White Biotechnology Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

White Biotechnology Market Size and Share:

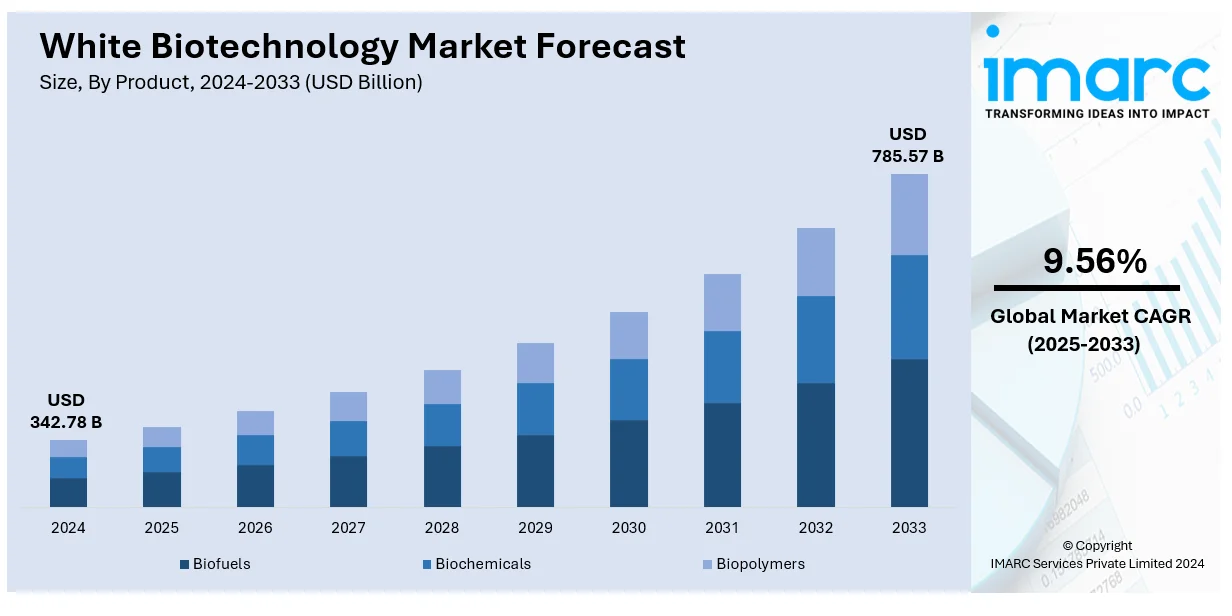

The global white biotechnology market size was valued at USD 342.78 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 785.57 Billion by 2033, exhibiting a CAGR of 9.56% from 2025-2033. North America currently dominates the market, holding a white biotechnology market share of over 44.7% in 2024. The market is driven by robust investments in research and development (R&D), strong industrial infrastructure, and growing demand for sustainable bio-based products across diverse industries in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 342.78 Billion |

| Market Forecast in 2033 | USD 785.57 Billion |

| Market Growth Rate (2025-2033) | 9.56% |

The global white biotechnology market is driven by the rising demand for sustainable and eco-friendly solutions aimed at minimizing carbon footprints in industrial processes. In addition, the rising adoption of bio-based products in sectors like chemicals, pharmaceuticals, and food is supporting the market growth. Moreover, continuous advancements in genetic engineering and enzyme technologies drive innovation, improving production efficiency, and thus fueling the market demand. Besides this, government policies promoting renewable resources and bioeconomy initiatives provide significant support, creating a positive white biotechnology market outlook. For example, China set out a development focus on biotechnology and bio-economy in its 14th Five-Year Plan (2021-2025) to raise the ratio of bio-based products to industrial added value. This strategic focus will lead to the further development of the white biotechnology industry. Also, the growing concerns over fossil fuel depletion and volatility encourage the shift to biofuels and biomaterials, boosting the market expansion. Furthermore, consumer preference for biodegradable and non-toxic products promotes the adoption of white biotechnology across diverse applications, catalyzing the market growth.

The United States holds a share of 86.90% in the white biotechnology market. The demand in the region is primarily driven by its strong biotechnology sector, backed by substantial private and public investments in innovation. For instance, in December 2023, the US Interagency Working Group on Data for the Bioeconomy issued a report describing a vision for improving data support for the bioeconomy, to provide high-quality biological data to support advances in the field. In line with this, the increasing focus on circular economy practices encourages the adoption of bio-based production methods, which is driving the market demand. Concurrently, the growing emphasis on reducing industrial waste and emissions aligns with the nation's sustainability goals, contributing to the market expansion. Besides this, a well-established infrastructure for research, coupled with collaboration between academic institutions and industries, promotes development, fostering the market growth. Furthermore, the expanding applications of bio-based chemicals in healthcare and agriculture are aiding the market demand. Apart from this, favorable trade policies and regulatory frameworks support the scaling of bio-industrial solutions across domestic and international markets, thereby propelling the white biotechnology market growth.

White Biotechnology Market Trends:

Rise in environmental concerns and sustainability

The intensifying global environmental issues, such as climate change and the depletion of natural resources, are acting as the primary growth drivers for the white biotechnology market. As the industries accept their contribution towards such issues, the demand for green products increases. White biotechnology provides a revolutionary approach by using biological systems in the production of biobased products to decrease the carbon impact and utilize waste. Businesses embrace these green options for compliance with sustainability initiatives, besides improving their environmental conservation and corporate responsibility initiatives. The ever-increasing concerns of environmental degradation by conventional industrial processes have placed white biotechnology as the go-to solution for industries seeking to effect change in their production processes for environmentally friendly operations. According to reports, air pollution is said to cause about seven million deaths globally each year, as estimated by the World Health Organization (WHO). It also data reveals that 9 out of 10 people breathe air polluted with unsafe levels of pollutants.

Rising government regulations and incentives

Governments worldwide are enacting policies and providing incentives that promote the adoption of bio-based technologies. Policies that have been put in place that encourage the use of renewable resources and bio-based products make it possible for industries to adopt white biotechnology. According to the International Energy Agency (IEA), global renewable energy (RE) consumption in power, heating, and transport is expected to rise nearly 60 percent over the 2024-2030 period. Moreover, the integration of R&D development of sustainable solutions is promoted through the use of incentives such as tax credits, grants, and subsidies. Furthermore, by associating their policies with these regulations and incentives, industries not only get to conform to them but also get to unlock possibilities for development. The governmental support for the white biotechnology market guarantees a legal environment for the stable development of the industry and the shift to the use of environmentally friendly products.

Escalating consumer demand for green products

The shifting consumer behavior has made them selective when purchasing goods and services. Consumers are increasingly seeking products that are sustainably made with minimal environmental impact. In addition to this, industries are transforming their focus to white biotechnology as a way of producing environmentally friendly products. Consumers desire more information about the processes and materials used, demanding the manufacturers to use bio-based processes, to meet these demands. The incorporation of white biotechnology also enables industries to provide products that capture the green consciences of consumers to create a better brand image and competitiveness in the market. The combination of consumer needs with the offerings in the white biotechnology industry strengthens consumer responsibility and environmental consciousness and makes industries adapt to change and implement more environmentally friendly procedures.

White Biotechnology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global white biotechnology market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Biofuels

- Biochemicals

- Biopolymers

Biofuels stand as the largest component in 2024, holding around 37.5% of the market because they are environmentally friendly and renewable. These are produced from biological feedstocks such as plant materials, algae, and waste, and are an effective replacement for fossil fuels, with lower emission of greenhouse gases (GHG) and depletion of resources. It is further driven by increased government policies and international standards in the emission of carbon. Enzymatic hydrolysis and microbial fermentation techniques, which had been considered major biotechnological challenges, have since evolved and enhanced biofuel production processes to be cheaper and more efficient to produce compared to other energy resources. Also, through blending biofuels into the energy matrix, energy security is enhanced, given the increasing market demand for consumers and industries for cleaner energy sources. As a result, the move towards biodiesel, bioethanol, and other low-carbon solutions within industries is fueling the white biotechnology market demand.

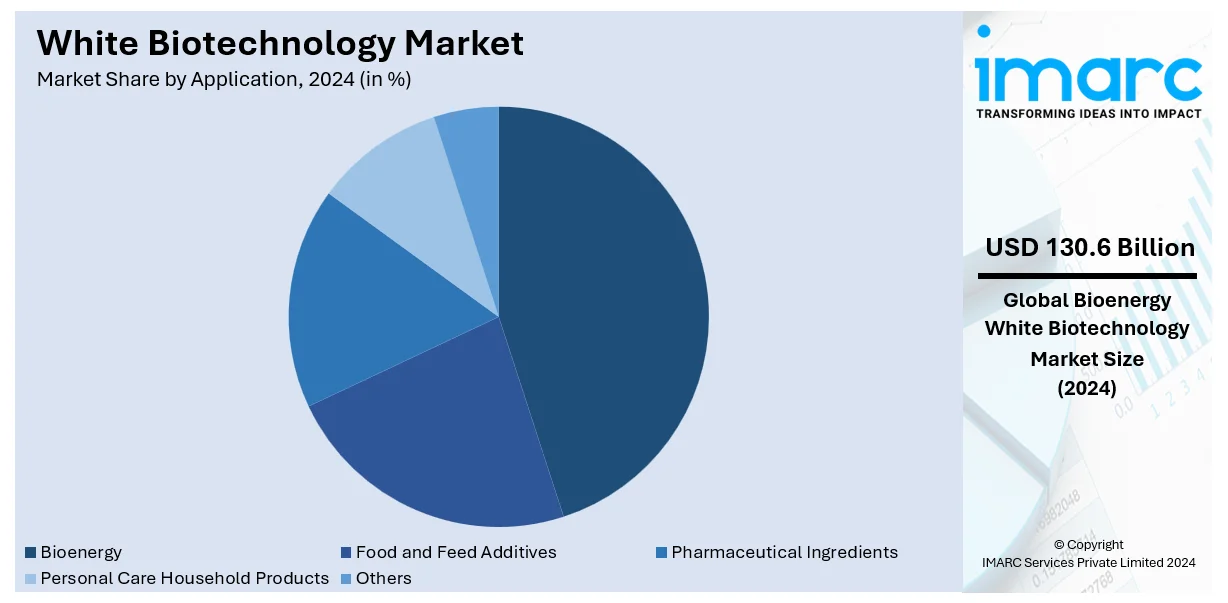

Analysis by Application:

- Bioenergy

- Food and Feed Additives

- Pharmaceutical Ingredients

- Personal Care Household Products

- Others

Bioenergy leads the market with around 38.1% of the market share in 2024. It pertains to energy obtained from biological sources including biomass, bio-agriculture waste, agricultural residues, and blackout through biochemical processes including fermentation, anaerobic digestion, and pyrolysis. It acts also as a strong force, promoting the cultivation of multiplicative and RE sources. The use of biological processes for the production of biofuels such as biogas, bioethanol, and biodiesel corresponds to white biotechnology by rejecting fossil fuels and encouraging green energy. Furthermore, the demand has increased due to the need for nations to transition towards the usage of bioenergy as a measure to decrease their impact on global warming. This demand, coupled with research that is continuously being conducted in the field of bioprocess optimization and genetic engineering, is boosting the white biotechnology market share. In addition to energy security, bioenergy is driving increased implementation of bio-based products to solve the world’s energy problems, as well as transforming the energy sector to develop bio-based sectors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the white biotechnology market forecast, North America accounted for the largest market share of over 44.7% in 2024. The demand in the region is increasing because its industrial focus is vast and the population has a heightened focus on sustainability and environmental issues, which provide a conducive environment for green solutions adoption. Government policies that encourage bio-based products, RE, and a low-carbon economy also drive the white biotechnology market. Furthermore, the region has a favorable research and innovation climate which promotes advances in bioprocessing, genetic engineering, and biocatalysis technologies. Also, the need to address the expectations of other sectors looking for solutions to the market opportunities and the need to address environmental challenges are in harmony with the principles of white biotechnology. North America is enjoying the position of a leader in the white biotechnology market and since the corporate establishments and the governments of this region are investing in bio-chemicals and friendly environmental alternatives the white biotechnological market is significantly growing and developing.

Key Regional Takeaways:

United States White Biotechnology Market Analysis

The United States plays a crucial role in the white biotechnology market, driven by multiple factors. A major driver is the growing demand for sustainable and eco-friendly production processes across various industries. This demand is propelled by a strong emphasis on R&D in biotechnology, with government agencies like the National Institutes of Health (NIH) and the Department of Energy (DOE) investing heavily in bioenergy. In addition, advancements in biotechnology, such as enzyme technology and synthetic biology, are enabling the development of innovative applications across sectors including chemicals, food and beverages (F&B), and textiles. These advancements enhance the efficiency and applicability of biotechnological processes, making operations more sustainable and reducing operational costs. Apart from this, supportive government policies and funding also play an instrumental role in fostering growth within the white biotechnology market. Additionally, the increasing consumer awareness among individuals about environmental issues is significantly influencing the white biotechnology market. As people increasingly seek eco-friendly alternatives, white biotechnology offers solutions such as bioplastics and biofuels that cater to this shift. According to the U.S. Energy Information Administration, the capacity to produce biofuels in the United States grew by 7% in 2023, reaching 24 billion gallons per year (gal/y) by the start of 2024. This growth expands the market for white biotech products, pushing companies to embrace biotechnological solutions to meet the rising demand for environmentally sustainable options. These factors collectively contribute to the robust growth of the white biotechnology market in the United States, reflecting a broader commitment to sustainability and innovation.

Europe White Biotechnology Market Analysis

Europe's white biotechnology market is expanding because of several key factors. Strict environmental regulations and a strong commitment to sustainability are driving industries to embrace eco-friendly production methods. White biotechnology is compatible with Europe’s environmental objectives since it provides solutions for lowering the emission of GHG and minimizing waste. Also, the governmental actions and grants are considered to be noteworthy. For example, Horizon Europe, the European Commission’s program for promoting research and innovation, has a higher level of funding for biotechnology than the corresponding American program, the NIH. This financial support helps to incubate ideas and to advance the growth of bio-based products. Also, the market trends for sustainable and ethical consumer products are exerting pressure on the market. The European people have shifted their preference for products produced from renewable resources, hence putting pressure on companies to adopt white biotechnology. Besides this, the availability of improved techniques of bio-based production through biotechnology such as synthetic biology and enzyme technology makes bio-based production more efficient and less costly. These innovations also allow the creation of high-performance biochemicals and biofuels, which will also help support market expansion. Also, the increasing application of white biotechnology in the production of pharmaceuticals, such as antibiotics, enzymes, and other biological products, is contributing to the market growth. The market researcher IMARC Group has stated that the Pharmaceutical Market in the UK was USD 38.82 Billion in 2023. As a result, all these factors are driving the growth of the white biotechnology market across Europe and establishing the region as a global hub for sustainable industrial processes.

Asia Pacific White Biotechnology Market Analysis

The Asia Pacific region is witnessing substantial growth in the white biotechnology market due to several key factors. Rapid industrialization and economic expansion are leading to a higher demand for sustainable and eco-friendly industrial processes. India's industrial production increased to 3.8% in December 2023 as against 2.4% in November 2023, revealed the data provided by the Ministry of Statistics and Programme Implementation (MoSPI). White biotechnology provides solutions that minimize environmental impact, aligning with the region's emphasis on sustainable development. Additionally, government initiatives and favorable policies are further driving market growth. Countries like China and India are investing heavily in biotechnology R&D, providing funding and establishing supportive regulatory frameworks to promote innovation and commercialization. In addition, the region's abundant biomass resources, including agricultural residues and forestry materials, provide a readily available and cost-effective feedstock for bio-based production. This availability supports the development of biofuels, biochemicals, and other bio-based products, further driving the market. Additionally, rising consumer awareness and the demand for sustainable products are shaping market dynamics. As consumers become more eco-conscious, there is an increasing preference for bio-based products, prompting industries to adopt white biotechnology solutions.

Latin America White Biotechnology Market Analysis

The white biotechnology market in Latin America is also growing, fueled by several key factors. Rapid technological advancements across industries are a significant contributor to this growth. In line with this, the governing agencies in the region have been providing massive amounts of funds to support white biotechnology, especially to research and educational institutions. Moreover, the growing popularity of green compounds and chemicals is a factor that makes industries seek white biotechnology solutions. Furthermore, the expansion of the pharmaceutical industry is driving the white biotechnology market. A research report shows that the Brazilian Drug Market Regulation System (CMED) has published a report that the country’s pharmaceutical market has turned over nearly USD 28.49 Billion. In addition to this, other factors that are also fueling the growth of the white biotechnology market in the Latin America region include, continuing development in technologies, policies that are put in place by the government, and the changing customer awareness towards using products that are environment friendly.

Middle East and Africa White Biotechnology Market Analysis

Biomass from agricultural residues and forestry material is easily available in the region which makes the bio-based production cost effective. Such availability helps to promote the growth of biofuel, biochemicals, and other related bio-based products which in turn boosts the market. Furthermore, the increasing emphasis on environmentally friendly and sustainable industrial processes is a key driver of the market. The market in the region is incorporating white biotechnology solutions to enhance value chain efficiency and meet global greening trends. Furthermore, white biotechnology allows for the creation of materials from renewable feedstock, which has far superior benefits compared to the existing methods. Moreover, it propels white biotechnology to produce enzymes that are used in the food processing industry. Concurrently, amylases, lipases, and proteases are used in the baking, brewing, and dairy industries respectively. According to the report of the IMARC Group, the Saudi Arabia dairy enzymes market share is expected to have a growth rate (CAGR) of 9.80% during the year 2024-2032.

Competitive Landscape:

The industry structure of the white biotechnology market is highly competitive, with intense product development, new collaborations, and acquisitions. Firms are investing more money in the R&D of bioproducts enzymes, and microbial strains for improvement and cost-effectiveness. A major development is the increasing strategic partnership agreements between biotechnology companies and chemical, agribusiness, and energy sectors for commercialization of the technologies. The market players are keen on broadening the offerings that can be used in increasingly larger application categories such as healthcare and food. Also included is a growing focus on using artificial intelligence (AI) and data analysis to enhance methods, and proper selection emphasizing well-ordered work design. Furthermore, efforts to secure government grants and funding for bioeconomy projects further intensify competition in this dynamic sector.

The report provides a comprehensive analysis of the competitive landscape in the white biotechnology market with detailed profiles of all major companies, including:

- Archer Daniels Midland Company

- BASF SE

- Cargill Inc.

- DuPont de Nemours Inc.

- Fujifilm Holdings Corporation

- General Electric Company

- Henkel AG & Co. KGaA

- Kaneka Corporation

- Koninklijke DSM N.V.

- Lonza Group AG

- Mitsubishi Corporation

- Novozymes A/S

Latest News and Developments:

- In July 2024: Researchers from BASF, the Austrian Research Centre of Industrial Biotechnology (acib), and the University of Graz in Austria co-developed an innovative computer-assisted model aimed at enhancing enzyme efficiency. This model is designed to accelerate the transition of new biocatalytic processes from the laboratory to production lines.

- July 2024: Debut Biotechnology launched BiotechXBeautyLabs™, offering beauty brands access to biotech-powered, sustainable product formulations without upfront research costs. This initiative enables brands to develop innovative, 95% bio-based products in as little as three months, addressing ingredient regulation challenges and promoting environmental sustainability.

- June 2024: BASF announced the FUMBIO project, leveraging the bacterium Basfia succiniciproducens to produce bio-based fumaric acid using sugar and CO2. This initiative, supported by Germany's Federal Ministry for Education and Research with €2.6 million funding, aims to reduce the carbon footprint of chemical production. The project highlights white biotechnology's potential for sustainable manufacturing.

- June 2024: Danone launched its Biotech Open Platform, focusing on white biotechnology to scale precision fermentation for sustainable ingredient and food production. Partnering with Michelin, DMC Biotechnologies, and Crédit Agricole, the €16M initiative aims to reduce environmental impact and drive innovation in biosourced materials and nutrients. This aligns with Danone's commitment to sustainable development and net-zero goals.

- In October 2023: BASF made a significant investment in a new fermentation plant at its Ludwigshafen site, dedicated to the production of biological and biotechnology-based crop protection products. Plant products that will create value for farmers such as biological fungicides and biological seed treatment will be produced in the plant.

- In December 2022: Covestro announced the expansion of its capabilities in industrial biotechnology. The plastics manufacturer plans to rely more on microorganisms and enzymes in order to enhance the sustainability of its products and production processes. Specifically, new recycling processes based on biotechnology are being developed.

- In November 2022: BASF SE hosted an event centered on technologies where microorganisms play a role in advancing sustainability. Due to the broad spectrum of technological capabilities, BASF is ready to work on climate-neutral chemistry designs. White biotechnology is gradually growing to be an important tool for BASF.

White Biotechnology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Biofuels, Biochemicals, Biopolymers |

| Applications Covered | Bioenergy, Food and Feed Additives, Pharmaceutical Ingredients, Personal Care and Household Products, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Archer Daniels Midland Company, BASF SE, Cargill Inc., DuPont de Nemours Inc., Fujifilm Holdings Corporation, General Electric Company, Henkel AG & Co. KGaA, Kaneka Corporation, Koninklijke DSM N.V., Lonza Group AG, Mitsubishi Corporation, Novozymes A/S, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the white biotechnology market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global white biotechnology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the white biotechnology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

White biotechnology, also known as industrial biotechnology, involves using biological processes, microorganisms, and enzymes to create bio-based products in industries like chemicals, energy, and materials. It focuses on sustainable solutions, reducing reliance on fossil fuels, lowering carbon emissions, and promoting eco-friendly industrial processes for a greener economy.

The white biotechnology market was valued at USD 342.78 Billion in 2024.

IMARC estimates the global white biotechnology market to exhibit a CAGR of 9.56% during 2025-2033.

Key factors driving the white biotechnology market are the growing demand for sustainable and eco-friendly industrial processes, advancements in genetic engineering and enzyme technologies, increasing adoption of bio-based products across industries, government policies supporting renewable resources, and rising concerns over fossil fuel depletion and environmental sustainability.

In 2024, biofuels represented the largest segment by product, driven by increasing demand for renewable energy sources and stringent policies targeting carbon emission reduction. Furthermore, ongoing technological advancements in biofuel production enhanced their efficiency and affordability, bolstering the market demand.

Bioenergy leads the market by application due to the growing reliance on renewable energy sources like biofuels and biogas. Moreover, the increasing efforts to combat climate change and reduce dependency on fossil fuels, driving its adoption across various regions, impelling the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the white biotechnology market include Archer Daniels Midland Company, BASF SE, Cargill Inc., DuPont de Nemours Inc., Fujifilm Holdings Corporation, General Electric Company, Henkel AG & Co. KGaA, Kaneka Corporation, Koninklijke DSM N.V., Lonza Group AG, Mitsubishi Corporation, Novozymes A/S, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)