Wood Chips Market Size, Share, Trends and Forecast by Product, Variety Type, Application, and Region, 2025-2033

Wood Chips Market Size and Share:

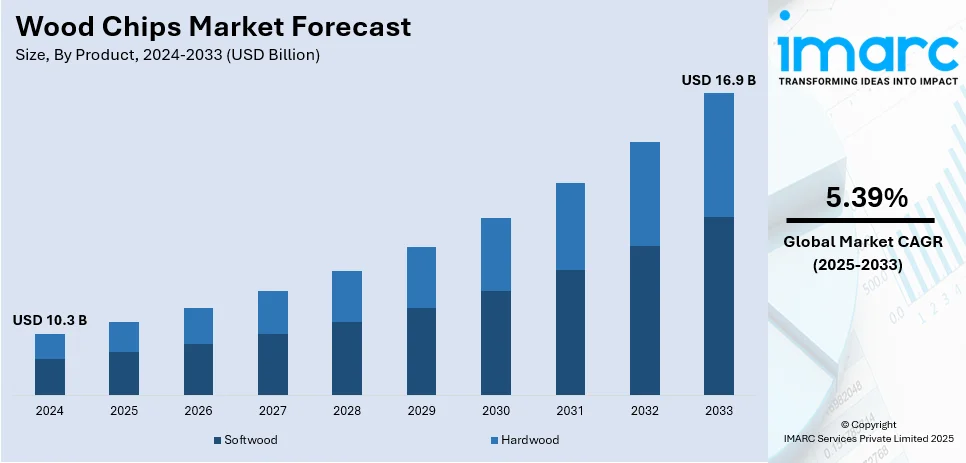

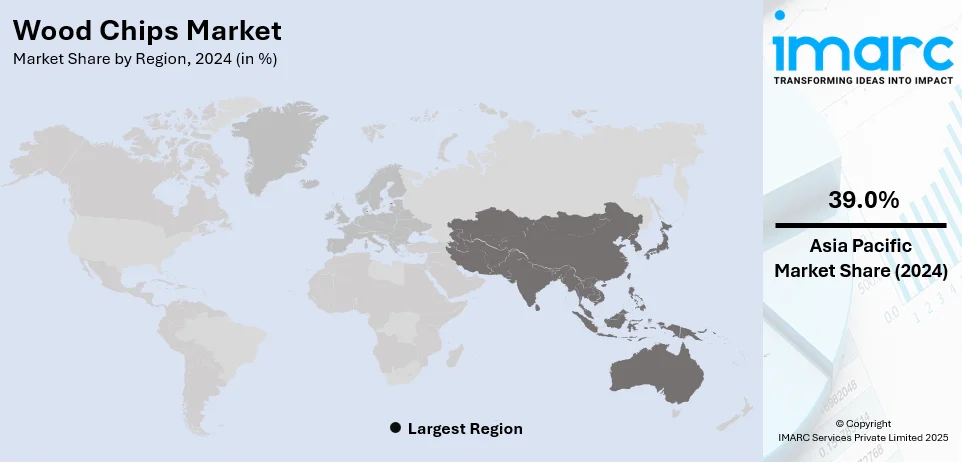

The global wood chips market size was valued at USD 10.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.9 Billion by 2033, exhibiting a CAGR of 5.39% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 39.0% in 2024. The increasing use of renewable sources of energy, rising application in the agriculture sector, and the growing construction activities represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.3 Billion |

| Market Forecast in 2033 | USD 16.9 Billion |

| Market Growth Rate (2025-2033) | 5.39% |

The wood chips market growth is due to rising demand for biomass energy, adding use in pulp and paper product, and expanding operations in landscaping and animal bedding. As countries concentrate on renewable energy sources, wood chips are gaining popularity as a cost-effective and sustainable option to fossil fuels. Biomass power plants, especially in Europe and North America, are driving significant demand. Also, the pulp and paper industry relies heavily on wood chips as a primary raw material for paper manufacturing. The growing packaging industry and demand for recycled paper further boost market growth. In agriculture and landscaping, wood chips are extensively used for mulching, humidity retention, and soil health enhancement. Government incentives promoting sustainable forestry and waste utilization also contribute to wood chips market demand expansion. With adding environmental mindfulness and advancements in processing technologies, the global wood chips market is anticipated to continue its upward line in the coming times.

The United States has emerged as a key regional market for wood chips driven by adding demand for renewable energy, rising use in the pulp and paper industry, and growing operations in landscaping and agriculture. As the country shifts towards sustainable energy results, wood chips are gaining traction as a crucial biomass energy for power generation. Government incentives promoting biomass energy, along with environmental interests over fossil energies, are accelerating market growth. also, the strong pulp and paper industry in the U.S. relies heavily on wood chips for production, farther boosting demand. The expansion ofeco-friendly packaging solutions also contributes to market growth. also, wood chips are extensively used in landscaping and agriculture for mulching, soil improvement, and humidity retention, supporting their steady demand. With ongoing technological advancements in biomass processing and increased focus on sustainability, the U.S. wood chips market is anticipated to expand further in the coming times.

Wood Chips Market Trends:

Rising product usage in various industries

There is an increase in the use of wood chips in the power generation. This, coupled with the rising awareness among individuals about the benefits of using renewable sources of energy, such as solar and wind power, to provide a more stable and reliable energy supply represents one of the major factors strengthening the growth of the market around the world. For example, as per Ember Energy, since 2000, renewables have increased from 19% to over 30% of the world's electricity, with solar and wind power rising from 0.2% to a record 13.4% in 2023. Moreover, wood chips are employed in the paper industry to manufacture napkins, handkerchiefs, toilet rolls, baby wipes, diapers, and other personal hygiene products. In addition, the growing utilization of wood chips in the agriculture sector to control weeds and retain moisture in the soil and nutrients as they break down is influencing the market positively. Besides this, the increasing usage of wood chips in landscaping to stabilize slopes, prevent soil erosion, and reduce the impact of heavy rainfall is creating a positive outlook for the market.

Increasing demand for biomass energy

The increasing shift toward renewable energy sources is a major driver of the wood chips market. In 2023, the United States installed a record 31 gigawatts (GW) of solar energy capacity, which was significantly more than the previous record set in 2021 and almost 55% more than installations in 2022. Wood chips are widely used as a biofuel for power generation, heating, and industrial processes, offering an eco-friendly alternative to fossil fuels. Governments and organizations worldwide are investing in biomass energy to reduce carbon emissions and enhance energy security. Countries in Europe, North America, and Asia-Pacific are expanding biomass power plants, increasing demand for wood chips as a sustainable fuel source. Additionally, incentives such as subsidies and tax benefits for renewable energy projects are further fueling market growth, making wood chips a key component of the global transition toward cleaner energy.

Expansion of wood-based panel industry

Wood chips are essential for manufacturing wood-based panels such as particleboard, oriented strand board (OSB), and medium-density fiberboard (MDF). The booming construction and furniture industries are driving demand for these materials, especially in emerging economies. As per IMARC Group, in 2024, the size of the global building construction market was USD 6.8 Trillion. According to IMARC Group's forecast, the market would increase at a compound annual growth rate (CAGR) of 4.9% from 2025 to 2033, reaching USD 10.5 Trillion. OSB and MDF are increasingly being used in residential and commercial buildings due to their cost-effectiveness, durability, and sustainability. Additionally, consumer preferences for eco-friendly and engineered wood furniture are boosting demand for wood-based panels. Manufacturers are also adopting advanced processing technologies to improve production efficiency and reduce waste, further enhancing the market for wood chips. As urbanization and infrastructure projects continue to grow globally, the demand for wood chips in panel production is expected to rise steadily.

Wood Chips Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wood chips market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, variety type, and application.

Analysis by Product:

- Softwood

- Hardwood

Softwood represented the largest section holding 47.6% share in the wood chips market due to its wide availability, fast growth rate, and different artificial operations. Softwood species similar as pine, spruce, and fir grow abundantly in North America, Europe, and Asia, making them a cost-effective and sustainable raw material. Their lower density and advanced cellulose content make them ideal for pulp and paper product, a crucial driver of the wood chips demand. also, softwood chips are considerably used in biomass energy production due to their effective combustion parcels and high energy affair. The wood- based panel industry also prefers softwood chips for manufacturing particleboard, MDF, and OSB, which are in high demand for construction and furniture operations. likewise, softwood’s capability to grow snappily compared to hardwood ensures a steady force, bolstering its dominance in the market.

Analysis by Variety Type:

- Forest Chips

- Recycled Chips

- Wood Residue Chips

- Others

Forest chips dominates the market due to their abundant accessibility, cost- effectiveness, and wide use in biomass energy and industrial operations. These chips are gathered from logging remainders, thinning operations, and low- quality timber, making them a sustainable derivate of timber administration. Either, the adding demand for renewable energy sources, particularly biomass power generation, has significantly boosted the consumption of forest chips. numerous countries, especially in Europe and North America, are promoting biomass as a cleaner volition to fossil energies, further driving demand. Also, forest chips are extensively used in the pulp and paper industry and wood- based panel production, icing steady market growth.

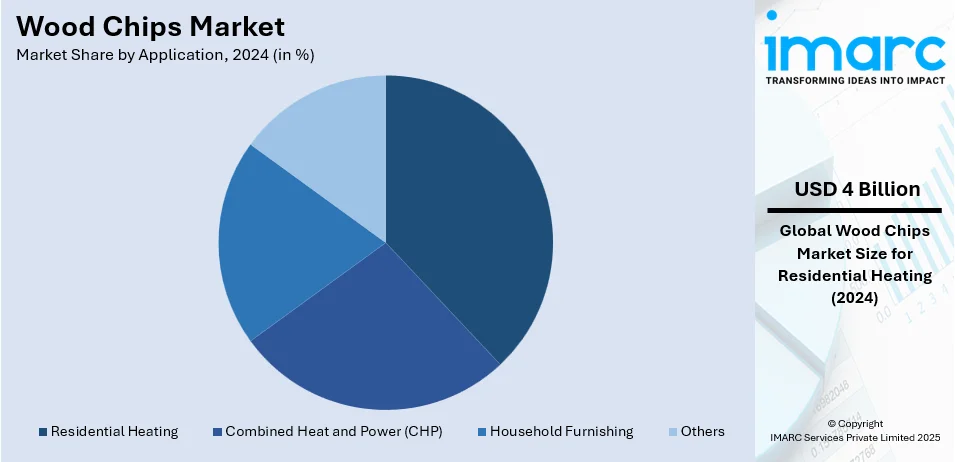

Analysis by Application:

- Combined Heat and Power (CHP)

- Household Furnishing

- Residential Heating

- Others

Residential heating represented the largest segment holding 38.6% share in market due to the growing shift toward renewable and cost-effective energy sources. Wood chips are widely used in biomass heating systems, particularly in colder regions such as North America and Europe, where households rely on wood-based heating for efficiency and sustainability. Rising energy costs and government incentives for biomass heating have further driven adoption, as wood chips offer a cheaper and eco-friendly alternative to fossil fuels. Also, advancements in biomass boiler technology have bettered effectiveness and convenience, making wood chip heating systems more appealing to homeowners. Countries like Germany, Sweden, and Austria have strong programs promoting biomass heating, farther boosting demand. As environmental interests grow and consumers seek sustainable heating options, the domestic sector continues to drive the wood chips market, substantiating its position as the largest portion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the wood chips market with 39.0% share due to its strong demand from the pulp & paper, biomass energy, and wood-based panel industries. Countries like China, Japan, and India are major consumers, with China leading in paper production and wood-based panel manufacturing. The region's rapid urbanization and infrastructure growth have driven the need for engineered wood products, boosting wood chip consumption. Additionally, the increasing focus on renewable energy has led to a surge in biomass power generation, particularly in Japan and South Korea, which import large volumes of wood chips for energy production. The availability of vast forest resources in countries like Vietnam, Indonesia, and Malaysia also supports the region’s dominance, with these nations being key exporters of wood chips. Government policies promoting sustainable forestry and investments in eco-friendly materials further contribute to market growth, solidifying Asia Pacific’s position as the largest segment in the global wood chips market.

Key Regional Takeaways:

United States Wood Chips Market Analysis

The growing adoption of wood chips in the United States is largely influenced by the expansion of household furnishing and renovation activities. For instance, construction spending in the United States stalled month-over-month to a seasonally adjusted annual rate of USD 2,153 Billion in November 2024. As consumers invest in home improvements and remodeling projects, the demand for sustainable and eco-friendly materials has surged. Wood chips are increasingly being used in these projects for their versatility, affordability, and environmental benefits. Wood chips serve as effective material in landscaping, floorings, and insulation, promoting greener homes and improving energy efficiency. This shift towards eco-conscious renovations has led to a steady rise in wood chip usage, driven by growing awareness of environmental impacts and the desire for sustainable living. The increased focus on energy-efficient home structures and the expansion of eco-friendly building materials have further fueled the adoption of wood chips across various residential renovation projects, enhancing both their functional and aesthetic value.

Asia Pacific Wood Chips Market Analysis

In the Asia-Pacific region, the adoption of wood chips has gained momentum due to the rapid expansion of the agriculture sector. For example, the Indian government plans to invest over USD 4.32 Million in 346 agritech businesses in 2020 with the goal of accelerating the expansion of the agricultural industry. With the growing demand for sustainable farming practices and the need for efficient waste management, wood chips offer a practical solution in the form of organic mulches and soil amendments. Their use in agricultural practices, such as improving soil fertility, preventing erosion, and managing moisture, has become increasingly popular. Moreover, the use of wood chips as animal bedding has contributed to their wider adoption in agricultural communities. This shift is further supported by increased government initiatives promoting sustainable farming practices and the growing interest in eco-friendly solutions within the region's booming agricultural landscape.

Europe Wood Chips Market Analysis

The increased investment in renewable energy has played a key role in driving the adoption of wood chips in Europe. For example, the EU-27 Member States' total installed solar PV capacity reached 269 GW by 2023, indicating a notable increase in solar energy investments throughout the region. With a growing shift toward cleaner energy sources, the demand for biomass as an alternative fuel has surged, particularly in the form of wood chips. Their utilization in power plants, industrial heating, and combined heat and power (CHP) systems has been supported by favorable government policies and incentives promoting the use of renewable energy. Wood chips are seen as an effective renewable resource to replace fossil fuels, especially in industries looking to reduce their carbon footprints and transition to greener energy sources. This trend is particularly evident in countries committed to meeting their renewable energy targets, further accelerating the use of wood chips in energy production.

Latin America Wood Chips Market Analysis

In Latin America, the growing adoption of wood chips is largely attributed to the expansion of the paper industry. For example, with over 31% of the world's kraft pulp production, Latin America controls the market. With the increasing demand for paper products across various sectors, the need for raw materials like wood chips has grown. Wood chips serve as an ideal feedstock for the pulp and paper manufacturing process, enabling higher production volumes and more efficient operations. As paper production continues to increase, manufacturers are turning to wood chips as a sustainable source of raw material, helping reduce environmental impact and minimize waste. This shift is further facilitated by advancements in wood chip processing technology, which enhances the efficiency of paper production, contributing to their increasing use in the region.

Middle East and Africa Wood Chips Market Analysis

The Middle East and Africa have seen a rise in the adoption of wood chips, fuelled by growing construction activities. Over 5,200 construction projects worth USD 819 Billion are reportedly under Saudi Arabia's supervision at the moment, accounting for 35% of the GCC's total active project value. As urbanization and infrastructure development accelerate, the demand for building materials has risen, with wood chips playing a key role in providing affordable, sustainable solutions for construction projects. They are increasingly used in landscaping, as a base material for paving, and in other construction-related applications. With the construction sector looking for eco-friendly alternatives to traditional materials, wood chips have become a viable option in many projects across the region. The emphasis on green building practices and sustainable urban development has further driven the demand for wood chips in this fast-growing construction industry.

Competitive Landscape:

Leading companies are increasing wood chip production capacity to meet growing demand from the pulp & paper, biomass energy, and wood-based panel industries. Expanding supply chains and securing long-term contracts with forest owners help stabilize raw material availability and pricing. Companies are investing in improved wood chipping and drying technologies to enhance efficiency, reduce waste, and optimize product quality. Innovations in wood pellet production and torrefaction processes are making biomass energy applications more efficient, attracting more buyers. Moreover, with increasing environmental concerns, key players are promoting sustainable forestry and responsible sourcing. Certifications like FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) help companies build credibility and attract eco-conscious customers. These efforts are creating a favorable wood chips market outlook.

The report provides a comprehensive analysis of the competitive landscape in the wood chips market with detailed profiles of all major companies, including:

- American Wood Resources LLC

- Axpo Holding AG

- Bio Eneco Sdn Bhd

- Cogent Forest Products Inc.

- Great Northern Timber Inc.

- LA.SO.LE. EST S.P.A.

- Mitsui & Co. Ltd.

- Verdo Holding A/S

Latest News and Developments:

- January 2025: River City Fibre LP, a joint venture between Arrow Transportation Systems Inc. and Simpcw Resources Group, processes low-value pulp logs and recovered lumber into wood chips, hog fuel, and sawdust for the Kamloops Kruger pulp mill. The partnership is slated to get up to USD 600,000 to purchase a de-wrapping station and an electric log loader, which will increase log processing efficiency and reduce emissions. This investment will also result in the creation of four new jobs. This move improves both environmental sustainability and local jobs.

- December 2024: Eternali is extending its activities in Brazil, acquiring 3.3 hectares of land in Moju, Pará, to build its next wood chip production facility. This new plant will help the company fulfill the region's growing need for biomass. The expansion follows the successful introduction of their first production site in Moju, which received great customer feedback. The proximity of sawmills in the area allows for cheap pricing and simple access to raw materials for wood chip manufacture.

- In March 2024, Orsted announced ambitions to expand its biomass power producing capacity throughout Europe. This expansion is predicted to dramatically increase demand for wood chips, which are a primary fuel source for biomass power plants. As a result, the wood chip market is expected to develop, particularly as Orsted commits to supporting renewable energy programs. This development emphasizes the growing importance of wood chips in sustainable energy production across the continent.

- In March 2024, Great Northern Timber team up with a local conservation organization to plant new trees in areas formerly cut for wood chips. The project's goal is to restore forest ecosystems while demonstrating the company's commitment to sustainable forestry techniques. By focusing on restocking regions affected by wood chip harvesting, the effort seeks to strike a balance between environmental stewardship and resource demand. This collaborative endeavor aims to lessen the environmental impact of wood chip production.

- In March 2024, Leading UK pellet manufacturer Drax Group announced a $300 Million investment to construct a new biomass power plant in Scotland. The demand for wood chips—especially those derived from sustainable forestry practices—will probably rise as a result of this operation. Drax's continued dedication to growing its infrastructure for renewable energy is reflected in the investment. The business is establishing itself as a significant force in the biomass industry driven by wood chips with this action.

Wood Chips Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Softwood, Hardwood |

| Variety Types Covered | Forest Chips, Recycled Chips, Wood Residue Chips, Others |

| Applications Covered | Combined Heat and Power (CHP), Household Furnishing, Residential Heating, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Wood Resources LLC, Axpo Holding AG, Bio Eneco Sdn Bhd, Cogent Forest Products Inc., Great Northern Timber Inc., LA.SO.LE. EST S.P.A., Mitsui & Co. Ltd., Verdo Holding A/S, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wood chips market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wood chips market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wood chips industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wood chips market was valued at USD 10.3 Billion in 2024.

The wood chips market is estimated to exhibit a CAGR of 5.39% during 2025-2033.

The increasing use of renewable sources of energy, rising application in the agriculture sector, and the growing construction activities represent some of the key factors driving the market.

Asia Pacific currently dominates the market with the growing demand for sustainable farming practices and the need for efficient waste management.

Some of the major players in the wood chips market include American Wood Resources LLC, Axpo Holding AG, Bio Eneco Sdn Bhd, Cogent Forest Products Inc., Great Northern Timber Inc., LA.SO.LE. EST S.P.A., Mitsui & Co. Ltd., Verdo Holding A/S, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)