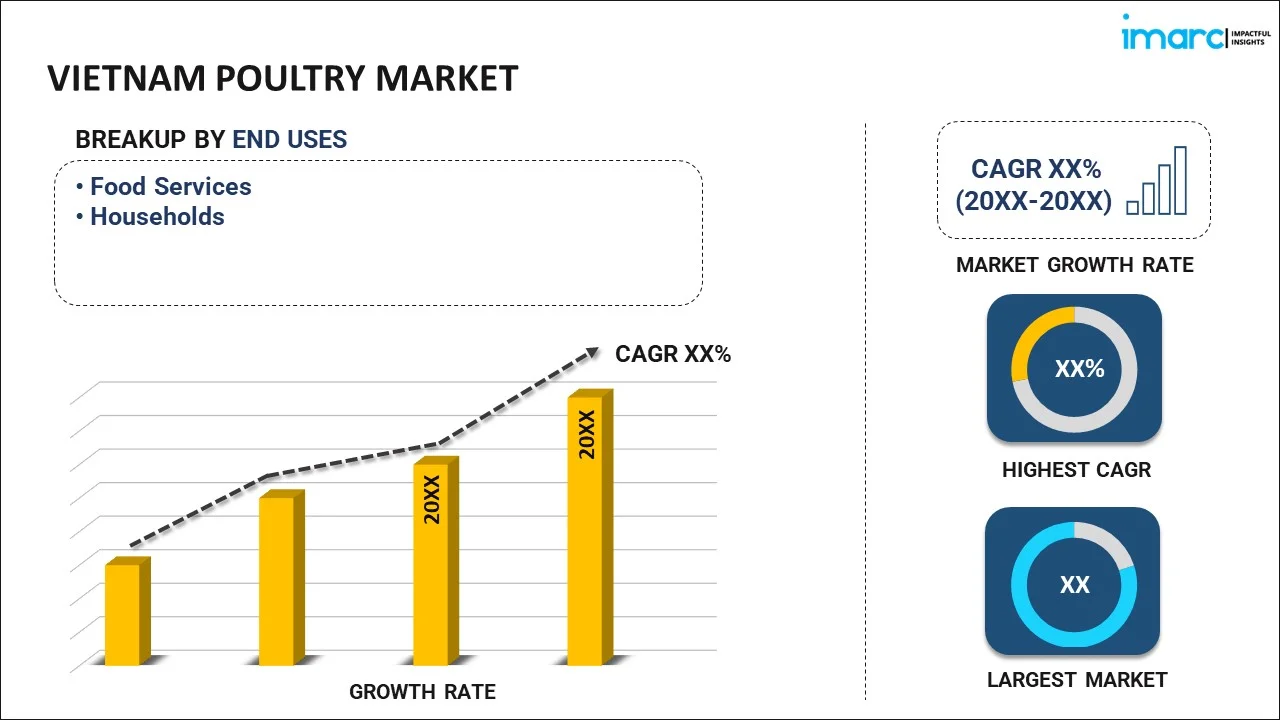

Vietnam Poultry Market Report by End Use (Food Services, Households), Distribution Channel (Traditional Retail Stores, Business to Business (B2B), Modern Retail Stores), and Region 2025-2033

Market Overview:

Vietnam poultry market size is projected to exhibit a growth rate (CAGR) of 7.18% during 2025-2033. The increasing economic growth, rapid urbanization, favorable government support to improve poultry farming practices, rising export opportunities, significant technological advancements in poultry farming technology, and shifting dietary habits due to rising preference for lean protein sources represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 7.18% |

Poultry refers to domesticated birds that are raised for different purposes, primarily for their meat and eggs. Some of the common poultry species include chickens, ducks, turkeys, and geese. These birds are a significant source of animal protein in various diets around the world. Poultry farming is an integral part of the global food industry, providing a reliable and relatively efficient means of producing meat and eggs. Chickens are the most widely raised poultry species, valued for their versatile meat and prolific egg production. They come in various breeds tailored for different purposes, such as broilers for meat and layers for eggs. Ducks, on the other hand, are known for their flavorful meat and are often consumed in Asian cuisines. Turkeys are a popular choice for festive occasions, particularly Thanksgiving, due to their large size and succulent meat. Geese are less commonly raised; however, are prized for their distinctive flavor, especially in European culinary traditions.

Vietnam Poultry Market Trends:

One of the primary factors driving the Vietnam poultry market is the increasing demand for poultry products, particularly chicken meat and eggs, due to a growing population and changing dietary preferences. Poultry products are considered affordable sources of protein, making them a staple in the Vietnamese diet. Additionally, as the purchasing power of individuals increases, they are becoming more inclined to include poultry products in their diets, thus contributing to market growth. Other than this, the ongoing urbanization in Vietnam has resulted in a shift from traditional agricultural practices to more intensive and commercial poultry farming. Urban consumers have easier access to poultry products, leading to higher consumption rates. Besides this, the growing health consciousness among consumers has led to a rising preference for lean protein sources like chicken over red meat. Chicken is perceived as a healthier option, and this shift in dietary habits has bolstered the poultry market. In line with this, the government of Vietnam has initiated steps to support the poultry industry by implementing policies that encourage investment, research, and development. This includes efforts to improve poultry farming practices, disease control, and food safety standards. Furthermore, the poultry industry across the region has also benefited from export opportunities. High-quality poultry products are being exported to international markets, contributing to increased revenue for local poultry farmers and processors. Moreover, advancements in poultry farming technology, including improved breeding techniques, disease management, and feed efficiency, have boosted poultry production and productivity across the country.

Vietnam Poultry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on end use and distribution channel.

End Use Insights:

- Food Services

- Households

The report has provided a detailed breakup and analysis of the market based on the end use. This includes food services and households.

Distribution Channel Insights:

- Traditional Retail Stores

- Business to Business (B2B)

- Modern Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes traditional retail stores, business to business (B2B), and modern retail stores.

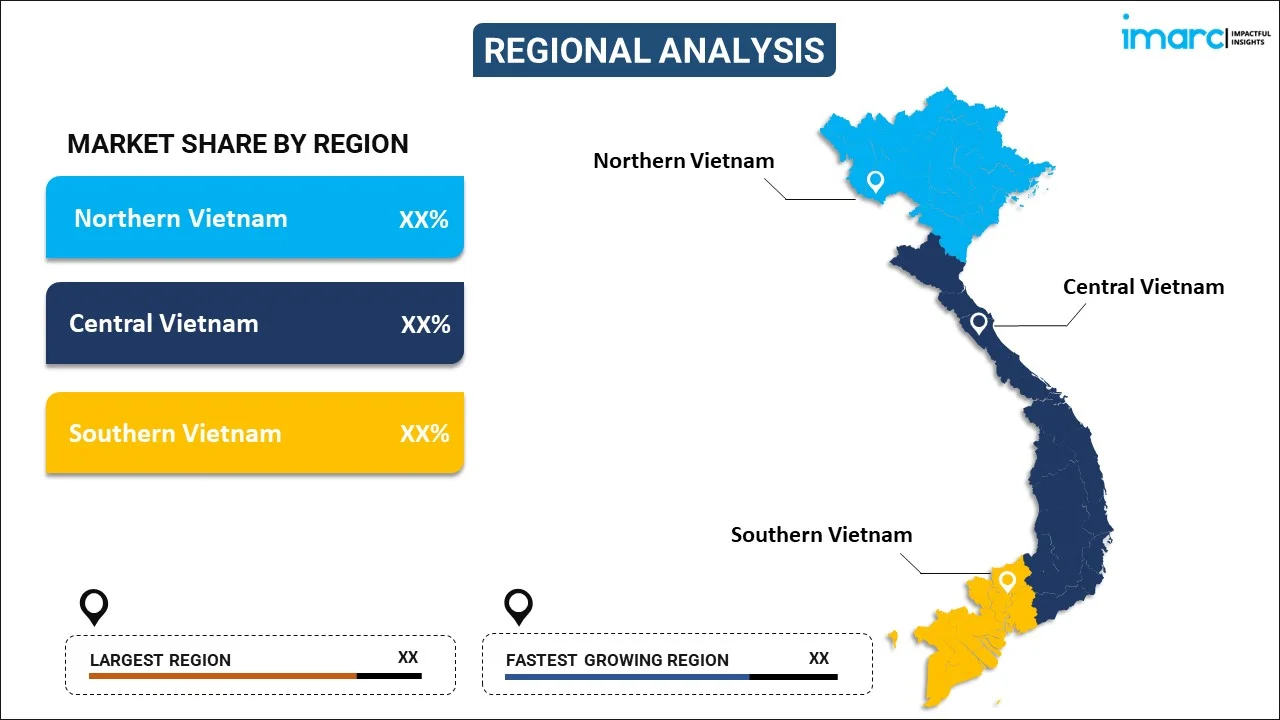

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Poultry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| End Uses Covered | Food Services, Households |

| Distribution Channels Covered | Traditional Retail Stores, Business to Business (B2B), Modern Retail Stores |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam poultry market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Vietnam poultry market?

- What is the breakup of the Vietnam poultry market on the basis of end use?

- What is the breakup of the Vietnam poultry market on the basis of distribution channel?

- What are the various stages in the value chain of the Vietnam poultry market?

- What are the key driving factors and challenges in the Vietnam poultry?

- What is the structure of the Vietnam poultry market and who are the key players?

- What is the degree of competition in the Vietnam poultry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam poultry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam poultry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam poultry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)