Million people across the European Union are suffering with celiac disease, for which gluten-free diet is the only treatment available. This disease prevalence significantly impacts the xanthan gum demand optimistically. Pharmaceutical applications also drive market growth, particularly in excipients for controlled drug release. Moreover, the cosmetics industry in Europe uses xanthan gum as a stabilizer in formulations, aligning with consumer preferences for natural and sustainable products. Regulations promoting clean-label and bio-based solutions contribute to the consistent demand in the region.

North America Xanthan Gum Market Analysis

North America is a mature market for xanthan gum, with significant contributions from the U.S. and Canada. The region's food industry extensively uses xanthan gum in gluten-free, vegan, and low-fat products. Furthermore, pharmaceutical companies in North America rely on xanthan gum for drug formulation, enhancing stability and viscosity. In addition, the oil and gas sector benefits from its use in drilling fluids and enhanced oil recovery applications. Consumer preference for clean-label products continues to shape the market, with xanthan gum being a popular choice for natural thickening agents. Increasing awareness about environmentally sustainable production processes also drives innovation among manufacturers. For instance, in September 2024, Jungbunzlauer announced significant investment of USD 200 Million for the development of first production plant for xanthan gum in Ontario, Canada. This development is backed by Invest Ontario with grant worth USD 4.8 Million.

Latin America Xanthan Gum Market Analysis

Latin America is an emerging market for xanthan gum, with growth fueled by its applications in the food, oil and gas, and pharmaceutical industries. Countries like Brazil and Mexico dominate due to fueling need for processed and convenience foods and significantly expanding food processing sectors. For instance, according to the U.S. Department of Agriculture, food processing sector in Brazil reported revenue of USD 231 Billion in the year 2023, 7.2% growth in comparison to 2022, with an optimistic outlook for stable economic expansion in 2024.The region's oil and gas sector also contributes significantly, using xanthan gum for drilling operations. Consumer preference for natural and sustainable additives is expected to sustain market growth in the coming years.

Middle East and Africa Xanthan Gum Market Analysis

The Middle East and Africa present moderate growth opportunities for xanthan gum, primarily driven by its applications in oil and gas and the food industry. Key markets like Saudi Arabia and South Africa are witnessing increasing adoption due to rising demand for processed foods and advancements in oil exploration activities. For instance, in November 2024, King Salman Energy Park, Saudi Arabia, announced partnership with five major manufacturing firms, including Dalipal Holdings, BioChem, Thermocables, MAN Industries, and Primetech, with an investment of USD 800 million. As per the agreement, BioChem will develop a xanthan gum production facility for oil drilling applications with 100,000 square meters capacity. Furthermore, the region's pharmaceutical and cosmetic industries are also adopting xanthan gum for its stabilizing properties. Growing awareness of natural and sustainable ingredients further supports market expansion.

Competitive Landscape:

The competitive landscape is highlighted by the presence of several key players, including Cargill, CP Kelco, and ADM. These companies focus on innovation, expanding production capacities, and strategic partnerships to strengthen their market positions. For instance, in June 2024, Tate & Lyle announced strategic acquisition of CP Kelco, a US-based producer of xanthan gum, from JM Huber in a deal valued at approximately £1.4 Billion (USD 1.75 Billion). Besides, the industry is highly consolidated, with a few major players dominating global supply, particularly in food, pharmaceutical, and oil and gas applications. Moreover, increasing demand for clean-label and natural ingredients drives manufacturers to invest in research and development for sustainable production processes. Regional players in emerging economies are also gaining traction due to cost advantages and proximity to key raw materials, intensifying competition in the global market.

The report provides a comprehensive analysis of the competitive landscape in the xanthan gum market with detailed profiles of all major companies, including:

- Archer Daniels Midland Company

- Cargill, Incorporated

- CP Kelco U.S., Inc

- Deosen Biochemical (Ordos) Ltd.

- Foodchem International Corporation

- Hebei Xinhe Biochemical Co., Ltd.

- Ingredion Incorporated

- Meihua Holdings Group Co., Ltd

- Qingdao Unionchem Co., Ltd

Latest News and Developments:

- In December 2024, BASF secured regulatory approval in China for Symbiocell, a plant-derived cosmetic ingredient that is developed to ease sensitive skin and contains xanthan gum with other ingredients such as butylene glycol and caprylyl glycol. The approval enables BASF to commercialize Symbiocell in China, catering to the bolstering need for sensitive skincare in the Asia Pacific.

- In April 2024, Seppic launched its new Temptation Collection, featuring new hair care, skin care, makeup, and nutricosmetic formulations. This line includes Bold Jelly Highlighter that is integrated with polymers and xanthan gum.

Xanthan Gum Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Oil and Gas, Food and Beverage, Pharmaceutical, Cosmetics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Archer Daniels Midland Company, Cargill, Incorporated, CP Kelco U.S., Inc, Deosen Biochemical (Ordos) Ltd., Foodchem International Corporation, Hebei Xinhe Biochemical Co., Ltd., Ingredion Incorporated, Meihua Holdings Group Co., Ltd, Qingdao Unionchem Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the xanthan gum market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global xanthan gum market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the xanthan gum industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The xanthan gum market was valued at USD 654.76 Million in 2024.

IMARC estimates the xanthan gum market to reach USD 1,163.86 Million by 2033, exhibiting a CAGR of 6.10% from 2025-2033.

Key factors driving market include magnifying need for gluten-free and vegan food products, its comprehensive utilization in oil and gas, food, and pharmaceuticals segments, bolstering shift towards natural additives, and innovations in sustainable production methodologies aiding clean-label product development.

Asia Pacific currently dominates the xanthan gum market, accounting for a share exceeding 43.2%. This dominance is fueled by its augmenting food processing sector, amplifying oil and gas activities, and increasing requirement for natural additives fueled by heightened disposable incomes as well as urbanization.

Some of the major players in the xanthan gum market include Archer Daniels Midland Company, Cargill, Incorporated, CP Kelco U.S., Inc, Deosen Biochemical (Ordos) Ltd., Foodchem International Corporation, Hebei Xinhe Biochemical Co., Ltd., Ingredion Incorporated, Meihua Holdings Group Co., Ltd, Qingdao Unionchem Co., Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)