Wireless Sensors Market Size, Share, Trends and Forecast by Product Type, Technology, End-Use, and Region, 2025-2033

Wireless Sensors Market Size and Share:

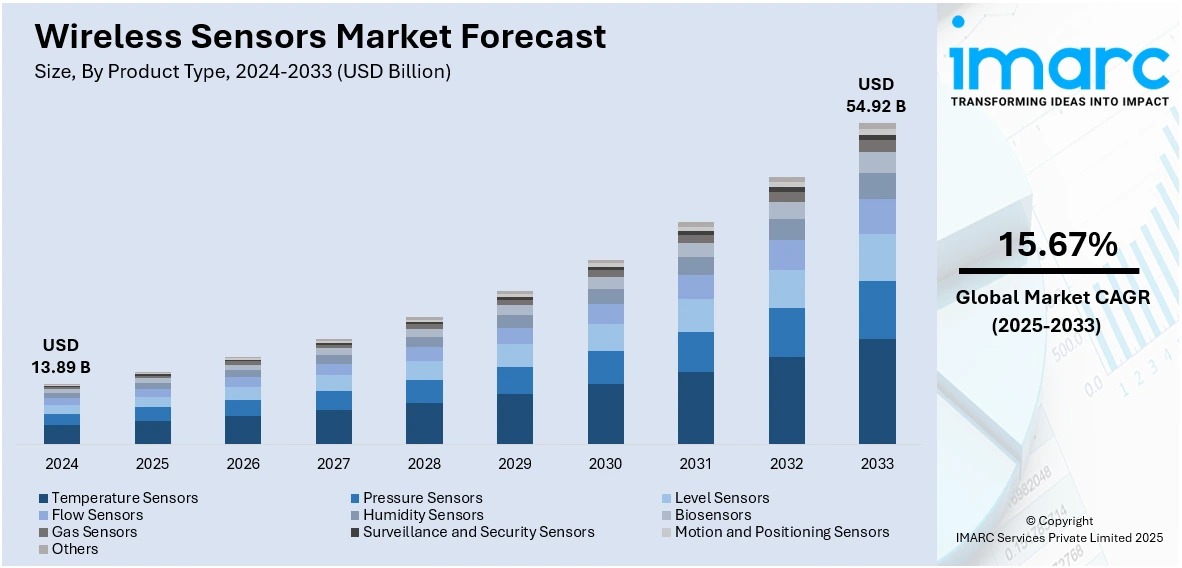

The global wireless sensors market size was valued at USD 13.89 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 54.92 Billion by 2033, exhibiting a CAGR of 15.67% from 2025-2033. North America currently dominates the market, holding a market share of 34.3% in 2024. The dominance of the region is accredited to its well-established technological infrastructure, rapid adoption of the Internet of Things (IoT) solutions, and high investments in research activities. Additionally, the growing demand for automation in sectors like healthcare, automotive, and manufacturing is bolstering the market growth. The presence of major players in the region, along with strong government initiatives to support smart technologies, contributes to the wireless sensors market share in the North American region.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.89 Billion |

|

Market Forecast in 2033

|

USD 54.92 Billion |

| Market Growth Rate (2025-2033) |

15.67%

|

The rise of the IoT is catalyzing the demand for wireless sensors. These sensors facilitate uninterrupted data gathering, timely monitoring, and effective automation across different application, such as smart residences, industrial automation, and healthcare. Apart from this, continuous technological progress, including the creation of low-energy sensors, enhanced wireless communication standards, and the miniaturization of sensors, is making wireless sensors more effective, affordable, and appropriate for various sectors. In addition, wireless sensors provide a more adaptable and economical option compared to wired sensors, lowering both installation and maintenance expenses. They can similarly be effortlessly expanded to accommodate the growing demands of extensive systems.

The United States is an essential part of the market, propelled by the continuing shift towards automation in its manufacturing industry. Wireless sensors are crucial for predictive maintenance, quality assurance, and real-time surveillance, enhancing operational efficiency and minimizing downtime. Additionally, the increasing deployment of sophisticated wireless sensor technologies, which provides long-range, energy-efficient capabilities, is a crucial element propelling the market. These sensors enhance energy efficiency, deliver strong performance, and allow for straightforward integration, making them perfect for uses like building management systems (BMS) and different industrial monitoring requirements. In 2024, Enless Wireless introduced its LoRaWAN US915 product line for the US and North American markets. Created for BMS applications, the sensors provided extended-range, energy-efficient performance while supporting temperature, humidity, carbon dioxide (CO2), and other metrics. They ensured seamless integration, durability, and energy-saving performance.

Wireless Sensors Market Trends:

Rapid Advancements in Technology

Recent advancements in sensor technology, wireless communication, and miniaturization are significantly improving the functions and uses of wireless sensors. For example, in 2022, Honeywell launched a groundbreaking sustainability initiative aimed at monitoring and optimizing carbon emissions. The Versatilis Signal Scout wireless Industrial Internet of Things (IIoT) leak detection sensors enabled companies to track emissions almost in real-time, helping industrial sectors meet greenhouse gas (GHG) reduction goals. Moreover, the rapid fusion of cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) with sensor systems is bolstering the market growth. As an illustration, STMicroelectronics launched its third-generation micro-electro-mechanical systems (MEMS) sensors in February 2022, offering improved performance for consumer mobile devices, smart industries, healthcare, and retail.

Growing Demand for Smart Homes and Buildings

The rising demand for smart homes and buildings is a crucial factor impelling the wireless sensors market growth. In alignment with this, both individuals and businesses are increasingly aimed at improving energy efficiency, security, and overall convenience, leading to the rising demand for smart systems that feature wireless sensors. According to industry reports, 18% of Americans possess smart home security cameras, sensors, or alarms, rising from 11% in 2020. In smart homes, wireless sensors serve multiple purposes including automated lighting, climate regulation, security systems, and energy management. These sensors enable homeowners to remotely oversee and manage their living spaces through smartphones or other connected gadgets. Moreover, they are utilized in commercial structures for management systems that enhance energy utilization, oversee heating, ventilation, and air conditioning (HVAC) systems, and maintain occupant comfort.

Increasing Adoption of Industrial Automation

The growing deployment of wireless sensors in industrial automation is offering a favorable wireless sensors market outlook. Industry reports indicate that the worldwide industrial automation market is worth USD 224 Billion. Additionally, India's industrial automation sector was estimated at USD 15 Billion in 2024 and is forecasted to hit USD 29 Billion by 2029. In this context, businesses are increasingly depending on wireless sensor networks to enhance operational efficiency, minimize downtime, and boost safety. In addition, they are utilized in production to oversee machinery, track manufacturing processes, and maintain quality assurance. Besides this, wireless sensors deliver real-time information on equipment functioning, enabling predictive maintenance and reducing the chances of unforeseen failures.

Wireless Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wireless sensors market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, technology, and end-use.

Analysis by Product Type:

- Temperature Sensors

- Pressure Sensors

- Level Sensors

- Flow Sensors

- Humidity Sensors

- Biosensors

- Gas Sensors

- Surveillance and Security Sensors

- Motion and Positioning Sensors

- Others

Flow sensors stand as the largest component in 2024, holding 22.7% of the market because of their essential function in overseeing and regulating fluid and gas movement across different sectors. These sensors play a vital role in fields like water management, oil and gas, chemical processing, and HVAC systems, where accurate measurement of flow rates is essential for safety and operational effectiveness. Flow sensors facilitate instant monitoring, enabling sectors to improve resource effectiveness, minimize waste, and avert system breakdowns. Their connection with IoT systems further improves data analysis, offering actionable insights for predictive maintenance and process enhancement. The rising focus on energy efficiency and environmental sustainability is driving the need for flow sensors, especially in sectors striving to reduce waste and enhance energy use. Furthermore, progress in wireless communication technology is enhancing the versatility and affordability of flow sensors, positioning them as an optimal option for various applications.

Analysis by Technology:

- Bluetooth

- Wi-Fi and WLAN

- Zigbee

- WirelessHART

- RFID

- EnOcean

- Others

RFID represents the largest segment, as it enables efficient, contactless data transfer over extended distances. RFID technology is becoming essential in sectors like logistics, inventory control, retail, and healthcare, where immediate tracking and data gathering are crucial. RFID systems facilitate effortless monitoring of goods, assets, and people, leading to lower operational expenses and improved visibility in the supply chain. Its minimal upkeep, robustness, and non-direct visibility features render RFID a compelling choice relative to other wireless technologies. The growing need for asset tracking, intelligent shelves, and inventory management solutions is further boosting RFID usage. In healthcare, RFID enhances patient safety by allowing precise monitoring of medical devices and medications. These advantages make RFID a favored option for numerous sectors pursuing efficiency and dependability. Furthermore, the wireless sensors market forecast shows continued growth, driven by the increasing adoption of RFID technology across various industries.

Analysis by End-Use:

- Industrial

- Medical

- Energy

- Defense

- Agriculture

- Office and Residential

- Others

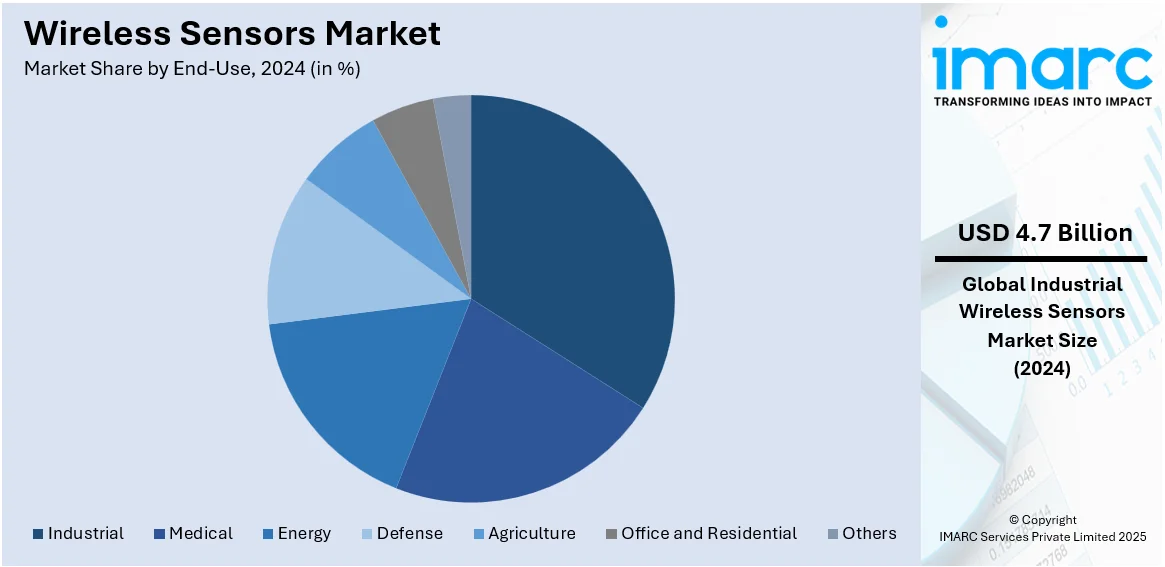

Industrial leads the market with 33.5% of market share in 2024 due to the rising need for automation, real-time monitoring, and predictive maintenance. Manufacturing industries are quickly embracing wireless sensor technologies to streamline operations, minimize downtime, and improve efficiency. These sensors are essential for tracking factors like temperature, humidity, pressure, and vibration in real-time, enabling improved management of production processes. Wireless sensors facilitate predictive maintenance, allowing companies to detect possible equipment failures before they happen, thereby decreasing expensive repairs and unexpected downtime. Moreover, the increasing trend of Industry 4.0, which highlights interconnected smart factories and IoT-based solutions, is a crucial factor propelling the use of wireless sensors in industrial settings. Additionally, these sensors offer flexibility in both installation and scalability, making them suitable for intricate industrial settings where wired systems are impractical or too expensive.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, North America held the largest market share of 34.3% because of the presence of a strong technological framework that facilitates the extensive use of cutting-edge wireless sensor technologies. The existence of significant market players in the United States and Canada, along with considerable investments in research operations, promotes innovation and speeds up market expansion. Furthermore, North America exhibits a strong connection to the IoT, which stimulates the need for wireless sensors across multiple applications, such as smart homes, industrial automation, healthcare, and automotive industries. The growing emphasis on automation and real-time data tracking, coupled with the need for wireless sensors in predictive maintenance, environmental oversight, and remote sensing, strengthens North America's leading role in the global wireless sensors market. For instance, in 2024, GroGuru launched a fully integrated wireless underground soil sensor device for ongoing root zone observation of yearly field crops. Developed in partnership with AquaCheck, the probe featured a 10-year battery life and simplified installation. It integrated with GroGuru® InSites, an AI-powered platform providing precise irrigation guidance.

Key Regional Takeaways:

United States Wireless Sensors Market Analysis

In North America, the market portion held by the United States was 88.30%, fueled by the increasing adoption of Industrial Internet of Things (IIoT) technologies that facilitate predictive maintenance and instantaneous equipment diagnostics in manufacturing settings. In accordance with this, the advancement of low-energy wireless protocols, such as Bluetooth Low Energy (BLE) and Zigbee, which improve sensor capabilities and compatibility, is strengthening the market growth. The growing use of contactless sensing solutions in remote patient monitoring and medical diagnostics is positively influencing the market. Moreover, the growth of smart agriculture, which incorporates wireless soil and climate sensors for precision farming techniques, is enhancing market momentum. USDA data indicates that the use of precision technology in smart agriculture in the United States increased by 133% from 2016 to 2023, with GPS guidance systems implemented on more than 72% of corn and soybean fields. Furthermore, the increasing incorporation of wireless sensors in building automation for energy-efficient HVAC and occupancy-driven lighting systems is boosting the market demand. In a similar manner, advantageous defense modernization efforts utilizing wireless environmental monitoring and surveillance systems are aiding in continuous product deployment. Additionally, new miniaturization trends facilitating the integration of compact sensors into mobile devices and consumer electronics are broadening market opportunities.

Europe Wireless Sensors Market Analysis

The European market is seeing expansion owing to the rise of smart manufacturing efforts within Industry 5.0, promoting the uptake of real-time monitoring and automation. In line with this, a greater focus on carbon neutrality and energy efficiency is driving the adoption of wireless energy monitoring systems in commercial structures and industrial facilities. Additionally, the extensive installation of smart meters throughout EU countries, improving integration in utility and infrastructure management, is supporting the market growth. The expanding electric vehicle (EV) industry, bolstered by strict emission regulations, is speeding up the adoption of the product. As per ACEA, battery-EV sales in the EU increased by 23.9% in the first quarter of 2025, totaling 412,997 units, which accounted for 15.2% of the entire EU market share. Additionally, the continuous advancement of smart cities through wireless traffic, pollution, and noise sensors is upgrading urban infrastructure and enhancing the market demand. Besides this, continual progress in NB-IoT and 5G networks facilitating high-efficiency, low-latency sensor applications is increasing the market attractiveness.

Asia Pacific Wireless Sensors Market Analysis

The wireless sensors market in the Asia Pacific region is driven by swift digital transformation in manufacturing industries throughout China, Japan, and South Korea, fostering the adoption of smart factories and real-time process tracking. The Ministry of Electronics & IT reports that India's digital economy accounted for 11.74% of GDP in 2022–23, totaling INR 31.64 Lakh Crore (USD 402 Billion). It is almost five times as productive as the rest of the economy. Moreover, the increase in telehealth adoption and the heightened need for wearable health devices are boosting the usage of small wireless biosensors. Furthermore, multiple extensive smart city projects in India, Singapore, and Australia, incorporating wireless environmental and infrastructure sensors, are improving urban effectiveness and increasing market demand. Additionally, the rising use of wireless sensors in precision agriculture tasks, including irrigation management and soil assessment, is promoting sustainable farming methods and strengthening the market growth. In addition, the growing user transition to connected home ecosystems, which include wireless sensors for motion, temperature, and air quality, is driving adoption in residential settings.

Latin America Wireless Sensors Market Analysis

In Latin America, the market is progressing attributed to the growing adoption of smart grid systems designed to enhance energy efficiency and update utility networks. In 2024, Enel declared a USD 3.7 Billion investment in Brazil (2024–2026), allocating USD 2.9 Billion for enhancements to the smart grid. The strategy focuses on enhancing grid resilience, expanding renewable energy, and growing the workforce to improve service reliability and assist Brazil's energy transition. Moreover, the growth of mining and oil & gas activities in nations, such as Brazil and Chile, is driving the need for wireless sensors that allow for real-time tracking in remote and unsafe settings. Besides this, the increase in cold chain logistics for pharmaceuticals and perishable items is speeding up the use of wireless temperature and humidity sensors to maintain supply chain integrity. Additionally, the increased regional emphasis on smart agriculture, which encourages sensor-driven monitoring of soil moisture and climate conditions, is bolstering the market growth.

Middle East and Africa Wireless Sensors Market Analysis

The growth of smart utility projects, such as water and electricity metering systems in urban areas of the UAE and Saudi Arabia, greatly propels the wireless sensors market in the Middle East and Africa. In late 2024, the Dubai Electricity and Water Authority (Dewa) invested USD 2 billion in smart grid initiatives, whereas Oman and Kuwait aim to deploy 1.2 million and 500,000 smart meters, respectively, in 2025. Furthermore, expanding infrastructure development in the area boosts the integration of wireless structural health monitoring systems for bridges and tall buildings, thus improving market attractiveness. Additionally, the growing use of wireless sensors in oil and gas exploration for detecting pressure, temperature, and gas leaks is enhancing operational safety. Besides this, the increasing need for smart irrigation systems is encouraging the use of sensors in dry farming areas, which is generating profitable market prospects.

Competitive Landscape:

The top wireless sensor firms are undertaking strategic actions to sustain their competitive advantage and strengthen the market growth. They are putting resources into research operations to innovate and advance their sensor technologies by aiming to boost accuracy, energy efficiency, and compatibility with new technologies. Furthermore, numerous players are enhancing their market presence via strategic alliances, mergers, and acquisitions to widen their technological abilities and geographic expansion. Additionally, they are working on eco-friendly sensors and solutions that promote energy efficiency and environmental oversight. In 2025, Johnson Controls launched the NSW8000 wireless sensor for Metasys BAS and FX controllers. It enables real-time temperature, humidity, and occupancy monitoring, with optional CO2 sensing. The sensor features wireless mesh connectivity, long battery life, and minimal installation impact.

The report provides a comprehensive analysis of the competitive landscape in the wireless sensors market with detailed profiles of all major companies, including:

- ABB Ltd

- STMicroelectronics

- Texas Instruments Incorporated

- Freescale Semiconductors Inc

- Rockwell Automation Inc.

- Emerson Electric Co

- Honeywell International Inc.

- Schneider Electric SA

- Endress+Hauser SA

- Yokogawa Electric Corporation

- Siemens AG

- General Electric

Latest News and Developments:

- March 2025: The Sumitomo Chemical Group has purchased HUCOM Wireless from South Korea to strengthen its film antenna operations. The Group intends to combine HUCOM's wireless module capabilities with its own sensor-driven film antenna technology via Dongwoo Fine-Chem, enhancing future IoT and Beyond 5G communication solutions for fast, transparent device integration.

- February 2025: Aranet introduced three new wireless sensors: Slab Weight, EC & pH, and Horticulture Drainage, improving its greenhouse irrigation monitoring system. Combined with the WET150 soil sensor and Aranet Cloud, these tools enable real-time, wireless management of fertigation, irrigation, and drainage, enhancing plant health, nutrient efficiency, and water usage.

- February 2025: Greatech introduced Sensoco Loomair Solar, a solar-powered, wireless CO₂ sensor designed for intelligent buildings. Incorporating Epishine’s indoor solar cells and e-peas’ power management IC, it is compatible with Mioty, LoRa, Sigfox, and Wireless M-Bus protocols, providing a sustainable, maintenance-free IoT solution that enables multi-connectivity and effective indoor energy harvesting.

- January 2025: CTC launched the WS200 Series ConnectSens wireless sensors, providing single-axis dynamic vibration signal measurement along with temperature output. Boasting a 1,200 ft range, Bluetooth Low Energy 5.2, and a battery lifespan of up to four years, these IP67-rated sensors facilitate dependable remote industrial condition monitoring and predictive maintenance.

Wireless Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Temperature Sensors, Pressure Sensors, Level Sensors, Flow Sensors, Humidity Sensors, Biosensors, Gas Sensors, Surveillance and Security Sensors, Motion and Positioning Sensors, Others |

| Technologies Covered | Bluetooth, Wi-Fi and WLAN, Zigbee, WirelessHART, RFID, EnOcean, Others |

| End-Uses Covered | Industrial, Medical, Energy, Defense, Agriculture, Office and Residential, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB Ltd, STMicroelectronics, Texas Instruments Incorporated, Freescale Semiconductors Inc, Rockwell Automation Inc., Emerson Electric Co, Honeywell International Inc., Schneider Electric SA, Endress+Hauser SA, Yokogawa Electric Corporation, Siemens AG, General Electric, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wireless sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wireless sensors market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wireless sensors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wireless sensors market was valued at USD 13.89 Billion in 2024.

The wireless sensors market is projected to exhibit a CAGR of 15.67% during 2025-2033, reaching a value of USD 54.92 Billion by 2033.

The wireless sensors market is expanding attributed to various factors, such as the increasing adoption of IoT technologies, demand for real-time data monitoring, the growing need for energy-efficient solutions, advancements in wireless communication, and rising applications in industries like healthcare, manufacturing, and smart homes.

North America currently dominates the wireless sensors market, accounting for a share of 34.3%. The dominance of the region is because of its advanced technological infrastructure, high adoption of IoT and automation, strong presence of key players, significant investments in research operations, and increasing demand for wireless sensor applications across industries such as healthcare, automotive, and manufacturing.

Some of the major players in the wireless sensors market include ABB Ltd, STMicroelectronics, Texas Instruments Incorporated, Freescale Semiconductors Inc, Rockwell Automation Inc., Emerson Electric Co, Honeywell International Inc., Schneider Electric SA, Endress+Hauser SA, Yokogawa Electric Corporation, Siemens AG, General Electric, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)