Well Cementing Services Market Size, Share, Trends and Forecast by Type, Well Type, Application, and Region, 2025-2033

Well Cementing Services Market Size and Share:

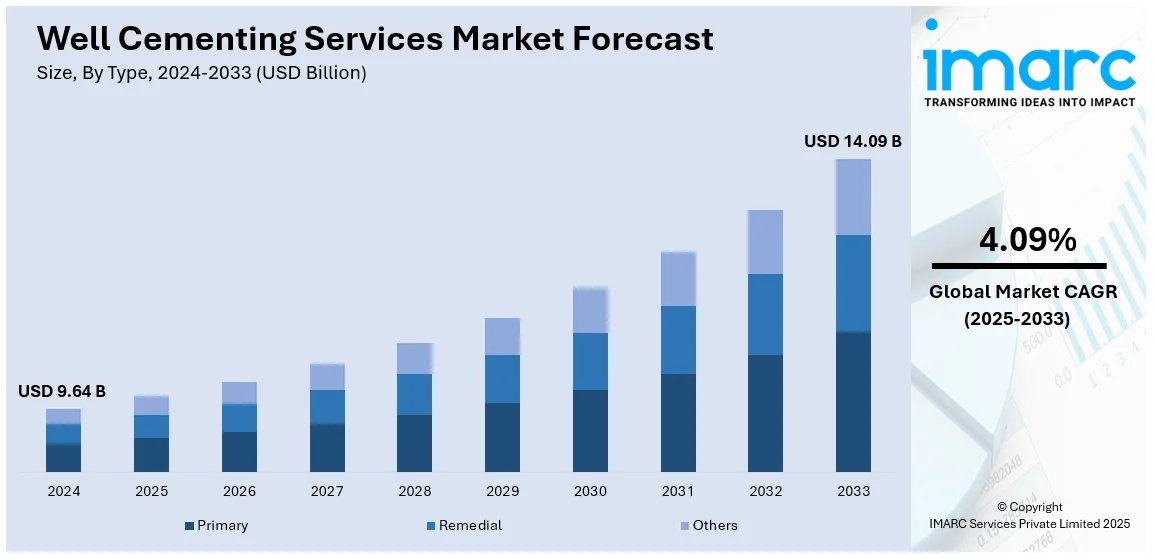

The global well cementing services market size was valued at USD 9.64 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.09 Billion by 2033, exhibiting a CAGR of 4.09% from 2025-2033. North America currently dominates the market, holding a market share of over 42.1% in 2024. The market is primarily driven by rising demand for Enhanced Oil Recovery (EOR) methods, ongoing innovations in cementing technologies for challenging conditions, and a growing emphasis on environmental sustainability, as companies adopt eco-friendly solutions to meet stricter regulatory requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.64 Billion |

|

Market Forecast in 2033

|

USD 14.09 Billion |

| Market Growth Rate (2025-2033) | 4.09% |

The growth of the global market is largely driven by rising oil and gas production, particularly in offshore and deepwater drilling. In line with this, continual technological advancements, including specialized cementing materials and more efficient pumping equipment, are enhancing well integrity and operational efficiency. A notable example is Hoffmann Green Cement Technologies, which signed a strategic licensing agreement with Cemblend Ltd on December 19, 2024, to expand its presence in the UK and Ireland. This agreement includes entry fees of up to EUR 2 Million and royalties tied to the commercialization of Hoffmann cements, supporting decarbonization efforts in construction. Additionally, growing exploration and production activities in emerging markets, such as the Middle East, Africa, and Asia-Pacific, further boost market demand. Besides this, strict regulatory requirements, and the need for improved well performance is also contributing to market growth.

The United States is a key regional market and is witnessing growth due to increased exploration and production, particularly in unconventional shale oil and gas plays. Similarly, the heightened demand for advanced wellbore integrity and sealing solutions, along with strict environmental regulations, is elevating the need for high-performance cementing services. Hydraulic fracturing and enhanced oil recovery techniques, which require specialized cementing for effective isolation, further fuel market growth. A strong emphasis on reducing operational downtime and maintaining safety standards also drives market demand. Moreover, the growing push for energy independence and expanding infrastructure projects in the U.S. supports this market's development. For instance, on December 3, 2024, Sublime Systems secured an up-to USD 87 Million award from the U.S. Department of Energy for a clean cement manufacturing plant in Holyoke, Mass., aiming to boost domestic cement production and create jobs.

Well Cementing Services Market Trends:

Increased Demand for Enhanced Oil Recovery (EOR)

Demand from EOR well cementing services is soaring rapidly. The U.S. Department of Energy notes that EOR techniques can ultimately produce 30% to 60% or more of a reservoir's original oil in place. All across the globe, the maturity level of oil fields compels operators to achieve the extraction levels at that maturity. Different methods are adopted globally through EOR like water flood, gas injectors, or even thermal techniques, all resulting in an upward push in enhanced recovery of oils from wells, hence leading to growth in well cementing services. Cementing helps in ensuring zonal isolation in proper manners that would not allow fluid migration and leak. The application of advanced cementing materials and technologies can render the company capable of offering improved sealing performance even for complicated environments like deepwater or high-pressure, high-temperature reservoirs. The emerging trend of oil operators to extend the productive life of existing fields instead of exploring new ones will drive demand for well cementing services that can support EOR operations, which will increase market opportunities.

Advancements in Cementing Technology

Well cementing technologies are revolutionizing the oil and gas sector due to drilling complexities and difficulties in operation. Such advanced technologies like expandable cements, microannulus cementing techniques, and fiber-reinforced cement allow solutions that would have otherwise not been possible. It has, for example solved some problems in ensuring the well integrity during deep-water drilling, prevention of leakages during high-pressure reservoirs, and sealing of microfractures which could form while drilling. According to the U.S. Energy Information Administration (EIA), offshore oil production accounted for about 30% of total global oil production over the past decade. As global offshore production continues to be a significant portion of total output, the demand for cementing solutions that can withstand the pressures of deepwater drilling environments is increasing. Expandable cements can grow with changes in the wellbore and ensure superior sealing performance, and microannulus cementing provides zonal isolation with no micro-annulus or channel. This is essential in ensuring that well operations are safely and efficiently accomplished in projects that often require unconventional cementing techniques such as in unconventional and deepwater projects. As industry exploration and production activities go deeper, technically more complex, the need for these high-end cementing solutions also is expected to increase significantly, in turn creating potential for growth by the service providers.

Focus on Environmental Sustainability

Environmental sustainability is an increasingly important driving force in the well cementing services market, with emphasis on reducing the carbon footprint and embracing greener technologies. As of 2022, there were 29 operational CCS facilities across the globe with a cumulative capture capacity of close to 40 million tonnes CO₂ per annum, based on the latest figures from the Global CCS Institute. Some countries like Brazil have also come up with their targets, inject 40 million tonnes of CO₂ by 2025. As a reaction to rising environmental regulations, companies are facing more demand for cementing solutions as oil and gas companies move ahead to decrease environmental impact. Markets for low-carbon cements will have a strong upward trend. Emissions reduction will come through the support of sustainable material. With governments and other stakeholders pushing for greener practices, well cementing service providers are embracing innovative solutions to align with sustainability objectives, further driving demand for environmentally friendly technologies in the sector.

Well Cementing Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global well cementing services market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, well type, and application.

Analysis by Type:

- Primary

- Remedial

- Others

Primary type dominates the market with 78.9% of the share in 2024 due to its essential role in ensuring wellbore integrity and preventing fluid migration during drilling and production. It is the most commonly used cementing method given its reliability, cost-effectiveness, and broad applicability across various well types, including conventional and unconventional oil and gas wells. Primary cementing provides a strong bond between the casing and formation, preventing leaks and ensuring zonal isolation, which is crucial for the success of drilling operations. Additionally, the advancement of cementing technologies, such as the development of specialized cement slurries, has further optimized primary cementing, driving its widespread adoption. The demand for wellbore safety, environmental protection, and operational efficiency contributes to its market dominance.

Analysis by Well Type:

- Oil

- Gas

- Shale Gas

Oil wells remain the dominant well type in the well cementing services market, accounting for 46.0% of the share in 2024, driven by the ongoing demand for crude oil across various industries. These wells require specialized cementing solutions to ensure wellbore integrity, zonal isolation, and prevent fluid migration during drilling and production. Cementing is critical to maintaining the structural stability of the wellbore, especially as oil reserves in conventional fields become more difficult to access. The application of advanced cementing materials helps mitigate challenges related to high pressures, temperatures, and corrosive environments. The oil well sector continues to benefit from technological advancements that optimize cement slurry formulations, making operations more efficient and cost-effective, thus sustaining demand for cementing services.

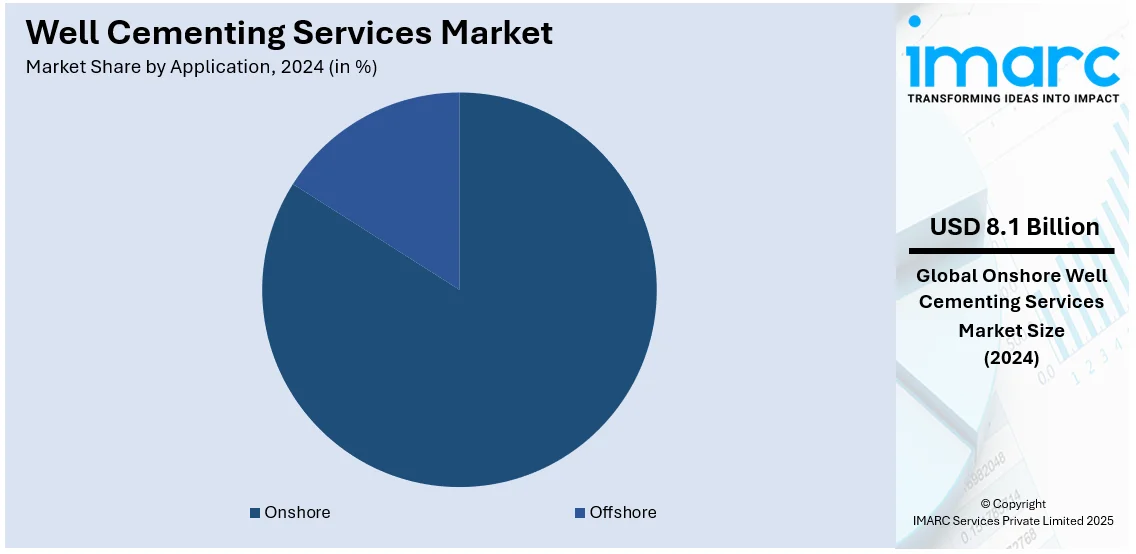

Analysis by Application:

- Onshore

- Offshore

Onshore leads the market with 83.8% of the share in 2024 due to the higher concentration of oil and gas exploration and production activities on land. Onshore wells are generally less complex and cost-intensive compared to offshore wells, making them more accessible and attractive for both large and independent operators. The demand for cementing services is particularly high in regions with abundant onshore reserves, such as North America, the Middle East, and parts of Asia. Furthermore, onshore operations benefit from easier logistics and lower operational costs, which drive demand for cementing solutions to ensure wellbore integrity and efficient production. The continued growth of shale oil and gas activities further boosts the dominance of onshore applications in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounts for 42.1% of the share in the market attributed to its robust oil and gas industry, driven by continued growth in unconventional resource extraction, particularly in shale plays like the Permian Basin. The region benefits from advanced infrastructure, technology adoption, and well-established regulatory frameworks that enhance the efficiency and safety of drilling operations. Additionally, the rise in carbon capture and storage (CCUS) projects in the U.S., bolstered by government incentives and environmental policies, further fuels demand for specialized cementing services. North America also maintains a competitive advantage with significant investments in energy independence and the development of sustainable technologies, positioning it as a leader in cementing services for both traditional and emerging oil and gas applications.

Key Regional Takeaways:

United States Well Cementing Services Market Analysis

The US well cementing services market is buoyed by high intensity shale exploration and production operations. The U.S. Energy Information Administration reported that in 2023, there was crude oil production of 12.9 million barrels per day with an attributable demand for well integrity services. Cementing service providers are also concentrated in the Permian Basin given the active drilling operations. Technological upgradations such as self-healing cement and advanced slurry systems upgrade market forces. Halliburton and Schlumberger are the most dominant operators to provide customized solutions that increase operational efficiency. Environmental regulations like Safe Drinking Water Act stress the use of cementing practices that are harmless to the environment. Domestic production expansion and export opportunities sustain the growth curve for U.S. players.

Europe Well Cementing Services Market Analysis

The market for well cementing services in Europe is primarily driven by offshore oil and gas production, decommissioning activities, and the rising focus on renewable energy. Norway, the UK, and the Netherlands lead the region, attributed to their extensive offshore fields in the North Sea and investments in energy transition. The UK government set aside over EUR 1.5 Billion (USD 1.88 Billion) for renewable energy projects in 2023, more than the amount allocated in the past. There was also an allocation of EUR 2.3 Billion (USD 2.88 Billion) for green hydrogen projects to be used in various parts of the country, as per reports. Energy sustainability and diversification are part of the EU's focus on environmental sustainability. This has pushed the adoption of eco-friendly cementing technologies such as low-carbon cement solutions. Companies such as Baker Hughes and Weatherford are in the forefront of this change and will support the shift to greener solutions. Additionally, increasing interest in geothermal energy projects has furthered the range of well cementing applications, encouraging innovation and growth within the European market.

Asia Pacific Well Cementing Services Market Analysis

Asia Pacific market is moving ahead due to increased investments in crude oil and natural gas production with huge geopolitical changeovers. In 2023, for example, according to China's state-owned corporation CNPC, the company's domestic crude oil production jumped to 209 million tons equivalent to over 4 million barrels per day for 2023, which would bring an increased rise in the drilling and maintenance processes in the reserves. Similarly, in India, ongoing exploration and production projects are driving cementing service needs. The government's aim to increase oil and gas output along with private investments create a favorable environment for the sector. Also, growing demand for eco-friendly cementing solutions in offshore and onshore drilling projects is acting as a stimulus for technological advancements. The market is witnessing the entry of global cementing service providers, which are offering customized solutions to meet the specific drilling challenges of the region.

Latin America Well Cementing Services Market Analysis

Latin America's well cementing services market is experiencing strong growth, explained by high-oil production figures at Brazil and other regional companies. According to the Brazilian Energy Research Office (EPE), in 2023, the national oil average of production in Brazil registered 3.575 million barrels per day (MMb/d), having reached 3.199 MMb/d by the first half of the period. Oil production growth will positively influence demand for cementing services that are necessary in offshore and onshore fields development, as well as maintaining existing ones. Argentina's production of unconventional oil within the Vaca Muerta formation also influences the need for cementing services. Expansion and investment into the pre-salt layer by Brazil along with its latest advances in drilling technologies have generated even greater needs for special cementing solutions. The region's focus on sustainability also encourages the use of low-carbon cementing technologies, thus opening up new opportunities for market innovation. The key players such as Baker Hughes and Halliburton are well-positioned to capitalize on these growth trends.

Middle East and Africa Well Cementing Services Market Analysis

In the Middle East and Africa, well cementing services market is in direct proportion to the oil production of the region, particularly in Saudi Arabia and other major regions. IEA reports that in 2023, Saudi Arabia's crude oil production averaged around 9.5 million bpd as part of its voluntary output cut to stabilize the global oil price. This level of production maintains Saudi Arabia among the largest oil-producing countries worldwide and maintains a continuing need for cementing services related to exploration, drilling, and maintaining reservoirs. There is increasing offshore production as well as deeper water drilling activities within the region that is continuing to increase demands for enhanced cementing solutions. The UAE and Algeria are expanding their production of oil, representing further growth opportunities for cementing service providers. The vast oil reserves in the region, coupled with the ongoing investments in the development of new fields, ensure that there will be a consistent demand for high-quality cementing services in these conventional and unconventional oil fields.

Competitive Landscape:

The competitive landscape of the market is shaped by a mix of global giants and specialized service providers. Major players, leverage advanced technologies, extensive expertise, and global reach to dominate the market. on the other hand, smaller, innovative firms are gaining ground by developing specialized cementing solutions for challenging environments like deepwater and high-pressure reservoirs. For example, on January 29, 2024, Halliburton launched the CorrosaLock™ cement system, designed for CO2 storage in carbon capture, utilization, and storage (CCUS) applications. Combining Portland-based cement with Halliburton's WellLock® resin, it enhances cement sheath elasticity, shear bond strength, and resistance to CO2 degradation, addressing the challenges of long-term underground CO2 storage. The system joins Halliburton's advanced CCUS portfolio. Strategic mergers, acquisitions, and partnerships are common as companies aim to expand their service portfolios, improve offerings, and extend their geographical presence.

The report provides a comprehensive analysis of the competitive landscape in the well cementing services market with detailed profiles of all major companies, including:

- Advanced Cementing Services Incorporated

- Baker Hughes Company

- Calfrac Well Services Ltd.

- China Oilfield Services Limited (China National Offshore Oil Corporation)

- Gulf Energy SAOC (National Energy Services Reunited)

- Halliburton Company

- Magnum Cementing Services Ltd.

- Sanjel Energy Services

- Schlumberger Limited

- Trican Well Service Ltd.

- Viking Services and Weatherford International PLC

Latest News and Developments:

- May 2024: Halliburton launched SentinelCem Pro cement system to help address severe lost circulation. The innovative system streamlines mixing operations, eliminates the need for pre-hydration, and offers improved efficiency. Its thixotropic properties enable deep fracture penetration, which helps to reduce nonproductive time (NPT) in well construction.

- February 2024: Baker Hughes signed a multi-year contract with Petrobras for integrated well construction services at Brazil’s Buzios field. Starting in 2025, services include drilling, cementing, and geosciences across three rigs.

Well Cementing Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Primary, Remedial, Others |

| Well Types Covered | Oil, Gas, Shale Gas |

| Applications Covered | Onshore, Offshore |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Cementing Services Incorporated, Baker Hughes Company, Calfrac Well Services Ltd., China Oilfield Services Limited (China National Offshore Oil Corporation), Gulf Energy SAOC (National Energy Services Reunited), Halliburton Company, Magnum Cementing Services Ltd., Sanjel Energy Services, Schlumberger Limited, Trican Well Service Ltd., Viking Services and Weatherford International PLC., etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the well cementing services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global well cementing services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the well cementing services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The well cementing services market was valued at USD 9.64 Billion in 2024.

The well cementing services market is projected to exhibit a CAGR of 4.09% during 2025-2033, reaching a value of USD 14.09 Billion by 2033.

Key factors driving the market include increasing oil and gas production, particularly offshore and deepwater drilling, the rising adoption of Enhanced Oil Recovery (EOR) methods, continuous technological advancements in cementing solutions, and the growing emphasis on environmental sustainability, with a focus on eco-friendly materials and carbon capture solutions.

North America currently dominates the well cementing services market, accounting for a share exceeding 42.1%. This dominance is fueled by high oil production, particularly from shale plays, advanced infrastructure, technological innovations, and strong regulatory support for efficient and sustainable energy practices.

Some of the major players in the well cementing services market include Advanced Cementing Services Incorporated, Baker Hughes Company, Calfrac Well Services Ltd., China Oilfield Services Limited (China National Offshore Oil Corporation), Gulf Energy SAOC (National Energy Services Reunited), Halliburton Company, Magnum Cementing Services Ltd., Sanjel Energy Services, Schlumberger Limited, Trican Well Service Ltd., and Viking Services and Weatherford International PLC., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)