Workwear Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, End User, and Region, 2026-2034

Workwear Market Size and Share:

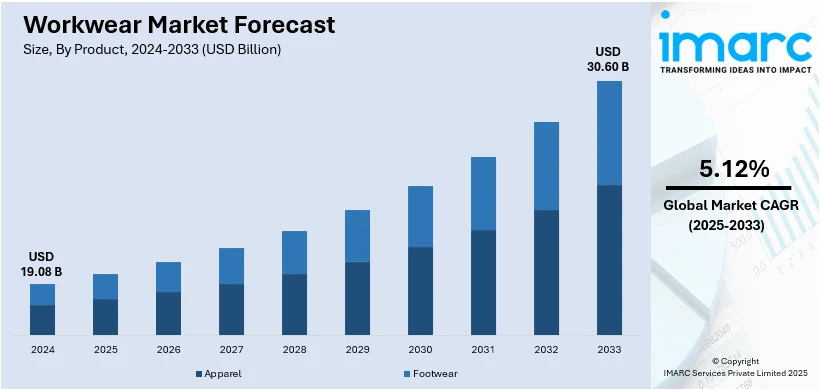

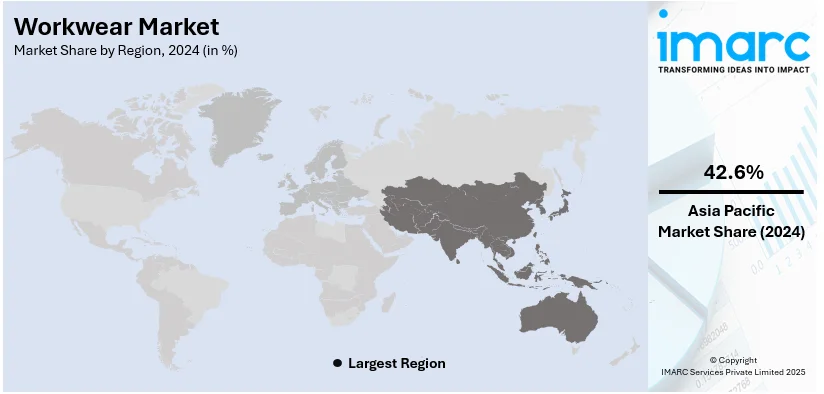

The global workwear market size was valued at USD 19.08 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 30.60 Billion by 2034, exhibiting a CAGR of 5.12% from 2026-2034. Asia Pacific currently dominates the market, holding a workwear market share of over 42.6% in 2024. The increasing recognition among employers of the importance of employee well-being in the workplace, along with the growing preference of workers for comfortable and ergonomically designed workwear, are key factors driving market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 19.08 Billion |

| Market Forecast in 2034 | USD 30.60 Billion |

| Market Growth Rate (2026-2034) | 5.12% |

A significant trend in the workwear market is the growing demand for sustainable and eco-friendly materials. Businesses are increasingly adopting work apparel made from organic cotton, recycled polyester, and biodegradable fabrics to align with environmental regulations and corporate sustainability goals. Innovations in fabric technology, such as water-saving dyeing techniques and bio-based textiles, are also gaining traction. Consumers and enterprises prioritize ethically sourced and durable workwear, driving brands to offer greener alternatives. Government policies promoting sustainable manufacturing and waste reduction further support this shift, influencing both large corporations and small businesses to invest in eco-conscious workwear solutions.

The U.S. workwear market is expanding due to stringent workplace safety regulations across industries like construction, manufacturing, and healthcare with a significant 84.00% workwear market share. The Occupational Safety and Health Administration (OSHA) mandates protective apparel to minimize occupational hazards, boosting demand for flame-resistant, high-visibility, and chemical-resistant clothing. Additionally, the rise in infrastructure projects and industrial activities fuels market growth. Companies are also investing in technologically advanced fabrics that enhance durability and comfort. The shift towards customized and branded workwear for corporate identity further supports demand. E-commerce platforms and direct-to-consumer (D2C) sales channels are playing a key role in reshaping market accessibility and distribution.

Workwear Market Trends:

Occupation safety regulations and awareness

The growing focus on occupational safety laws is positively affecting the market. The regulatory authorities and governments of the world are enforcing strict safety norms and guidelines to ensure the protection of workers from all types of occupational risks. For example, in 2024, more than 400 Indian workers who lost their lives in India owing to workplace safety negligence. This is fueling the demand for duty-specific workwear that is tailored to satisfy these safety needs. Furthermore, heightened awareness among business owners regarding the need to care for the workers in the working environment is also providing a supportive market perspective. Aside from that, employers are increasingly investing more in high-class work clothing with protective capabilities that guard against a particular risk or threat, whether fire, exposure to chemicals, or bodily damage. In addition, a number of manufacturers of workwear are constantly developing new materials and technologies to reinforce the protective attributes of their offerings, thereby aiding the workwear market growth.

Rising urbanization and expansion of prominent sectors

High industrialization and development of the core industries, including construction, manufacturing, healthcare, and automotive are the other significant drivers of the market growth. For instance, industrial production (IIP) growth in India accelerated to a six-month high of 5.2% year-on-year in November 2024. Furthermore, the increasing need to protect the workers from being injured by falls, scratches, and exposure to bad weather conditions is propelling the market growth stronger. Along with this, the increasing prevalence of hospital-acquired infections is driving the demand for specialist uniforms that adhere to hygiene standards in the medical sector. Further, leading market players are designing specialist workwear for harsh weather conditions, such as insulated jackets, water-proof trousers, and cold-resistant gloves, to ensure workers' comfort and protection from the weather.

Increased emphasis on comfort and ergonomics

The increasing tastes of employees and workers for workwear that is comfortable and ergonomically designed are having a positive impact on the market. Workwear companies are more and more using stretch materials, breathable materials, and ergonomic cuts to cater to these comfort issues. Besides this, they are constantly working to create products that balance safety, functionality, and wearer comfort. In addition, the players are using advances in materials and design to produce comfortable and practical clothing. Stretch fabrics offer flexibility, breathable fabrics offer ventilation, and ergonomic cutting provides a better fit. Furthermore, the enhanced utilization of innovative textiles such as moisture-wicking textiles and antimicrobial coatings is improving hygiene.

Growth of E-commerce for Workwear

The growth of e-commerce for workwear is gaining momentum as companies and solo consumers increasingly seek specialized clothing options on digital channels. The reason behind this is due to the convenience of online shopping, greater product range, and the ease of comparing quality, usability, and price. E-commerce websites serve various industries such as construction, healthcare, manufacturing, and hospitality, from safety equipment to professional attire. Advanced filtering mechanisms, size charts, and personalization features facilitate effective procurement, particularly for organizations managing worker attire across multiple facilities. Additionally, the inclusion of artificial intelligence (AI) driven recommendation engines and group order control capabilities makes buying easier. Electronic platforms also facilitate vendors' ability to quickly adapt to shifting industry standards and seasonal trends. As remote and hybrid work arrangements continue, the call for branded, comfortable, and durable workwear continues growing. Furthermore, e-commerce is assuming a central role in reshaping the distribution and accessibility of occupational clothing worldwide.

Workwear Market Challenges:

The workwear industry, although developing consistently, is confronted with a number of subtle issues that must be addressed with sensitivity. Among the primary issues is balancing functionality and comfort, as end consumers increasingly demand clothing that passes safety requirements without sacrificing usability. Furthermore, volatile raw material prices and supply chain interruptions can influence production schedules and stability of prices. For producers and retailers, compliance with varied industry-specific demands ranging from flame retardancy in industrial environments to antimicrobiality in healthcare is complicating product development. Sustainability is another changing expectation, as consumers prefer environmentally friendly materials and ethical sourcing, which can prove challenging to execute within large-scale operations. Growth in e-commerce creates visibility and access but also pressure to provide wide size ranges, simple returns, and secure delivery. In spite of these challenges, the workwear market continues to be strong, and players are busy seeking innovation and partnership to map product offerings against changing consumer needs and regulatory requirements.

Workwear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Workwear market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, application, distribution channel and end user.

Analysis by Product:

- Apparel

- Footwear

Apparel account for the largest market share with a 78.7% share due to its essential role in workplace safety, comfort, and compliance. Industries such as construction, manufacturing, and healthcare require specialized clothing, including high-visibility vests, flame-resistant suits, and chemical-resistant uniforms, driving consistent demand. Regulatory requirements mandate protective apparel, further boosting market expansion. Advancements in fabric technology, such as moisture-wicking, antimicrobial, and lightweight materials, enhance durability and worker comfort. Additionally, the rising trend of branded corporate workwear supports market growth. The expansion of e-commerce and D2C sales channels has improved accessibility, allowing businesses to procure customized, high-performance apparel, reinforcing apparel’s dominance in the workwear market.

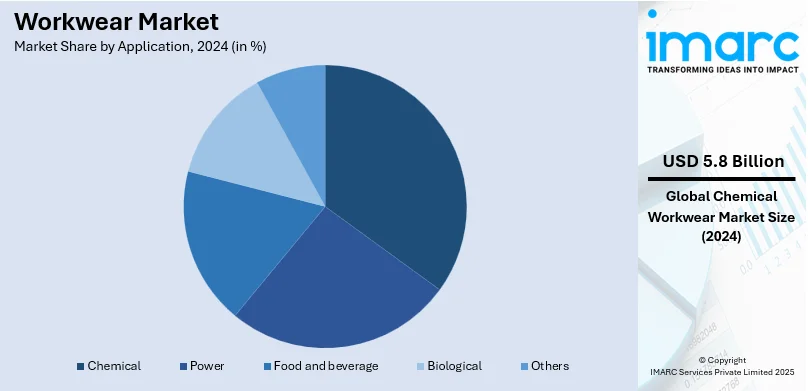

Analysis by Application:

- Chemical

- Power

- Food and beverage

- Biological

- Others

Based on the workwear market outlook, the chemical industry holds a dominant 30.4% share in the workwear market due to stringent safety regulations requiring protective clothing to prevent exposure to hazardous substances. Workers in chemical manufacturing, pharmaceuticals, and petrochemicals face risks from chemical spills, toxic fumes, and corrosive materials, necessitating flame-resistant, chemical-resistant, and anti-static apparel. Regulatory bodies mandate specialized workwear to ensure workplace safety, driving continuous demand. Additionally, advancements in protective fabric technology, including multi-layered and breathable materials, enhance worker comfort while maintaining safety standards. The industry’s large workforce and the need for frequent workwear replacements due to contamination risks further contribute to its significant market share in the workwear segment.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- E-commerce

- Others

Specialty stores dominate the workwear market as they offer a wide range of industry-specific apparel, ensuring compliance with workplace safety regulations. These stores provide high-quality, durable, and specialized protective clothing tailored for sectors such as construction, manufacturing, and healthcare. Customers prefer specialty stores for expert guidance, proper fitting, and customization options, including company branding and specific safety features. Additionally, these stores maintain strong partnerships with businesses for bulk purchases, reinforcing their market presence. The availability of premium and performance-enhancing workwear, along with in-store trials and immediate product access, further drives consumer preference. Despite e-commerce growth, specialty stores remain crucial for workwear procurement due to their reliability and personalized services.

Analysis by End User:

- Men

- Women

Men account for a high 88.95% market share in workwear fueled by increased employment rate in physically demanding occupations like construction, manufacturing, oil & gas, and mining. These industries demand tough, protective work clothes, spurring demand for flame-resistant, high-visibility, and weather-resistant clothing. Furthermore, workplace safety legislations require protective equipment, also increasing the market growth. High incidence of male employees in industrial and trade jobs favors consistent demand. In addition, the presence of varied product alternatives, such as personalized and performance-enhancing uniforms, supports market growth. Increasing e-commerce penetration and corporate uniform schemes also enhance men's superiority in the uniform market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the workwear market forecast, Asia Pacific enjoys a leadership position with 42.6% market share in the global workwear market with the high growth of industrialization, developing manufacturing industries, and increasing construction activity. China, India, and Japan possess strong industrial bases and hence generate tremendous demand for protective and resilient workwear. Regulation by governments in terms of safety for workers, especially in risk-prone sectors like mining, oil & gas, and chemicals, is compelling adoption. Moreover, the area also enjoys low-cost labor and mass production of textiles to allow competitive pricing. Growing multinational presence and awareness of workplace safety enhance market growth. Boost in e-commerce and call for branded work apparel also fuels the top market position of the region.

Key Regional Takeaways:

North America Workwear Market Analysis

The North America workwear market is growing with the help of strict workplace safety standards, rising industrialization, and the growing need for tough protective clothing. Construction, manufacturing, healthcare, and oil & gas industries are major drivers of market growth based on Occupational Safety and Health Administration (OSHA) regulations that require protective wear. Improvements in fabric materials such as flame-resistant, moisture-wicking, and antimicrobial fabrics are improving worker protection and comfort. Sustainability patterns are impacting manufacturers to incorporate environmental-friendly materials and ethically produced processes. The increasing uptake of personalized and branded workwear for corporate identity is also driving workwear market demand. Increased e-commerce and D2C channels are changing market dynamics, offering companies better access to premium workwear. Firms are investing more in ergonomic designs and intelligent textiles embedded with monitoring capabilities to enhance workplace safety and efficiency. Generally, the North American workwear market is transforming towards innovation, compliance with regulations, and sustainability.

United States Workwear Market Analysis

Rapid industrialization in the United States is a major driving factor for workwear demand. For example, the United States industrial production jumped by 0.9% in December 2024, representing the highest growth since February and well above market estimates of a rise of 0.3%. The expansion of manufacturing, construction, and energy sectors necessitates protective clothing and gear to ensure worker safety. Stringent workplace safety regulations, coupled with a growing emphasis on employee well-being, further propel the workwear market growth. Industries like automotive, aerospace, and technology also contribute significantly to the demand for specialized workwear, including flame-resistant clothing, high-visibility apparel, and cleanroom suits. The increasing focus on workplace safety and the continuous growth of industrial activities are expected to sustain the growth of the workwear market in the US. Additionally, the rise of e-commerce and logistics sectors fuels the need for durable and comfortable workwear for warehouse and delivery personnel.

Asia Pacific Workwear Market Analysis

The growing workwear adoption due to growing supermarkets and hypermarkets distribution channels in Asia-pacific is reshaping the market dynamics, making workwear more accessible to a broader consumer base. According to reports, there are 66,225 supermarkets in India as of January 23, 2025, which is an 3.88% increase from 2023. These retail chains offer a convenient one-stop shopping experience for businesses and individual consumers, providing a wide variety of workwear at competitive prices. The rising disposable income and increasing awareness of workplace safety have encouraged industries such as manufacturing, construction, and retail to invest in high-quality workwear. Furthermore, international brands are capitalizing on the rapid urbanization and industrial growth in Asia-pacific by expanding their presence in supermarkets and hypermarkets, ensuring a steady supply of professional and protective clothing.

Europe Workwear Market Analysis

The robust food and beverage sector in Europe is a significant driver for workwear adoption. Strict hygiene regulations and food safety standards necessitate the use of specialized workwear, including chef coats, aprons, and headwear, in food processing and preparation environments. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. The growing emphasis on food safety and traceability across the European Union further strengthens this demand. Furthermore, the expansion of the hospitality industry, including restaurants and hotels, contributes to the workwear market, as these establishments require staff uniforms for branding and presentation purposes. The increasing consumer awareness regarding food safety and hygiene, coupled with the growth of the food and beverage sector, is propelling the workwear market in Europe. The need for comfortable and functional workwear in these sectors also plays a role.

Latin America Workwear Market Analysis

The workwear industry in Latin America is experiencing significant growth, driven by growing workwear adoption by E-commerce distribution. Based on reports, the Latin America market has over 300 Million digital consumers. The increase in online shopping platforms has revolutionized how companies procure and supply workwear, making it easily accessible to both small businesses and large companies. The growth of E-commerce giants and local online marketplaces has made it possible for companies in manufacturing, retail, and healthcare industries to easily buy standardized workwear in bulk. Brazil, Mexico, and Argentina are seeing a move toward e-procurement, as companies prefer to utilize adjustable and inexpensive workwear solutions.

Middle East and Africa Workwear Market Analysis

The growing chemical industry, more so oil and gas, in the Middle East and Africa is a key driver of workwear demand. The Middle East is set to start 621 projects between 2023 and 2027, of which upstream projects would be 81, midstream would be 141, the refinery at 84, and petrochemicals would be the highest at 315 projects. These sectors have dangerous working environments, and hence specialized protective attire, such as flame-resistant garments, chemical-resistant coveralls, and respiratory masks. The stringent safety laws and the dangerous nature of these industries make high-quality workwear essential to guarantee workers' safety. The expansion of allied industries like construction and manufacturing also drives demand for workwear in the country.

Competitive Landscape:

The workwear industry is extremely competitive, with many players emphasizing innovation, quality, and adherence to industry standards. Firms distinguish themselves through innovative fabric technologies, providing flame-resistant, moisture-wicking, and antimicrobial properties to address changing workplace safety and comfort requirements. Sustainability is an important competitive aspect, with most brands incorporating recycled materials and environmentally friendly manufacturing processes. Pricing approaches differ, with high-end products focusing on durability and performance and low-cost ones appealing to cost-sensitive consumers. Distribution channels such as D2C sales, e-commerce, and bulk corporate orders are key to market positioning. Customization services such as company branding and customized fits add to competitiveness among workwear suppliers.

The report provides a comprehensive analysis of the competitive landscape in the workwear market with detailed profiles of all major companies, including:

- 3M Company

- A. Lafont SAS (CEPOVETT Group)

- Alexandra Workwear

- Alisco Group

- Ansell Ltd.

- Aramark

- Carhartt Inc.

- Engelbert Strauss GmbH & Co. KG

- Honeywell International Inc.

- Hultafors Group AB

- Kimberly-Clark Corporation

- Workwear Group Pty. Ltd

Latest News and Developments:

- December 2024: RONA Inc. has partnered with Tilley Endurables to launch its first workwear line, Tilley Tuff Workwear, available at select RONA and RONA+ stores. Designed by Joe Mimran, the collection blends durability, functionality, and style for professionals and DIYers. RONA’s Chief Merchandising Officer, Doug Young, highlighted the collaboration’s unique value and future aspirations.

- November 2024: Red Wing Shoes, a global leader in safety footwear manufacturing, has launched three new work boot lines—Draftsmith, Polar X, and VersaPro—designed for diverse trade environments. These innovations reinforce Red Wing's commitment to quality and protection across industries, from renewable energy to extreme cold-weather job sites. The launches follow a strong year for Red Wing, which introduced SuperSole X this summer and TruGuard Lite in the spring.

- October 2024: Ororo® launched its first-ever Workwear Collection, featuring eight durable and versatile heated apparel pieces. The collection includes advanced heating technology, with the world's first jacket offering dual control and a dual-source heating system. Designed for tough environments, it ensures warmth, safety, and visibility across various industries.

- February 2024: BRUNT Workwear expands into physical retail, partnering with 23 wholesalers to bring its bestselling boots, including The Marin and Bolduc, to over 110 U.S. locations. This marks a shift from its DTC model after three years of rapid growth. The move enhances accessibility for 23 million trades workers in construction, installation, maintenance, and repair industries.

- January 2024: PULSAR® has launched the Life collection, a new line of environmentally responsible hi-visibility workwear made with GRS-certified fabrics. The collection includes 12 durable and inclusive garments, such as reversible puffer jackets, stretch combat trousers, and insulated parkas. Designed for professionals across industries, all pieces meet EN ISO 20471 standards and come in yellow and orange.

Workwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Apparel, Footwear |

| Applications Covered | Chemical, Power, Food and Beverage, Biological, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Others |

| End Users Covered | Men, Women |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, A. Lafont SAS (CEPOVETT Group), Alexandra Workwear, Alisco Group, Ansell Ltd., Aramark, Carhartt Inc., Engelbert Strauss GmbH & Co. KG, Honeywell International Inc., Hultafors Group AB, Kimberly-Clark Corporation, Workwear Group Pty. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the workwear market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global workwear market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the workwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The workwear market was valued at USD 19.08 Billion in 2024.

The Workwear market was valued at USD 30.60 Billion in 2033, exhibiting a CAGR of 5.12% during 2025-2033.

The workwear market is driven by stringent workplace safety regulations, rising industrialization, and demand for durable, high-performance apparel. Growth in construction, manufacturing, and healthcare sectors boosts adoption. Sustainability trends, technological advancements in fabrics, and increasing corporate branding needs further fuel market expansion, alongside the rise of e-commerce and D2C sales.

Asia Pacific dominates the workwear market due to rapid industrialization, a strong manufacturing base, and expanding construction activities. Stringent workplace safety regulations, cost-effective textile production, and a growing workforce drive demand. The rise of multinational companies, increased e-commerce penetration, and the need for protective apparel further strengthen the region’s market leadership.

Some of the major players in the workwear market include 3M Company, A. Lafont SAS (CEPOVETT Group), Alexandra Workwear, Alisco Group, Ansell Ltd., Aramark, Carhartt Inc., Engelbert Strauss GmbH & Co. KG, Honeywell International Inc., Hultafors Group AB, Kimberly-Clark Corporation, Workwear Group Pty. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)