Wood Based Panels Market Report by Product Type (Medium Density Fiberboard (MDF)/High Density Fiberboard (HDF), Oriented Strand Board (OSB), Particleboard, Softboard and Hardboard, Plywood, and Others), Distribution Channel (Direct Sales, Online Stores, Specialty Stores, and Others), Application (Furniture, Construction, Packaging, and Others), and Region 2026-2034

Wood Based Panels Market Size:

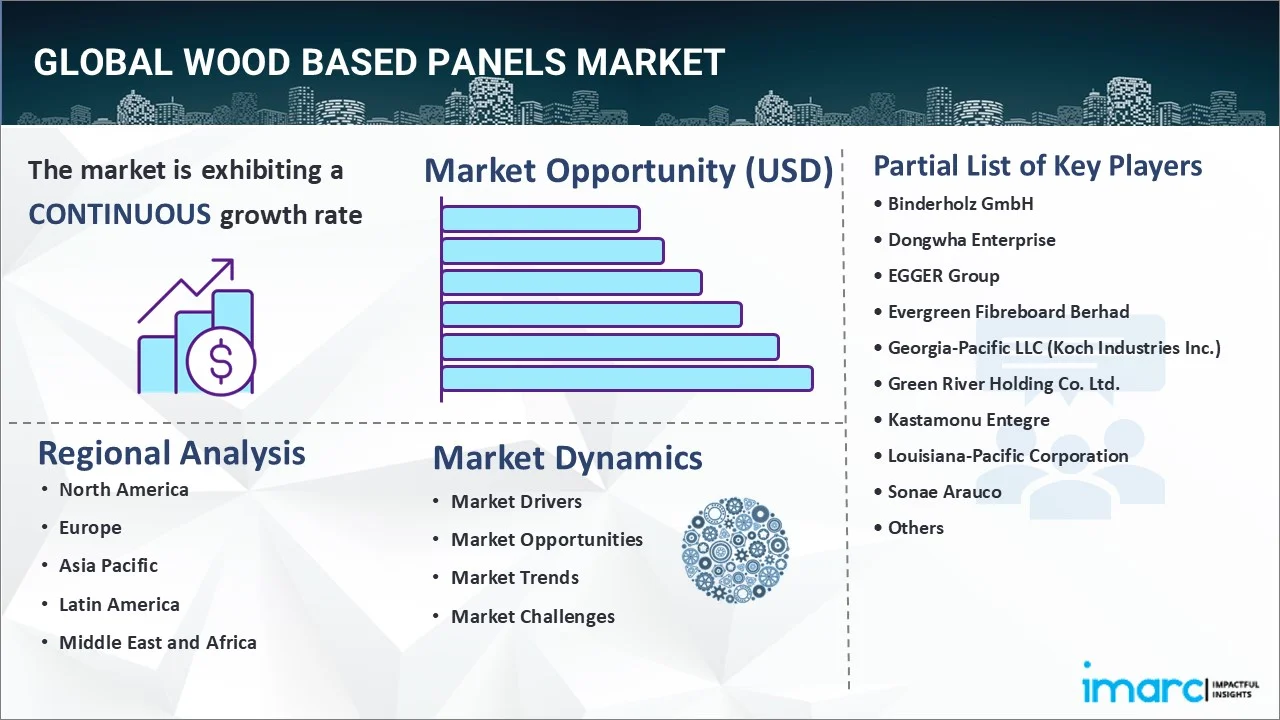

The global wood based panels market size reached USD 194.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 303.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The market is continuously witnessing growing on account of several factors, which include increasing advancements in wood recycling technologies to maintain sustainability in furniture production, heightened need for lightweight and functional furniture pieces, and rising adoption of wood based construction components to retain the sustainability factor in the construction sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 194.1 Billion |

|

Market Forecast in 2034

|

USD 303.4 Billion |

| Market Growth Rate 2026-2034 | 4.94% |

Wood Based Panels Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth because of the increasing utilization of several forms of sustainable and recyclable components in the construction industry. Also, the increasing need for light weight and useful furniture is driving the need for wood based panels.

- Key Market Trends: Major market trends consist of heightened need for eco-friendly products among the masses owing to the rise in the environmental consciousness and growing preferences for aesthetically pleasing furniture.

- Geographical Trends: Asia Pacific represents the largest market because of the heightened environmental consciousness among individuals and businesses, increasing usage of wood panels in the construction sector, and presence of numerous flagship stores of well known furniture producers.

- Competitive Landscape: Some of the major market players in the wood based panels industry include Binderholz GmbH, Dongwha Enterprise, EGGER Group, Evergreen Fibreboard Berhad, Georgia-Pacific LLC (Koch Industries Inc.), Green River Holding Co. Ltd., Kastamonu Entegre, Louisiana-Pacific Corporation, Sonae Arauco, Starbank Panel Products Ltd., West Fraser Timber Co. Ltd., Weyerhaeuser Company, among many others.

- Challenges and Opportunities: Difficulties include problems with deforestation and troubles getting the right manufacturer certifications. However, it is anticipated that these issues will be resolved by the growing use of cutting-edge technologies in wood recycling.

To get more information on this market Request Sample

Wood Based Panels Market Trends:

Rising Demand for Sustainable and Eco-friendly Products

The market for wood-based panels is driven by user demand for environment friendly and sustainable products. Materials with less of an influence on the environment are more preferred as companies and people are becoming more environmentally concerned. Wood-based panels are gaining traction because they provide a renewable substitute for synthetic materials. This is especially true of wood derived from reclaimed and responsibly managed forests. For example, in 2023, Biffa presented circular recycling ideas for John Lewis in collaboration with Timberpak Ltd, a wood recycling company.

The trend is additionally propelled by strict guidelines and certificates guaranteeing the sustainability of wood-based products. In order to increase the sustainability profile of their wood panels and appeal to eco-aware consumers and companies looking to boost their green credentials, companies are investing in innovative manufacturing procedures.

Technological Advancements in Production Processes

Continuous improvements in manufacturing techniques are driving the market expansion for wood-based panels. Technological advancements in manufacturing are producing goods with higher quality, greater efficiency, and lower waste. Advancements in adhesive technology, automated manufacturing lines, and continuous press technology have made it possible for producers to create panels that exhibit exceptional strength, durability, and visual appeal. Furthermore, in order to improve quality control and streamline operations, digital technologies like artificial intelligence (AI) and the internet of things (IoT) are being incorporated into production systems. For instance, Metalube developed a novel lubrication technology in 2024 that not only helped the wood panel sector address air quality issues, but also improve the efficiency of wood panels.

Growth in the Construction and Furniture Sectors

Wood panels are widely used in the furniture and building industries to create a wide range of structures. Because of their strength, durability, and affordability, wood-based panels find widespread use in the building sector for structural, interior design, and insulation purposes. The demand for these materials is being driven by an increase in residential and commercial construction projects, especially in emerging nations. Concurrently, there is a notable rise in the furniture sector as a result of growing disposable incomes, evolving lifestyle choices, and heightened urbanization. In 2023, Wooden Bazar revealed the debut of its newest collection of finely carved wooden furniture.

Wood Based Panels Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wood based panels market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on product type, distribution channel and application.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Medium Density Fiberboard (MDF)/High Density Fiberboard (HDF)

- Oriented Strand Board (OSB)

- Particleboard

- Softboard and Hardboard

- Plywood

- Others

Plywood accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium density fiberboard (MDF)/high density fiberboard (HDF), oriented strand board (OSB), particleboard, softboard and hardboard, plywood, and others. According to the report, plywood represented the largest segment.

Because of its extraordinary adaptability and abundance of uses, plywood is becoming more and more popular in the manufacturing of wood panels. Plywood is a strong, flexible material with many uses that is made by fusing together thin layers of wood veneer. It is an excellent material for both structural and non-structural building applications, including wall sheathing, flooring, roofing, and furniture manufacturing. This is due to its adaptability. It may be creatively used in a range of projects by designers and builders since it can be polished, molded, and sliced in many ways. The IMARC Group predicts that the global plywood market is expected to reach US$ 73.3 Billion by 2032.

Breakup by Distribution Channel:

- Direct Sales

- Online Stores

- Specialty Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales, online stores, specialty stores, and others.

Direct sales represent a significant segment in the distribution of wood-based panels, catering primarily to large-scale purchasers such as construction companies, furniture manufacturers, and industrial clients. Direct communication between buyers and producers through this channel enables specialized orders, large purchases, and solutions that are specifically designed to fulfill project specifications.

Online retailers are becoming a more significant means of distribution for wood-based panels due to the growth of e-commerce. Online marketplaces provide a quick and easy option for customers and small companies to peruse, evaluate, and buy wood panels from numerous vendors.

Specialty stores play a crucial role in the distribution of wood-based panels, particularly for customers seeking expert advice and high-quality, niche products. These stores cater to professional builders, architects, interior designers, and do-it-yourself (DIY) enthusiasts who require specific types of wood panels for unique applications, thereby propelling the wood based panels market growth.

Breakup by Application:

- Furniture

- Construction

- Packaging

- Others

Furniture represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes furniture, construction, packaging, and others. According to the report, furniture represented the largest segment.

Because of the growing demand for cost-effective, versatile, and visually pleasing furniture options, the use of wood-based panels is rising. Additionally, furniture pieces like shelves, tables, chairs, and cabinets are commonly constructed using wood panels like medium density fiber board (MDF), plywood, and particleboard. These materials offer a feasible alternative to solid wood with improved strength, stability, and design flexibility at a lower price. Manufacturers can offer a wide range of styles and finishes to meet diverse customer preferences due to the simplicity of applying laminate or veneer wood panels. The increased demand for environment friendly and sustainable furniture has led to a rise in popularity of wood-based panels, as they can be produced using recycled and renewable materials. Furthermore, according to data shared by the IMARC Group, the worldwide furniture market is projected to hit US$ 701.7 Billion by 2032.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest wood based panels market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for wood based panels.

The Asia Pacific wood-based panels market is driven by a combination of factors including rapid urbanization, industrialization, and an expanding middle class. Additionally, the escalating demand for affordable and stylish furniture in the region is increasing the use of plywood, MDF, and particleboard. Technological advancements in manufacturing processes are enhancing the quality and performance of these panels, making them more competitive with traditional solid wood products. Environmental concerns and regulatory measures are growing emphasis on sustainable sourcing and eco-friendly products. Moreover, the region's significant manufacturing base and availability of raw materials contribute to the competitiveness of local producers in both domestic and export markets. Manufacturers are also expanding their operations and opening new stores to reach more number of customers. For instance, Remax Furniture in 2024, announced the grand opening of its flagship store in New Delhi, India.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the wood based panels industry include Binderholz GmbH, Dongwha Enterprise, EGGER Group, Evergreen Fibreboard Berhad, Georgia-Pacific LLC (Koch Industries Inc.), Green River Holding Co. Ltd., Kastamonu Entegre, Louisiana-Pacific Corporation, Sonae Arauco, Starbank Panel Products Ltd., West Fraser Timber Co. Ltd. Weyerhaeuser Company, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Leading companies are heavily investing in advanced manufacturing technologies to improve the quality, efficiency, and sustainability of their wood-based panels. Innovations such as continuous press technology, advanced adhesives, and automation are helping manufacturers produce higher-quality panels with better durability and aesthetic appeal. To cater to diverse market demands, key players are expanding their product portfolios. This includes developing new types of panels with enhanced features, such as fire resistance, water resistance, and improved acoustic properties. Companies are adopting eco-friendly practices by sourcing wood from sustainably managed forests and increasing the use of recycled materials in their products. For instance, Binderholz Group in 2024, announced that they will be supplying CLT BBS, glulam, and 3 layered solid wood panels to Tllburg University for constructing a 5-storey lecture hall center. The timber construction components were installed in such a manner that they can be easily dismantled for further usage.

Key Regional Takeaways:

United States Wood Based Panels Market Analysis

The US wood based panels industry is growing strongly, fueled by mounting demand for environmentally friendly building materials, especially in the face of rising environmental awareness and the need for green building solutions. Among the driving factors is the expanding use of Cross-Laminated Timber (CLT) in building projects that provides a sturdy alternative to conventional building materials like steel and concrete. CLT is becoming increasingly popular because it is structurally stable, sustainable, and has less environmental footprints. For instance, in October 2024, Microsoft initiated the construction of its initial data centers in Northern Virginia with the use of CLT. The action is likely to decrease carbon emissions by as much as 65%, showcasing the environmental advantage of wood-based materials. It marks the increasing wave of leveraging environmentally friendly, renewable materials for construction. As developers and industries more and more turn towards green building approaches, the demand for products like plywood, MDF, and particleboard has also increased substantially. Also, the US market is gaining advantages from increased awareness of green building solutions and green construction approaches. As a whole, the increasing demand for low-carbon solutions and energy-efficient buildings is likely to continue propelling demand for wood-based panels across the United States.

Europe Wood Based Panels Market Analysis

In Europe, the demand for wood based panels is being strongly driven by a growing commitment to sustainability and eco-conscious practices within the construction industry. The European market has witnessed significant strides in the adoption of engineered wood products as part of the larger movement towards reducing carbon footprints in construction. One of the most notable developments in this regard is the increasing use of CO₂-binding engineered wood, which plays a key role in green building projects aimed at achieving carbon neutrality. At the forefront of these innovations, the LIGNA exhibition, held in March 2025, showcased breakthroughs in engineered wood, particularly in prefabrication and production systems for wood-based materials. Industry leaders such as Minda, Weinig, and Dieffenbacher highlighted cutting-edge advancements aimed at improving the efficiency of wood resources while promoting sustainable, circular economy practices. This shift in focus toward reducing waste, optimizing resource use, and increasing production efficiency is driving market growth and increasing demand for wood-based panels. Furthermore, European governments have implemented several policies and incentives to encourage sustainable construction, further bolstering demand for wood-based materials.

Asia Pacific Wood Based Panels Market Analysis

Asia Pacific's wood-based panels market is undergoing significant changes due to a combination of regulatory reforms and a rising preference for sustainable and locally produced products. Regulatory frameworks, such as India's introduction of the BIS Quality Control Order (QCO) in February 2025, are playing a pivotal role in reshaping the region's market dynamics. The QCO mandates certification for materials such as MDF, particleboard, and blockboard, thereby raising quality standards and enhancing the credibility of domestically produced wood-based panels. In response to this regulation, India has seen an uptick in demand for locally manufactured wood-based products, as it also led to a halt in imports from Russia. This shift is strengthening local supply chains, reducing the dependency on imported products, and ensuring a steady supply of certified, high-quality materials for the construction industry. Moreover, the QCO is encouraging local manufacturers to invest in advanced production technologies, boosting the adoption of more sustainable and eco-friendly practices. With an increasing emphasis on environmentally friendly materials and efficient resource management, the Asia Pacific region is witnessing robust growth in the market. As countries such as India, China, and Japan continue to prioritize green building materials and sustainable construction practices, the demand for wood-based panels is expected to continue increasing.

Latin America Wood Based Panels Market Analysis

The Latin American wood based panels market is undergoing notable growth, majorly driven by the increased demand for decor papers and associated products used in construction and interior design applications. One of the key drivers behind this surge is the expansion of production capacity by major manufacturers in the region. For example, in April 2025, Munksjö, a leading producer in the industry, doubled its decor paper production capacity at its Caieiras plant in Brazil. This expansion enabled Munksjö to meet the growing demand in Brazil and its neighboring countries, thereby reinforcing its position as the sole producer of decorative paper in the region. The demand for decor paper, especially for use in furniture and interior design, has been growing steadily as Latin American countries focus on modernizing their construction and furniture sectors. Brazil, in particular, is experiencing a surge in demand for stylish and functional interior solutions, thereby increasing the need for high-quality wood-based panels. Moreover, the growing construction boom in countries like Brazil, Argentina, and Mexico, coupled with expanding urbanization, is further contributing to the increase in demand for wood-based materials. As the region seeks to enhance both residential and commercial infrastructure, the demand for durable, aesthetically appealing wood-based products, such as MDF and particle boards, is expected to increase.

Middle East and Africa Wood Based Panels Market Analysis

The wood-based panels market in the Middle East and Africa (MEA) region is experiencing robust growth, driven by increasing demand for sustainable building materials and rising construction activity. A key trend supporting the market's expansion is the growing interest in eco-friendly materials that can reduce the environmental impact of construction projects. The Dubai WoodShow, held in March 2025, served as a significant platform for discussing emerging trends and opportunities in the timber and wood-based panel sectors. This event brought together industry professionals from around the globe to explore innovations and discuss the evolving needs of the construction sector in the Middle East and Africa (MEA) region. The growing demand for wood-based panels, driven by a surge in residential, commercial, and infrastructure construction projects, is expected to continue driving market expansion. Additionally, the MEA region is increasingly adopting sustainable building practices, which has led to a rise in demand for high-quality wood-based panels as part of these green construction efforts. The importance of the timber trade and sustainable construction solutions was also highlighted during the Dubai WoodShow, with an emphasis on the need for improved sourcing and the efficient use of timber resources.

Wood Based Panels Market Recent News:

- April 2025: Sonae Arauco launched the world's first dry fiberboard recycling line, marking a significant development in the wood-based panels market. This innovation, developed with ANDRITZ, enhances sustainability by integrating recycled wood into MDF production, boosting competitiveness and supporting circular bioeconomy models in the industry.

- April 2025: Nviro and NPI launched the N+N System Wall, a bio-based construction solution combining cellulose insulation and wood-based panels. This collaboration aimed to meet stricter CO2 emission regulations in Denmark, promoting sustainable construction practices and advancing the wood-based panels market with eco-friendly alternatives.

- April 2025: Huntsman unveiled bio-based I-BOND resins for OSB and particleboard at LIGNA 2025. These resins, incorporating up to 25% bio-based content, reduced the carbon footprint of composite wood products by up to 30%, supporting sustainability goals and enhancing the performance and emissions standards of wood-based panels.

- January 2025: Kronospan showcased innovative, sustainable wood-based panels at BAU 2025, including eco-friendly Kronobuild and Kronoart panels made from recycled wood. These products, along with the new Kronodesign Trend Collection and PerfectPad underlay, emphasized sustainability and resource efficiency, driving growth in the wood-based panels market.

- November 2024: Metro-Ply ordered a new MDF line from Siempelkamp for its Surat Thani facility in Thailand. This expansion, featuring advanced machinery and a 25% increase in particleboard capacity, strengthened Metro-Ply’s position as a leading wood-based panel producer in Southeast Asia, enhancing regional production capabilities.

Wood Based Panels Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Density Fiberboard (MDF)/High Density Fiberboard (HDF), Oriented Strand Board (OSB), Particleboard, Softboard and Hardboard, Plywood, Others |

| Distribution Channels Covered | Direct Sales, Online Stores, Specialty Stores, Others |

| Applications Covered | Furniture, Construction, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Binderholz GmbH, Dongwha Enterprise, EGGER Group, Evergreen Fibreboard Berhad, Georgia-Pacific LLC (Koch Industries Inc.), Green River Holding Co. Ltd., Kastamonu Entegre, Louisiana-Pacific Corporation, Sonae Arauco, Starbank Panel Products Ltd., West Fraser Timber Co. Ltd., Weyerhaeuser Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wood based panels market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wood based panels industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global wood based panels market was valued at USD 194.1 Billion in 2025.

We expect the global wood based panels market to exhibit a CAGR of 4.94% during 2026-2034.

The extensive utilization of wood based panels across construction, packaging, and shipping industries, as they are cost-effective, aesthetically appealing, and temperature-resistant with enhanced shape stability, is primarily driving the global wood based panels market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary halt in numerous construction activities, thereby negatively impacting the overall demand for wood based panels.

Based on the product type, the global wood based panels market has been segmented into Medium Density Fiberboard (MDF)/High Density Fiberboard (HDF), Oriented Strand Board (OSB), particleboard, softboard and hardboard, plywood, and others. Among these, plywood represents the largest market share.

Based on the application, the global wood based panels market can be bifurcated into furniture, construction, packaging, and others. Currently, furniture accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America, where Asia-Pacific currently dominates the global market.

Some of the major players in the global wood based panels market include Binderholz GmbH, Dongwha Enterprise, EGGER Group, Evergreen Fibreboard Berhad, Georgia-Pacific LLC (Koch Industries Inc.), Green River Holding Co. Ltd., Kastamonu Entegre, Louisiana-Pacific Corporation, Sonae Arauco, Starbank Panel Products Ltd., West Fraser Timber Co. Ltd., and Weyerhaeuser Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)