Vision Care Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Vision Care Market Size and Share:

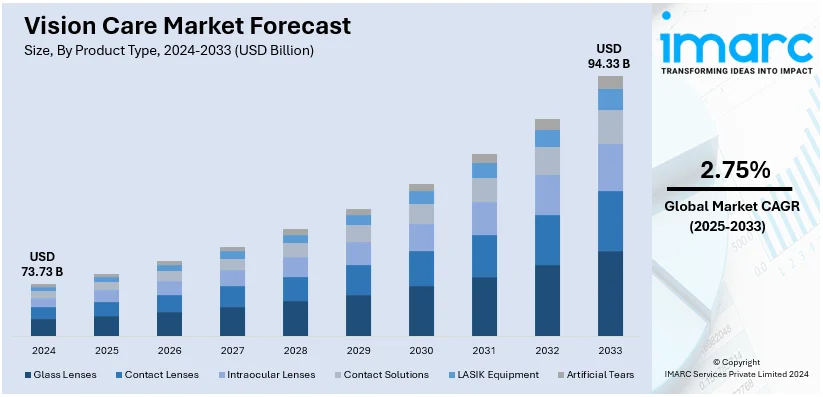

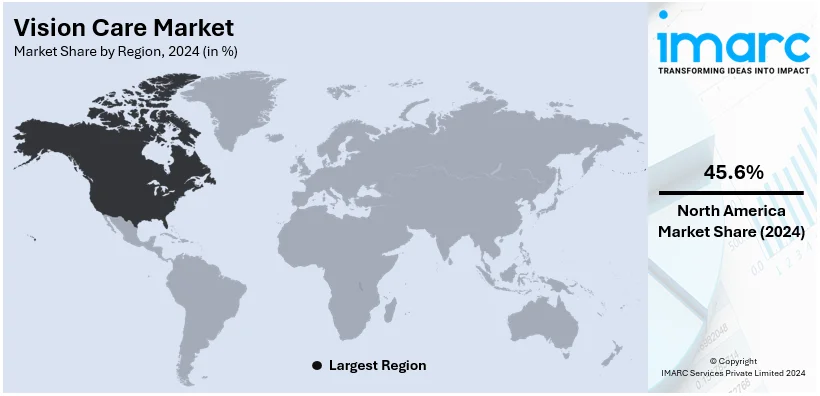

The global vision care market size was valued at USD 73.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 94.33 Billion by 2033, exhibiting a CAGR of 2.75% from 2025-2033. North America currently dominates the market, holding a market share of over 45.6% in 2024. Better access to healthcare services, heightened awareness about the importance of eye health, and emerging technological advancements in contact lenses, eyeglass frames, and lens materials are some of the major factors propelling the market in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 73.73 Billion |

|

Market Forecast in 2033

|

USD 94.33 Billion |

| Market Growth Rate (2025-2033) | 2.75% |

Vision related ailments are serious issues which hamper normal eyesight of individuals, the occurrence of vision-related disorders, such as myopia, hyperopia, presbyopia, and astigmatism, is increasing owing to the high usage of smartphones and other electronic devices. Prolonged screen time, both for work and leisure, has led to a rise in cases of digital eye strain, also known as computer vision syndrome. Some of the symptoms of digital eye strain are dryness, irritation, blurred vision, and headaches, which affect productivity and overall quality of life. In response, there has been growing demand for blue light-blocking lenses, anti-reflective coatings, and other specialized eyewear designed to mitigate the effects of extended screen exposure. In addition to refractive errors, age-related eye diseases such as cataracts, macular degeneration, and glaucoma are contributing significantly to the vision care market growth. These conditions are becoming more common due to the aging global population, necessitating regular eye exams and advanced treatment solutions.

To get more information on this market, Request Sample

The United States has emerged as a key region in the vision care market owing to several factors. One of the primary drivers of the US market is the increasing prevalence of vision impairments and eye disorders among the population. Conditions such as myopia, hyperopia, astigmatism, and presbyopia are becoming more widespread due to factors such as changing lifestyles and increased screen time. Technological advancements in the vision care industry have opened up new opportunities for growth in the US. Innovative diagnostic tools, surgical techniques, and wearable technologies have transformed how eye health is managed. For example, artificial intelligence (AI) and machine learning (ML) are widely utilized for detecting eye diseases like diabetic retinopathy and glaucoma at an earlier stage, improving patient outcomes. In the field of vision correction, procedures are becoming increasingly safe and effective, making them more appealing to people looking for alternatives to traditional eyewear. Furthermore, smart glasses equipped with augmented reality (AR) features are gaining traction, blending functionality with vision correction. Moreover, the IMARC Group predicts that the US AI market is expected to reach USD 97,084.2 million by 2032. This will further enhance vision care services in the country.

Vision Care Market Trends:

Easy Access to Healthcare Services

The increasing improvement in healthcare services is positively influencing the market. According to World Health Organization data, at least 2.2 billion people worldwide suffer from a visual impairment, and of them, at least 1 billion have an impairment that could have been prevented or still needs treatment. This high prevalence makes it even more crucial to have easy access to healthcare services. In addition, governments and healthcare organizations are enhancing access to vision care services with numerous initiatives such as establishing vision care clinics in remote and underserved areas, conducting eye health awareness campaigns, and integrating eye care services into primary healthcare systems, thus contributing to the market growth. Moreover, the integration of telemedicine and online consultation platforms has made it possible for individuals to seek professional advice from ophthalmologists and optometrists without the need for physical appointments, representing another major growth-inducing factor. According to the vision care market forecast, this digital transformation in healthcare is expected to play a pivotal role in addressing the unmet needs of individuals facing geographical barriers or mobility challenges. Besides this, collaborations between non-governmental organizations (NGOs), private healthcare providers, and international agencies are resulting in community-based eye care programs focusing on early detection and treatment of common vision problems, thus preventing avoidable vision impairments, which is propelling the market growth.

Growing Awareness Regarding Importance of Eye Health

The importance of eye health with the rising awareness campaigns is motivating individuals to prioritize their visual well-being. These campaigns are essential in educating individuals about the significance of regular eye check-ups, early detection of eye conditions, and adopting healthy practices to maintain optimal eye health. In addition, awareness campaigns are reaching audiences through various channels, including social media, traditional media outlets, community events, and educational programs thus contributing to the market growth. Also, the educational campaigns provide information about common eye conditions such as myopia, astigmatism, and age-related macular degeneration, while highlighting the potential risks associated with prolonged screen time and inadequate protective measures thus augmenting the market growth. Moreover, individuals are now inclined to schedule regular eye examinations, and early detection of eye conditions allows for timely interventions, minimizing the risk of vision loss and preserving visual acuity which represents another major growth-inducing factor. Furthermore, these campaigns emphasize the importance of ultraviolet (UV) protection for the eyes, fostering the use of sunglasses and other protective eyewear. Although unaddressed vision impairment can affect education and social inclusion, straightforward remedies like glasses can significantly change the situation. In May 2024, the WHO introduced the global SPECS 2030 initiative to guarantee access to quality, affordable spectacles and associated person-centered services for all those in need.

Increasing Popularity of Contact Lenses for Active Lifestyles

As per the IMARC Group, the worldwide contact lenses market size attained USD 9.0 Billion in 2024. The rising popularity of contact lenses, especially among individuals engaged in sports and active lifestyles, is bolstering the growth of the market. Contact lenses offer several advantages over spectacles, including a wider field of vision, better compatibility with protective gear, and enhanced comfort during physical activities. These benefits make them the preferred choice for athletes and fitness enthusiasts who require clear and stable vision without the inconvenience of frames. Technological advancements are further boosting the demand, with modern lenses offering features like UV protection, extended wear options, and improved oxygen permeability for added comfort. Additionally, aesthetic preferences, such as colored and cosmetic lenses, are contributing to their growing adoption. As awareness about the advantages of contact lenses increases and more people prioritize convenience and performance, the demand for innovative vision care solutions is expected to rise, driving market expansion.

Vision Care Market Growth Drivers:

Technological Innovations

Technological advancements are impelling the market growth. Ongoing innovation in lens design, like the introduction of smart lenses and blue light blocking lenses, is boosting both corrective and preventive eye health. Advancements in surgical techniques, including minimal invasive methods like bladeless LASIK and femtosecond laser technology, are enhancing surgery accuracy, decreasing recovery periods, and increasing patient suitability for corrective surgical procedures. Furthermore, new therapies like gene therapy and stem cell therapies are providing hopeful remedies for erstwhile untreatable or hard-to-treat eye diseases, such as inherited retinal diseases and degenerative diseases. Artificial intelligence (AI) integration in diagnostic equipment is also revolutionizing vision disorders' early detection and monitoring. Together, these technological developments are facilitating the uptake of high-end vision care products and advanced surgical procedures, eventually reinforcing the overall market potential and stimulating increased investment in research and development (R&D).

Aging Population

The constantly increasing aging population globally is driving the market. With improved life expectancy, the incidence of age-related ocular diseases like age-related macular degeneration (AMD), cataracts, presbyopia, and glaucoma is also increasing proportionately. Older persons frequently need to undergo regular eye checks, sophisticated diagnostics, surgery, and long-term management of chronic ocular disease to preserve maximum vision and maximum quality of life. This population trend is driving the demand for cataract operations, intraocular lenses, and supportive interventions that forestall or mitigate visual impairment. Also, governments and healthcare practitioners are focusing more on elderly eye care through the implementation of screening programs and funding strategies that enhance access to ophthalmic services among older people.

Vision Care Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vision care market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Glass Lenses

- Contact Lenses

- Intraocular Lenses

- Contact Solutions

- LASIK Equipment

- Artificial Tears

Glass lenses lead the market with around 35.8% of the vision care market share in 2024. Glass lenses also known as eyeglasses or spectacles are driven by the traditional and widely used vision correction solution. They offer various designs and coatings to address refractive errors like myopia, hyperopia, and astigmatism due to their durability, scratch resistance, and affordability to individuals seeking reliable and cost-effective visual correction. Additionally, glass lenses offer excellent ultraviolet (UV) protection, shielding the eyes from harmful ultraviolet rays which enhance eye health, thus contributing to the market growth. Glass lenses are particularly beneficial for individuals with strong prescriptions. Due to their higher refractive index compared to plastic, glass lenses can be made thinner and lighter, even for high prescriptions. This helps reduce the "bulky" appearance that is often associated with strong corrective lenses, providing a much more appealing and comfortable eyewear solution.

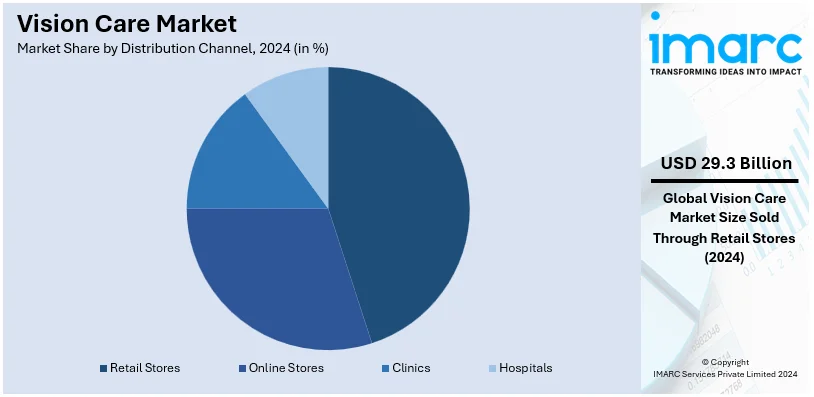

Analysis by Distribution Channel:

- Retail Stores

- Online Stores

- Clinics

- Hospitals

Retail stores dominate the overall market with around 38.6% of market share in 2024. Retail stores offer unparalleled accessibility to consumers seeking vision care products. In addition, these stores are strategically positioned in urban and rural locales, ensuring easy availability for a numerous clientele. It facilitates convenience and enhances the brand's visibility, fostering trust and familiarity among consumers. Moreover, retail stores provide a tactile and immersive shopping experience, allowing customers to interact directly with products which are essential in the vision care sector. Also, consumers can examine eyewear, try on frames, and consult knowledgeable staff, thereby making informed decisions that align with their optical needs and preferences thus contributing to the market growth. Furthermore, the comprehensive nature of retail stores engenders a one-stop solution for all vision care requirements. These establishments include various eyeglasses, contact lenses, and accessories under a single roof which simplifies the shopping journey and resonates with consumers seeking convenience and variety.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of 45.6%. According to the report, North America holds the biggest vision care market share, driven by the growing healthcare infrastructure, characterized by advanced medical facilities and cutting-edge technologies. In addition, the increasing eye care centers, equipped with state-of-the-art diagnostic tools and treatment options are contributing to exceptional patient care. Moreover, the growing emphasis on research and innovation is essential resulting in collaborations between renowned medical institutions, optometry schools, and pharmaceutical companies yielding groundbreaking advancements in ocular health. Besides this, consumers are willing to invest in premium eye care services and products, and the increasing public awareness campaigns and government support for preventive eye care initiatives are fostering a culture of proactive ocular health management to ensure sustained demand for vision care services, thus accelerating market growth. In 2024, Kian Capital Partners and RF Investment Partners introduced US VisionMed Partners, which is a management services organization (MSO). US VisionMed Partners aims to enhance optometry practices across the nation by offering a distinctive model centered on advanced medical services.

Key Regional Takeaways:

United States Vision Care Market Analysis

The United States hold 88.90% of the market share in North America. An aging population and increased rates of vision impairments are driving the U.S. market for vision care. According to the CDC, about 12 million Americans 40 years of age and older suffer from vision impairment. About 75% of adults require some form of vision correction globally, and increasing use of corrective lenses is driving up demand for surgical procedures, contact lenses, and eyeglasses. As screen time continues to rise, so do the technologies that can help it, like blue light-blocking lenses. Studies show that the average American uses digital gadgets for nearly seven hours per day, and this creates a great demand for eye care solutions. Moreover, the growing need for protective solutions is also driven by the fact that most Millennials report experiencing symptoms of digital eye strain. Yet another driving factor for the industry is the increasing refractive surgeries, which is also being furthered by increased insurance cover. According to Mariette Eye Clinic statistics, there are more than 700,000 surgeries every year on LASIK alone. Government policies and programs, such as Medicaid, which offer reasonably priced eyewear and vision screening, are other expansions for the market.

Europe Vision Care Market Analysis

In Europe, where 20% of the population is 65 years of age or more, ageing demographics are the main driver of the vision care business. Age-related macular degeneration (AMD) and cataracts are more likely to affect this demographic, which increases the need for vision correction devices and procedures. Given that over 70% of Europeans spend more than three hours daily using digital gadgets, the region has experienced the upsurge in digital eye strain. As a result of this trend, anti-glare and blue light blocking lenses are becoming popular nowadays. This requirement of paediatric vision care solutions is also fueled by a projection based on a research study report indicating that by 2050, myopia would have affected 56% of the population in Western Europe, 54% in Central Europe, and 50% in Eastern Europe. Government funding for eye care check-ups and robust health care systems in Europe promote market growth. Investment in vision care technologies, such as advanced intraocular lenses (IOLs) for cataract surgery, has risen in countries like Germany, the UK, and France.

Asia Pacific Vision Care Market Analysis

The market is growing rapidly in the Asia-Pacific region due to the rise in myopia and presbyopia. According to a white paper research published on Saturday by the China Charities Aid Foundation for Children and the ophthalmic medical chain group Huaxia Eye Hospital, the country's high school students, who are between the ages of 16 and 18, have an 89.7% myopia rate. The rate is 78.2% for 13 to 15-year-old middle school pupils and 54% for 7 to 12-year-old children. Affordable spectacles and eyeglasses are finding widespread use while healthcare delivery systems become reachable in developing nations such as Indonesia and India. Being the leader, India is managing to offer almost 6 million surgeries to the countrymen related to cataract yearly, thanks to programs under National Programme for Control of Blindness, among others. Fast urbanisation and growth of digital consumers in this Asia-Pacific economy are likely to contribute in increasing frequency of digital eyestrain where consumers require shields for their eyes and leading edge contact lens.

Latin America Vision Care Market Analysis

Increasing awareness regarding the eye and the incidence of uncorrected refractive defects are the factors driving the Latin American market for vision care. Vision impairments account for an estimated 7 Million and 11 Million in Mexico and Brazil, making it the highest demand-generating market, as per an industrial report. The activities of the government also increase growth, such as the free screening programs carried out in schools. Increasing the Middle-class: The high-class sunglasses organizations, along with sophisticated lens adoption, are by the burgeoning middle class. Moreover, the treatments of Diabetic retinopathy also gaining demands because of this region has growing diabetes incidences over 32 million populations have been affected. Thus said a research paper of the National Library of Medicine.

Middle East and Africa Vision Care Market Analysis

The high incidence of glaucoma and cataracts is a prime driver of market across the Middle East and Africa. The International Agency for the Prevention of Blindness has estimated that, in 2020, there were 54 million in the Middle East and North Africa who would suffer visual loss. Three and half million of them would be blind. Through government and non-governmental organization efforts, like the free cataract surgery in sub-Saharan Africa, restricted access to health service facilities is gradually on the increase. With the increasing population of cities and the resultant increased use of smartphones, there is a growing need for eyewear that addresses digital eye strain. The adoption of vision correction devices in this region is also prompted by growing awareness campaigns of preventable blindness by such organisations as the World Health Organisation (WHO).

Competitive Landscape:

At present, key players in the market are strategically implementing various measures to strengthen their positions and remain competitive in a rapidly evolving industry. These efforts encompass innovation, expansion, strategic partnerships, and a focus on customer-centric approaches. Additionally, companies are investing in research and development (R&D) to introduce innovative products that address emerging trends and consumer needs including advanced contact lens materials, lens coatings, and design options to offer visual clarity and improve comfort and eye health. Moreover, they are embracing digital platforms and e-commerce channels to engage with customers directly and provide convenient purchasing options. Online platforms allow customers to order contact lenses, eyeglasses, and related products with ease. Also, digital tools are used to offer virtual try-on experiences, aiding customers in selecting frames and lenses that suit their preferences. Furthermore, key players are focusing on providing personalized solutions by offering customization options for eyewear and contact lenses which allows customers to choose frame styles, lens coatings, and prescription options that cater to their individual preferences and needs. In 2024, A new online marketplace has been introduced by Bausch + Lomb with the goal of simplifying the eye care process. The platform gives eye care providers access to a wide range of goods and services in one convenient location, such as lenses, eye care products, and professional resources. By making ordering and inventory management easier, the program seeks to increase productivity and assist practitioners in providing better patient care.

The report provides a comprehensive analysis of the competitive landscape in the vision care market with detailed profiles of all major companies, including:

- Alcon Inc.

- Bausch Health Companies Inc.

- CooperVision

- Essilor

- EssilorLuxottica

- HOYA Corporation

- Johnson & Johnson Vision Care, Inc.

- Menicon

- ZEISS Vision

Latest News and Developments:

- October 2025: ZEISS Vision Care, a global leader in eye and vision care technology, revealed that it has entered into a binding agreement to purchase a 10% share in Ocumeda AG from the Fielmann Group for €10 million, aiming to eventually acquire as much as a 25% stake. The deal places Ocumeda's value at €100 million.

- October 2025: The World Health Organization (WHO) has teamed up with the OneSight EssilorLuxottica Foundation to enhance access to vision care in the aspirational blocks of NITI Aayog. The partnership aids the WHO's worldwide SPECS 2030 goal to enhance effective refractive error coverage by 40% by 2030 and seeks to bolster primary healthcare systems through the incorporation of eye health services in underserved areas. The project will expand on Karnataka’s effective ASHA Kirana initiative, a comprehensive model that incorporates eye health services into primary healthcare frameworks.

- August 2025: Alcon Inc. has agreed to acquire Staar Surgical Co. for approximately $1.5 billion, providing the Swiss eye-care company with a new vision-correction solution. According to a statement, the company will offer $28 in cash for each Staar share, representing a 51% premium over Monday’s closing price. Alcon intends to increase debt to fund the acquisition, anticipated to boost earnings growth in its second year. Staar, based in California, provides vision-correction options known as Implantable Collamer Lenses, or ICLs, which can be applied via a minimally invasive procedure.

- August 2025: Eyebot, the firm responsible for the 90-second vision test kiosk providing doctor-approved glasses prescriptions, has announced that it has secured $20 million in Series A funding. The round was spearheaded by General Catalyst, with contributions from returning investors AlleyCorp, Baukunst, Village Global, and Ubiquity Ventures. This latest funding round will enable Eyebot to grow into hundreds of new retail locations, enhance its clinical and engineering teams, and strengthen its collaboration with eye care professionals.

- June 2025: Carl Zeiss Vision International GmbH revealed that it has signed a definitive deal to purchase all shares in Brighten Optix, which is listed on the Taipei Exchange. Brighten Optix is a prominent name in the realm of orthokeratology and specialized contact lenses. The abilities and offerings of Brighten Optix will now be key to ZEISS Vision Care’s success and long-term strategy. Through this acquisition, ZEISS Vision Care is significantly enhancing its already effective myopia management portfolio.

- April 2025: The Clinton Health Access Initiative (CHAI) and the OneSight EssilorLuxottica Foundation have declared a multi-year collaboration aimed at improving access to eyeglasses and developing sustainable vision care techniques throughout Africa. United in their commitment to health equity, the partnership seeks to tackle one of the continent’s most prevalent yet overlooked public health issues: unaddressed vision impairment.

Vision Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Glass Lenses, Contact Lenses, Intraocular Lenses, Contact Solutions, LASIK Equipment, Artificial Tears |

| Distributions Channels Covered | Retail Stores, Online Stores, Clinics, Hospitals |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Alcon Inc., Bausch Health Companies Inc., CooperVision, Essilor, EssilorLuxottica, HOYA Corporation, Johnson & Johnson Vision Care, Inc., Menicon, ZEISS Vision, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vision care market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vision care market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vision care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Vision care refers to the comprehensive management and treatment of eye health, including diagnosing, preventing, and correcting vision-related disorders. It encompasses a range of products and services, such as eyeglasses, contact lenses, refractive surgeries, and routine eye exams, to improve and maintain optimal vision health.

The vision care market was valued at USD 73.73 Billion in 2024.

IMARC estimates the global vision care market to exhibit a CAGR of 2.75% during 2025-2033.

Key drivers of the global vision care market include the rising prevalence of vision disorders such as myopia, presbyopia, and astigmatism due to increased screen time, aging populations driving demand for age-related eye care solutions, and technological advancements in eyewear and contact lenses, improving vision correction options.

In 2024, glass lenses represented the largest segment by product type, driven by their durability, scratch resistance, and effectiveness in addressing various refractive errors like myopia and astigmatism.

Retail stores lead the market by distribution channel, owing to their accessibility, ability to provide personalized customer experiences, and availability of a wide range of products in one location, making them a convenient option for consumers.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global vision care market include Alcon Inc., Bausch Health Companies Inc., CooperVision, Essilor, EssilorLuxottica, HOYA Corporation, Johnson & Johnson Vision Care, Inc., Menicon, ZEISS Vision, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)