Wheat Flour Market Report by Type (All-Purpose Flour, Semolina Flour, Whole-Wheat Flour, Fine Wheat Flour, Bread Flour, and Others), End-Use (Food Use, Feed Use, Bio-Fuel, and Others), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Convenience Stores, Specialty Stores, Online, and Others), and Region 2026-2034

Wheat Flour Market, 2025 Size and Share

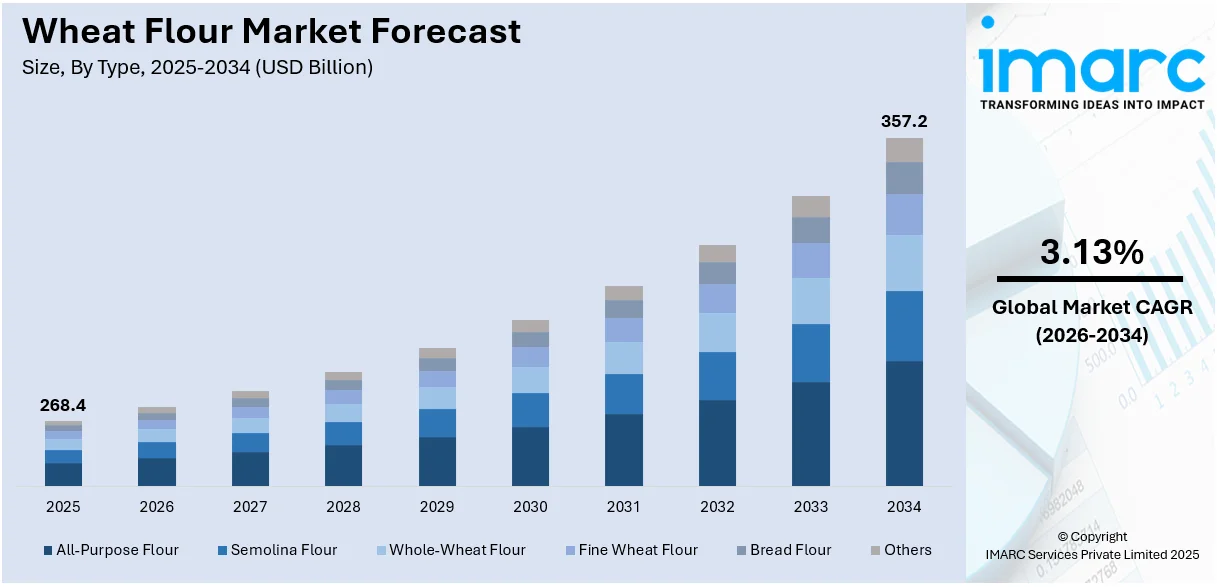

The global wheat flour market size reached USD 268.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 357.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.13% during 2026-2034. The burgeoning population growth, shifting dietary preferences, rapid urbanization, fluctuations in wheat production, escalating health-consciousness among consumers, and advancements in milling technology are influencing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 268.4 Billion |

|

Market Forecast in 2034

|

USD 357.2 Billion |

| Market Growth Rate 2026-2034 | 3.13% |

Wheat flour is a staple ingredient derived from grinding the kernels of wheat grains. The process involves removing the outer husk and bran layers, resulting in a finely ground powder. It is commonly used in baking and cooking, owing to its versatile nature and widespread availability. Wheat flour contains essential nutrients such as carbohydrates, proteins, dietary fiber, and B vitamins like folate and niacin. Its consumption can contribute to energy production, proper digestion, and overall well-being. However, it's worth noting that refined wheat flour may lack some nutrients due to the removal of the bran and germ during processing. There are various types of wheat flour, each offering distinct characteristics, which include all-purpose and whole wheat flour.

To get more information on this market Request Sample

The global wheat flour market is influenced by the burgeoning population growth and changing dietary preferences. This is further supported by rapid urbanization and hectic lifestyles, which have driven the need for convenient and versatile food options. In line with this, fluctuations in wheat production due to weather conditions and crop diseases play a crucial role in market growth. Additionally, health consciousness among consumers prompts a shift towards whole wheat and organic options, impacting market growth. Apart from this, the growth of the bakery and confectionery industry, coupled with the increasing number of fast-food chains globally, amplifies market growth. Furthermore, technological advancements in milling processes and packaging contribute to improved product quality and extended shelf life, driving market expansion.

Wheat Flour Market Trends/Drivers:

Population growth and changing dietary preferences

Population growth remains a pivotal driver of the global wheat flour market, as the expanding global populace demands sustenance. Coupled with this demographic surge is a significant shift in dietary preferences. The increasing awareness of the importance of a balanced diet drives people to incorporate wheat-based products into their meals. This inclination is fortified by the perceived health benefits of wheat flour, which is a source of essential nutrients like carbohydrates and fiber. As urbanization accelerates, creating fast-paced lifestyles, convenient and easily accessible food options become essential. Wheat flour, being a versatile ingredient, is well-suited to meet these demands, making it a staple in various culinary applications. This combination of population growth and evolving dietary habits acts as a catalyst for sustained growth in the wheat flour market.

Fluctuations in wheat production

The wheat flour market's stability is intimately linked to the vagaries of weather conditions and the prevalence of crop diseases. Global wheat production is profoundly affected by climatic variations such as droughts, excessive rainfall, or unseasonal weather patterns, which can lead to reduced harvests and subsequently impact the supply of wheat flour. Furthermore, the susceptibility of wheat crops to diseases can result in significant losses, affecting both quantity and quality. Rusts, smuts, and blights are among the various diseases that can devastate wheat crops. These fluctuations in production influence market dynamics, leading to shifts in prices and supply. Given the importance of wheat as a staple food source, such disruptions can have widespread implications for food security and market stability, emphasizing the crucial role that agricultural resilience plays in shaping the wheat flour market.

Rapid urbanization and hectic lifestyles

Rapid urbanization and the resultant transformation of lifestyles have engendered a growing demand for convenient food options. As urban centers expand, more individuals find themselves navigating busy routines with limited time for meal preparation. This paradigm shift has elevated the significance of easily accessible and ready-to-eat food products, where wheat flour-based offerings find a prominent place. Its versatility lends itself to an array of quick and convenient meal solutions, such as bread, instant noodles, and other processed foods. Urban consumers' preference for foods that align with their busy lives has thus fueled the demand for wheat flour-based products. In essence, the rise of urbanization and the associated hectic lifestyles have acted as a driving force behind the wheat flour market's evolution, emphasizing the intersection of changing societal dynamics and food consumption patterns.

Wheat Flour Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wheat flour market report, along with forecasts at the global and regional levels from 2026-2034. Our report has categorized the market based on type, end-use and distribution channel.

Breakup by Type:

- All-Purpose Flour

- Semolina Flour

- Whole-Wheat Flour

- Fine Wheat Flour

- Bread Flour

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes all-purpose flour, semolina flour, whole-wheat flour, fine wheat flour, bread flour, and others.

All-purpose flour segment is driving owing to its versatility across culinary applications, catering to baking and cooking needs. Semolina flour's growth is due to the global surge of pasta and couscous production, fueled by their increasing popularity. In line with health-conscious trends, the ascendancy of whole-wheat flour is marked by its enriched nutritional profile, containing wheat bran and germ. Fine wheat flour carves a niche in the premium baking realm due to its capacity to yield refined textures in baked delicacies. The enduring demand for bread flour is upheld by its role as a staple, reflecting consistent worldwide consumption of bread products. Additionally, the market is influenced by specialized flours, such as gluten-free or organic variants, driven by dietary preferences and health-conscious choices.

Breakup by End-Use:

- Food Use

- Feed Use

- Bio-Fuel

- Others

Food use dominates the market

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes food use, feed use, bio-fuel, and others. According to the report, food use represented the largest segment.

The food use segments within the global wheat flour market is driven by the shifting dietary preferences towards healthier options. Additionally, the burgeoning bakery and confectionery industry heavily relies on wheat flour for its versatility and reliable performance in creating a range of products. Furthermore, the convenience trend has led to a surge in demand for processed foods, driving the utilization of wheat flour in ready-to-eat meals, snacks, and convenience foods. On the other hand, the gluten-free movement has fostered demand for alternative flours such as rice flour or almond flour, impacting traditional wheat flour usage. Moreover, the growth of the global population is directly linked to the increase in demand for staple foods like bread and pasta, further propelling the wheat flour market.

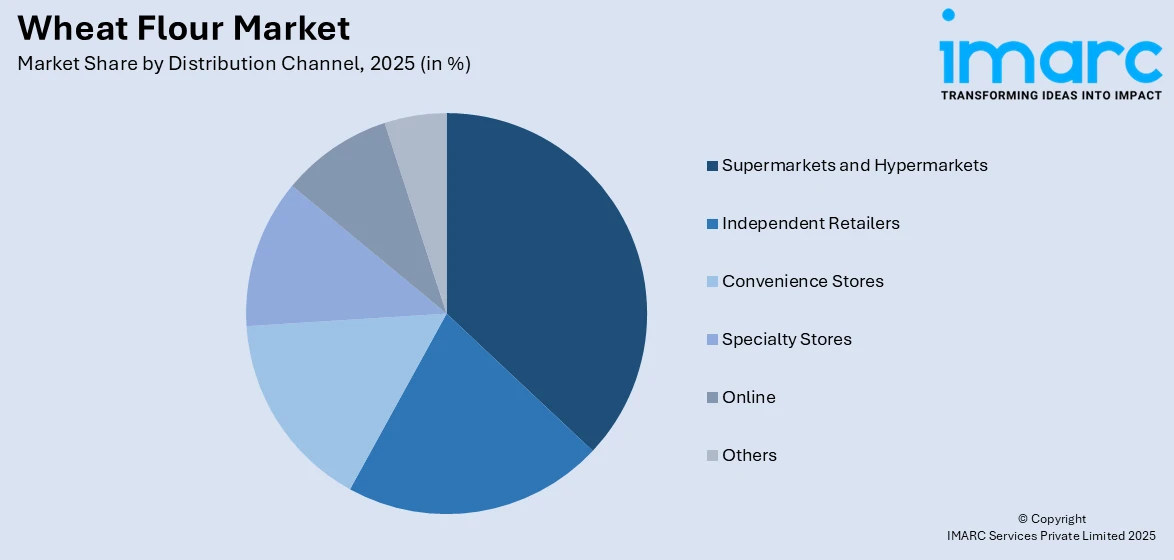

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Independent Retailers

- Convenience Stores

- Specialty Stores

- Online

- Others

Supermarkets and hypermarkets dominate the market

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, independent retailers, convenience stores, specialty stores, online, and others. According to the report, supermarkets and hypermarkets represented the largest segment.

The growth of supermarkets and hypermarkets in the global wheat flour market is driven by changing consumer preferences and escalating preferability for convenience. In line with this, urbanization and population growth propel the expansion of these stores, as urban residents seek accessible shopping options. Furthermore, product diversification and branding amplify appeal, allowing supermarkets and hypermarkets to showcase various wheat flour brands and specialty products, catering to diverse preferences. Strategic store locations in densely populated areas optimize distribution networks, reducing supply chain complexities. Apart from this, technology and data analytics enhance inventory management, customer engagement, and personalized marketing, contributing to overall growth.

Breakup by Region:

- China

- India

- European Union

- Turkey

- United States

- Rest of the World

China exhibits a clear dominance, accounting for the largest wheat flour market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, India, European Union, Turkey, the United States, and the rest of the world. According to the report, China accounted for the largest market share.

China dominates the global wheat flour market due to the country’s substantial population growth, which has surged the demand for wheat flour for staple foods like noodles, dumplings, and steamed buns. This consumption pattern consistently propels demand. Moreover, China's expanding middle class has led to a surge in demand for processed foods, bakery products, and snacks, further boosting the need for wheat flour. In line with this, government policies supporting agricultural modernization and increased wheat production contribute to China's self-sufficiency goals. Additionally, China's strategic investments in wheat cultivation technologies enhance yield and quality, bolstering its competitive edge. Furthermore, China's global trade presence allows it to both import and export wheat flour as market conditions dictate. This strategic flexibility positions China as a market influencer. The nation's evolving dietary preferences, coupled with economic growth, shape consumption trends, impacting global wheat flour dynamics.

Competitive Landscape:

The competitive landscape within the global wheat flour market is characterized by a dynamic interplay of various factors. Market players compete not only on price but also on product quality, distribution efficiency, and technological innovation. Differentiation strategies, such as offering specialty flour variants for specific culinary applications, further intensify competition. Regulatory compliance, sustainability practices, and supply chain resilience are becoming crucial differentiators as well. Market trends like the rising preference for healthier and organic options, along with shifts in consumer dietary habits, influence the competitive dynamics. Moreover, the geographical diversity of wheat production areas contributes to varying cost structures and supply capabilities among competitors. As the market evolves, adaptability to changing consumer preferences and the ability to leverage digital platforms for marketing and distribution are becoming essential.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Acarsan Holding

- Allied Pinnacle Pty Ltd

- Archer Daniels Midland Company

- Ardent Mills

- Bob’s Red Mill Natural Foods

- General Mills, Inc.

- Goodmills Group GmbH

- Hodgson Mill

- Interflour Group Pte Ltd

- King Arthur Baking Company

- Manildra Group

- Mennel Milling

- Nisshin Flour Milling INC

Recent Developments:

- In August 2020, General Mills, Inc. announced to invest $48 million to expand its frozen dough facility in Joplin.

- In June 2022, Archer Daniels Midland Company acquired Prairie Pulse Inc., owners of a milling, pulse crop cleaning, and packaging facility in Vanscoy, Sask., doubling its pulse footprint in the region.

- In December 2021, Ardent Mills successfully completed the acquisition of substantially all the business assets of Firebird Artisan Mills, a leading gluten-free, specialty grain and pulse milling company.

Wheat Flour Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | All-Purpose Flour, Semolina Flour, Whole-Wheat Flour, Fine Wheat Flour, Bread Flour, Others |

| End-Uses Covered | Food Use, Feed Use, Bio-Fuel, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Independent Retailers, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | China, India, European Union, Turkey, United States, Rest of the World |

| Companies Covered | Acarsan Holding, Allied Pinnacle Pty Ltd, Archer Daniels Midland Company, Ardent Mills, Bob’s Red Mill Natural Foods, General Mills, Inc., Goodmills Group GmbH, Hodgson Mill, Interflour Group Pte Ltd, King Arthur Baking Company, Manildra Group, Mennel Milling, Nisshin Flour Milling INC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wheat flour market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wheat flour market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wheat flour industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The demand for wheat flour has increased on account of the lockdowns and stay-at-home orders imposed by governments to curb the spread of the coronavirus disease (COVID-19). However, these measures have also disrupted the supply chains, which is negatively impacting the market growth.

The global wheat flour market reached a value of USD 268.4 Billion in 2025.

The global wheat flour market is expected to exhibit a CAGR of 3.13% during 2026-2034.

The growing utilization of wheat flour in the food industry is bolstering the market growth. This is further supported by factors like shifting dietary preferences and the inflating per capita incomes of the consumers.

The growing application of wheat flour in non-food applications such as the production of adhesives, plastics, and personal care products represents one of the major trends in the market.

Based on the type, the market is bifurcated into all-purpose, semolina, whole-wheat, fine wheat, bread flour and others.

The market is categorized into food use, feed use, biofuel and others, among which the food industry exhibits a clear dominance.

Based on the distribution channel, the market has been categorized into supermarkets and hypermarkets, independent retailers, convenience stores, specialty stores, online and others. The majority of the wheat flour is distributed through supermarkets and hypermarkets.

Region-wise, China holds the leading position in the market. Other major regions include India, the European Union, Turkey, and the United States.

The leading industry players are Acarsan Holding, Allied Pinnacle Pty Ltd, Archer Daniels Midland Company, Ardent Mills, Bob’s Red Mill Natural Foods, General Mills, Inc., Goodmills Group GmbH, Hodgson Mill, Interflour Group Pte Ltd, King Arthur Baking Company, Manildra Group, Mennel Milling, and Nisshin Flour Milling INC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)