Wireless Testing Market Size, Share, Trends and Forecast by Offering, Technology, Application, and Region, 2025-2033

Wireless Testing Market Size and Share:

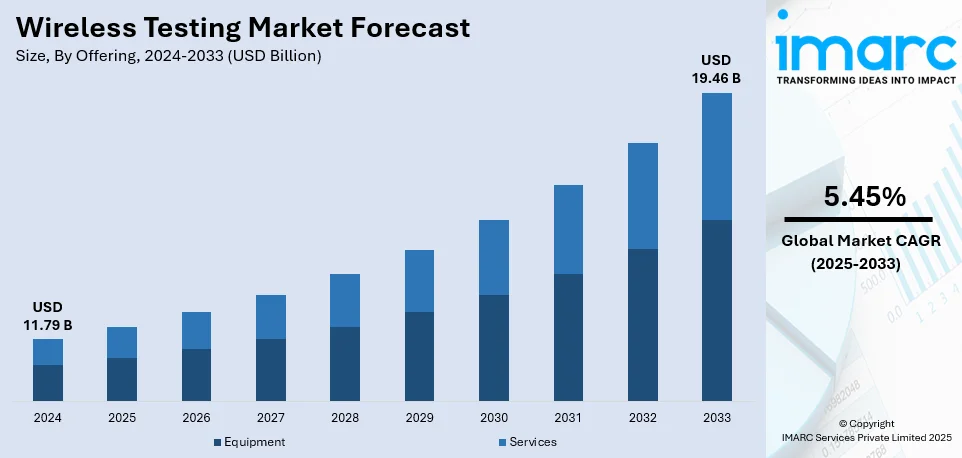

The global wireless testing market size was valued at USD 11.79 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.46 Billion by 2033, exhibiting a CAGR of 5.45% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.2% in 2024. The wireless testing market share is expanding rapidly due to the growing adoption of fifth-generation (5G), the Internet of Things (IoT), autonomous vehicles, smart healthcare, and industrial automation, with increasing regulatory compliance requirements and rising demand for reliable connectivity driving investments in advanced testing solutions across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.79 Billion |

|

Market Forecast in 2033

|

USD 19.46 Billion |

| Market Growth Rate (2025-2033) | 5.45% |

From remote patient monitoring to wireless medical implants, smart healthcare devices are transforming the medical industry. Wearable fitness trackers, glucose monitors, smart pacemakers, and telemedicine tools all rely on wireless connectivity to function properly. Also, in the year 2025, it is expected that more than 70 million Americans will use remote patient monitoring (RPM). Since these devices deal with sensitive health data, they must meet strict regulatory standards for performance and security. A slight connectivity glitch in a remote monitoring device could mean the difference between life and death. That is why medical device manufacturers invest heavily in wireless testing to ensure reliability and accuracy. The rise of smart hospitals, where everything from patient beds to infusion pumps is connected via Wi-Fi and Bluetooth, is another major factor boosting the wireless testing market growth. If these networks experience interference or downtime, it can disrupt critical medical operations. Thorough testing ensures that wireless medical systems function smoothly, even in complex hospital environments.

The United States is a major market disruptor in North America with 88.30%. Manufacturers are rapidly adopting Industry 4.0 technologies, which rely heavily on wireless communication. The market for Industry 4.0 in the country is expanding tremendously and is said to growth at a rate of 20.57% from 2024 to 2032. In smart factories, robots, automated conveyor belts, and predictive maintenance systems all communicate through wireless networks. Since factories are filled with machinery that can create electromagnetic interference, rigorous wireless testing is essential to prevent signal disruptions. Industrial Wi-Fi, private 5G networks, and other wireless technologies must be tested to ensure they provide reliable connectivity in harsh environments, thus bolstering the expansion of wireless testing market share in the United States.

Wireless Testing Market Trends:

Rising Adoption of 5G and IoT Devices

Major drivers for the wireless testing market demand are the deployment of 5G networks on a wide scale and the growing adoption of IoT devices. The GSMA projects that 5G connections will reach 1.5 billion by 2025, increasing the need for comprehensive network testing and validation. High-speed data transfer, ultra-low latency, and large-scale connectivity are offered by 5G technology, and thus it becomes very essential in many industries like telecommunications, automotive, healthcare, and industrial automation. For that, manufacturers should carry out tough wireless testing about network reliability, signal integrity, and compliance with global regulatory standards for smooth integration and performance. Additionally, IoT devices will use various forms of wireless communication, including Wi-Fi, Bluetooth, Zigbee, and LoRa, demanding more extensive verification to ensure they interoperate seamlessly and are not compromised. So, as these 5G and IoT environments continue to proliferate, more testing companies and organizations are developing more sophisticated wireless testing equipment-including spectrum analyzers, network emulators, and RF testing solutions. This increasing demand for high-precision testing tools would further fuel growth in the market, allowing products to reach faster time-to-market and improved reliability of connected devices.

Growing Demand for Over-the-Air (OTA) Testing

OTA testing has become even more necessary because of the advanced development in wireless technologies like Wi-Fi 6, Bluetooth 5.0, and mmWave communication. In contrast to its traditional wired counterpart, the verification of performance in real-life scenarios with OTA testing also figures prominently, including antenna efficiency, signal propagation, and network interference. There is a trend by regulatory bodies like the FCC in the US and ETSI in Europe towards OTA testing. This trend is especially true for consumer electronics such as smartphones, wearables, and smart home devices that have to go through extensive RF testing to ensure smooth connectivity. In India, the Economic Survey 2023-24 indicates that internet subscribers have surged from 251 million in March 2014 to 954 million in March 2024, with 914 million accessing the internet via wireless phones. This substantial increase in wireless internet usage highlights the critical importance of OTA testing to ensure device compliance with regulatory standards and optimal performance across diverse environments. OTA testing also features in the automotive sector in relation to vehicle-to-everything (V2X) communication, thus increasing safety and enhancing autonomous driving. This rising complexity for wireless networks has already started showing a need for specialized OTA test chambers, reverberation chambers, and anechoic chambers due to which market players are developing sophisticated testing solutions that improve accuracy and efficiency.

Shift Toward AI-Driven Test Automation

As per the wireless testing market trends, artificial intelligence (AI) and machine learning (ML) are transforming wireless testing by automating, obtaining real-time insights, and promising predictive maintenance. Traditional wireless testing methods, through their manual nature, have time-consuming processes that contribute to errors and inefficiency. The Economic Survey 2023-24 notes that over 69 laboratories have been designated as conformity assessment bodies for various evaluations, including Electromagnetic Interference (EMI), Electromagnetic Compatibility (EMC), safety assessments, technical requirements, and Radio Frequency (RF) testing of telecom products. Test automation with AI-driven capabilities enhances the efficiency of test execution by reducing complexity in test scenarios, flagging irregular patterns, and optimizing test execution. Telecommunications, aerospace, and the automotive industry are among those using AI-powered testing solutions to reduce time taken to bring a product into market with increased network reliability. For example, AI-based RF testing can identify signal loss, predict possible failures, and adjust test parameters. Moreover, cloud-based AI analytics allow for real-time monitoring as well as remote diagnostics that save on operational costs and downtime. It would be important in the future development of the wireless testing market where AI-driven automation will be vital in ensuring a high accuracy rate in tests while minimizing human involvement and, ultimately, enhancing overall network performance.

Wireless Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wireless testing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, technology, and application.

Analysis by Offering:

- Equipment

- Services

As per the wireless testing market outlook, equipment leads the market with around 63.8% of market share in 2024, driven by the rising need for advanced testing solutions across industries such as telecommunications, automotive, consumer electronics, and healthcare. With the rapid deployment of 5G, IoT expansion, and growing reliance on wireless communication, manufacturers require sophisticated testing tools, including signal analyzers, network testers, spectrum analyzers, and OTA test systems. The increasing complexity of wireless standards necessitates highly accurate and automated testing solutions, fueling demand for cutting-edge equipment that ensures compliance, performance optimization, and seamless connectivity in real-world conditions.

Analysis by Technology:

- Wi-Fi

- Bluetooth

- 2G/3G

- 4G/LTE

- 5G

- Others

Based on the wireless testing market forecast, Wi-Fi leads the market with around 36.8% of market share in 2024, driven by the increasing adoption of Wi-Fi 6 and 6E, and emerging Wi-Fi 7 standards across industries. With growing demand for high-speed, low-latency connectivity in smart homes, enterprises, public infrastructure, and industrial automation, rigorous testing is essential to ensure performance, security, and compliance with regulatory standards. The expansion of IoT devices, cloud computing, and remote work environments further accelerates the need for Wi-Fi testing solutions, including signal strength analysis, interference assessment, and real-world performance validation. As Wi-Fi continues evolving to support higher data rates and greater device densities, testing remains crucial for seamless connectivity and network reliability.

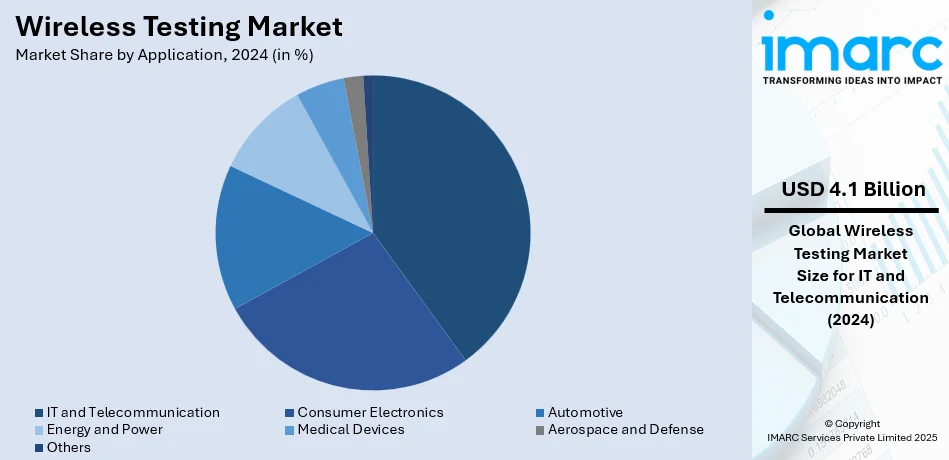

Analysis by Application:

- Consumer Electronics

- Automotive

- IT and Telecommunication

- Energy and Power

- Medical Devices

- Aerospace and Defense

- Others

IT and telecommunication lead the market with around 35.0% of market share in 2024, fueled by rapid advancements in 5G deployment, cloud computing, and expanding mobile networks. Telecom operators, network infrastructure providers, and device manufacturers rely on rigorous testing to ensure seamless connectivity, minimal latency, and high-speed data transmission. With increasing mobile data traffic, spectrum congestion, and the need for uninterrupted wireless communication, testing solutions validate network performance, spectrum efficiency, and compliance with evolving global standards. The expansion of fiber-to-wireless integration, small-cell deployments, and private 5G networks in enterprises further amplifies demand for testing equipment and services, making this segment a key driver of market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.2%, driven by rapid 5G deployment, strong telecommunications infrastructure, and high adoption of advanced wireless technologies across industries. The region's dominance is fueled by significant investments from major telecom operators, regulatory bodies enforcing stringent compliance standards, and increasing demand for IoT, autonomous vehicles, and smart city applications. The presence of leading wireless testing solution providers, along with extensive R&D in next-generation connectivity, strengthens market growth. The expansion of private 5G networks in enterprises, rising consumer demand for high-speed internet, and continuous advancements in Wi-Fi and satellite communication further boost the need for rigorous wireless testing solutions in North America.

Key Regional Takeaways:

United States Wireless Testing Market Analysis

The U.S. wireless testing market is expanding with the rapid deployment of 5G networks, the growing IoT ecosystem, and stringent regulatory requirements. As of the end of 2023, according to 5G Americas, there were more than 197 million 5G connections in the United States, which demands full-scale network testing for performance, security, and compliance. The number of IoT-connected devices is expected to exceed 15 billion by 2025, as per reports, and will continue driving demand for testing solutions across health care, automobiles, and smart manufacturing. Some of the industry leaders in terms of advanced wireless testing solutions include Keysight Technologies and Viavi Solutions. Another factor driving investment in wireless testing infrastructure is the government regulations as well as growing cybersecurity concerns. All these involve the autonomous vehicle, smart cities, and industrial automation, which is expected to prolong the growth of the market. The future of wireless testing further depends upon AI-driven testing solutions and real-time network monitoring.

Europe Wireless Testing Market Analysis

Stringent regulatory compliance, expansive 5G networks, and rising Internet of Things are driving the wireless testing market in Europe. According to European Commission, 5G coverage across the EU has expanded to reach 81% of people's population in 2023, thus increasing the need for network testing services. ETSI also mandates the ETSI scheme of cellular testing, strictly adhering to wireless device testing. The focus for countries such as Germany, France, and the UK will be on massive investment in Industry 4.0, involving high-end testing of wireless networks in automation and smart manufacturing. In Germany, its automotive sector is a giant for connected car technology, leading to the importance of wireless testing development. Innovative companies like Rohde & Schwarz and Spirent Communications will make significant innovations in RF, cybersecurity, and compliance testing. EU focus on sustainable digital transformation and energy-efficient wireless networks drives testing advancement, and the continent becomes an important region for growth in the wireless testing market.

Asia Pacific Wireless Testing Market Analysis

Asia-Pacific is seeing increasing growth in the wireless testing market due to extensive rollouts of 5G, rising adoption of IoT, and increased smartphone penetration. According to China's Ministry of Industry and Information Technology (MIIT), more than 2.9 million 5G base stations were in operation by 2023, giving a sense of the level of network testing and optimization that needs to be performed. The telecom sector in India is booming. Under the Digital India initiative, the government has set aside USD 11.2 billion (Union Budget 2023-24) for 5G infrastructure. Japan and South Korea are at the forefront of innovation in 5G and IoT. Hence, it is crucial to have a strong wireless testing solution. Compliance testing demand comes from the strong presence of consumer electronics in this region, which also manufacture smartphones and IoT devices. Some companies such as Anritsu and Keysight Technologies invest in AI-driven wireless testing and automation. Other drivers that enhance the growth in the advanced wireless testing solution are the growing number of industries implementing private 5G networks for applications like healthcare, manufacturing, and logistics.

Latin America Wireless Testing Market Analysis

Increasing mobile penetration, expansive 5G networks, and strict regulatory requirements are driving Latin America's wireless testing market. According to GSMA, by 2030, 60% of 5G adoption in Latin America will lead to telecom operators investing in testing and optimization solutions. Brazil leads the region, having invested over USD 8.5 billion in 5G spectrum auctions at the end of 2021, driving network expansion and demand for testing. Mexico and Argentina are further building out their telecommunication infrastructures. In addition to these two regions, ANATEL of Brazil and IFT of Mexico implement some of the world's highest standards of ensuring the safety and efficiency of wireless devices. Moreover, smart cities are coming to this region as well as industrial adoption of the IoT, from agricultural fields to logistics, making this a big demand area. Organizations are exploiting AI and automation for improved wireless testing productivity. Government incentives supporting digital transformation in the region are another market growth driver.

Middle East and Africa Wireless Testing Market Analysis

The Middle East and Africa region is witnessing the growth of its wireless testing market, mainly with increasing investments in 5G infrastructure, an increase in penetration of smartphones, and government-driven digital transformation projects. A 2023 report shows that in the GCC states of Saudi Arabia, the UAE, Qatar, Oman, Kuwait, and Bahrain, 5G subscriptions exceeded 26 million by the end of 2023, signaling rapid adoption across the region of next-generation connectivity. Strong investments in wireless networks are being seen by governments through smart cities, industrial automation, and digital economy initiatives. Major demand is generated in Saudi Arabia through Vision 2030, and the digital strategy of the UAE. Improvement in internet access and mobile broadband expansion are further driving the growth of network testing needs in Africa. Rohde & Schwarz and Anritsu are increasing their presence in this region to serve telecom operators. The growing adoption of IoT and cybersecurity concerns is further propelling the wireless testing market.

Competitive Landscape:

Key players in the market are expanding their service offerings through acquisitions, investing in advanced testing solutions, and strengthening compliance capabilities to meet growing industry demands. They are enhancing their testing portfolios to support 5G deployment, IoT expansion, and evolving wireless communication standards. Companies are also increasing R&D efforts to develop high-precision testing solutions for emerging technologies like Wi-Fi 6E, smart devices, and autonomous systems. With the rapid evolution of wireless technologies, they are focusing on improving automation, AI-driven testing, and remote testing capabilities to enhance efficiency and accuracy. Strategic partnerships with network providers, regulatory bodies, and equipment manufacturers are being formed to ensure seamless integration of new wireless standards. Additionally, efforts are being made to streamline regulatory compliance testing, ensuring that devices meet international certification requirements. The demand for private wireless networks, smart infrastructure, and industrial automation is pushing companies to offer more specialized testing solutions, reinforcing their market position in an increasingly connected world.

The report provides a comprehensive analysis of the competitive landscape in the wireless testing market with detailed profiles of all major companies, including:

- Anritsu Corporation

- Bureau Veritas

- Dekra SE

- Electro Magnetic Test Inc.

- Eurofins Scientific

- EXFO Inc.

- Intertek Group PLC

- Keysight Technolgies

- Rohde & Schwarz GmbH & Co. KG

- SGS S.A.

- Thales Group

- TÜV Rheinland

- Viavi Solutions Inc

Latest News and Developments:

- February 2025: Wellell has adopted Anritsu’s MT8821C and MT8862A wireless test solutions to enhance IoT connectivity in its CPAP devices and pressure relief mattresses. This collaboration ensures stable, high-quality wireless performance in medical devices, reinforcing Wellell’s commitment to smart healthcare innovations. Anritsu aims to drive industry advancements through this partnership.

- January 2025: Bureau Veritas confirmed merger discussions with SGS, potentially forming a USD 33 billion European testing giant. Both firms provide wireless connectivity testing, cybersecurity certification, and regulatory compliance services. The merger would significantly consolidate the inspection, testing, and certification market, outpacing competitors with a dominant industry presence.

- December 2024: Rohde & Schwarz launches the R&S LCM Network Performance Monitoring Probe, enhancing private network testing. The compact solution integrates advanced analytics and real-time monitoring for 4G/5G networks, ensuring seamless connectivity in business-critical environments. It enables proactive issue detection, optimizing service quality and network reliability.

- November 2024: TÜV Rheinland Shenzhen has secured authorization to provide testing services for key IoT wireless protocols: Thread, Matter 1.4, and Zigbee. This expansion strengthens its leadership in wireless certification, helping manufacturers ensure interoperability and reliability for smart home devices, accelerating global market entry with comprehensive testing and compliance solutions.

- January 2024: DEKRA became the first Authorized Test Laboratory in Europe and Asia to certify Wi-Fi 7 devices under the Wi-Fi CERTIFIED 7™ program. Its authorized locations include Málaga (Spain), Guangzhou (China), and Taiwan, reinforcing its leadership in wireless testing.

Wireless Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Equipment, Services |

| Technologies Covered | Wi-Fi, Bluetooth, 2G/3G, 4G/LTE, 5G, Others |

| Applications Covered | Consumer Electronics, Automotive, IT and Telecommunication, Energy and Power, Medical Devices, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anritsu Corporation, Bureau Veritas, Dekra SE, Electro Magnetic Test Inc., Eurofins Scientific, EXFO Inc., Intertek Group PLC, Keysight Technolgies, Rohde & Schwarz GmbH & Co. KG, SGS S.A., Thales Group, TÜV Rheinland, Viavi Solutions Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wireless testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wireless testing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wireless testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wireless testing market was valued at USD 11.79 Billion in 2024.

The wireless testing market is projected to exhibit a CAGR of 5.45% during 2025-2033, reaching a value of USD 19.46 Billion by 2033.

The wireless testing market is growing due to rapid 5G deployment, increasing IoT adoption, rising demand for high-speed connectivity, stringent regulatory compliance, expanding smart devices, and industrial automation.

North America currently dominates the wireless testing market, accounting for a share of 43.2%. North America's dominance in the market is driven by extensive 5G deployment, strong telecom infrastructure, high IoT adoption, stringent regulations, and growing demand for advanced connectivity solutions.

Some of the major players in the wireless testing market include Anritsu Corporation, Bureau Veritas, Dekra SE, Electro Magnetic Test Inc., Eurofins Scientific, EXFO Inc., Intertek Group PLC, Keysight Technolgies, Rohde & Schwarz GmbH & Co. KG, SGS S.A., Thales Group, TÜV Rheinland, Viavi Solutions Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)