Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2026-2034

Watch Market Size and Share:

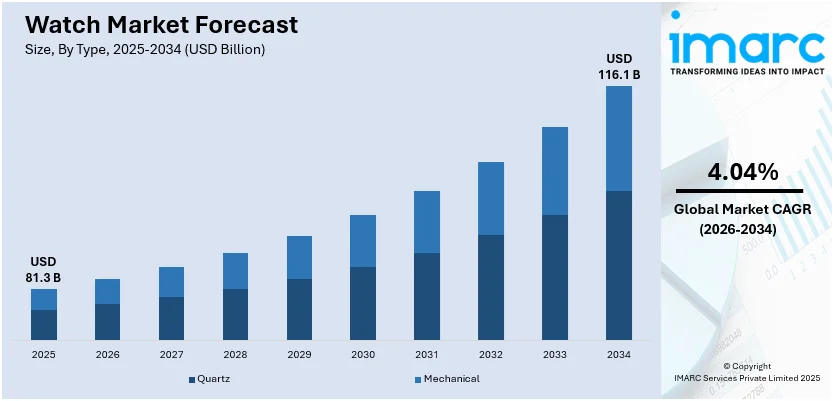

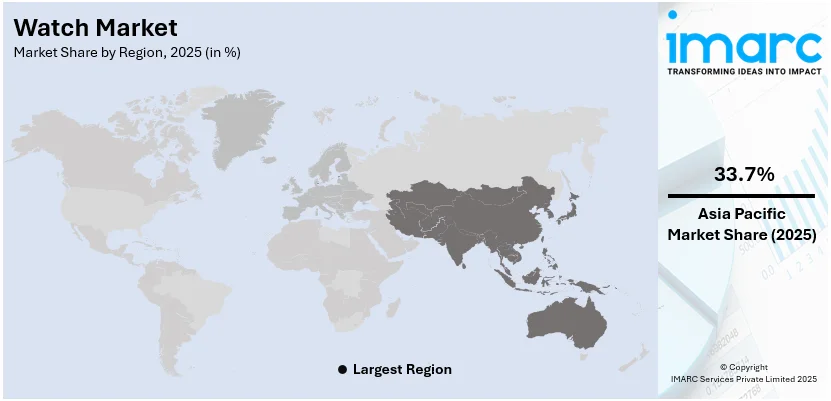

The global watch market size was valued at USD 81.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 116.1 Billion by 2034, exhibiting a CAGR of 4.04% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 33.7% in 2025. The changing fashion and lifestyle trends, significant technological advancements, growing economic prosperity, increasing adoption of premium accessories, strong marketing and branding, and rapid expansion of online retail and e-commerce are some of the major factors expanding the watch industry market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 81.3 Billion |

| Market Forecast in 2034 | USD 116.1 Billion |

| Market Growth Rate (2026-2034) | 4.04% |

The global watch market is driven by the rising demand for luxury and smartwatches, reflecting a blend of style and functionality. Increasing disposable incomes, particularly in emerging economies, are propelling the demand for high-end timepieces. The growing adoption of smartwatches for health monitoring and connectivity is also contributing substantially to industry expansion. According to the IMARC Group, the global smartwatch market size reached USD 53.2 Billion in 2024 and is forecasted to reach USD 218.9 Billion by 2033, exhibiting a CAGR of 17% during 2025-2033. In addition to this, the enduring appeal of traditional analog watches among collectors and enthusiasts sustains their market segment. Furthermore, e-commerce platforms and omnichannel retail strategies are enhancing accessibility, driving the global watch market forward.

To get more information on this market Request Sample

The United States has emerged as a key regional market for watches, driven by the growing popularity of smartwatches, reflecting consumer demand for fitness tracking, health monitoring, and connectivity features. As per a report published by the IMARC Group, the United States smartwatch market is projected to exhibit a CAGR of 17.70% during 2024-2032. Moreover, rising disposable incomes and a strong preference for luxury watches among affluent buyers further propel global watch market growth. The appeal of traditional mechanical and analog watches remains strong, driven by collectors and enthusiasts. Brand collaborations, exclusive launches, and innovative designs cater to evolving consumer preferences. Additionally, the increasing focus on sustainability and eco-friendly materials in watchmaking also resonates with environmentally conscious consumers, contributing to industry expansion.

Watch Market Trends:

Growing economic prosperity

During periods of economic prosperity, when disposable income rises and consumer confidence is high, the demand for luxury and premium watches tends to rise. Affluent consumers view watches as functional timekeeping devices and status symbols that reflect their success. As personal finances stabilize and improve, consumers are more inclined to invest in high-quality watches that showcase their achievements. As reported by the Bureau of Labor Statistics, the average income for the calendar year 2023 increased by 8.3% against expenditures that had risen by 5.9%, with a particularly high growth of 9.9% in the low-income sector. As a result, luxury and premium watches correspond to growing consumer demand where disposable incomes rise. Furthermore, economic growth fosters a sense of optimism, encouraging consumers to indulge in non-essential luxury purchases such as watches.

Heightened preferences for luxury watches

The market of luxury watches is experiencing growth, owing to rise in the awareness about luxury brands, the quality-driven shift in consumer preference, and the integration of leading edge technology. Today, more people are giving importance to crafts, precision, and heritage. As a result, premium watches have become status symbols. Modern functionalities such as smart watches and advanced materials are further enhancing the appeal of luxury watches. This attracts both old-school collectors and new-generation tech-inclined buyers. Moreover, the growing penetration of luxury watch brands in emerging markets is impelling the market growth. Notably, trends such as aesthetic-driven collecting are reshaping consumer behavior, with watches becoming not only functional items but also artistic expressions of personal style. Brands like Garmin’s Marq collection are capitalizing on these shifts by targeting new demographics and regions, blending luxury with modern wearables to appeal to a broader audience.

Changing fashion and lifestyle trends

Evolving fashion trends and changing lifestyle preferences are significantly influencing the global watch industry. Consumers are seeking watches that align with their personal style, whether classic, minimalist, sporty, or avant-garde. Moreover, the influence of celebrities, fashion personalities, and social media further increases the impact of these trends. As per a recent study, 67% of consumers reported that social media plays an important role in their purchasing decision. In addition, brands that adeptly incorporate the latest design elements, materials, and colors in their watches are more likely to resonate with consumers. According to the watch industry report, as fashion and lifestyles continue to evolve, the market is exhibiting flexibility, offering innovative products to cater to diverse consumer aesthetics.

Significant technological advancements

Advancements in watch technologies, such as smartwatches, are contributing substantially to market expansion. Smartwatches offer an array of features beyond timekeeping, including fitness tracking, notifications, GPS functionality, and app integration. This caters to a tech-savvy consumer demographic seeking devices capable of enhancing their daily lives. The rise of wearable technology has also blurred the lines between traditional watches and smartwatches. To stay competitive, traditional watch manufacturers have responded by incorporating smart capabilities into their designs. This convergence of technology and horology has attracted a new segment of consumers who value both functionality and style in their timepieces. As technology continues to advance, the watch market is expertly navigating the delicate balance between traditional craftsmanship and cutting-edge innovation, propelling industry growth.

Watch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global watch market report, along with forecasts at the global, regional and country levels for 2026-2034. Our report has categorized the market based on type, price range, distribution channel, and end user.

Analysis by Type:

- Quartz

- Mechanical

Quartz leads the market with around 71.0% of market share in 2025. This dominance is largely due to their exceptional accuracy and reliability. Quartz watches use the oscillations of a quartz crystal to control timekeeping with remarkable accuracy, outperforming traditional mechanical watches. Furthermore, the relatively lower production costs associated with quartz movements contribute to their market dominance, making these watches more accessible to a broader consumer base. This affordability aligns with the preferences of budget-conscious consumers who still desire a reliable timekeeping device. In addition to this, the integration of quartz movements with innovative designs and functionalities has kept them relevant in a technologically evolving world, attracting both traditionalists and those seeking modern conveniences.

Analysis by Price Range:

- Low-Range

- Mid-Range

- Luxury

Low-range exhibits a clear dominance in the market with around 49.9% of the global watch market share in 2025. Low-range watches offer an entry point for individuals seeking functional timepieces without straining their budgets. This affordability makes watches accessible to students, young professionals, and cost-conscious consumers. Additionally, the proliferation of e-commerce platforms has significantly expanded the reach of low-range watches. Online retail allows brands to efficiently market and distribute their products, catering to a global audience and further driving demand for budget-friendly options. Moreover, the increasing attention to fashion and style across various demographics has led to a demand for multiple watches to complement different outfits. Consumers often choose to own several affordable watches, each catering to a distinct style preference or occasion.

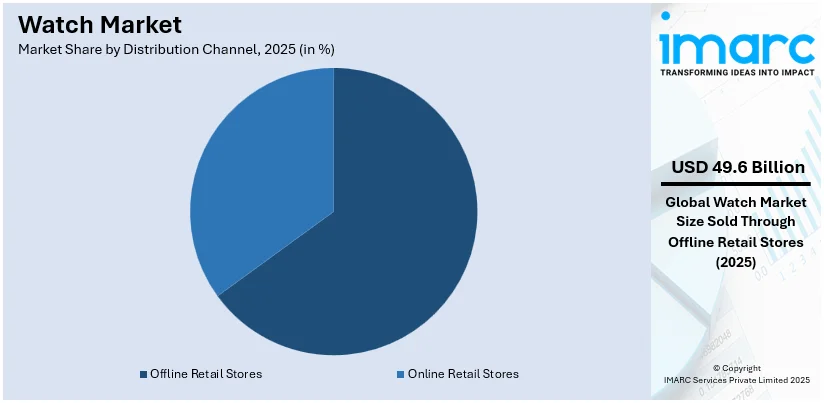

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online Retail Stores

- Offline Retail Stores

Offline retail stores represent the leading segment, with around 63.6% of watch market share in 2025. The traditional shopping experience offered by brick-and-mortar stores allows customers to physically interact with and try on watches before making a purchase. This tactile experience builds trust and confidence in the quality and design of the product. In addition to this, offline retail provides personalized customer service through knowledgeable sales representatives who can offer expert advice, guide customers through choices, and address queries in real-time. This fosters customer loyalty and enhances the overall shopping experience. Furthermore, the established network of physical stores, often located in prime retail locations, provides convenience to customers who prefer immediate gratification and face-to-face interactions.

Analysis by End User:

- Men

- Women

- Unisex

Based on the end user, the market has been segregated into men, women, and unisex. Watches have long been a symbol of masculinity, style, and status. For men, watches transcend mere timekeeping. They are an expression of personal taste, professionalism, and even accomplishment. Watches for men often feature bold designs, intricate detailing, and a wide range of functionalities, catering to diverse preferences. From classic dress watches to rugged sports watches and sophisticated chronographs, the male demographic appreciates watches as both utilitarian tools and fashion statements.

Watches for women have evolved beyond mere accessories into expressions of elegance, refinement, and individuality. Watch designs for women span from delicate and minimalist to opulent and ornate, reflecting various personal styles and occasions. Beyond aesthetics, watches catering to women often integrate features such as gemstone embellishments and versatile straps. These watches are embraced as versatile fashion accessories that complement outfits, enhance femininity, and project sophistication.

The unisex segment acknowledges that personal style transcends traditional gender norms. Unisex watches offer timeless designs and neutral color palettes that appeal to individuals who prefer a watch that complements different looks. This inclusive approach highlights the versatility of watches, emphasizing their role as expressions of personal identity rather than conforming to prescribed gender roles. The unisex segment also caters to those who seek a watch that resonates with their individuality and stands apart from conventional gender categorizations.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 33.7%. The immense population in the region, combined with rising disposable incomes, fosters a substantial consumer base with diverse preferences. As personal wealth increases, individuals are more inclined to invest in luxury goods, including watches, as symbols of status and accomplishment. Besides this, cultural significance plays a vital role. In numerous Asian countries, gifting watches carries cultural and social significance, making watches sought-after items for special occasions and celebrations. This cultural practice further propels market demand. Additionally, the region possesses a rich legacy of watchmaking expertise and craftsmanship. Countries such as Japan and Switzerland have established themselves as watch manufacturing powerhouses, producing both innovative and traditional timepieces that cater to the needs of both local and global consumers.

Key Regional Takeaways:

United States Watch Market Analysis

In 2025, the United States accounts for over 85.60% of the watch market in North America. The United States watch market is experiencing robust growth, driven by rising the demand for luxury products as well as smartwatches. Based on the National Retail Federation (NRF), retail sales for 2024 are expected to rise by 2.5-3.5% compared to 2023, with an identical growth trend is expected during the holiday season as well. The NRF has also forecasted that retail returns in 2024 will be USD 890 Billion, which translates to 17% of all sales of merchandise, as compared to 15% in 2023. This is largely due to the increased affluence and consumer interest in wearable technology. Consumers in the United States are increasingly focusing on quality and functionality, and premium timepieces and smartwatches are at the forefront of this market. Moreover, the rising trend of health and fitness tracking is making wearables more popular. In addition, the traditional watches as well as smartwatches market space is dominated mainly by Fossil, Apple, and Rolex, with an unrelenting stronghold.

Europe Watch Market Analysis

The European watch industry is flourishing due to growing demand for luxury products, as well as smart watches. The Swiss Watch Industry Federation recorded the exports of Switzerland for 2023 to CHF 26.7 Billion (USD 29.93 Billion), a record-breaking 7.6% higher than exports the previous year. Watches priced at over USD 500 contributed largely to this sum, as the export value of Swiss watches in the price segment between 500 and 3000 CHF had an approximate sum of 4.4 billion Swiss francs in 2023. In the high-end segment, performance is again good, although fewer brands show a strong clientele such as Omega, Patek Philippe, and TAG Heuer. Smartwatches are also gaining popularity, particularly in Germany, France, and the UK. More than 12 million smartwatches were sold in 2023 in this region, exhibiting a 9% year-over-year improvement. Additionally, brands are adopting more sustainable production methodologies, which include recycling metals and even materials for watch production. European watch manufacturers are also investing in research and development (R&D) to improve the functionality and design of their watches, particularly with a growing demand for multifunctional watches.

Asia Pacific Watch Market Analysis

With an increase in disposable incomes, rapid urbanization, and a higher number of people in the middle class, the Asia Pacific watch market is driven by rising demand for affordable as well as luxury watches. Increasing awareness about branded timepieces along with preference for stylish and functional accessories is further driving the growth of the market. As smartwatches are popularly used for fitness tracking, health monitoring, and connectivity, it is attracting technology-driven customers across the region. As a result, smartwatches are also experiencing explosive growth, and markets such as Japan, South Korea, and India are showing a remarkable year-over-year increase in sales. According to a report, over 40 million smartwatches were sold in Asia Pacific in 2023, with India showing a 35% annual growth rate. In addition to this, the Asia Pacific watch market is also driven forward by international brands and local designers collaborating, along with an increasing focus on eco-friendly materials and sustainable practices.

Latin America Watch Market Analysis

The Latin America watch market is driven by continuously rising disposable incomes and increasingly rising demand for stylish and useful accessories. Growing urbanization and consumer preference for branded products are the primary reasons why consumers can spend money on timepieces that reflect their personal style or status. Smartwatches that support fitness tracking, monitoring health, and connectivity-related applications are also gaining popularity. According to an industrial report, the smartwatch market in Latin America increased by 10% in 2023. Increased e-commerce platforms and online retailing channels are providing easy access to a large number of watch brands, thus generating sales across urban and rural geographies. Moreover, the penchant of the region toward luxury products, along with limited launch and brand association events, is also enhancing the attractiveness of high-end watches. Local manufacturing and distribution networks are catering to diverse consumer preferences, while the growing awareness about eco-friendly materials and sustainable practices further aligns with evolving consumer values, driving the Latin America watch market.

Middle East and Africa Watch Market Analysis

In the Middle East and Africa, high disposable incomes as well as a high-income customer base are driving the demand for watches. The GCC countries are expected to witness a significant growth in their watch market, which is projected to reach USD 7.88 billion by 2029, according to an industrial report. Additionally, luxury products will account for 70% of sales in the watch market by 2024, as the middle class in Saudi Arabia grows and drives demand for high-end timepieces. Swiss brands are particularly in demand here, with individuals preferring premium products. Smartwatches are also witnessing growth, particularly in the UAE and Saudi Arabia, where the adoption of technology is very high. According to GfK, the sale of smartwatches in the region increased by 14% in 2023. In addition to this, the growth in this market is supported by the expansion of luxury retail stores and online channels for sales, and by the focus of the region on innovation, which sets it as a key market for wearable technology.

Competitive Landscape:

Prominent watch brands are investing in research and development (R&D) to create innovative watch designs and employ novel materials. This includes experimenting with new metals, ceramics, and even sustainable materials. Moreover, numerous traditional watch manufacturers have embraced technological advancements, introducing smartwatch models alongside their traditional offerings. This integration allows them to tap into the growing demand for tech-enhanced wearables and offer consumers a diverse range of products. Additionally, collaborations with celebrities, designers, and other brands create exclusivity. Limited edition releases generate excitement among collectors and enthusiasts, driving sales and brand visibility. Other than this, key players are establishing strong online presences through official websites and partnering with e-commerce platforms. This move is enhancing accessibility and allowing brands to engage directly with customers, offer personalized experiences, and expand their global reach. In line with this, renowned watch brands are investing in their physical retail spaces, creating immersive and luxurious environments that align with their brand identity. Exceptional in-store experiences foster customer loyalty and brand advocacy.

The report provides a comprehensive analysis of the competitive landscape in the watch market with detailed profiles of all major companies, including:

- Apple Inc.

- Cartier

- Casio Computer Co. Ltd.

- Citizen Watch Co. Ltd.

- Fossil Group

- MOVADO Group Inc

- Patek Philippe SA

- Rolex SA

- Samsung Electronics Co. Ltd.

- Seiko Watch Corporation

- The Swatch Group Ltd

- Titan Company Limited

- Xiaomi Corporation

Latest News and Developments:

- May 2025: Goldsmiths, UK’s one of the major luxury watch and jewelry brand opened its new and refurbished showroom in the country. The showroom is located on the ground floor of the Bentall Shopping Center.

- June 2025: European Watch Company (EWC), the leading spot for luxury pre-owned watches, is excited to unveil its exclusive collaboration with Chubb, a global insurance leader. The new partnership with a highly reputable brand in the insurance sector will provide global coverage for EWC clients’ precious watch collections.

- April 2025: The Grand Seiko Tentagraph movement got introduced in the Tokyo Lion design. The model is developed for efficient performance in any sporting scenario.

- June 2025: Green Abyss joins the Blancpain X Swatch Bioceramic Scuba Fifty Fathoms Collection representing a cutting-edge combination of deep green shades with a hint of sandy beige and black. The novel watch draws influence from the ocean’s depths and nature’s most mysterious ecosystems, designed for individuals captivated by exploration and unfamiliarity.

Watch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apple Inc., Cartier, Casio Computer Co. Ltd., Citizen Watch Co. Ltd., Fossil Group, MOVADO Group Inc, Patek Philippe SA, Rolex SA, Samsung Electronics Co. Ltd., Seiko Watch Corporation, The Swatch Group Ltd, Titan Company Limited, Xiaomi Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the watch market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global watch market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the watch industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A watch is a timekeeping device worn on the wrist or carried in a pocket, designed to measure and display time accurately. It consists of a clock face or digital display enclosed in a case, powered by mechanical, quartz, or digital mechanisms. Beyond functionality, watches serve as fashion accessories, status symbols, and tools for tracking activities or health metrics.

The watch market was valued at USD 81.3 Billion in 2025.

IMARC estimates the global watch market to exhibit a CAGR of 4.04% during 2026-2034.

The rising demand for luxury and smartwatches, increasing disposable incomes, particularly in emerging economies, advancements in watchmaking technologies and innovative designs, growing e-commerce platforms and omnichannel retail strategies, and the popularity of eco-friendly materials and sustainable practices in watch production are the primary factors driving the global watch market.

According to the report, quartz represented the largest segment by type due to its high precision, affordability, and low maintenance requirements.

Low-range leads the market by price range, driven by its affordability and accessibility to a broad consumer base.

Offline retail stores represent the leading segment by distribution channel as they provide a personalized shopping experience and the opportunity to physically inspect products.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global watch market include Apple Inc., Cartier, Casio Computer Co. Ltd., Citizen Watch Co. Ltd., Fossil Group, MOVADO Group Inc, Patek Philippe SA, Rolex SA, Samsung Electronics Co. Ltd., Seiko Watch Corporation, The Swatch Group Ltd, Titan Company Limited, Xiaomi Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)