White Wine Market Size, Share, Trends and Forecast by Product Type, Body Type, Sweetness Level, Sales Channel, and Region, 2025-2033

White Wine Market Size and Share:

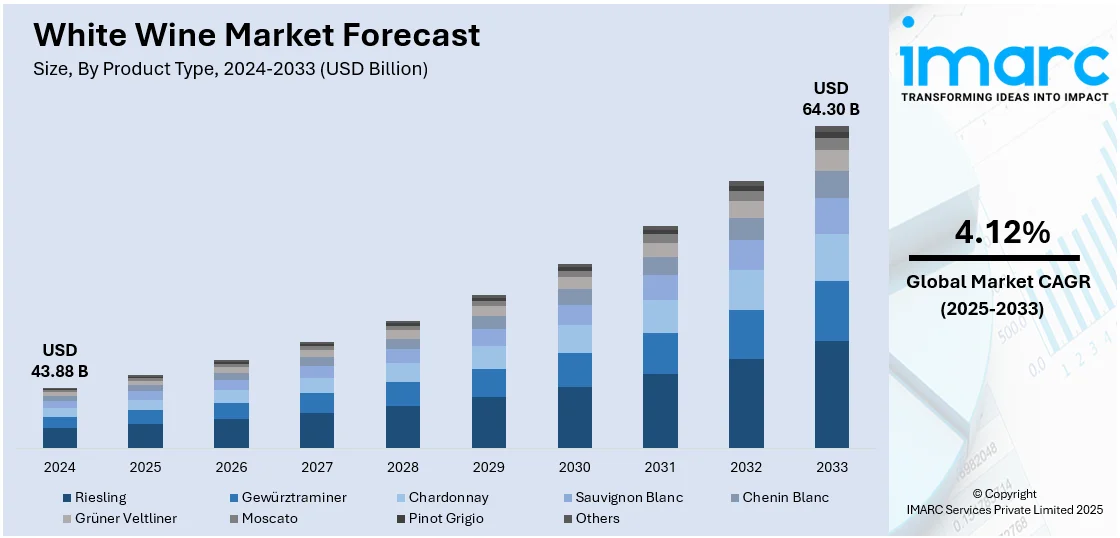

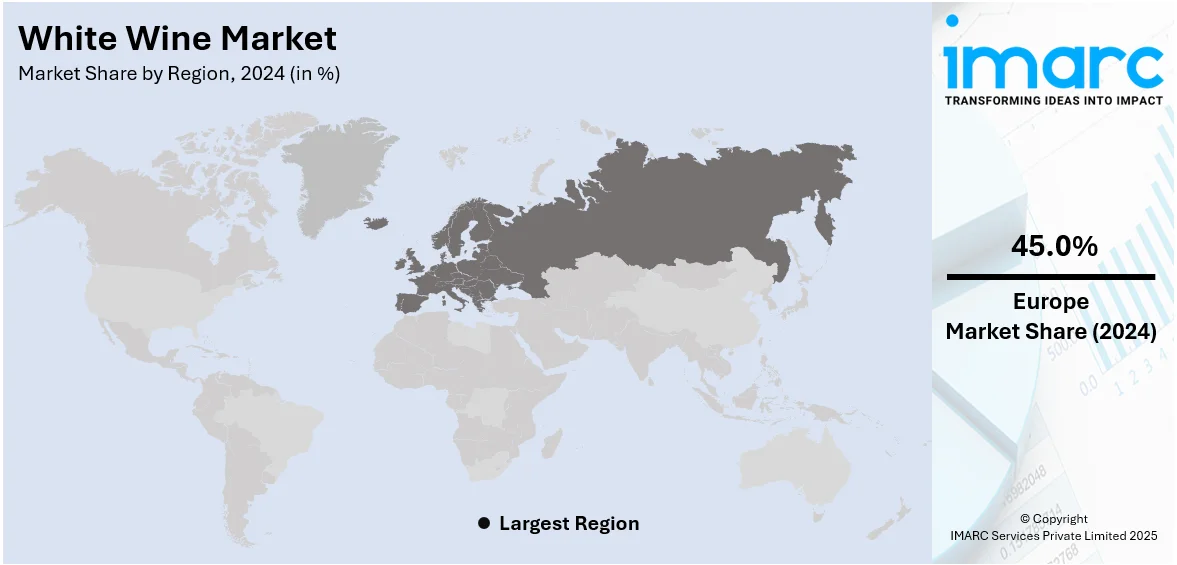

The global white wine market size was valued at USD 43.88 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 64.30 Billion by 2033, exhibiting a CAGR of 4.12% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 45.0% in 2024, driven by its rich winemaking heritage, renowned wine-producing countries, and increasing consumer demand for high-quality white wines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 43.88 Billion |

|

Market Forecast in 2033

|

USD 64.30 Billion |

| Market Growth Rate 2025-2033 | 4.12% |

One major driver of the white wine market is the increasing consumer preference for premium and organic wines. Growing awareness of quality, sustainability, and health-conscious consumption is driving demand for organic, biodynamic, and low-sulfite white wines. Consumers, particularly millennials and Gen Z, are seeking wines with transparency in sourcing and production methods. Wineries are responding by adopting sustainable viticulture practices and certifications to meet evolving expectations. Additionally, rising disposable income in emerging markets is boosting the premiumization trend, further accelerating market growth. For instance, in August 2024, Round Pond Estate began its harvest, picking Chardonnay for Blanc de Blancs and sparkling brut. The optimal brix between 18.3 and 18.7and acidity levels highlight the growing demand for premium white wines. This shift in consumer behavior is compelling winemakers to innovate and differentiate through eco-friendly production and branding.

The United States plays a significant role in the white wine market as both a leading producer and consumer. California, Oregon, and Washington are key wine-producing regions, with wineries focusing on high-quality varietals such as Chardonnay, Sauvignon Blanc, and Riesling. The country’s strong distribution networks, expanding e-commerce channels, and wine tourism contribute to market growth. Increasing consumer preference for premium, organic, and sustainable wines is driving innovation in viticulture and production. For instance, in 2024, E & J Gallo, one of the largest wine companies in the U.S. and also globally, contributed 3% of the world’s annual wine supply, equivalent to 35 billion bottles. Additionally, the U.S. is a major exporter of white wines, particularly to Canada, Europe, and Asia, strengthening its position as a global market influencer and fostering international trade partnerships.

White Wine Market Trends:

Premiumization and the Shift Toward High-Quality Wines

The ongoing trend in the white wine market is moving ever-forward into the realm of premium and high-quality products. With shifting consumer preferences favors products in a higher price category that emphasize quality, origin story, and craftsmanship. Consumers, especially millennials and Gen Z, are willing to pay for wines that are different in character, flavor, and authenticity. The 2023 National Survey on Drug Use and Health (NSDUH) stated that 16.9 Million young adults ages 18 to 25 (49.6% in this age group) reported drinking alcohol. This has spurred wineries in innovation of boutique, small-batch production of organic and biodynamic wines required for the increasing demand for sustainability and environmental responsibility. Premium wines also appeal to consumers willing to pay for the healthier natural alternatives that mostly come packaged in eco-friendly packaging. Last but certainly not the least, collectors and connoisseurs in the ever-more-sophisticated global wine-drinking populace strengthen this trend.

Sustainability and Organic Wine Production

The demand for organic, biodynamic, and sustainably produced white wines is ever-increasing. Environmental and ethical consumerism is a growing subject among consumers, and its effects have been felt in the wine industry. The adoption of sustainable viticulture, which involves organic farming, minimal intervention winemaking, and green packaging, is gaining ground. For example, in June 2024, Bonterra Organic Estates revamped its label as organic wine sales surged by 27.9%, reflecting a shift in consumer preferences toward sustainable brands that align with their values. Emphasizing biodiversity, the redesigned label features wildlife illustrations. As a leader in Regenerative Organic Certified® winemaking, Bonterra continues to drive climate-smart farming and environmental stewardship, strengthening its presence in the expanding organic wine market. In addition, many wineries obtain organic and biodynamic certifications to enhance transparency and build consumer trust, aligning with global trends toward sustainability and wellness-focused consumption. Organic white wines, in particular, attract health-conscious consumers seeking products that complement their eco-friendly values and wellness-oriented lifestyles

E-commerce and Direct-to-Consumer Sales

The rise of e-commerce and direct-to-consumer (DTC) sales channels is another key trend reshaping the white wine market. The convenience of online shopping and the ability to access a diverse range of wines from the comfort of home have made e-commerce a dominant force in the industry. Additionally, wineries are increasingly focusing on DTC sales, offering consumers personalized experiences, subscription models, and exclusive releases. The COVID-19 pandemic accelerated the adoption of online wine sales, and many consumers have continued to embrace the convenience and variety available through digital platforms. As e-commerce grows, wineries are investing in digital marketing, social media presence, and enhanced logistics to meet the growing demand for home delivery and online wine shopping experiences.Top of FormBottom of Form According to the U.S. Bureau of Labor Statistics, from 2022 to 2023, average consumer spending increased 5.9%, compared with 9.0% from 2021 to 2022. Moreover, the e commerce sector is now a USD 6 Trillion industry and will reach the USD 8 trillion mark by 2027, according to reports.

White Wine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global white wine market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, body type, sweetness level, and sales channel.

Analysis by Product Type:

- Riesling

- Gewürztraminer

- Chardonnay

- Sauvignon Blanc

- Chenin Blanc

- Grüner Veltliner

- Moscato

- Pinot Grigio

- Others

Riesling stand as the largest product type in 2024. This classical varietal is favored for its aromatic permutations, refreshing acidity, and versatility, catering to the generic tastes of consumers. This variety originated in Germany, Austria, and certain regions of France, where it gained a strong following. Today, it enjoys global popularity due to its exceptional versatility with food. Riesling strikes a perfect balance between sweetness and acidity and is produced in both dry and sweet styles, both widely favored. Growing consumer demand for high-quality white wines continues to rise, reinforcing Riesling’s dominant position in the market and solidifying its status as a leading choice among wine enthusiasts.

Analysis by Body Type:

- Light Bodied

- Medium Bodied

- Full-Bodied

Light-bodied white wines like Sauvignon Blanc and Pinot Grigio have started to leave their marks on the marketplace as they are well known for their refreshing personalities. Lower alcohol and higher acidity have made them a target to consumers with a bent toward health and easy drinking. These wines are now deliberately targeting a light fare pairing as well as being served in casual settings and summer markets.

Most medium-bodied wines are those such as Chardonnay, Chenin Blanc, etc. They are balanced wines; thus, cater to customers with their rich but crisp profile. These wines are now attracting customers who like complexity in flavors without being overly syrupy. This also gives them versatility in pairing with light dishes and with richer ones, so naturally, a staple in restaurant and cellar alike, thus reaching a wide array of consumers.

Full-bodied white wines such as oaked Chardonnay display a certain richness and texture and most importantly, depth of flavor. These broad wines will serve as attraction to congregate enthusiasts who want such bold and complex wines that could be paired with heavy food. This is indeed showing a growing trend in the higher end of premium wine. Given that it is a preference for consumers in relation to indulgent escapade and flavorful experience, this will therefore raise the bar of high-end sales.

Analysis by Sweetness Level:

- Dry

- Semi-Sweet

- Sweet

The dry white wine kinds of Sauvignon Blanc and Chardonnay find themselves at the forefront of a versatile offer because of the special ability these wines hold in food pairing. The category has direct appeal to consumers looking for very crisp and clean flavors with practically no sweetness. This offers a dry segment surging through health-conscious consumers and people in search of a more refined balanced experience in an array of settings from formal dining to casual hang-outs.

The semi-sweet whites with Riesling and Muscat serve the market by filling the void between dry and sweet preference. Their balance of sweetness has an appeal to a wide range of consumers, especially the ones just entering the wine-world or searching for something more approachable. The demand for easy-drinking, refreshing wines is further augmented by the casual and seasonal markets.

The sweet white wines like late-harvest Riesling and Sauternes serve the needs of the consumer who seeks rich and luscious flavors. These wines are fostering expansion within niche markets, especially for dessert wine lovers or special occasions. Their attraction in sweet dish pairing or enjoyed on their own is a widespread trend in fine dining, premium markets, or a gift option.

Analysis by Sales Channel:

- Modern Trade

- Grocery Store

- Convenience Stores

- E-Commerce

- Others

Modern trade leads the market in 2024. Supermarkets, hypermarkets, and big retail chains have become the foremost distribution channels offering a wide selection of white wines catering to diverse consumer preferences. The convenience of one-stop shopping that also includes an organized section for wine increases consumer confidence and sets the trend for wine consumption in retail stores. Meanwhile, premiumization of white wines has greatly benefited from modern trade, where retailers provide a carefully curated selection of high-quality wines and limited editions. These outlets also provide opportunities for in-store tasting and promotion activities that engage consumers and drive sales. Growing in the same direction is another modern trend: online grocery shopping, which has further boosted market growth by offering easy access to a wide assortment of wines.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 45.0%. The high wine culture and lengthy history of winemaking in the region are largely responsible for the stronghold it enjoys in the market today, particularly in countries like France, Italy, Spain, and Germany. With respect to some outstanding varieties of white wines, namely Chardonnay, Sauvignon Blanc, and Riesling that are well in demand around the world, these countries remain the major producers. Europe has ample wine tourism, festivals, and tasting events, which add to its market charm and subsequently draw consumers and wine lovers from all over the world. The region has also advanced in distribution systems and retail networks and has stepped into organic and sustainable wine production practices, all of which, in tandem, support Europe's leadership in the global market for white wine.

Key Regional Takeaways:

United States White Wine Market Analysis

US accounts for 82.60% share of the market in North America. Fluctuating consumer trends, the premiumization process, and wine tourism are among the most prominent factors influencing the United States White Wine Market. The demand from white wines among the millennial and Gen Z consumers has greatly increased, mainly due to the light, refreshing style of drink, an essential feature that comes with low alcohol content. Reports show in 2023 there were 72.7 Million millennials in the United States, who constituted almost 21.7% of the population. Premiumization drives by quality in the U.S. wine industry is another major driver. Clients nowadays would like to spend money on better wines made from estate-grown grapes, especially wines that support sustainability and organic farming. This attitude matches the broader trend of health-conscious and ecologically responsible consumption. Furthermore, these packagings like cans and single-serve options are giving white wine better accessibility for on-the-go occasions, helping earn their share in the market. Regions famous for wine tourism like Napa Valley, Sonoma, and the Finger Lakes have added their fare share to the whites following directly to the consumers. Tourists in these countries hunt down the local offerings of white wine, thus boosting direct-to-consumer sales. The rise of e-commerce platforms and direct shipment from wineries has helped in facilitating the access of several varieties of white wines to customers all over the US, further expanding the industry. Machineries like social media and influencer advertisement are also becoming a big factor influencing the trend of preference among wines in the state.

North America White Wine Market Analysis

The North American white wine market is experiencing steady growth, driven by increasing consumer preference for healthier alcoholic beverages and a growing interest in wine culture. The market is characterized by a wide variety of white wine options, including Chardonnay, Sauvignon Blanc, and Pinot Grigio, with a strong focus on organic and sustainable production methods. North American consumers are increasingly leaning towards lower-alcohol, low-sugar, and vegan-friendly white wines, contributing to the rise of innovative offerings from wineries. The U.S. remains the dominant market, accounting for the largest share, followed by Canada. For instance, in 2024, the U.S. wine industry, valued at over USD 107 Billion, is the largest and most dynamic globally, with more than 11,000 wineries spread across all 50 states. The market's growth is also fueled by wine tourism, digital platforms for wine sales, and the rising popularity of wine-pairing events. Competitive pricing and product diversification are key factors in capturing a broader consumer base.

Asia Pacific White Wine Market Analysis

The Asia Pacific white wine market is experiencing rapid growth due to rapid urbanization, rising disposable incomes, and a shift in cultural attitudes toward wine consumption. As per the Press Information Bureau (PIB), it is expected that by 2030, more than 40% of India's population will live in urban areas. As more middle-class consumers in countries like China, Japan, South Korea, and India embrace wine as a sophisticated lifestyle choice, white wine is gaining traction due to its mild taste and food-friendly attributes. Varieties like Riesling, Sauvignon Blanc, and Chardonnay are particularly popular, pairing well with the region’s diverse cuisines, ranging from seafood to spicy dishes. Moreover, the growing wine education initiatives across Asia Pacific are also fueling market expansion. Wine appreciation events, sommelier programs, and wine-tasting experiences are increasing consumer awareness and knowledge about white wines. This is leading to a surge in demand for both imported and locally produced white wines. Notably, countries like China and Australia have emerged as key players, with Australia’s well-established vineyards and exports contributing significantly to the regional market. Health and wellness trends are also positively influencing the white wine market in the region. Many consumers are perceiving white wine as a lighter and healthier alternative to spirits and beer. This perception, coupled with the increasing popularity of low-alcohol and organic white wine options, is broadening the product’s appeal.

Europe White Wine Market Analysis

Europe, as the birthplace of many globally renowned white wines, enjoys a robust market driven by its deep-rooted wine culture, rich heritage, and diverse production capabilities. The region’s longstanding tradition of white wine production, spanning countries like France, Italy, Germany, and Spain, continues to underpin market growth. Varietals such as Chardonnay, Sauvignon Blanc, Riesling, and Pinot Grigio are iconic and widely celebrated both domestically and internationally. A growing emphasis on sustainability and organic production is significantly influencing the European white wine market. European Union regulations and initiatives promoting eco-friendly viticulture are encouraging producers to adopt organic and biodynamic practices. These wines resonate with the region’s eco-conscious consumers, creating a strong demand for sustainable and eco-labeled white wines. In addition, the rise of wine tourism across Europe is further bolstering the market growth. Additionally, festivals and events dedicated to white wine, such as Germany’s Riesling Weeks, further promote the market growth. Another critical driver is the increasing interest in food and wine pairings, particularly in culinary capitals like Paris, Milan, and Barcelona. White wines are often preferred for their versatility, pairing effortlessly with a wide array of European dishes, ranging from seafood to cheese-based recipes. The European market is also benefiting from strong export demand, particularly to North America and Asia. Moreover, the rising number of online shoppers due to the ease of internet services is catalyzing the demand for white wine among individuals. According to the Council of the EU and the European Council, the share of e-shoppers grew from 53% in 2010 to 75% in 2023, an increase of 22 percentage points (pp) in the EU.

Latin America White Wine Market Analysis

The Latin American white wine market is expanding steadily because of growing domestic production, increasing wine tourism, and a rising preference for lighter alcoholic beverages. Countries like Chile and Argentina, known for their strong red wine heritage, are increasingly focusing on white wine varieties like Sauvignon Blanc, Chardonnay, and Torrontés, the latter being a signature Argentinian white wine. Wine tourism in regions such as Mendoza and the Casablanca Valley has played a pivotal role in promoting white wine consumption. Visitors are often seeking out local white wine offerings, contributing to both domestic sales and international exports. Additionally, younger consumers in urban areas are embracing white wine as a refreshing alternative to beer and spirits, especially in warmer climates. The growing popularity of food and wine pairings, supported by white wine’s ability to complement Latin American seafood and ceviche dishes, is further fueling market growth. Furthermore, the growing demand for white whine due to the increasing social media influence on individuals is offering a favorable market outlook. As per reports, Brazil was home to 152.4 Million social media users in January 2023.

Middle East and Africa White Wine Market Analysis

The evolving consumer preferences, increasing tourism, and a shift toward premium alcoholic beverages is impelling the market growth. In regions like South Africa, white wine production is thriving, with Chenin Blanc, Sauvignon Blanc, and Chardonnay being key varieties. South Africa’s globally recognized wine regions, such as Stellenbosch and Franschhoek, contribute significantly to domestic and export markets. Tourism is another critical driver, especially in wine-producing countries. Wine-tasting events and vineyard tours are increasing awareness and consumption of white wines among international and local visitors. In the Middle East, the growing demand for premium white wines due to the rising number of luxury hotels and restaurants is impelling the market growth. According to the IMARC Group, Saudi Arabia luxury hotel market reached USD 1.1 Billion in 2024. Moreover, the growing popularity of lighter, food-friendly beverages has positioned white wine as a preferred choice for pairing with regional cuisines, driving steady market growth in these areas.

Competitive Landscape:

The competitive landscape of the white wine market is characterized by the presence of established global wineries, regional producers, and emerging boutique vineyards. Leading companies dominate through extensive distribution networks and premium product portfolios. For instance, in December 2024, Treasury Wine Estates expanded its Brighter Future Initiative in Napa Valley, enhancing sustainability efforts in the region. TWE’s support for the Valley Stewards Fund aligns with its commitment to preserving Napa's vineyard health, vital for producing premium white wines, while focusing on fire safety and environmental resilience. Innovation in organic, biodynamic, and low-alcohol wines is intensifying competition, with producers focusing on sustainability and consumer preferences. Private-label brands and direct-to-consumer sales channels are expanding, increasing market fragmentation. Additionally, strategic mergers, acquisitions, and collaborations are reshaping the industry, while e-commerce and digital marketing strategies are enhancing brand visibility and customer engagement.

The report provides a comprehensive analysis of the competitive landscape in the white wine market with detailed profiles of all major companies, including:

- Accolade Wines

- Casella Family Brands

- Caviros Winery

- Château Lafite Rothschild

- Constellation Brands Inc.

- E & J Gallo Winery

- Grupo Peñaflor S.A.

- Marchesi Antinori Srl

- The Wine Group

- Treasury Wine Estates

- Vina Concha Y Toro

- Yantai Changyu Pioneer Wine Company Limited

Latest News and Developments:

- December 2024: Sèchey, a pioneer in the alternative adult beverage sector, revealed the nationwide debut of its latest offering, an individual serving sparkling white wine with alcohol removed, sold only at Target stores. Providing a special 200 ml edition gives guests an elegant, inclusive choice for a non-alcoholic festive drink, and the attached bottle tag is perfect for gifts.

- October 2024: Château Pichon Baron released new white wine. The wine was produced using whole bunch pressing and subsequently fermented in barrels that are one year old. It was not subjected to malolactic fermentation and was matured for nine months in oak with frequent stirring of the lees.

- September 2024: Bordeaux estate Château d’Issan unveiled its new white wine blend that will be released in June 2025, with the inaugural harvest of a 1.7-hectare plot of Viognier, Roussanne, Marsanne, and Rolle (Vermentino). The plot sits in the centre of Château d’Issan‘s walled vineyard and was planted in 2021 following detailed soil analysis of some of the vineyards during the Covid pandemic. This revealed a small plot of predominantly clay topsoils and limestone subsoils, ideal for white wines.

- August 2024: Tesco launched a white wine made from a new disease resistant hybrid grape variety. Tesco Finest Floreal has been developed in response to the increasing challenges posed by climate change.

White Wine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Riesling, Gewürztraminer, Chardonnay, Sauvignon Blanc, Chenin Blanc, Grüner Veltliner, Moscato, Pinot Grigio, Others |

| Body Types Covered | Light Bodied, Medium Bodied, Full-Bodied |

| Sweetness Levels Covered | Dry, Semi-Sweet, Sweet |

| Sales Channels Covered | Modern Trade, Grocery Store, Convenience Stores, E-Commerce, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accolade Wines, Casella Family Brands, Caviros Winery, Château Lafite Rothschild, Constellation Brands Inc., E & J Gallo Winery, Grupo Peñaflor S.A., Marchesi Antinori Srl, The Wine Group, Treasury Wine Estates, Vina Concha Y Toro and Yantai Changyu Pioneer Wine Company Limited. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the white wine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global white wine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the white wine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The white wine market was valued at USD 43.88 Billion in 2024.

IMARC estimates the white wine market to reach USD 64.30 Billion by 2033, exhibiting a CAGR of 4.12% during 2025-2033.

Key factors driving the white wine market include growing consumer demand for premium and organic wines, increasing health-consciousness, and rising interest in sustainable and eco-friendly production. Additionally, the popularity of wine tourism, the expanding middle class in emerging markets, and innovations in wine production are also contributing to market growth.

Europe currently dominates the market with 45.0% share, driven by its historical wine production, renowned regions like France, Italy, and Spain, and a growing preference for high-quality, sustainable wines. Additionally, the rising trend of wine tourism, along with strong export capabilities, further supports Europe’s dominance in the white wine market.

Some of the major players in the white wine market include Accolade Wines, Casella Family Brands, Caviros Winery, Château Lafite Rothschild, Constellation Brands Inc., E & J Gallo Winery, Grupo Peñaflor S.A., Marchesi Antinori Srl, The Wine Group, Treasury Wine Estates, Vina Concha Y Toro, Yantai Changyu Pioneer Wine Company Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)