Wi-Fi 7 Market Size, Share, Trends and Forecast by Offering, Location Type, Application, Vertical, and Region, 2025-2033

Wi-Fi 7 Market Size and Share:

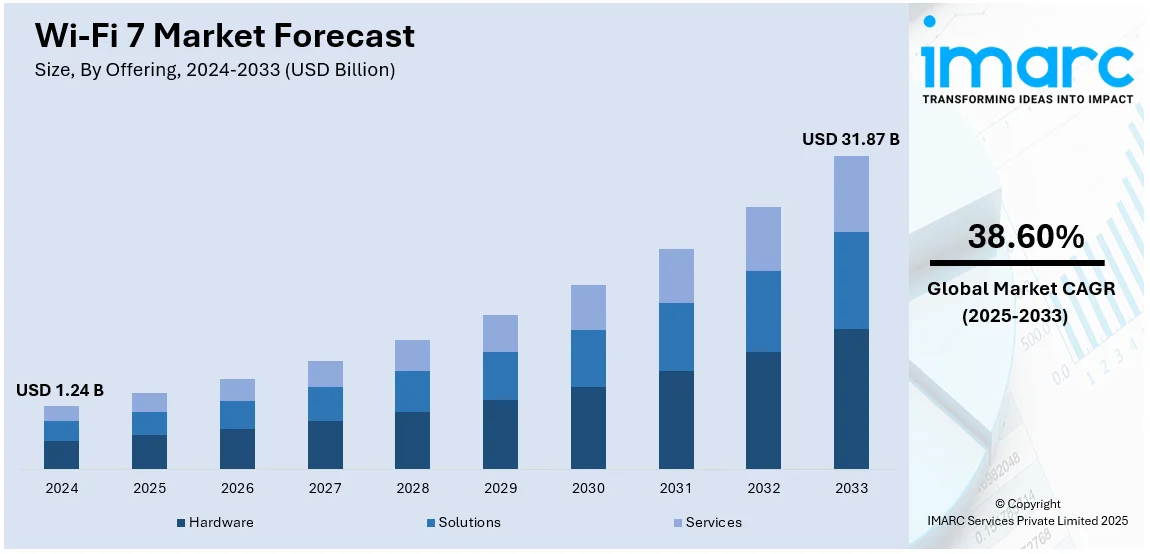

The global Wi-Fi 7 market size was valued at USD 1.24 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 31.87 Billion by 2033, exhibiting a CAGR of 38.60% from 2025-2033. North America currently dominates the market, holding a market share of over 42.5% in 2024. The global market is primarily driven by the growing need for high-speed, low-latency wireless networks to support advanced applications such as AR, VR, and cloud gaming, alongside significant advancements in telecommunications infrastructure and the need for high-performance network solutions in enterprise and consumer applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.24 Billion |

| Market Forecast in 2033 | USD 31.87 Billion |

| Market Growth Rate (2025-2033) | 38.60% |

The global market is driven by the increasing demand for ultra-fast and reliable internet connectivity to support bandwidth-intensive applications such as 4K/8K video streaming, augmented reality (AR), virtual reality (VR), and online gaming. Along with this, the growing adoption of smart devices, Internet of Things (IoT) technologies, and the proliferation of high-performance enterprise applications further fuel the Wi-Fi 7 market. Additionally, continual advancements in telecommunications infrastructure and the push for seamless integration of Wi-Fi networks with 5G are key contributors of market growth. On 12th March 2024, Dell Technologies and TAWAL signed an MoU to advance Saudi Arabia's telecommunications sector. Together, they will work to explore edge computing, Open RAN technology, and 5G innovation that can help scale networks and deploy smart solutions. Dell will support TAWAL in building infrastructure capabilities to deliver tailored industry solutions. Moreover, the growing number of enterprises seeking enhanced network efficiency and reduced latency to support mission-critical operations also bolster the demand for Wi-Fi 7 solutions, ensuring robust market expansion.

The United States stands out as a key regional market, primarily driven by the rapid digital transformation across industries, emphasizing the need for high-speed and reliable connectivity. The expansion of remote work, online education, and telehealth services is accelerating the demand for advanced wireless solutions. Besides this, the U.S. government’s initiatives to bridge the digital divide and improve broadband infrastructure further accelerate adoption. The USD 42 billion BEAD Program, launched on May 2, 2024, which is a part of President Biden’s “Investing in America” initiative, aims to provide affordable high-speed internet nationwide by addressing geographic and infrastructural challenges. States with high-cost, remote areas such as Alaska receive USD 1,377.01per-resident funding, while developed states such as California see lower allocations (USD 46.45 per resident). The program’s targeted investments seek to bridge the digital divide and expand broadband access across all regions. In addition, growing investments in smart cities, connected homes, and industrial IoT applications also drive the need for Wi-Fi 7's enhanced capabilities. Furthermore, the increasing reliance on cloud computing and edge technologies highlights the importance of seamless, high-performance wireless networks in the country.

Wi-Fi 7 Market Trends:

Integration with Emerging Technologies

Wi-Fi 7 is increasingly being integrated with emerging technologies such as artificial intelligence (AI) and machine learning (ML) to optimize network management and performance. AI-driven systems enhance resource allocation, predict network congestion, and ensure seamless connectivity in high-demand environments. Along with this, the integration of Wi-Fi 7 with edge computing and IoT ecosystems enables real-time data processing, supporting applications in smart homes, industrial automation, and healthcare. This trend underlines the market's shift toward more intelligent, self-optimizing networks, which are crucial for managing complex, multi-device environments in both consumer and enterprise settings. On 25th June 2024, TrueBusiness collaborated with HPE Aruba for Thailand's first "Private Wi-Fi as a Service" service based on Wi-Fi 7 and edge AI-powered technology. With this flexible, project-based approach, TrueBusiness enables all types of businesses to use optimal connectivity while enhancing the speed of digital transformation and smoothing the network with robust security and performance.

Adoption of Multi-Gigabit Internet Services

The transition to multi-gigabit internet services globally is accelerating the adoption of Wi-Fi 7 technology. Internet service providers (ISPs) are upgrading their infrastructure to deliver higher bandwidths, aligning with Wi-Fi 7’s capability to support speeds exceeding 30 Gbps. This trend is particularly significant in regions with widespread fiber-optic deployments. In addition, consumers and enterprises demand enhanced wireless experiences, particularly for 8K streaming, cloud gaming, and immersive virtual environments. On 21st December 2024, ASUS launched NUC 14 Pro AI, a mini-PC compact powered by Intel Core Ultra processors, dedicated to processing AI, gaming, and edge computing. With as much as 120 platform TOPS and additional features including Wi-Fi 7, Thunderbolt 4, and robust security, the device provides a high performance in a 0.6-liter chassis, thus ideal for IoT and enterprise usage. As ISPs promote multi-gigabit plans, Wi-Fi 7-enabled devices become critical to fully leveraging these services, fostering widespread technology adoption.

Growth of Enterprise-Grade Wi-Fi Solutions

The demand for enterprise-grade Wi-Fi solutions is shaping the Wi-Fi 7 market, with organizations prioritizing advanced connectivity to support hybrid work models and digital transformation strategies. Wi-Fi 7's improved network slicing and Quality of Service (QoS) capabilities allow businesses to allocate bandwidth efficiently across various applications. Moreover, industries such as healthcare, manufacturing, and retail benefit from their ultra-low latency and high throughput. Concurrently, the ability to support dense environments, such as conferences and stadiums, positions Wi-Fi 7 as a critical technology for business continuity and productivity in increasingly connected enterprise environments. On 7th October 2024, Qualcomm Technologies launched the Networking Pro A7 Elite platform, which integrates Wi-Fi 7 with an AI co-processor offering 40 TOPS of performance for advanced edge AI processing. The company says it is designed to render applications such as security, energy management, and virtual assistants better, more private, and more responsive, with a seamless experience for connected devices, including legacy systems.

Wi-Fi 7 Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Wi-Fi 7 market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, location type, application, and vertical.

Analysis by Offering:

- Hardware

- System on Chip

- Access Points

- Routers

- Others

- Solutions

- Services

The hardware component is driven by the rise of demand in advanced network infrastructure that can deliver connectivity at high speeds and at low latency. Key components of hardware are routers, access points, modems, and network interface cards, which play a huge role in creating Wi-Fi 7 networks. While designing these hardware components, manufacturers are incorporating multi-channel support, wider frequency bands, and more advanced network slicing in these devices. The penetration of smart homes, IoT devices, and connected workplaces escalates the hardware demand. Enterprises are upgrading to compatible hardware to enhance operational efficiency and meet the requirements of bandwidth-intensive applications, positioning this segment as a critical driver of market growth.

The solutions segment is witnessing significant growth as organizations increasingly seek software and cloud-based platforms to enhance Wi-Fi 7 network management. These solutions include advanced analytics tools, network optimization software, and security applications that ensure seamless connectivity and robust data protection. Cloud-based solutions are taking a prominent position, especially helping in centralizing network controls and real-time monitoring within both enterprises and service providers. As the complexity associated with IoT and high-density environments continues to increase networks, these solutions assure enhanced QoS and the traffic management features. For organizations, this segment makes it possible to tap in the maximum potential of their deployed Wi-Fi 7 infrastructures and meet dynamic requirements for connectivity.

The services segment plays a pivotal role in the market, encompassing installation, maintenance, consulting, and managed services. As organizations adopt Wi-Fi 7 technologies, they require expert guidance to deploy and optimize their networks effectively. Managed services, in particular, are gaining prominence, offering end-to-end network management solutions that reduce operational burdens for enterprises. Training and support services are also crucial for ensuring the seamless integration of Wi-Fi 7 into existing systems. Additionally, service providers are expanding their offerings to include network assessments and security audits, addressing the growing need for reliable and secure connectivity in diverse applications, from residential to industrial settings.

Analysis by Location Type:

- Indoor

- Outdoor

Outdoor leads the market as the demand for reliable, high-speed connectivity in open and large-scale environments increases. Applications such as smart city projects, outdoor public Wi-Fi hotspots, and large-scale events drive the need for advanced outdoor Wi-Fi solutions. Wi-Fi 7’s expanded range and improved interference management render it ideal for providing seamless connectivity in challenging outdoor conditions. Industries such as transportation, logistics, and agriculture benefit from outdoor Wi-Fi 7 networks for operations such as fleet management, remote monitoring, and automation. As municipalities and enterprises invest in upgrading outdoor wireless infrastructure, this segment is poised to play a pivotal role in the widespread adoption of Wi-Fi 7 technologies.

Analysis by Application:

- Immersive Technologies

- HD Video Streaming and Video Streaming

- Smart Home Devices

- IoT and Industry 4.0

- Telemedicine

- Public Wi-Fi and Dense Environments

- Others

Immersive technologies dominate the market share in 2024. The adoption of Wi-Fi 7 is revolutionizing immersive technologies such as augmented reality (AR), virtual reality (VR), and extended reality (XR). These applications demand ultra-fast connectivity and low-latency networks to deliver seamless experiences. Wi-Fi 7's multi-gigabit speeds and improved capacity render it a critical enabler for immersive gaming, virtual collaboration, and digital training platforms. Industries including education, entertainment, and healthcare are leveraging these advancements for virtual simulations and telepresence. As immersive technologies grow across consumer and enterprise markets, Wi-Fi 7 plays a pivotal role in addressing bandwidth and performance challenges, ensuring smooth and uninterrupted user experiences. All these factors contribute significantly to the growth of the segment.

Analysis by Vertical:

- Retail

- Manufacturing

- Media and Entertainment

- Healthcare and Life Sciences

- Transportation and Logistics

- Travel and Hospitality

- Education

- Residential

- Others

Media and entertainment account for the largest share in the market. The media and entertainment sector benefit from Wi-Fi 7’s capabilities to deliver high-quality streaming, real-time content creation, and seamless live broadcasting. With growing demand for 4K and 8K content, Wi-Fi 7’s multi-gigabit speeds ensure smooth playback and upload experiences. Its low latency is essential for live streaming, gaming, and virtual events, thereby propelling the segment growth. Additionally, creative professionals leverage its high bandwidth for fast file sharing and collaboration on cloud-based platforms. As consumer expectations for immersive and high-definition content grow, Wi-Fi 7 is poised to be a vital tool for meeting the changing connectivity needs of the media and entertainment industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America holds a leading share of 42.5% in the market and is driven by the region’s early adoption of advanced technologies and robust telecommunications infrastructure. High demand for ultra-fast internet across industries, including healthcare, education, and media, supports market growth. The widespread adoption of smart devices, IoT, and AR/VR applications further enhances demand for Wi-Fi 7. The U.S. and Canada, in particular, are investing in upgrading broadband infrastructure and rolling out next-generation networks. Enterprises in the region seek Wi-Fi 7 for enhanced connectivity to support hybrid work environments and digital transformation initiatives. These factors, combined with strong consumer demand for high-speed home networks, position North America as a dominant market.

Key Regional Takeaways:

United States Wi-Fi 7 Market Analysis

In 2024, the United States represented 92.5% of the North America Wi-Fi 7 market, driven by rapid advancements in digital infrastructure and the increasing demand for high-speed, low-latency connectivity. The widespread adoption of IoT devices, smart homes, and enterprise-level digital transformation initiatives are fueling the need for robust wireless networks. Wi-Fi 7’s ability to support bandwidth-intensive applications including 8K streaming, AR/VR, and remote work solutions positions are a critical technology for businesses and consumers. The U.S. government’s focus on bridging the digital divide through broadband expansion initiatives further supports market growth. Additionally, the country’s strong technology ecosystem, encompassing leading manufacturers and service providers, ensures rapid adoption of Wi-Fi 7 solutions across industries. On 19th September 2024, Juniper Networks, leading the industry in secure AI-driven networking, expanded its AI-Native Networking Platform with new Wi-Fi 7 access points, and high-power campus EX switches. These new platforms, based on Mist ^{TM} AI and Cloud-Native Services, present the best throughput, least latency, extended range, and more reliability for a seamless, sustainable, and affordable migration to Wi-Fi 7 technology.

Europe Wi-Fi 7 Market Analysis

The market in Europe is poised to grow significantly, driven by increasing digital transformation efforts across industries and robust government initiatives supporting advanced telecommunications infrastructure. On 17th April 2024, five leading technology firms, including Ericsson, IBM, Intel, Nokia, and Vodafone, urged policymakers to bolster Europe's digital competitiveness and prioritize it for the incoming European Commission. Ahead of the D9+ digital ministers' meeting in Dublin, the companies emphasized the need for a robust Digital Single Market, increased investment in digital connectivity, and reduced regulatory burdens to support emerging technologies such as AI, quantum computing, and 5G. Key countries such as Germany, the UK, and France are at the forefront, adopting Wi-Fi 7 to enhance connectivity in smart cities, manufacturing, healthcare, and residential applications. The rise in remote work, online education, and demand for high-quality streaming accelerates the need for high-speed and reliable wireless networks. Europe’s focus on sustainable and energy-efficient technologies also aligns with Wi-Fi 7’s optimized performance.

Asia Pacific Wi-Fi 7 Market Analysis

The Asia Pacific market is witnessing rapid growth, driven by the region’s expanding digital ecosystem and large-scale adoption of smart technologies. Countries including China, Japan, South Korea, and India are leading the charge with investments in telecommunications infrastructure to support next-generation connectivity. The rise of smart cities, industrial automation, and IoT applications in the region fuels demand for Wi-Fi 7’s high-speed, low-latency capabilities. Under the National Industrial Corridor Development Programme (NICDP), India approved 12 industrial smart cities on August 29, 2024. These towns would get a planned investment of INR 286.02 billion (USD 3.41 Billion). It has sanctioned three railway projects across four states to enhance logistics besides a hydro-power initiative meant to upgrade power infrastructure in the Northeast region. Additionally, the increasing popularity of online education, digital entertainment, and remote work drives adoption in residential and enterprise sectors. With government-backed initiatives and private sector investments accelerating digital transformation, Asia Pacific is emerging as a critical hub for Wi-Fi 7 innovation and deployment across diverse industries.

Latin America Wi-Fi 7 Market Analysis

The Latin American region is witnessing growth in Wi-Fi 7 due to the digital transformation and modernization of the telecommunications infrastructure in the region. Brazil, Mexico, and Argentina lead the demand for advanced wireless solutions to support smart city projects, e-learning, and telemedicine.. The growing deployment of IoT devices and e-commerce activities also increase the requirement for reliable, high-speed connectivity. Challenges such as uneven broadband access continue to exist, but government and private sector investments are rapidly upgrading infrastructure. Wi-Fi 7 is poised to be a critical technology in urban and rural connectivity projects given it can support bandwidth-intensive applications. As Latin America continues its march towards digitalization, the adoption of Wi-Fi 7 is expected to increase exponentially across all sectors.

Middle East and Africa Wi-Fi 7 Market Analysis

Wi-Fi 7 adoption is growing in the Middle East and Africa (MEA) as countries invest in digital transformation and advanced connectivity solutions. Among the leading adopters in GCC countries, such as Saudi Arabia and the UAE, are the smart city projects and massive infrastructure development programs. A significant increase in IoT applications, digital education, and telehealth services is further fueling the demand for reliable, high-speed wireless networks. On 11th December 2024, Laria Education Group, a global leader in international education systems, announced it has collaborated with Bahwan CyberTek (BCT) to accelerate its digital transformation in education across the Middle East. Under this collaboration, BCT will help Faria improve its K12 solutions by enabling BCT's regional expertise in a locally tailored, culturally aligned product and providing local support, thereby expanding its capabilities and reach. While there are areas with limited broadband infrastructure, governments and leading global tech providers are constantly working on programs that ease the connection between this region and the world. Highly advanced features, including high bandwidth and low latency, support numerous application scenarios in both urban and industrial environments, are resulting in widespread roll-out of Wi-Fi 7 across MEA.

Competitive Landscape:

The market competitive landscape is highly innovative due to the efforts made by leading players to innovate further advanced technologies that could be deployed for gaining competitive advantages. A lot of research and development (R&D) is being employed to enable their Wi-Fi 7 offerings faster, with greater capacity, and reliable. They are offering leading-edge hardware and software solutions, which are especially suited to applications in smart homes, enterprise networks, and industrial automation. Strategic partnerships and collaboration with the telecommunications providers are fast becoming common to speed the deployment of Wi-Fi 7 infrastructure. Players also are expanding their product lines with cost-effective solutions aimed at a variety of different market segments while focusing their designs on sustainability and energy efficiency in response to growing consumer and regulatory requirements.

The report provides a comprehensive analysis of the competitive landscape in the Wi-Fi 7 market with detailed profiles of all major companies, including:

- Broadcom Inc

- HFCL Limited

- Huawei Technologies Co., Ltd

- Intel Corporation

- MaxLinear

- MediaTek Inc.

- Netgear Inc.

- Qualcomm Technologies, Inc

- TP-Link India Private Limited

- ZTE Corporation

Latest News and Developments:

- October 28, 2024: Huawei became the leading vendor for Wi-Fi CERTIFIED 7 products securing 22 enterprise-class certifications for Wi-Fi 7 devices under various use case scenarios including IoT and outdoor. Innovation in WLAN technology of Huawei will continue to drive next-generation wireless networks for a better industry, from educational institutes, finance sector and intelligent manufacturing, as their leadership is reinforced during this Wi-Fi 7 epoch.

- September 11, 2024: Intel launched its first AI-powered PC platform with Wi-Fi 7, Core Ultra 200V Series. The peak speeds reached up to 5.8 Gbps. Introduced on September 3, it increases connectivity, reduces power consumption, and simplifies Wi-Fi 7 adoption. It will power more than 80 designs from leading OEMs and marks a significant milestone for Intel in its connectivity innovation.

Wi-Fi 7 Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Location Types Covered | Indoor, Outdoor |

| Applications Covered | Retail, Manufacturing, Media and Entertainment, Healthcare and Life Sciences, Transportation and Logistics, Travel and Hospitality, Education, Residential, Others |

| Verticals Covered | Retail, Manufacturing, Media and Entertainment, Healthcare and Life Sciences, Transportation and Logistics, Travel and Hospitality, Education, Residential, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc, HFCL Limited, Huawei Technologies Co., Ltd, Intel Corporation, MaxLinear, MediaTek Inc., Netgear Inc., Qualcomm Technologies, Inc, TP-Link India Private Limited, ZTE Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Wi-Fi 7 market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Wi-Fi 7 market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Wi-Fi 7 industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global Wi-Fi 7 market was valued at USD 1.24 Billion in 2024.

The global Wi-Fi 7 market is estimated to reach USD 31.87 Billion by 2033, exhibiting a CAGR of 38.60% from 2025-2033.

The global market is majorly driven by increasing demand for ultra-fast internet connectivity, support for bandwidth-heavy applications (like AR/VR, cloud gaming), the growing adoption of IoT and smart devices, and the need for improved infrastructure for seamless 5G integration and enterprise network performance.

North America currently dominates the Wi-Fi 7 market, holding a market share of over 42.5% in 2024. The dominance is driven by the region's robust technological infrastructure, high consumer adoption of advanced connectivity solutions, and the widespread presence of leading tech companies.

Some of the major players in the global Wi-Fi 7 market include Broadcom Inc, HFCL Limited, Huawei Technologies Co., Ltd, Intel Corporation, MaxLinear, MediaTek Inc., Netgear Inc., Qualcomm Technologies, Inc, TP-Link India Private Limited, and ZTE Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)