Wireless POS Terminals Market Size, Share, Trends and Forecast by Type, Component, Technology, Industry, and Region, 2025-2033

Wireless POS Terminals Market Size and Share:

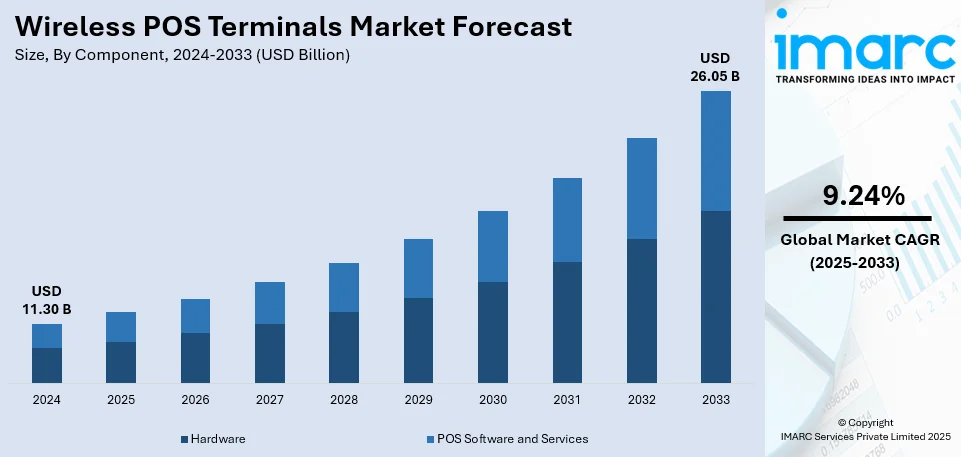

The global wireless POS terminals market size was valued at USD 11.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.05 Billion by 2033, exhibiting a CAGR of 9.24% from 2025-2033. North America currently dominates the market, holding a market share of over 35.9% in 2024. The ongoing expansion of small and medium enterprises (SMEs), growing adoption of contactless payments, rapid expansion of retail and hospitality sectors, and the recent advancements in cloud-based POS solutions are some of the major factors boosting the wireless POS terminals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.30 Billion |

|

Market Forecast in 2033

|

USD 26.05 Billion |

| Market Growth Rate (2025-2033) | 9.24% |

The expansion of small and medium enterprises (SMEs) significantly propels the global wireless POS terminals market growth. As of February 2025, the Udyam Registration Portal recorded over 5.84 million micro-enterprises, 737,411 small enterprises, and 69,334 medium enterprises, reflecting the sector's substantial scale. The surge in SMEs has led to a heightened demand for efficient transaction processing solutions. Wireless POS terminals offer SMEs advantages such as mobility, cost-effectiveness, and streamlined operations, making them an attractive choice. Government initiatives have further facilitated this adoption. This supportive environment encourages SMEs to integrate advanced technologies like wireless POS systems, thereby enhancing their operational efficiency and contributing to the expansion of the global wireless POS terminals market share.

Several main factors are driving the US wireless POS terminals market demand. A significant contributor is the increasing consumer preference for contactless payments. According to the Federal Reserve Payments Study, general-purpose card payments surpassed 153.3 billion transactions worth $9.76 trillion in 2022, up 6.0% in volume and 10.5% in value from the previous year. Notably, in-person payments constituted 63.8% of these transactions, with 19.7% utilizing contactless methods. The expansion of the retail sector also plays a crucial role. Retail and food services sales in December 2024 totaled $729.2 billion, up 0.4% from the previous month and 3.9% from December 2023, according to the US Census Bureau. This growth underscores the escalating demand for efficient transaction processing solutions, prompting retailers to adopt advanced wireless POS systems to enhance customer experience and streamline operations.

Wireless POS Terminals Market Trends:

Growing Adoption of Contactless Payments

The growing demand for fast and secure transactions among consumers is driving the adoption of contactless payment technologies, like mobile wallets, NFC-enabled cards, and QR code-based payments. Businesses are integrating these solutions to enhance customer experience and reduce transaction times, making wireless POS terminals an essential component of modern payment infrastructure. An industrial survey conducted with over 200 global CXOs in the fintech and payments sector reveals that 27% of companies currently provide contactless payment options, while 36% intend to adopt them in the coming year. In June 2023, payabl., a leading FinTech company, launched a new point-of-sale (POS) solution that allows businesses to process payments for both online and offline transactions through a single terminal. This innovation enhances omnichannel payment services, allowing seamless in-person purchases at retail locations while streamlining payment processing across multiple sales channels. As businesses continue to prioritize convenience and efficiency, the demand for wireless POS terminals is expected to rise, further driving market growth.

Expansion of Retail and Hospitality Sectors

The rapidly expanding retail, e-commerce, and hospitality industries across the world require the implementation of flexible and mobile payment solutions. The availability of wireless POS terminals provides restaurant owners, hoteliers, and retail shops with easy, frictionless transactions and thereby improve their efficiency of operation as well as satisfaction level for their customers. According to IBEF, India's tourism and hospitality sector will generate revenue of more than USD 59 billion by 2028. This growth is driving the implementation of advanced payment systems, such as wireless POS terminals, to meet the growing demand for domestic and international travel. As businesses, in turn, focus on offering convenience and digital transformation, the wireless POS solution demand is forecasted to increase, thus propelling further market growth.

Advancements in Cloud-Based POS Solutions

The emergence of cloud technology has changed the face of the wireless POS terminal market as it allows for real-time data tracking, remote management, and easy integration with multiple payment platforms. Cloud-connected POS systems help businesses streamline their operations, manage inventory efficiently, and analyze sales trends in real time, thereby leading to improved decision-making and enhanced customer service. Visa introduced the Visa Acceptance Cloud (VAC) in January 2022, a groundbreaking cloud-based payment technology designed to transform any device into a payment terminal connected to the cloud. The innovation enables acquirers, payment service providers, POS makers, and IoT participants to transition from hardware-embedded payment processing to an easy-to-use "cloud" approach. Such advancements are driving the widespread adoption of wireless POS terminals, and with flexibility, security, and efficiency also projected to increase their businesses, this is seen to further fuel the growth of the market.

Wireless POS Terminals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wireless POS terminals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, technology, and industry.

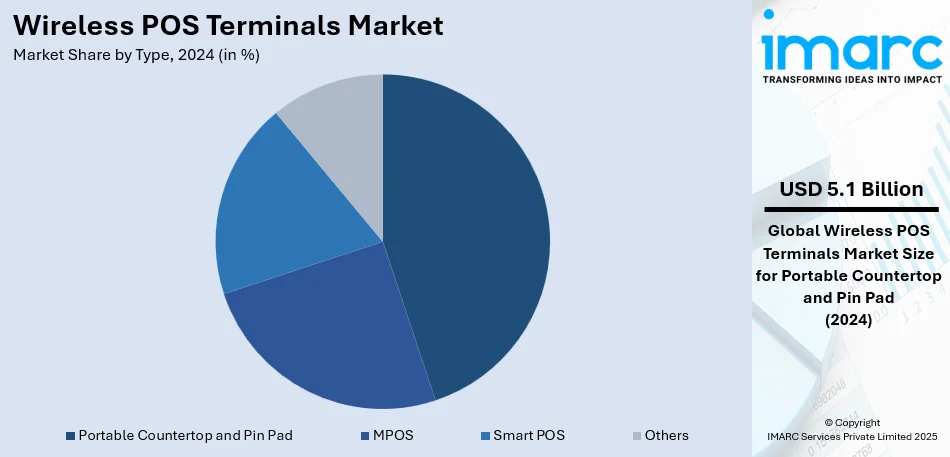

Analysis by Type:

- Portable Countertop and Pin Pad

- MPOS

- Smart POS

- Others

As per the global wireless POS terminals market outlook, portable countertop and PIN pad devices accounted for around 44.8%. The products have gained preference as they are sleek in design, user-friendly, and highly acceptable in many types of retail. These can easily be taken anywhere by the merchants, so there is not much waiting time from the customer, which can ultimately enhance the level of service. Secure PIN entry pads are integrated to ensure compliance with payment security standards, thereby increasing consumer confidence. The cost-effectiveness and ease of deployment of these terminals make them highly adopted, especially by small and medium-sized enterprises that require reliable payment solutions without significant infrastructure investments. The portable countertop and PIN pad devices are expected to continue their dominant position in the market as demand for flexible and mobile payment options continues to rise.

Analysis by Component:

- Hardware

- POS Software and Services

According to the latest wireless POS terminals market forecast, the hardware component segment commands the majority share, comprising approximately 64.8% of the market. This dominance is attributed to the essential role hardware plays in transaction processing, encompassing devices such as payment terminals, barcode scanners, and receipt printers. The increasing need for robust and durable hardware solutions that can withstand high transaction volumes in sectors like retail and hospitality contributes to this substantial market share. Additionally, advancements in hardware technology, including the development of sleeker and more efficient devices, have spurred upgrades and replacements, further driving the market growth. As businesses continue to prioritize secure and efficient transaction processing, the hardware segment is poised to retain its leading position in the wireless POS terminals market.

Analysis by Technology:

- NFC Terminal

- Non-NFC Terminal

The near field communication (NFC) terminals are at a prominent position in the wireless POS terminals market. NFC technology facilitates contactless payments, allowing customers to make transactions quickly by merely tapping their payment cards or mobile devices near the terminal. Consumer preference for contactless payment methods, which has been driven by the need for hygienic transaction processes, has made NFC-enabled terminals very popular. Benefits accruing to companies include faster execution of transactions along with improved customers' satisfaction on account of much reduced waiting period and better comfort in shopping processes. As usage of digital wallet and mobile transaction is going high, the scope for NFC devices is expected in the future years as well.

Analysis by Industry:

- Retail

- Hospitality

- Healthcare

- Transportation

- Sports and Entertainment

- Others

The retail industry is the largest sector using wireless POS terminals, accounting for around 38.9% of the market share. Retailers use these systems to streamline operations, manage inventory in real-time, and improve customer experiences through fast and flexible payment options. The ability to process transactions anywhere within the store allows for improved customer service and reduced checkout lines. Moreover, integration of wireless POS systems with customer relationship management (CRM) enables retailers to collect valuable consumer data, thus allowing them to develop specific marketing campaigns based on the insights. As the retail industry continues to transform with omnichannel strategies and personalized shopping experiences, dependence on the more advanced wireless POS terminals is expected to increase, further solidifying the sector's leading market position.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Geographically, North America holds the largest share in the wireless POS terminals market, accounting for approximately 35.9%. This supremacy is fueled by the region's sophisticated technological infrastructure, high acceptance rates of innovative payment methods, and a strong presence of major market competitors. The widespread use of credit and debit cards, along with a growing preference for contactless payments, has propelled the demand for wireless POS terminals. Furthermore, supportive government measures promoting cashless transactions and the rapid expansion of the e-commerce sector help to drive market growth in this region. As North America continues to lead in payment technology advancements and consumer adoption of digital payment methods, it is expected to maintain its significant market share in the wireless POS terminals industry.

Key Regional Takeaways:

United States Wireless POS Terminals Market Analysis

The United States wireless POS terminals market is expanding rapidly due to the rapidly expanding e-commerce and digital transactions. According to the U.S. Census Bureau, total e-commerce sales for 2021 reached USD 870.8 billion, up by 14.2% from 2020. This represents the increasing preference of consumers towards online and cashless transactions, resulting in their growing demand for wireless POS terminals for convenient and secure transactions.

More and more, retailers, restaurants, and service providers are going mobile and using cloud-based POS systems to drive greater customer experiences and operational efficiencies. Wireless POS terminals enable instant, real-time payment processing and inventory management along with omnichannel transaction capabilities. It becomes a necessary tool for businesses adopting the digital economy. The growth in e-commerce will continue, as consumers increasingly expect faster and more secure payment. This trend accelerates the adoption of wireless POS solutions and provides a basis for sustained expansion for the United States wireless POS market, driven by technological advancements and evolving consumer behavior.

Europe Wireless POS Terminals Market Analysis

The rapid adoption of contactless payments is a major driver for the growth of the wireless POS terminals market in Europe. Over 75% of in-store Visa payments across the region are now contactless, reflecting a strong consumer preference for faster and more convenient transactions, as per reports. In several European countries, the share of Visa transactions made via contactless payments has more than doubled year-on-year. Additionally, many of Europe’s largest economies have experienced at least a 20% increase in contactless transactions over the past year, according to 2020 industry reports.

This trend is fueled by widespread merchant adoption, advancements in payment technology, and regulatory support for contactless limits. The COVID-19 pandemic further accelerated this shift, as businesses and consumers sought safer, touch-free payment solutions. Retailers, hospitality providers, and service businesses are rapidly deploying wireless POS terminals to accommodate growing demand. As contactless payments continue to expand, the wireless POS terminals market in Europe is poised for sustained growth.

Asia Pacific Wireless POS Terminals Market Analysis

Digital payment systems, particularly Unified Payments Interface (UPI), are among the most important growth drivers for the Asia Pacific region's wireless POS terminals market. In FY22, the transaction value through UPI reached nearly 86% of India's GDP, showing its absolute dominance in the digital payment landscape, as per reports. At the end of 2023, total transaction volume under the UPI from the NIC was reached at 83.75 billion, showing the speedy expansion of cashless transactions in the region.

Currently, this boom in digital payments through UPI and other mobile payment solutions is changing the retail and service sectors, making it possible for companies to opt for wireless POS terminals that offer not only easier, safe, but also very efficient transactions. The increasing preference for digital payments by consumers in countries such as India, China, and Southeast Asia will increase demand for wireless POS terminals. The growth of contactless and mobile payments, coupled with government initiatives to promote digital financial inclusion, will continue to fuel market expansion in the Asia Pacific region.

Latin America Wireless POS Terminals Market Analysis

One important driver for the growth of the wireless POS terminals market in Latin America is the rising demand for credit and debit cards. As per a Fiserv study conducted in 2021, 28% people in Brazil prefer credit and debit cards as their mode of payment, followed by 22% PIX, 11% digital wallets, 9% barcode payments, and 6% cash. This high reliance on card-based transactions is therefore a huge opportunity for businesses to adopt wireless POS terminals for efficient, secure, and smooth payment.

Digital wallets and mobile payments are fast taking the world, and the retailer and service provider are now spending money on wireless POS terminals supporting a range of payment options like contactless payment. Other factors include growth in the digital payment platforms like PIX and increased customer confidence in card-based and digital transactions. Ongoing efforts for cashless payment and digital inclusion in Latin America will further fuel the growth of the wireless POS terminals market in the region.

Middle East and Africa Wireless POS Terminals Market Analysis

Wireless POS terminals market is witnessing strong growth in the MEA region mainly due to a high level of mobile penetration coupled with digital payments. The total number of unique mobile subscribers reached 400 million in the MENA region as of 2020, thereby accounting for nearly 65% of the population, GSMA reports. A large and pervasive mobile network usage has therefore resulted in newer payment systems in terms of contactless and mobile-based payments. These have enhanced demand for wireless POS terminals further.

One of the notable developments in the region is the acquisition of POSRocket by Foodics, a Saudi-based restaurant technology provider, in January 2022. This acquisition enabled Foodics customers to integrate payments, capital spending, and infrastructure management within a single ecosystem, providing seamless digital transaction solutions. With increasing use of mobile payments among businesses and consumers, as well as advancements in POS technologies, the need for wireless POS terminals in the MEA region will continue to increase due to increasing adoption of digital payment.

Competitive Landscape:

Leading players in the wireless POS terminals market are actively innovating to strengthen their market presence and meet evolving consumer demands. They are focusing on technological advancements by integrating AI-driven analytics, cloud-based solutions, and enhanced security features such as tokenization and biometric authentication. Many companies are expanding their NFC-enabled and mobile POS (mPOS) solutions to cater to the rising demand for contactless payments. To increase their global footprint, major players are engaging in strategic partnerships and acquisitions, collaborating with fintech firms, payment processors, and retailers. They are also investing in multi-currency and cross-border payment capabilities to facilitate seamless international transactions. Additionally, subscription-based and Software-as-a-Service (SaaS) models are gaining traction, offering businesses cost-effective and scalable POS solutions. Security remains a top priority, with companies ensuring compliance with EMV, PCI DSS, and GDPR regulations to protect consumer data. They are also focusing on energy-efficient hardware and sustainability initiatives to meet regulatory standards and corporate social responsibility goals.

The report provides a comprehensive analysis of the competitive landscape in the wireless POS terminals market with detailed profiles of all major companies, including:

- Ingenico

- Verifone

- First Data

- PAX Global Technology

- NCR Corporation

- Diebold Nixdorf

- BBPOS

- Elavon

- Castles Technology

- Winpos

- Bitel

- Cegid Group

- Squirrel Systems

- Newland Payment Technology

- Citixsys Americas

- Izettle

- Revel Systems

- ShopKeep

- TouchBistro Inc.

- Vend

Latest News and Developments:

- July 2024: Scheidt & Bachmann collaborated with ChargePoint to present the first OCPI-compliant payment terminal under the SIQMA PowerPay brand. The innovative solution accelerates payments at electric vehicle charging stations while offering the highest possible security due to PCI compliance under the latest standards of Open Charge Point Interface.

- June 2024: Leading global digital payment company WSPN has just announced a strategic partnership with Singapore-based regulated exchange DigiFT, which has a focus on on-chain RWA. According to the officials, this would boost the implementation of stablecoin applications and amplify Web3-based payment and investment solutions worldwide.

- May 2024: Taoping Inc. unveiled an enhanced AI-powered smart terminal that uses AIGC and is fully compatible with the intelligent cloud platform offered by the company, thereby augmenting its technology.

- Feb 2023: Ingenico announced a partnership with Splitit, which provides white-label, BNPL in-store purchase solutions that allow customers to make seamless, one-tap installment payments at checkout.

Wireless POS Terminals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable Countertop and Pin Pad, MPOS, Smart POS, Others |

| Components Covered | Hardware, POS Software and Services |

| Technologies Covered | NFC Terminal, Non-NFC Terminal |

| Industries Covered | Retail, Hospitality, Healthcare, Transportation, Sports and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ingenico, Verifone, First Data, PAX Global Technology, NCR Corporation, Diebold Nixdorf, BBPOS, Elavon, Castles Technology, Winpos, Bitel, Cegid Group, Squirrel Systems, Newland Payment Technology, Citixsys Americas, Izettle, Revel Systems, ShopKeep, TouchBistro Inc., Vend, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wireless POS terminals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wireless POS terminals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wireless POS terminals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wireless POS terminals market was valued at USD 11.30 Billion in 2024.

IMARC estimates the wireless POS terminals market to exhibit a CAGR of 9.24% during 2025-2033, reaching USD 26.05 Billion by 2033.

The ongoing expansion of small and medium enterprises (SMEs), growing adoption of contactless payments, rapid expansion of retail and hospitality sectors, and the recent advancements in cloud-based POS solutions are some of the major factors boosting the wireless POS terminals market share.

North America currently dominates the market, driven by the region's advanced technological infrastructure, high adoption rates of innovative payment solutions, and a strong presence of key market players.

Some of the major players in the wireless POS terminals market include Ingenico, Verifone, First Data, PAX Global Technology, NCR Corporation, Diebold Nixdorf, BBPOS, Elavon, Castles Technology, Winpos, Bitel, Cegid Group, Squirrel Systems, Newland Payment Technology, Citixsys Americas, Izettle, Revel Systems, ShopKeep, TouchBistro Inc., Vend, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)