Water Scooter Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Application, and Region 2026-2034

Water Scooter Market Size and Share:

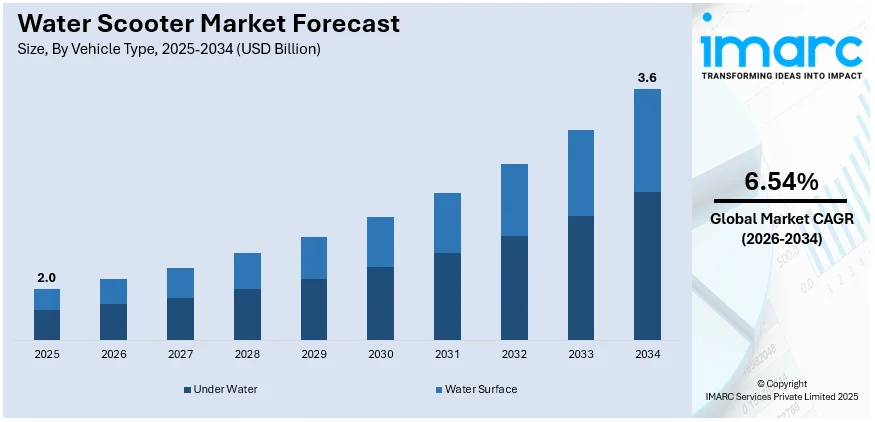

The global water scooter market size was valued at USD 2.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.6 Billion by 2034, exhibiting a CAGR of 6.54% during 2026-2034. North America dominates the market in 2025. The market is rapidly expanding due to the rising interest in water sports, rapid technological advancements, increasing disposable income of individuals, growing tourism, and the advent of eco-friendly innovations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.0 Billion |

|

Market Forecast in 2034

|

USD 3.6 Billion |

| Market Growth Rate 2026-2034 | 6.54% |

People are increasingly shifting toward water-based adventures as a way to unwind and explore the outdoors. Water scooters, being fun and easy to ride, have become a go-to choice for thrill-seekers and vacationers. In the United States, the Sports & Fitness Industry Association (SFIA) reported that water sports participation grew by over 9% in 2023, indicating a rising enthusiasm for such activities. Coastal areas, lakes, and resorts around the world are now promoting water sports as a major attraction. Families, groups of friends, and solo travellers are also following this trend as they look for unique ways to enjoy their leisure time. Another reason for the growing interest in water scooters is that they offer a blend of adrenaline and accessibility. Unlike other water vehicles that might require specialized training, water scooters are beginner-friendly, allowing first-timers to join the sport with minimal hassle.

To get more information on this market Request Sample

The United States is a major market disruptor because of the growing disposable income of individuals in the country. The disposable personal income increased to 21995.10 USD billion in November from 21934 USD billion in October of 2024. As people's incomes increase, they are more inclined to spend on experiences such as water sports. Water scooters fall into the category of leisure activities that symbolize a fun and active lifestyle. For many, owning or renting a water scooter has become a status symbol, representing a shift toward more experiential and luxury-oriented spending. Urbanization also plays a major part in this growing trend. City-dwellers often look for weekend getaways to escape their busy lifestyles, and water sports like riding a scooter offer a perfect blend of relaxation and excitement. This demand is particularly visible in the USA where middle-class growth is fueling interest in recreational water activities.

Water Scooter Market Trends:

Rising Popularity of Water Sports and Adventure Tourism

Increased demand of water-based activities for recreational use and adventure tourism are considered main factors in pushing the demand forward for water scooters. According to a recent article by Travel and Tour, the adventure tourism market for 2022 was calculated at USD 324.90 billion. Its projection is expected to surge further, increasing to approximately USD 1,947.5 Billion during the period of 2032. More and more people are currently searching for thrilling experiences on water. Water scooters are thrilling ways to explore the ocean and lakes, and they are really gaining acceptance. Additionally, water sports tourism is increasing as many coastal destinations offer water scooter rentals to the tourists. The rapid growth of adventure tourism in recent years is driving the demand for water scooters as these are gaining popularity among the tourists and locals seeking adventure and leisure activities on water.

Technological Innovations Enhancing User Experience

Continuous technological advancement in water scooters is contributing highly to market growth. GPS tracking, smartphone integration, advanced safety mechanisms, and customizable speed settings enhance the overall user experience, thus making water scooters more attractive to both recreational and professional users. Examples of this include some modern water scooters that feature app-based controls to monitor in real-time how they are performing and to create routes, plus better ergonomics for enhanced comfort and ease of use. These innovations spur consumer interest and increase the scope of the market. International tourism is also likely to recover around 90% of its pre-pandemic levels by the end of this year. The World Tourism Organization (UNWTO) reported that between January and September 2023, an estimated 975 million international tourists traveled internationally, a growth of 38% compared to the same months of 2022. Such a rise in global tourism has increased the demand for water-based recreational activities, such as water scooters, as more tourists seek adventure and unique water sports experiences.

Government Initiatives and Eco-Friendly Regulations

Governments around the world are now encouraging and implementing eco-friendly transportation. Electric water scooters are among these options that a government could look for sustainability. Regulatory authorities are enforcing tighter emissions regulations and offering incentives to encourage businesses and consumers to adopt eco-friendly products. For instance, the government of Dubai has played a very significant role in developing tourism and sustainable transportation through positive policies, such as tax breaks, relaxed visa requirements, and infrastructure developments as part of the Dubai Tourism Vision 2025. The vision seeks to bring in 25 million visitors every year, thus increasing the need for eco-friendly water activities, including electric water scooters. Japanese officials have recently established the "Visit Japan" program, aiming for 40 million inbound tourists to be visiting each year by 2020, and 60 million by 2030. All of this contributes to growing demands for green, eco-friendly options for leisurely activities and fun, leading the water scooter market to increase especially for electric.

Water Scooter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global water scooter market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on vehicle type, propulsion type and application.

Analysis by Vehicle Type:

- Under Water

- Water Surface

Water surface leads the market share in 2025. This growth is fueled by its extensive use in both recreational and professional applications. These scooters are highly popular among tourists and adventure enthusiasts for activities like coastal exploration, water sports, and leisure rides. Their adaptability, user-friendliness, and compatibility with various water bodies make them the preferred option. The segment benefits significantly from rental models offered at tourist hotspots, making water scooters accessible to a broader audience. Additionally, improvements in design, including greater stability and enhanced safety features, have further increased their appeal, reinforcing their dominant position in the market.

Analysis by Propulsion Type:

- Fuel Operated

- Battery Operated

The fuel-operated segment leads the water scooter market in 2025, owing to its superior performance and longer operational range compared to electric counterparts. These scooters are favored for high-speed recreational activities, professional uses, and areas where charging infrastructure is limited. Their robust engines and ability to sustain longer rides make them ideal for adventure seekers and rental operators. Additionally, advancements in fuel efficiency and engine technology have enhanced their appeal, ensuring lower emissions and operational costs. Despite growing interest in eco-friendly alternatives, fuel-operated water scooters remain the dominant choice due to their widespread availability, reliability, and ability to meet the demands of both individual users and commercial operators.

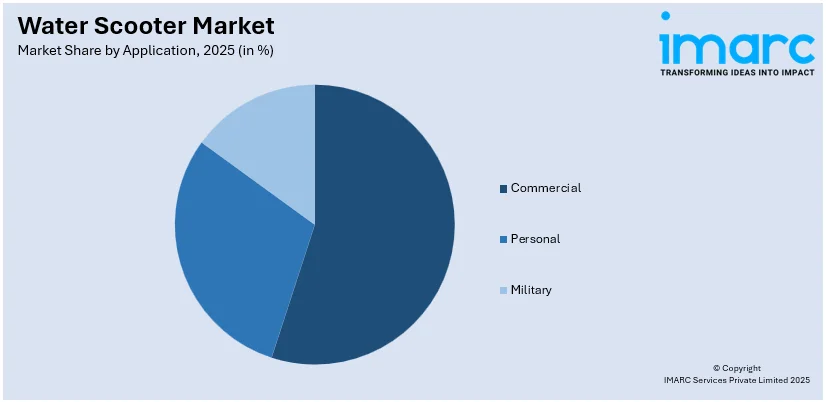

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Personal

- Commercial

- Military

The commercial segment holds the largest share in the water scooter market in 2025, driven by its extensive use in tourism, rental services, and water sports facilities. Coastal resorts, adventure parks, and tour operators increasingly rely on water scooters to attract tourists and provide unique experiences, fueling demand in this segment. Their inclusion in guided tours, recreational packages, and event activities highlights their versatility and appeal. Additionally, the rise in water-based tourism globally, coupled with strategic investments in coastal destinations, has further boosted the commercial segment's dominance. Rental models, which make water scooters accessible to a wider audience without ownership barriers, also play a crucial role in this segment's growth.

Regional Analysis

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America represented the largest market share across the globe. This growth is fueled by the region’s well-developed water sports infrastructure, high disposable incomes, and a strong culture of outdoor recreation. The United States, in particular, is a key contributor, with popular coastal and lake destinations offering water scooters as part of tourism and leisure packages. Furthermore, the presence of top manufacturers and rental operators boosts market accessibility. The growing popularity of water-based adventure activities, coupled with frequent promotional campaigns by tourism boards, has further solidified the region’s leadership. Furthermore, advancements in technology and increasing participation in water sports activities across Canada and the U.S. contribute to sustained demand in this segment.

Key Regional Takeaways:

United States Water Scooter Market Analysis

The United States water scooter market has a bright outlook, riding the wave of a booming USD 170 Billion recreational boating industry. Boat show season runs from January to March and is the perfect opportunity for the industry to unveil new water scooter innovations. In fact, NMMA expects two million Americans to visit boat shows during this season, which makes up 85% of the country's recreational marine industry. Boat retailers and manufacturers have traditionally made 30% to 50% of their total annual sales through these events, and growing consumer interest in outdoor recreation has elevated interest in water scooters as useful and exciting watercraft. Displaying advances in designs and technologies at such shows keeps the water scooters in front of enthusiasts and new buyers' eyes. This seasonal exposure catalyzes market growth as it enhances sales and increases consumer participation in water sport activities.

Europe Water Scooter Market Analysis

The European water scooter market is witnessing an uptick in tourism. According to an industry report, there were 780.1 million nights spent in EU tourist accommodations in the second quarter of 2024. Higher demand for water-based recreational activities, such as water scooters, has resulted from increased tourism. Most of the European coastal and lakeside destinations now offer water scooter rentals to keep up with the growing number of tourists looking for an adrenaline-pumping water adventure.

As tourists look for unique experiences, water scooters are a thrilling and environmentally friendly way to explore the vast waterways of Europe. The growth of water sports tourism is also fueling demand for water scooters in the Mediterranean and the Adriatic coast, which are popular tourist destinations. With the growing demand for experiential travel and outdoor recreation, the European water scooter market will experience significant growth, supported by a rising inflow of tourists eager to discover new and exciting water-based activities.

Asia Pacific Water Scooter Market Analysis

The Asia Pacific water scooter market is growing exponentially due to the rising international tourism. In 2023, international visitor arrivals in 47 destinations across the Asia Pacific region increased to 522 million, with a growth rate of 94.3% compared to the previous year. China alone received over 82 million visitors, and the USA recorded more than 66 million arrivals, according to Pacific Asia Travel Association (PATA).

With more tourists seeking unique and thrilling water-based activities, the demand for water scooters is increasing, especially in coastal and lakeside destinations. Water scooter rentals are becoming popular among tourists looking for exciting ways to explore the region's scenic waterways. It has led to boom travel and adventure tourism, besides a growing demand for eco-friendly and recreational activities that have promoted the growth of water scooters in Asia Pacific and has therefore been one of the most booming growth sectors in this region.

Latin America Water Scooter Market Analysis

The Latin American water scooter market is bound to grow as international tourism rises. International arrivals to South America had reached 32.92 million travellers in 2023 and is expected to recover to the pre-pandemic level by 2024, according to industry reports. The increase in tourism is now demanding more recreation activities, mainly at coastal places.

In line with the increased desire of tourists to experience more exciting and diverse activities, water scooters are becoming an exciting way for visitors to experience the region's beaches and waters. Many of the coastal resorts and destinations now offer water scooter rentals to fulfill the increasing interest. This trend, combined with the emphasis on adventure tourism, is driving the fast growth of the water scooter market in Latin America. As the tourism industry continues to recover, water scooters are becoming part of the recreational offerings in the region.

Middle East and Africa Water Scooter Market Analysis

A burgeoning tourism trend across the Middle East and Africa is becoming a great prospect in terms of expanding the water scooter market. For example, industrial reports show international arrivals in the Middle East was 29% more in 2024 as compared to that of 2019, becoming the world's fastest-growing region. In respect to Africa, tourist arrivals surged 6% higher than those in the corresponding period of 2019.

As tourism continues to flourish, visitors are seeking unique and thrilling recreational experiences, and water sports are becoming increasingly popular. Coastal destinations across both regions are responding by offering water scooter rentals, allowing tourists to explore their pristine beaches and waterways in an exciting and environmentally friendly way. This growing interest in adventure tourism and water-based recreational activities is further driving the demand for water scooters, hence fueling the expansion of the market in the Middle East and Africa as travelers seek memorable experiences.

Competitive Landscape:

To bolster their positions, major market participants are concentrating on innovation, strategic alliances, and regional growth. They are making research and development (R&D) investments in order to launch cutting-edge models with enhanced safety features, eco-friendly propulsion systems, and performance. For example, electric water scooters are becoming more popular as these companies try to satisfy customers who care about the environment. Another popular strategy that enables firms to expand their market presence in areas with strong demand is cooperation with resorts and tourist operators. Additionally, businesses are using social media and digital platforms to improve customer interaction and target younger, adventure-seeking consumers with their products. Key stakeholders are also investigating rental and sharing strategies to reach a wider audience, especially in tourist-heavy locations. By prioritizing sustainability, accessibility, and performance improvements, these companies are not only meeting current market needs but also positioning themselves for future growth leadership.

The report provides a comprehensive analysis of the competitive landscape in the water scooter market with detailed profiles of all major companies, including:

- Bombardier Recreational Products Inc.

- Dive Xtras Inc.

- Divertug

- Kawasaki Heavy Industries Ltd.

- Nellis Engineering Inc.

- SubGravity

- Suex Srl

- Torpedo Inc.

- TUSA Inc.

- Yamaha Motor Co. Ltd.

Latest News and Developments:

- August 2024: Gogoro has partnered with Nebula Energy to introduce battery swapping stations and Smartscooters in Kathmandu Valley, Nepal. This collaboration is anticipated to accelerate the adoption of electric two-wheel vehicles in the area.

- February 2024: WardWizard Innovations and Mobility Ltd, a prominent electric vehicle maker under the 'Joy e-bike' brand, revealed its concept for a hydrogen-powered electric two-wheeler at the first-ever Bharat Mobility Global Expo 2024.

- August 2023: The Hydroflyer, an electric hydrofoil board, was launched into the market. Priced at USD 15,000, it can go up to 27 mph and is being marketed as the mountain bike of the sea.

Water Scooter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Under Water, Water Surface |

| Propulsion Types Covered | Fuel Operated, Battery Operated |

| Applications Covered | Personal, Commercial, Military |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bombardier Recreational Products Inc., Dive Xtras Inc., Divertug, Kawasaki Heavy Industries Ltd., Nellis Engineering Inc., SubGravity, Suex Srl, Torpedo Inc., TUSA Inc., Yamaha Motor Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the water scooter market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global water scooter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the water scooter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A water scooter, also known as a personal watercraft (PWC), is a compact and motorized vehicle that is designed for water-based activities. It allows riders to travel across water surfaces at varying speeds, making it popular for recreation, sports, and rescue operations. It is available in common types, including sit-down and stand-up models.

The water scooter market was valued at USD 2.0 Billion in 2025.

IMARC estimates the global water scooter market to exhibit a CAGR of 6.54% during 2026-2034.

The global water scooter market is driven by the increasing interest in water sports, rapid advancements in scooter technology, rising disposable incomes, and growth in tourism. Eco-friendly innovations, rental models enhancing accessibility, and social media promotion further boost demand, catering to both recreational and commercial users worldwide.

According to the report, water surface represented the largest segment by vehicle type, as they are versatile, widely available, and cater to both recreational and professional users.

Fuel operated leads the market by propulsion type as these scooters offer superior speed, range, and performance.

Commercial is the leading segment by application, as it benefits from water scooters’ widespread use in tourism, rental services, and water sports facilities.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global water scooter market include Bombardier Recreational Products Inc., Dive Xtras Inc., Divertug, Kawasaki Heavy Industries Ltd., Nellis Engineering Inc., SubGravity, Suex Srl, Torpedo Inc., TUSA Inc., Yamaha Motor Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)