Virtual Private Network Market Size, Share, Trends and Forecast by Component, Type, Deployment Mode, End Use Industry, and Region, 2025-2033

Virtual Private Network Market Size and Share:

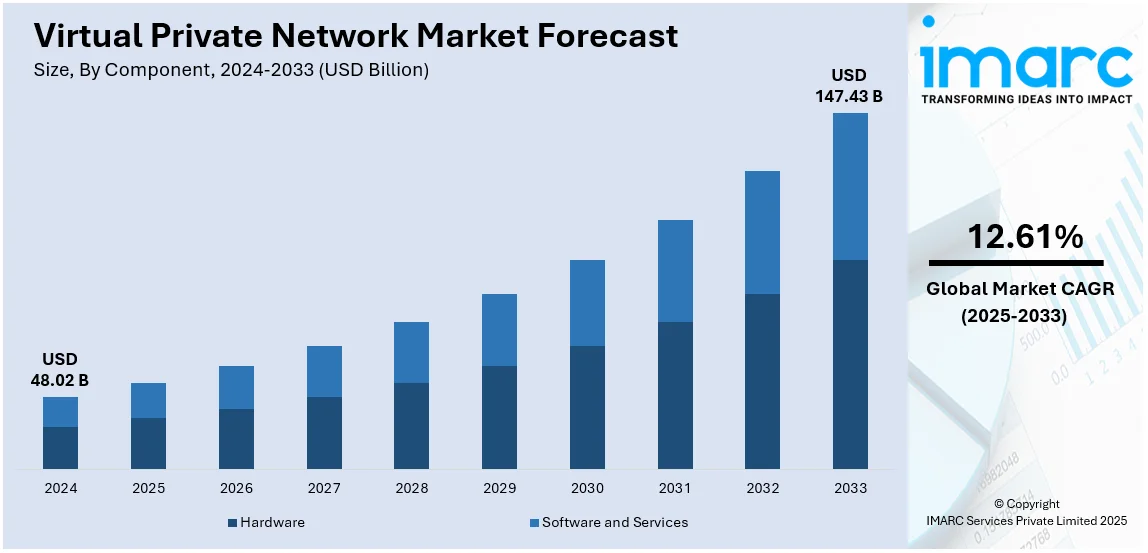

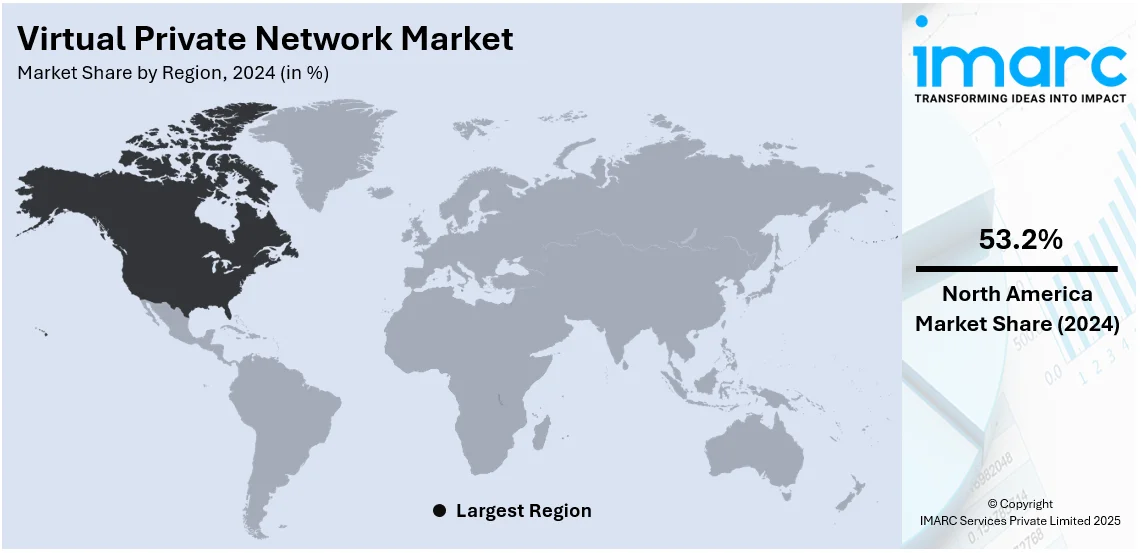

The global virtual private network market size was valued at USD 48.02 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 147.43 Billion by 2033, exhibiting a CAGR of 12.61% during 2025-2033. North America currently dominates the market, holding a significant market share of over 53.2% in 2024. The market is fueled by rising cyber threats, remote work adoption, data privacy concerns, regulatory compliance, and cloud service usage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.02 Billion |

|

Market Forecast in 2033

|

USD 147.43 Billion |

| Market Growth Rate (2025-2033) | 12.61% |

The virtual private network (VPN) market is primarily influenced by the increasing prevalence of cyberattacks and data breaches, which have heightened the need for secure, encrypted communication channels. The demand for VPNs to guarantee safe access to company resources from several locations has increased due to the growing popularity of remote work and hybrid work models. Businesses and consumers seek secure surfing solutions because of growing worries about data privacy, particularly considering increased tracking and surveillance. Organizations are also compelled to use VPNs to comply with data protection regulations in industries including government, healthcare, and finance. The use of VPNs to safeguard data and apps housed in the cloud has increased due to the quick development of cloud computing and SaaS platforms. The factors, collectively, are creating a positive virtual private network market outlook across the globe.

In the United States, the virtual private network (VPN) market is driven by several key factors, including the rising frequency of cyberattacks and data breaches, prompting businesses and individuals to seek secure communication solutions. The widespread shift to remote and hybrid work environments has increased the demand for VPNs to enable secure access to corporate networks from diverse locations. Regulatory requirements for data privacy and protection, especially in sectors like finance, healthcare, and government, are pushing organizations to adopt VPN solutions to ensure compliance with laws such as HIPAA and PCI DSS. Additionally, growing concerns over personal data privacy and the increasing use of cloud services further accelerate the adoption of VPNs. These factors, coupled with technological advancements in encryption and security, are fueling virtual private network market growth in the U.S. For instance, in October 2024, the notable VPN service IPVanish, announced the launch of IPVanish Advanced, a complete package that includes the brand-new IPVanish Secure Browser and Livedrive-powered Cloud Storage. These services are intended to give its VPN clients extra security and risk control.

Virtual Private Network Market Trends:

Cybersecurity Threats

The increasing frequency of cyberattacks, data breaches, and ransomware attacks is a major virtual private network market trends. According to industry reports, The FBI's Internet Crime Complaint Center received over 880,418 complaints in 2023, indicating that over USD 12.5 billion in potential damages were reported. Furthermore, with ransomware responsible for more than 72% of cybersecurity attacks in 2023, it remained the greatest cyber threat. As organizations and individuals face growing threats from hackers and cybercriminals, VPNs offer an essential solution to protect sensitive data, secure communications, and prevent unauthorized access. With the rise of phishing scams, malware, and advanced persistent threats (APTs), VPNs provide strong encryption protocols to safeguard private information from external risks. The surge in cybercrime activities across industries, including finance, healthcare, and government, has led to heightened demand for secure internet browsing and data protection solutions, driving the adoption of VPN technologies.

Rising Remote Work Culture

The shift to remote and hybrid work models has accelerated the demand for VPNs. According to industry reports, although 62% of employees work full-time in offices, the percentage has decreased by 6% since 2023. The percentage of totally hybrid vehicles is 27%, which is unchanged from 2023 when 26% were entirely hybrid. Additionally, 11% work entirely from home (a 57% rise from 7%), which represents a complete 180-degree change as remote workers displaced fully in-office professionals. With more employees working from home or distributed across multiple locations, secure access to corporate networks, data, and applications is crucial. VPNs allow businesses to maintain secure connections between remote users and internal systems, ensuring that sensitive company information remains protected from unauthorized access. The need for seamless collaboration, secure file sharing, and access to enterprise resources has made VPNs indispensable for companies managing remote workforces. This growing reliance on VPNs is expected to continue as organizations embrace flexible work environments in the future.

Increasing Cloud Adoption

The widespread adoption of cloud services represents one of the major virtual private network market trends. As more organizations move their data and applications to the cloud, securing these assets becomes a top priority. VPNs provide encrypted tunnels to protect data being transmitted between users and cloud environments, ensuring secure access and communication. The need for secure connections to cloud storage, SaaS platforms, and remote cloud resources has increased as businesses shift toward cloud-first strategies. VPNs enable organizations to ensure privacy and data protection while accessing cloud services, fueling demand as cloud-based solutions become integral to business operations across various industries. For instance, in June 2024, Quantum Xchange, which provides crypto agility, visibility, and management solutions for the future of encryption, announced that version 4.0 of its quantum-safe key delivery platform Phio TX is now generally available. This version includes Phio VPN, the first Virtual Private Network (VPN) to integrate AI-native networking with quantum-safe key management and delivery.

Virtual Private Network Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global virtual private network market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, type, deployment mode, and end use industry.

Analysis by Component:

- Hardware

- Software and Services

Hardware holds the largest share of the virtual private network (VPN) market due to its superior performance, security, and scalability compared to software-based solutions. Dedicated hardware VPNs deliver excellent encryption with speed benefits and stable connections to satisfy the enterprise's demand for fast data transfers with secure communication. Their seamless integration capability into existing network infrastructure along with their potential for large-scale deployments makes them highly appealing. Hardware VPN technologies enable IT teams to achieve detailed configuration control which helps meet regulatory demands found in financial institutions as well as healthcare organizations. Secure remote access applications and data security needs drive organizations towards implementing hardware VPN solutions.

Analysis by Type:

- Remote Access VPN

- Site-to-Site VPN

- Others

Remote access VPN electronics leads the market with around 32.0% of the market share in 2024. Remote access VPN holds the largest share of the virtual private network (VPN) market due to the growing demand for secure, remote connectivity in today’s hybrid and remote work environments. It enables employees, freelancers, and business partners to securely access organizational resources from any location, ensuring data protection and productivity. The increasing adoption of bring-your-own-device (BYOD) policies and cloud-based applications has further driven the need for remote access VPNs. With advanced encryption, user authentication, and ease of deployment, these VPNs are widely favored across industries. The rising focus on cybersecurity and regulatory compliance also contributes to their dominant market position.

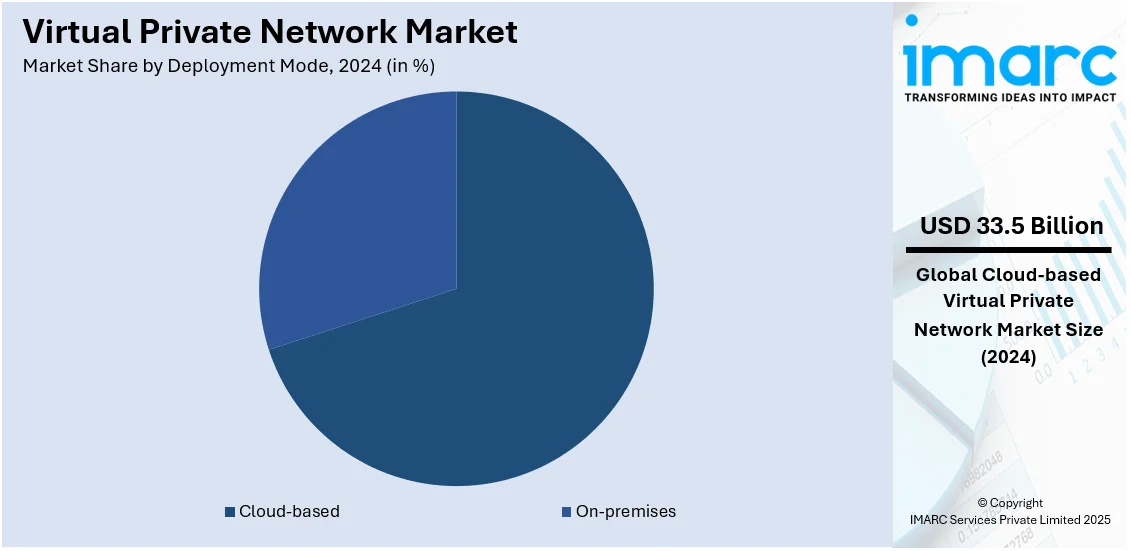

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based leads the market with around 69.7% of the market share in 2024. Cloud-based VPNs hold the largest share of the virtual private network (VPN) market because they offer flexibility and scalability along with cost-saving benefits. These modern VPN solutions no longer require dedicated hardware so any business from small to large can utilize their functionality. Cloud solutions work perfectly to support hybrid and remote work and provide secure anywhere access to business resources. Their deployment process requires minimal setup infrastructure along with straightforward maintenance procedures which minimize hardware acquisition expenses for IT departments. The rise of cloud computing, SaaS applications, and the demand for secure data transmission further drive their adoption. Additionally, their ability to integrate with existing cloud services and enhance mobility solidifies their market leadership.

Analysis by End Use Industry:

- BFSI

- Healthcare

- IT

- Government

- Manufacturing

- Others

The BFSI sector is expected to hold a significant virtual private network market share due to its stringent requirements for data security and compliance. Financial institutions deal with sensitive customer information and transactional data, making robust encryption and secure access critical. VPNs protect against cyberattacks, data breaches, and unauthorized access, ensuring regulatory compliance with standards like GDPR and PCI DSS. The sector’s increasing reliance on digital banking, mobile applications, and remote work solutions further drives VPN adoption. Additionally, the need to safeguard financial operations across distributed networks and provide secure access for customers and employees boosts demand for BFSI.

Healthcare is a major contributor to the VPN market due to the need to secure sensitive patient data and comply with regulations like HIPAA. With the rise of telemedicine, electronic health records (EHRs), and remote consultations, VPNs ensure secure data transmission and access to medical systems. Healthcare providers can protect themselves and their patients from data exposure by using VPNs to guard against cybersecurity threats along with protecting patients' information while preventing ransomware and data breaches. Through VPN connections healthcare providers enable the smooth execution of medical staff collaboration while providing support for distant monitoring equipment. The growing incorporation of digital solutions along with cloud platforms and IoT components in healthcare delivery creates expanding requirements for VPN solutions.

The IT sector drives significant demand for VPNs as it relies heavily on secure network connections for remote access, software development, and data management. With widespread adoption of cloud computing, BYOD policies, and hybrid work environments, VPNs play a crucial role in safeguarding sensitive business information. IT companies require secure access for distributed teams and global operations, making VPNs indispensable. Additionally, VPNs help protect intellectual property, source code, and client data from cyberattacks and unauthorized access. As cybersecurity threats evolve, IT organizations prioritize advanced VPN solutions for data encryption, scalability, and seamless integration with their digital infrastructure.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 53.2%. The virtual private network (VPN) market in North America is driven by increasing cybersecurity threats, such as data breaches and ransomware attacks, prompting organizations to adopt secure connectivity solutions. The rise in remote and hybrid work models has amplified demand for VPNs to enable secure access to corporate networks. Growing adoption of cloud computing, SaaS applications, and bring-your-own-device (BYOD) policies further drives VPN usage. Regulatory requirements for data protection, especially in industries like BFSI and healthcare, also boost demand. Technological advancements, including AI-driven VPNs, enhance user experience and security, making them more attractive. Additionally, the increasing need for privacy in personal internet usage and government initiatives promoting cybersecurity awareness fuel market growth in the region.

Key Regional Takeaways:

United States Virtual Private Network Market Analysis

In 2024, the United States accounted for the largest market share of over 83.70% in North America. The increasing reliance on cloud-based platforms has significantly influenced the adoption of virtual private networks. According to survey, over 51% of businesses now leverage cloud services. This trend stems from the necessity for secure and reliable access to remote resources, especially as businesses enhance their digital infrastructure to optimize workflows. The deployment of collaborative tools and storage solutions has elevated the demand for network protection mechanisms, encouraging organizations to integrate VPNs into their operations. Remote and hybrid working models have intensified the need for encrypted communication, ensuring data integrity and confidentiality. With the rise of scalable services, enterprises are leveraging advanced virtual network technologies to safeguard sensitive information during transit. The heightened awareness around data breaches has also prompted institutions to prioritize privacy solutions. Furthermore, education, retail, and entertainment sectors are embracing secure connectivity, illustrating the broad applicability of VPN services in the evolving technological landscape.

Asia Pacific Virtual Private Network Market Analysis

The expansion of small and medium-sized enterprises, alongside manufacturing advancements, has catalyzed the widespread adoption of virtual private networks. According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. In a competitive landscape, businesses are prioritizing streamlined operations and secure remote access to ensure continuity in production lines and supply chain networks. VPN technologies are increasingly adopted to mitigate risks related to industrial espionage and unauthorized access. Manufacturing units embracing digitized operations are using VPNs to facilitate real-time monitoring and protect intellectual property. Additionally, the growth of e-commerce enterprises has driven demand for secure payment gateways and customer interaction platforms. SMEs seeking affordable yet robust security solutions are adopting virtual private networks to enhance operational efficiency. Moreover, localized industries exploring global markets require reliable encrypted connections for secure cross-border communication, further boosting the demand for VPN technologies. This trend underscores the sector’s reliance on technology for scalability and operational resilience.

Europe Virtual Private Network Market Analysis

The surge in the adoption of virtual private networks aligns with the evolving requirements of the BFSI sector. According to reports, in 2021, the European Union had 784 foreign bank branches, 619 of which were from fellow EU members and 165 from third countries. As institutions enhance digital service offerings, VPNs serve as a cornerstone for ensuring secure interactions across financial platforms. With increasing reliance on virtual banking and electronic transactions, robust encryption and data masking are critical to preserving client trust. The increasing usage of mobile applications for financial transactions further elevates the need for secure and stable networks. VPN solutions are vital in preventing unauthorized access to sensitive information, ensuring compliance with data protection frameworks. Additionally, investment firms and insurance agencies are adopting advanced network solutions to secure confidential customer data. The increasing complexity of cyberattacks targeting financial institutions has driven the sector to proactively implement preventive measures. These dynamics highlight the sector’s strategic integration of VPNs to bolster digital transformation and safeguard client assets.

Latin America Virtual Private Network Market Analysis

The expanding privatization of healthcare facilities has amplified the demand for secure communication networks to safeguard patient data. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. Virtual private networks enable healthcare providers to establish encrypted connections, ensuring the confidentiality of electronic health records and telemedicine platforms. As more organizations digitize operations, secure remote access is crucial for facilitating consultations, data sharing, and research collaborations. Expanding healthcare infrastructure has also driven the adoption of reliable network security solutions to streamline administrative and operational workflows. VPNs have become indispensable for institutions aiming to maintain compliance with stringent data security protocols while delivering enhanced patient experiences.

Middle East and Africa Virtual Private Network Market Analysis

The growing focus on enhancing IT infrastructure has led to a marked increase in the adoption of virtual private networks. For instance, the total amount spent on ICT in the Middle East, Turkey, and Africa (META) is expected to surpass USD 238 billion this year, representing a 4.5% growth over 2023. Organizations are leveraging VPNs to ensure secure remote access and streamline operations across multiple locations. With an emphasis on developing robust network frameworks, the integration of VPN solutions is enabling enterprises to protect sensitive information during digital transformation initiatives. The rise of technology-driven businesses has further amplified the demand for secure connectivity solutions to facilitate collaboration, improve operational efficiency, and support business continuity. This reflects the region's commitment to fostering innovation while addressing cybersecurity challenges effectively.

Competitive Landscape:

Key competitors in the fiercely competitive virtual private network (VPN) market prioritize security, scalability, and innovation. Major players in the industry include Palo Alto Networks, Check Point Software Technologies, Cisco Systems, NordVPN, and Fortinet. To satisfy changing client demands, these companies make significant investments in cutting-edge encryption technology, intuitive user interfaces, and AI-driven solutions. Smaller businesses and startups also add to market diversity by providing affordable, specialized solutions catered to sectors or geographical areas. Mergers, acquisitions, and strategic alliances are frequent and improve product portfolios and worldwide reach. As the need for cloud-based VPNs, remote work tools, and strong cybersecurity measures grows, the competition heats up, spurring constant technological developments to preserve market leadership and consumer confidence.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Array Networks Inc.

- Avast Software s.r.o.

- BlackBerry Limited

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Citrix Systems Inc.

- CyberGhost S.R.L.

- Google LLC

- International Business Machines Corporation

- Juniper Networks Inc.

- Microsoft Corporation

- NetMotion Software (Absolute Software Corporation)

Latest News and Developments:

- December 2024: IPVanish has enhanced its VPN service with an expanded server network spanning 108 countries and a new Double Hop VPN feature. This innovation routes traffic through two servers for added encryption and IP anonymity. The upgrades emphasize IPVanish’s commitment to superior security and privacy. These advancements bolster global accessibility and user convenience.

- December 2024: VPN Proxy Master is revolutionizing the booming VPN market, which surged over 30% in 2024 amid rising cybersecurity concerns. Offering enhanced features and exclusive holiday deals, the trusted network security provider caters to the growing demand for online privacy and secure, unrestricted internet access.

- October 2024: Proton VPN has introduced an Apple TV app, enabling users to stream geo-restricted content worldwide. The app encrypts Apple TV activity and allows access to region-specific content effortlessly. Users can connect to servers in other countries, unlocking unavailable shows and enhancing their streaming experience.

- October 2024: With over 300 million customers worldwide, Turbo VPN is a well-known free VPN service that recently released an enhanced version specifically for the US market. This free service challenges the dominance of premium VPNs by promising improved security, speed, and user-friendliness. Turbo VPN seeks to transform the VPN market in the United States by emphasizing online freedom and privacy.

- August 2024: Proton VPN has unveiled three updates to enhance free speech and privacy. These include new servers for censorship-prone regions, an anti-censorship protocol for Windows, and a feature for Android users to hide the VPN app. The Swiss-based provider remains committed to combating censorship globally.

Virtual Private Network Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software and Services |

| Types Covered | Remote Access VPN, Site-to-Site VPN, and Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Use Industries Covered | BFSI, Healthcare, IT, Government, Manufacturing, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Array Networks Inc., Avast Software s.r.o., BlackBerry Limited, Check Point Software Technologies Ltd., Cisco Systems Inc., Citrix Systems Inc., CyberGhost S.R.L., Google LLC, International Business Machines Corporation, Juniper Networks Inc., Microsoft Corporation and NetMotion Software (Absolute Software Corporation) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the virtual private network market from 2019-2033.

- The virtual private network market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the virtual private network industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The virtual private network market was valued at USD 48.02 Billion in 2024.

The virtual private network market is projected to exhibit a CAGR of 12.61% during 2025-2033, reaching a value of USD 147.43 Billion by 2033.

Factors driving the virtual private network (VPN) market include the increasing frequency of cyberattacks, rising data privacy concerns, the shift to remote work, regulatory compliance requirements, and the growing use of cloud services. Additionally, advancements in encryption technologies and the need for secure communications in various sectors further fuel market growth.

North America currently dominates the cell separation technologies market, accounting for a share of 53.2%. Rising cybersecurity threats, remote work adoption, regulatory compliance, cloud computing growth, and increasing privacy concerns drive North America's VPN market. These factors, collectively, are creating a positive virtual private network market outlook across the region.

Some of the major players in the virtual private network market include Array Networks Inc., Avast Software s.r.o., BlackBerry Limited, Check Point Software Technologies Ltd., Cisco Systems Inc., Citrix Systems Inc., CyberGhost S.R.L., Google LLC, International Business Machines Corporation, Juniper Networks Inc., Microsoft Corporation and NetMotion Software (Absolute Software Corporation)

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)