Vinyl Ester Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2025-2033

Vinyl Ester Market Size and Share:

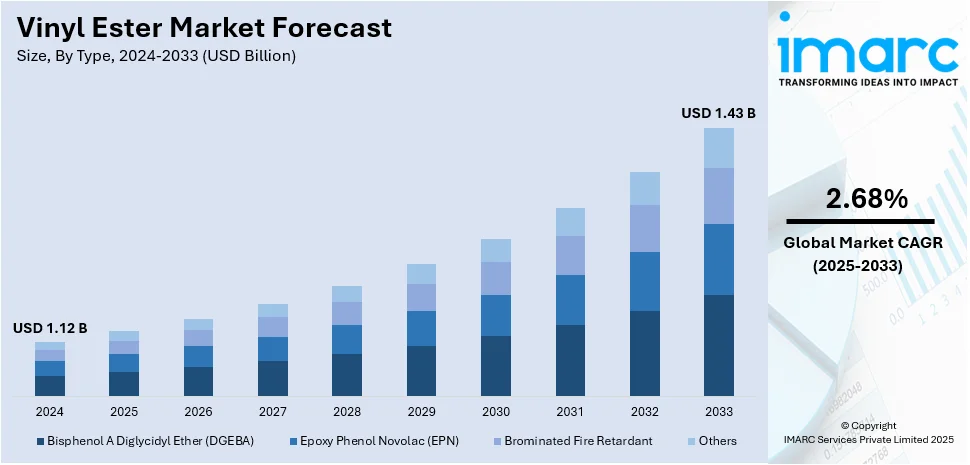

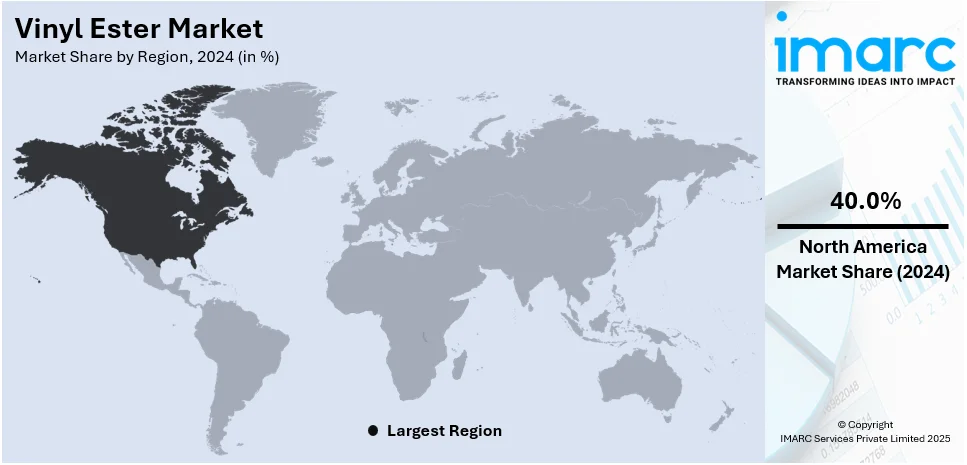

The global vinyl ester market size was valued at USD 1.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.43 Billion by 2033, exhibiting a CAGR of 2.68% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024. The vinyl ester market share is influenced by its demand in the marine sector, rising application in chemical storage containers, and its essential function in the expanding fiber-reinforced plastics market, supported by its enhanced strength, resistance to corrosion, and compatibility with different reinforcements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.12 Billion |

|

Market Forecast in 2033

|

USD 1.43 Billion |

| Market Growth Rate (2025-2033) | 2.68% |

The vinyl ester market is driven by the rising need for long-lasting and corrosion-resistant materials in sectors such as construction, automotive, and marine, which has enhanced the use of vinyl ester resins. These materials possess excellent resistance to chemical degradation, rendering them perfect for application in demanding environments. Additionally, the growth of the composite materials market, driven by advancements in lightweight and high-strength materials, has further propelled the demand for vinyl ester. The material's low maintenance cost and excellent mechanical properties also add to its appeal in various end-use sectors. Moreover, the shift towards eco-friendly and sustainable solutions is pushing manufacturers to seek alternatives to traditional materials, with vinyl ester offering a viable solution. The ongoing expansion of infrastructure projects, especially in emerging economies, is also expected to continue fueling demand for vinyl ester resins in construction applications.

The United States stands out as a key market disruptor, driven by its strong industrial base and technological leadership. With heavy research and development investments, US companies are leading new markets and better developing vinyl ester resin formulas to make them more versatile and cost-effective. This encourages expanded usage in industries such as oil and gas, marine, and wind energy where endurance and protection from harsh environments are critical. Furthermore, the emphasis of the US government on infrastructure development and sustainability programs increases demand for high-performance materials such as vinyl ester, especially in water treatment and construction applications. The strategic location of the country as a global manufacturing center also promotes the export of advanced vinyl ester solutions, shaping market trends worldwide. With growing environmental issues, the US market's demand for environmentally friendly, green alternatives fuels the transition towards sustainable resin technologies faster, thereby placing the US at the forefront as a disruptive factor in driving market transformation and mapping the future of the vinyl ester demand.

Vinyl Ester Market Trends:

Rising demand from the marine industry

The marine industry's consistent growth has been a significant propellant for the global vinyl ester market. The robust growth in maritime trade and booming tourism industry is triggering a surge in vinyl ester demand. According to UN Tourism, an estimated 1.4 Billion international tourists were recorded, an increase of 11% over 2023. Renowned for its exceptional water and corrosion resistance, vinyl ester is extensively deployed to manufacture various marine structures, including boats, yachts, naval vessels, offshore platforms, and marine transportation equipment. Its ability to endure harsh marine environments of the corrosive effects of seawater and the wear and tear induced by waves and harsh weather conditions makes it an ideal substitute for traditional materials. Moreover, the rise of recreational boating activities, driven by increasing disposable income and the growing popularity of water sports and leisure activities, further shapes the vinyl ester market outlook.

Increasing utilization in the construction of chemical storage tanks

Vinyl ester, with its excellent chemical-resistant attributes, is widely utilized in the fabrication of chemical storage tanks. As industrial sectors across the globe continue their expansion trajectory, the imperative for secure, robust, and long-lasting storage solutions becomes more pressing. Moreover, the chemical industry's extensive and diverse needs for safely storing various chemicals, ranging from potent acids and alkalis to aggressive solvents, require materials that can withstand corrosive effects. According to India Brand Equity Foundation, specialty chemicals account for 20% of the global chemicals industry's USD 4 Trillion. Vinyl ester adeptly satisfies these requirements, thus considerably bolstering its market demand. Furthermore, the growing environmental awareness and increasingly stringent regulatory compliances necessitate the use of leakage-proof materials in storage tank construction, further escalating vinyl ester's popularity. Additionally, the burgeoning pharmaceutical and agrochemical industries also contribute to the growing demand for vinyl ester in tank construction due to similar storage needs.

Role in fiber-reinforced plastics (FRP)

The escalating use of vinyl ester in fabricating fiber-reinforced plastics (FRP) significantly propels the global market. FRP is finding diverse applications across numerous sectors due to their robust strength, lightweight, and exceptional durability. Among these are the automotive, construction, and aerospace industries, which are witnessing consistent growth, pushing the demand for vinyl ester, a crucial component of FRP. According to reports, an estimated USD 50 Billion was invested in architecture, engineering, and construction (AEC) tech between 2020 to 2022, 85 percent higher than the previous three years. Further fuelling this demand is the rising trend of replacing traditional materials like steel and aluminum with FRP in various applications, driven by FRP's advantageous properties and cost-effectiveness. Additionally, FRP's resistance to corrosion, low maintenance requirements, and design flexibility make them an attractive choice in corrosive and harsh environments, thus increasing the demand for vinyl ester. Furthermore, the growing focus on reducing carbon emissions and enhancing energy efficiency underscores the importance of lightweight materials such as FRP, potentially driving the vinyl ester market growth.

Vinyl Ester Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vinyl ester market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, and application.

Analysis by Type:

- Bisphenol A Diglycidyl Ether (DGEBA)

- Epoxy Phenol Novolac (EPN)

- Brominated Fire Retardant

- Others

Bisphenol A Diglycidyl Ether (DGEBA) stands as the largest component in 2024, holding around 52.5% of the market. The world demand for diglycidyl ether of bisphenol A (DGEBA), a leading species of epoxy resin, is being driven by its increasing application in the production of coatings, adhesives, and sealants. With industries across the globe, particularly those in the construction and automotive industries, still on the growth curve, the demand for such products is increasing, thus fueling the demand for DGEBA. Besides, DGEBA is employed in the production of high-performance composites because of its high mechanical properties and high dimensional stability. The growing need for such composites in aerospace, sports, and wind turbine applications is driving the demand for DGEBA. Furthermore, the electrical insulating characteristics of DGEBA make it a popular material for electrical and electronic applications. As the electronics sector continues to grow, more so with the introduction of 5G and Internet of Things (IoT) technologies, demand for DGEBA will continue to grow.

Analysis by Distribution Channel:

- Offline

- Online

Consumer electronics lead the market share in 2024. With the increasing proliferation of high-speed internet and smartphones, the online segment is witnessing substantial growth. It provides consumers with the convenience of shopping anytime, anywhere, coupled with a wider range of product options, user reviews, and competitive pricing. The trend toward online shopping due to recent shifts in consumer behavior following the COVID-19 pandemic is creating a favorable outlook for market expansion. In addition to this, widespread product availability through traditional brick-and-mortar stores, which include supermarkets, hypermarkets, specialty stores, and others, is strengthening the market growth. In line with this, the surging consumer's preference for offline shopping due to the tactile experience it offers, allowing them to physically examine products before purchasing, is influencing the market growth. Additionally, instant ownership, professional assistance, and avoidance of shipping costs are contributing to the market's growth.

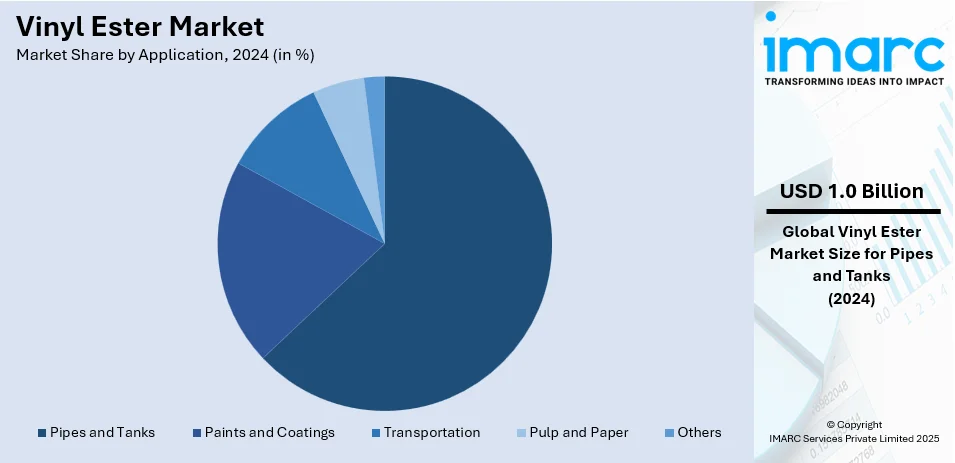

Analysis by Application:

- Pipes and Tanks

- Paints and Coatings

- Transportation

- Pulp and Paper

- Others

Pipes and tanks lead the market with around 63.2% of market share in 2024. The escalating demand for vinyl ester-based pipes and tanks is providing a substantial boost to the market growth. Key industries, such as oil & gas, wastewater treatment, and chemical processing, are opting for vinyl ester-based solutions due to their exceptional corrosion resistance and durability. The oil and gas industry requires robust materials, such as vinyl ester, for pipes that can endure corrosive substances and extreme conditions. Additionally, wastewater treatment plants are increasingly using vinyl ester-based tanks and pipes because of their resistance to corrosive gases and liquids. In the chemical processing industry, vinyl ester's resistance to a wide array of chemicals makes it an ideal choice for constructing tanks and piping systems, ensuring safe and efficient operations. Moreover, the demand for these materials is being driven by the water and wastewater management sector due to growing environmental concerns and stricter regulations for sustainable infrastructure.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%. The demand for vinyl ester in North America is seeing a considerable uptick due to a combination of industrial growth and infrastructural development. The North American region, particularly the United States, has a substantial presence of industries such as oil & gas, chemical processing, and marine, all of which extensively use vinyl ester. Furthermore, North America is witnessing an increased emphasis on the use of durable, lightweight materials in the construction and automotive sectors, which directly impacts the demand for vinyl ester. Additionally, heightened environmental awareness and regulatory compliance in the region are fostering the use of corrosion-resistant materials in wastewater management systems. The increased investment in renewable energy, particularly wind energy, is another contributing factor, as vinyl ester is a preferred material for manufacturing wind turbine blades.

Key Regional Takeaways:

United States Vinyl Ester Market Analysis

In 2024, the United States accounted for over 83.80% of the vinyl ester market in North America. Vinyl ester adoption is increasing due to growing chemical sector expansion, leading to higher demand for corrosion-resistant materials in chemical processing plants. According to reports, the U.S. chemical manufacturing industry total FDI in the industry was USD 766.7 Billion in 2023. Industries requiring high-performance resins for pipes, tanks, and protective linings are driving market growth. The chemical sector’s focus on sustainability and advanced manufacturing techniques further fuels demand for vinyl ester in coatings and composite applications. Rising infrastructure investments, particularly in industrial construction and chemical storage facilities, boost consumption of these resins. Stringent regulations regarding emissions and workplace safety encourage the use of durable, chemically resistant materials, supporting vinyl ester applications. Technological advancements in resin formulations enhance performance characteristics, making them suitable for various chemical industry needs. With industrial expansion accelerating, end-use sectors continue to prioritize cost-effective, high-strength alternatives, ensuring steady market progression.

Asia Pacific Vinyl Ester Market Analysis

Rising demand from the marine industry due to large coastal area increases vinyl ester consumption in shipbuilding, offshore structures, and marine coatings. For instance, India’s coastline has grown by 47.6%, from 7,516 km in 1970 to 11,098 km in 2023-24. Coastal infrastructure projects and growing shipbuilding activities require corrosion-resistant resins, supporting increased utilization. Marine transportation expansion necessitates durable materials for hulls, decks, and storage tanks, driving resin adoption. Enhanced durability and chemical resistance make these materials essential for high-performance marine applications. Offshore drilling platforms and coastal defense structures benefit from the superior mechanical properties of vinyl ester, ensuring structural longevity. Increased investment in maritime trade infrastructure, along with stringent environmental standards, strengthens demand for advanced composite solutions. As shipbuilders and offshore industries expand operations, the need for high-strength, water-resistant resins grow, fostering market growth.

Europe Vinyl Ester Market Analysis

Growing investment in wastewater treatment plants propels vinyl ester usage, as industries prioritize corrosion-resistant materials for treatment tanks, pipelines, and filtration systems. According to reports in 2023, EU countries invested about approximately USD 69.2 Billion into assets essential to provide environmental protection services. These services included wastewater treatment plants. Municipal and industrial wastewater facilities require chemically durable materials to withstand harsh treatment processes, elevating demand for specialized resins. Stringent environmental regulations mandate high-performance solutions for efficient wastewater management, prompting increased adoption of advanced composite materials. The push for sustainable water treatment infrastructure encourages the use of long-lasting, chemically stable resins in facility construction and maintenance. Advancements in treatment technologies further promote the integration of high-strength, chemical-resistant materials to enhance efficiency and longevity. Infrastructure modernization initiatives support the transition toward advanced composite solutions, positioning vinyl ester as a preferred material in wastewater applications.

Latin America Vinyl Ester Market Analysis

Growing online distribution channel enables wider accessibility of vinyl ester resins, facilitating market expansion across industrial sectors. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Increased digitalization of supply chains enhances procurement efficiency, streamlining transactions and delivery processes. Industrial buyers benefit from direct access to specialized resins, reducing dependency on traditional distribution networks. Improved logistics infrastructure supports seamless transportation and availability, further driving adoption. Competitive pricing and enhanced customer outreach via e-commerce platforms strengthen market penetration, ensuring broader industry utilization.

Middle East and Africa Vinyl Ester Market Analysis

Growing oil and gas industry accelerates vinyl ester applications in pipeline coatings, storage tanks, and refinery infrastructure. According to reports, during the period 2024-2028, a total of 668 oil and gas projects are expected to commence operations in the Middle East. Enhanced demand for corrosion-resistant materials in drilling and transportation operations supports increased utilization. Harsh environmental conditions necessitate high-performance solutions, boosting demand for durable, chemically resistant resins. Expansion of offshore and onshore extraction activities reinforces market growth, ensuring continued adoption in critical applications.

Competitive Landscape:

Some of the key players operating in the market for vinyl esters are attempting hard to facilitate growth and innovations through a few key strategic focus areas. Dominant players are heavily investing into R&D, and they aim to improve performance characteristics of the vinyl ester resins such as their hardness, chemical resistances, and heat stability. This has resulted in the creation of high-end formulations that target particular industries such as automotive, marine, and wind power, where there is a fast-growing need for lightweight, high-strength, and corrosion-resistant materials. Furthermore, most players are also aggressively targeting sustainability by creating more environmentally friendly vinyl ester solutions, responding to the increasing consumer demand for green and sustainable materials. Alongside, these organizations are increasing production capacities to achieve the growing demand globally, mainly from developing countries, by opening new manufacturing units and improving the distribution channels. Strategic alliances and acquisitions are equally prevalent in the industry, with major players targeting to enhance technology capabilities and enlarge market presence. In addition to that, educating and working alongside end-users across sectors is highlighted with the goal of promoting the benefits of vinyl ester to create additional applications within different industries.

The report provides a comprehensive analysis of the competitive landscape in the vinyl ester market with detailed profiles of all major companies, including:

- Akzo Nobel N.V.

- Ashland Global Holdings Inc.

- INEOS Limited

- Interplastic Corporation

- Nivitex Fibreglass and Resins

- Poliya Composite Resins and Polymers Inc.

- Polynt spa

- Scott Bader Company Ltd.

- Showa Denko K. K.

- Sino Polymer Co. Ltd.

- Swancor Holding Co Ltd.

Latest News and Developments:

- January 2025: Perstorp, a PETRONAS Chemicals subsidiary, will open a new Amsterdam site in early 2025 to produce synthetic esters, expanding into specialty fluids. The facility, acquired near the city, aligns with Perstorp’s growth strategy, including vinyl ester offerings.

- December 2024: KPS Capital Partners will acquire INEOS Composites for USD 1.785 Billion, with completion expected in 2025. INEOS Composites, a global leader in specialty resins, produces vinyl ester resins for industries like construction and wind energy. KPS plans to enhance profitability and innovation under CEO Andrew Miller’s leadership.

- November 2024: Japan’s Nippon Paint Holdings (Tokyo) plans to acquire US resin producer AOC (Collierville) for USD 2.3 bn, including vinyl ester resins. Pending approvals, the deal is set to close in H1 2025. AOC, with 14 plants worldwide, had 2023 sales of USD 1.5 Billion.

- August 2024: Ineos has begun expanding its vinyl ester resin production in Changzhou, Jiangsu, with an annual capacity of 18,000 tons. The project, launched at Binjiang New Materials Industrial Park, strengthens its global supply. This expansion aligns with growing demand in advanced composites and coatings.

- August 2024: Hexion and Clariant have partnered to enhance fire protection with advanced intumescent coatings using VeoVa vinyl ester-based binders. This collaboration optimizes char formation and fire resistance for critical applications. The innovation aims to improve structural integrity and safety during fire incidents.

Vinyl Ester Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bisphenol A Diglycidyl Ether (DGEBA), Epoxy Phenol Novolac (EPN), Brominated Fire Retardant, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Pipes and Tanks, Paints and Coatings, Transportation, Pulp and Paper, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akzo Nobel N.V., Ashland Global Holdings Inc., INEOS Limited, Interplastic Corporation, Nivitex Fibreglass and Resins, Poliya Composite Resins and Polymers Inc., Polynt spa, Scott Bader Company Ltd., Showa Denko K. K., Sino Polymer Co. Ltd., Swancor Holding Co Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vinyl ester market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vinyl ester market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vinyl ester industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vinyl ester market was valued at USD 1.12 Billion in 2024.

The vinyl ester market is projected to exhibit a CAGR of 2.68% during 2025-2033.

The vinyl ester market is driven by its superior chemical resistance, durability, and high mechanical strength, making it ideal for industries like automotive, construction, and marine. Additionally, the growing demand for lightweight, eco-friendly materials, along with advancements in resin technology, further boosts market growth and adoption across sectors.

North America currently dominates the market driven by the region's growing demand for corrosion-resistant and high-performance materials in industries like automotive, construction, and marine.

Some of the major players in the vinyl ester market include Akzo Nobel N.V., Ashland Global Holdings Inc., INEOS Limited, Interplastic Corporation, Nivitex Fibreglass and Resins, Poliya Composite Resins and Polymers Inc., Polynt spa, Scott Bader Company Ltd., Showa Denko K. K., Sino Polymer Co. Ltd., Swancor Holding Co Ltd. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)