Well Intervention Market Report by Service Type (Logging and Bottomhole Survey, Tubing/Packer Failure Repair, Stimulation, Sand Control, Zonal Isolation, Artificial Lift, Fishing, and Others), Well Type (Vertical Well, Horizontal Well), Application (Onshore Applications, Offshore Applications), and Region 2025-2033

Well Intervention Market Size:

The global well intervention market size reached USD 8.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.6% during 2025-2033. The increasing number of mature oil and gas fields, the rising demand for refined petroleum products, rapid technological advancements, and the growing demand for oil and gas are some of the factors propelling the well intervention market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.3 Billion |

|

Market Forecast in 2033

|

USD 11.4 Billion |

| Market Growth Rate (2025-2033) | 3.6% |

Well Intervention Market Analysis:

- Major Market Drivers: The increasing demand for oil and gas and rapid technological advancements are driving the well intervention market growth.

- Key Market Trends: The increasing focus on efficiency and the rising demand for integrated services are emerging as well intervention market recent developments.

- Geographical Trends: North America is dominating the well intervention market demand. The well intervention market 2021 report shows that Asia Pacific is also playing an important role in driving the well intervention market statistics.

- Competitive Landscape: Aker Solutions, Archer Limited, and Baker Hughes Company are some of the companies driving the well intervention market outlook.

- Challenges and Opportunities: The complexity of operations is a challenge, which is hampering the well intervention market revenue. The well intervention market price is driven by rapid technological innovations. This also acts as one of the well intervention market opportunities.

Well Intervention Market Trends:

Increasing Investment in the Offshore Sector

The increasing investment in offshore platforms is driving the market. The main priorities for major upstream nations like the US, China, Russia, and Norway are expanding well recovery from current wells and exploring new reservoirs. The need for oilfield services, such as completion, intervention, offshore drilling, floating platforms, and workover services, has increased globally as a result of this. Offshore areas, like deep underwater, have a large amount of oil and gas that can't be easily reached. So, companies are spending more to find ways to get to these resources. They need well intervention to keep these offshore wells working well. This means using tools and techniques to fix problems and make sure the wells produce as much oil and gas as possible.

Rising Focus on Enhancing Operational Efficiency of Wells

The adoption of intelligent digitized devices, services, and solutions has increased due to the growing emphasis on improving operational efficiency and the drop in operating and capital expenses. The extensive use of data analysis, modern technologies, wireless mobility, and data collection platforms has made it possible to significantly increase performance and decision-making. Intelligent decision-making, analysis, efficient measurement, and modelling are all part of the production optimization process, which raises the output production of oil from oilfields even more.

Increasing Discoveries in the Oil & Gas Industry

The well intervention market will rise as a result of the rising number of oil and gas finds in oilfield reserves and the notable technological advancements that have increased the production output from oil wells. Alaska in the United States, the Golan Heights in Israel, Alpine High in West Texas, the Stabroek block in Tilapia, Yellowtail (oil), and Haimara (gas-condensate), an offshore gas discovery with the Lang Lebah-1RDR2 exploration well, are just a few of the increasingly notable discoveries. In the upcoming years, it is predicted that oil prices will rise. This would facilitate investment in oil and gas finds and exploration activities by independent exploration companies, gas production companies, and oil field operators.

Well intervention Industry Segmentation:

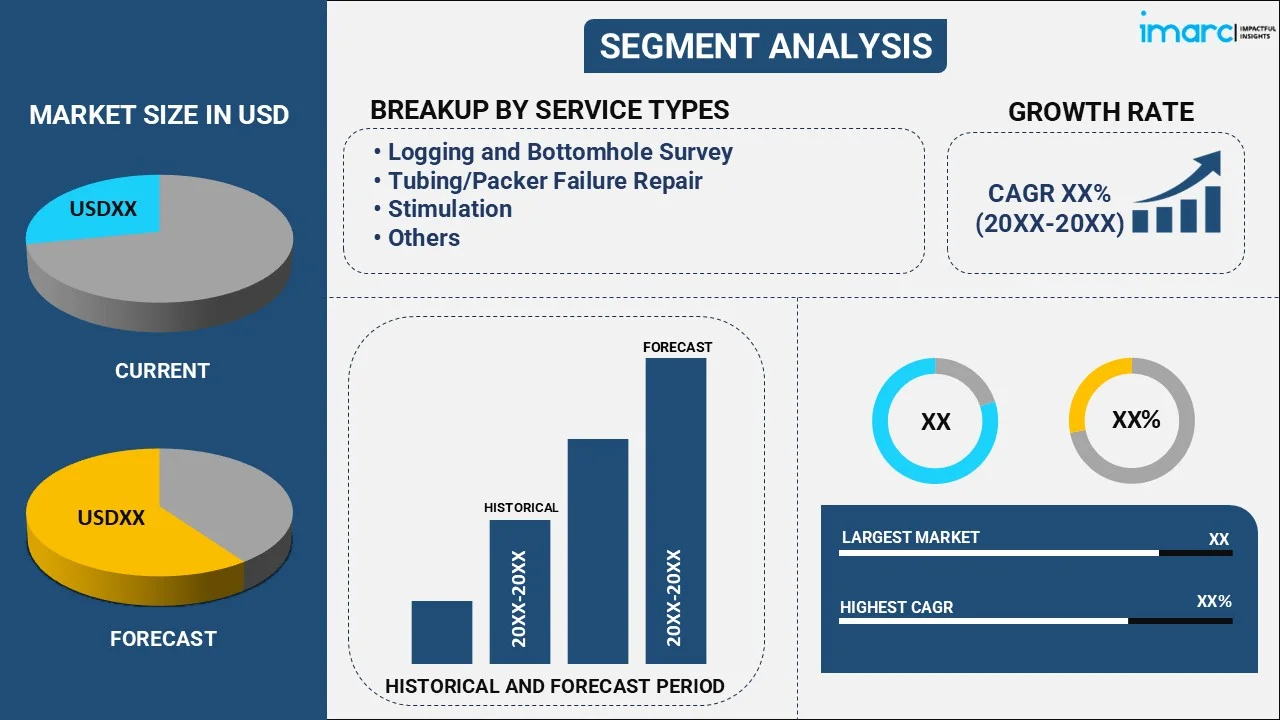

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on service type, well type, and application.

Breakup by Service Type:

- Logging and Bottomhole Survey

- Tubing/Packer Failure Repair

- Stimulation

- Sand Control

- Zonal Isolation

- Artificial Lift

- Fishing

- Others

Logging and bottomhole survey account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the service type. This includes logging and bottomhole survey, tubing/packer failure repair, stimulation, sand control, zonal isolation, artificial lift, fishing, and others. According to the report, logging and bottomhole survey represented the largest segment.

The industry revenue for well intervention is mostly derived from the logging and bottom hole survey segment, which commands the highest market share. In order to assess reservoir features, wellbore conditions, and fluid properties, data from downhole sensors and instruments are gathered and analyzed in this segment. By offering vital insights into the well's performance and spotting possible problems or areas for improvement, logging and bottom hole survey services are essential for optimizing production and reservoir management. The increasing demand for precise and thorough data to support well-informed decision-making and boost overall productivity is the driving force behind the need for these services.

Breakup by Well Type:

- Vertical Well

- Horizontal Well

Horizontal well account for the majority of the market share

A detailed breakup and analysis of the well intervention market based on the well type has also been provided in the report. This includes vertical and horizontal well. According to the report, horizontal well represented the largest segment.

Horizontal wells are playing an important role in boosting the market. Unlike traditional vertical wells, horizontal wells go sideways through the underground rock layers. They can access more oil and gas, making them popular. But sometimes, these wells need help to keep producing. That's where well intervention comes in. Companies use tools and techniques to fix problems in horizontal wells, like clearing blockages. As more companies drill horizontal wells, the need for well intervention grows. So, as horizontal wells are becoming more common, the market is also growing to keep these wells running smoothly and producing as much as possible.

Breakup by Application:

- Onshore Applications

- Offshore Applications

Onshore applications dominate the well intervention market

The report has provided a detailed breakup and analysis of the well intervention market based on the application. This includes onshore and offshore applications. According to the report, onshore applications represented the largest segment.

In onshore operations, well intervention tasks are completed in onshore oil and gas fields. For a number of reasons, this market segment is the dominant one. First off, compared to offshore operations, onshore operations usually have more wells. This is mostly due to the fact that onshore fields are frequently bigger and easier to reach, enabling more extensive drilling operations. Because of this, there is a constant need for well intervention services in onshore operations. Second, compared to offshore activities, onshore operations have lower operating expenses. The lack of intricate logistical obstacles, such the deployment and transportation of offshore rigs, makes well intervention operations more affordable. Onshore operations are preferred by businesses because they can more profitably allocate resources and equipment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest well intervention market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America leads due to its strong oil and gas sector. The region has abundant shale reserves and modern technologies. The United States has a substantial market share due to its abundant supply of shale gas and oil. The region continues to dominate the market with a rise in procedures like hydraulic fracturing. Extensive oil and gas exploration efforts are being driven by the growing energy demand resulting from rapid industrialization and urbanization. As a result, in order to guarantee the highest possible production and extraction efficiency, effective well interventions become imperative.

Leading Key Players in the Well Intervention Industry:

By making investments in cutting-edge technologies and growing their service offerings, major players are propelling the market. These businesses, which include significant oilfield service providers and specialist intervention organizations, are always creating new instruments and methods to raise the effectiveness and performance of their wells. They serve the various demands of oil and gas operators globally by providing a broad range of services, from simple maintenance to intricate interventions. Key actors make ensuring that wells are optimized for optimal production and lifetime by utilizing their resources and skills. By their dedication to quality and ongoing development, they also significantly contribute to the advancement of industry standards and best practices, which in turn propels market expansion as a whole.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Aker Solutions

- Archer Limited

- Baker Hughes Company (General Electric)

- China Oilfield Services Ltd. (China National Offshore Oil Corporation)

- Expro Group

- Halliburton Company

- Schlumberger Limited

- Scientific Drilling International Inc.

- Superior Energy Services Inc.

- Vallourec

- Weatherford International Plc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- October 2, 2023: Aker Solutions, SLB, and Subsea7 announced the closing of the OneSubsea joint venture.

- March 15, 2024: Archer Limited acquired 65% of Vertikal Services AS and strengthened its engineering services portfolio.

- April 5, 2024: Baker Hughes Company announced to supply Cedar LNG in Canada with electric driven liquefaction technologies.

Well Intervention Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Logging and Bottomhole Survey, Tubing/Packer Failure Repair, Stimulation, Sand Control, Zonal Isolation, Artificial Lift, Fishing, Others |

| Well Types Covered | Vertical Well, Horizontal Well |

| Applications Covered | Onshore Applications, Offshore Applications |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aker Solutions, Archer Limited, Baker Hughes Company (General Electric), China Oilfield Services Ltd. (China National Offshore Oil Corporation), Expro Group, Halliburton Company, Schlumberger Limited, Scientific Drilling International Inc., Superior Energy Services Inc., Vallourec, Weatherford International Plc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global well intervention market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global well intervention market?

- What is the impact of each driver, restraint, and opportunity on the global well intervention market?

- What are the key regional markets?

- Which countries represent the most attractive well intervention market?

- Who is the largest region in well intervention market?

- How big is the well intervention market?

- What is the breakup of the market based on the service type?

- Which is the most attractive service type in the well intervention market?

- What is the breakup of the market based on the well type?

- Which is the most attractive well type in the well intervention market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the well intervention market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global well intervention market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the well intervention market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global well intervention market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the well intervention industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)