Waste to Energy Market Report by Technology (Thermal, Biochemical, and Others), Waste Type (Municipal Waste, Process Waste, Agriculture Waste, Medical Waste, and Others), and Region 2025-2033

Waste to Energy Market Size:

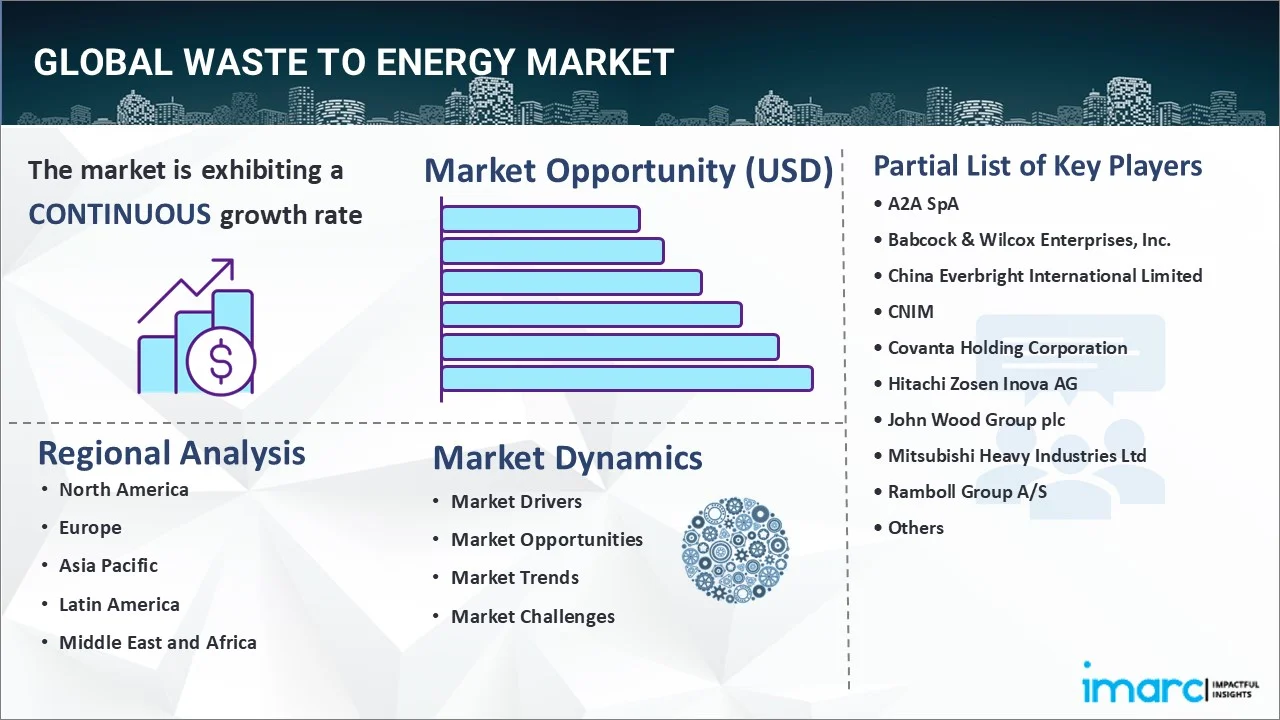

The global waste to energy market size reached USD 46.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 72.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.1% during 2025-2033. The increasing industrial waste generation, the rapid industrialization, the growing urbanization, the economic expansion of developing countries, the escalating rates of municipal solid waste (MSW) production, and the launch of new technologies are some of the factors propelling waste to energy demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 46.4 Billion |

|

Market Forecast in 2033

|

USD 72.4 Billion |

| Market Growth Rate (2025-2033) | 5.1% |

Waste to Energy Market Analysis:

- Major Market Drivers: Increasing focus on renewable energy sources and waste management solutions drives the market.

- Key Market Trends: Adoption of advanced technologies such as anaerobic digestion and thermal gasification for efficient waste conversion into energy are some of the market trends.

- Geographical Trends: Europe is dominating the market, primarily driven by the increasing adoption of waste to energy solutions.

- Competitive Landscape: A2A SpA, Babcock & Wilcox Enterprises, Inc., and China Everbright International Limited are some of the major companies, among many others.

- Challenges and Opportunities: Balancing environmental concerns with economic viability poses challenges, while waste to energy market recent opportunities lie in using technological advancements for increased efficiency in waste to energy processes.

Waste to Energy Market Trends:

Rising regulatory backing

Regulatory assistance is essential for providing a boost to the market's expansion. Governments all around the world are starting to understand the significance of renewable energy production. They are putting in place different measures and rules to encourage the use of these technologies. An example of this is feed-in tariffs which provide assured rates for electricity produced from waste to energy initiatives, guaranteeing a constant income flow and lowering financial uncertainties for investors. Renewable energy mandates necessitate a specific portion of energy to come from renewable sources, such as waste to energy, thus generating a market demand for these projects. Furthermore, regulatory frameworks might offer incentives like tax breaks, funding, or financial aid to encourage more investment in waste to energy infrastructure. In general, regulatory assistance creates the essential structure and motivations for the waste to energy market revenue to flourish, encouraging innovation, investment, and the acceptance of sustainable waste management solutions.

Rising levels of waste production

The rapid growth of cities and industries is resulting in the rising amount of waste produced. This presents major obstacles for waste management techniques. These technologies provide an answer to this crisis by transforming waste materials into valuable energy sources. In addition, the growth of cities and industrial areas frequently results in a lack of space for landfills, requiring the use of different waste management approaches. These initiatives tackle this problem by offering a practical way to redirect waste away from landfills and generate renewable energy at the same time. This double advantage makes waste to energy a desirable choice for governments, municipalities, and industries aiming to effectively handle their waste while helping renewable energy goals and environmental sustainability.

Increasing concerns about energy security

Concerns about energy security are important for governments and industries worldwide. By using waste materials from within the country as fuel, waste to energy projects reduce the dangers linked to unpredictable fuel prices and shortages, offering a reliable and eco-friendly energy source for communities and industries. Moreover, these plants could be strategically positioned close to urban areas and industrial clusters, reducing energy loss during transmission and guaranteeing a consistent power supply to nearby grids. This method of producing energy in specific areas improves energy security by varying the energy sources and decreasing dependence on centralized power plants, therefore making energy systems more resistant to external shocks and interruptions. The waste to energy market forecast shows significant growth in the coming years.

Waste to Energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology and waste type.

Breakup by Technology:

- Thermal

- Incineration

- Pyrolysis

- Gasification

- Biochemical

- Others

Thermal (incineration) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology. This includes thermal (incineration, pyrolysis, and gasification), biochemical, and others. According to the report, thermal (incineration) represented the largest segment.

The thermal segment is leading in the waste to energy market outlook. The incineration process plays a crucial role in the market by providing a dependable and effective way to convert solid waste into energy. Through the use of elevated temperatures to burn waste products, thermal incineration creates heat that can be harnessed for generating electricity or heating structures. This method decreases the amount of waste that needs to be disposed of and also offers an energy source to meet energy needs and lessen dependence on fossil fuels.

Breakup by Waste Type:

- Municipal Waste

- Process Waste

- Agriculture Waste

- Medical Waste

- Others

Municipal waste accounts for the majority of the market share

A detailed breakup and analysis of the waste to energy market report based on the waste type has also been provided in the report. This includes municipal waste, process waste, agriculture waste, medical waste, and others. According to the report, municipal waste represented the largest segment.

The waste to energy market overview shows that municipal waste is leading the market. Waste produced by households, businesses, and institutions is a major factor in the expansion of the market. As cities grow and industries advance, the amount of trash produced increases, creating obstacles for old ways of handling waste. Converting municipal solid waste into energy resources through these technologies is a sustainable solution that decreases the reliance on landfill space and lessens environmental impacts. The energy generated from city waste can assist in meeting the energy needs of the community. Governments and municipalities around the globe are investing in these projects to effectively manage municipal waste streams and produce renewable energy, due to the growing awareness of the environmental and economic advantages.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest waste to energy market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe is leading the market.

Europe leads the waste to energy market statistics due to various reasons. Stringent waste management rules, restricted landfill availability, and expensive energy costs have driven European nations to put money into sustainable waste management alternatives. Furthermore, government support through policies like feed-in tariffs and incentives for renewable energy encourages the growth of these initiatives. Moreover, Europe's strong position in this sector is supported by a reliable infrastructure, technological progress, and a dedicated focus on environmental sustainability. Moreover, the region's market leadership is fueled by the growth in public knowledge and the embrace of waste to energy as a valuable renewable energy option, encouraging ongoing advancements and investments in related technologies.

Leading Key Players in the Waste to Energy Industry:

The waste to energy market recent developments are being propelled by key players who are making investments in research and development, technological advancements, and forming strategic partnerships. These companies use their skills to create innovative solutions. The major stakeholders are engaging in partnerships to diversify their range of services. For instance, Hitachi Zosen Inova AG (HZI), a Swiss-based company and a wholly-owned subsidiary of Hitachi Zosen Corporation, has entered into an agreement with Viessmann Industriesysteme GmbH, headquartered in Hessen, Eder, Germany. Under this agreement, HZI will acquire all shares of Schmack Biogas Service GmbH (SBS) and microbEnergy GmbH (ME), both engaged in the biogas business. These companies are currently owned by the Schmack Group, which is affiliated with Viessmann. Moreover, the major waste to energy market companies actively participate in various discussions to push for favorable policies and regulations that encourage the use of these technologies. Key players have a vital role in driving innovation and shaping the market by showing leadership in sustainability and promoting industry collaboration.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- A2A SpA

- Babcock & Wilcox Enterprises, Inc.

- China Everbright International Limited

- CNIM

- Covanta Holding Corporation

- Hitachi Zosen Inova AG

- John Wood Group plc

- Mitsubishi Heavy Industries Ltd

- Ramboll Group A/S

- Veolia Environnement S.A.

- WIN Waste Innovations

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- March 9, 2024: A2A SpA and Enel signed an agreement for the reorganisation of electricity networks in Lombardy.

- April 22, 2024: Babcock & Wilcox Enterprises, Inc. announced that its B&W Environmental segment has been awarded a contract for approximately $15 million to supply environmental equipment for an industrial facility in the Middle East.

- October 31, 2022: China Everbright International Limited announced that its portfolio company SatixFy was successfully listed on NYSE American on 28th October 2022 with the symbol “SATX”, via a merger with Endurance Acquisition Corp.

Waste to Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Waste Types Covered | Municipal Waste, Process Waste, Agriculture Waste, Medical Waste, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A2A SpA, Babcock & Wilcox Enterprises, Inc., China Everbright International Limited, CNIM, Covanta Holding Corporation, Hitachi Zosen Inova AG, John Wood Group plc, Mitsubishi Heavy Industries Ltd, Ramboll Group A/S, Veolia Environnement S.A., WIN Waste Innovations, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the waste to energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global waste to energy market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the waste to energy industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste to energy market was valued at USD 46.4 Billion in 2024.

IMARC estimates the waste to energy market to exhibit a CAGR of 5.1% during 2025-2033.

The growing demand for renewable energy sources, increasing waste generation and landfill concerns, advancements in waste-to-energy conversion technologies, government regulations promoting waste management and sustainability, and rising awareness about environmental issues and the need for cleaner energy solutions are the primary factors driving the waste to energy market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the waste to energy market include A2A SpA, Babcock & Wilcox Enterprises, Inc., China Everbright International Limited, CNIM, Covanta Holding Corporation, Hitachi Zosen Inova AG, John Wood Group plc, Mitsubishi Heavy Industries Ltd, Ramboll Group A/S, Veolia Environnement S.A., WIN Waste Innovations, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)