Women's Health Market Size, Share, Trends and Forecast by Age Group Type, Application, Distribution Channel, and Region, 2025-2033

Women's Health Market Size and Share:

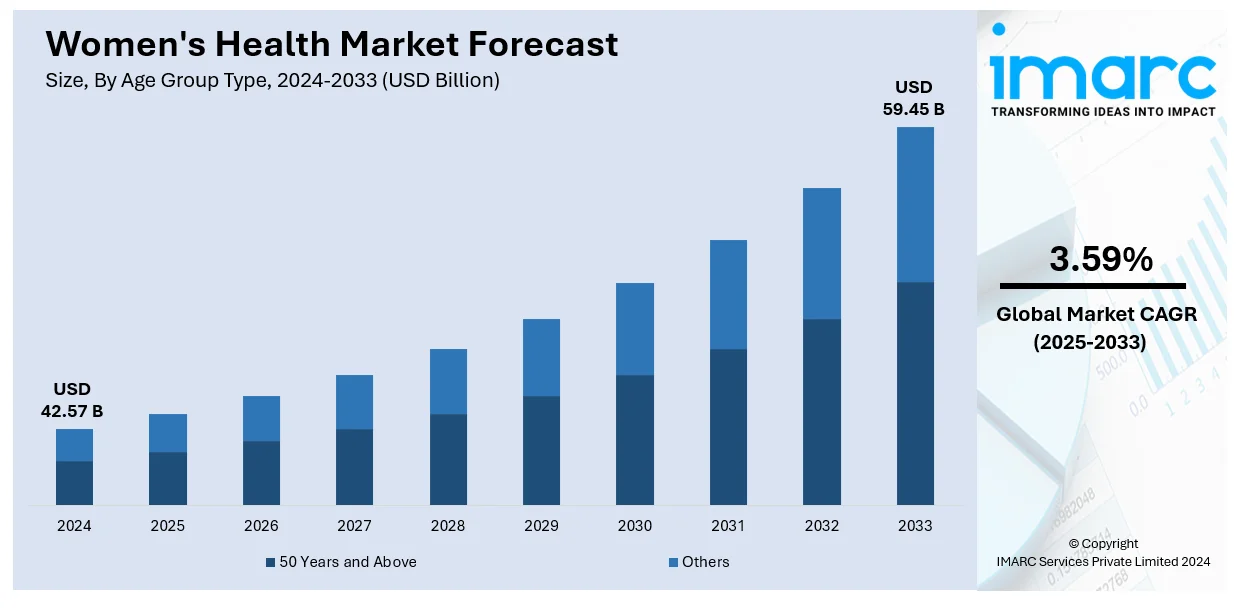

The global women’s health market size was valued at USD 42.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 59.45 Billion by 2033, exhibiting a CAGR of 3.59% from 2025-2033. North America currently dominates the market, holding a market share of over 43.0% in 2024. The market is driven by rising awareness and public health initiatives targeting gender-specific conditions, improving early detection and access to care. Advancements in diagnostic tools, telehealth, and reproductive technologies are streamlining treatment pathways and empowering patient-centric healthcare. The growing prevalence of post-menopausal disorders and aging demographics continues to boost demand for specialized services, further augmenting the women’s health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 42.57 Billion |

| Market Forecast in 2033 | USD 59.45 Billion |

| Market Growth Rate 2025-2033 | 3.59% |

The growing awareness about women's health issues globally, driven by a push to public health campaigns and educational programs, is offering a favorable market outlook. Governing bodies and non-profit organizations (NPOs) are prioritizing women's health, leading to better screening, diagnosis, and treatments for issues specific to women, such as breast cancer, cervical cancer, osteoporosis, and menopause. According to the women’s health market statistics, the growing number of post-menopausal conditions is driving the demand for healthcare services tailored to older women. This demographic shift pushes the development of treatments for health issues that primarily affect women as they age, including cardiovascular diseases and bone-related conditions. Furthermore, innovations in medical technology, such as telehealth, wearable health trackers, and improved diagnostic tools, are making it easier and more efficient to address women's health concerns. These advancements are particularly impactful in reproductive health technologies, including fertility treatments and management software for pregnancy and postpartum care.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by dedicated funding by major health organizations to support research and startups focused on women’s health. This targeted financial support fuels advancements in treatment and diagnosis specific to women, enhancing the overall healthcare offerings and outcomes in this crucial area. In 2024, tthe American Heart Association revealed the introduction of the Go Red For Women Fund, a $75 million program designed to assist startups concentrating on women’s heart health. The fund will allocate resources to early to mid-stage firms in the US and worldwide, targeting issues like heart disease, stroke, and Alzheimer's. This initiative is a component of AHA's larger objective to improve public knowledge and finance research in heart health.

Women's Health Market Trends:

Increased Awareness and Government Initiatives

Over the past few years, governments across the globe, non-profit organizations, and international agencies have played an instrumental role in heightening awareness about women's health issues. This has been primarily achieved through campaigns, policy changes, and funding for research and services. According to the World Health Organization (WHO), global health spending on women’s health initiatives increased by 25% between 2017 and 2022. These initiatives have fostered an environment where health matters are gaining global attention, leading to increased demand for women's health products and services. Moreover, these government initiatives often include provisions for health screenings, diagnostic tests, and preventive measures, which further drive the growth of the industry. Various government acts, for instance, make preventative services for a mandatory health insurance provision, amplifying the demand for such services.

Continuous Advancements in Technology

The rapid advancement in technology has significantly impacted the women's health market growth. Along with this, diagnostic tools and therapies have evolved and improved, which have led to better disease detection, more effective treatments, and increased survival rates. Digital health technologies, such as telehealth, mobile apps, and wearable devices are now assisting women in tracking and managing their health more efficiently. An industry report indicates that in July 2024, Flo, a mobile period tracking application based in London, generated the highest revenue globally, earning around USD 8.8 million in-app during that month. The Natural Cycles, located in Stockholm, secured the second position, generating around USD 950,000 in revenues. Advanced technologies, including artificial intelligence and machine learning, are also being employed in the diagnosis and treatment of various related issues. These technological advancements ensure more effective and personalized healthcare solutions for women, but also stimulate the market's growth by creating new opportunities and demands. The rise in monetization of digital health solutions is a sign of shifting consumer behavior towards self-directed wellness options. AI-based diagnostics and personalized treatment platforms are unveiling new, uncharted market segments in reproductive and chronic care. Global technology startups are expanding their services across various segments, including menstrual health, fertility, and menopause management, making their products more attractive to investors. This momentum, fueled by technology, is accelerating entry into markets and improving access to services globally.

Rising Incidences of Chronic Diseases

An increasing incidence of chronic diseases among women, such as cancer (specifically breast and cervical cancer), cardiovascular diseases, diabetes, and osteoporosis, is driving the need for these services. According to the Centers for Disease Control and Prevention (CDC), 1 in 3 women in the US suffers from cardiovascular disease, and breast cancer remains the second leading cause of death among women, with 1 in 8 women being diagnosed in their lifetime. According to global health organizations, non-communicable diseases, notably cancer, and cardiovascular diseases, are responsible for the majority of deaths among women across the globe. In confluence with this, this alarming rise in chronic conditions among women necessitates timely detection, effective treatment options, and increased preventive care, which are the major propellers for the women's health industry. Also, reproductive health remains a significant aspect of the market. The industry is witnessing a growing emphasis on access to family planning services, prenatal care, and safe childbirth practices to reduce maternal and infant mortality rates, further offering a favorable women’s health market outlook.

Women's Health Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global women’s health market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on age group type, application and distribution channel.

Analysis by Age Group Type:

- 50 Years and Above

- Postmenopausal Osteoporosis

- Endometriosis and Uterine Fibroids

- Menopause

- Others

50 years and above lead the industry with 52.0% of market share in 2024. The 50 years and above age group in the industry has witnessed significant market drivers over the past decades. One of the primary factors contributing to this trend is the global demographic shift towards an aging population, leading to an increased number of women entering this age bracket. Additionally, advancements in healthcare technology and increased access to medical services have enabled better diagnoses and treatments for age-related health conditions in women. In addition, the growing awareness among this demographic regarding preventive healthcare measures and wellness has influenced the demand for specialized products and services catering to their unique needs. As women in this age group seek to maintain their health and quality of life, there is an escalating demand for menopause-related treatments, bone health supplements, and preventive screenings. According to the women’s health market research report, this market segment's potential for growth is further bolstered by the expanding focus on research, allowing the industry to offer targeted and evidence-based solutions.

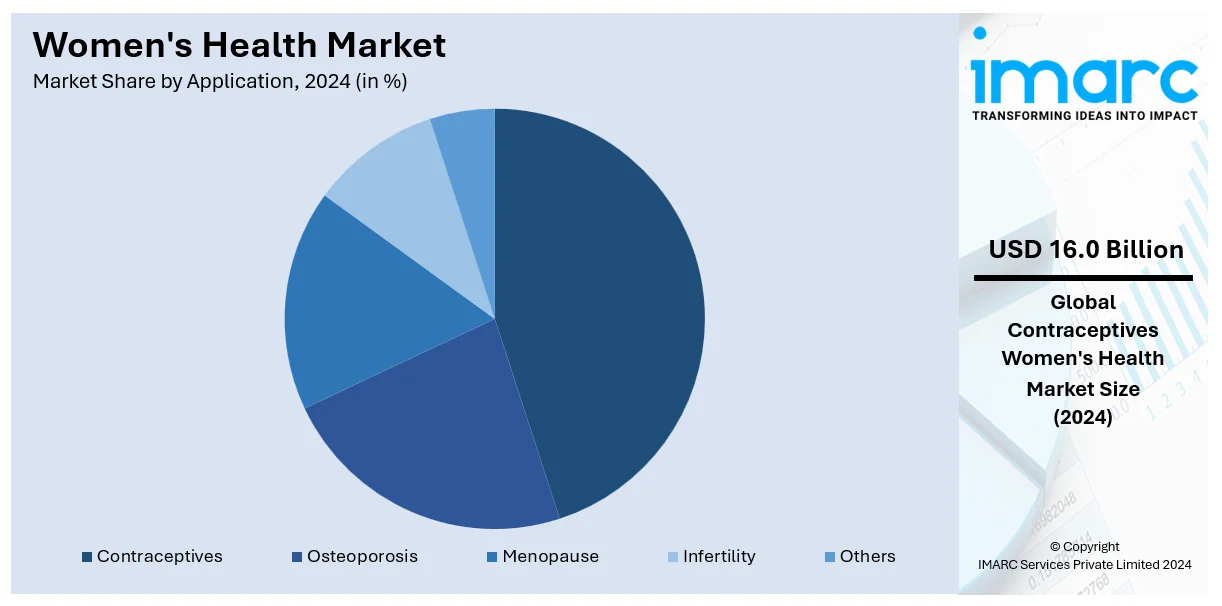

Analysis by Application:

- Contraceptives

- Osteoporosis

- Menopause

- Infertility

- Others

Contraceptive represents the largest segment, accounting 37.5% market share in 2024. The industry has been significantly influenced by the increasing global awareness of family planning and reproductive health. Governments, organizations, and healthcare providers are emphasizing the importance of safe and effective contraceptive methods to empower women to make informed choices about their reproductive health. Additionally, advancements in medical technology have led to the development of a wide range of contraceptive options, offering women more choices and personalized solutions to suit their preferences and needs. In confluence with this, the shifting societal attitudes towards women's rights and gender equality have resulted in greater access to contraceptive products and services, enabling women to take control of their reproductive decisions. Furthermore, the growing prevalence of sexually transmitted infections has reinforced the importance of using contraceptives as a means of protection.

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Hospital pharmacies hold the biggest women’s health market share. One of the key factors contributing to the prominence of this distribution channel is the rising demand for specialized women's health medications and treatments within hospital settings. Hospitals serve as essential centers for comprehensive medical care, making them an ideal platform to provide a wide range of women's health products, including contraceptives, hormone therapies, fertility medications, and prenatal supplements. Additionally, the increasing prevalence of chronic conditions, such as gynecological disorders and menopause-related symptoms, has led to a growing need for prompt access to medications and treatments, which hospital pharmacies can efficiently cater to. Furthermore, regulatory initiatives and healthcare policies that encourage hospitals to maintain well-stocked pharmacies with a focus on women's health contribute to the expansion of this distribution channel.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 43.0%. The industry in North America is influenced by the region's aging population. It contributes to an increased demand for women's health services and products catering to menopausal and post-menopausal women. Additionally, the growing awareness and emphasis on preventive healthcare measures among women drive the market for screenings, wellness programs, and specialized treatments. In addition, advancements in medical research and technology facilitate the development of innovative solutions, encouraging investment and competition in the industry. Moreover, favorable healthcare policies and insurance coverage for women's health services bolster market growth. Apart from this, shifting cultural attitudes towards women's empowerment and gender equality enhances access to comprehensive healthcare, including family planning and contraceptive options. Furthermore, strategic marketing efforts and educational campaigns by industry players to promote health and wellness further fuel market expansion. In 2024, OLLY Canada launched the "Wellness on Your Terms" campaign in Toronto, aimed at destigmatizing women's health issues and empowering women to take control of their wellness. The campaign includes wildpostings with empowering messages and a donation of $25,000 to support women's health research. OLLY's initiative reflects a commitment to fostering a supportive community and promoting open dialogue about women's health needs.

Key Regional Takeaways:

United States Women's Health Market Analysis

In North America, the United States accounted for 87.70% of the total market share. In the United States, there is rapid growth in women's health because more people have an awareness of their health and a high level of investment in health. CDC recorded that 2023 marked the period with over 50 million women requiring reproductive and hormonal healthcare services. Growing chronic diseases, including menopause and polycystic ovary syndrome, increase demand for treatment options. Major pharmaceutical companies include Pfizer and AbbVie as the forerunners in the development of novel therapies that target women's health. Furthermore, the market is enhanced by government efforts toward women's healthcare, like Medicaid, that covers almost 1 in 5 women of reproductive age in the US Innovative treatments are set to be led by HRT and contraceptives.

Europe Women's Health Market Analysis

Europe provides vast scope for growth in women's health care due to demographic changes and shifts in health care priorities. According to an industrial report, women make up 51.2% of the population of the European Community (EC), amounting to 191 million, with an average life expectancy of 80 years. Preventive health practices are highly institutionalized; for example, cervical smear tests and mammography have an annual participation rate of 40% and 18%, respectively. Despite all this, many serious health issues still prevail. About 20% of women are overweight, with a higher risk of cardiovascular disease and diabetes, which calls for the expansion of prevention and intervention programs. The rates of hospitalization among older women are also increasing, as 10% require inpatient care annually and are hospitalized for longer periods than the other age groups. Moreover, the increasing number of age-related conditions, including osteoporosis, calls for more targeted treatments and awareness programs. These factors align to make Europe a prime zone for women's healthcare solutions in the world today.

Asia Pacific Women's Health Market Analysis

The Asia Pacific women's health market demand is poised to grow substantially by demographic trends as well as growth in need in healthcare. By 2030, the total female population within the East Asia and Pacific region is projected by the World Bank to be roughly 1.37 billion people. This implies a rising requirement for complete care in health facilities, such as reproductive health and maternal care or age-related conditions. Governments and organizations operating within the region are funding gender-based initiatives to make healthcare services more accessible. World Bank's Gender Strategy 2024-2030 focuses on promoting gender equality and increasing healthcare access, creating room for innovation and investment in women's health. Moreover, growing awareness regarding health issues coupled with supportive policies is encouraging the uptake of advanced treatments and preventive care. As awareness increases, there will be demand for special healthcare products and services being delivered to women; therefore, the Asia Pacific region will be the region driving growth.

Latin America Women's Health Market Analysis

Latin America is seen as an up-and-coming region with increasing government health care spending, promising women's health growth. For example, public health expenditure was at 4.5% of the GDP and 10.94% of the total public spending in 2021 for Brazil, as per reports. Such regional commitment to investing in healthcare creates further scope for improved services related to women's health care, particularly in the reproductive area and oncological areas. Latin America is expected to see increasing access to health care, heightened awareness of the issues of women's health, and continued efforts by the government, which increases the market size. The rise in non-communicable diseases and increased screening programs for cervical cancer are additional factors driving the demand for innovation. Public-private partnerships also provide an important pathway for reducing disparities in healthcare provision so that women belonging to all sections of society benefit from modern care. Such trends place Latin America on the radar of the global women's health market as an important growth area.

Middle East and Africa Women's Health Market Analysis

Over the last twenty years, significant health gains in maternity care were found for women and families from the Middle East and Africa regions. Data from the World Health Organization have indicated that in the MENA region, maternal mortality ratio is down from 108 deaths for every 100,000 live births in the year 2000 to 56 deaths per 100,000 live births in 2020. These have been drastically reduced by close to 50% and remain mostly influenced by health infrastructure enhancement, skilled delivery attendant availability, and more developed maternity health policies. The focus of the governments has been on reducing the maternal mortality ratio through increased spending on healthcare, targeted programs, and expansion of access to antenatal and postnatal care. However, a lot still remains to be seen in the context of maternal health, especially for rural areas. Therefore, continued progress in regional disparities will determine the future health outcomes of women in the MEA region.

Competitive Landscape:

Major market participants are concentrating on broadening their product ranges through research and development of new pharmaceuticals and medical devices specifically aimed at women's health concerns. They are putting resources into digital health solutions, such as applications and remote monitoring technologies, to improve patient engagement and adherence. These firms are also engaged in educational efforts to promote awareness of women's health topics, enhancing both demand and accessibility. Key players collaborate with healthcare organizations to broaden their influence and improve the reliability of their health initiatives. These partnerships are essential for providing reliable information and services, particularly in areas that lack sufficient support. In 2025, the Federation of Obstetric and Gynaecological Societies of India (FOGSI) launched Arogya Sakhi, an app dedicated to enhancing women's health education. The app addresses various health concerns, including cervical cancer, menopause, vaccinations, and pregnancy. The aim is to provide reliable information and support, particularly for those who might find it difficult to see a doctor, and it is supported by UNICEF.

The report provides a comprehensive analysis of the competitive landscape in the women’s health market with detailed profiles of all major companies, including:

- Abbott Laboratories

- AbbVie Inc.

- Agile Therapeutics Inc.

- Amgen Inc.

- Bayer AG

- F. Hoffmann-La Roche AG

- Ferring Pharmaceuticals

- FUJIFILM Holdings Corporation

- Hologic Inc.

- Lupin Limited

- Novo Nordisk A/S

- Pfizer Inc.

Latest News and Developments:

- March 2025: The Irish government launched Women's Health Week 2025 to mark the third anniversary of the Women's Health Action Plan, supported by €180 million in funding to enhance services for women. This year's focus includes expanding gendered mental health services, improving cardiovascular and bone health in midlife and beyond, and supporting everyday health through initiatives like period dignity programs and increased breastfeeding support. The government aims to address historical healthcare inequalities and ensure equitable access to quality care for all women across Ireland.

- January 2025: The Gates Foundation and Brazil's Ministry of Health co-chaired the Global Alliance for Women's Health, which has enlisted more than 120 member organizations and won USD 55 Million in its first year to advance data, research, and care delivery. The alliance aims to roll out the WHIT platform with McKinsey in 2025 to track health inequities and publish its second "Women's Health Gap" report. Focusing on nine underinvested conditions, this effort aims to create USD 1 Trillion in GDP annually by 2040, thereby underscoring women's health as a matter of paramount economic importance.

- November 2024: Design Bridge and Partners collaborated with Bayer to launch WOMEN | Bayer, a new brand committed to improving women's healthcare. It is an initiative that addresses myths, simplifies complex issues, and advances research while connecting with women around the world.

- October 2024: SkinSpirit has collaborated with Allergan Aesthetics to support young girls pursuing STEM careers via Girls Inc. SkinSpirit will make a USD 5,000 donation and encourage clients to donate between November 1–15.

- August 2024: Agile Therapeutics revealed that Insud Pharma, S.L. has finalized its acquisition of the company via its fully owned subsidiary, Exeltis USA, Inc. This deal enhances Insud's portfolio in women's health. Agile shareholders are receiving USD 1.52 for each share, and Agile stock will cease trading.

- June 2023: AbbVie Inc. revealed the names of the 20 amazing women business owners who will receive grants and mentoring from the IFundWomen and BOTOX® Cosmetic award programme.

- June 2023: Agile Therapeutics Inc. declared that participants of MMCAP Infuse would have access to the Twirla (levonorgestrel and ethinyl estradiol) transdermal system. The company expects that this enhanced supply will positively influence demand growth and factory sales in the non-retail sector, which increased by 20% and 15%, respectively, from Q4 2022 to Q1 2023.

Women's Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Group Types Covered |

|

| Applications Covered | Contraceptives, Osteoporosis, Menopause, Infertility, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, AbbVie Inc., Agile Therapeutics Inc., Amgen Inc., Bayer AG, F. Hoffmann-La Roche AG, Ferring Pharmaceuticals, FUJIFILM Holdings Corporation, Hologic Inc., Lupin Limited, Novo Nordisk A/S, Pfizer Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the women’s health market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global women’s health market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the women’s health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The women’s health market was valued at USD 42.57 Billion in 2024.

IMARC Group estimates the market to reach USD 59.45 Billion by 2033, exhibiting a CAGR of 3.59% from 2025-2033.

The women's health market is primarily propelled by increasing awareness about health issues that are women-specific, advancements in personalized and preventative healthcare, and rising healthcare expenditures. Additionally, demographic shifts like an aging female population contribute significantly to the demand for tailored health services and products, supporting the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the women’s health market include Abbott Laboratories, AbbVie Inc., Agile Therapeutics Inc., Amgen Inc., Bayer AG, F. Hoffmann-La Roche AG, Ferring Pharmaceuticals, FUJIFILM Holdings Corporation, Hologic Inc., Lupin Limited, Novo Nordisk A/S, Pfizer Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)