Viral Vector Manufacturing Market Size, Share, Trends and Forecast by Type, Disease, Application, End User, and Region, 2025-2033

Viral Vector Manufacturing Market Size and Share:

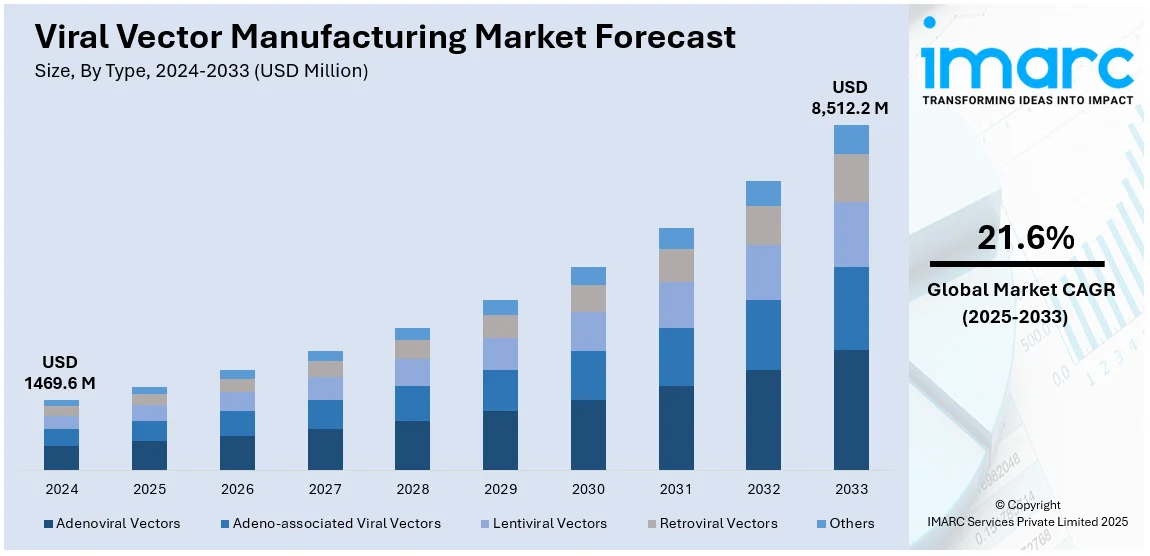

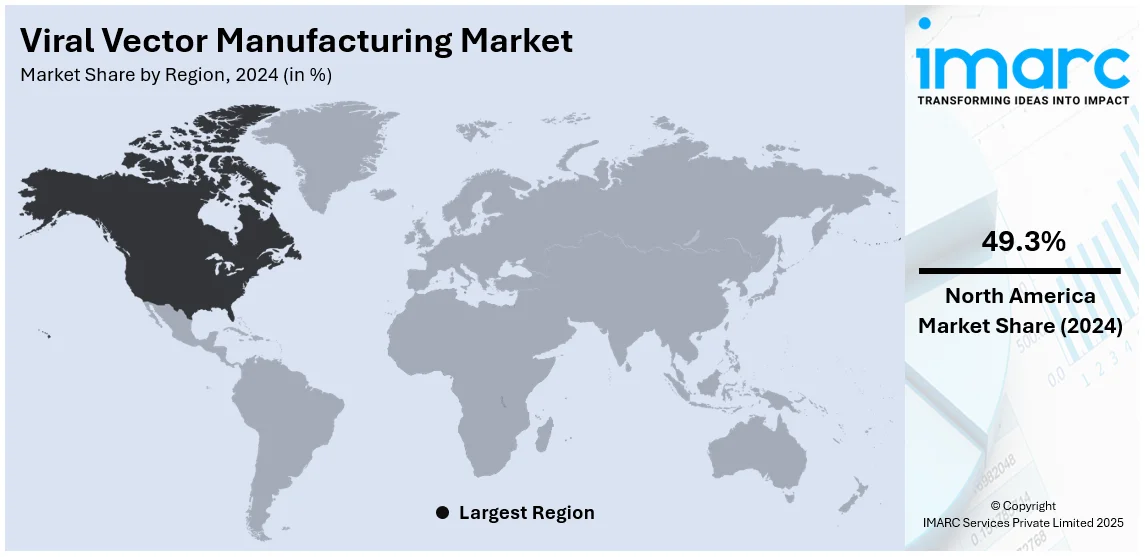

The global viral vector manufacturing market size was valued at USD 1,469.6 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,512.2 Million by 2033, exhibiting a CAGR of 21.6% from 2025-2033. North America currently dominates the market, holding a market share of over 49.3% in 2024. The rising prevalence of genetic disorders, increasing adoption of gene therapies, advanced biotechnology infrastructure, expanding clinical trials, strong government funding, robust R&D investments, and the presence of leading pharmaceutical companies drive the viral vector manufacturing market in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,469.6 Million |

|

Market Forecast in 2033

|

USD 8,512.2 Million |

| Market Growth Rate (2025-2033) | 21.6% |

The global viral vector manufacturing market is experiencing significant growth, driven by the increasing prevalence of genetic disorders and infectious diseases, coupled with advancements in gene and cell therapy. The growing adoption of viral vectors in the development of innovative therapies for rare diseases, cancer, and neurological disorders is a key factor boosting demand. Expanding clinical trials for gene therapies and rising government investments in biotechnology and pharmaceutical research are further supporting market expansion. Moreover, the development of scalable manufacturing technologies and improved production processes has boosted the efficiency and cost-effectiveness of viral vector production. Increasing collaborations between pharmaceutical companies and research institutions are also accelerating the development of novel therapies, further propelling the growth of the viral vector manufacturing market.

To get more information on this market, Request Sample

The United States is emerging as one of the key markets with 91.90% of the total market share, propelled by several key factors. A significant driver is the increasing prevalence of genetic disorders and cancers, which has intensified the demand for gene and cell therapies utilizing viral vectors. This growth is further supported by substantial government investments in biotechnology and the presence of numerous contract development and manufacturing organizations (CDMOs) in the country. Additionally, advancements in scalable manufacturing technologies have enhanced production efficiency, meeting the rising demand for viral vectors in therapeutic applications. The expanding pipeline of gene therapies and increasing clinical trials are also contributing to the market's expansion, positioning the U.S. as a leading hub for viral vector manufacturing.

Viral Vector Manufacturing Market Trends:

Market Growth and Investment

As of March 18, 2024, the FDA has approved 36 gene therapies. There are more than 500 in development. The agency predicts that, by 2025, it will approve around 10 to 20 products every year in gene therapy. The increase is fueled by a boost in biotechnology investment and new technologies being developed in the gene therapy arena. Proactivity by the FDA in regulating gene therapy has allowed a few of these treatment solutions to be fast-tracked and approved rapidly. The expected approvals annually represent the growing trust built for the safety and efficacy profiles of gene therapies. The actual number of approved gene therapies and the robust pipeline depict an active market poised for significant growth. This trend is set to continue; however, market expansion will significantly be driven by the commitment by the FDA toward innovative therapies. As a response to this increase, pharmaceutical firms are investing extensively in viral vector manufacturing to answer the growing demands of gene therapy. This is because a sustained supply of good quality viral vectors is essential in guaranteeing successful gene therapies. The FDA support and the industry investment in manufacturing infrastructure are critical to overcome the challenges of scaling up production. These efforts are meant to ensure that the benefits of gene therapies are accessible to a broader patient population.

Technological Advancements and Process Optimization

The growth in the market is driven by the technological advancement in viral vector manufacturing, such as cell line development and improvement in production processes. The stable packaging cell lines increase the efficiency of viral vector production, thereby fueling the growth of the market. For instance, the HEK293 cell line technology adopted by Samsung Biologics increased viral vector yield by 25% in 2022. This will be further facilitated by the automation and AI that is being incorporated into manufacturing processes. It lowers costs and simplifies scaling. This is necessary to meet the increased demand for clinical-grade viral vectors for gene therapies.

Regulatory and Manufacturing Challenges

Despite these development prospects, this viral vector manufacturing market is struggling with several issues, most of which involve regulating and the difficulties of scaling up production. According to a 2023 article, approval times for viral vector-based therapies are becoming increasingly lengthy, with approval processes sometimes taking as long as 3-5 years. Additionally, scaling up while ensuring quality control and minimizing contaminant exposures during manufacturing is one area of major concern. In response, the FDA and EMA, among other regulatory bodies, are engaging with industry stakeholders to establish clearer guidelines for the manufacturing of viral vectors. The evolving regulatory landscape will influence production strategies and could slow the time to market, thus affecting the overall growth of the industry.

Viral Vector Manufacturing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global viral vector manufacturing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, disease, application, and end user.

Analysis by Type:

- Adenoviral Vectors

- Adeno-associated Viral Vectors

- Lentiviral Vectors

- Retroviral Vectors

- Others

In 2024, Adeno-associated viral (AAV) vectors emerge as the largest segment in the viral vector manufacturing market, driven by their versatility and safety profile. AAV vectors are frequently utilized in gene therapy due to their minimal immune response and their effectiveness in delivering therapeutic genes to specific target cells with precision. Their significant role in treating genetic disorders, such as spinal muscular atrophy (SMA) and inherited retinal diseases, has propelled their demand. The ongoing advancements in AAV vector engineering have further enhanced their efficiency, scalability, and therapeutic potential. Additionally, the increasing number of FDA-approved AAV-based therapies and the growing pipeline of clinical trials utilizing AAV vectors reinforce their dominance, making them a crucial component of the expanding gene therapy landscape.

Analysis by Disease:

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

In 2024, cancer emerged as the leading application segment in the viral vector manufacturing market, accounting for approximately 37.6% of the market share. The dominance of this segment is attributed to the growing adoption of viral vectors in gene therapies and oncolytic virotherapy for treating various types of cancer. Advances in immunotherapy, such as CAR-T cell therapies, which rely on viral vectors for genetic modifications, have further driven this growth. The growing global prevalence of cancer, along with increased investments in oncology research and clinical trials, has driven the demand for innovative treatment solutions. Furthermore, the approval of viral vector-based therapies for specific cancers highlights their efficacy, solidifying their role in transforming cancer treatment strategies globally.

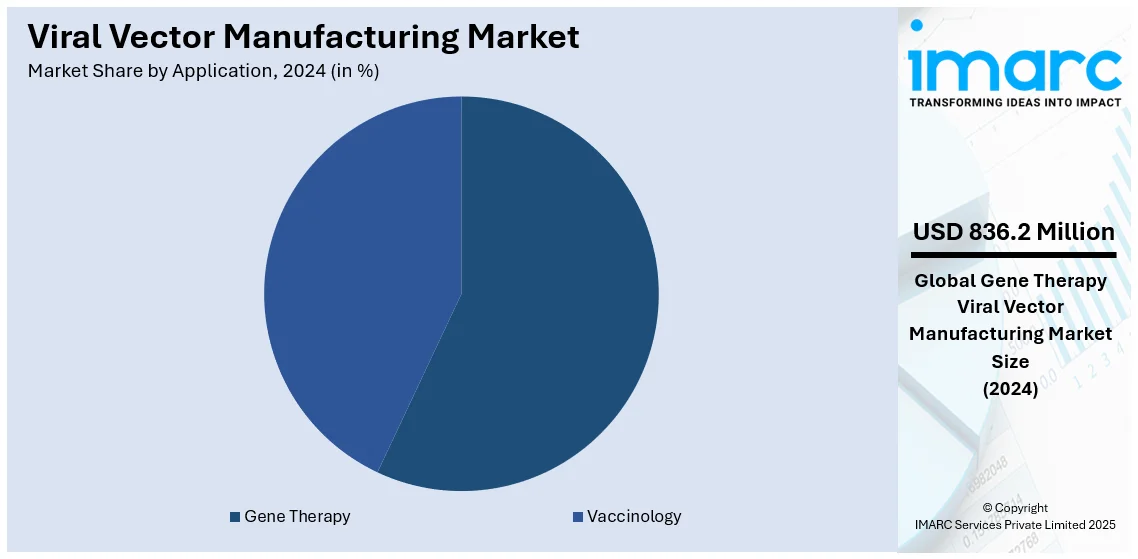

Analysis by Application:

- Gene Therapy

- Vaccinology

In 2024, gene therapy dominated the viral vector manufacturing market, accounting for approximately 56.9% of the market share. This leadership is driven by the growing adoption of gene therapies to treat genetic disorders, cancers, and rare diseases. Viral vectors, especially adeno-associated viruses (AAV) and lentiviruses, play a crucial role in delivering therapeutic genes to target cells with accuracy and efficiency. The expanding pipeline of gene therapy candidates and increasing regulatory approvals have significantly boosted demand. Notable advancements in viral vector engineering and scalable manufacturing technologies further support this segment's growth. Additionally, rising investments from pharmaceutical companies and government initiatives aimed at advancing gene therapy research contribute to its prominence, positioning it as a transformative force in modern medicine.

Analysis by End User:

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

Pharmaceutical and biopharmaceutical companies are the primary end-users in the viral vector manufacturing market. These companies drive demand due to their extensive use of viral vectors in gene and cell therapy development, clinical trials, and commercial-scale manufacturing. Rising investments in personalized medicine and innovative therapies further strengthen this segment's dominance.

Research institutes play a crucial role in the viral vector manufacturing market by fostering innovation and advancing preclinical studies. These institutes focus on developing novel therapies for genetic disorders, cancer, and rare diseases. Collaborations with pharmaceutical companies and increased government funding for biotechnology research further enhance their contribution to market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The market share in North America is seen to have crossed over 49.3% in the year 2024. The key factors that boosted the North America viral vector manufacturing market include a rapid growth rate of the aerospace and energy industries in North America, which are seen to be the largest consumers of viral vector manufacturings. Furthermore, a robust base of companies in the region has further promoted innovation and growth in the viral vector manufacturing market. In addition, North America has a strong research and development infrastructure, with many universities and research institutions conducting cutting-edge research in materials science and engineering, further driving the viral vector manufacturing market.

Key Regional Takeaways:

United States Viral Vector Manufacturing Market Analysis

The U.S. viral vector manufacturing market is growing fast as demand for gene therapies continues to increase along with advanced manufacturing technologies. In fact, as per a snapshot of global gene therapy trials, there were over 3,900 clinical trials across the world by March 2023, of which a majority was conducted in the United States, as per reports. The CHIPS and Science Act in 2022 gave authorization to USD 280 billion to advance U.S. scientific and technological research, some of which is aligning with advancements in biotechnology. Portfolio leaders, such as Thermo Fisher Scientific and Catalent, continue to add capacity in the United States to meet demand. Growth is driven by innovations in scalable production processes and federal incentives. This focus on quality and regulatory compliance helps strengthen U.S. leadership in viral vector manufacturing while exploiting export opportunities to improve its position globally in the biotech industry.

Europe Viral Vector Manufacturing Market Analysis

The viral vector manufacturing market in Europe is growing as the investment in biotechnology and R&D funding is increasing. Horizon Europe, the European Union's leading research and innovation initiative, has designated EUR 11.5 billion (USD 12.6 billion) for the advancement of biotechnology and pharmaceutical research and development. InvestEU will also invest more than EUR 1 billion (USD 1.1 billion) in biotech and medicines-related investments, thus boosting innovation in vector production. BioNTech and Oxford Biomedica are some of the regional leaders in scalable manufacturing technologies. Strict regulatory frameworks by the EU guarantee the highest safety and quality standards for the production of cutting-edge therapies. Collaborative public-private partnerships and sustainable integration further boost Europe's position as a global hub for viral vector manufacturing, with strategic funding initiatives ensuring growth and technological advancement.

Asia Pacific Viral Vector Manufacturing Market Analysis

The Asia Pacific market for viral vector manufacturing is growing with a rapid speed as there has been an increasing investment in the field of biotechnology and governmental policies. As China's government invested heavily into the R&D in biotechnology, public R&D investment exceeded USD 3.8 billion from 2008 to 2020, as per reports, the commitment for advancements in gene therapy and viral vector technologies can be seen. The "Make in India" initiative by India and the regenerative medicine thrust by Japan are encouraging local manufacturing capabilities. Regional players such as WuXi AppTec and Samsung Biologics are exploiting partnerships to scale up and transfer technology. The growing clinical trials and need for cost-effective production solutions are making the region a major player in the global viral vector manufacturing market. Integration of new manufacturing technologies and supportive policies also fuels growth in the sector in Asia Pacific.

Latin America Viral Vector Manufacturing Market Analysis

The viral vector manufacturing market in Latin America is expected to expand in the upcoming years, fueled by higher investments in biotechnology and progress in gene therapy. GEMMABio has also recently announced a partnership with the health ministry in Brazil worth USD 100 million to introduce gene therapies for rare diseases into the country, taking a huge leap forward in accessing gene therapies across the region. Expanding its biotechnology sector, the industry will also grow at an estimated CAGR of 14.2% between 2024 and 2030 to help drive growing demand for manufacturing gene therapy in Brazil, as per an industry report. Strong biotechnology leadership from Brazil makes this strategic alliance position it strategically within Latin America's gene therapy and viral vector manufacturing market. Countries like Mexico and Argentina are also investing in local production capabilities and international collaborations, so Latin America will continue to strengthen its role in global biomanufacturing.

Middle East and Africa Viral Vector Manufacturing Market Analysis

The viral vector manufacturing market in Middle East and Africa is growing by increasing healthcare spend and government interest in enhancing infrastructure of biotechnology. According to International Trade Administration (ITA), Saudi Arabia accounts for 60 percent of the Gulf Cooperation Council (GCC) countries’ healthcare expenditure. In 2023, Saudi allocated USD 50.4 billion (16.96% of the budget) on healthcare and social development, emphasizing the importance and focus on biotechnology and the healthcare industries in the country. The Saudi Arabian Government is adopting healthcare privatization as part of Vision 2030, which includes significant investments into biotech and gene therapy manufacturing. This environment is making the region increasingly attractive to homegrown and foreign players alike and positions it well as a future hub for the manufacturing of viral vectors, as countries in the region seek to augment their self-sufficiency in advanced healthcare technologies.

Competitive Landscape:

The global viral vector manufacturing market is highly competitive, with leading companies focusing on technological advancements, expanding their production capabilities, and forming strategic partnerships to strengthen their market standing. Major companies dominate the market with extensive expertise and robust production capabilities. These firms invest heavily in R&D to enhance vector engineering, scalability, and manufacturing efficiency. Emerging players and contract development and manufacturing organizations (CDMOs) are also gaining traction by offering cost-effective solutions and specialized services. Partnerships between pharmaceutical companies, research institutes, and vector manufacturers are increasingly common, aimed at accelerating gene therapy development and commercialization. The competitive environment is also influenced by regional companies expanding their operations to address the increasing global demand for viral vectors.

The report provides a comprehensive analysis of the competitive landscape in the viral vector manufacturing market with detailed profiles of all major companies, including:

- Aldevron LLC

- Catalent, Inc

- Charles River Laboratories International Inc.

- Cytiva (Danaher Corporation)

- F. Hoffmann-La Roche Ltd

- FUJIFILM Diosynth Biotechnologies

- Genezen

- Kaneka Corporation

- Lonza

- Merck KGaA

- Oxford Biomedica PLC

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- November 2024: Fujifilm Diosynth Biotechnologies declared it has expanded cell therapy manufacturing at Thousand Oaks, California, adding new production suites and improved development laboratories, as well as growing cleanroom capacity. It says the about USD 200 million project supports both growing needs in viral vector and cell therapy productions, including those for clinical as well as commercial-scale programs.

- October 2024: Lonza said that it had finalized the acquisition of a large-scale biologics manufacturing site located in Vacaville, US, from Roche. This acquisition expands Lonza's US biologics footprint, supports commercial manufacturing and the development of a strong pipeline of viral vector-based molecules.

- October 2024: FinVector announced that the company has opened its high-tech global gene therapy manufacturing facility, Finport, on October 3, 2024. Located in Kuopio, this plant manufactures viral vector-based drug substances for Ferring Pharmaceuticals' FDA-approved gene therapy, Adstiladrin. The specialized production for that drug might serve as an advantageous foundation to enter new regions.

- May 2024: Merck and Co Inc stated that it had agreed to purchase Mirus Bio, a USD 600 million deal to increase its capabilities in manufacturing viral vectors. The acquisition would enhance Merck's portfolio through Mirus Bio's transfection reagents. It will add the latter to the list of integrated solutions the company provides in gene therapies, following the demand for viral vector-based therapies. It is set to increase 30% in 2028.

- March 2024: Oxford Biomedica reports the company received high demand for its CDMO services with a number of agreements signed in a variety of different viral vector types. The programs include late-stage lentiviral vectors CAR-T therapy in the treatment of multiple myeloma, and AAV-based gene therapy for cardiac indications. These also include process development and GMP manufacturing.

Viral Vector Manufacturing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Adenoviral Vectors, Adeno-associated Viral Vectors, Lentiviral Vectors, Retroviral Vectors, Others |

| Diseases Covered | Cancer, Genetic Disorders, Infectious Diseases, Others |

| Applications Covered | Gene Therapy, Vaccinology |

| End Users Covered | Pharmaceutical and Biopharmaceutical Companies, Research Institutes |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aldevron LLC, Catalent, Inc, Charles River Laboratories International Inc., Cytiva (Danaher Corporation), F. Hoffmann-La Roche Ltd, FUJIFILM Diosynth Biotechnologies, Genezen, Kaneka Corporation, Lonza, Merck KGaA, Oxford Biomedica PLC, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the viral vector manufacturing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global viral vector manufacturing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the viral vector manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Viral vector manufacturing involves the production of viral vectors, which are engineered viruses used to deliver genetic material into cells for therapeutic purposes, particularly in gene therapy, cancer treatments, and vaccines. It is a crucial process in developing and scaling gene and cell therapies.

The global viral vector manufacturing market was valued at USD 1,469.6 Million in 2024.

IMARC estimates the global viral vector manufacturing market to exhibit a CAGR of 21.6% during 2025-2033.

Key drivers include the increasing prevalence of genetic disorders, the rising adoption of gene therapies, advancements in biotechnology, growing clinical trials, government funding, robust R&D investments, and the presence of major pharmaceutical companies.

In 2024, Adeno-associated viral (AAV) vectors represented the largest segment by type, driven by their versatility, low immunogenicity, and ability to treat genetic disorders like spinal muscular atrophy and inherited retinal diseases.

Cancer leads the market by disease, owing to the increasing adoption of viral vectors in gene therapies and oncolytic virotherapy for treating various types of cancer.

Gene therapy is the leading segment by application, driven by the growing use of viral vectors in treating genetic disorders, cancers, and rare diseases, supported by increasing regulatory approvals and technological advancements.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global viral vector manufacturing market include Aldevron LLC, Catalent, Inc, Charles River Laboratories International Inc., Cytiva (Danaher Corporation), F. Hoffmann-La Roche Ltd, FUJIFILM Diosynth Biotechnologies, Genezen, Kaneka Corporation, Lonza, Merck KGaA, Oxford Biomedica PLC, Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)