Wood Furniture Market Report by Wood Type, Distribution Channel, End User, and Region 2025-2033

Wood Furniture Market Size and Share:

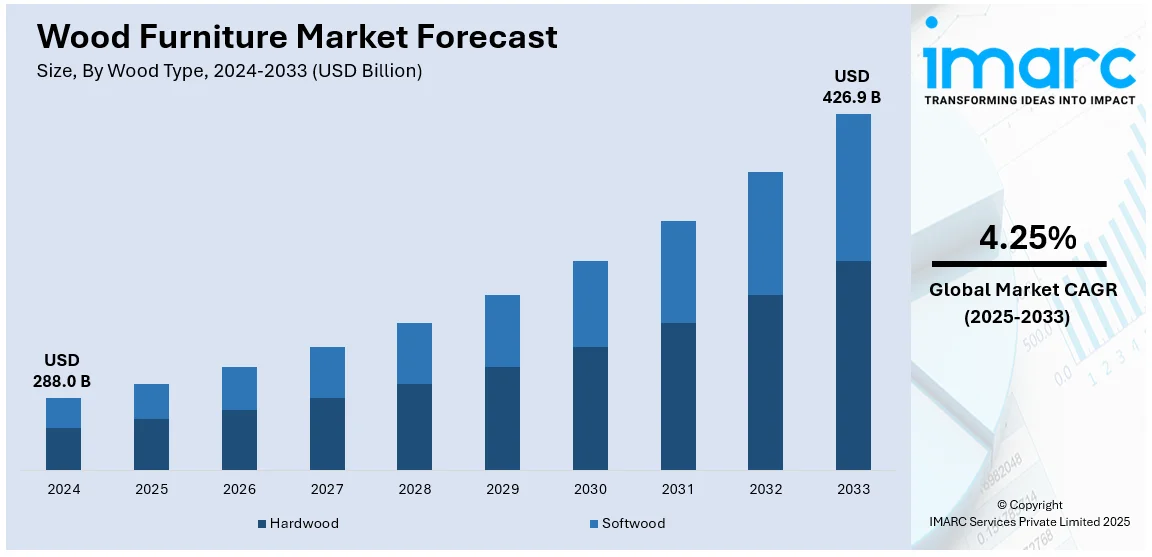

The global wood furniture market size was valued at USD 288.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 426.9 Billion by 2033, exhibiting a CAGR of 4.25% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 40% in 2024. The wood furniture market share is primarily driven by the escalating demand for wood furniture materials in residential applications, the growing need for compact and multi-functional furniture to maximize space utilization in smaller apartments and increasing awareness regarding environmental issues.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 288.0 Billion |

|

Market Forecast in 2033

|

USD 426.9 Billion |

| Market Growth Rate (2025-2033) | 4.25% |

The global wood furniture market growth is driven by several key factors, including rising consumer demand for sustainable and eco-friendly products. As environmental consciousness grows, wood furniture is being increasingly preferred for its renewable nature. Urbanization and evolving interior design trends also contribute to growth, with consumers seeking innovative, stylish, and functional wooden furnishings. According to industry reports, 57.5% of the total global population lived in urban areas in 2024. Additionally, the expansion of the real estate sector, both residential and commercial, is significantly boosting demand for quality furniture. Technological advancements in wood processing and production techniques further support the market by improving efficiency and reducing costs.

The United States has emerged as a key regional market for wood furniture, primarily driven by a growing demand for high-quality, sustainable, and eco-friendly furniture. With increasing awareness about environmental issues, consumers are opting for wood furniture made from responsibly sourced materials, aligning with green building practices. Additionally, the popularity of custom-made furniture and e-commerce platforms is expanding access to a wide variety of designs. As per a report published by the IMARC Group, the United States e-commerce market size is projected to exhibit a CAGR of 6.80% during 2024-2032. Besides this, the rise of homeownership and renovation trends in suburban and urban areas has led to a greater need for stylish, durable, and functional wood furnishings.

Wood Furniture Market Trends:

Sustainability and eco-consciousness

As per the wood furniture market trends, one key driver of the industry is its sustainability. Now, consumers make purchasing decisions concerning the environmental factors associated with what they buy and prefer furniture obtained from responsible raw material sources. With the growing consciousness regarding deforestation and carbon footprint, many are on the lookout for products labeled with certifications of organizations such as the Forest Stewardship Council, ensuring that wood comes from the right sources. As per industry reports, carbon dioxide emissions were projected to rise by 0.8% in 2024, equating to approximately 37.4 Billion Tons. As consumer sentiment in favor of environmental responsibility continues to grow, the demand for wood furniture is increasing.

Customization and personalization

The popularity of customized and personalized interior space furnishings has led to the massive growth of the wood furniture market demand. Consumers are no longer satisfied with homogeneous, mass-manufactured furnishings and want every piece of furnishing to convey their personal identities and requirements. Deloitte reports that 42% of consumers prefer buying furniture from companies that offer customization options for their products. With e-commerce platforms that allow individuals to customize everything from color to size or even the type of wood used, they are empowered to design furniture specifically tailored to their homes. The growing popularity of interior design and home renovation has also increased awareness about the possibility of unique, custom-designed wooden pieces. This shift toward bespoke and customized furniture is driving the market forward.

Technological advancements and manufacturing innovations

Increasing technological advancements in production processes are creating a positive wood furniture market outlook. Changes in manufacturing, particularly computer-aided design (CAD) and robotic machinery, have enabled better accurate output in delicate wooden designs and patterns. Such innovations have made manufacturing high-quality pieces faster while decreasing the amount of material wasted. In addition, furniture is now being integrated with smart technology, where it can contain built-in charging ports, wireless speakers, or lighting. Such advancements in technology are very good news for the wood furniture market as it now becomes possible to sell beautiful and useful products, dealing with the diverse needs of consumers today.

Wood Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wood furniture market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on wood type, distribution channel, and end user.

Analysis by Wood Type:

- Hardwood

- Softwood

Hardwood stands as the largest component in 2024, holding around 60.0% of the market. Hardwood accounts for the largest part of the wood furniture market due to its strength, durability, and aesthetic appeal. Some of the popular species of trees in terms of resistance to wear and tear are oak, maple, and walnut, which fit very well for long-lasting furniture. In addition, rich, natural grains and textures from hardwood give a premium appearance to furniture and fit in well with consumer preference for quality and timelessness. Hardwood is also versatile; thus, it can be used for various furniture types ranging from modern to traditional. It has a dense composition that can be carved into detailed designs, which adds to its attractiveness in residential and commercial places.

Analysis by Distribution Channel:

- Retail

- Mass Market Player

- Furniture Stores

- Monobrand Furniture Stores

- Online

Retail represents the leading market segment in 2024. Retail leads the wood furniture market since it provides consumers with direct access to a wide variety of styles, designs, and price points. Brick-and-mortar stores give consumers a tactile feel of inspecting furniture in person, which guides quality, finish, and comfort before finalizing a purchase. With the easy convenience of online retail, the reach has become wider, and many e-commerce sites even offer doorstep delivery, with easy return policies and customized furniture options that fit the specific needs of buyers. Retail channels, physical and online, also provide promotions and financing options, making it easier for consumers to invest in quality wood furniture. This convenience and availability have cemented retail's hold on the market.

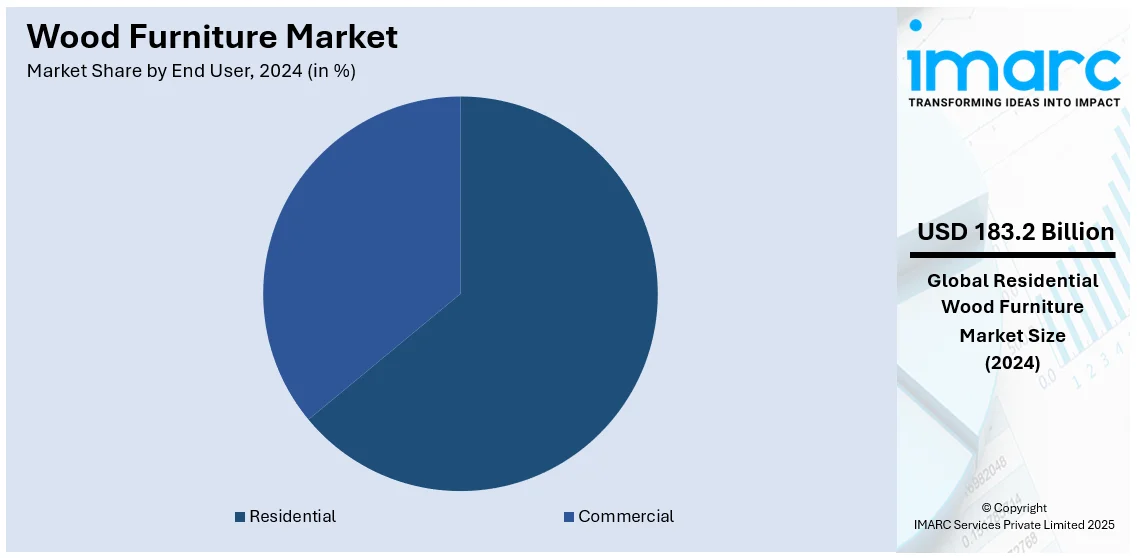

Analysis by End User:

- Residential

- Commercial

Residential leads the market with around 63.6% of market share in 2024. Residential demand constitutes the largest segment of the market for wood furniture since homes remain the main premises where individuals find functional and good-looking furniture. As the level of living standards improves, home furniture buyers consider quality and aesthetic appeal in order to satisfy their preferences. Hence, they seek durable furniture that is classically beautiful. Wooden furniture is also provided in many forms ranging from modern to traditional designs that align with various styles in residential areas. Another reason behind the steady growth in demand for wood furniture is home renovation and improvement trends among younger generations for living rooms, bedrooms, and kitchens, which further fuels the residential market domination.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40%. Asia Pacific dominates the wood furniture market due to several factors, including its vast production capacity and lower manufacturing costs. Countries such as China, India, and Vietnam are major furniture manufacturers, benefiting from abundant raw materials and established supply chains. The region also has a strong export market, supplying wood furniture to North America, Europe, and other global markets. Rapid urbanization, rapidly increasing disposable incomes, and the growing middle class in countries such as China and India have boosted domestic demand for quality furniture. According to the wood furniture market forecast, as Asia Pacific is a region of low-cost, mass-produced furniture creates an attraction for budget-conscious consumers globally.

Key Regional Takeaways:

United States Wood Furniture Market Analysis

In 2024, the United States accounts for over 75.90% of the wood furniture market in North America. The United States wood furniture market is driven by strong consumer preferences for high-quality, sustainable, and aesthetically appealing furniture. Higher consumer spending and a growing emphasis on home improvement projects are driving the demand for wood furniture, particularly in the residential sector. According to the U.S. Bureau of Labor Statistics, from 2022 to 2023, average consumer spending increased 5.9%, compared with 9.0% from 2021 to 2022. With an aging housing stock across the country, homeowners are investing in renovations, driving the need for durable and customizable furniture options. In addition, e-commerce is revolutionizing the wood furniture market by offering consumers access to a wide range of styles and designs. Online platforms are making purchasing furniture more convenient, increasing overall market penetration. Apart from this, increasing preferences for American-made products and eco-friendly options are catalyzing the demand for solid wood furniture crafted from sustainable timber. Furthermore, the rise in hybrid working models post-pandemic is leading to increased demand for ergonomic and functional home office furniture, boosting market growth. Overall, a combination of economic recovery, changing consumer behavior, and a focus on sustainability and innovation underpins the growth of the U.S. wood furniture market.

Asia Pacific Wood Furniture Market Analysis

The Asia Pacific wood furniture market is propelled by rapid urbanization, rising disposable incomes, and expanding housing and construction activities across the region. As per the Press Information Bureau, more than 40% of the total population of India is projected to live in urban areas by 2030. Moreover, countries such as China, India, and Vietnam are witnessing significant growth in middle-class populations, resulting in increased spending on home furnishings and decor. The burgeoning real estate sector in the region is also driving the demand for both residential and commercial furniture, including high-quality wood furniture. Furthermore, one of the major drivers in the region is the availability of cost-effective manufacturing and abundant raw materials. Countries such as Vietnam, Indonesia, and Malaysia have established themselves as major exporters of wood furniture, leveraging their skilled labor force and rich forest resources. These countries also benefit from trade agreements that promote exports to North America, Europe, and other regions. In addition, consumer preferences in the Asia Pacific region are shifting toward sustainable and customizable furniture solutions. With growing environmental awareness, there is a rising demand for furniture made from certified sustainable wood, including bamboo and teak. Besides this, technological advancements, such as 3D visualization tools and augmented reality (AR), are enhancing the shopping experience and boosting market growth.

Europe Wood Furniture Market Analysis

The European wood furniture market is supported by a combination of traditional craftsmanship, modern innovation, and environmental consciousness. Europe has a long-standing reputation for producing high-quality, artisanal wood furniture, with countries such as Italy, Germany, and Sweden being key contributors. The growing demand for premium furniture with intricate designs and superior durability is thereby creating a favorable market outlook. Sustainability is also a significant driver in Europe, with consumers increasingly opting for furniture made from responsibly sourced and certified wood. Initiatives such as the European Union Timber Regulation (EUTR) ensure that imported and domestically produced wood products comply with strict sustainability standards. This regulatory framework, combined with rising consumer awareness, is leading to a rise in demand for eco-friendly and recyclable furniture. Besides this, the trend toward compact and multi-functional furniture is gaining popularity as urbanization continues across Europe. For instance, as per the CIA, the urban population in Germany was 77.8% of total population in 2023. With an increasing number of individuals living in apartments and smaller spaces, consumers are seeking furniture that optimizes functionality without compromising on style. Modular and space-saving designs are particularly popular in countries such as the UK, France, and the Netherlands. Digitalization in the furniture retail industry is further contributing to the market growth.

Latin America Wood Furniture Market Analysis

The Latin America wood furniture market is largely fueled by the region's abundant natural resources and the growing demand for locally crafted furniture. Brazil, Mexico, and Chile are major markets with their rich timber reserves and skilled workforces, allowing the production of high-quality furniture for both domestic and export markets. Timber data was reported at 55,728,807.000 Cub m in 2023 in Brazil, according to the CEIC. The region's traditional craftsmanship and the use of exotic woods, such as mahogany and rosewood, also attract premium markets worldwide. Urbanization and inflating income levels are also encouraging consumers to invest in better-quality furniture, especially in metropolitan areas. In addition, the growing focus on sustainable forestry practices in countries such as Brazil has placed the region in a position to supply eco-friendly wood furniture. Trade agreements also drive furniture exports to North America and Europe.

Middle East and Africa Wood Furniture Market Analysis

Increasing infrastructure development and growing preference for luxury interiors drive the Middle East and Africa wood furniture market. Construction sectors in the Gulf Cooperation Council (GCC) countries are flourishing and are driving strong demand for high-quality furniture in residential, commercial, and hospitality projects. According to reports, the construction sector within the MENA region has managed to be so robust, awarding as much as USD 101 Billion in projects in the first half of the year. Higher incomes within urban centers such as Dubai, Riyadh, and Johannesburg are also boosting consumer spending on high-end wooden furniture, offering both durability and beauty. The use of exotic woods and intricate craftsmanship is becoming a hallmark of luxury furniture in the region.

Competitive Landscape:

Key players in the wood furniture market are adopting various strategies to propel growth and further expand the market. Many are now moving toward sourcing sustainably and being environmentally friendly by using certified wood and encouraging environment-friendly production processes. This appeals to consumers who increasingly demand green products. Also, companies are increasing product offerings that have new designs, in addition to customized pieces according to shifting consumer preferences. The rise of e-commerce platforms has also been a significant trend, with brands offering online shopping, virtual consultations, and easy delivery services. Moreover, partnerships with interior designers and home décor influencers are helping to increase brand visibility and drive consumer interest in premium wood furniture.

The report provides a comprehensive analysis of the competitive landscape in the wood furniture market with detailed profiles of all major companies, including:

- Ashley Furniture Industries Inc.

- Haworth Inc.

- Herman Miller Inc.

- HNI Corporation

- Inter IKEA Systems B.V.

- Kinnarps AB

- Klaussner Home Furnishing

- KOKUYO Co. Ltd.

- La-Z-Boy Incorporated

- Okamura Corporation

- Steelcase Inc.

- Williams-Sonoma Inc.

Latest News and Developments:

- February 2024: Merino Industries Ltd., a leader in surface solutions, introduced FABWood, an innovative product set to revolutionize the furniture and woodworking industry. FABWood seamlessly blends sustainability and innovation, standing out as a novel product.

- June 2024: Hettich launched Onsys Magma Black hinge for dark wood furniture. The product is highlighted for its subtle taste and unique black finish, created to compliment dark colored furniture.

- October 2024: Nilkamal launched Nilkamal Homes, a fresh retail brand dedicated to premium home furniture and decor. Nilkamal Homes is introducing 60 stores in 35 cities, featuring a combination of company-operated and franchise outlets, providing a wide array of high-quality products aimed at improving the beauty of Indian residences.

- June 2024: British designer John Pawson developed a custom wooden furniture collection for Danish maker and longtime partner Dinesen. Called the Pawson Furniture Collection, the items are each inspired by the length of a wooden plank. It signifies 30 years of partnership between Pawson and Dinesen and is based on their initial furniture collection developed in 1992.

- December 2024: WoodenStreet obtained Rs 354 crore ($43 Million) in Series C funding from Premji Invest to grow its retail footprint, boost manufacturing capabilities, and broaden its merchandise range. The Indian furniture company plans to launch new outlets in tier-1 and tier-2 cities, strengthening its presence in the expanding home and furniture industry.

Wood Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Wood Types Covered | Hardwood, Softwood |

| Distribution Channels Covered |

|

| End Users Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ashley Furniture Industries Inc., Haworth Inc., Herman Miller Inc., HNI Corporation, Inter IKEA Systems B.V., Kinnarps AB, Klaussner Home Furnishing, KOKUYO Co. Ltd., La-Z-Boy Incorporated, Okamura Corporation, Steelcase Inc., Williams-Sonoma Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wood furniture market from 2019-2033.

- The wood furniture market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wood furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wood furniture market was valued at USD 288.0 Billion in 2024.

IMARC estimates the wood furniture market to exhibit a CAGR of 4.25% during 2025-2033.

The increasing demand for sustainable and eco-friendly products, growing popularity of customized and personalized furniture, rising disposable income and consumer spending on home décor, advancements in manufacturing technologies and production efficiency, and expansion of the real estate and housing sectors are the primary factors driving the wood furniture market.

Asia Pacific currently dominates the market due to its large-scale production capabilities and cost-effective manufacturing.

Some of the major players in the wood furniture market include Ashley Furniture Industries Inc., Haworth Inc., Herman Miller Inc., HNI Corporation, Inter IKEA Systems B.V., Kinnarps AB, Klaussner Home Furnishing, KOKUYO Co. Ltd., La-Z-Boy Incorporated, Okamura Corporation, Steelcase Inc., Williams-Sonoma Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)