Waste Heat Recovery Boiler Market Size, Share, Trends and Forecast by Type, Waste Heat Temperature, Waste Heat Source, Orientation, End-Use Industry, and Region, 2025-2033

Waste Heat Recovery Boiler Market Size and Share:

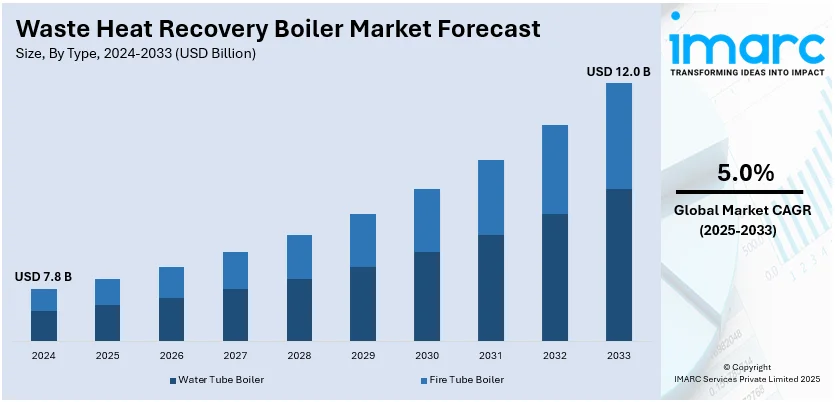

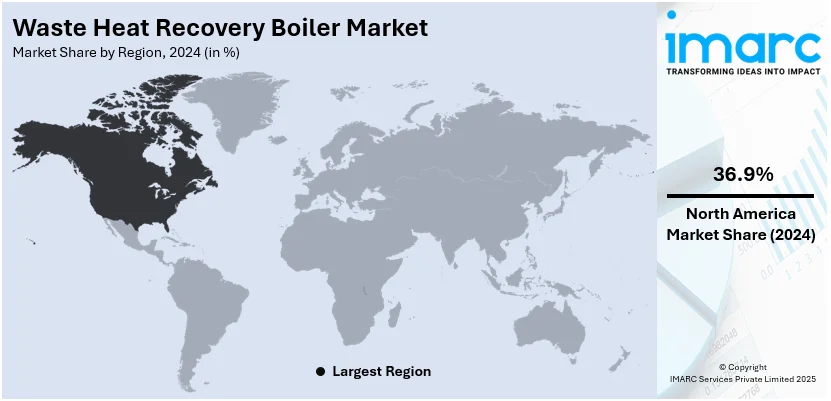

The global waste heat recovery boiler market size was valued at USD 7.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.0 Billion by 2033, exhibiting a CAGR of 5.0% from 2025-2033. North America currently dominates the market, holding a market share of over 36.9% in 2024, driven by technological advancements, energy efficiency demands, and industrial decarbonization initiatives. Innovations in heat recovery systems, along with increasing adoption across industries, are enhancing energy savings, reducing emissions, and optimizing operational costs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.8 Billion |

|

Market Forecast in 2033

|

USD 12.0 Billion |

| Market Growth Rate (2025-2033) | 5.0% |

Waste heat recovery boiler market finds growth opportunities under the impacts of rising industrial consumption of energy and strict environmental conditions. This system is in preference by industries with cement, steel, chemical industries, and electric power generation segments to cut carbon emissions and overall cost of business operations. Emission reduction policies and energy efficiency mandates are being enforced by governments worldwide, forcing industries to adopt heat recovery solutions as part of their processes. Advancements in the high-temperature heat exchanger, modular designs of boilers, and automation techniques are further drivers for market growth. Moreover, decarbonization and sustainable operation of industries prompt companies to make investments in modern waste heat utilisation strategies by improving overall efficiency and profitability in the system.

In the United States, the waste heat recovery boiler market is growing due to federal incentives, sustainability goals, and rising industrial energy consumption. For instance, in 2024, the EIA forecasted that power sales would reach 1,503 Billion kWh for residential consumers, 1,413 billion kWh for commercial customers, and 1,039 Billion kWh for industrial customers. Moreover, the Department of Energy (DOE) as well as Environmental Protection Agency (EPA) are encouraging this adoption through proper regulatory policies along with funding mechanisms. Industries are investing considerably in highly efficient boilers and even combined heat as well as power systems to acquire energy efficiency rating. Additional growth of industries in natural gases and heavy type is also proving to be great opportunities for applications in power and other industrial heating opportunities.

Waste Heat Recovery Boiler Market Trends:

Growth Driven by Industrial Demand and Energy Efficiency

Significant growth in the power, oil and gas, and chemical industries, along with the increasing requirement for energy-efficient industrial processes, is one of the key factors driving the growth of the market. The global oil and gas market size reached USD 20.3 Billion in 2024. Apart from reusing waste heat, a WHB can also be used for removing heat from a process fluid that needs to be cooled down for transportation or storage. Furthermore, the rising environmental consciousness among the masses is also creating a positive impact on the market growth.

Rising Environmental Awareness and Government Initiatives

Resulting from the growing energy demand, there is an increasing preference for utilizing renewable resources to develop environment-friendly energy with minimal greenhouse gas (GHG) emissions. According to the WMO Greenhouse Gas Bulletin, released to inform the UN Climate Change Conference (COP), CO₂ levels have risen by 11.4% (42.9 ppm) since 2004, when they were recorded at 377.1 ppm by WMO’s Global Atmosphere Watch network. Other factors, including growing investments in combined cycle power plants across the globe, especially in emerging nations, along with the implementation of various government initiatives to promote sustainable infrastructural development, are projected to drive the market further.

Technological Advancements and Integration of Waste Heat Recovery Systems

The growing adoption of advanced technologies in waste heat recovery systems (WHRS) is significantly impacting the Waste Heat Recovery Boiler Market. For instance, in September 2024, the Government of Egypt inaugurated Heidelberg Materials, Egypt's innovative Waste Heat Recovery System at its Helwan plant. This USD 30 Million project will generate up to 20 MW of power, reduce energy consumption, and lower CO2 emissions by 40 Ktons annually. Furthermore, another key factor includes innovations with improved thermodynamic cycles, high-efficiency heat exchangers, and further integration with industrial automation systems. These technological changes improve the whole efficiency of the WHBs with reduced energy use and operational expenditure. In addition, the requirement for industrial decarbonization will increase the usage of waste heat recovery systems through industries, resulting in further momentum for market expansion. This trend is anticipated to continue, as industries focus is rising on higher efficiency and sustainability of energy.

Waste Heat Recovery Boiler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global waste heat recovery boiler market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, waste heat temperature, waste heat source, orientation, and end-use industry.

Analysis by Type:

- Water Tube Boiler

- Fire Tube Boiler

Water tube boiler leads the market with around 64.7% of market share in 2024, owing to their superior efficiency and ability to handle high-pressure applications. Unlike fire tube boilers, water tube boilers circulate water through tubes heated by waste gases, allowing for more efficient heat transfer and faster steam production. This design enables them to handle higher heat loads and pressure conditions, making them ideal for industries such as power generation, steel, and petrochemicals. The versatility, reliability, and compact design of water tube boilers make them the preferred choice for large-scale, high-efficiency waste heat recovery applications.

Analysis by Waste Heat Temperature:

- Medium Temperature

- High Temperature

- Ultra-High Temperature

High temperature leads the market with around 51.9% of market share in 2024, primarily due to its ability to yield greater energy recovery. Industries such as steel, cement, and petrochemical production generate high-temperature waste gases that are ideal for efficient heat recovery. At elevated temperatures, waste heat can be converted into steam or electricity with minimal energy loss, improving overall operational efficiency. Additionally, high-temperature recovery systems contribute significantly to reducing fuel consumption and carbon emissions. As industries continue to prioritize sustainability and energy efficiency, the demand for high-temperature waste heat recovery boilers is expected to remain strong.

Analysis by Waste Heat Source:

- Oil Engine Exhaust

- Gas Engine Exhaust

- Gas Turbine Exhaust

- Incinerator Exit Gases

- Others

Oil engine exhaust stand as the largest waste heat source in 2024, holding around 26.8% of the market, due to its significant heat generation during the combustion process in engines. The high-temperature exhaust gases from oil engines offer substantial energy recovery potential, which can be utilized to generate steam or electricity. This is especially beneficial in industries such as power generation, marine, and oil and gas, where oil engines are extensively used. Recovering waste heat from engine exhaust improves energy efficiency, reduces fuel consumption, and lowers carbon emissions, making it a crucial source for sustainable operations and cost-effective energy management in various sectors.

Analysis by Orientation:

- Horizontal

- Vertical

Horizontal leads the market with around 80.5% of market share in 2024, favored for its efficiency and space optimization. This configuration is commonly used in industries where larger heat recovery capacities are required, such as in power generation and heavy manufacturing. Horizontal boilers offer easy access for maintenance, improved heat transfer, and enhanced fluid flow, making them ideal for high-capacity installations. Their compact design also allows for better integration into existing plant infrastructures, minimizing the need for extensive modifications. These factors, coupled with their reliability and versatility, position horizontal waste heat recovery boilers as the preferred choice in the market.

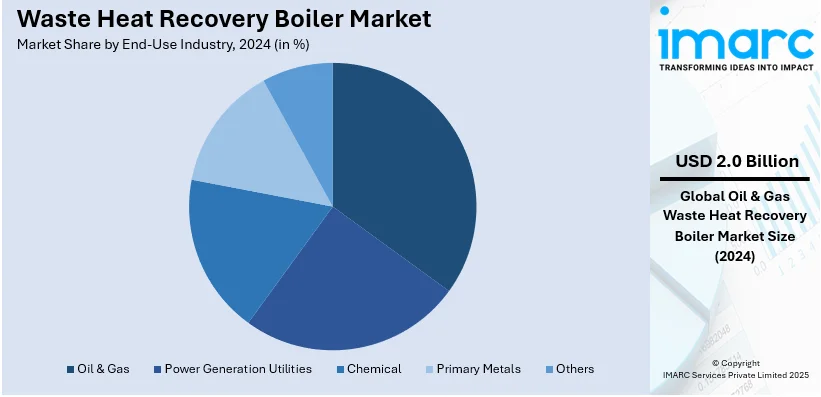

Analysis by End-Use Industry:

- Power Generation Utilities

- Oil & Gas

- Chemical

- Primary Metals

- Others

Oil & gas stand as the largest end-use industry in 2024, holding around 26% of the market, driven by the sector's high energy consumption and significant heat generation during refining and production processes. Waste heat recovery systems are critical for improving energy efficiency, reducing operational costs, and minimizing environmental impact in this industry. By capturing and reusing excess heat, oil and gas facilities can lower fuel consumption and emissions. Additionally, the industry's focus on sustainability and compliance with stringent environmental regulations further accelerates the adoption of waste heat recovery boilers, solidifying their role in enhancing energy efficiency within the sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.9%. The region’s emphasis on energy efficiency, combined with stringent environmental regulations, accelerates the adoption of waste heat recovery systems across key industries. Additionally, high demand for energy efficiency, coupled with stringent environmental regulations, has accelerated the adoption of waste heat recovery systems in the region. Industries such as cement, steel, and chemical manufacturing are major contributors to market growth. Furthermore, North American governments' incentives and policies supporting clean energy technologies bolster the market's expansion. Besides this, the region's advanced infrastructure, technological expertise, and commitment to reducing carbon emissions position it as the dominant player in the global market.

Key Regional Takeaways:

United States Waste Heat Recovery Boiler Market Analysis

In 2024, United States accounted for 85.20% of the market share in North America. The U.S. waste heat recovery boiler market is driven by a combination of regulatory pressures, rising energy costs, and technological advancements in energy efficiency. According to the Environmental Protection Agency (EPA), U.S. greenhouse gas emissions in 2022 totaled 6,343 Million Metric Tons (14.0 Trillion Pounds) of carbon dioxide equivalents, highlighting the urgent need for industries to adopt sustainable practices to reduce emissions. The EPA has implemented stringent regulations to curb these emissions, encouraging industries to adopt energy-saving technologies like waste heat recovery boilers. As energy prices continue to rise and demand for industrial energy efficiency grows, waste heat recovery systems provide an economically viable solution for many sectors. Industries such as chemicals, metal, and cement, where high temperature processes generate substantial waste heat, are increasingly integrating these systems. Furthermore, advancements in waste heat recovery technologies, including organic Rankine cycles and improved heat exchangers, are enhancing system efficiency and cost-effectiveness. The EPA also supports the adoption of clean energy solutions through various government incentives, further encouraging industries to invest in waste heat recovery technologies. As sustainability becomes more critical and operational costs continue to climb, waste heat recovery systems are proving to be a key strategy for reducing both environmental impact and energy expenses, positioning the U.S. as a leader in sustainable industrial practices.

Europe Waste Heat Recovery Boiler Market Analysis

The European waste heat recovery boiler market is experiencing robust growth due to the region’s commitment to environmental sustainability, energy efficiency, and regulatory compliance. According to the European Parliament, the EU was the world’s fourth largest greenhouse gas emitter in 2023, following China, the United States, and India. The EU’s share in global emissions fell from 15.2% in 1990 to 6.0% in 2023, reflecting the region's efforts to reduce its carbon footprint. These stringent environmental regulations, coupled with the European Green Deal, are driving industries to adopt technologies like waste heat recovery boilers to meet emissions reduction targets. Industries such as manufacturing, steel, and cement, which are energy-intensive, are increasingly implementing waste heat recovery systems to cut down energy costs and minimize environmental impact. Rising energy prices across Europe further push industries to optimize energy usage, making waste heat recovery a cost-effective solution. Technological advancements, including more efficient heat exchangers and the development of new materials, have made these systems even more attractive. Furthermore, government incentives and subsidies are accelerating the installation of waste heat recovery systems, with nations like Germany, France, and the UK taking a proactive approach to encourage clean energy solutions. These combined factors are positioning Europe as a leader in sustainable industrial practices.

Asia Pacific Waste Heat Recovery Boiler Market Analysis

In the APAC region, the growth of the waste heat recovery boiler market is primarily driven by rapid industrialization and urbanization, particularly in countries like China and India, where energy demands are soaring. According to the World Bank, East Asia and the Pacific is the world’s most rapidly urbanizing region, with an average annual urbanization rate of 3%. This rapid urbanization is fueling industrial growth, which in turn increases the need for energy-efficient technologies like waste heat recovery systems. Additionally, stringent environmental regulations in these countries are pressuring industries to reduce emissions and improve sustainability. The rising cost of fossil fuels further encourages companies to explore alternative energy solutions, with waste heat recovery presenting an economically viable option. Growing awareness of climate change and global sustainability goals is also driving demand. Governments in countries like Japan and South Korea are providing incentives for the adoption of clean technologies, boosting the market for waste heat recovery boilers in the region.

Latin America Waste Heat Recovery Boiler Market Analysis

In Latin America, the waste heat recovery boiler market is supported by the increasing focus on sustainable energy solutions and the rising demand for energy efficiency in industrial sectors such as cement, chemicals, and metallurgy. According to reports, urbanization in Latin American countries is now around 80%, higher than in most other regions, which is driving industrial growth and energy consumption. As the region faces energy supply challenges, waste heat recovery systems offer a cost-effective way to optimize energy use. Governments are also implementing stricter environmental regulations, accelerating the adoption of these technologies across Latin America.

Middle East and Africa Waste Heat Recovery Boiler Market Analysis

In the Middle East and Africa, the waste heat recovery boiler market is driven by the need for energy efficiency in energy-intensive industries such as oil and gas, petrochemicals, and steel manufacturing. According to the World Bank, the Middle East and North Africa (MENA) region is already 64% urbanized, which is increasing industrial activity and energy consumption. The rising energy costs and the emphasis on sustainability are pushing industries to adopt waste heat recovery systems to reduce energy consumption and minimize carbon footprints. Additionally, the region’s economic diversification efforts, such as Saudi Arabia’s Vision 2030, further support the adoption of clean technologies.

Competitive Landscape:

The waste heat recovery boiler market is highly competitive, driven by industrial expansion, energy efficiency regulations, and rising demand for sustainable power solutions. Manufacturers focus on advanced heat exchanger designs, high-efficiency materials, and automation integration to improve system performance. The market is witnessing strategic collaborations between boiler manufacturers, engineering firms, and energy service providers to optimize industrial waste heat utilization. For instance, in November 2024, GEA collaborated with Asahi India Glass's sustainability strategy by supplying two waste heat recovery systems for its glass manufacturing plants in Soniyana, Rajasthan, and Roorkee, Uttarakhand. These systems will generate 15,500 MWh annually per plant, reducing carbon emissions by 13,000 tons each year. Additionally, increasing adoption across cement, chemical, metal processing, and power generation industries is intensifying competition. Companies are also investing in modular and customized solutions to cater to diverse industry requirements. Furthermore, technological innovation and regulatory compliance remain key competitive factors shaping market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the waste heat recovery boiler market with detailed profiles of all major companies, including:

- ABB Ltd.

- Alfa Laval

- Bosch Industriekessel GmbH

- Forbes Marshall

- IHI Corporation

- Kawasaki Heavy Industries, Ltd

- Mitsubishi Heavy Industries Ltd.

- Terrapin Geothermics

- Thermax

Latest News and Developments:

- January 2025: Thermax has commissioned a 10 TPH biomass-fired hybrid boiler for a US-based pharmaceutical company in western India. Managed by Thermax Onsite Energy Solutions Limited (TOESL) under a build-own-operate model, the solution ensures efficient operations, reliable biomass fuel supply, and aligns with sustainability goals.

- December 2024: The Placo® plant in Val-de-Cognac has implemented a waste heat recovery system, cutting CO2 emissions by 14%, energy use by 10.6%, and water consumption by 10%. Supported by ADEME and regional partners, this €11.4 million project replaces a 900 kW gas boiler, advancing Placo®’s sustainability goals.

- May 2024: Valmet will upgrade a recovery boiler for Kuantum Papers Limited in Punjab, India, enhancing efficiency and performance. Based on a pre-engineering study, the project will be completed by February 2025. Kuantum Papers chose Valmet for its expertise in recovery boiler technology, focusing on increased steam generation and operational improvements.

- January 2023: Valmet delivered a new boiler and heat recovery system for Seinäjoen Energia’s Kapernaum district heating center. The upgrade, using biofuels and waste heat, replaced peat and supports Seinäjoen Energia's goal of carbon neutrality in district heating and electricity by 2030.

- April 2022: Alfa Laval has introduced the E-PowerPack, a waste heat recovery system that converts heat from engine exhaust, steam, and cooling water into electrical power using Organic Rankine Cycle (ORC) technology. Capable of handling heat sources from 550°C to 75°C, the modular solution delivers up to 200 kW of net electrical output. Designed to improve vessel Energy Efficiency Index (EEDI/EEXI) and Carbon Intensity Indicator (CII), the E-PowerPack reduces CO2 emissions, lowers fuel costs, and supports compliance with tightening sustainability regulations.

Waste Heat Recovery Boiler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Water Tube Boiler, Fire Tube Boiler |

| Waste Heat Temperatures Covered | Medium Temperature, High Temperature, Ultra-High Temperature |

| Waste Heat Sources Covered | Oil Engine Exhaust, Gas Engine Exhaust, Gas Turbine Exhaust, Incinerator Exit Gases, Others |

| Orientations Covered | Horizontal, Vertical |

| End-Use Industries Covered | Power Generation Utilities, Oil & Gas, Chemical, Primary Metals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Alfa Laval, Bosch Industriekessel GmbH, Forbes Marshall, IHI Corporation, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries Ltd., Terrapin Geothermics, Thermax, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the waste heat recovery boiler market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global waste heat recovery boiler market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the waste heat recovery boiler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste heat recovery boiler market was valued at USD 7.8 Billion in 2024.

IMARC estimates the global waste heat recovery boiler market to reach USD 12.0 Billion in 2033, exhibiting a CAGR of 5.0% during 2025-2033.

The market is experiencing significant growth, driven by technological advancements, energy efficiency demands, and industrial decarbonization initiatives. Innovations in heat recovery systems, along with increasing adoption across industries, are enhancing energy savings, reducing emissions, and optimizing operational costs.

North America currently dominates the market, holding a market share of over 36.9% in 2024. This superior market position is enabled by strong industrial demand, rigorous environmental regulations, and a focus on energy efficiency. The region's commitment to sustainable practices and advanced technological integration further accelerates market growth.

Some of the major players in the waste heat recovery boiler market include ABB Ltd., Alfa Laval, Bosch Industriekessel GmbH, Forbes Marshall, IHI Corporation, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries Ltd., Terrapin Geothermics, Thermax, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)