Vietnam Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

Vietnam Sportswear Market Size and Share:

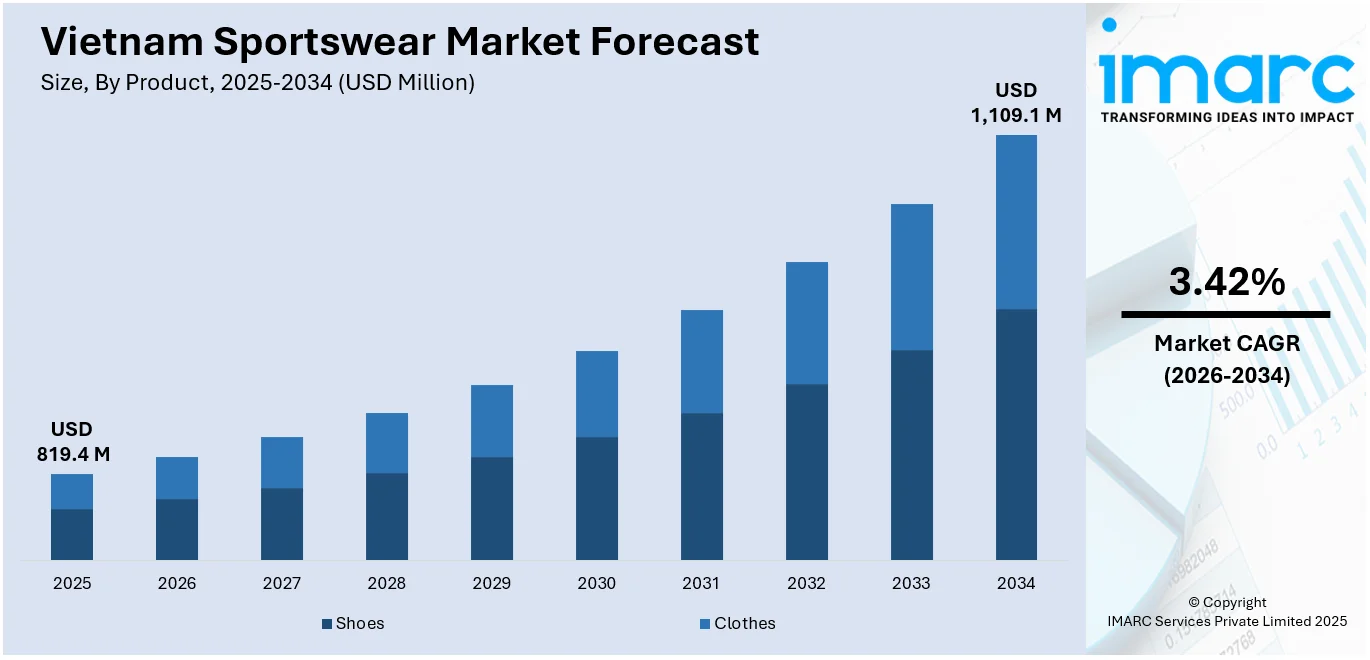

The Vietnam sportswear market size was valued at USD 819.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,109.1 Million by 2034, exhibiting a CAGR of 3.42% from 2026-2034. Southern Vietnam currently dominates the market, holding a market share of 38.7% in 2025. The market is experiencing significant growth, driven by the rising fitness awareness, growing urbanization rates, and increasing demand for stylish, functional apparel. Moreover, rapid growth in athleisure, e-commerce, and local brand presence is also strengthening the overall Vietnam sportswear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 819.4 Million |

| Market Forecast in 2034 | USD 1,109.1 Million |

| Market Growth Rate (2026-2034) | 3.42% |

Vietnam's sportswear market is being driven by a growing awareness of health and wellness, especially among younger demographics and urban populations. Increasing participation in gym workouts, yoga, running events, and cycling clubs has sparked demand for athletic apparel that blends performance with comfort. Social media fitness influencers and government-backed health campaigns have also contributed to a shift in lifestyle choices. As fitness becomes a routine priority, consumers are spending more on functional, breathable, and stylish sportswear.

To get more information on this market Request Sample

Rapid urbanization and a tech-savvy population have accelerated online shopping in Vietnam, creating strong opportunities for sportswear brands. E-commerce platforms, flash sales, and mobile-first marketing have made global and regional labels more accessible than ever. International players like Nike, Adidas, and Puma continue to expand retail footprints while competing with rising local brands that cater to Vietnamese preferences. For instance, in November 2024, Puma opened its first flagship store in Vietnam, located in the Vincom Dong Khoi shopping mall in Ho Chi Minh City. This move supports the brand's growth strategy in Southeast Asia, where it first entered in the 2000s. Blackpink’s Rose serves as Puma’s global brand ambassador. As disposable incomes rise, consumers increasingly seek branded sportswear for exercise and also as part of everyday fashion.

Vietnam Sportswear Market Trends:

Rise of Local Brands

Vietnamese sportswear startups are capturing attention with designs that blend affordability, cultural relevance, and functionality. These homegrown labels are tapping into national identity, incorporating traditional motifs and climate-appropriate fabrics to appeal to local preferences. Their ability to adapt quickly to fashion trends and offer value-driven alternatives to global brands has earned them a loyal customer base. For instance, in March 2025, Coolmate launched its Women's Sports line at the Sports Partnership Day 2025, featuring top Vietnamese athletes. The collection aims for high functionality in sports and daily wear at accessible prices. CEO Pham Chi Nhu announced plans for market expansion and product innovation, including future children's clothing lines. Strategic use of social media and local influencers further boosts visibility, contributing significantly to Vietnam sportswear market growth.

Influencer and Celebrity Marketing

Collaborations with Vietnamese athletes, fitness influencers, and entertainers are playing a central role in reshaping brand engagement strategies. For instance, in January 2024, in Hanoi, the Vietnam Football Federation and Dong Luc Sports Group unveiled the new national football team uniform branded Jogarbola. The partnership, effective from 2024 to 2027, aims to enhance team performance while showcasing Vietnam's cultural pride through distinctive designs and quality apparel. These partnerships help sportswear brands build authenticity and connect with niche audiences through relatable role models. From social media campaigns to co-branded product lines, these endorsements influence style and performance perceptions. According to the Vietnam sportswear market forecast, such marketing strategies are expected to remain crucial in driving brand loyalty and expanding consumer reach across urban and suburban demographics.

Rising Focus on Sustainability

Demand for eco-friendly sportswear is rising in Vietnam, driven by millennials and Gen Z who prioritize environmental responsibility. Brands are responding with collections made from recycled polyester, organic cotton, and biodegradable materials. These sustainable options not only reduce environmental impact but also align with growing consumer expectations for ethical production. Certifications, transparency in sourcing, and green packaging are further influencing purchase decisions. As awareness grows, eco-conscious design is becoming a key differentiator in the evolving Vietnam sportswear market landscape. These factors are collectively creating a positive Vietnam sportswear market outlook.

Vietnam Sportswear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam sportswear market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, distribution channel, and end user.

Analysis by Product:

- Shoes

- Clothes

Shoes stand as the largest product in 2025, holding around 57.8% of the market. Shoes represent the largest product segment in Vietnam’s sportswear market due to rising demand for performance-oriented and lifestyle footwear. Consumers are investing in athletic shoes not only for sports activities but also for daily wear, influenced by comfort, durability, and fashion appeal. Global and local brands are expanding their sneaker lines, capitalizing on athleisure and streetwear trends. Strong retail presence, social media buzz, and collaborations with athletes further boost sales, solidifying footwear’s dominance in Vietnam’s sportswear market.

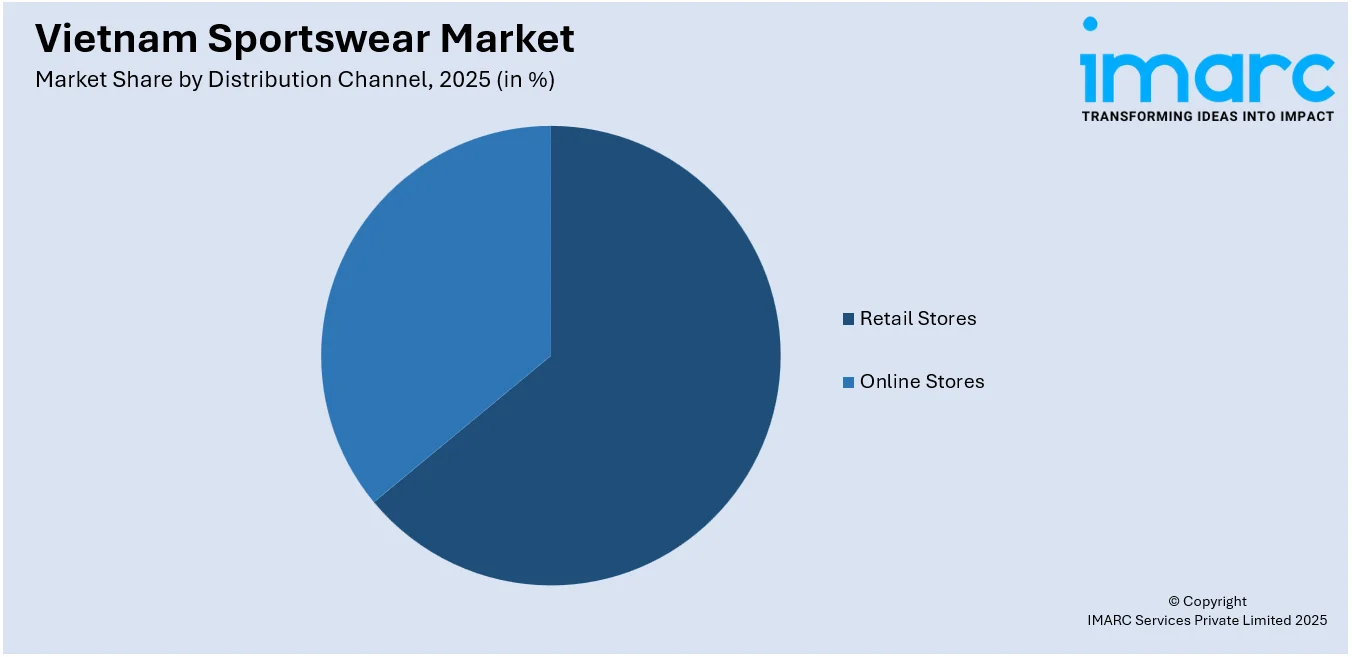

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Retail Stores

Retail stores lead the market with around 63.7% of market share in 2025. Physical retail stores continue to lead the Vietnam sportswear market, offering consumers the advantage of product trial, instant purchases, and personalized service. Many shoppers prefer in-store experiences to assess fit, quality, and comfort—especially for high-value items like footwear and performance apparel. Leading global and domestic brands are investing in flagship outlets and multi-brand stores across urban centers. Storefront visibility, curated displays, and localized marketing further enhance brand engagement, making retail stores a dominant distribution channel in Vietnam.

Analysis by End User:

- Men

- Women

- Kids

Men leads the market with around 48.7% of market share in 2025. The men’s segment holds a leading share in Vietnam’s sportswear market, driven by rising participation in fitness activities, gym culture, and sports like football and running. Male consumers are increasingly seeking performance gear that balances functionality with style. Brands are expanding men’s collections with moisture-wicking fabrics, sleek designs, and sport-specific features. Marketing campaigns targeting male audiences through athletes and fitness influencers have also fueled demand. This steady interest positions men as the primary consumer group in Vietnam’s sportswear market.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2025, Southern Vietnam accounted for the largest market share of over 38.7%. Southern Vietnam, particularly Ho Chi Minh City, accounts for the largest share of the country’s sportswear market. The region's strong economic base, dense urban population, and growing health consciousness contribute to high demand for athletic apparel and footwear. Gyms, fitness clubs, and organized sports events are more prevalent here, driving consistent consumer interest. Additionally, the presence of major retail hubs and shopping malls supports brand visibility and accessibility, cementing Southern Vietnam’s position as the dominant market for sportswear.

Competitive Landscape:

The Vietnam sportswear market is highly competitive, featuring a mix of international giants, regional labels, and emerging domestic players. Companies compete on product innovation, pricing strategies, distribution networks, and brand image. E-commerce and social media are pivotal for outreach, while retail expansion into malls and standalone outlets strengthens market penetration. Sustainability, customization, and tech-enhanced apparel are becoming key differentiators. Players are also investing in influencer collaborations and localized marketing to capture diverse consumer segments across urban and semi-urban regions.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam sportswear market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Intermax Co. Ltd., a Vietnamese apparel manufacturing group, established a partnership with Aaron Corp dba JP Sportswear. As part of this partnership, JP Sportswear will reportedly be exclusively in charge of producing and promoting athletic and athleisure clothing companies and retailers for the INTERMAX group of companies, which includes Maxcore, MK Global, and INTERMAX CO., LTD.

- April 2025: Hoka launched its first standalone store in Vietnam at Ho Chi Minh City’s Saigon Centre, partnering with distributor CBS. The outlet features 3D foot-scanning technology for personalized shoe recommendations, offering road/trail running and streetwear styles.

Vietnam Sportswear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam sportswear market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam sportswear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam sportswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sportswear market was valued at USD 819.4 Million in 2025.

The Vietnam sportswear market is growing due to rising health awareness, increased participation in fitness and sports activities, urban lifestyle shifts, and demand for athleisure. E-commerce growth, influencer marketing, and expanding middle-class income levels are further fueling consumer interest and market expansion.

IMARC estimates the sportswear market to reach USD 1,109.1 Million by 2034, exhibiting a CAGR of 3.42% from 2026-2034.

Southern Vietnam currently dominates the Vietnam sportswear market due to higher urbanization, fitness-focused lifestyles, stronger retail infrastructure, and greater consumer spending power in metropolitan areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)