Warehousing and Storage Market Size, Share, Trends, and Forecast by Type of Warehouses, Ownership, End-Use, and Region, 2025-2033

Warehousing and Storage Market Size and Share:

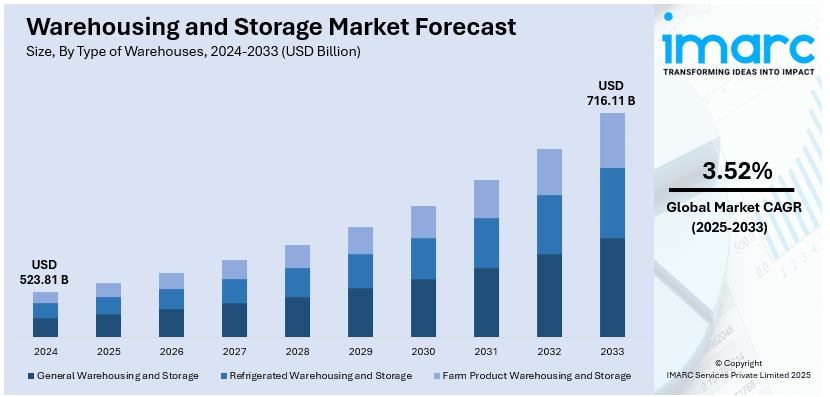

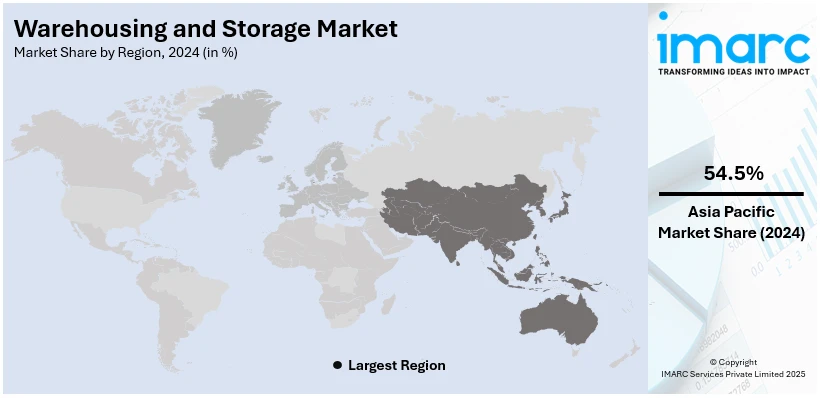

The global warehousing and storage market size was valued at USD 523.81 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 716.11 Billion by 2033, exhibiting a CAGR of 3.52% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 54.5% in 2024. The e-commerce growth, supply chain optimization, third-party logistics (3PL) expansion, cold storage demand, and technological advancements like automation and smart warehousing are some of the major factors fueling the warehousing and storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 523.81 Billion |

|

Market Forecast in 2033

|

USD 716.11 Billion |

| Market Growth Rate 2025-2033 | 3.52% |

The market for warehousing and storage is driven by multiple factors, including e-commerce expansion, supply chain optimization, and increasing reliance on third-party logistics (3PL) services. The rise of online retail, same-day delivery, and omnichannel distribution has significantly increased demand for fulfillment centers and distribution hubs. Additionally, urbanization and industrialization are fueling the need for strategically located warehouses near key transportation networks. The growing demand for cold storage solutions in the food, pharmaceuticals, and biotechnology industries is another key driver. Furthermore, technological advancements such as automation, robotics, and smart warehousing improve operational efficiency. Sustainability initiatives, including green warehouses and energy-efficient storage solutions, are also shaping market trends, as businesses seek to reduce costs and enhance environmental responsibility.

The market for warehousing and storage in the United States is driven by the rapid growth of e-commerce, increasing demand for third-party logistics (3PL) services, and advancements in automation and smart warehousing. For instance, in March 2024, LG Business Solutions USA, a technology supplier, announced that it would make its U.S. warehouse autonomous mobile robot (AMR) debut at the MODEX industry trade exhibition in Atlanta. The Mounting Type CLOi CarryBot and the Rolltainer Type CLOi CarryBot are the two variants of the CLOi CarryBot robot line, which was introduced to Asian markets in 2022. The Mounting Type robot has shelves available in two shelving sizes to accommodate the package size you wish to transport between warehouses. The rise of same-day and next-day deliveries has led to higher demand for fulfillment centers and last-mile warehouses. Additionally, the expansion of cold storage facilities due to increasing demand for frozen foods and pharmaceuticals is shaping the market. Businesses are also optimizing supply chains by strategically locating warehouses near urban centers and transportation hubs. Sustainability initiatives, including energy-efficient storage and eco-friendly warehouses, further contribute to market growth.

Warehousing and Storage Market Trends:

Supply Chain Optimization and Third-Party Logistics (3PL) Growth

Companies are optimizing supply chains by using strategically located warehouses near transportation hubs, urban centers, and ports to reduce transit times and costs. The growth of third-party logistics (3PL) providers allows businesses to outsource storage, distribution, and order fulfillment, providing cost-effective, scalable, and technology-driven solutions. Increasing globalization has led to higher demand for cross-border logistics, making warehousing a crucial part of supply chain efficiency. Businesses are also investing in distribution centers to ensure uninterrupted supply chains, reduce stock shortages, and manage inventory more effectively in response to fluctuating consumer demands and economic conditions. For instance, in December 2023, US-based Panattoni, a major player in industrial and logistics real estate development worldwide, plans to invest Rs 110 crore by March 2025 to create a warehouse park in Delhi-NCR, marking its inaugural project in the Indian market.

Technological Advancements and Smart Warehousing

The adoption of automation, robotics, the Internet of Things (IoT), and artificial intelligence (AI) is transforming warehousing operations. Automated storage and retrieval systems (AS/RS), autonomous mobile robots (AMRs), and AI-driven inventory tracking enhance warehouse efficiency, reducing labor costs and errors. Real-time data analytics and predictive inventory management allow businesses to make informed decisions, optimizing warehouse space and operations. Cloud-based warehouse management systems (WMS) improve visibility and coordination across supply chains. With rising labor costs and increasing order volumes, companies are rapidly integrating smart warehousing technologies to enhance productivity and meet the growing demands of modern logistics. For instance, in February 2025, inventory intelligence provider Gather AI revealed that it would enhance its DJI drones with new US-manufactured Starling 2 Logis drones that utilize ModalAI's VOXL 2 autopilot for collecting customer warehouse inventory information. This feature, set to launch in Q2 2025, will assist warehouse operations and innovation teams in fully leveraging the Gather AI software solution for enhanced counting efficiency and application versatility.

Cold Storage Expansion and Industry-Specific Demand

The demand for temperature-controlled warehousing is growing due to increased storage needs for perishable goods, pharmaceuticals, and biotechnology products. The rise of online grocery shopping, frozen food consumption, and vaccine storage requirements has fueled cold chain logistics investments. Additionally, industries like automotive, electronics, and chemicals require specialized warehousing solutions with specific storage conditions. Companies are investing in energy-efficient refrigeration systems and automation to improve cold storage efficiency. As regulations tighten and demand for food safety and medical storage increases, the cold storage segment continues to create a positive warehousing and storage market outlook. For instance, in July 2024, Walmart employees, local elected representatives, and community residents commemorated the grand opening of a new 730,000-square-foot perishable distribution center (PDC) in Lancaster. Fresh produce, dairy, eggs, flowers, and frozen goods are handled and managed at the new facility, which is located 15 miles south of Dallas, before being delivered to nearby Walmart stores. The advanced fulfillment center opened in 2023, and the new PDC is Walmart's second location in Lancaster.

Warehousing and Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global warehousing and storage market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on type of warehouses, ownership, and end-use.

Analysis by Type of Warehouses:

- General Warehousing and Storage

- Refrigerated Warehousing and Storage

- Farm Product Warehousing and Storage

General warehousing and storage stand as the largest type of warehouses in 2024, holding around 69.3% of the market due to their versatility, cost-effectiveness, and high demand across multiple industries. These facilities store a large variety of goods, such as industrial equipment, consumer products, and raw materials, catering to sectors like retail, manufacturing, and e-commerce. The rise of online shopping and global supply chain expansion has further increased demand for efficient storage solutions. General warehouses provide flexibility in storage duration and inventory management, making them ideal for businesses needing scalable solutions. Additionally, advancements in warehouse automation and logistics infrastructure have boosted their efficiency and market dominance.

Analysis by Ownership:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

Private warehouses lead the market with around 65.4% of the market share in 2024 due to their exclusive ownership, operational efficiency, and customized storage solutions. Businesses, especially in sectors like retail, manufacturing, and e-commerce, prefer private warehouses to maintain control over inventory, ensure faster order fulfillment, and optimize supply chain management. These facilities offer advanced storage technologies, automation, and tailored logistics solutions, enhancing efficiency and cost savings. With the rise of direct-to-consumer (DTC) brands and just-in-time inventory systems, companies invest in private warehouses for better security, reliability, and seamless distribution, making them the dominant choice in the warehousing industry.

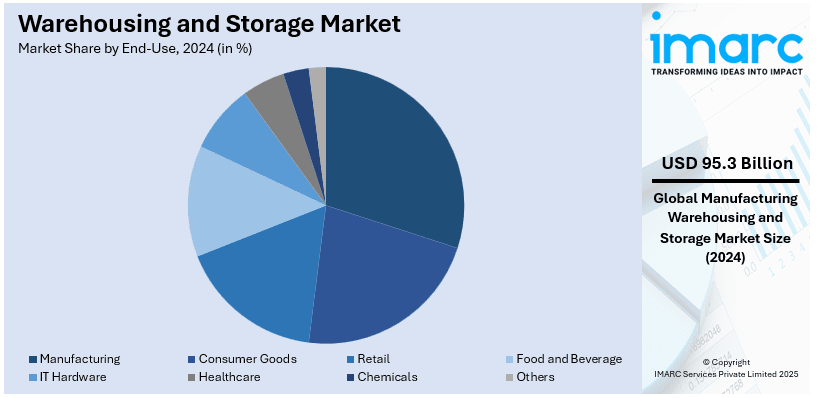

Analysis by End-Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverage

- IT Hardware

- Healthcare

- Chemicals

- Others

Manufacturing leads the market with around 18.2% of the market share in 2024 due to its high demand for raw material storage, inventory management, and distribution facilities. Warehouses are needed by manufacturers to hold finished goods, work-in-progress items, and raw materials prior to distribution. The growth of industries like automobile, electronics, pharmaceuticals, and FMCG has further driven demand for specialized storage solutions. Additionally, global supply chains and just-in-time (JIT) inventory systems necessitate efficient warehousing to minimize production delays. Automation, robotics, and smart warehousing technologies enhance efficiency, making warehousing a critical component of manufacturing operations, ensuring a smooth supply chain and production continuity.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest share of over 54.5% of the warehousing and storage market in North America. Asia-Pacific is witnessing a dynamic transformation in warehousing and storage, propelled by the rapid expansion of the manufacturing industry. According to the India Brand Equity Foundation, India's manufacturing sector is poised to reach USD 1 Trillion by 2025-26. The surge in large-scale industrial production, driven by consumer goods, automotive, electronics, and heavy machinery, is escalating the demand for expansive storage facilities with efficient supply chain management. The manufacturing sector’s shift towards just-in-time production and lean inventory practices has heightened the necessity for strategically located warehouses near industrial zones and major transportation hubs. Advanced warehousing solutions, including high-density racking, automation, and AI-driven inventory tracking, are becoming standard to support streamlined manufacturing processes. The increasing complexity of supply chains, along with cross-border trade growth, is prompting investments in multi-modal logistics hubs for seamless integration of storage and transportation. With rising labor costs and efficiency-focused production models, warehousing and storage are embracing robotics and smart management systems to enhance productivity.

Key Regional Takeaways:

North America Warehousing and Storage Market Analysis

The warehousing and storage demand in North America is driven by the increasing demand for efficient supply chain management, rapid growth of e-commerce, and advancements in warehouse automation technologies. The rise of online shopping, same-day deliveries, and omnichannel retailing has significantly boosted the need for fulfillment centers and last-mile distribution hubs. Additionally, the expansion of cold storage facilities due to rising demand for frozen food, pharmaceuticals, and biotech products is shaping the market. Supply chain optimization, with businesses strategically locating warehouses near urban centers and transportation hubs, further fuels growth. Moreover, the increasing reliance on third-party logistics (3PL) providers for scalable and cost-effective storage solutions enhances market expansion, making warehousing a crucial part of North America’s logistics network.

United States Warehousing and Storage Market Analysis

In 2024, the United States accounted for over 89.80% of the warehousing and storage market in North America. The United States is experiencing a significant expansion in warehousing and storage due to increasing demand from the chemicals sector. According to the International Trade Administration, the U.S. chemical manufacturing industry total FDI in the industry was USD 766.7 Billion in 2023. The growing chemicals industry is driving the need for specialized storage facilities with temperature and humidity control to accommodate hazardous and non-hazardous materials. Rising production volumes, stringent safety regulations, and evolving distribution networks are pushing for advanced warehousing solutions with automated handling systems and robust inventory management. The chemicals sector's expansion has led to a surge in bulk storage, dedicated logistics hubs, and third-party logistics providers catering to customized chemical storage needs. The shift towards sustainable warehousing, incorporating energy-efficient designs and eco-friendly storage materials, is also gaining traction. With the chemicals industry focusing on high-value formulations and specialty products, warehousing and storage solutions are evolving to ensure compliance with strict industry standards. The continuous rise in chemical exports and domestic distribution is further amplifying the need for optimized supply chain solutions, reinforcing the integration of smart technologies in warehousing and storage operations.

Europe Warehousing and Storage Market Analysis

Europe is seeing an increasing reliance on warehousing and storage solutions, fuelled by the growing demand from the healthcare sector. According to reports, at over USD 512.8 billion in 2022, Germany had the highest amount of current healthcare spending of any EU nation. The expansion of pharmaceutical manufacturing, medical device production, and biotechnology advancements is driving the need for temperature-controlled and highly secure storage facilities. Stringent regulations regarding the handling, distribution, and storage of medical products are shaping the adoption of high-tech warehousing infrastructure, including automated climate control and real-time monitoring. The healthcare industry’s shift toward personalized medicine and biologics is prompting specialized storage solutions with customized environmental conditions. The growing emphasis on pandemic preparedness and vaccine distribution has intensified the demand for strategic storage locations that facilitate rapid deployment and regulatory compliance. With the healthcare sector expanding digital supply chain management, warehousing and storage are incorporating AI-powered inventory tracking and automated picking systems.

Latin America Warehousing and Storage Market Analysis

Latin America is experiencing a surge in warehousing and storage demand due to the rise in online shopping. According to reports, the Latin America market currently boasts over 300 Million digital buyers. The rapid expansion of e-commerce platforms and digital marketplaces is increasing the need for fulfilment centers and last-mile delivery hubs. Warehousing infrastructure is evolving to support quick order processing, real-time inventory tracking, and streamlined distribution networks. The adoption of smart warehousing solutions, including automated sorting systems and AI-driven logistics, is enhancing operational efficiency. The shift toward omnichannel retailing is driving the development of flexible storage solutions catering to dynamic consumer demand patterns. With increasing competition among online retailers, investments in warehousing and storage technology are accelerating to ensure faster order fulfilment.

Middle East and Africa Warehousing and Storage Market Analysis

Middle East and Africa are witnessing substantial growth in warehousing and storage, driven by the expanding logistics sector. According to reports, logistics in the Middle East is booming as GCC countries leverage their strategic location, with 30% of global trade passing through the Red Sea and Gulf of Aden, driving further expansion and diversification in the sector. The increasing movement of goods across regional and international trade routes is boosting demand for large-scale storage facilities with efficient inventory management. Investments in multi-modal logistics hubs and free trade zones are enhancing warehousing infrastructure to support cross-border commerce. The rising adoption of automation and real-time tracking systems is optimizing supply chain operations.

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the global warehousing and storage market with detailed profiles of all major companies, including:

- Central Warehousing Corporation (CWC)

- CEVA Logistics

- Deutsche Post AG

- DSV A/S

- FedEx

- Geodis Group

- GMK Logistics (CTI Logistics Limited)

- Indu Logistics

- Nippon Express Holdings, Inc.

- RXO Inc.

- Ryder System, Inc.

- Sozo Logistics (Pty) Ltd

- XPO, Inc.

Latest News and Developments:

- December 2024: IEL Limited has entered the warehousing and storage sector with a land acquisition in Lucknow for its first project. The company, known for chemical and commodity trading, purchased 29,598.89 square meters in Sarojini Nagar for ₹11.80 crores. This marks a strategic expansion beyond its core business of chemicals, dyes, and pigments. IEL aims to strengthen its presence in warehousing and storage while leveraging its global trade expertise.

- June 2024: A.P. Moller - Maersk launched a low-greenhouse gas emission warehouse at Taulov Dry Port in Fredericia, Denmark. This facility sets a new global benchmark for sustainable warehousing, aligning with Maersk’s net-zero CO2 emissions goal by 2040. It enhances logistics in the Nordics, improving cargo handling across sea, road, and air. The initiative strengthens Maersk’s role in sustainable supply chain solutions.

- May 2024: Lineage, Inc. expanded its facility in Lębork, Pomorskie, Northern Poland, boosting pallet space by 30% to over 40,000 spaces. This expansion caters to rising demand in Central and Eastern Europe (CEE), reinforcing its regional presence. It follows the company's establishment of a new regional headquarters in Warsaw in November 2023. The move enhances Lineage’s storage and distribution capabilities across the region.

- June 2024: Massimo Group and Armlogi have partnered to streamline vehicle assembly and delivery in key U.S. markets. Massimo will assemble vehicles at Armlogi’s warehouses in Savannah, GA, Edison, NJ, and Walnut, CA. Armlogi will handle inventory management, storage, logistics, and delivery. This collaboration aims to enhance efficiency in vehicle distribution and supply chain operations.

- February 2024: Maersk has launched a logistics campus in Dublin, Ireland, to strengthen supply chain operations. The facility offers end-to-end logistics, storage solutions, and efficient transportation services. It provides businesses with a centralized platform to manage supply chains seamlessly. This initiative aims to enhance integration and efficiency in Irish logistics networks.

Warehousing and Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Warehouses Covered | General Warehousing and Storage, Refrigerated Warehousing and Storage, Farm Product Warehousing and Storage |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| End-Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverage, IT Hardware, Healthcare, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Central Warehousing Corporation (CWC), CEVA Logistics, Deutsche Post AG, DSV A/S, FedEx, Geodis Group, GMK Logistics (CTI Logistics Limited), Indu Logistics, Nippon Express Holdings, Inc., RXO Inc., Ryder System, Inc., Sozo Logistics (Pty) Ltd, XPO, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the warehousing and storage market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global warehousing and storage market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the warehousing and storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The warehousing and storage market was valued at USD 523.81 Billion in 2024.

The warehousing and storage market is projected to exhibit a CAGR of 3.52% during 2025-2033, reaching a value of USD 716.11 Billion by 2033.

The warehousing and storage market is driven by e-commerce growth, supply chain optimization, increasing third-party logistics (3PL) adoption, and technological advancements like automation and smart warehousing. Rising demand for cold storage in food and pharmaceuticals, strategic warehouse locations, and sustainability initiatives further fuel market expansion across industries.

Asia Pacific currently dominates the warehousing and storage market due to E-commerce growth, infrastructure development, rising third-party logistics (3PL), urbanization, cold storage demand, and warehouse automation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)