Viral Clearance Market Report by Method (Viral Removal, Viral Inactivation), Application (Recombinant Proteins, Blood and Blood Products, Cellular and Gene Therapy Products, Vaccine, and Others), End User (Pharmaceutical and Biotechnology Companies, Contract Research Organizations, Academic Research Institutes, and Others), and Region 2025-2033

Viral Clearance Market Size:

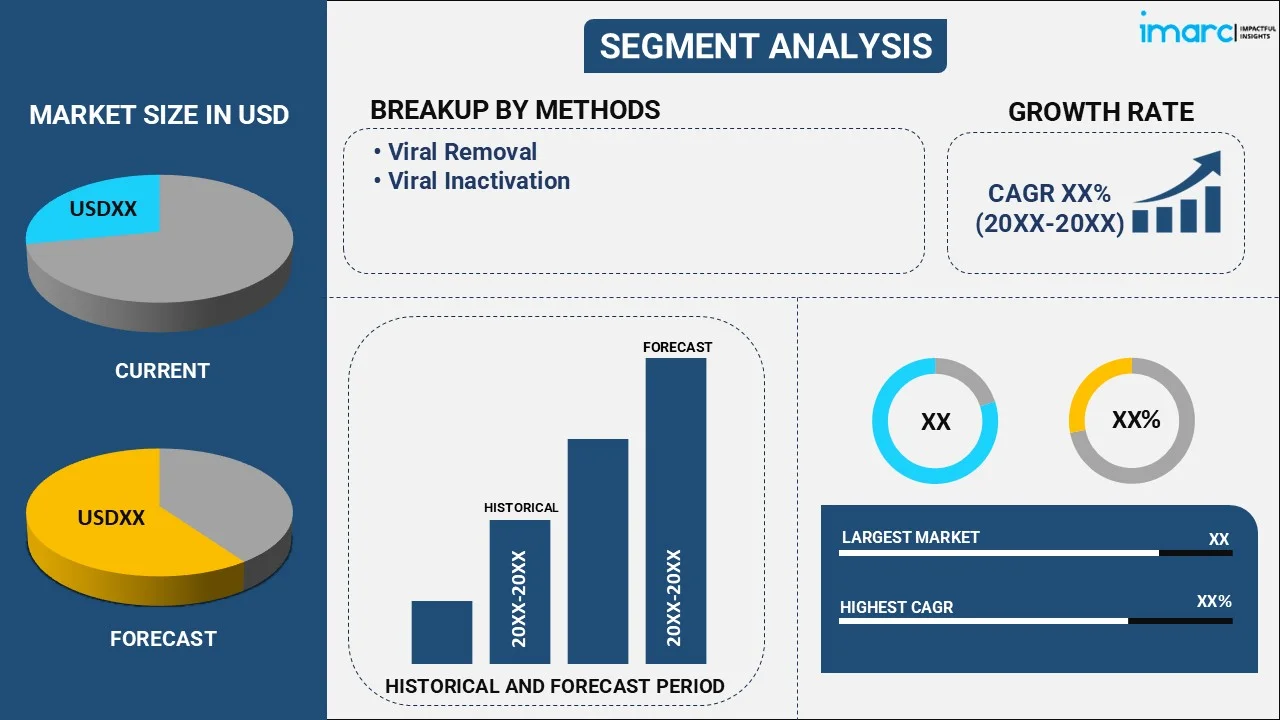

The global viral clearance market size reached USD 867.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,313.2 Million by 2033, exhibiting a growth rate (CAGR) of 18.54% during 2025-2033. The market is driven by the increasing prevalence of chronic diseases, imposition of stringent regulatory requirements, emergence of infectious diseases and pandemic preparedness, rapid advancements in clearance technologies, growth in biosimilars and biologics, and burgeoning innovations in virus detection.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 867.2 Million |

|

Market Forecast in 2033

|

USD 4,313.2 Million |

| Market Growth Rate 2025-2033 | 18.54% |

Viral Clearance Market Analysis:

- Major Market Drivers: Tight viral clearance procedures are required to guarantee product safety due to the rising prevalence of chronic illnesses like diabetes and cancer. Furthermore, biopharmaceutical companies are establishing extensive plans to comply with safety standards due to regulatory bodies' strict criteria. Further rapid technical developments in virus-clearing techniques, such as chromatography and nanofiltration, which improve the effectiveness and dependability of virus removal and inactivation procedures are propelling the market growth.

- Key Market Trends: The desire for affordable therapeutic options and the expiry of patents on blockbuster pharmaceuticals have resulted in a notable increase in the manufacture of biologics and biosimilars. Furthermore, contract research organizations (CROs) and contract manufacturing organizations (CMOs), who are experts in viral clearance, are being used by the biopharmaceutical sector more and more to outsource production and research activities.

- Geographical Trends: North America dominates this market, owing to a strong biopharmaceutical sector, extensive research and development (R&D) investments, and tight regulatory frameworks. Other emerging countries are also seeing greater investment and growth by important firms looking to broaden their worldwide reach and meet the growing demand for viral clearance products.

- Competitive Landscape: Some of the major market players in the viral clearance industry include Charles River Laboratories Inc., Creative Biogene Inc, Eurofins Scientific SE, Merck & Co Inc, Sartorius AG, Syngene International Limited (Biocon Ltd), Texcell, and WuXi Biologics Inc, among many others.

- Challenges and Opportunities: One of the main obstacles is the expense and complexity of viral clearance procedures, which can be prohibitive for biopharmaceutical businesses that are small and medium-sized. On the other hand, the necessity of pandemic preparation and the ongoing introduction of novel viral threats underscore the vital significance of strong viral safety procedures, offering prospects for advancements in viral clearance technology. Furthermore, there are a lot of opportunities for the creation and use of cutting-edge viral clearance techniques due to the expanding market for cell and gene therapies, which demand strict viral safety regulations.

Viral Clearance Market Trends:

Increasing Prevalence of Chronic Diseases

There is a rising incidence of chronic diseases such as cancer, diabetes, and autoimmune disorders, which is one of the major factors that is boosting the demand for this industry. As per the Centre for Disease Control and Prevention (CDC), 6 in 10 adults in the U.S. are suffering from chronic diseases. And 4 out of 10 people have more than two chronic conditions. Also, about 21% of the geriatric adults in India have at least one chronic disease. This hike has increased the use of biopharmaceuticals, which include monoclonal antibodies, vaccines, and cell and gene therapies. They are derived from biological sources which pose a risk of viral contamination. To ensure viral safety to protect patients and meet regulatory requirements, there is a need to develop safe and effective therapies, which is pushing companies to adopt comprehensive viral clearance strategies, including both viral inactivation and removal techniques.

Imposition of Stringent Regulatory Requirements and Standards

Several regulatory agencies, such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other global health authorities have established rigorous guidelines and standards for viral safety in biopharmaceutical production. For example, in January 2024, the FDA published a final guidance on the viral safety of biotechnology products, outlining recommended approaches for viral testing, viral clearance, and submitting related marketing application data. They recommended that biotechnology organizations adjust the type and extent of viral testing and viral clearance assessments they use on a case-by-case and step-by-step basis in consideration of specific products and production processes. Compliance with these regulations is mandatory for market approval and commercialization of biopharmaceutical products. This includes implementing viral clearance steps during the manufacturing process, performing viral safety studies, and conducting regular audits and inspections.

Emergence of Infectious Diseases and Pandemic Preparedness

The emergence of new infectious diseases and global pandemics, such as the coronavirus pandemic, has highlighted the critical importance of viral safety in the development and production of vaccines and therapeutics. There was a total of 704,753,890 cases of coronavirus across the globe, with 7,010,681 deaths. The rapid spread of infectious diseases like coronavirus necessitates the need for swift and effective responses, including the development of safe and effective medical countermeasures. This development works parallelly with ensuring viral safety in the production of vaccines and therapeutics, which is important to prevent the introduction of viral contaminants and to safeguard public health. The coronavirus pandemic has underscored the need for robust clearance protocols and the importance of preparedness in addressing future pandemics.

Viral Clearance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on method, application, and end user.

Breakup by Method:

- Viral Removal

- Chromatography

- Nanofiltration

- Precipitation

- Viral Inactivation

- Low pH

- Solvent Detergent Method

- Heat Pasteurization

- Others

Viral removal accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the method. This includes viral removal (chromatography, nanofiltration, and precipitation) and viral inactivation (low pH, solvent detergent method, heat pasteurization, and others). According to the report, viral removal represented the largest segment.

According to the viral clearance market report, the viral removal segment represented the largest segment. It includes techniques such as nanofiltration and chromatography, which are pivotal in physically eliminating viral contaminants from biopharmaceutical products. Viral removal methods are favored for their high efficacy in reducing viral loads without compromising the integrity or efficacy of the final product. Moreover, its proven reliability, widespread adoption in biopharmaceutical manufacturing, and continuous advancements in filtration and chromatography technologies that enhance their efficiency and effectiveness are boosting the viral clearance market share.

Breakup by Application:

- Recombinant Proteins

- Blood and Blood Products

- Cellular and Gene Therapy Products

- Vaccine

- Others

Recombinant proteins hold the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes recombinant proteins, blood and blood products, cellular and gene therapy products, vaccine, and others. According to the report, recombinant proteins accounted for the largest market share.

Recombinant proteins represented the largest segment, attributed to the extensive use of these proteins in a wide range of therapeutic and diagnostic applications, including monoclonal antibodies, enzymes, and hormones. Moreover, the production of recombinant proteins involves complex biomanufacturing processes that inherently carry the risk of viral contamination, boosting the use of viral clearance to ensure viral safety, meet stringent regulatory requirements, and guarantee patient safety. Moreover, the rising chronic diseases and advancements in biotechnology, propelling the need for effective clearance solutions, are major viral clearance market growth factors.

Breakup by End User:

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

- Academic Research Institutes

- Others

Pharmaceutical and biotechnology companies represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes pharmaceutical and biotechnology companies, contract research organizations, academic research institutes, and others. According to the report, pharmaceutical and biotechnology companies represented the largest segment.

As per the viral clearance market segment analysis, pharmaceutical and biotechnology companies accounted for the largest market share. These companies are at the forefront of developing and manufacturing biopharmaceutical products, including vaccines, monoclonal antibodies, and gene therapies, which require stringent viral safety measures to ensure their efficacy and safety. Moreover, the need for compliance with rigorous regulatory standards and the high stakes of product quality and patient safety, driving pharmaceutical and biotechnology companies to invest in advanced viral clearance technologies and processes, is boosting the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest viral clearance market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for viral clearance.

Based on the viral clearance market report, North America emerged as the largest region. This dominance is attributed to the presence of a robust biopharmaceutical industry, significant investment in research and development (R&D), and stringent regulatory frameworks that mandate rigorous viral safety protocols. Moreover, the region is hub to numerous leading pharmaceutical and biotechnology companies, research institutions, and a well-established healthcare infrastructure. Additionally, the high prevalence of chronic diseases and the increasing demand for advanced biologics and gene therapies, driving the need for effective solutions, is enhancing the viral clearance market size.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the viral clearance industry include Charles River Laboratories Inc., Creative Biogene Inc, Eurofins Scientific SE, Merck & Co Inc, Sartorius AG, Syngene International Limited (Biocon Ltd), Texcell, WuXi Biologics Inc, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are actively engaging in strategic initiatives to strengthen their market position and enhance their product offerings. They are investing in research and development (R&D) to innovate and improve viral clearance technologies, such as advanced nanofiltration, chromatography, and viral inactivation methods. Moreover, some companies are forming collaborations and partnerships with biopharmaceutical companies, contract research organizations (CROs), and academic institutions to expand their technological capabilities and address complex viral safety challenges. Additionally, market leaders are focusing on expanding their global footprint by establishing new facilities and enhancing their presence in emerging markets. They are also implementing stringent quality control measures and compliance protocols to meet regulatory standards and ensure the highest levels of product safety.

Viral Clearance Market News:

- In June 2023, Texcell announced the expansion of its viral clearance and biosafety facility in Frederick, U.S. The company has planned to open a 27,000 sq. ft. facility in the same city. This expansion is aimed to enhance its service offerings.

- In November 2023, Merck launched its innovative Deviron detergent portfolio that is designed to be more effective than conventional virus inactivation methods and to facilitate compliance with evolving regulatory standards.

Viral Clearance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Methods Covered |

|

| Applications Covered | Recombinant Proteins, Blood and Blood Products, Cellular and Gene Therapy Products, Vaccine, Others |

| End Users Covered | Pharmaceutical and Biotechnology Companies, Contract Research Organizations, Academic Research Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Charles River Laboratories Inc., Creative Biogene Inc, Eurofins Scientific SE, Merck & Co Inc, Sartorius AG, Syngene International Limited (Biocon Ltd), Texcell, WuXi Biologics Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the viral clearance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global viral clearance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the viral clearance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The viral clearance market was valued at USD 867.2 Million in 2024.

The viral clearance market is projected to exhibit a (CAGR) of 18.54% during 2025-2033, reaching a value of USD 4,313.2 Million by 2033.

The viral clearance industry is led by growing demand for biopharmaceuticals, the need for rigorous regulatory compliance of product safety, and the growing emphasis on virus elimination in biologics production. Advances in chromatography and filtration technologies and increasing R&D expenditure on cell culture-based drugs are driving the implementation of viral clearance solutions across the world.

North America currently dominates the viral clearance market because of its robust base for biopharmaceutical manufacturing, stringent regulatory environment, and large-scale clinical research activities. Its presence of key biotechnology companies, greater biologics production, and high investment in research and development (R&D) and safety assurance contribute immensely to the region becoming a market leader globally.

Some of the major players in the viral clearance market include Charles River Laboratories Inc., Creative Biogene Inc, Eurofins Scientific SE, Merck & Co Inc, Sartorius AG, Syngene International Limited (Biocon Ltd), Texcell, WuXi Biologics Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)