Wind Turbine Components Market Size, Share, Trends and Forecast by Component, Wind Turbine Type, Wind Farm Type, and Region, 2025-2033

Wind Turbine Components Market Size and Share:

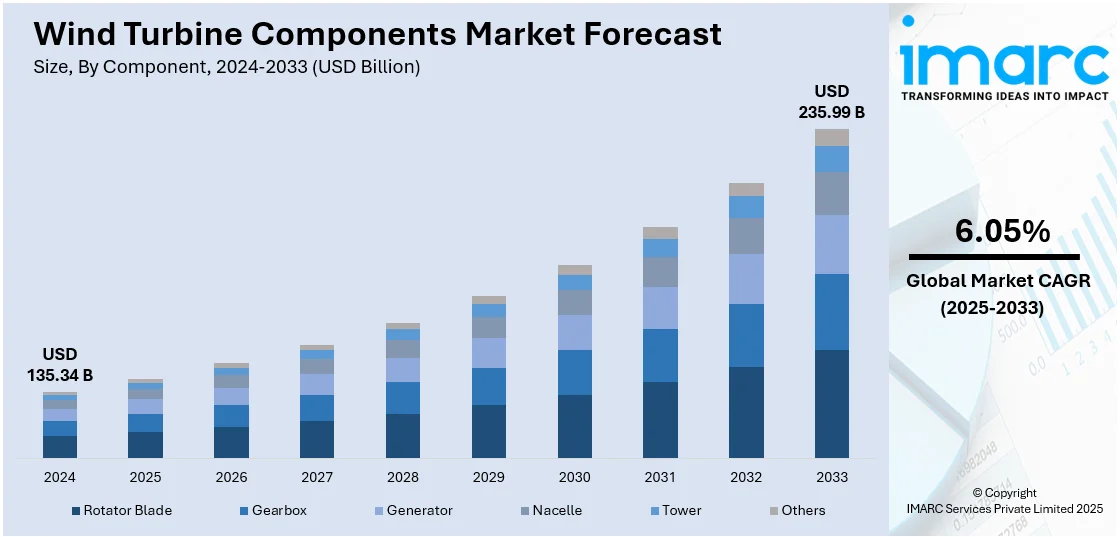

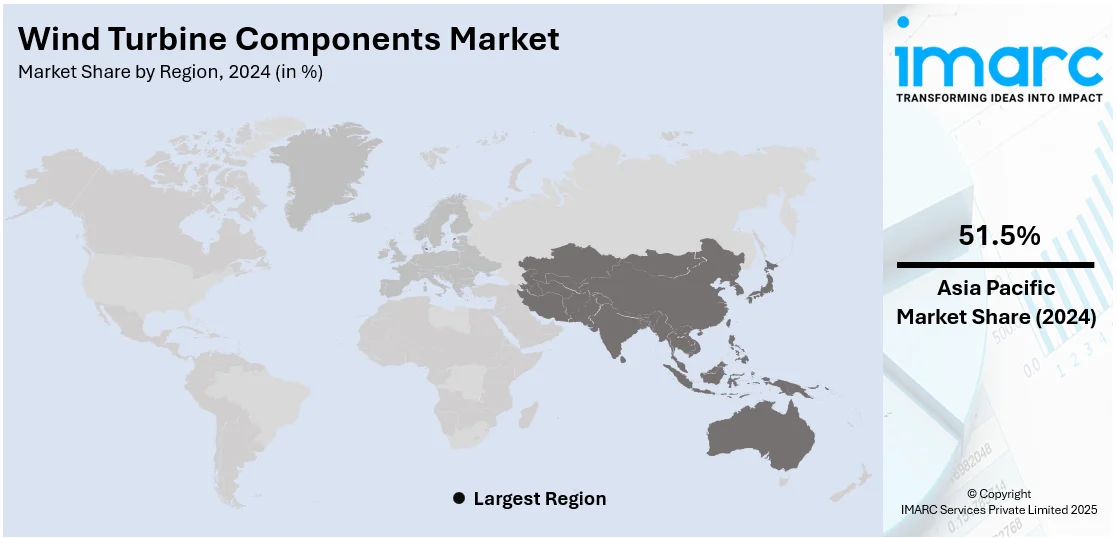

The global wind turbine components market size was valued at USD 135.34 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 235.99 Billion by 2033, exhibiting a CAGR of 6.05% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 51.5% in 2024. The wind turbine components market share is driven by the growing need to meet international climate goals and reduce reliance on fossil fuels and rapid technological progress enhancing the efficiency and operational capabilities of wind turbine.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 135.34 Billion |

|

Market Forecast in 2033

|

USD 235.99 Billion |

| Market Growth Rate 2025-2033 | 6.05% |

The market is witnessing strong growth due to the worldwide transition toward renewable energy and higher investment in wind power infrastructure. Governments around the world are supporting policies and subsidies to encourage the adoption of clean energy, which is driving the installation of wind farms. This increase in installations is creating a need for turbine components like blades, nacelles, gearboxes, generators, and towers. Technological advances are also positively influencing the market, with innovations bringing larger and more efficient turbines that can produce higher power outputs. Offshore wind power is also becoming a major growth area, as it has higher efficiency and lower land-use restrictions, further driving the component demand.

The United States wind turbine market is driven by several factors. The Inflation Reduction Act and tax credits for production are establishing a positive regulatory environment, encouraging both onshore and offshore wind development. Both are catalyzing the demand for major components like blades, hubs, towers, and gearboxes. The requirement is also driven by the growth in offshore wind capacity along the East and West Coasts, needing specialized and durable turbine components. Technological advancements, such as the development of taller towers and longer blades, are boosting turbine efficiency and facilitating deployment in low-wind-speed areas. Furthermore, an increasing emphasis on domestic manufacturing and supply chain resilience is promoting localized production of parts, minimizing dependency on imports. In 2024, Vestas was awarded a 270 MW order to equip an unspecified wind project in the US. The order comprises 60 V163-4.5 MW turbines, Vestas' newest high-capacity factor turbine and the project has been developed by Steelhead Americas, Vestas' North American development business.

Wind Turbine Components Market Trends:

Increasing Demand for Renewable Energy

The rising need to meet international climate goals and reduce reliance on fossil fuels is driving the demand for renewable energy sources, which represents one of the key factors influencing the growth of the market across the globe. According to the data from Invest India, as of March 2024, renewable energy sources, including hydropower, have a combined installed capacity of 190.57 GW. This rise is driven by the growing need to decrease greenhouse gas (GHG) emissions and the urgent need for energy security, making wind power a favored choice in national energy portfolios. For instance, India has set a target to reduce the carbon intensity of the nation's economy by less than 45% by the end of the decade, achieve 50% cumulative electric power installed by 2030 from renewables, and achieve net-zero carbon emissions by 2070. India aims for 500 GW of renewable energy installed capacity by 2030, which is further propelling the wind turbine market growth.

Technological Advancements in Turbine Design

Rapid technological progress enhancing the efficiency and operational capabilities of wind turbine is contributing to the growth of the market. These technological improvements not only make wind turbine components more appealing but also expand their applicability to previously unsuitable locations thereby bolstering the market growth. Further supporting this trend, the US Department of Energy's (DOE) Wind Energy Technologies Office (WETO) announced a USD 5.1 Million investment in research and technology development focused on advanced modeling and analysis for next-generation offshore wind turbine components blades. Moreover, according to the National Renewable Energy Laboratory (NREL), in a recent National Renewable Energy Laboratory (NREL) study, researchers found that technology innovations making their way into commercial markets today and in coming years could unlock 80% more economically viable wind energy capacity within the contiguous United States.

Government Incentives and Support

The rising government policies and financial incentives, including feed-in tariffs and grants across the globe are playing an essential role in accelerating the adoption of wind energy, thus influencing the market growth. Adding to this momentum, the International Energy Agency (IEA) reports that global energy investment exceeded USD 3 Trillion for the first time in 2024, with USD 2 Trillion allocated to clean energy technologies and infrastructure. Moreover, the Ministry of New and Renewable Energy is implementing the National Green Hydrogen Mission, approved by the Union Cabinet on 4th January 2023, with an outlay of rupees 19,744 crore. The overarching objective of the mission is to make India the Global Hub for the production, usage, and export of Green Hydrogen and its derivatives. This is further offering a favorable wind turbine components market outlook.

Wind Turbine Components Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wind turbine components market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, wind turbine type, and wind farm type.

Analysis by Component:

- Rotator Blade

- Gearbox

- Generator

- Nacelle

- Tower

- Others

The rotator blade stands as the largest component in 2024, holding 25.8% of the market. It is the core part of a wind turbine that absorbs wind energy and transforms it into rotational motion for generating electricity. Trends in rotator blade manufacturing concentrate on increasing the length of blades and their efficiency to yield higher energy, especially for big wind farms and offshore windfarms. More extended blades are being made, sometimes longer than 80 meters, with longer-length manufacturers relying on sophisticated composite materials such as carbon fiber and fiberglass to improve strength without added weight. Innovations in technology like modular blade designs are helping to solve transportation and installation problems, particularly in challenging terrains or offshore settings. Moreover, there is an increase in the focus on sustainability, and hence there is research on recyclable materials for blades and recycling at the end of life. These innovations combined with policy encouragement and increasing investment in renewable energy are contributing to the market growth.

Analysis by Wind Turbine Type:

- Grid Connected

- Standalone

Standalone leads the market with 69.9% of market share in 2024. Standalone wind turbines or off-grid wind systems are becoming increasingly popular in areas where grid connection is weak or non-existent. They are independent of centralized electricity grids, offering localized energy solutions for remote villages, agricultural farms, and industrial facilities. One of the major trends driving the need for standalone wind turbine is an increase in the demand for decentralized renewable energy systems, particularly in developing countries and rural areas. Technological innovations are improving the reliability and efficiency of independent systems, making them more suitable for continuous power supply. Coupling with energy storage systems, like batteries, further enhances system stability and allows for uninterrupted electricity supply during low-wind periods. Favorable government policies and incentives for rural electrification are also promoting the use of these systems. As the world's attention to sustainability grows, individual wind turbines provide a practical and environment friendly means of extending access to clean energy beyond the reach of traditional grid infrastructure.

Analysis by Wind Farm Type:

- Onshore

- Offshore

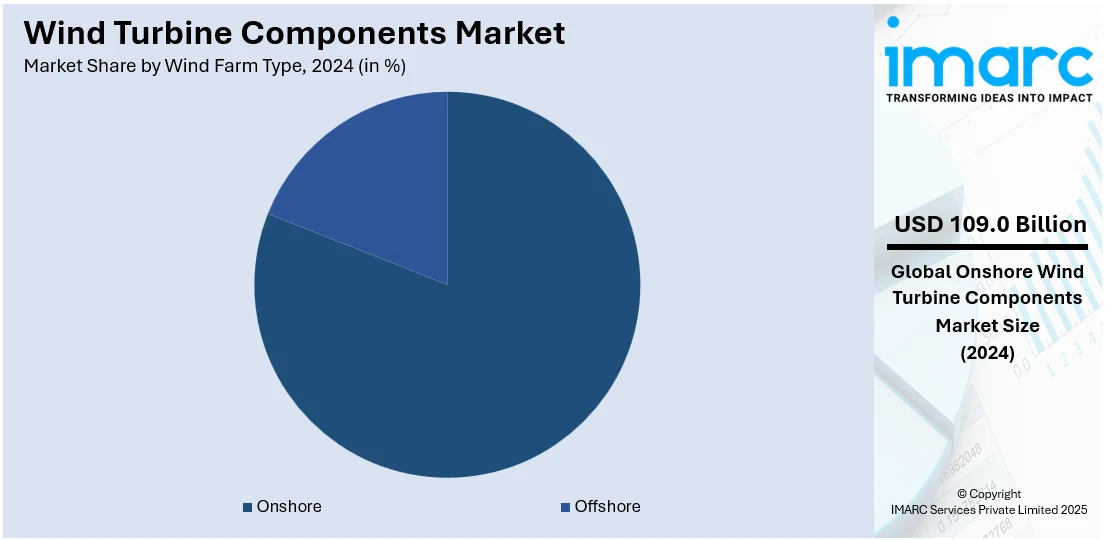

Onshore leads the market with 80.5% of market share in 2024. Onshore wind farms are the most conventional and extensively used form of wind energy system, comprising of wind turbines installed on land to harness wind power for electricity generation. These farms are generally set up in regions with stable wind patterns, including open plains, hilltops, or coastlines. One of the major benefits of onshore wind farms is their relatively lower installation and maintenance costs compared to their offshore brethren, making them a financially attractive option for large-scale renewable energy schemes. The onshore wind industry is experiencing innovations due to government stimuli, renewable energy targets, and technical improvements that enhance turbine efficiency and output. New onshore turbines have taller towers and longer rotor blades, enabling energy capture even in low-wind-speed areas. Moreover, modular construction methods and advances in logistics are optimizing the installation process.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 51.5%. Government incentives and policies like renewable purchase obligations and feed-in tariffs play a crucial role in promoting wind energy projects in the region, especially in countries like China and India. For example, in March 2023, the Government of India implemented the Production Linked Incentive (PLI) Scheme under the National Program on High-Efficiency Solar PV Modules, for achieving domestic manufacturing capacity of legal ward scale in High-Efficiency Solar PV Modules, with an outlay of rupees 24,000 crore. Rapid economic growth and urbanization in the region increase the power demand, pushing for investments in renewable energy infrastructure. For instance, in February 2024, Spain-based renewable energy company ACCIONA Energia announced that it would build a new 412 MWp photovoltaic project in the state of Rajasthan. As per the press release by the company, the project will be commissioned by 2025. This is expected to fuel the wind turbine components market forecast across the region over the coming years.

Key Regional Takeaways:

United States Wind Turbine Components Market Analysis

The United States market has consistently grown, holding a share of 87.90%, driven by supportive regulatory frameworks, federal incentives, and a growing shift toward clean energy sources. As part of a broader decarbonization strategy, the integration of renewables into the national grid has accelerated, leading to a significant rise in wind energy capacity installations. According to the International Energy Agency, investment in clean energy in the United States exceeded USD 300 Billion in 2024, underscoring the scale of national commitment to renewable power. This investment wave has amplified technological advancements, improving turbine efficiency and energy output, thereby enhancing wind power’s competitiveness in the energy mix. The market benefits from vast land availability and favorable wind conditions across diverse regions, supporting onshore and offshore projects. Continued grid modernization efforts and transmission infrastructure development are enabling broader integration of wind energy. In addition, strong participation from private and institutional investors has reinforced market momentum. Industrial and commercial sector demand for renewable power procurement further contributes to the market's expansion. As policy support and innovation continue to evolve, the US market remains dynamic and well-positioned for sustained growth in alignment with long-term energy goals.

Europe Wind Turbine Components Market Analysis

The Europe market is mature and technologically advanced, marked by a substantial installed capacity and ongoing innovation. Governmental ambitions for carbon neutrality, such as Germany’s target to achieve net greenhouse gas neutrality by 2045, with interim goals of reducing emissions by at least 65% by 2030 and 88% by 2040 compared to 1990 levels, as per the Clean Energy Wire, have driven strong investment in wind infrastructure. Both onshore and offshore installations are contributing significantly to the region’s renewable energy mix, supported by favorable policies, long-term planning, and cross-border collaboration. Technological advancements in turbine design, operational performance, and digital monitoring systems are improving efficiency and project viability. The region’s dedication to energy transition and grid decarbonization has created a supportive environment for ongoing deployments. Additionally, investments in interconnectors and smart grid technologies are enhancing distribution capabilities and grid stability. Europe’s longstanding leadership in wind energy continues to influence global best practices and deployment strategies.

Asia Pacific Wind Turbine Components Market Analysis

The Asia Pacific market is undergoing rapid expansion, propelled by rising energy demand, supportive environmental policies, and increased integration of renewable sources. Accelerating urbanization and industrialization have led to a surge in electricity consumption, prompting significant investments in wind energy infrastructure. The region’s diverse wind potential and availability of scalable land make it ideal for the widespread deployment of onshore wind farms. According to the Ministry of New and Renewable Energy, the year 2024 recorded a landmark 3.4 GW of new wind capacity, marking a 21% increase in installations over 2023. This growth reflects the region’s proactive approach to advancing its renewable energy agenda. Governments are rolling out long-term policies to encourage wind power generation, while ongoing reductions in turbine costs and improvements in capacity factors are enhancing project viability. The expansion of grid infrastructure and increased regional collaboration in clean energy initiatives are further accelerating the market’s growth trajectory.

Latin America Wind Turbine Components Market Analysis

The Latin America market is thriving due to cost competitiveness and abundant high-wind resource zones, promoting energy diversification and sustainability. Strategic initiatives and rising investments in grid infrastructure are supporting efforts to increase the share of renewable energy. According to the Brazilian National Renewable Energy (NR) plan, Brazil's PDE 2034, developed by the Ministry of Mines and Energy in collaboration with the Energy Research Company, targets a 7% reduction in energy consumption by 2034, aligning with broader regional goals for a sustainable energy transition. This strategic vision is encouraging the adoption of wind energy solutions. Technological advancements, declining capital costs, and growing investor interest in the Latin American market are enhancing project feasibility and presenting new market opportunities.

Middle East and Africa Wind Turbine Components Market Analysis

The Middle East and Africa market is expanding due to cleaner energy transitions, with key regions offering promising onshore wind development opportunities. Policy-driven initiatives and national energy strategies are encouraging the adoption of renewables, paving the way for new wind energy projects. According to the International Energy Agency, around USD 110 Billion was invested in energy across Africa in 2024, with nearly USD 70 Billion allocated to fossil fuel supply and power and the remainder directed toward clean energy technologies. This significant allocation toward renewables underscores a growing regional commitment to diversifying energy sources. Technological advancements and rising investor interest are driving market progress in wind energy, aligning with regional renewable energy ambitions for energy diversification and sustainability.

Competitive Landscape:

Industry players in the wind market are actively involved in strategic efforts to improve their position in the market and respond to the increasing demand for renewable energy. Strategic activities involve improving manufacturing capacity, entering strategic alliances, and spending on research and development to develop innovative high-performance components like high-end rotor blades, gearboxes, and generators. Businesses are also looking at supply chain localization to lower costs and import dependence, especially in emerging markets. Further, various key market players are signing long-term deals with wind farm developers to guarantee stable component demand. Smart technologies and predictive maintenance systems' integration also indicate the direction of the industry toward efficiency, reliability, and sustainable growth.

The report provides a comprehensive analysis of the competitive landscape in the wind turbine components market with detailed profiles of all major companies, including:

- CS Wind Corporation

- ENERCON Global GmbH

- GE Vernova

- Goldwind Science & Technology Co., Ltd.

- Mingyang Smart Energy Group Co., Ltd

- Nanjing High Speed Gear Manufacturing Co., Ltd.

- Siemens Gamesa

- Sinoma Science & Technology Co., Ltd

- Suzlon Energy Limited

- TPI Composites Inc.

- Vestas Wind System A/S

- ZF Friedrichshafen AG

Latest News and Developments:

- September 2024: RE Technologies GmbH and Senvion India launched a 4.2M160 wind turbine generator, their first 4 MW WTG. Designed for low-wind and harsh environments, it featured a 160m rotor, modular design, and 85% locally sourced components.

- September 2024: Envision Energy launched a 5MW onshore wind turbine for the Indian market. Unveiled at WindEnergy Hamburg 2024, the EN 182/5MW platform promised 40% more annual energy and up to 10% lower LCOE.

Wind Turbine Components Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Rotator Blade, Gearbox, Generator, Nacelle, Tower, Others |

| Wind Turbine Types Covered | Grid Connected, Standalone |

| Wind Farm Types Covered | Onshore, Offshore |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CS Wind Corporation, ENERCON Global GmbH, GE Vernova, Goldwind Science & Technology Co., Ltd., Mingyang Smart Energy Group Co., Ltd, Nanjing High Speed Gear Manufacturing Co., Ltd., Siemens Gamesa, Sinoma Science & Technology Co., Ltd, Suzlon Energy Limited, TPI Composites Inc., Vestas Wind System A/S, ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wind turbine components market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wind turbine components market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wind turbine components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wind turbine components market was valued at USD 135.34 Billion in 2024.

The wind turbine components market is projected to exhibit a CAGR of 6.05% during 2025-2033, reaching a value of USD 235.99 Billion by 2033.

The market is driven by the global push to reduce reliance on fossil fuels, meet climate targets, and rising investments in wind infrastructure. Technological advancements in turbine efficiency and supportive government policies further fuel growth.

Asia Pacific currently dominates the wind turbine components market, accounting for a share of 51.5% in 2024. This is attributed to strong government support, increasing renewable energy targets, and growing power demand across key countries like China and India.

Some of the major players in the wind turbine components market include CS Wind Corporation, ENERCON Global GmbH, GE Vernova, Goldwind Science & Technology Co., Ltd., Mingyang Smart Energy Group Co., Ltd, Nanjing High Speed Gear Manufacturing Co., Ltd., Siemens Gamesa, Sinoma Science & Technology Co., Ltd, Suzlon Energy Limited, TPI Composites Inc., Vestas Wind System A/S, ZF Friedrichshafen AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)